Self -Employed Tax Worksheet

Calculating and organizing your taxes as a self-employed individual can be a daunting task. However, with the help of worksheets specifically designed for this purpose, you can simplify the process and ensure accurate reporting of your income and expenses. Worksheets provide a structured format to track and calculate your self-employment earnings and deductible expenses, making tax preparation more manageable for freelancers, independent contractors, and small business owners.

Table of Images 👆

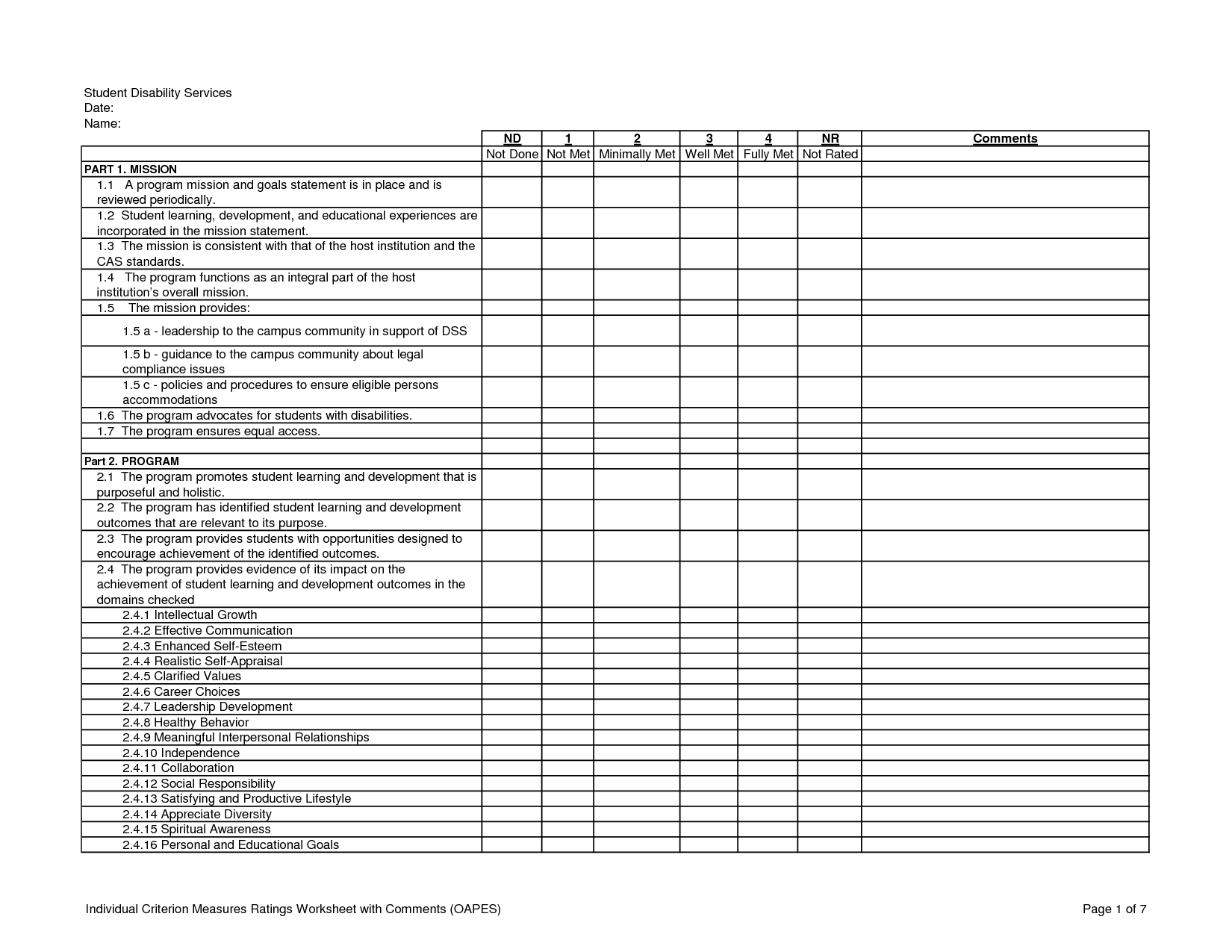

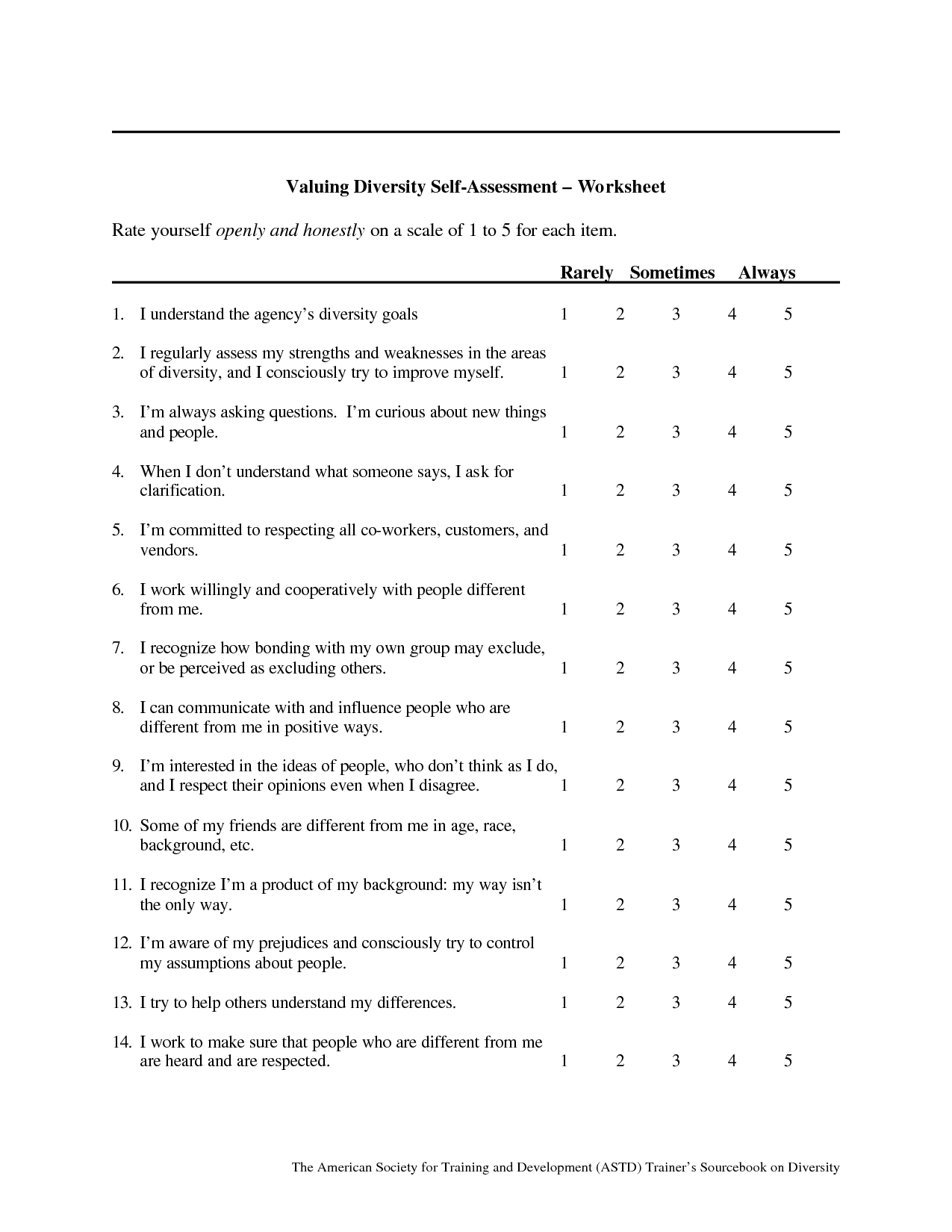

- Free Self-Esteem Building Worksheets

- Personal Self-Assessment Worksheets

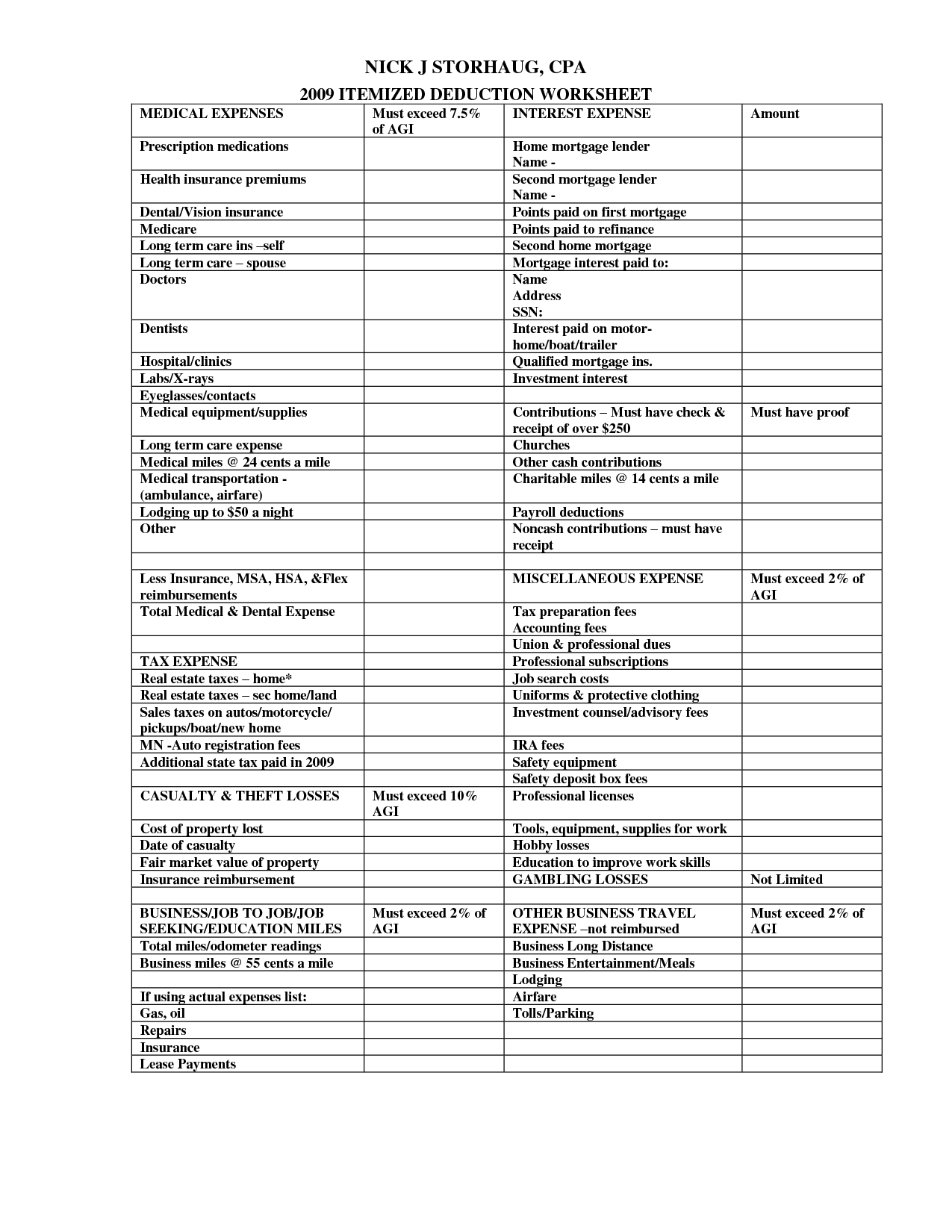

- Tax Itemized Deduction Worksheet

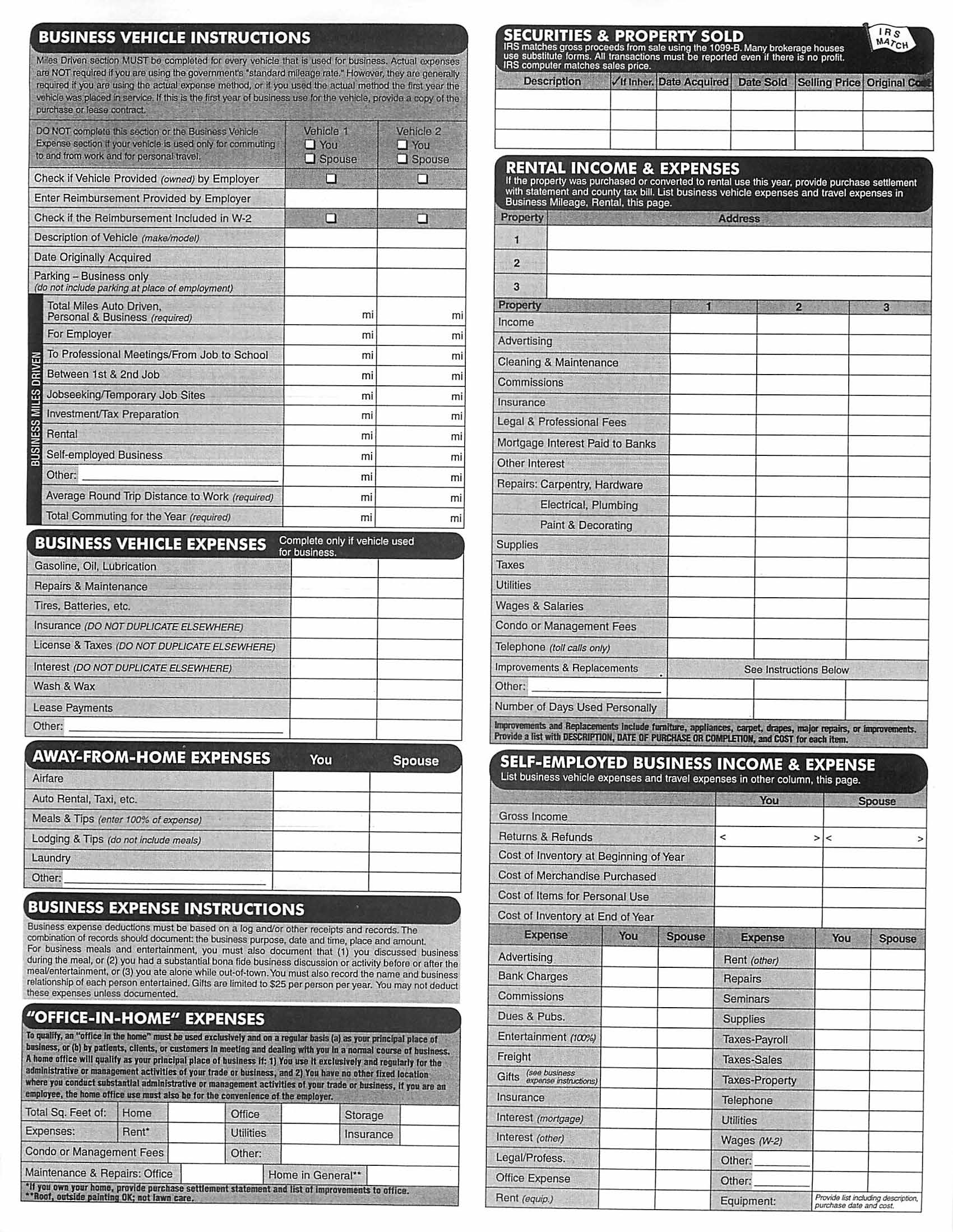

- Tax Preparation Organizer Worksheet

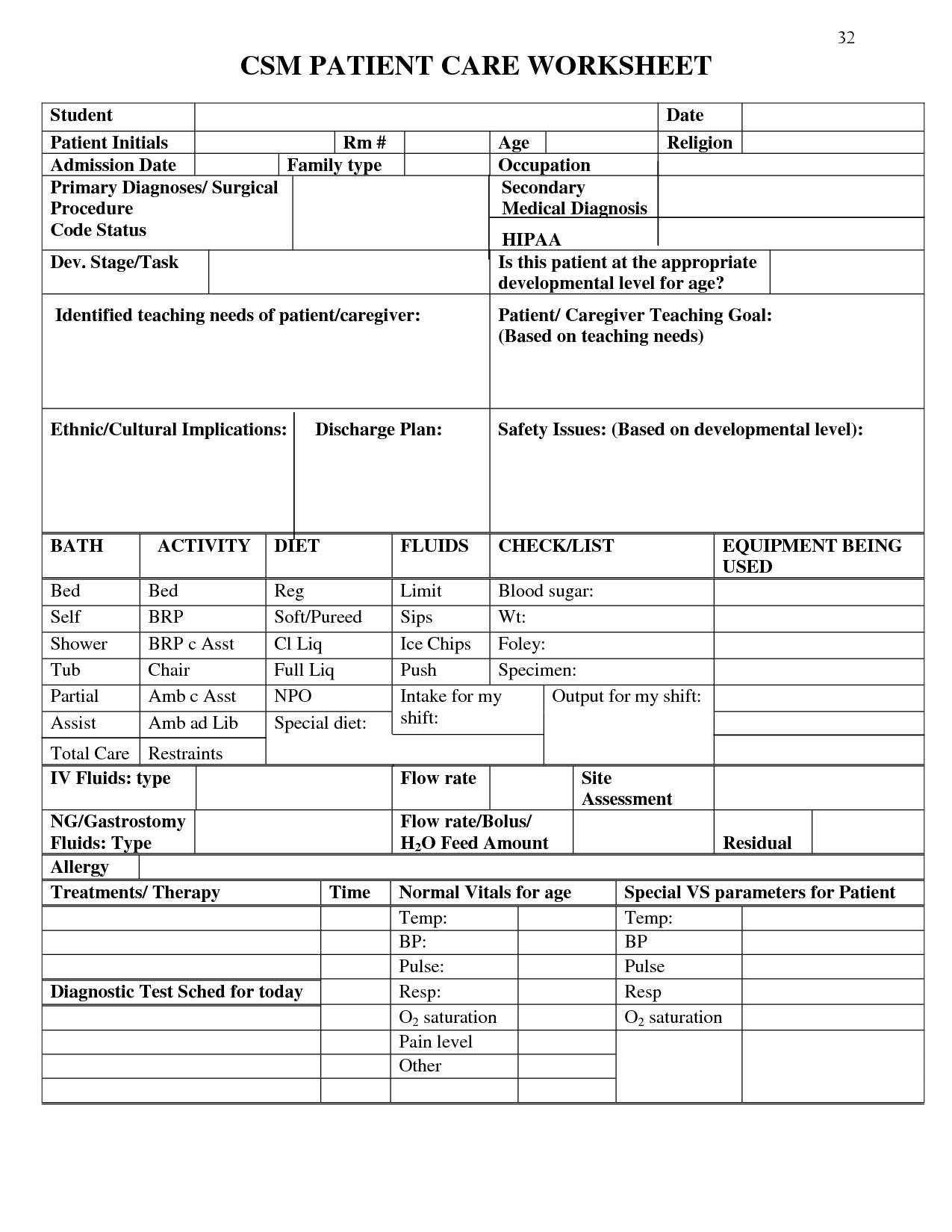

- Nursing Patient Worksheets

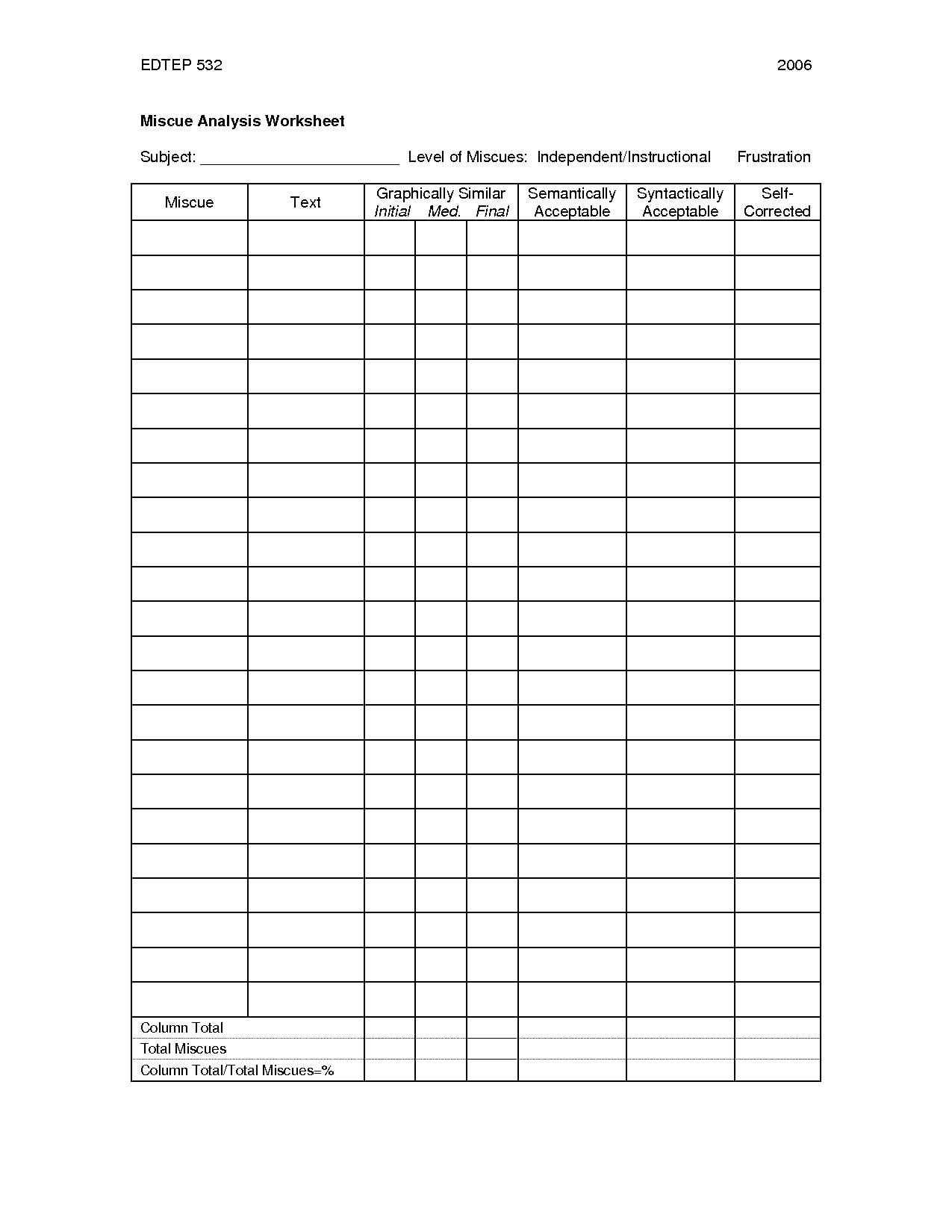

- Miscue Analysis Worksheet for Reading

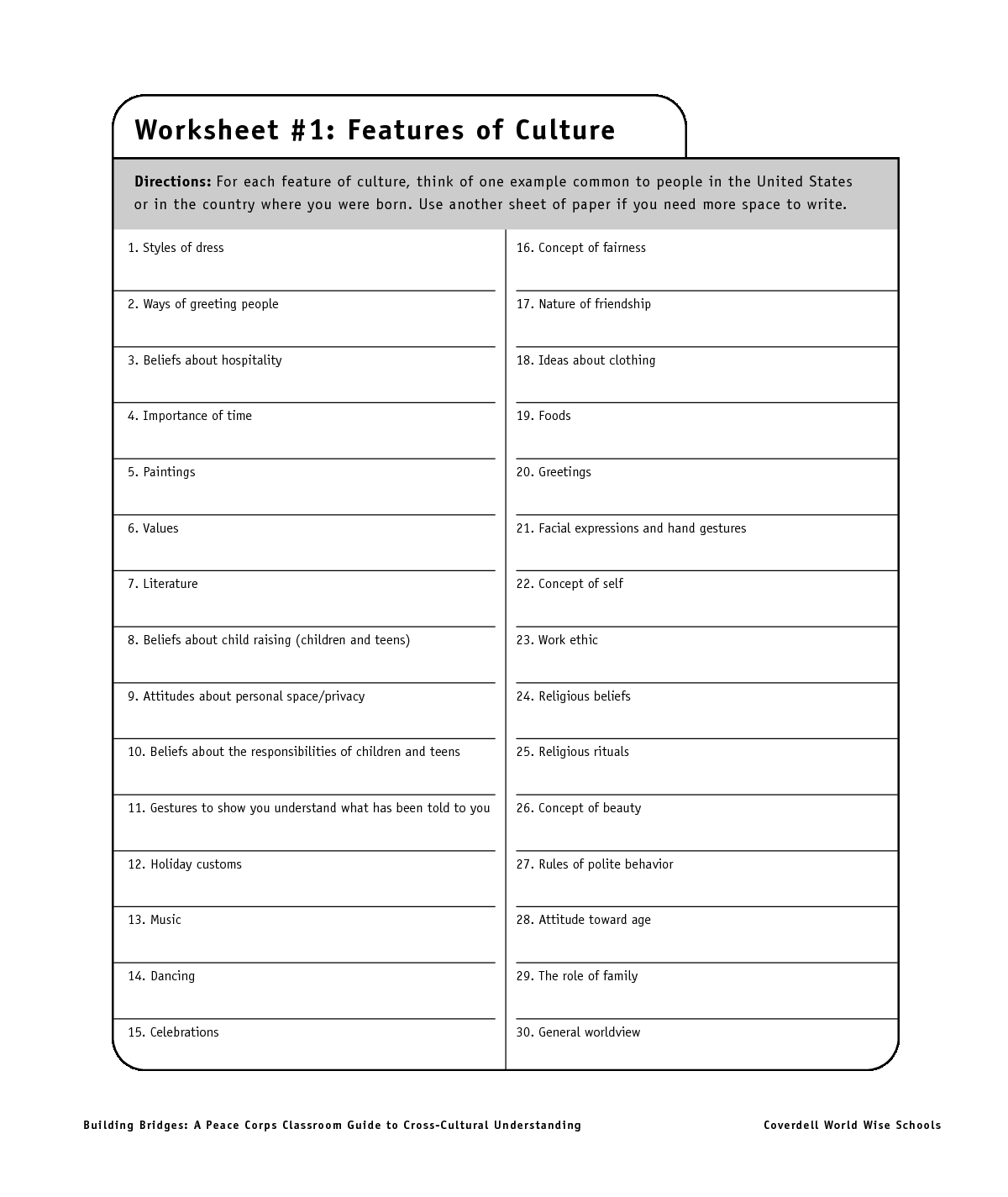

- Features of Culture Worksheet

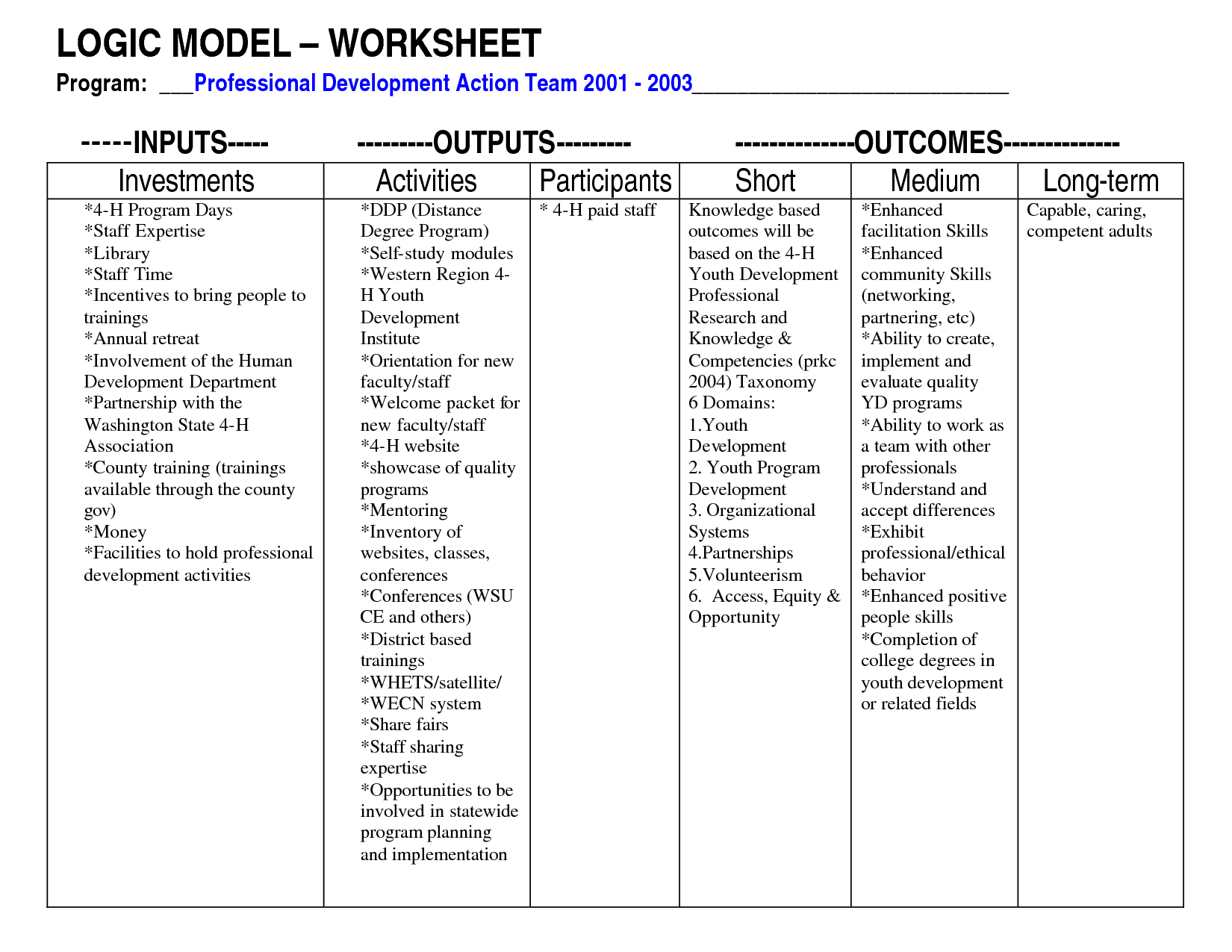

- Logic Model Worksheet

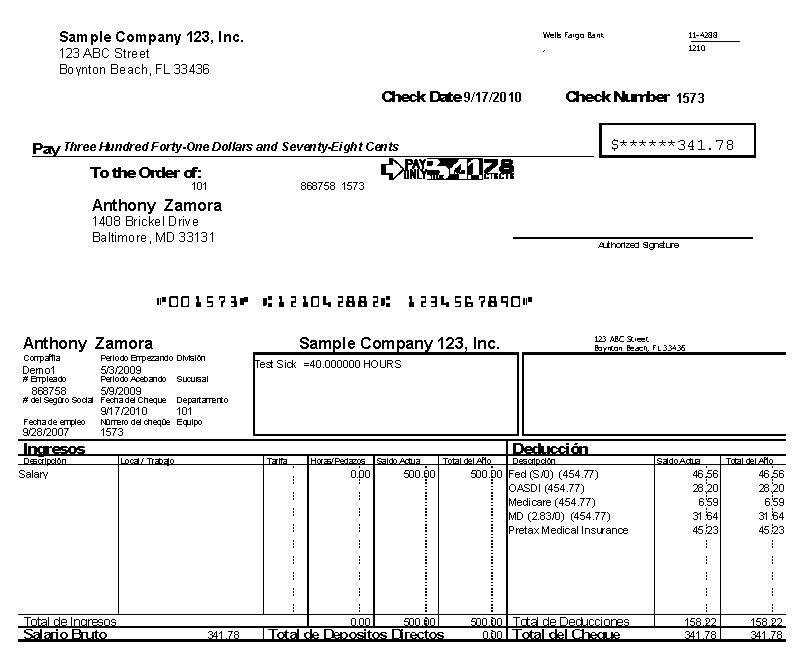

- Sample Check Stubs

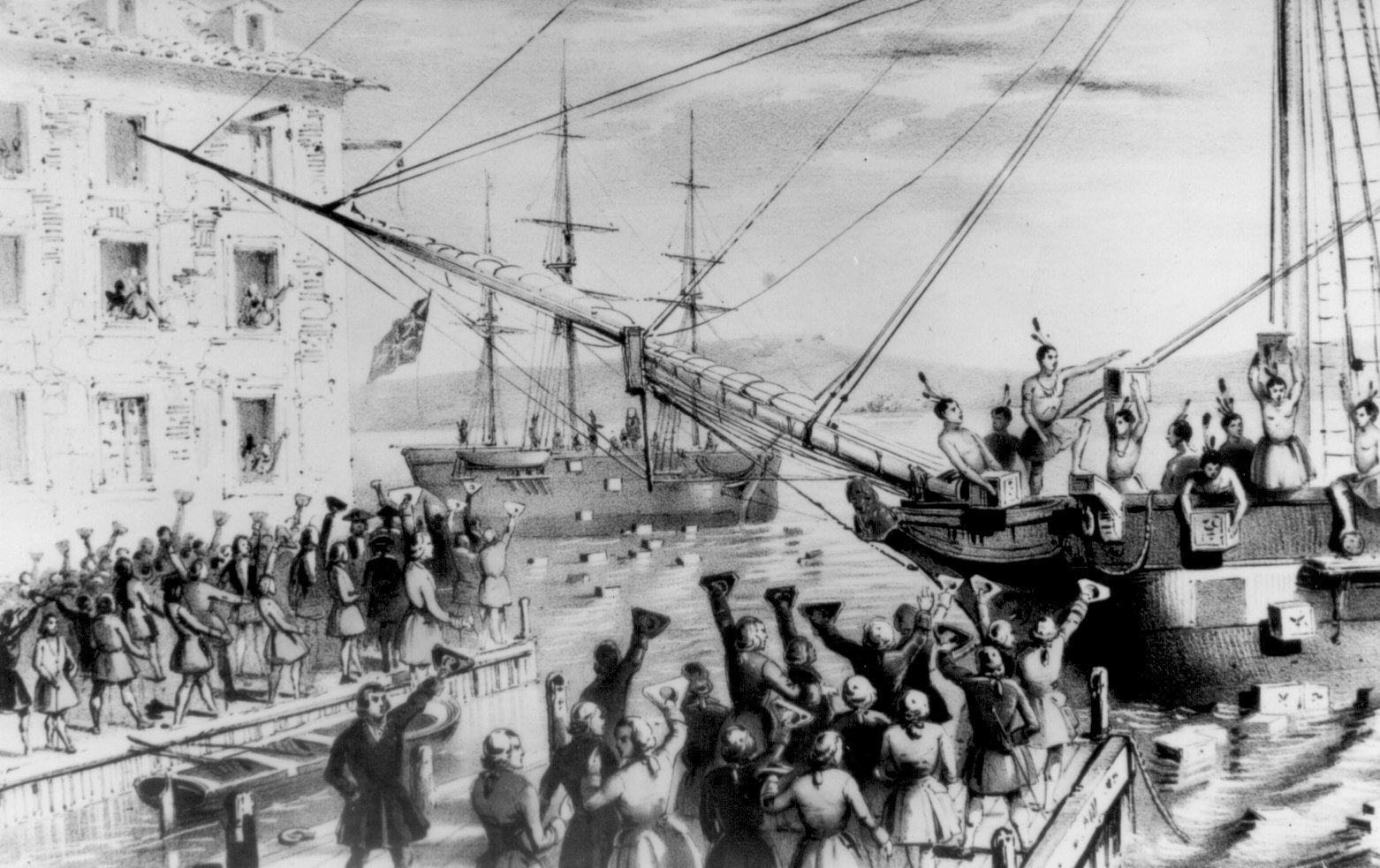

- 1773 Boston Tea Party Act

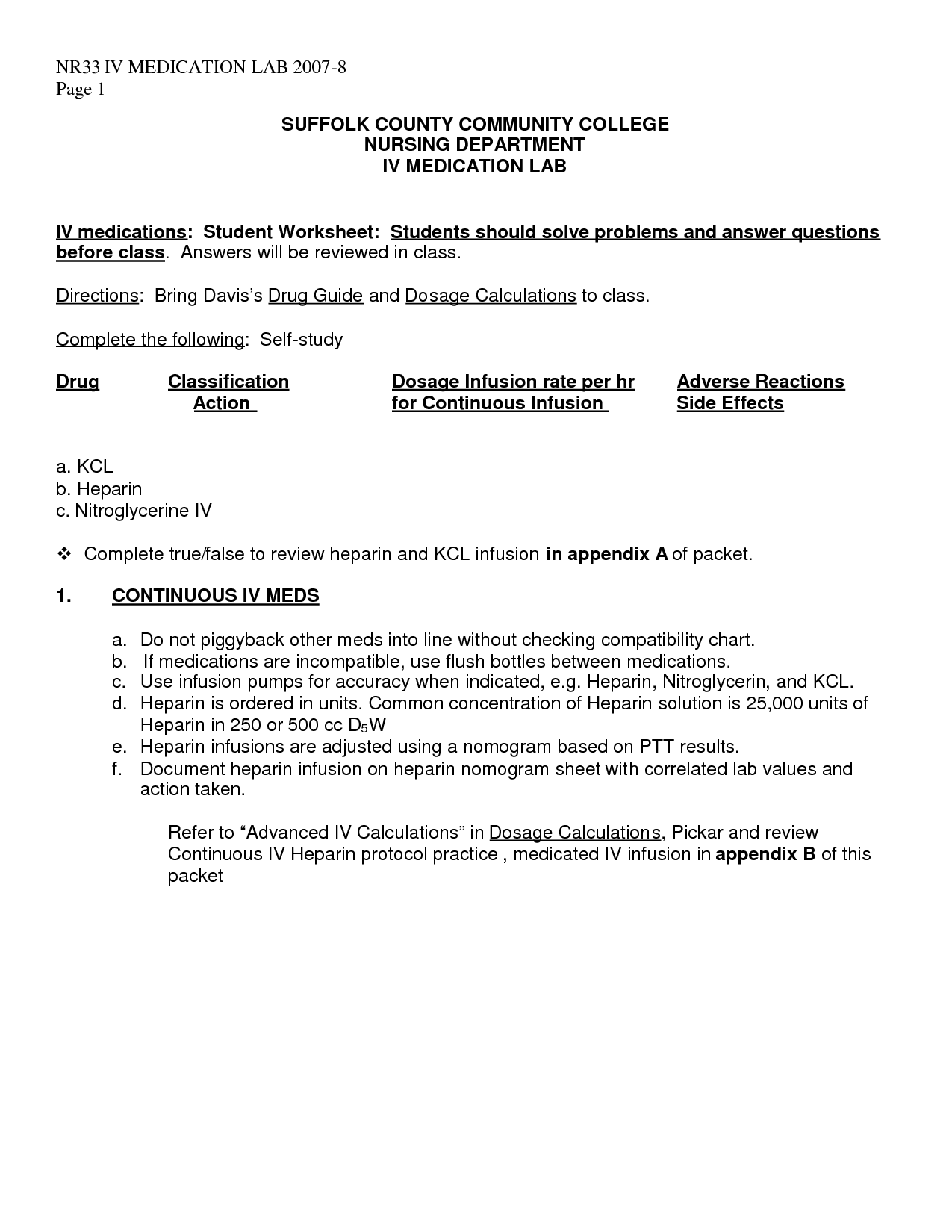

- Dosage Calculation Practice Worksheets

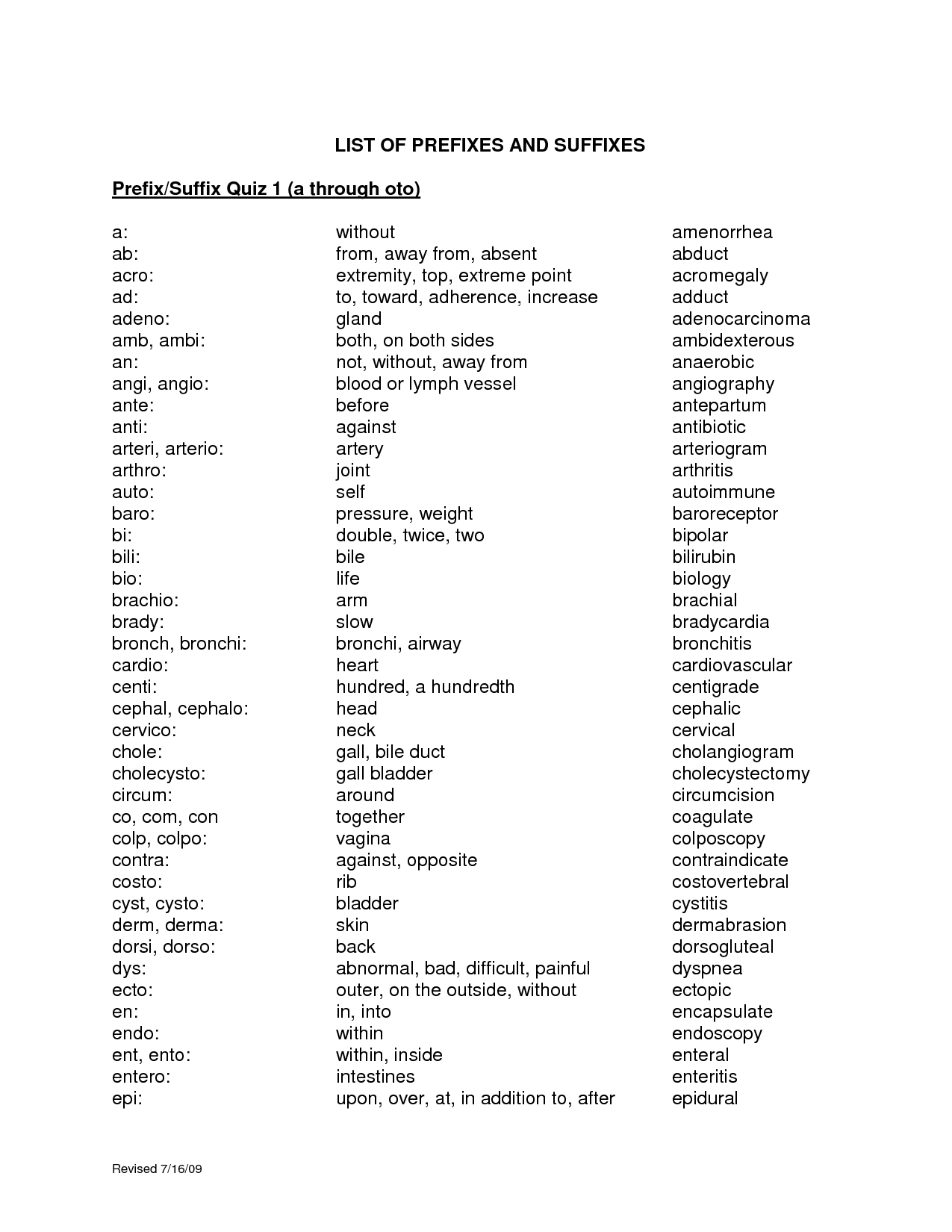

- Prefix and Suffix Word List

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a self-employed tax worksheet used for?

A self-employed tax worksheet is used to help self-employed individuals calculate their estimated tax liability by taking into account their income, deductions, and credits. It assists in determining the total amount of income subject to self-employment tax and helps in planning for quarterly estimated tax payments to avoid underpayment penalties and the need for a lump sum payment at tax time.

How do you calculate self-employment tax?

To calculate self-employment tax, you first need to determine your net self-employment income by subtracting your business expenses from your revenue. Once you have your net income, you can calculate the self-employment tax by multiplying it by 15.3%, which is the combined rate for Social Security and Medicare taxes. This total amount will be your self-employment tax, but keep in mind that only the first $142,800 of net income is subject to the Social Security portion of the tax for the year 2021.

What is the purpose of the income section on the worksheet?

The purpose of the income section on the worksheet is to record and calculate all sources of income that an individual or a company receives. This section helps in assessing the total earnings, understanding where the money is coming from, and evaluating the financial stability or profitability of the entity. It is a crucial part of budgeting and financial planning to ensure that expenses are covered, savings goals are met, and overall financial health is maintained.

What expenses can be deducted on the self-employed tax worksheet?

Self-employed individuals can deduct several expenses on their tax worksheet, including business expenses such as supplies, equipment, office rent, utilities, travel expenses, marketing and advertising costs, insurance premiums, and professional fees. Additionally, they can also deduct expenses like home office deductions, internet and phone bills, vehicle expenses, and health insurance premiums. It's important to keep detailed records and receipts for all expenses in order to claim them accurately on the self-employed tax worksheet.

How do you calculate net self-employment income?

To calculate net self-employment income, subtract business expenses from gross self-employment income. Gross self-employment income includes all revenue earned from self-employment activities. Business expenses are the costs incurred in operating the business, such as supplies, utilities, and travel expenses. Subtracting these expenses from gross income will provide you with your net self-employment income, which represents the profit earned from your self-employment activities.

Is it necessary to complete a self-employed tax worksheet if you have a loss from your business?

Yes, it is necessary to complete a self-employed tax worksheet even if you have a loss from your business. This is because you still need to report the loss on your tax return and may be able to use it to offset other income or carry it forward to future years. Additionally, properly documenting and calculating your business losses is important for maintaining accurate financial records and complying with tax regulations.

Can you claim the home office deduction on the self-employed tax worksheet?

Yes, self-employed individuals can claim the home office deduction on the self-employed tax worksheet if they meet the criteria for a home office deduction. To qualify, the space must be used regularly and exclusively for business purposes. The deduction allows self-employed individuals to deduct a portion of their home expenses, such as rent, mortgage interest, utilities, and maintenance, based on the percentage of the home used for business. It is important to keep detailed records and follow the IRS guidelines for claiming this deduction.

What is the difference between the self-employment tax and income tax?

The main difference between self-employment tax and income tax is who pays it and for what purpose. Self-employment tax is a social security and Medicare tax that self-employed individuals are required to pay on their net earnings, while income tax is a tax on an individual's income that is paid to the government to fund public services, programs, and government operations. Self-employment tax is specific to self-employed individuals, while income tax applies to all taxpayers, regardless of their employment status.

How do you determine your self-employment tax rate?

To determine your self-employment tax rate, you will need to calculate 15.3% of your net earnings from self-employment. This tax rate consists of two parts: 12.4% for Social Security and 2.9% for Medicare. You are required to pay self-employment tax if your net earnings are $400 or more in a tax year. It's essential to consult with a tax professional or use tax software to accurately calculate and report your self-employment tax.

Are there any self-employment tax deductions or credits available on the worksheet?

Yes, there are tax deductions and credits available for self-employed individuals on the worksheet. Some common deductions include business expenses, like supplies, equipment, and travel costs related to your self-employment. Additionally, you may be able to claim a deduction for self-employed health insurance premiums, retirement contributions, and the deduction for half of your self-employment taxes. It's important to carefully review the tax laws and consult with a tax professional to ensure you are maximizing your deductions and credits as a self-employed individual.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments