Tax Organizer Worksheet

Tax season can be a daunting time for individuals and business owners alike. It's important to have all your financial details in order, and that's where a tax organizer worksheet can be incredibly helpful. Designed specifically for individuals and small businesses, this worksheet serves as an essential tool to keep track of all your income, expenses, and deductions, helping you navigate through the tax filing process with ease and accuracy.

Table of Images 👆

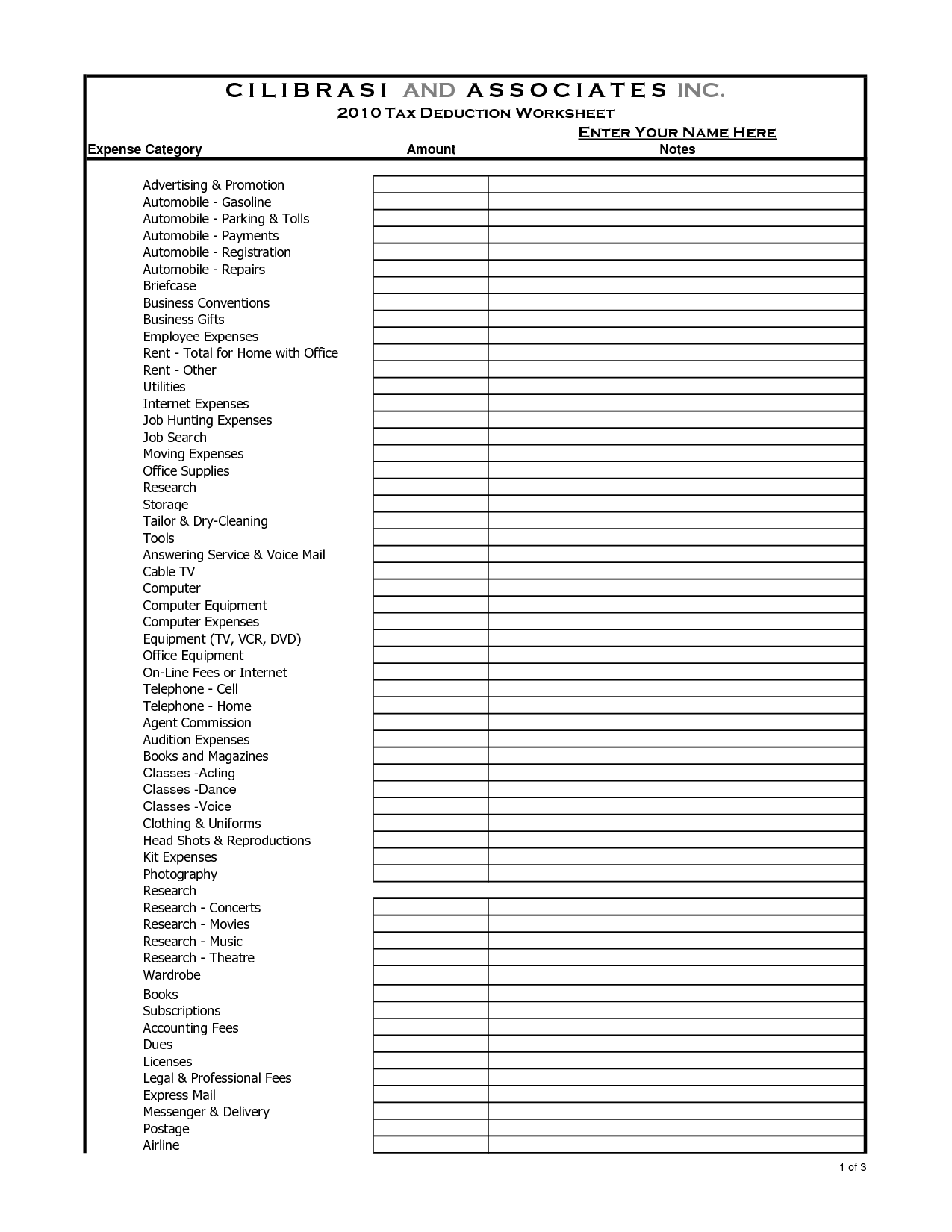

- Tax Deduction Worksheet

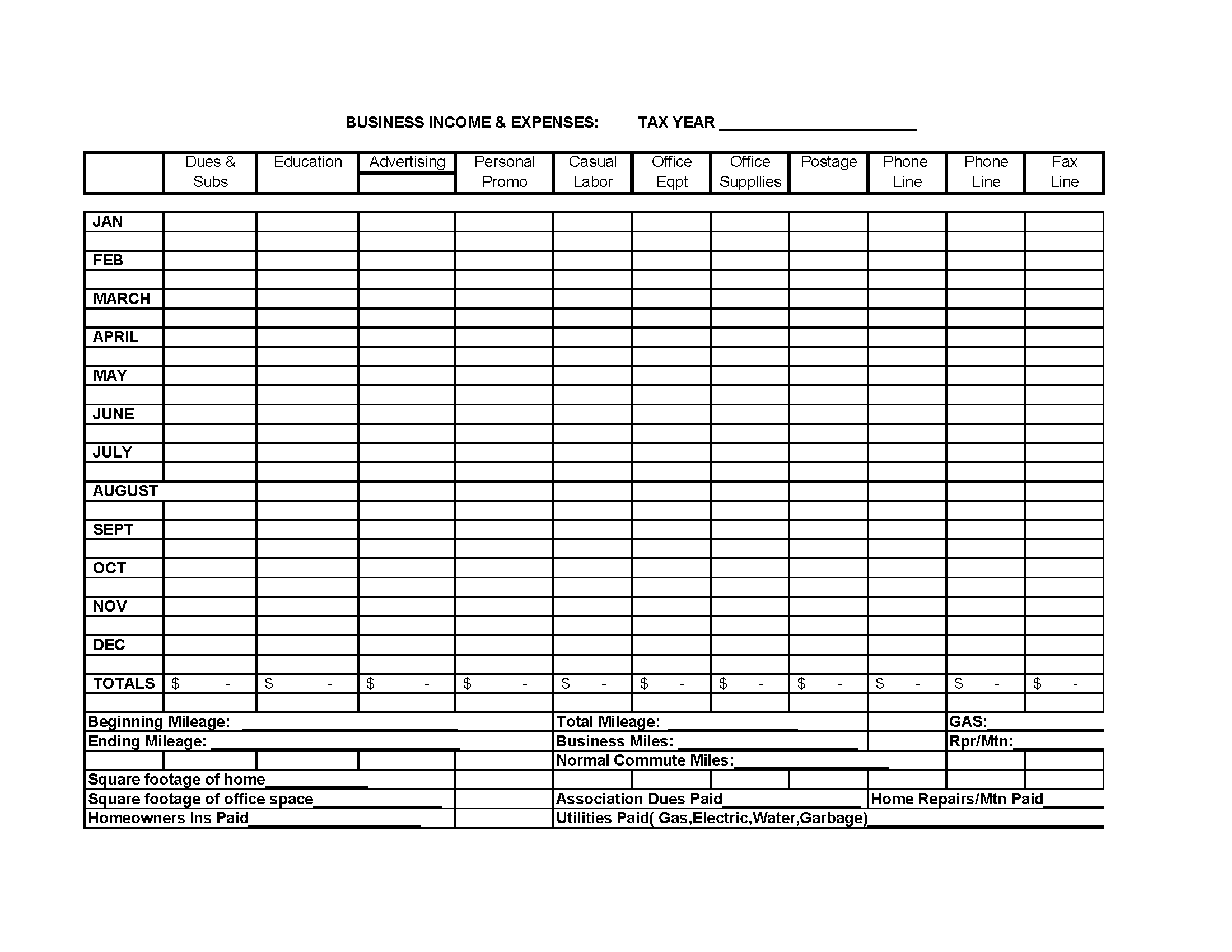

- Business Income Expense Spreadsheet Template

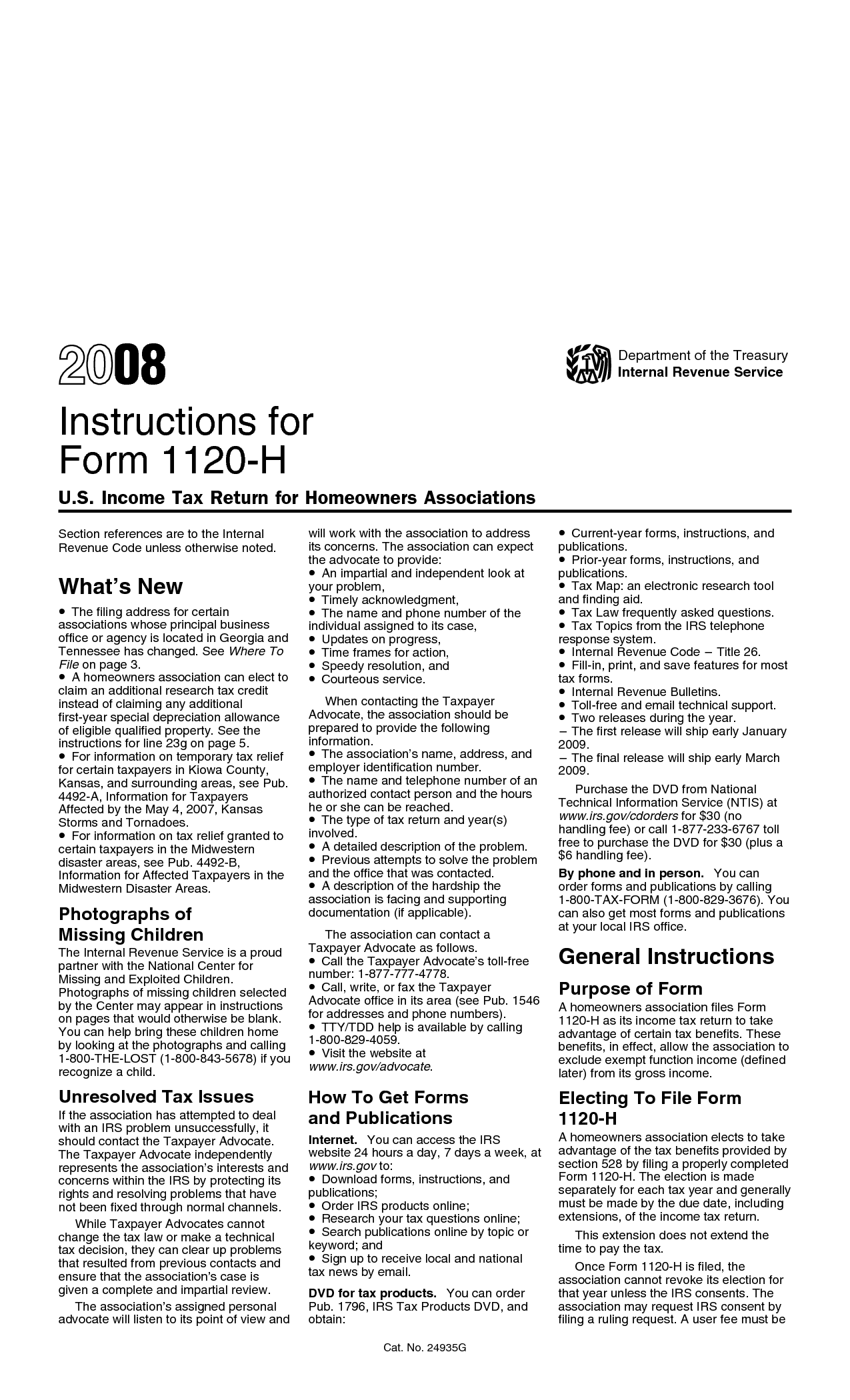

- Printable Tax Form 1120 2014

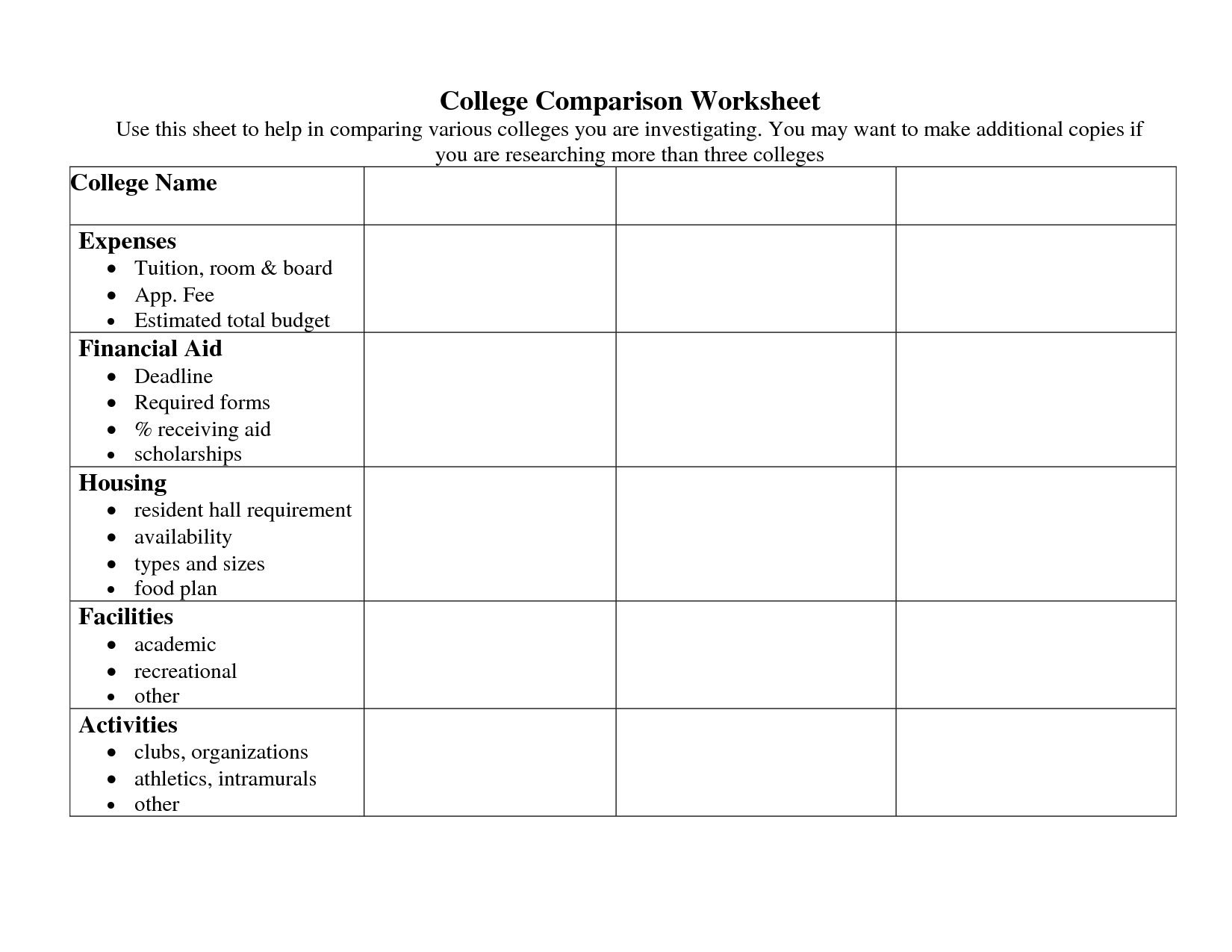

- College Essay Graphic Organizer

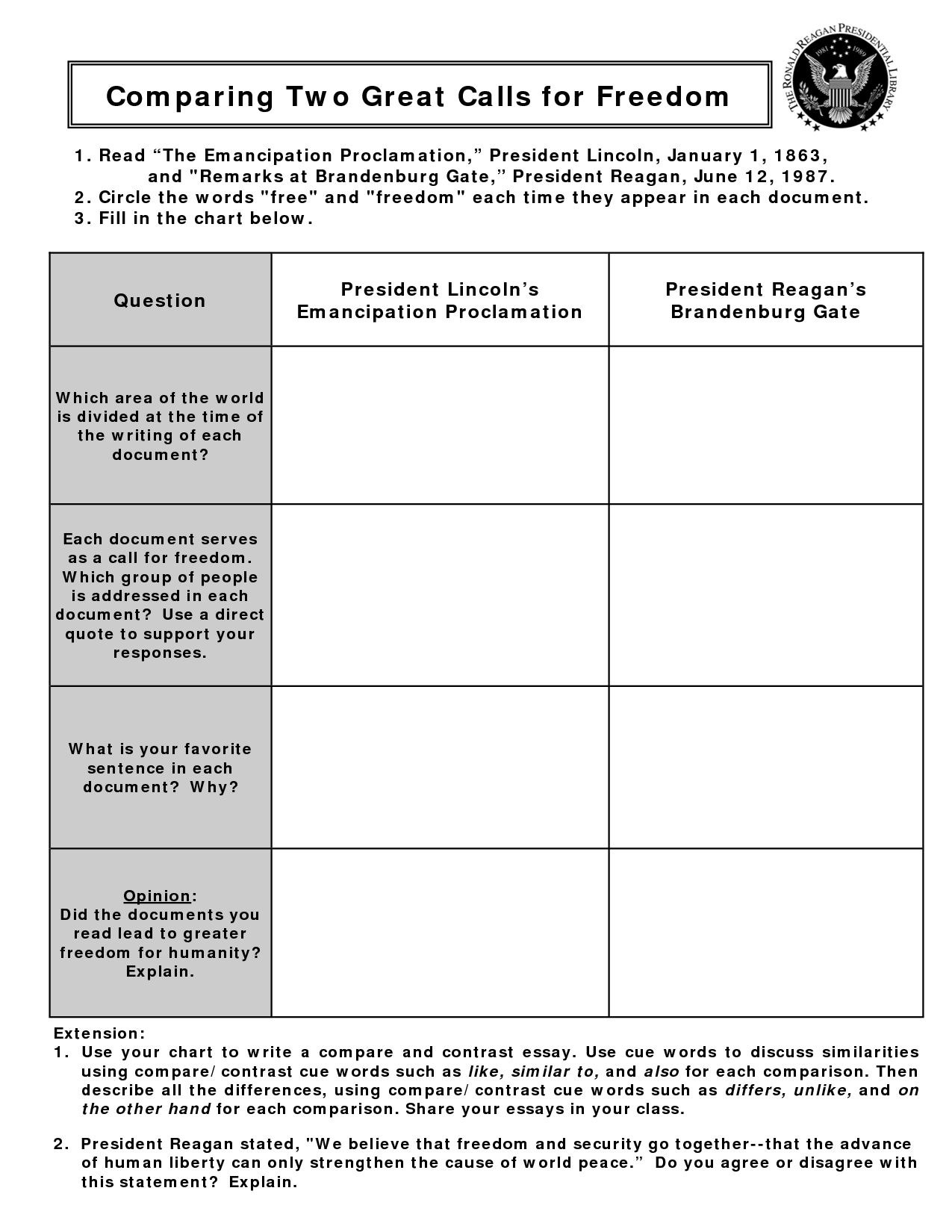

- Compare and Contrast Essay Organizer

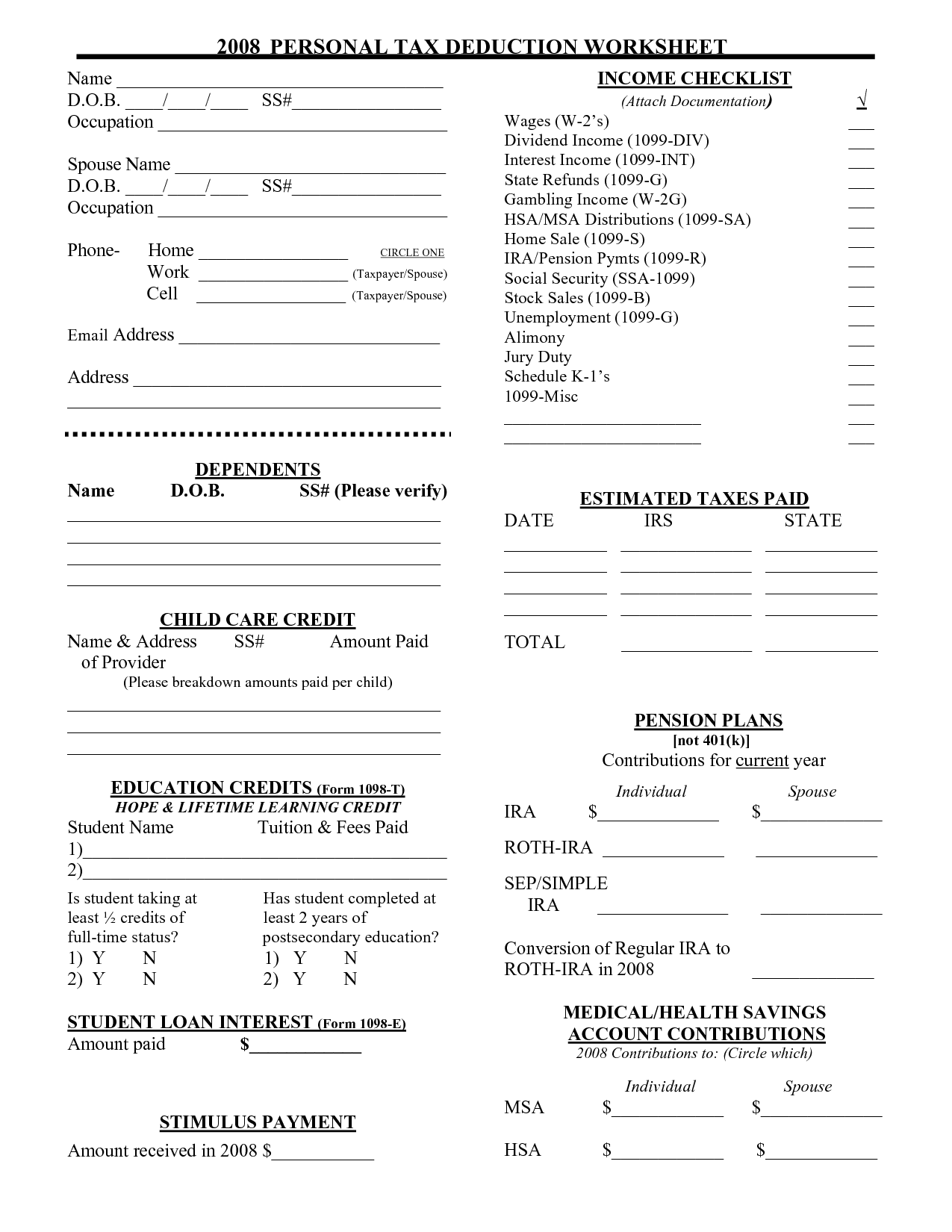

- Personal Tax Deduction Worksheet

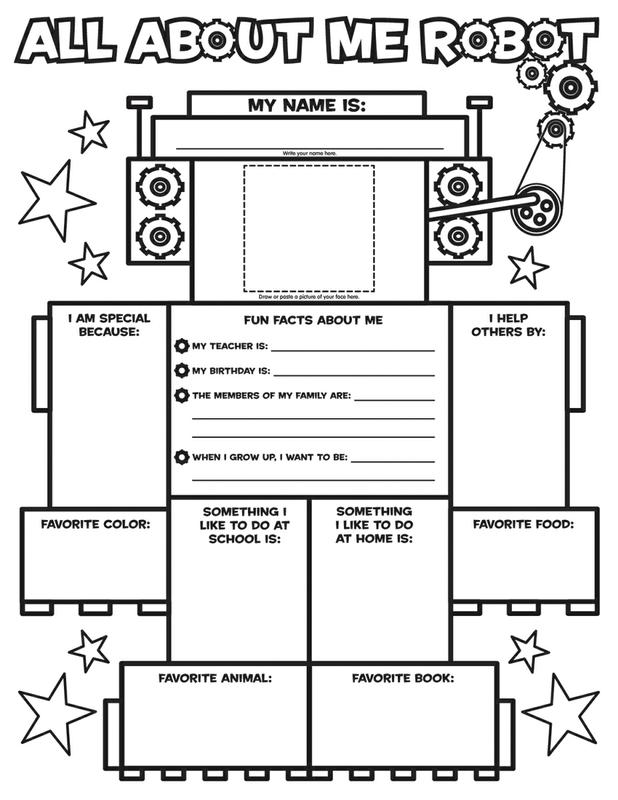

- All About Me Graphic Organizer

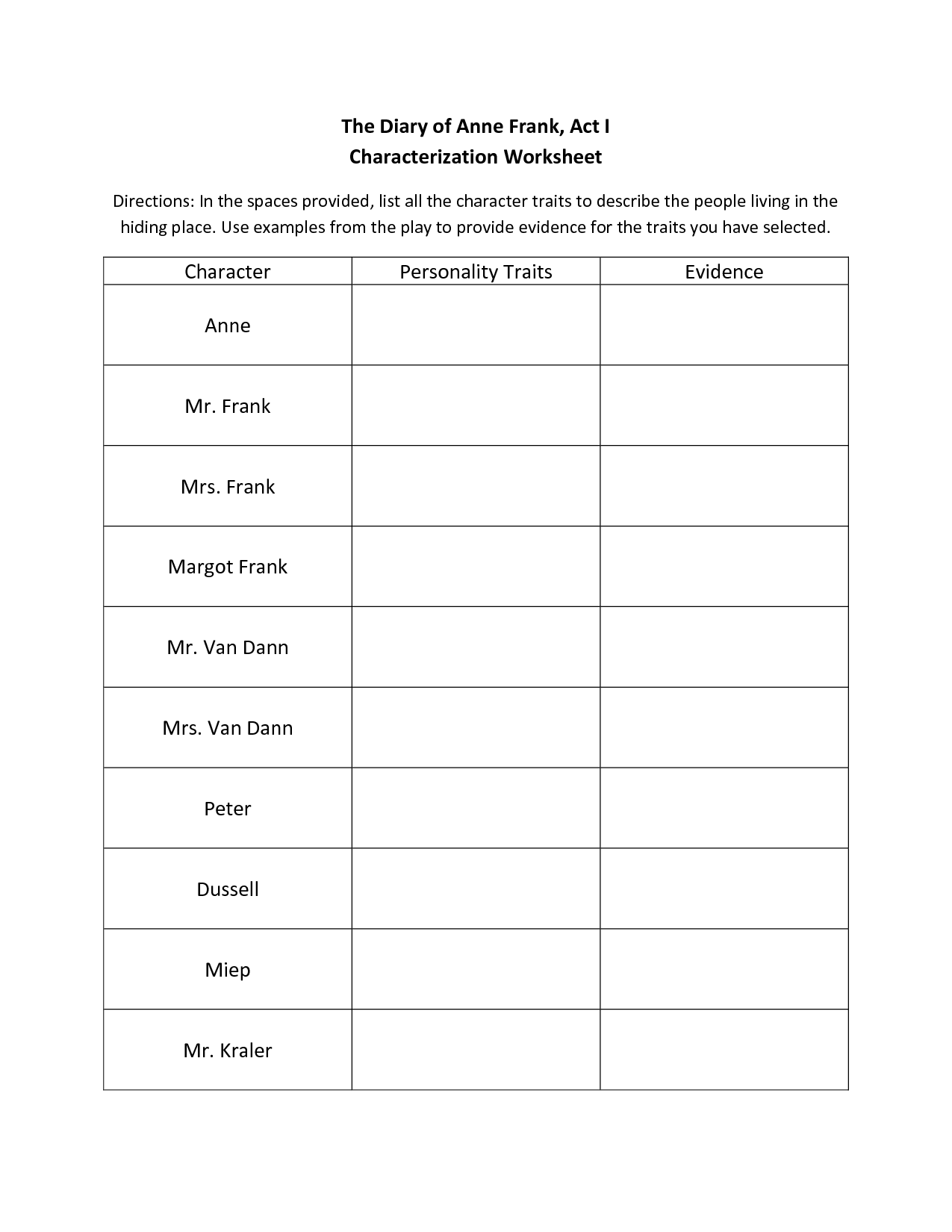

- Anne Frank Character Worksheet

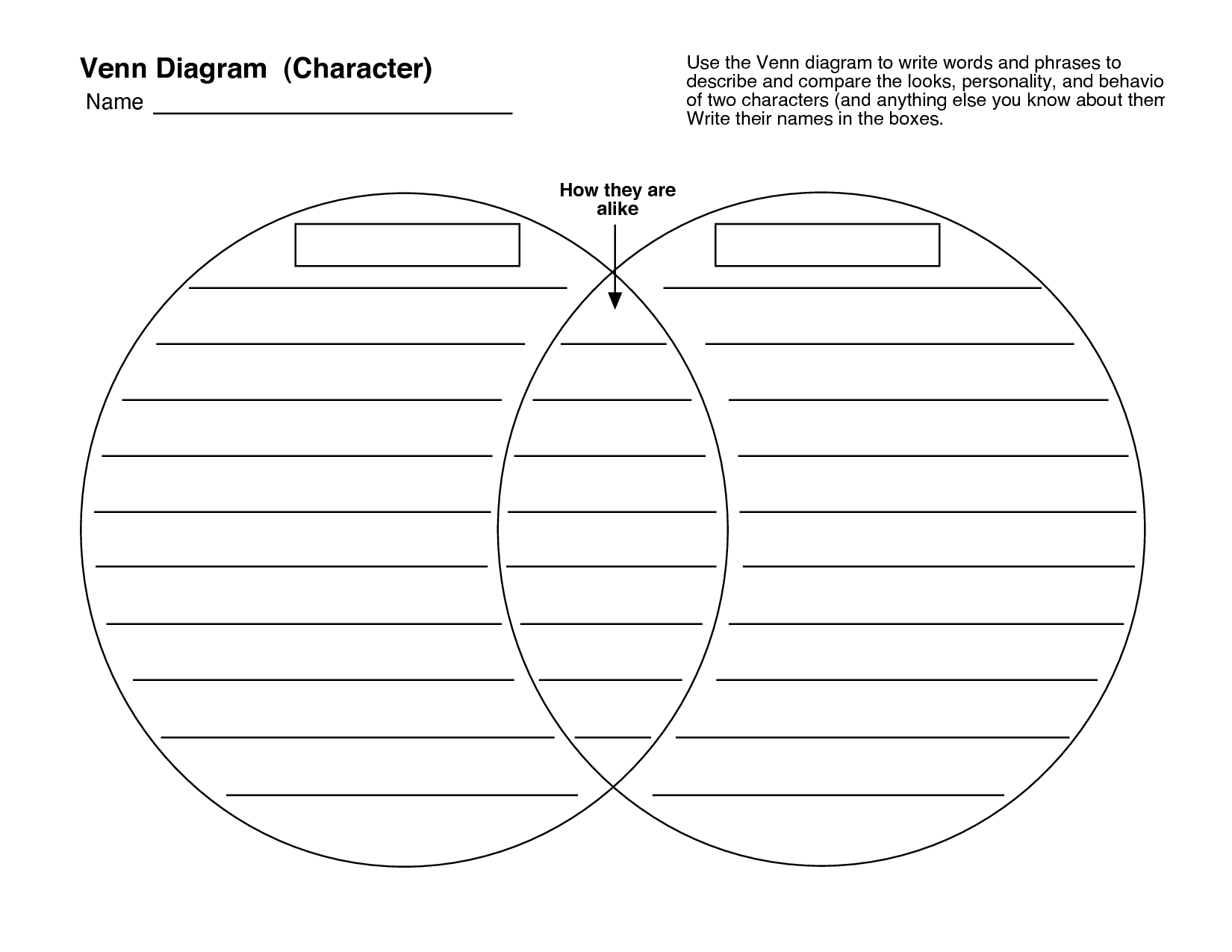

- Printable Venn Diagram Template

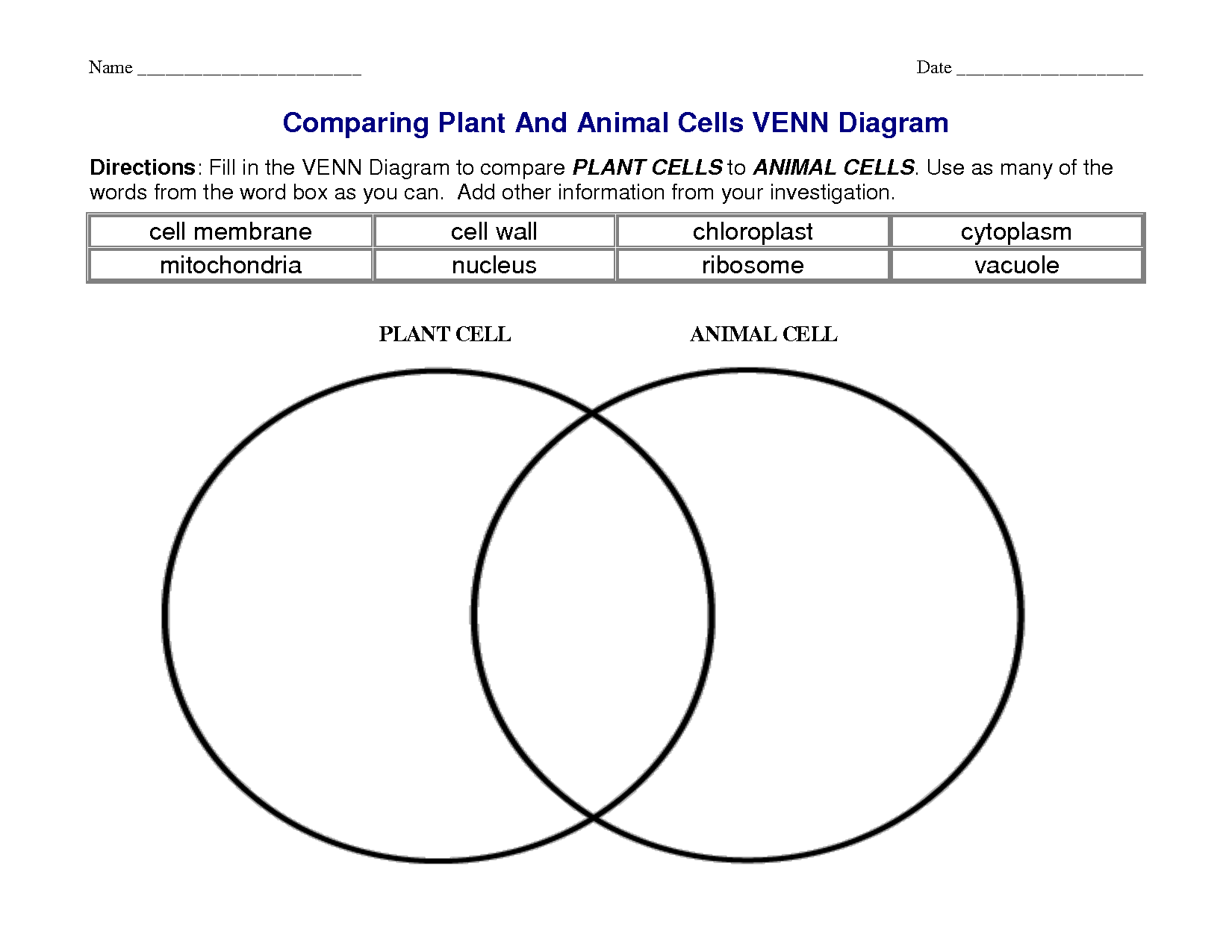

- Plant and Animal Cell Venn Diagram

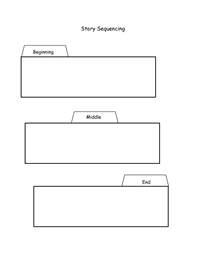

- Story Sequencing Worksheets First Grade

- Maryland Tax Form

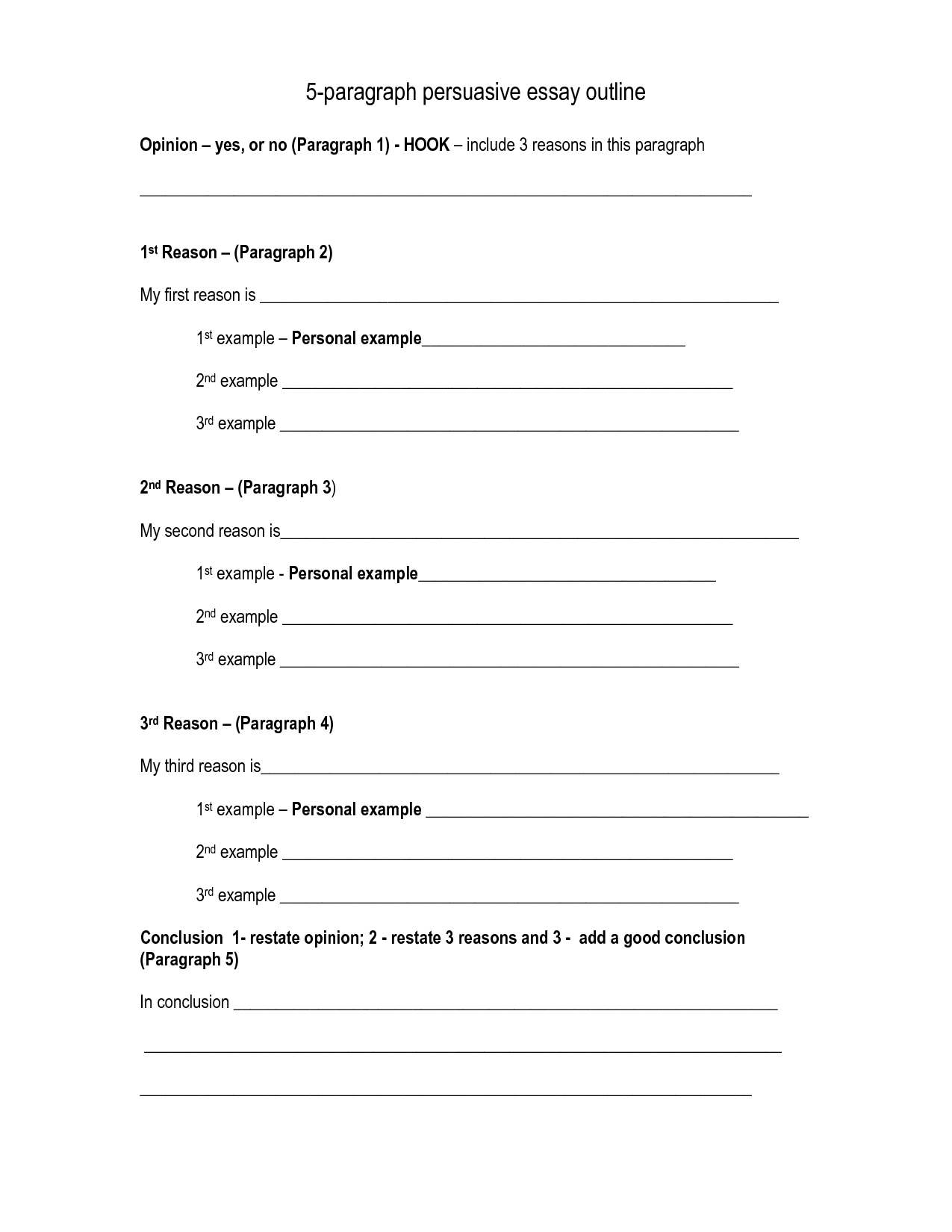

- Persuasive Essay Outline Template

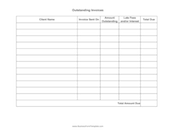

- Free Printable Gifts Received List

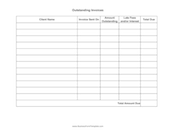

- Free Printable Gifts Received List

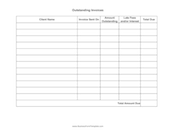

- Free Printable Gifts Received List

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a Tax Organizer Worksheet?

A tax organizer worksheet is a tool used by individuals and businesses to gather all the necessary information and documents needed to prepare and file their taxes accurately. It typically includes sections for income sources, deductions, credits, and other relevant financial information to ensure that all aspects of one's finances are properly considered when completing tax returns. This helps to streamline the tax preparation process and ensures that no important details are overlooked.

Who typically uses a Tax Organizer Worksheet?

A Tax Organizer Worksheet is typically used by individuals and businesses preparing their income tax returns. It helps them gather and organize all the necessary information and documents required to accurately report their income and deductions to the taxing authorities.

Why is a Tax Organizer Worksheet important for filing taxes?

A Tax Organizer Worksheet is important for filing taxes because it helps individuals and businesses gather all necessary financial information and documents in one place. This organized approach simplifies the tax filing process by ensuring that nothing essential is overlooked, potentially leading to fewer errors and reducing the risk of penalties or audits. Additionally, using a Tax Organizer Worksheet can help to save time and stress by structuring the process and making it easier to navigate the complex requirements of tax filing.

What information does a Tax Organizer Worksheet collect?

A Tax Organizer Worksheet collects essential information such as personal details, income sources, expenses, deductions, credits, and other relevant financial data needed for preparing and filing an individual's tax return. It helps taxpayers organize and gather all the necessary information required by their tax preparer to ensure an accurate and efficient tax filing process.

How can a Tax Organizer Worksheet help in identifying tax deductions?

A Tax Organizer Worksheet can help in identifying tax deductions by providing a comprehensive list of potential deductions and expenses that an individual or business may qualify for. By systematically listing out expenses such as medical costs, charitable donations, work-related expenses, and investment costs, the worksheet prompts taxpayers to gather and organize relevant documentation to support their claims. This organized approach allows taxpayers to easily review their financial information and ensure that they are taking advantage of all available deductions, ultimately potentially maximizing their tax savings.

What role does a Tax Organizer Worksheet play in organizing financial documents?

A Tax Organizer Worksheet serves as a structured guide to help individuals gather and organize their financial documents essential for accurately preparing their tax returns. It typically outlines various categories of income, expenses, deductions, and credits, prompting taxpayers to gather relevant receipts, statements, and forms in an organized manner. By completing the worksheet, individuals can ensure they have all necessary financial information readily available for their tax preparation process, making it more efficient and reducing the likelihood of missing important details or potential deductions.

How can a Tax Organizer Worksheet help with tracking expenses and income?

A Tax Organizer Worksheet can help track expenses and income by providing a structured template that categorizes different types of financial activities, such as income sources, deductions, and credits. By filling out this worksheet throughout the year, individuals can systematically record and organize their financial information, making it easier to calculate their tax obligations accurately and efficiently when it comes time to file taxes. This tool not only helps individuals stay organized but also ensures that they do not overlook any deductible expenses or sources of income, ultimately leading to a more comprehensive and streamlined tax preparation process.

What are some tips for completing a Tax Organizer Worksheet accurately?

To complete a tax organizer worksheet accurately, start by gathering all necessary documents such as W-2s, 1099s, and receipts. Organize your information by income, deductions, and credits. Be sure to review the instructions for each section to ensure you are providing the correct information. Double-check your entries for accuracy and completeness before submitting the worksheet. It may also be helpful to seek guidance from a tax professional if you have any questions or uncertainties.

Can a Tax Organizer Worksheet be used for multiple tax years?

No, a Tax Organizer Worksheet is typically designed for a specific tax year and should be filled out anew for each tax year. Using a previous year's worksheet may not reflect accurate or up-to-date information for the current tax year. It is important to update the worksheet annually to ensure that all relevant financial and tax information is accurately recorded for that specific tax year.

How can a Tax Organizer Worksheet simplify the tax filing process?

A Tax Organizer Worksheet can simplify the tax filing process by providing a structured and organized layout for taxpayers to gather all their necessary tax information in one place. It helps individuals to systematically compile and categorize their financial records, receipts, and deductions, making it easier to ensure that no important details are overlooked or forgotten. By having all pertinent data in one document, it can streamline the preparation of tax returns and minimize the time and effort needed to complete the filing process accurately.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments