Simple-Interest Printable Worksheets

Are you in search of simple-interest printable worksheets to help your child practice their math skills? Look no further! We have a variety of worksheets available that focus specifically on the concept of simple interest. Designed for students in elementary and middle school, these worksheets provide ample opportunities for your child to grasp the key concepts and hone their problem-solving abilities.

Table of Images 👆

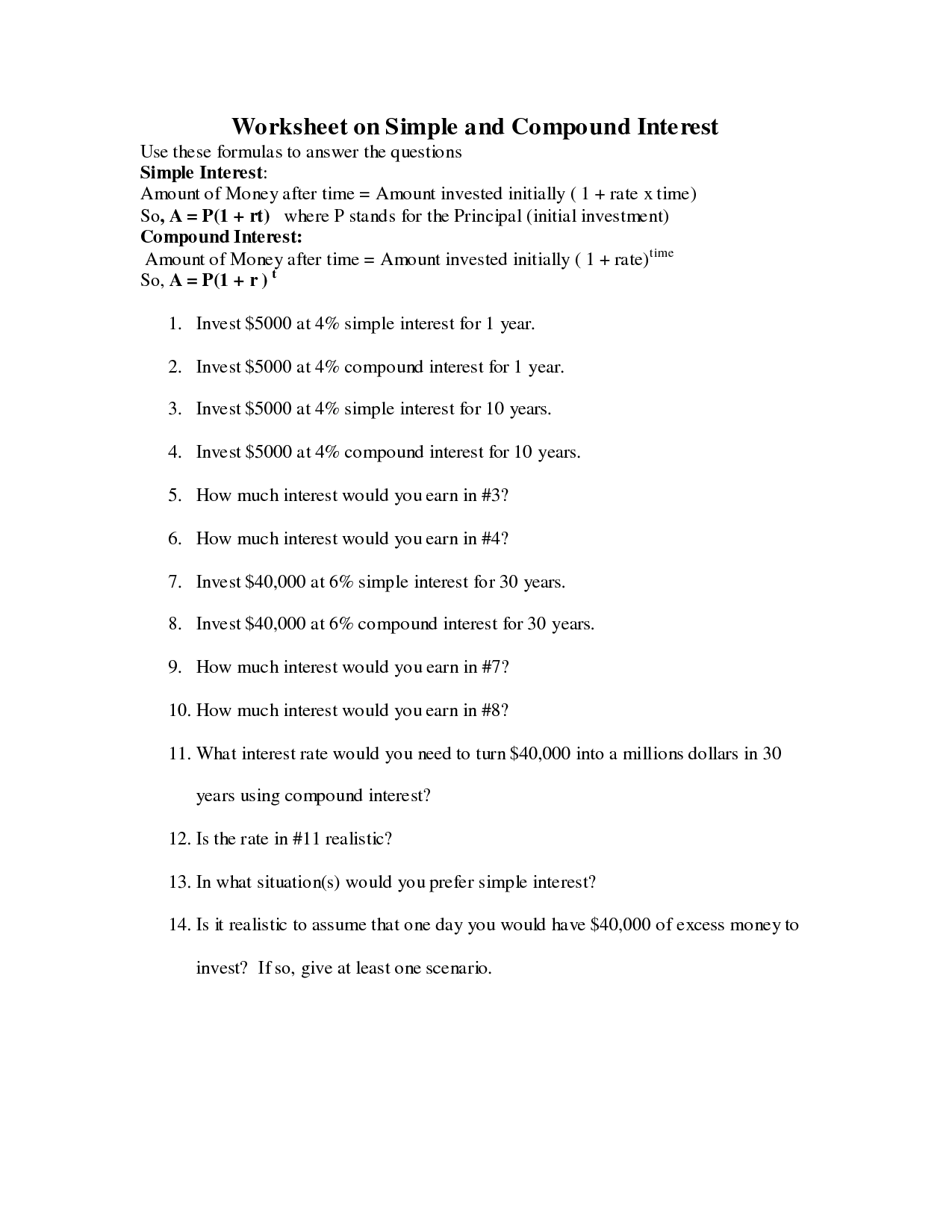

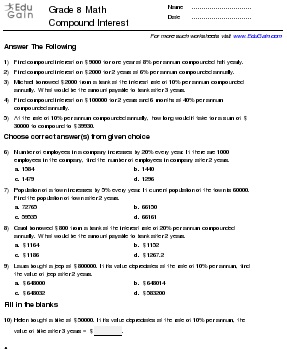

- Simple and Compound Interest Worksheets

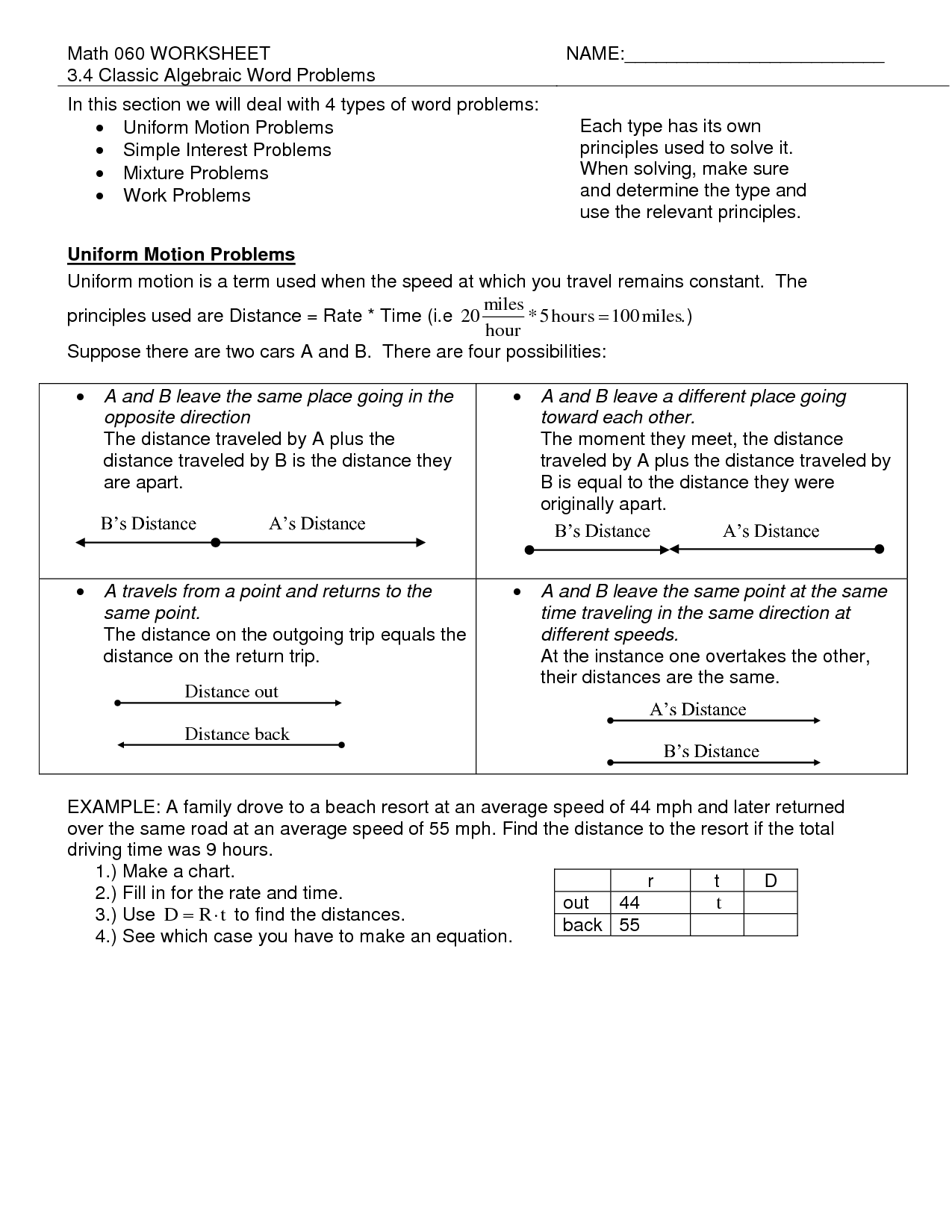

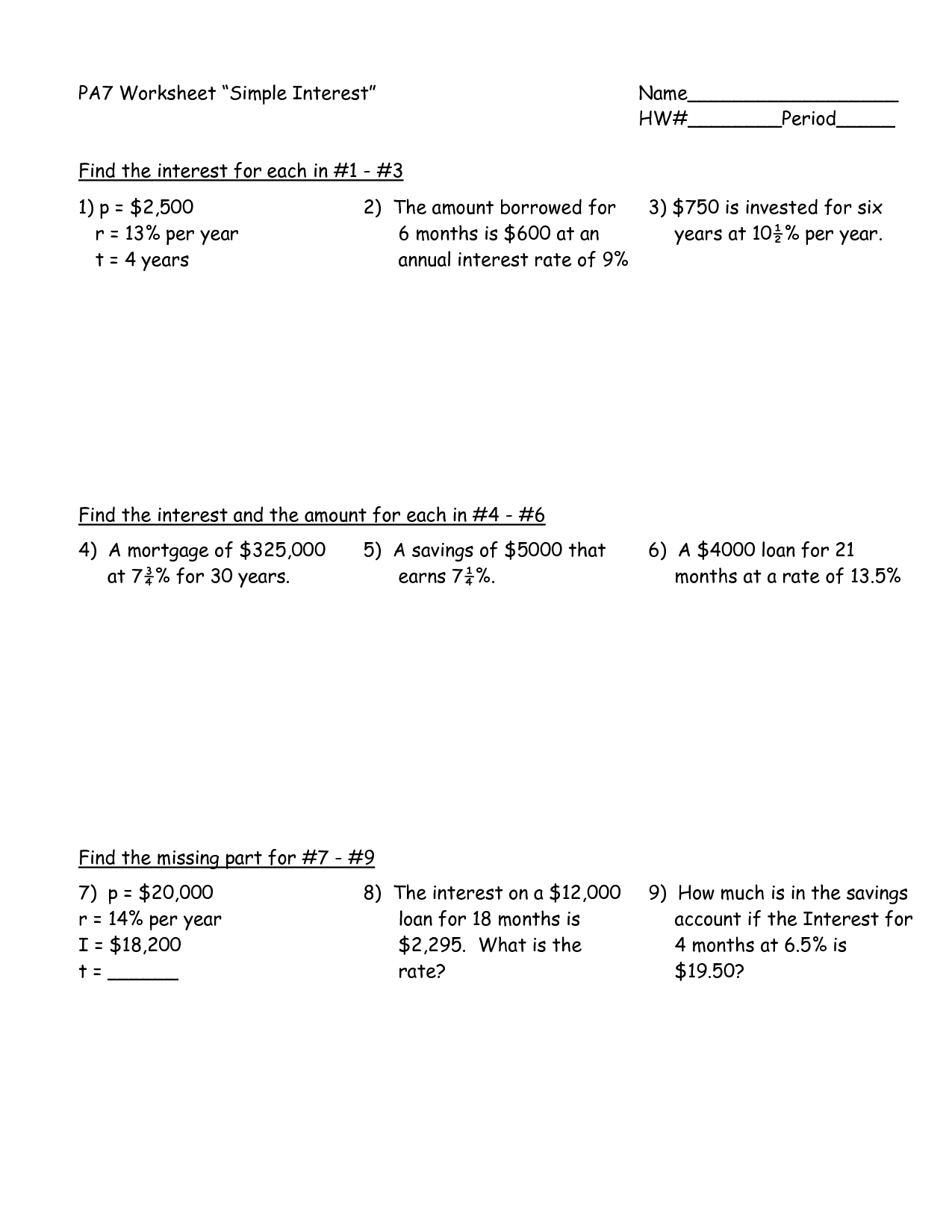

- 8th Grade Math Worksheet for Simple Interest

- Simple-Interest Word Problems Worksheet

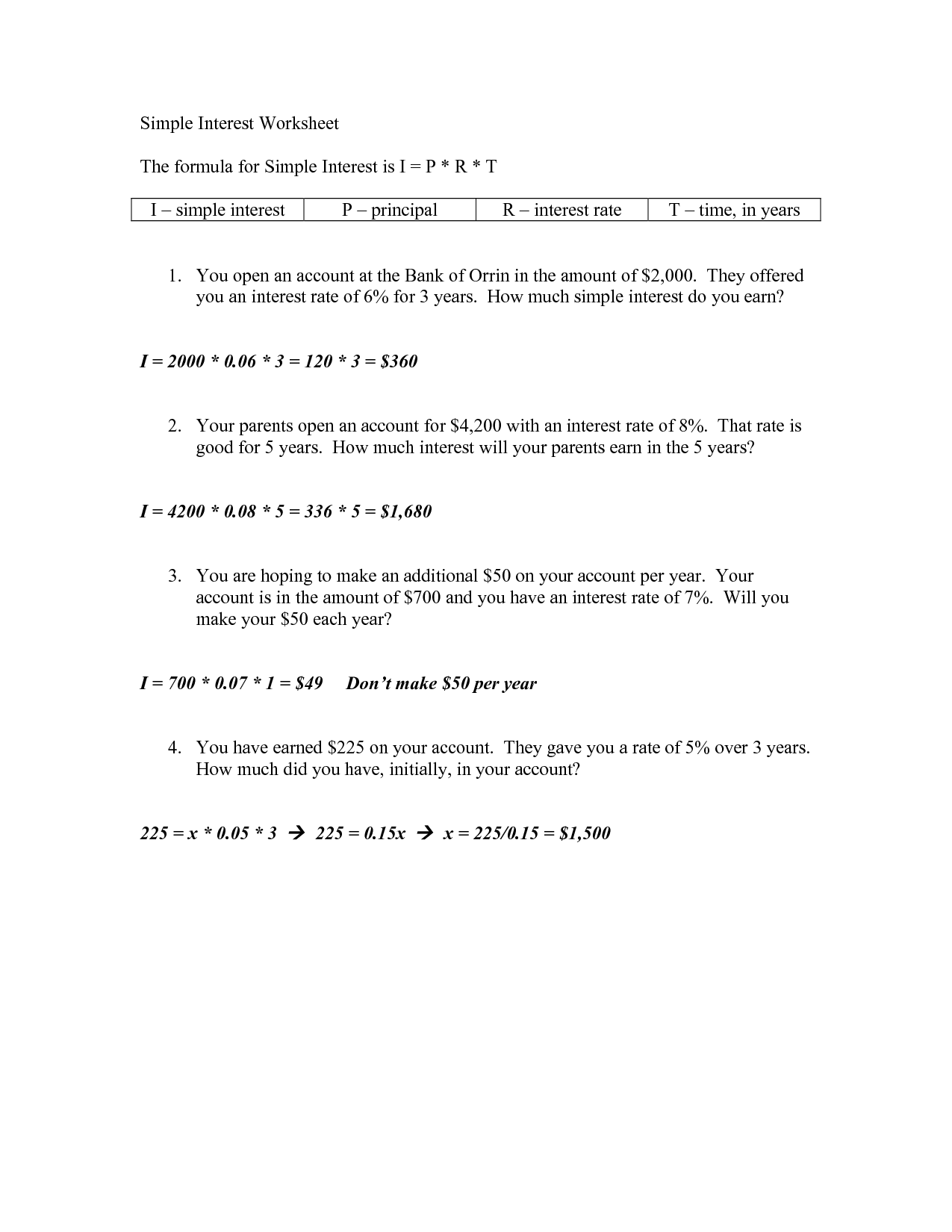

- Simple-Interest Worksheet

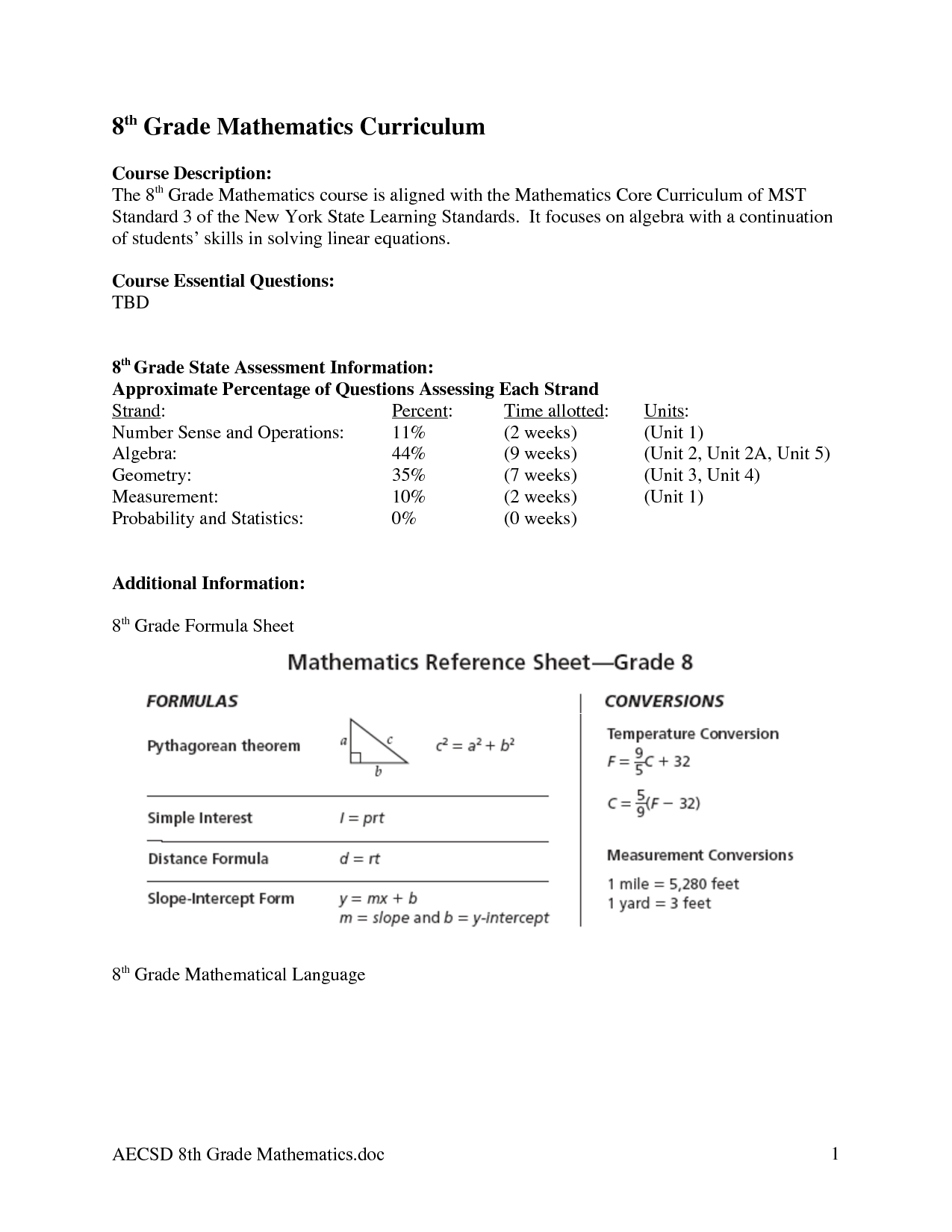

- 8th Grade Math Worksheets Printable

- Simple and Compound Interest Practice Worksheet

- Simple-Interest Math Worksheets

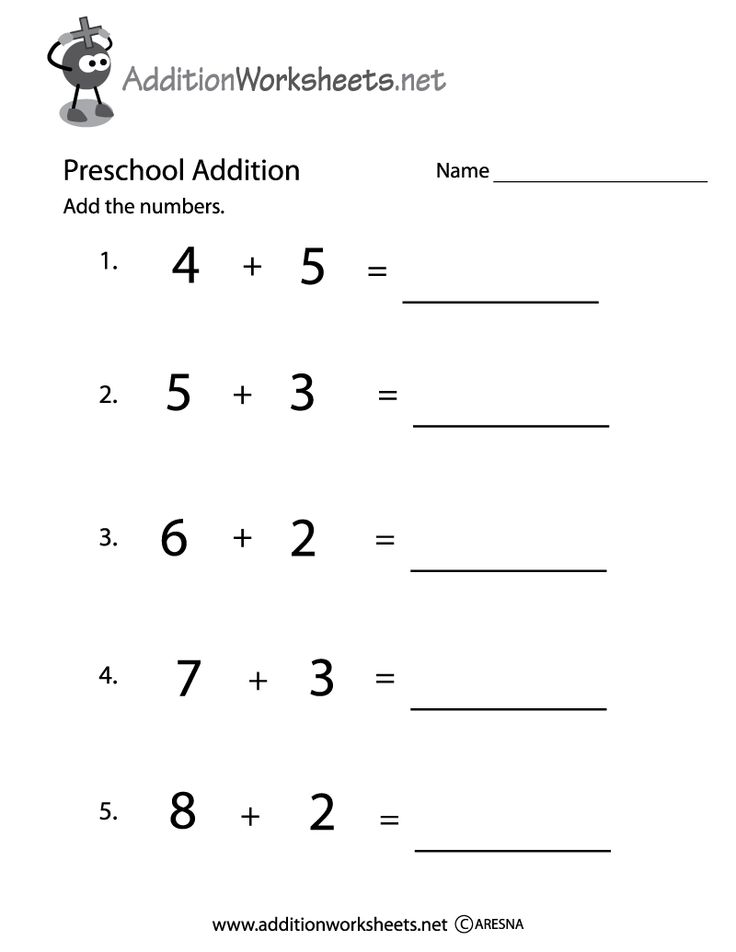

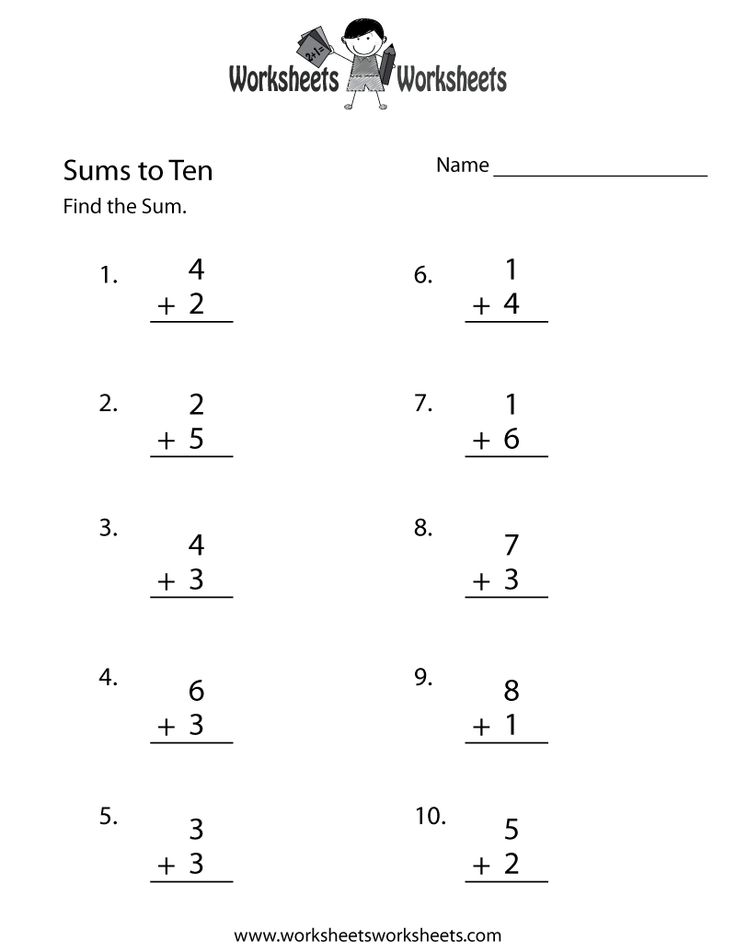

- Printable Simple Addition Worksheet

- Simple Addition Math Worksheets Printable

- Student Interest Inventory Printable

- Number Bonds Worksheets Answer

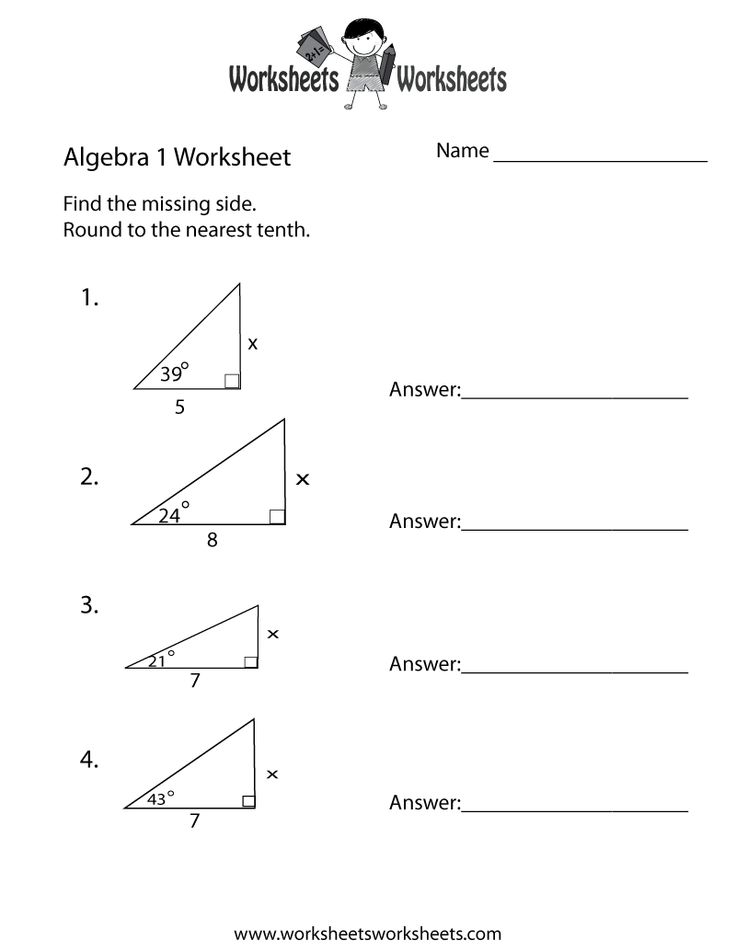

- Algebra 1 Worksheets Printable

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a simple interest?

Simple interest is a method of calculating interest that is applied only to the principal amount of a loan or investment. It does not take into account any interest that has been added on previously. The formula for simple interest is: interest = principal x rate x time. This means that the amount of interest accrued is directly proportional to the principal amount, the interest rate, and the length of time the money is loaned or invested for.

How is the simple interest calculated?

Simple interest is calculated by multiplying the principal amount of the loan or investment by the interest rate and the time period the money is borrowed or invested for. The formula for calculating simple interest is: Interest = (Principal amount) x (Interest rate) x (Time period). This type of interest does not compound, meaning that the interest amount remains constant throughout the period of the loan or investment.

What is the formula for calculating simple interest?

The formula for calculating simple interest is: I = P * r * t, where I is the interest amount, P is the principal amount, r is the rate of interest, and t is the time period in years.

How is the principal amount determined in simple interest?

The principal amount in simple interest is determined by the initial amount of money borrowed or invested. It is the original sum of money on which interest is calculated. This principal amount remains constant throughout the duration of the simple interest calculation and does not change unless additional funds are borrowed or invested.

How does the interest rate affect the amount of simple interest earned?

The interest rate directly impacts the amount of simple interest earned. A higher interest rate will result in a larger amount of simple interest earned on a principal amount, while a lower interest rate will result in a smaller amount of simple interest earned. This relationship shows that the interest rate is a significant factor in determining the total amount of interest accrued over a period of time.

Can simple interest be earned on investments or loans?

Yes, simple interest can be earned on investments or loans. Simple interest is calculated based on the initial principal amount of the investment or loan. The interest is determined by multiplying the principal amount by the interest rate and the time period. This means that the interest earned or paid remains constant throughout the duration of the investment or loan.

What are some real-life examples where simple interest is applicable?

Some real-life examples where simple interest is applicable include savings accounts, car loans, personal loans, and mortgages. For savings accounts, the interest earned is usually calculated using simple interest. Car loans and personal loans also often use simple interest to determine the total amount to be repaid over the loan term. Similarly, some mortgages may use simple interest to determine monthly payments.

How can simple interest be used to compare different investment or loan options?

Simple interest can be used to compare different investment or loan options by calculating the total amount of interest earned or paid over the same period of time. By comparing the total interest amounts for each option, investors or borrowers can determine which option will provide the highest return on an investment or cost the least in interest payments. This allows individuals to make more informed decisions when choosing between different investment or loan opportunities.

Are there any disadvantages or limitations of using simple interest?

While simple interest is easier to calculate and understand compared to compound interest, one major disadvantage is that it does not take into account the compounding effect of interest earnings over time. This means that simple interest may result in lower returns on investments or loans compared to compound interest, which can grow exponentially over time. Additionally, simple interest does not consider fluctuations in interest rates or changes in the principal amount, limiting its accuracy and applicability in complex financial scenarios.

Are there any variations or modifications of the simple interest formula?

Yes, there are variations and modifications of the simple interest formula that can be used depending on the specific scenario. One common modification is the compound interest formula, which takes into account the effect of earning interest on both the original principal and any accumulated interest. This formula is used for situations where interest is added to the principal amount at regular intervals. Another variation is the continuously compounded interest formula, which assumes that interest is added infinitely often, resulting in a more complex mathematical equation. These variations provide more accurate calculations for scenarios where interest is compounded more frequently than once or at regular intervals.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments