Trial Balance Worksheet

A trial balance worksheet is a tool used in accounting to ensure the accuracy and completeness of a company's financial records. It serves as a summary of all the accounts in a company's general ledger, with each account listed and its corresponding balance noted. This essential document provides a clear snapshot of a company's financial position and aids in the identification of any discrepancies that may require further investigation. For accountants and financial professionals who value accuracy and efficiency in their work, the trial balance worksheet is an invaluable resource.

Table of Images 👆

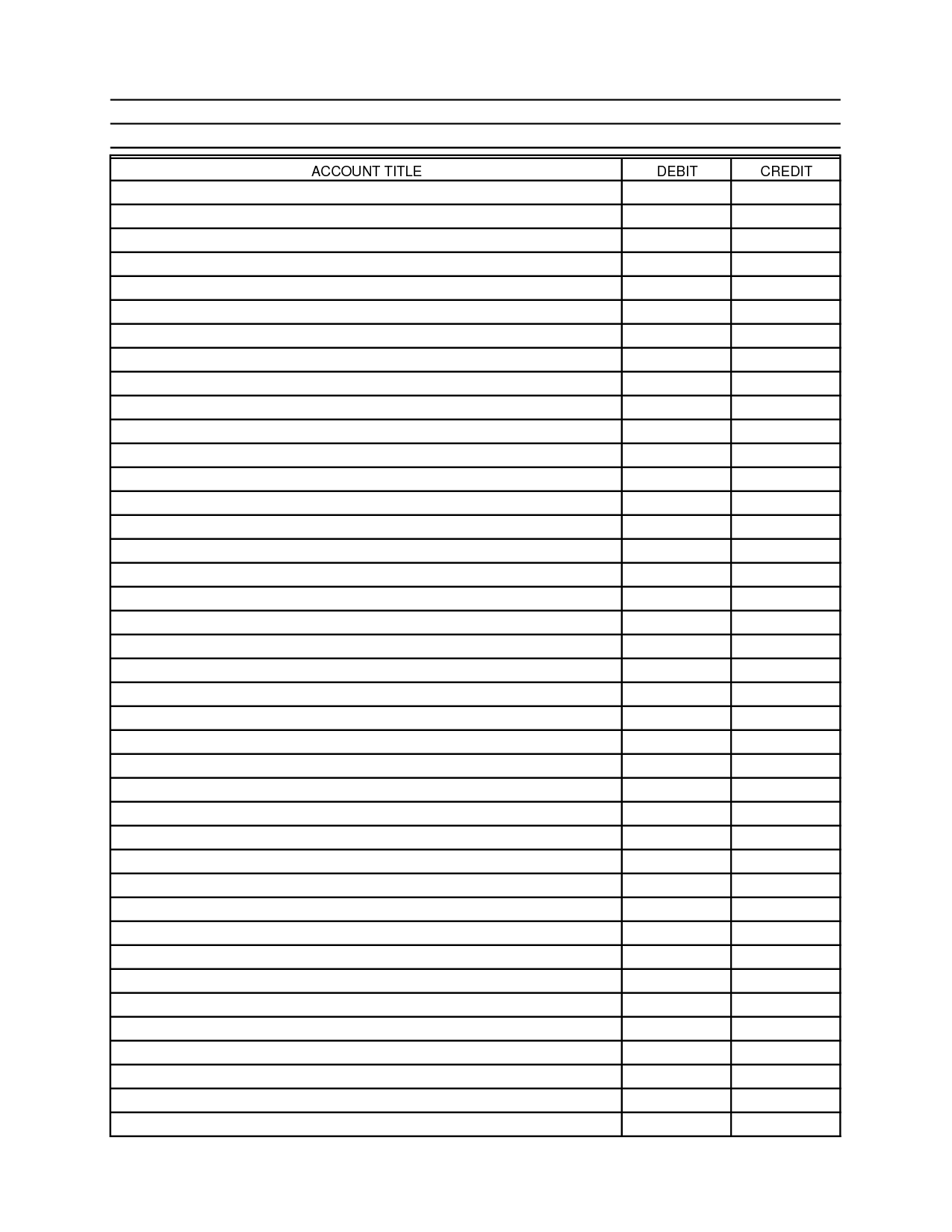

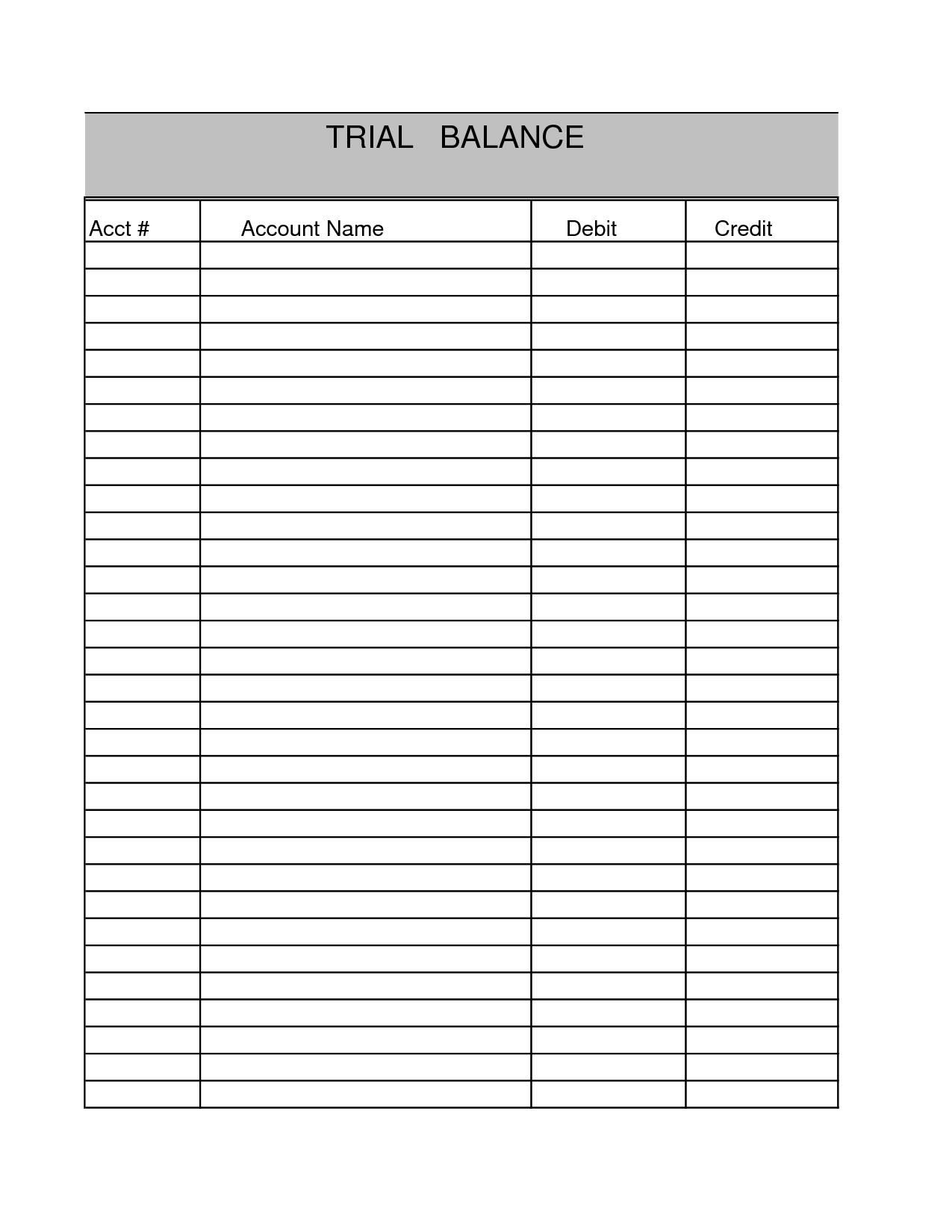

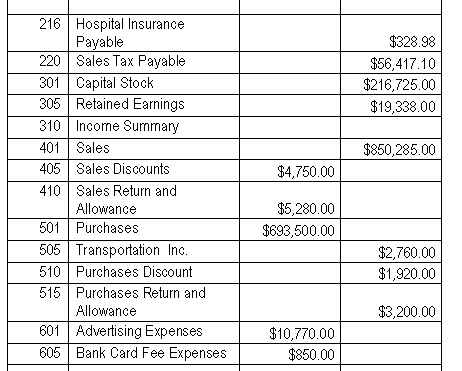

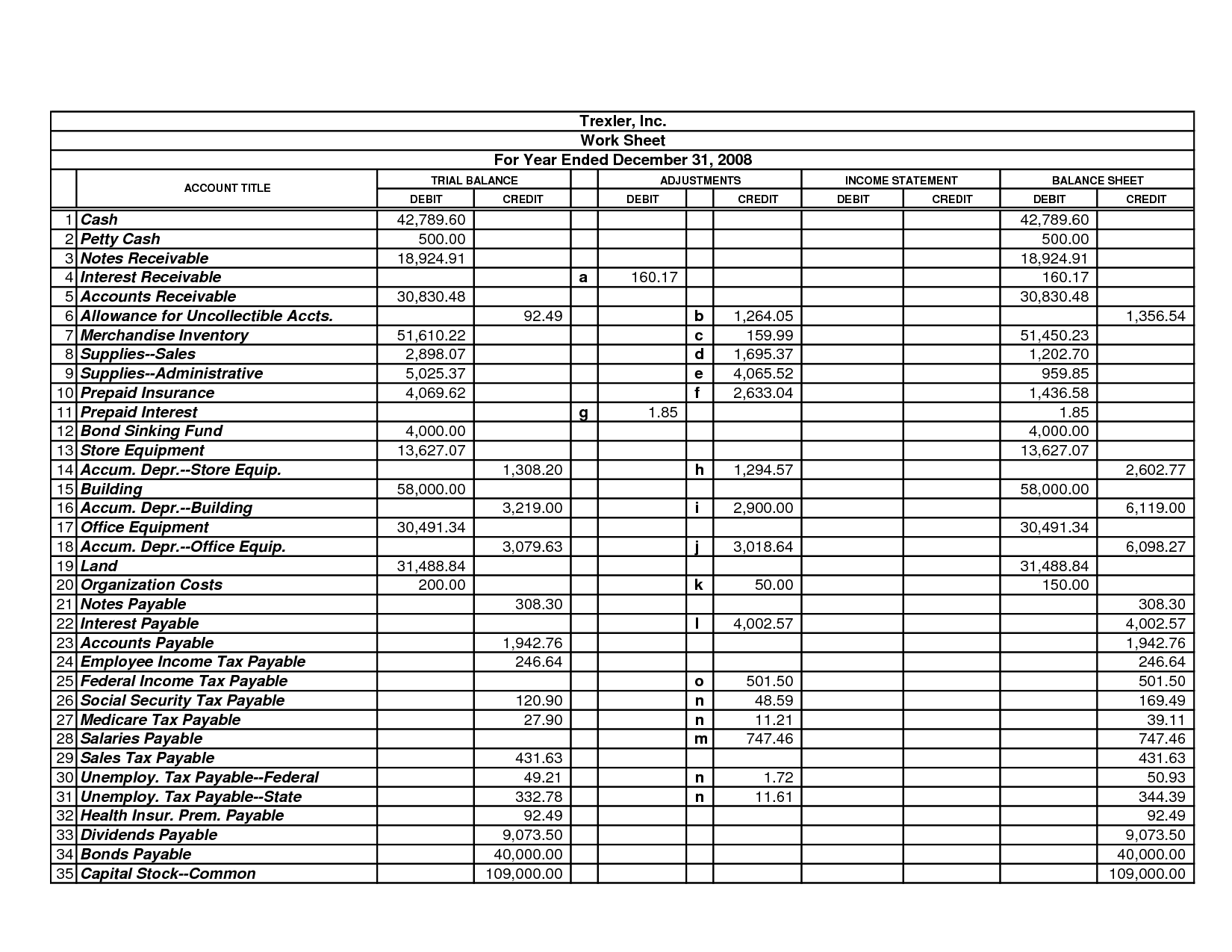

- Accounting Trial Balance Template

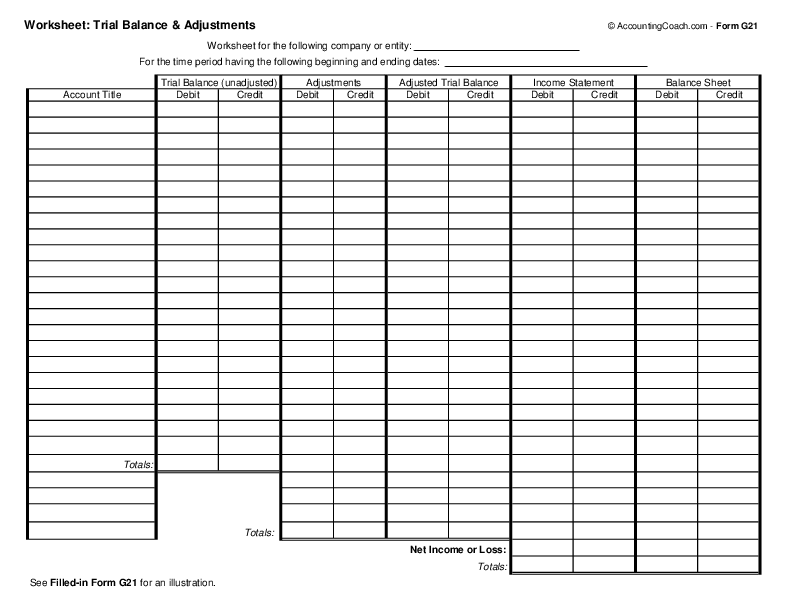

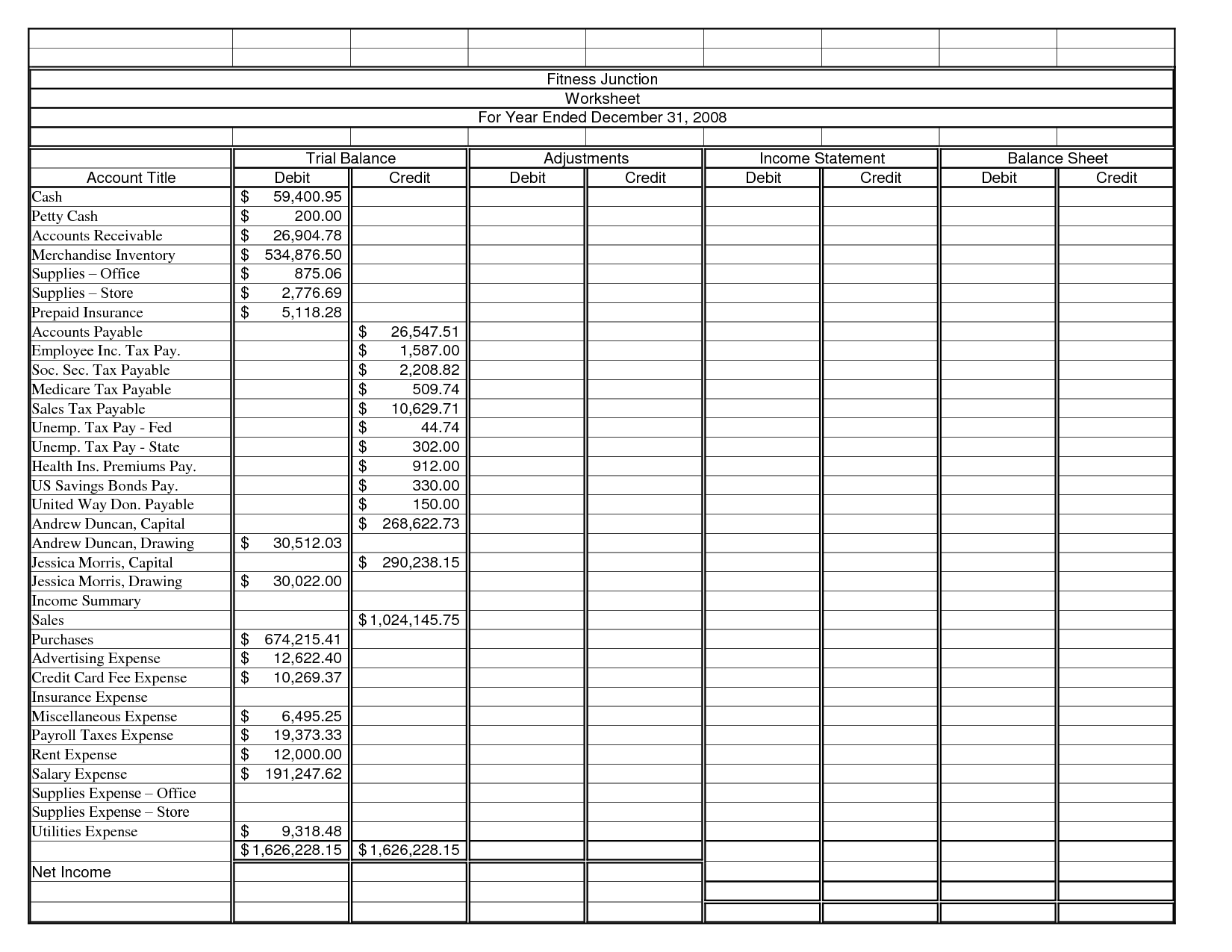

- Accounting Trial Balance Worksheet Template

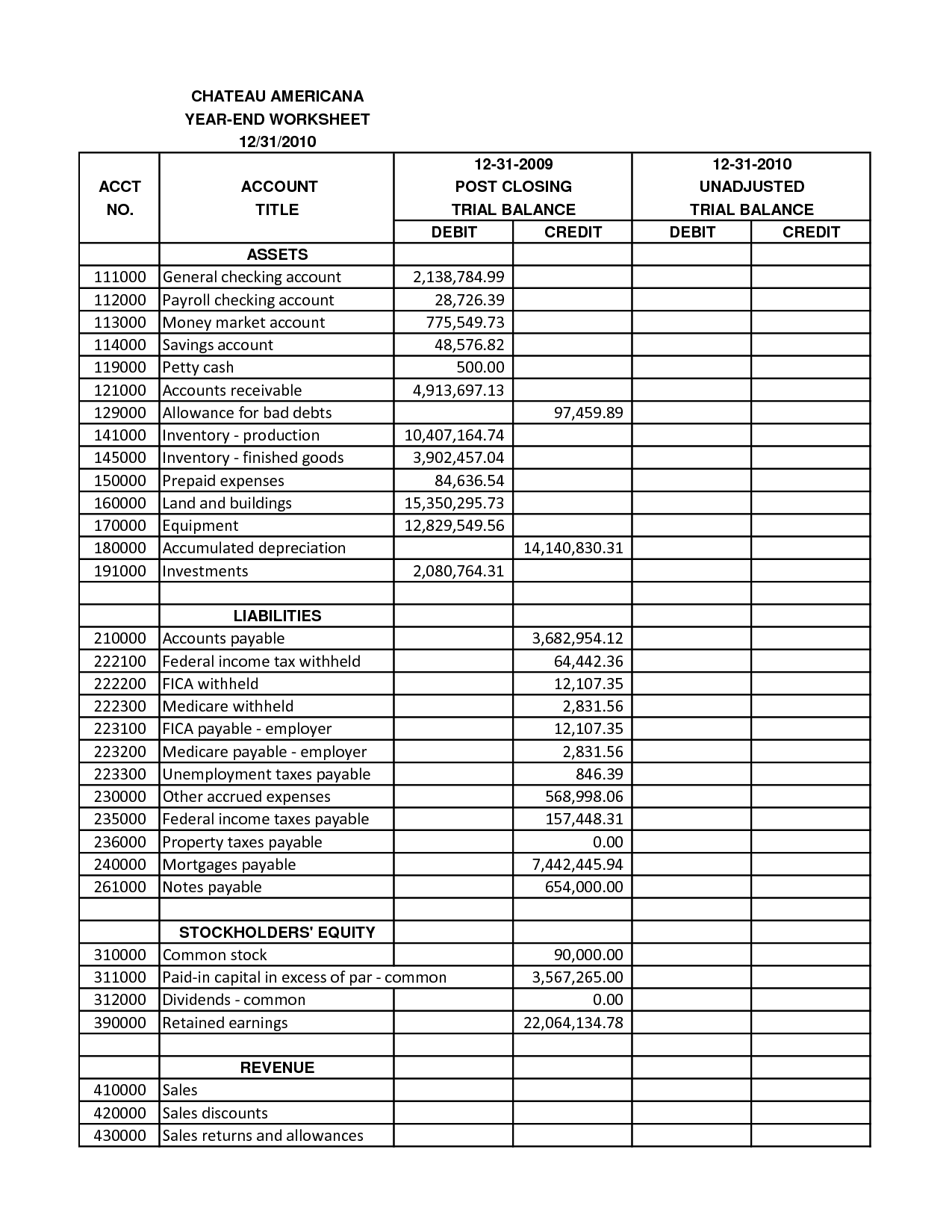

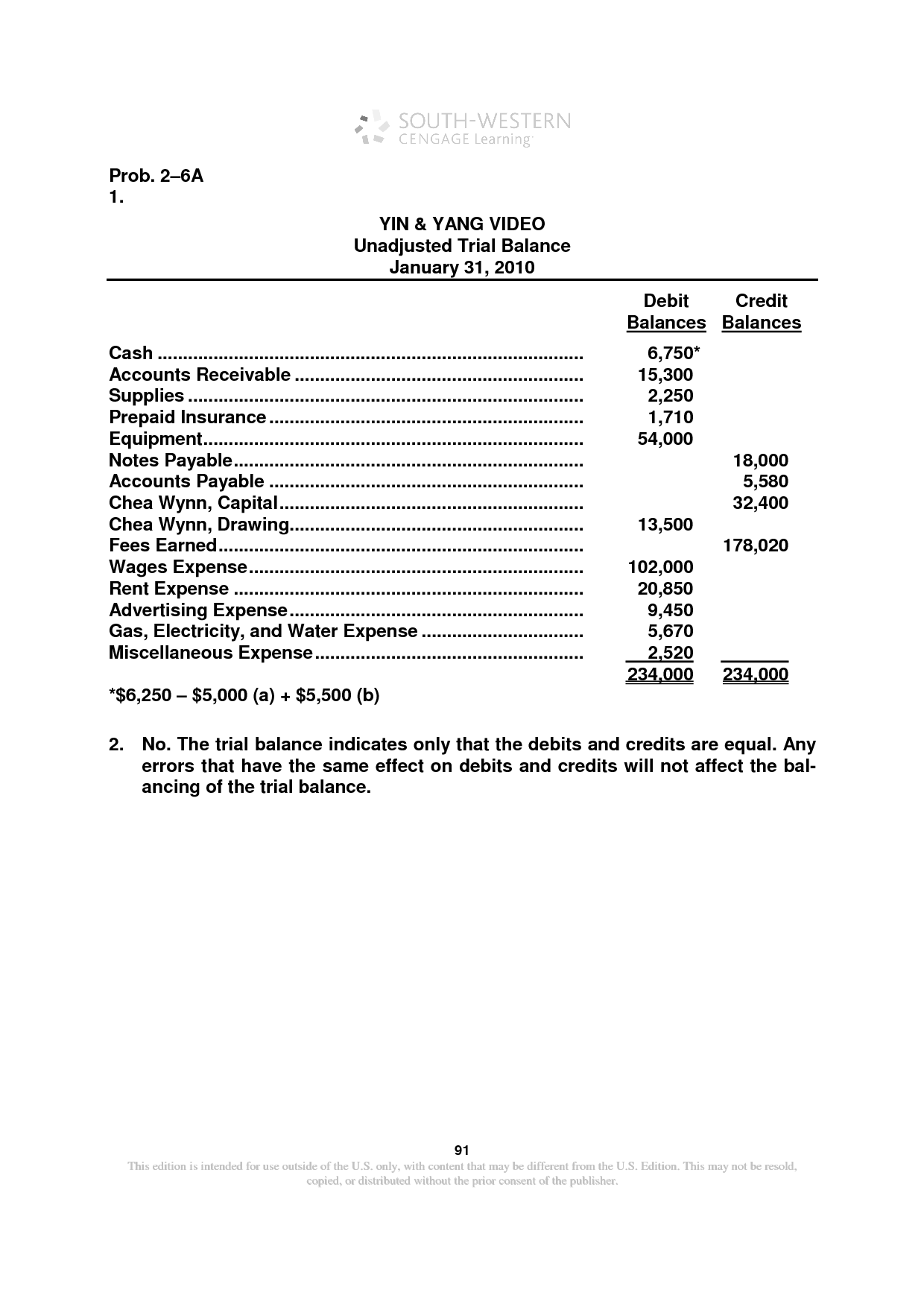

- Trial Balance Template Excel

- Trial Balance Worksheet Template

- Trial Balance Sheet Template Printable

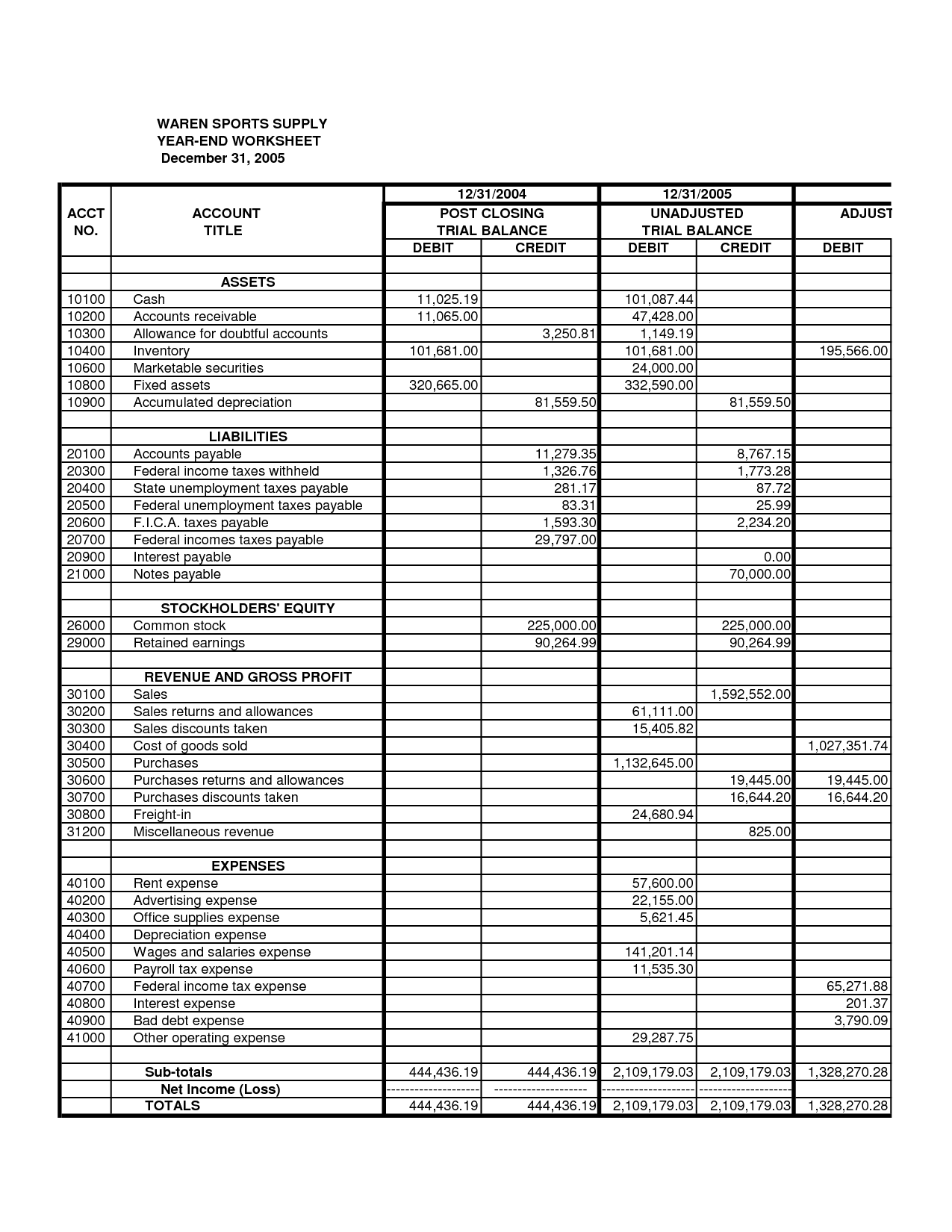

- Waren Sports Supply 2013 Unadjusted Trial Balance

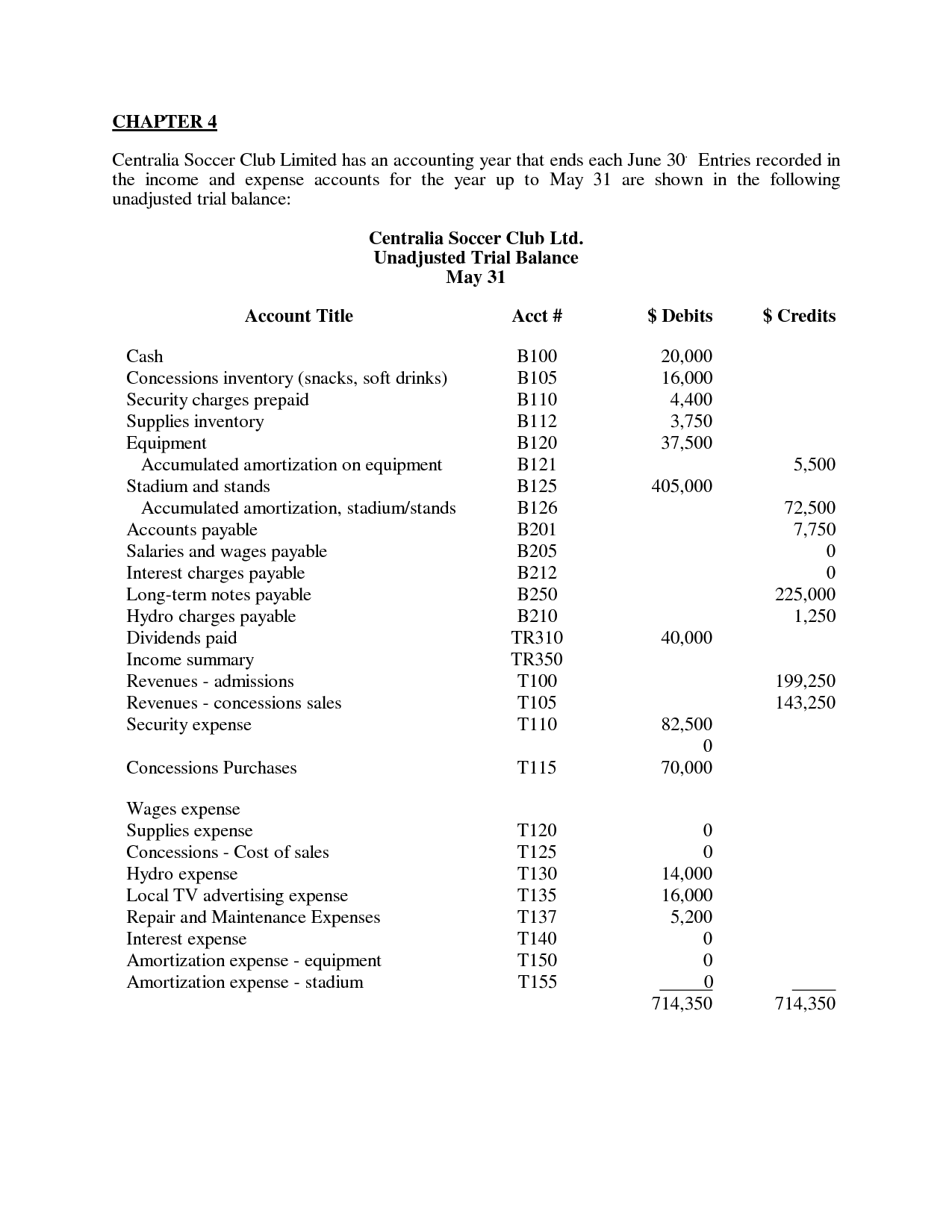

- Unadjusted Trial Balance Worksheet Template

- Blank Accounting Balance Sheet Worksheets

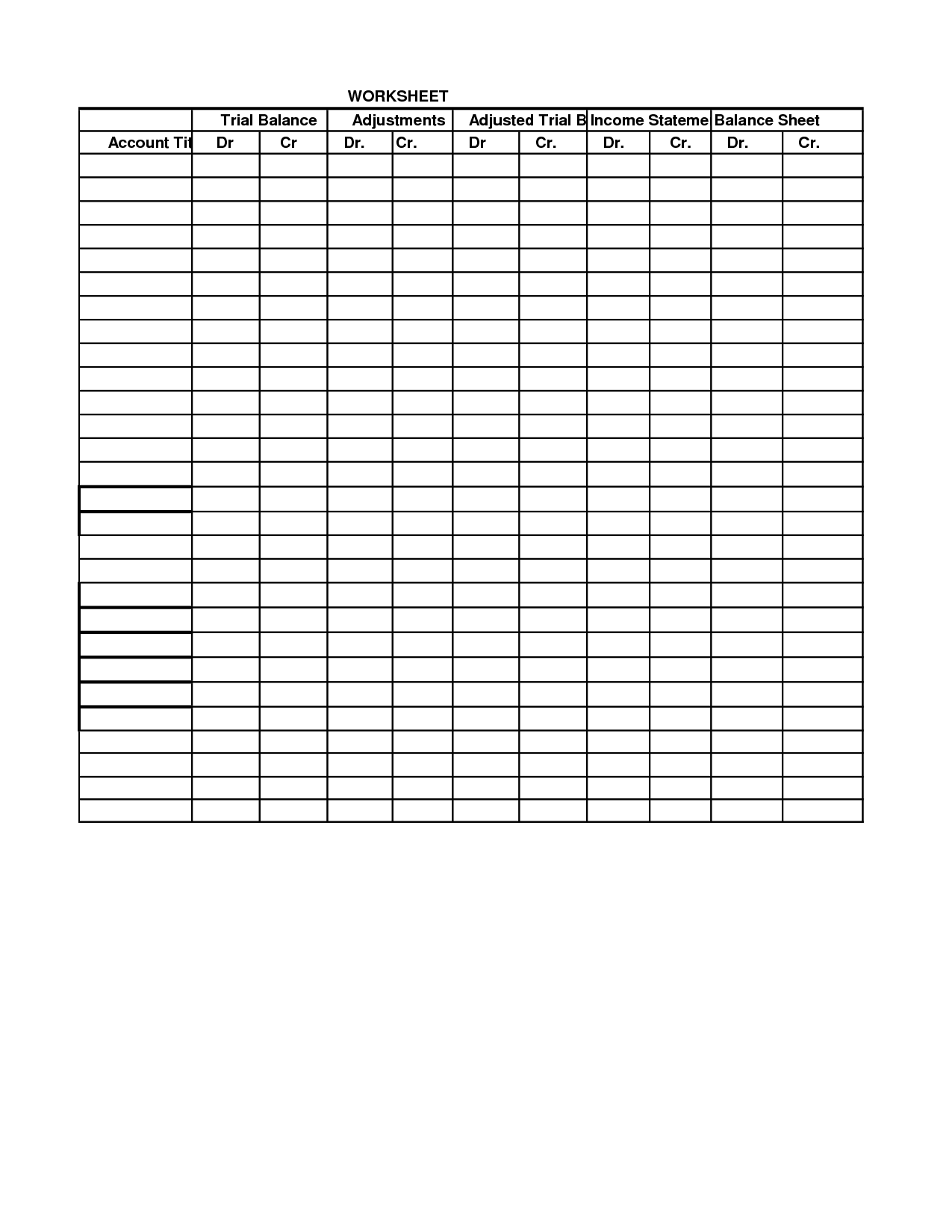

- Blank 10 Column Worksheet

- Columns of the Balance Sheet Worksheet

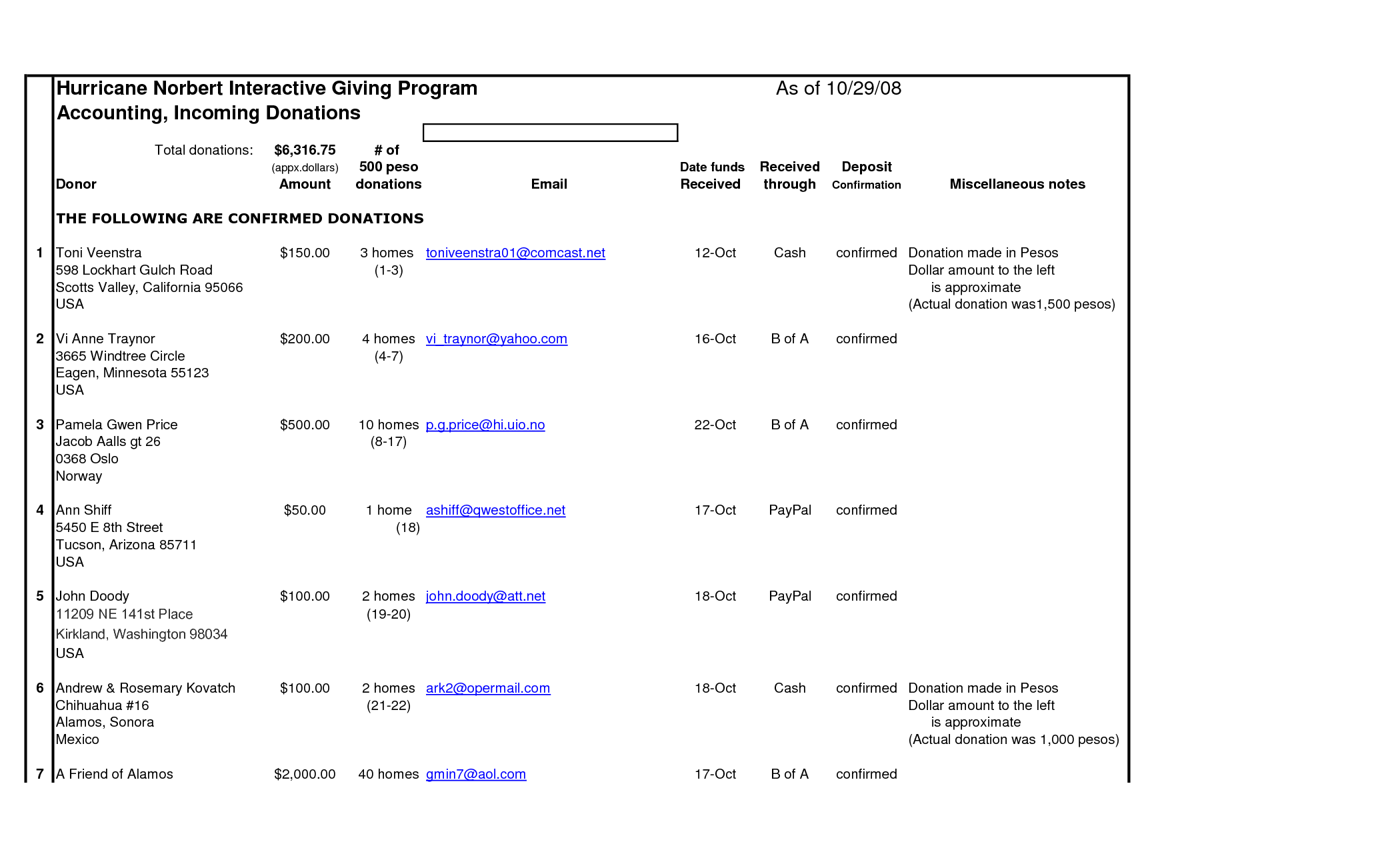

- Petty Cash Reconciliation Worksheet

- Unadjusted Trial Balance Worksheet Template

- Accounting Worksheet

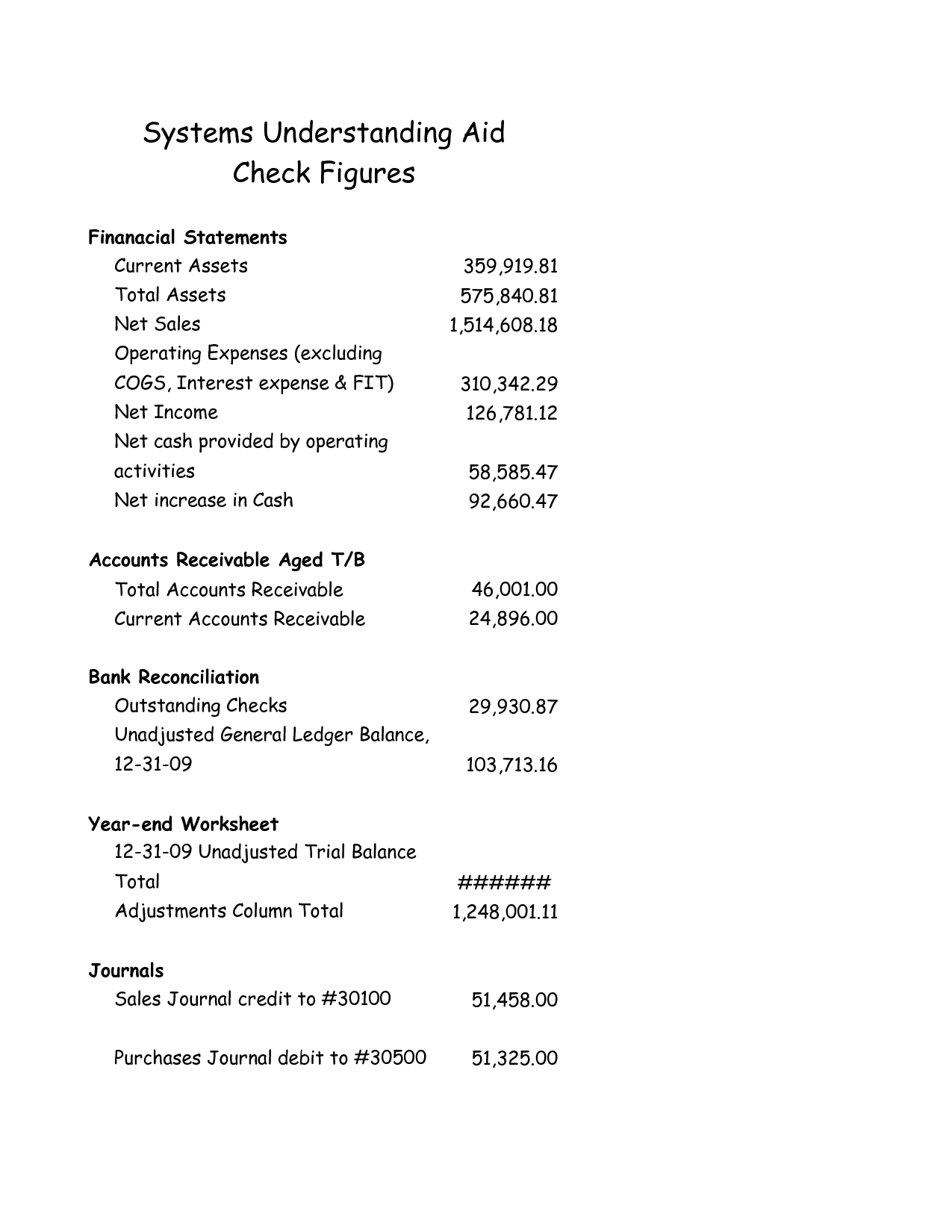

- ACCT 2301 Key to Practice Set

- Blank 4 Column Spreadsheet Template

- Equipment Inventory Sheet

- Sample Financial Statements GASB

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a trial balance worksheet?

A trial balance worksheet is a financial statement that lists all of the accounts in a company's general ledger along with their respective debit or credit balances. It is used to ensure that the total debits equal the total credits, which helps to identify errors in the accounting records before the financial statements are prepared. The trial balance worksheet is an important tool in the accounting process to ensure accuracy and integrity of the financial information.

Why is a trial balance worksheet important in accounting?

A trial balance worksheet is important in accounting as it is used to ensure that the total debits equal the total credits before preparing financial statements. This helps to detect errors or inaccuracies in the books of accounts, providing a systematic way to verify the accuracy of the recorded financial transactions and providing a snapshot of the company's financial position at a specific point in time. By identifying discrepancies in the trial balance, accountants can rectify errors before generating financial statements for stakeholders.

What is the purpose of preparing a trial balance worksheet?

The purpose of preparing a trial balance worksheet is to ensure that the total of all debits equals the total of all credits in a company's accounting system. This helps in verifying the accuracy of the accounts and financial statements, as any discrepancies or errors can be identified and corrected before the final financial reports are generated. It also provides a snapshot of the company's financial position at a specific point in time.

What are the main components of a trial balance worksheet?

A trial balance worksheet typically includes the name of the business or entity, a column for listing all the account names and corresponding account numbers, columns for recording the debit and credit balances of each account, and a section for calculating the total debit and credit balances to ensure they are equal, in order to verify the accuracy of the financial records.

How is a trial balance worksheet prepared?

To prepare a trial balance worksheet, all ledger accounts are first listed in a columnar format with their respective debit and credit balances. The total of all debit balances is calculated and compared to the total of all credit balances to ensure they are equal. Any discrepancies are investigated and corrected before finalizing the trial balance. The trial balance worksheet serves as a preliminary step to creating accurate financial statements by verifying the accuracy of the general ledger accounts.

What criteria do you use to list accounts on a trial balance worksheet?

Accounts listed on a trial balance worksheet are typically organized by categories such as assets, liabilities, equity, revenues, and expenses. Within each category, accounts are listed in a specific order based on their account number, with assets typically listed first in ascending order, followed by liabilities, equity, revenues, and expenses. This order helps facilitate the preparation of financial statements and ensures the accuracy of the trial balance.

What is the significance of balancing a trial balance worksheet?

Balancing a trial balance worksheet is crucial because it ensures that the total debits equal the total credits, which indicates that all transactions have been properly recorded. A balanced trial balance is a strong indication of the accuracy of the financial records and helps in identifying errors and discrepancies that need to be investigated and resolved before preparing financial statements. It is an important step in the accounting process to maintain the integrity and reliability of financial information for decision-making purposes.

How does a trial balance worksheet help in detecting errors in financial records?

A trial balance worksheet helps in detecting errors in financial records by ensuring that total debits equal total credits for all accounts, providing a quick way to identify inconsistencies or discrepancies. If the trial balance does not balance, it indicates that there may be errors such as posting mistakes, omissions, or inaccurate entries in the financial records. By comparing the trial balance to the general ledger account balances, accountants can pinpoint errors and discrepancies, facilitating the process of correcting and reconciling the financial statements.

What types of errors can be identified through a trial balance worksheet?

A trial balance worksheet can help identify errors such as mathematical mistakes, posting errors, transposition errors, omission of accounts, and incorrect ledger account balances that may result in the debits not equaling the credits. Identifying and rectifying these errors through the trial balance can ensure the accuracy of the financial statements and provide a true representation of the company's financial position.

What steps should be taken if the trial balance worksheet does not balance?

If the trial balance worksheet does not balance, the following steps can be taken to identify and correct the error: first, double-check all account balances and ensure that they have been accurately recorded; second, verify that all debits and credits have been correctly entered; third, review the journal entries and ledger accounts for any discrepancies or errors; fourth, check for transposition errors or mistakes in totaling; fifth, look for omitted entries or incorrectly posted transactions; sixth, reconcile the trial balance with the general ledger to pinpoint any discrepancies. If the error cannot be found, consider seeking assistance from a supervisor or accounting professional.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments