Tax Deduction Worksheet 2014

Are you a small business owner or freelancer looking for a simple and effective way to track your tax deductions for the year? Look no further! Our Tax Deduction Worksheet for 2014 is the perfect tool to help you organize and calculate all your eligible expenses. Whether you're a sole proprietor or have a small team, this worksheet is designed to save you time and headaches when it comes to tax season.

Table of Images 👆

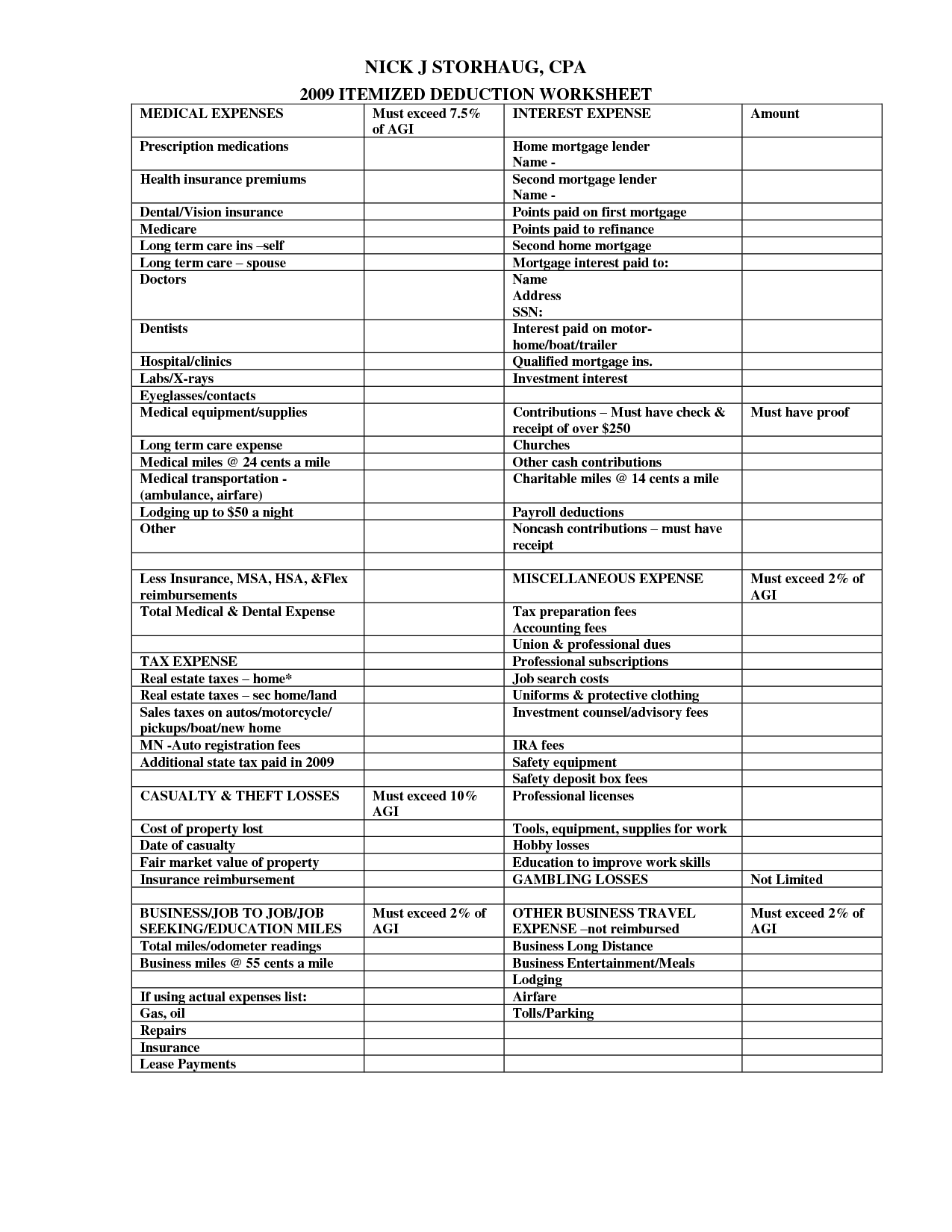

- Tax Itemized Deduction Worksheet

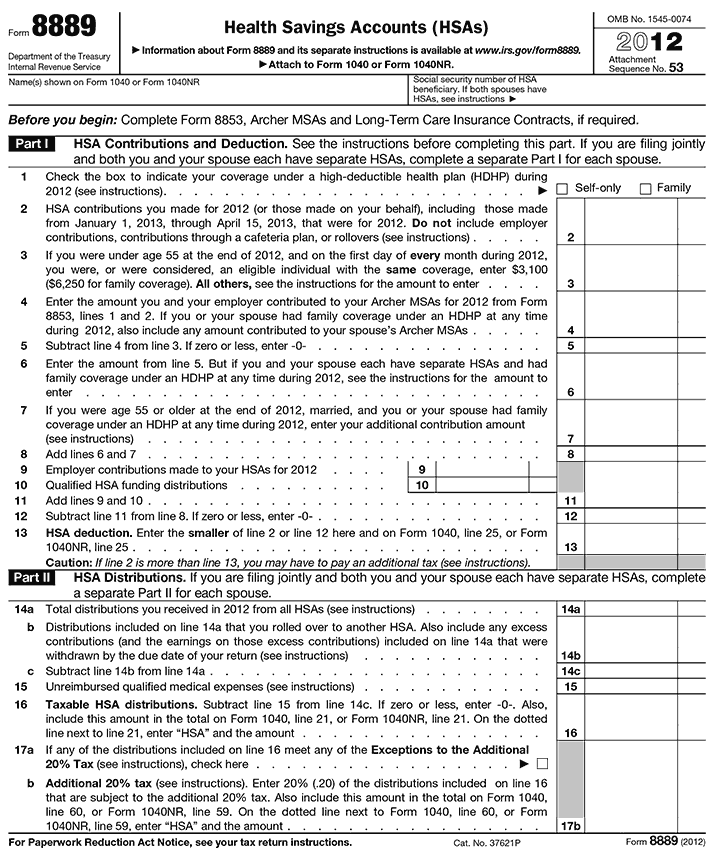

- Completed Form 8889 Example 2014

- Small Business Tax Deduction Worksheet

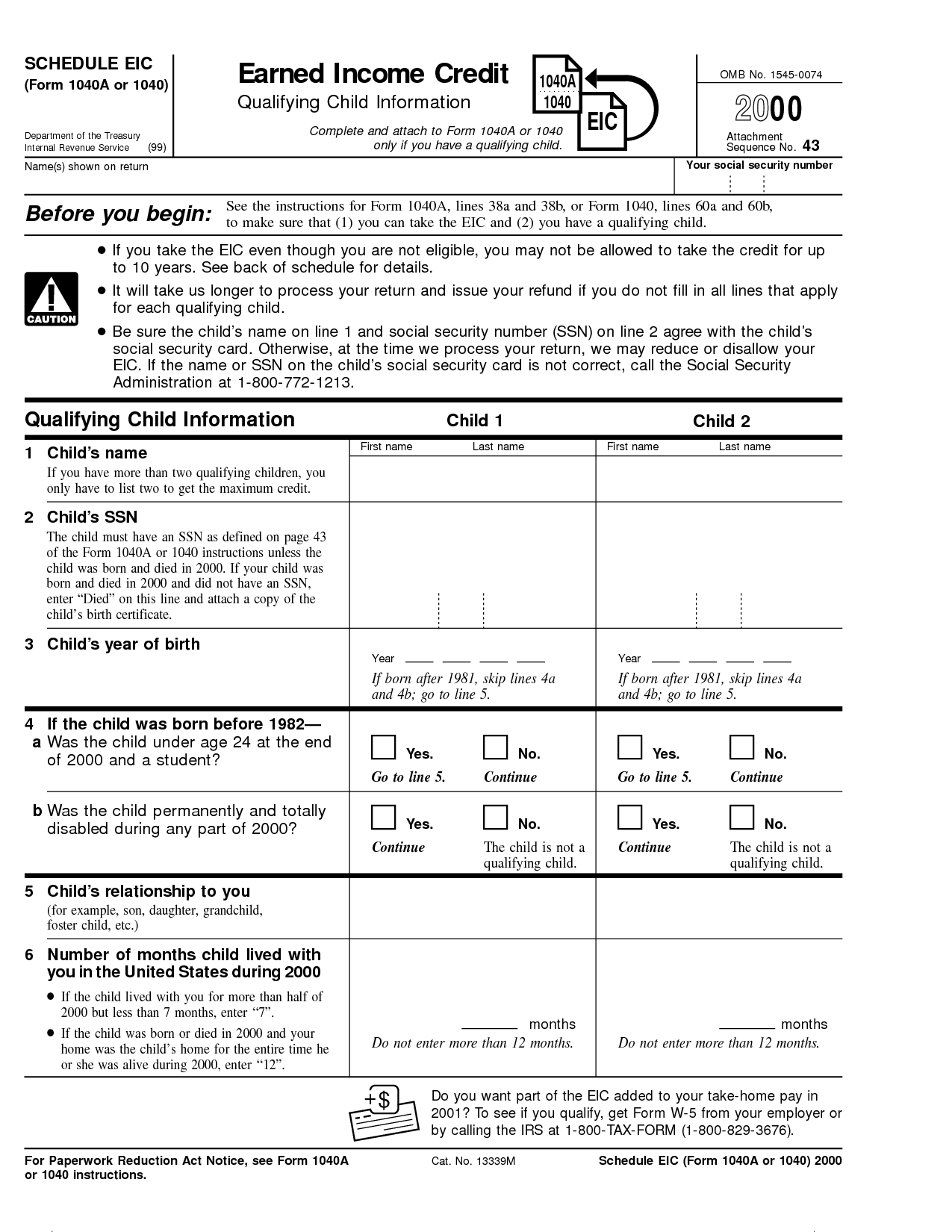

- Earned Income Credit EIC Worksheet

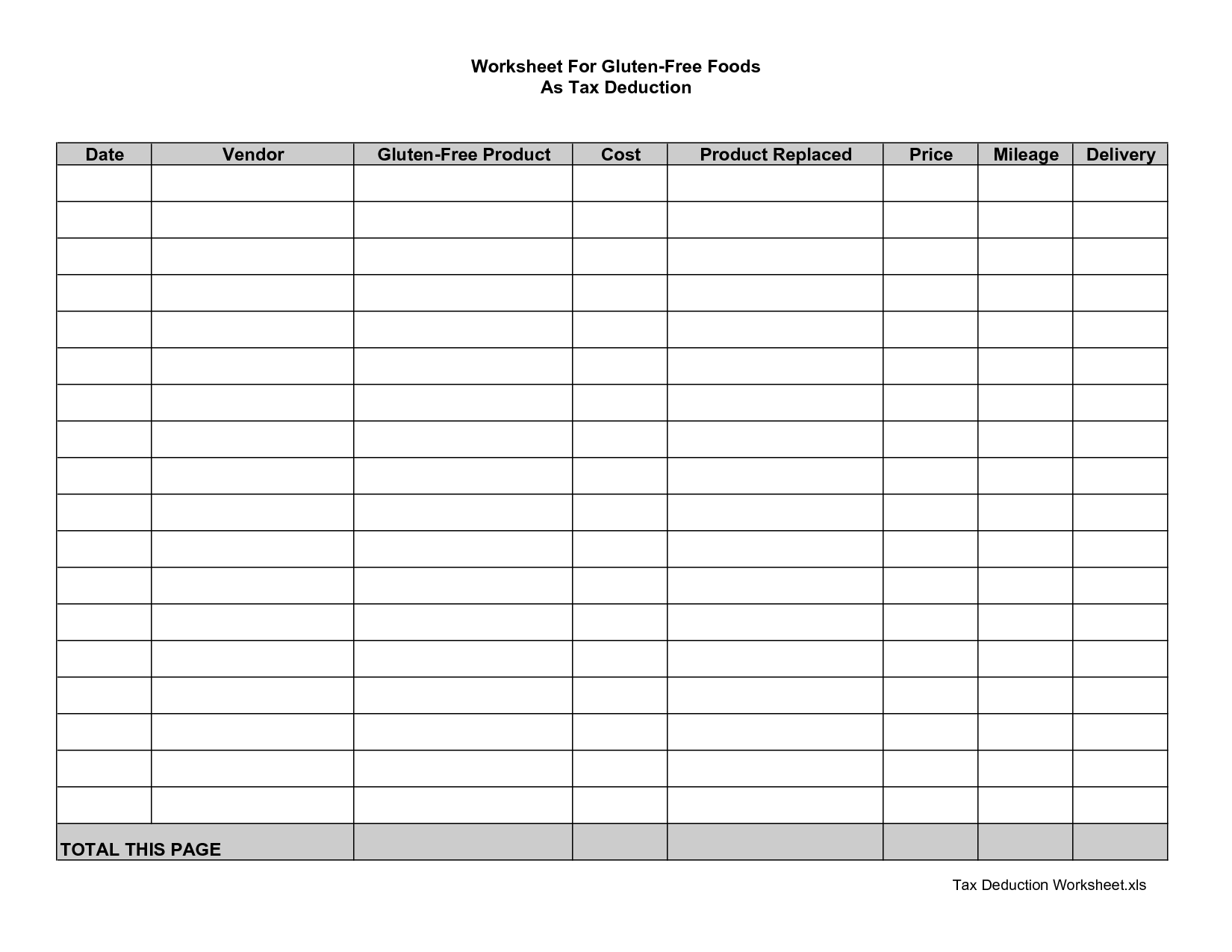

- Business Tax Deductions Worksheet

- Tax Form 4562 Examples

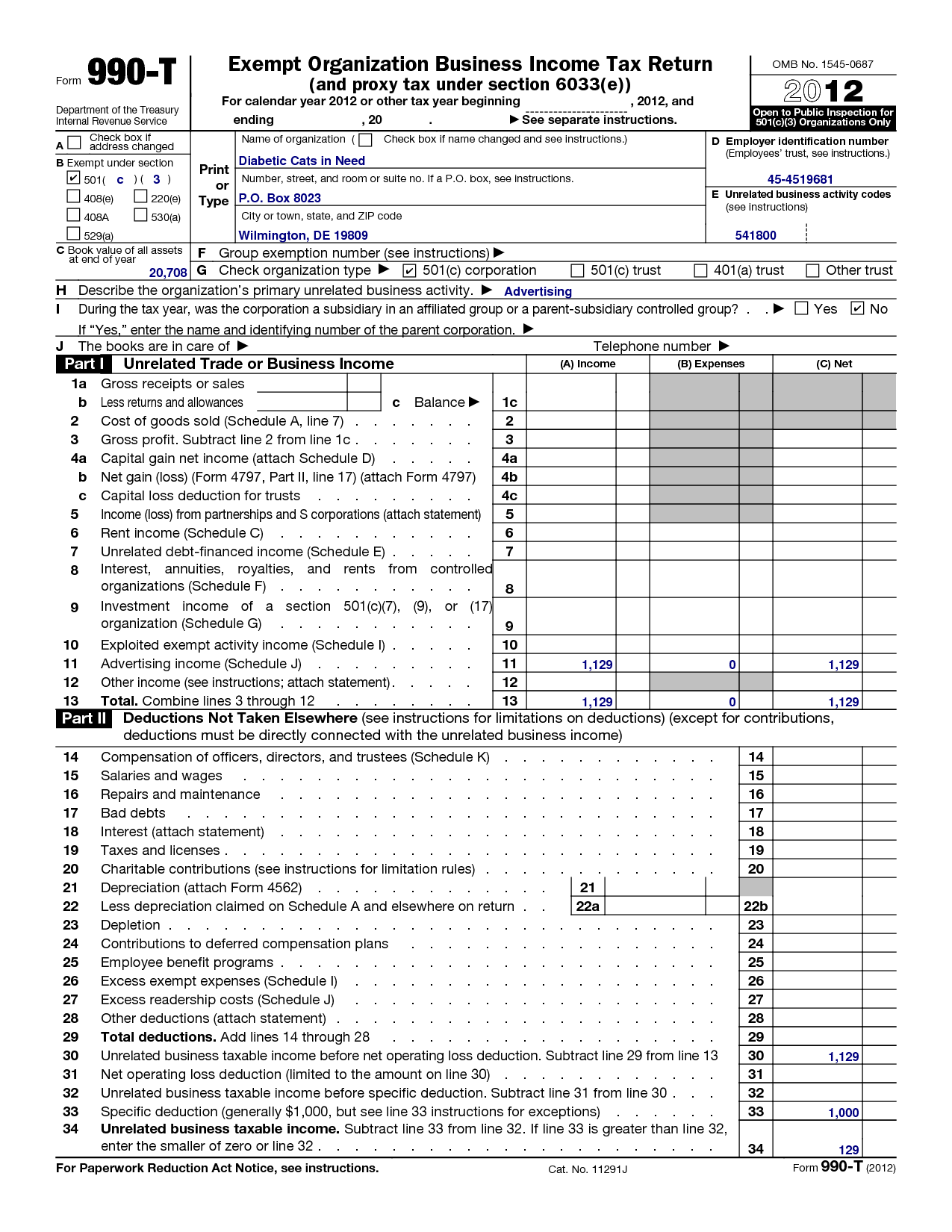

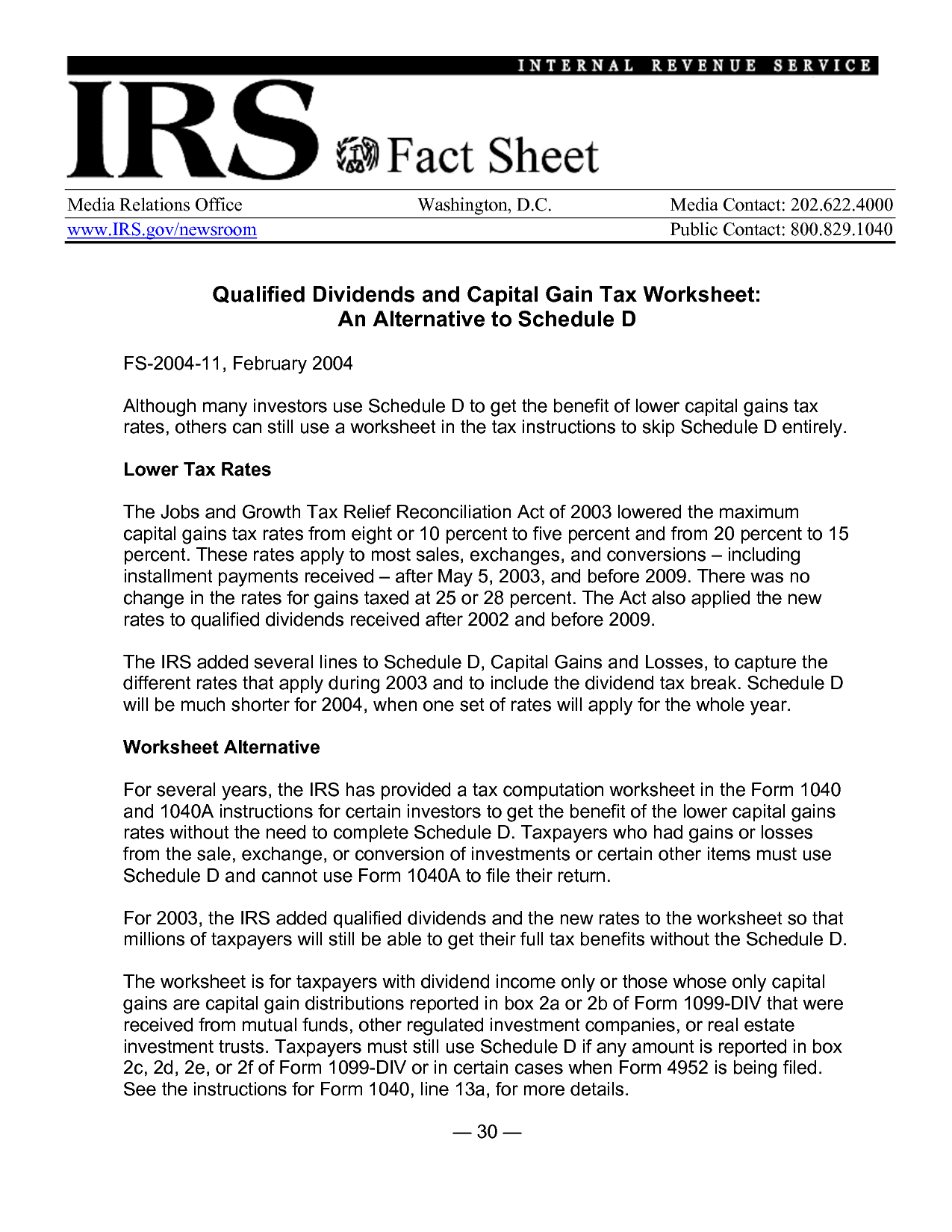

- IRS Capital Gains and Qualified Dividends Worksheet.pdf

- Federal Tax Form Schedule K

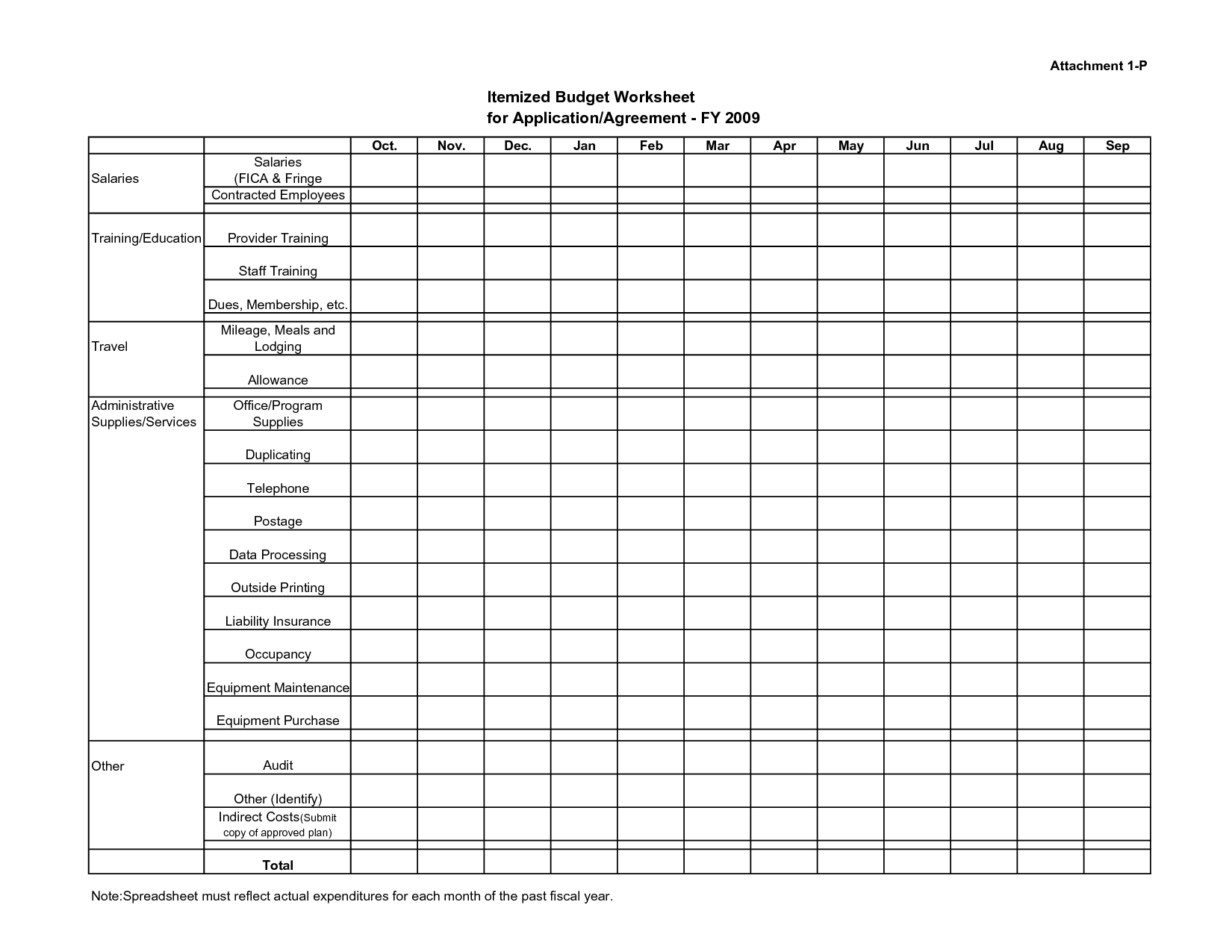

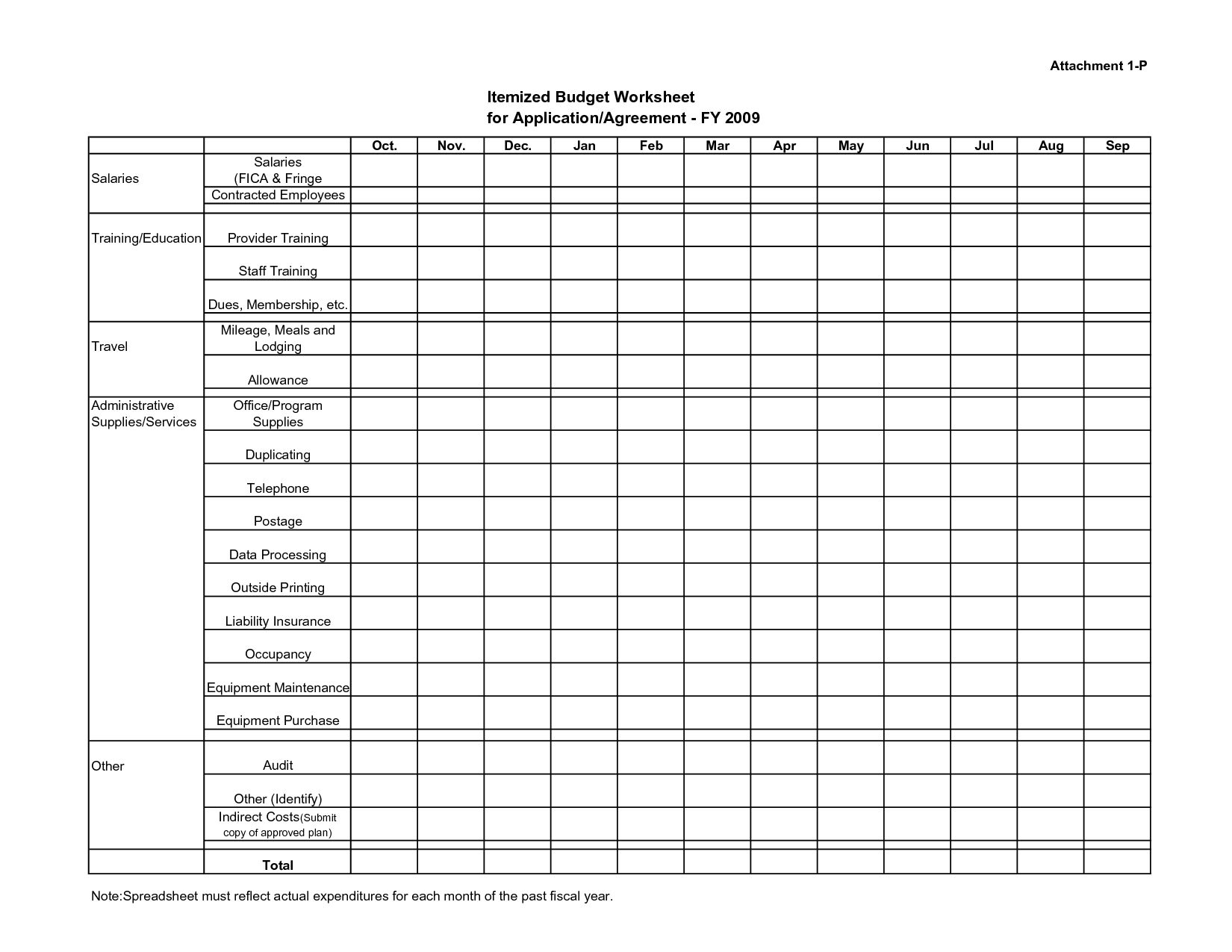

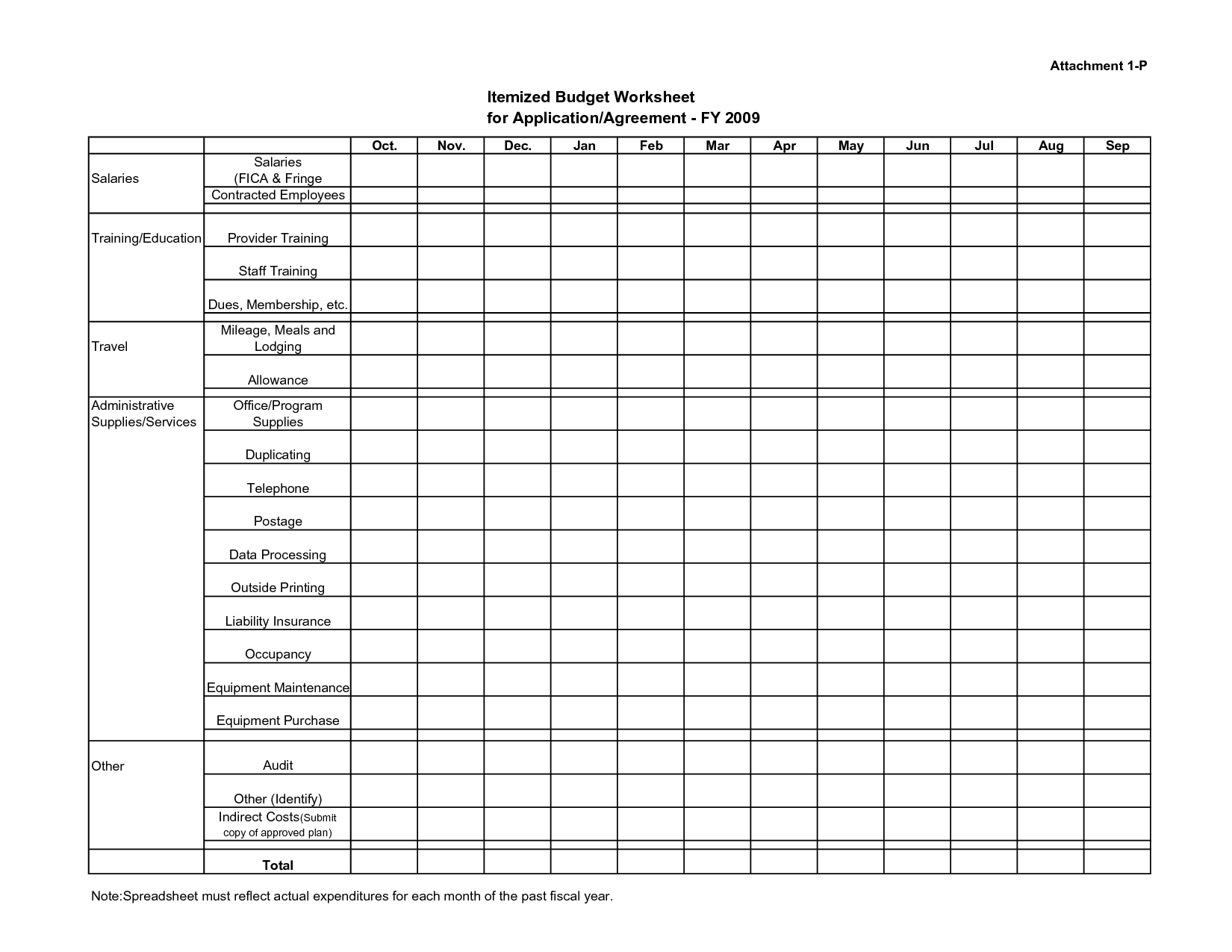

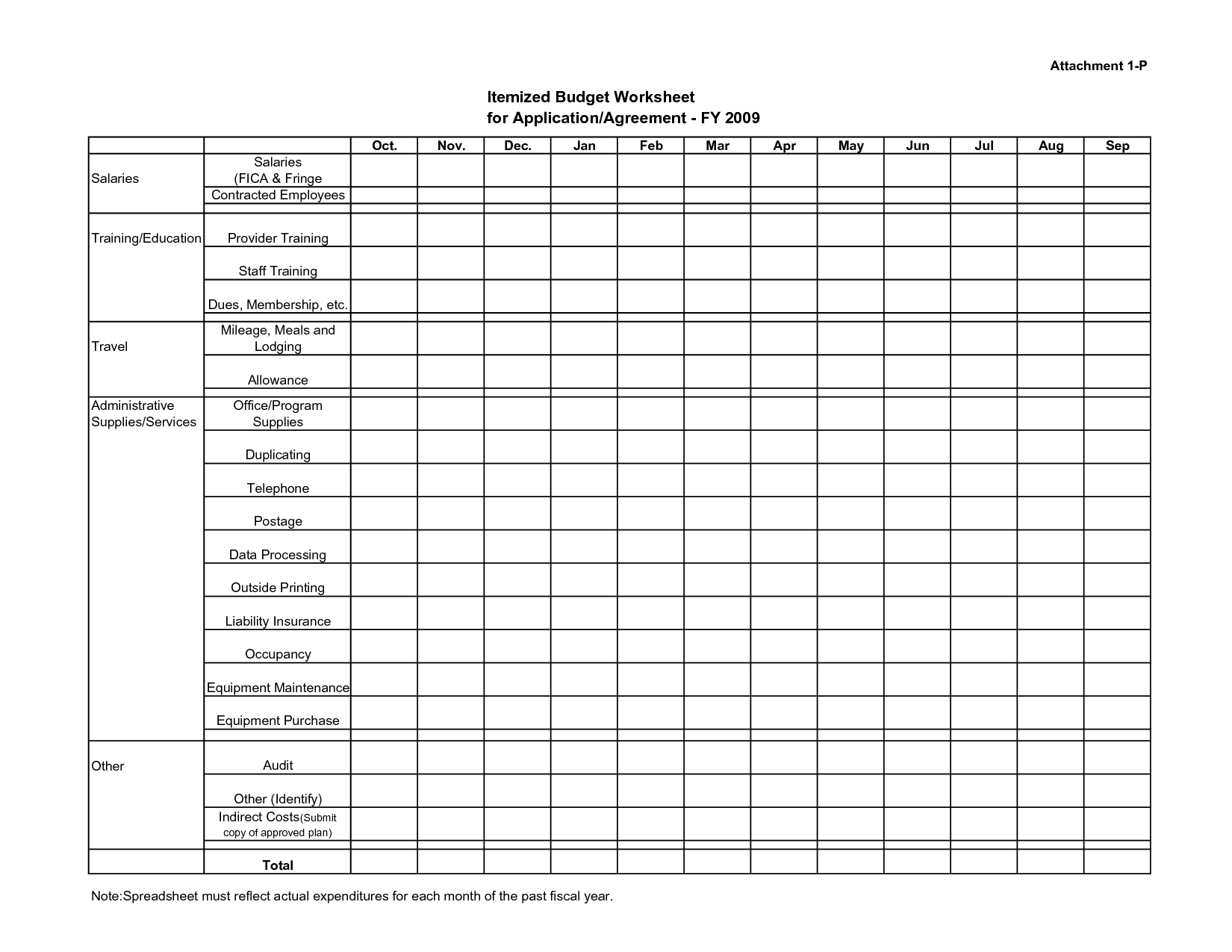

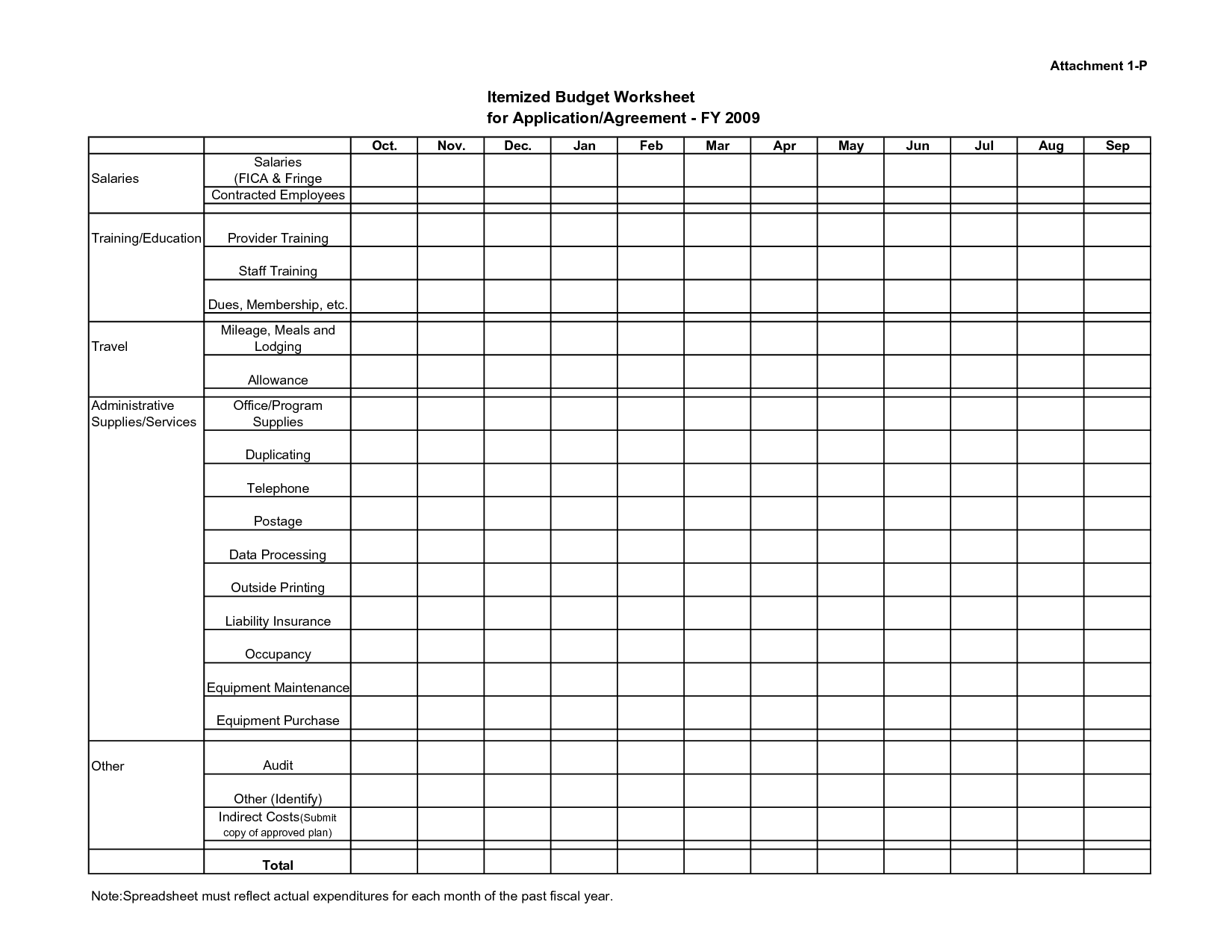

- Itemized Budget Worksheet Template

- Itemized Budget Worksheet Template

- Itemized Budget Worksheet Template

- Itemized Budget Worksheet Template

- Itemized Budget Worksheet Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

How can using a tax deduction worksheet for 2014 benefit me?

Using a tax deduction worksheet for 2014 can benefit you by helping you keep track of your eligible expenses and maximize your deductions, potentially reducing your taxable income and lowering your overall tax liability.

What information should be included in a tax deduction worksheet for 2014?

A tax deduction worksheet for 2014 should include information such as the taxpayer's income, expenses, and deductions, including details on mortgage interest, medical expenses, charitable contributions, and any other eligible deductions. It should also include supporting documentation such as receipts and statements.

Are there specific deductions that can be claimed using a tax deduction worksheet for 2014?

Yes, there are specific deductions that can be claimed using a tax deduction worksheet for 2014, such as those for medical expenses, mortgage interest, charitable contributions, and education expenses.

How can a tax deduction worksheet for 2014 help me track expenses related to my business?

A tax deduction worksheet for 2014 can help you track and categorize expenses that are directly related to your business, allowing you to claim these expenses as deductions on your tax return. It provides a organized system for documenting and calculating your deductible expenses, ultimately helping you maximize your potential tax savings.

Can a tax deduction worksheet for 2014 be used for deductions related to a rental property?

Yes, a tax deduction worksheet for 2014 can be used for deductions related to a rental property if the deductions are applicable to that tax year and meet the IRS requirements for rental property deductions.

Are there any guidelines or tips for filling out a tax deduction worksheet for 2014 if I have income from a related entity?

When filling out a tax deduction worksheet for 2014 with income from a related entity, it is important to accurately report all income and expenses related to that entity, following the guidelines provided by the IRS. Consult with a tax professional for specific tips and advice tailored to your situation.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments