Setting Up a Budget Worksheet

Creating and maintaining a budget is essential for anyone who wants to take control of their finances and achieve their financial goals. A budget worksheet is a valuable tool that can help you track your income, expenses, and savings in a systematic and organized way. With an easy-to-use format that allows you to input your financial information and calculate your budget at a glance, a budget worksheet can be a game-changer for individuals and families looking to optimize their financial management.

Table of Images 👆

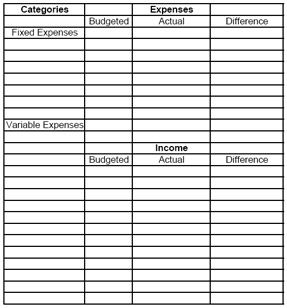

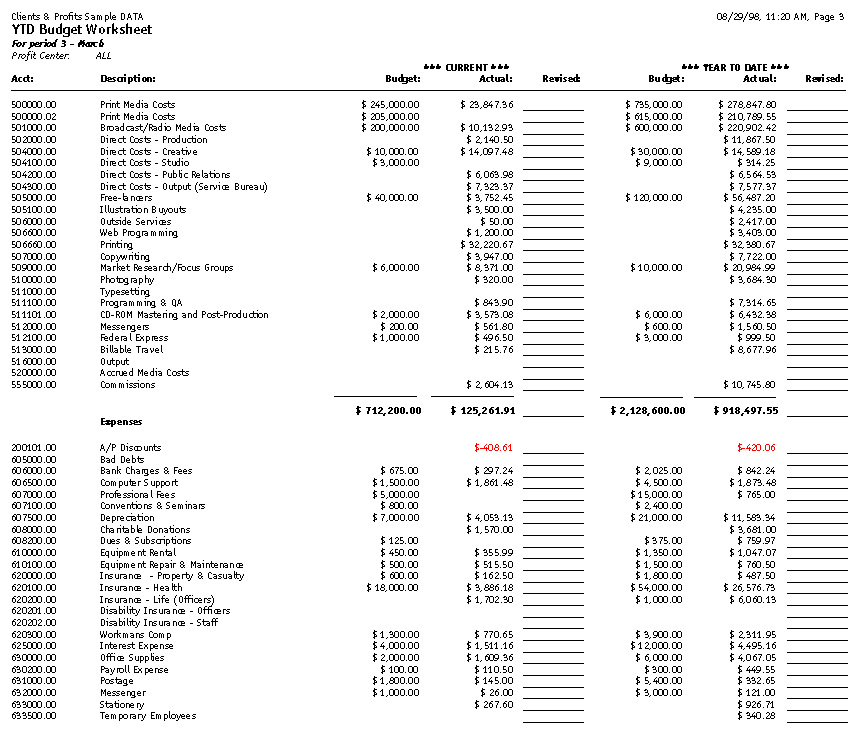

- Budget Worksheet

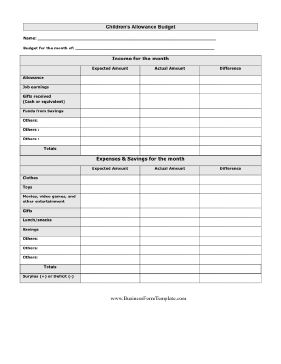

- Basic Business Budget Worksheet

- Business Budget Forms Templates Printable

- Church Budget Worksheet Template

- Printable Household Budget Worksheets

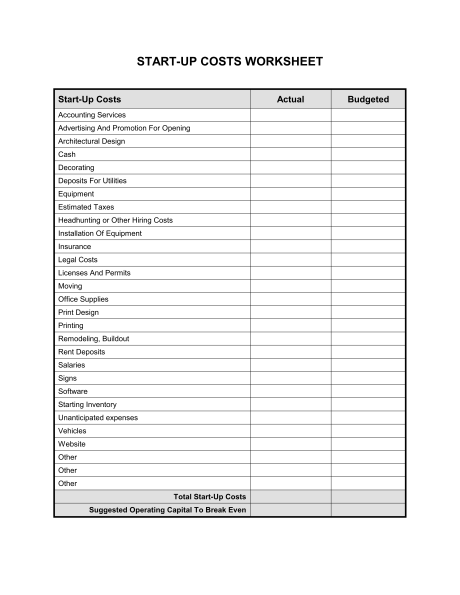

- Business Start Up Costs Spreadsheet

- Blank Personal Monthly Budget Worksheet

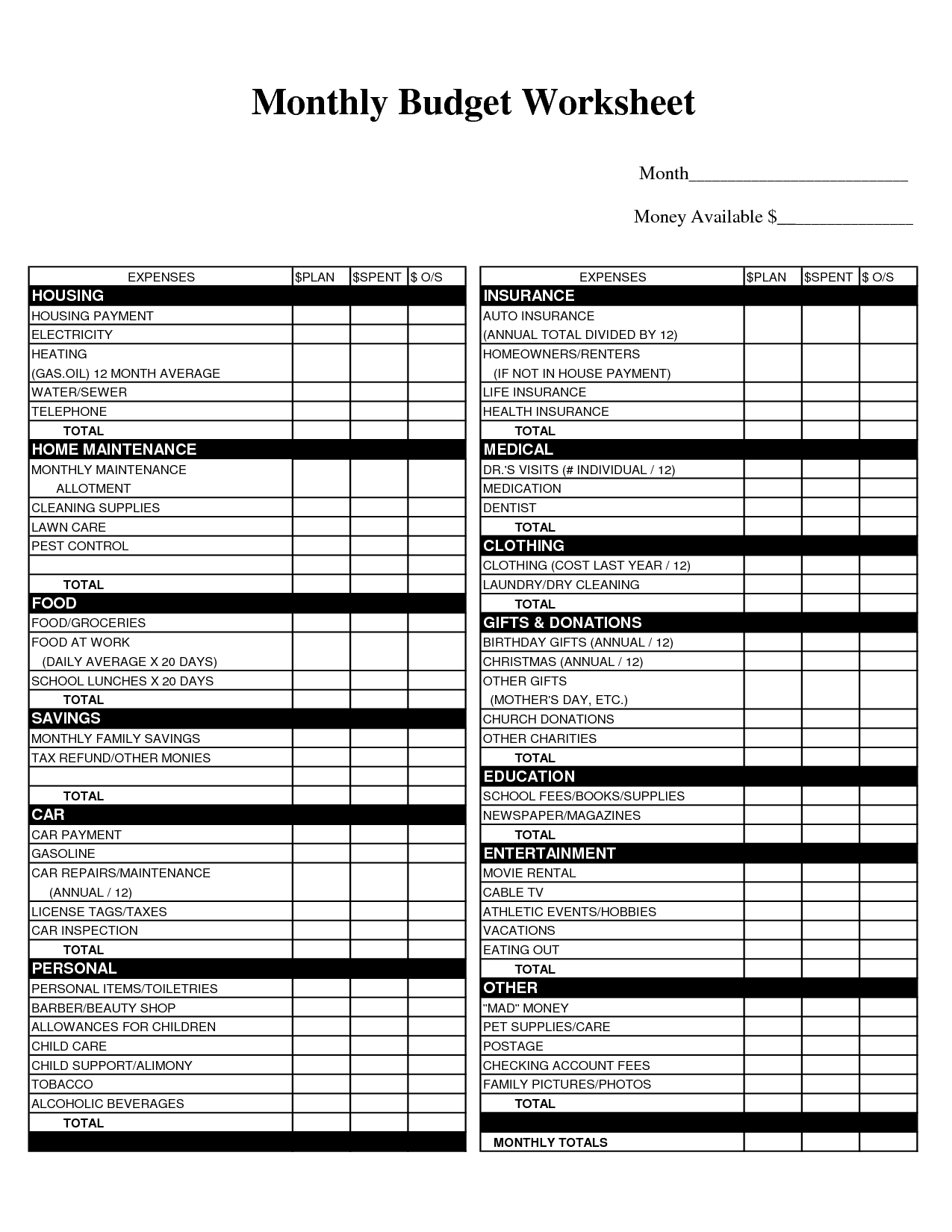

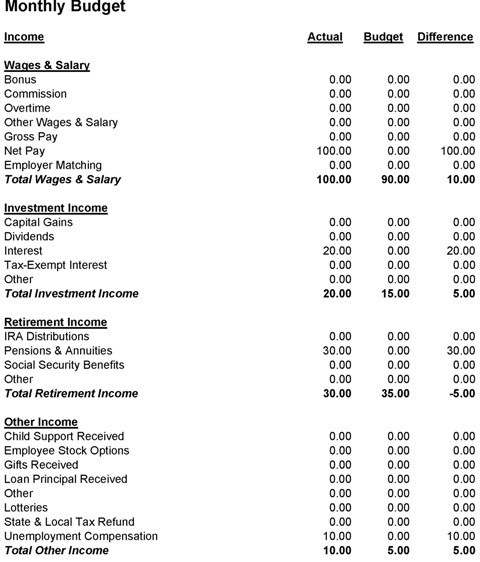

- Monthly Budget Worksheet PDF

- The Monthly Home Budget Worksheet for Excel

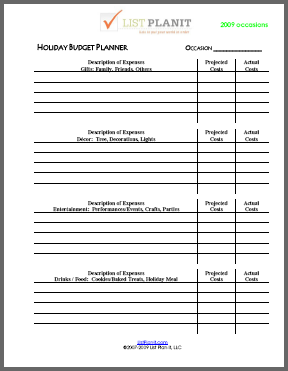

- Holiday Budget Worksheet

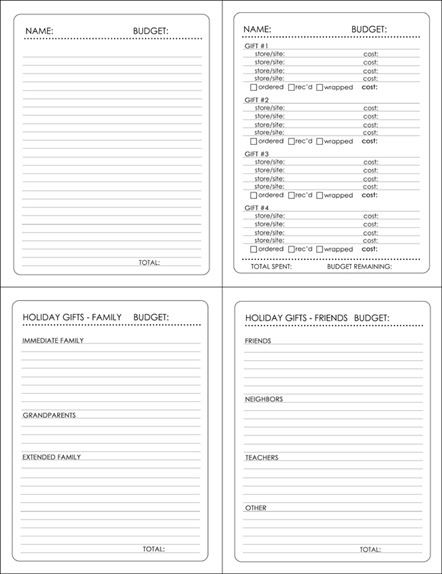

- Printable Christmas Gift Budget

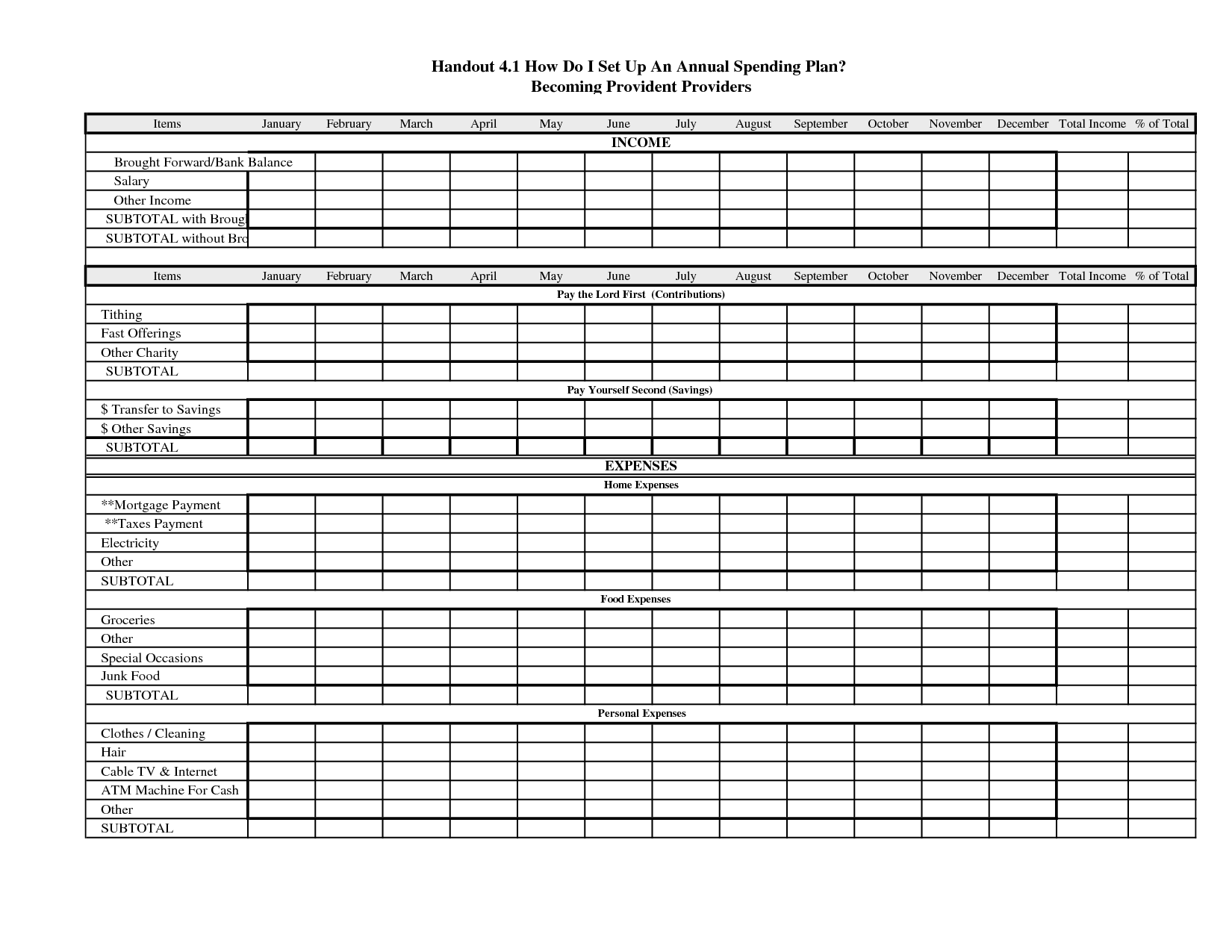

- Annual Budget Spreadsheet Template

- Blank Worksheet Budget Sheet

- Household Financial Budget Worksheet

- Grocery Shopping Lesson Plan Worksheet

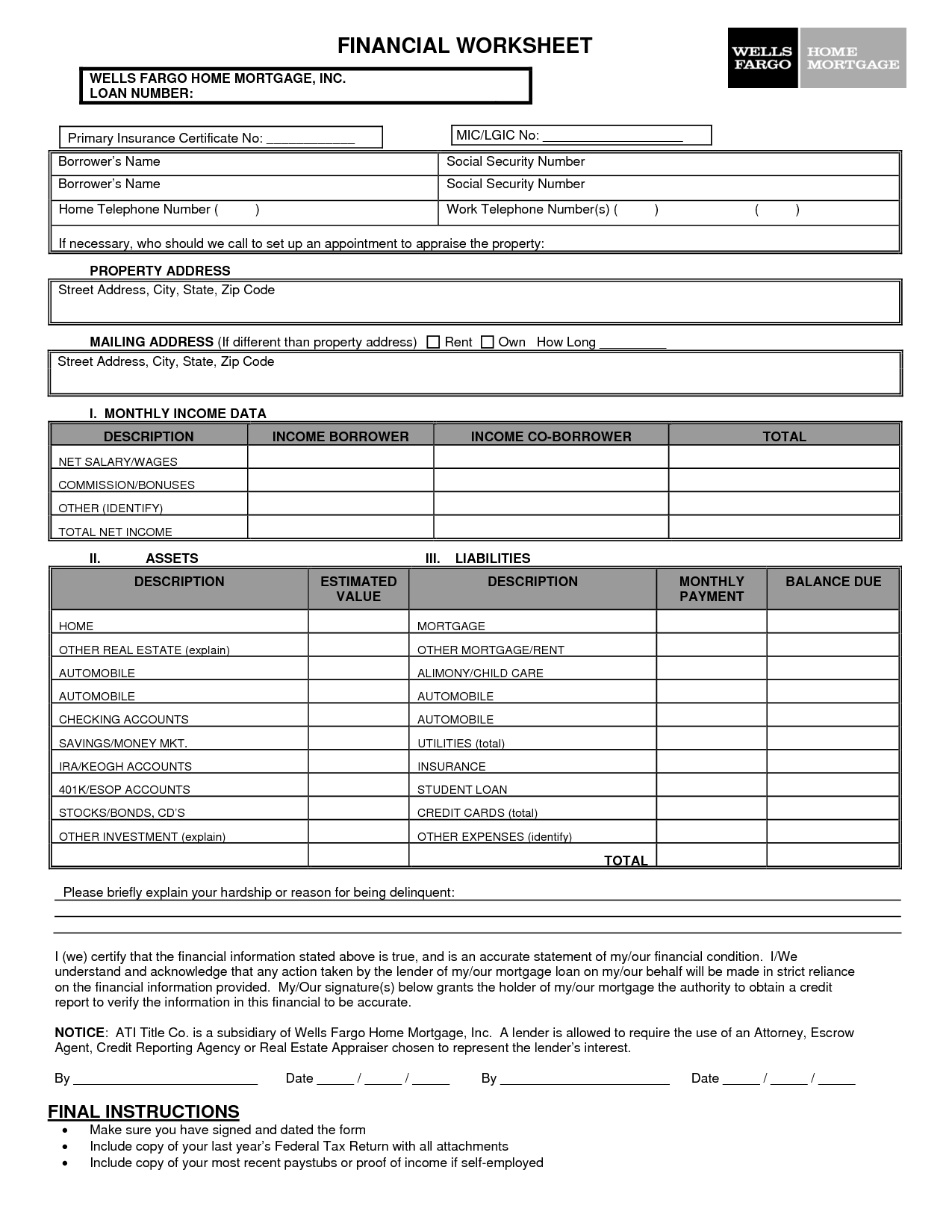

- Wells Fargo Financial Worksheet

- Free Household Budget Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

What is the purpose of setting up a budget worksheet?

The purpose of setting up a budget worksheet is to effectively track, manage, and analyze your finances. It allows you to plan how much money you will allocate to different expense categories, keep track of your spending, identify areas where you can cut costs or save more, and ultimately work towards your financial goals by ensuring you are living within your means and making sound financial decisions.

How often should a budget worksheet be updated?

A budget worksheet should ideally be updated on a regular basis, such as at least once a month or whenever there are significant changes to your income or expenses. Regular updates help in keeping track of your financial situation, making adjustments as needed, and staying on top of your financial goals.

What are the essential components of a budget worksheet?

A budget worksheet typically includes sections for income sources, expenses (fixed and variable), savings goals, debt payments, and a section for tracking actual spending against the budgeted amounts. It is essential to have a clear layout, accurate figures, and calculation formulas to ensure that the budget stays balanced and that financial goals are met. Regularly updating and reviewing the budget worksheet is also crucial for effective financial planning and management.

How can one determine their income sources on a budget worksheet?

To determine income sources on a budget worksheet, you need to identify all sources of income that regularly come in each month. This includes salaries, wages, bonuses, rental income, side hustles, child support, and any other sources of money you receive. List each income source and its corresponding amount on the budget worksheet to get a clear picture of your total monthly income.

How should expenses be categorized on a budget worksheet?

Expenses should be categorized on a budget worksheet based on their type, such as housing, transportation, groceries, utilities, and entertainment. This helps to clearly see where money is being spent and identify areas for potential cost savings. Additionally, subcategories can be detailed within each main category to provide more specific information on spending patterns and help in creating a more detailed and accurate budget.

What strategies can be used to estimate variable expenses on a budget worksheet?

To estimate variable expenses on a budget worksheet, consider reviewing past expenses for each category, such as groceries, transportation, and entertainment, and calculating an average monthly spend. You can also break down variable expenses into sub-categories to forecast potential fluctuations, like seasonal changes in utility bills. Additionally, consider using budgeting tools or apps that track spending trends and provide insights to help estimate future variable expenses more accurately. Regularly updating and adjusting your estimates based on actual spending will help in fine-tuning your budget worksheet for better financial planning.

How can one prioritize savings or debt repayment on a budget worksheet?

To prioritize savings or debt repayment on a budget worksheet, start by listing out all sources of income and expenses. Then, categorize your expenses into essentials (such as rent, utilities, and groceries) and non-essentials (like dining out or entertainment). After covering essential expenses, allocate a portion of your income towards both savings and debt repayment. Consider focusing on high-interest debt first to minimize overall interest costs while also building an emergency fund for unexpected expenses. Adjust your budget as needed to ensure consistent progress towards both savings and debt repayment goals.

What are some common mistakes to avoid when setting up a budget worksheet?

Some common mistakes to avoid when setting up a budget worksheet include not accurately tracking all expenses, underestimating or forgetting certain expenses, not adjusting the budget periodically, not accounting for irregular expenses, ignoring savings or emergency funds, and not being realistic about income and expenses. It's important to be thorough, detailed, and realistic when creating a budget worksheet to ensure it is effective in managing finances.

How can a budget worksheet help in tracking financial goals?

A budget worksheet can help in tracking financial goals by providing a clear overview of income and expenses, allowing individuals to allocate funds towards specific goals. By outlining income sources and categorizing expenses, one can identify areas where spending can be reduced or reallocated to prioritize savings and investments towards achieving financial goals. Regularly updating and comparing the budget worksheet enables individuals to track progress, make adjustments if needed, and stay focused on their long-term financial objectives.

What are some useful tips for staying motivated and disciplined when using a budget worksheet?

To stay motivated and disciplined when using a budget worksheet, set specific financial goals, track your progress regularly, reward yourself for meeting milestones, be realistic with your budget, review and adjust as needed, stay focused on the bigger picture, and seek support from friends or family for accountability. Additionally, find ways to make budgeting enjoyable by incorporating elements that align with your interests or preferences. Remember that staying committed to your budget will lead to greater financial stability and peace of mind in the long run.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments