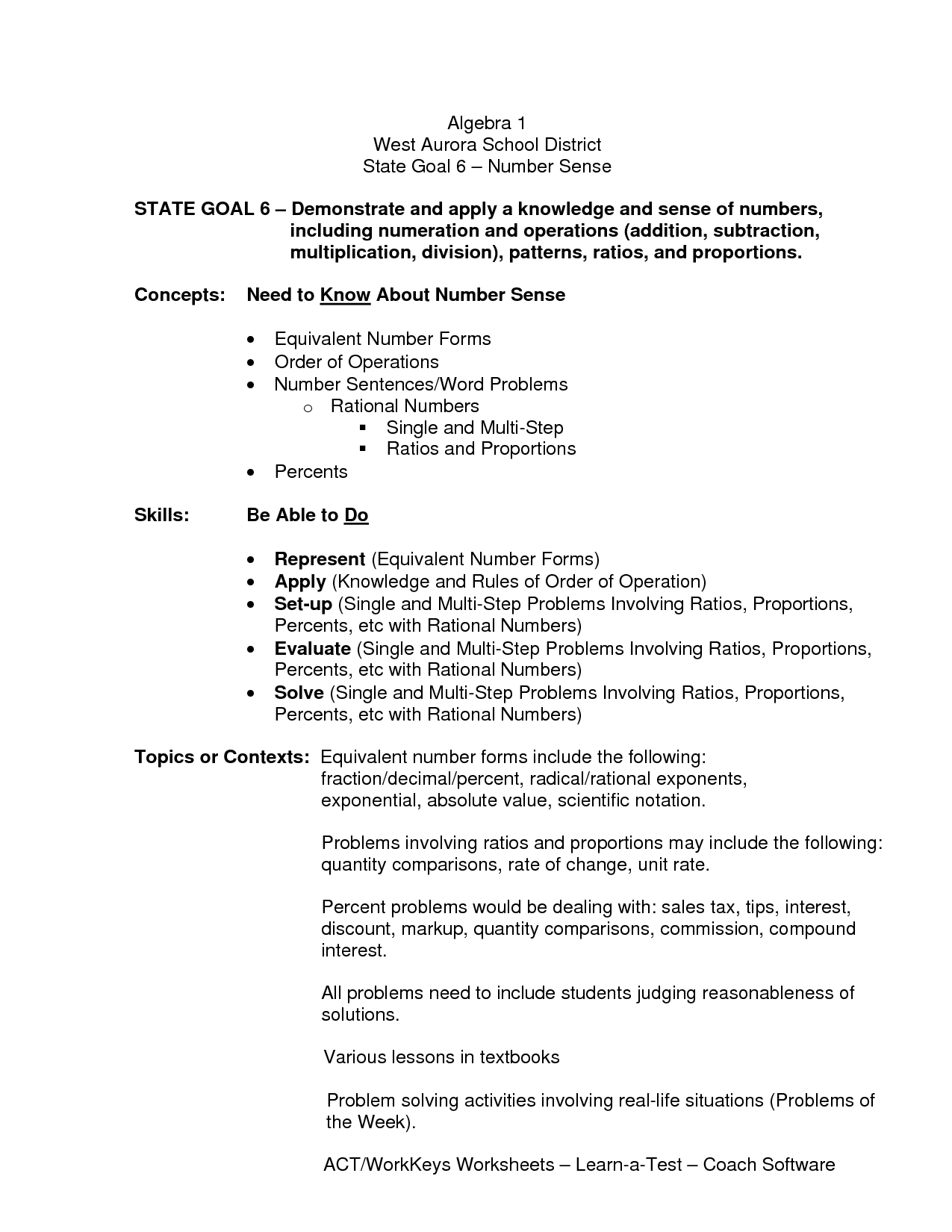

Sales Tax Worksheets for Middle School

Sales tax worksheets are an essential tool for middle school students who want to gain a solid understanding of how sales tax works. By providing a structured format, these worksheets give students the opportunity to practice calculating sales tax and reinforce their understanding of the concept. Whether it's a math class or a personal finance lesson, these worksheets offer a valuable resource for students to sharpen their skills and become more confident with real-world financial calculations.

Table of Images 👆

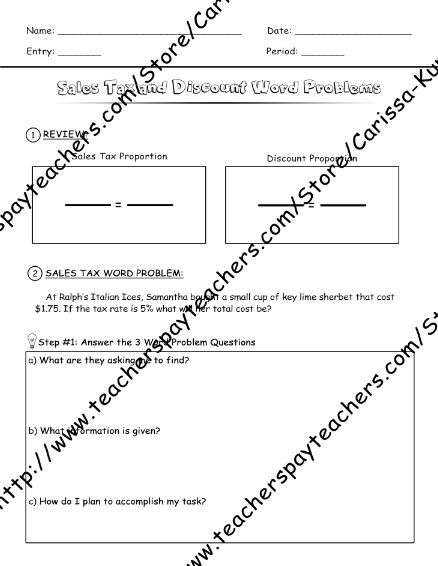

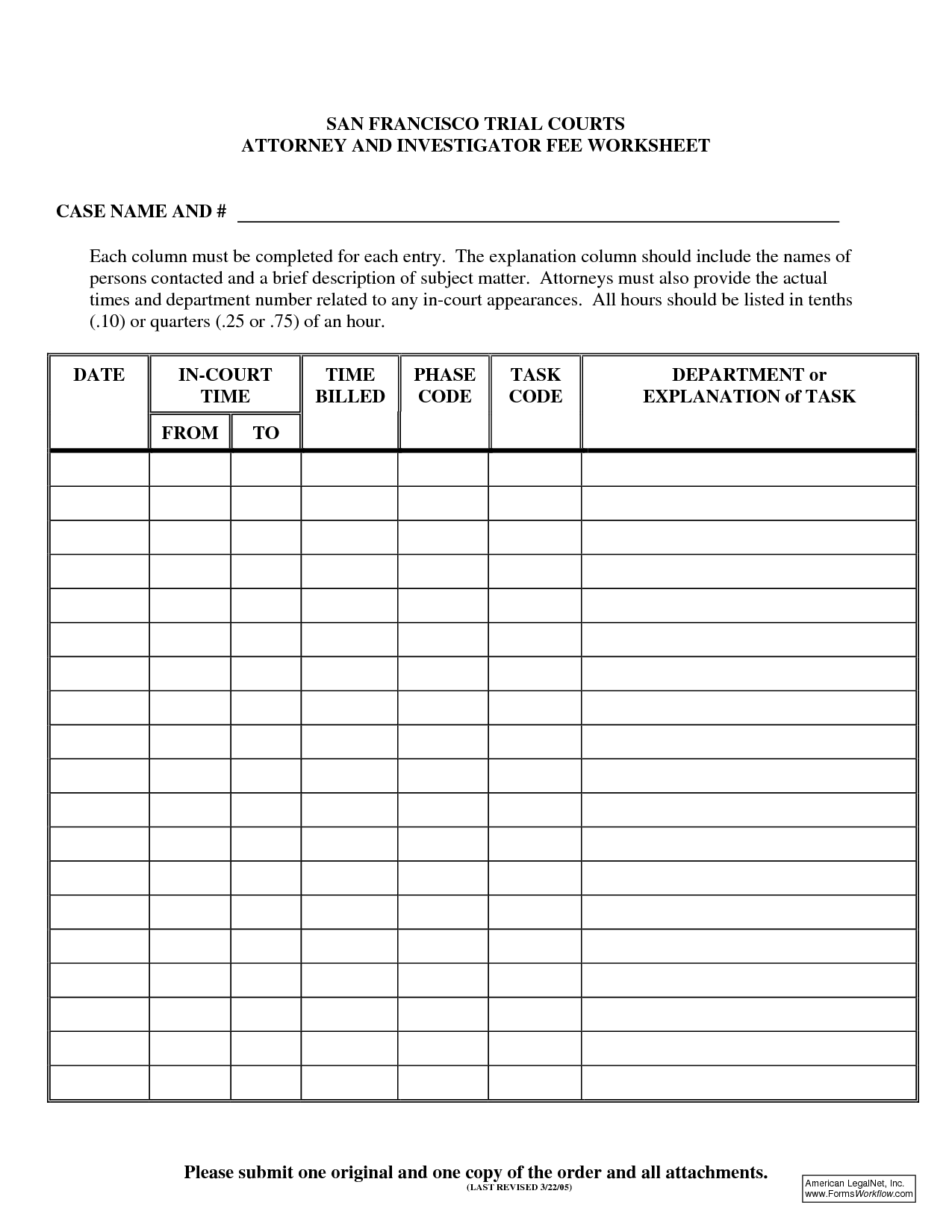

- Worksheets On Sales Tax and Discounts

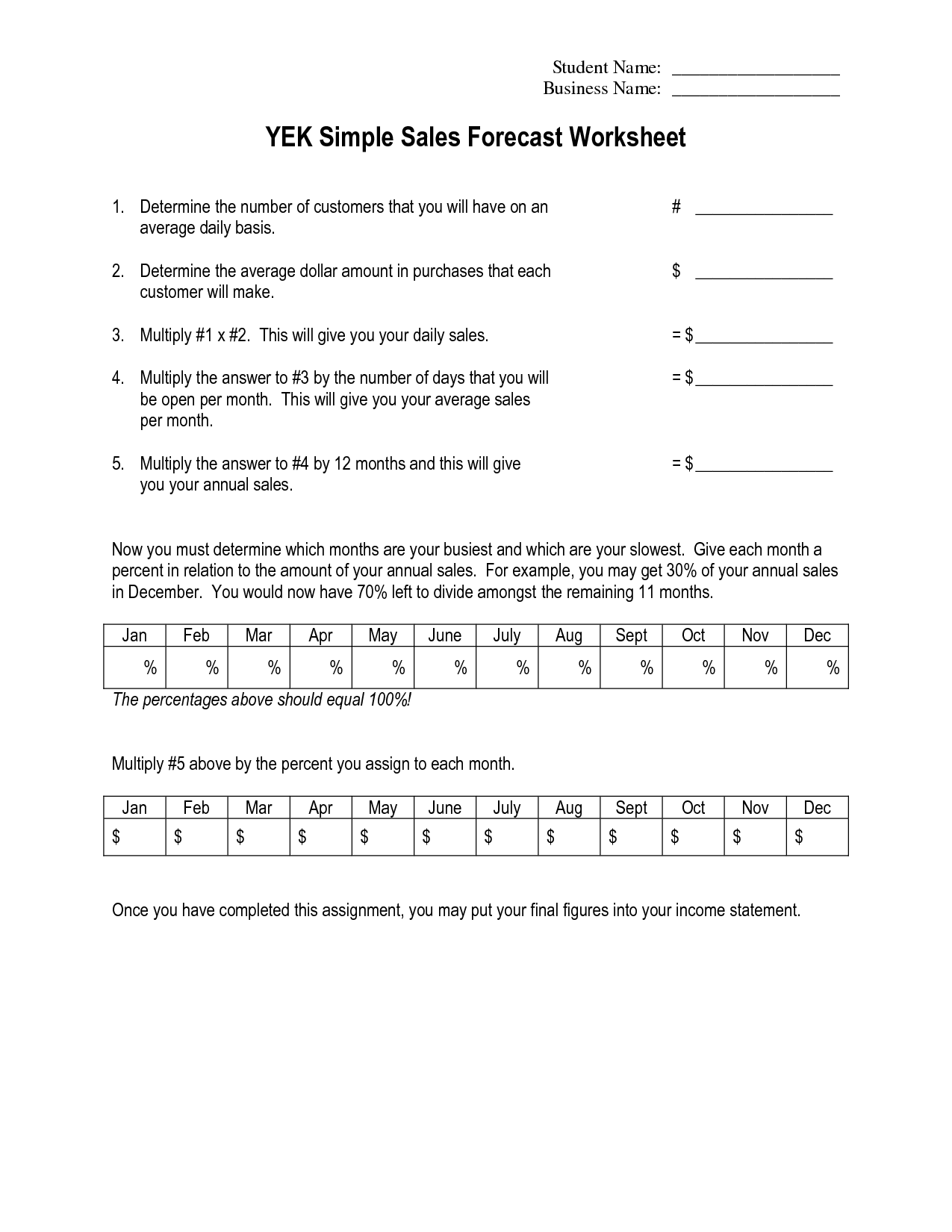

- Simple Sales Tax Worksheet

- Printable Sales Tax Worksheets

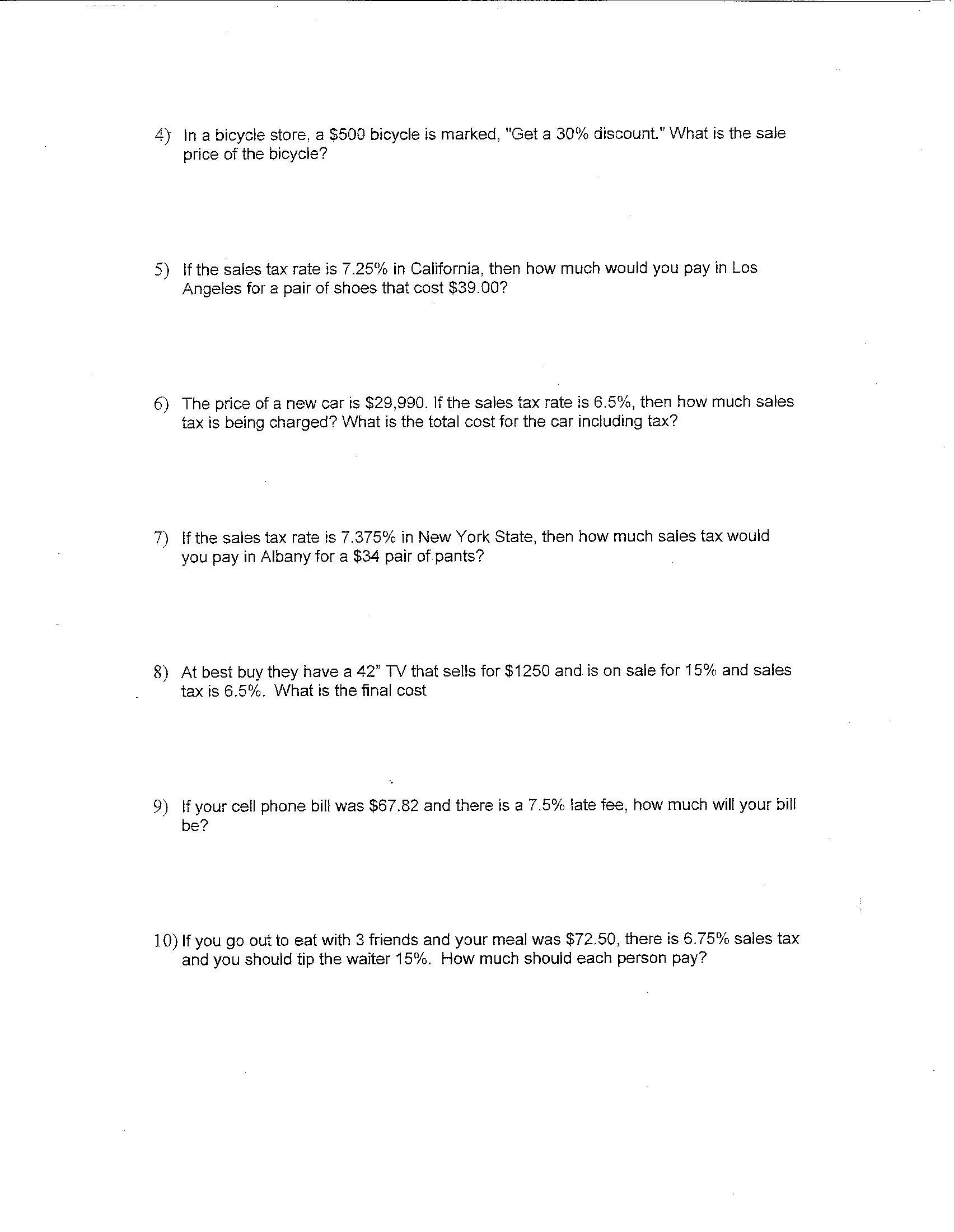

- Sales Tax and Discount Worksheets

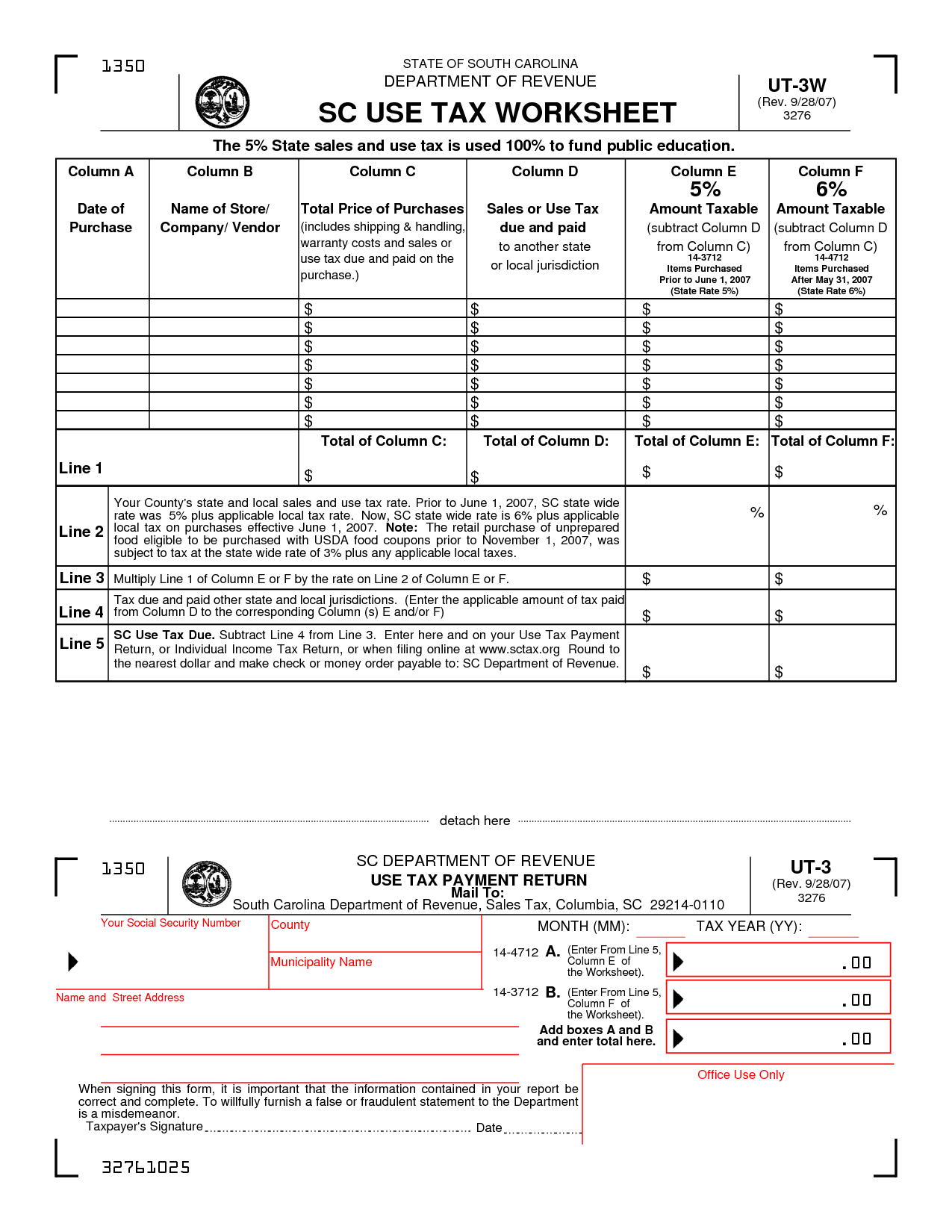

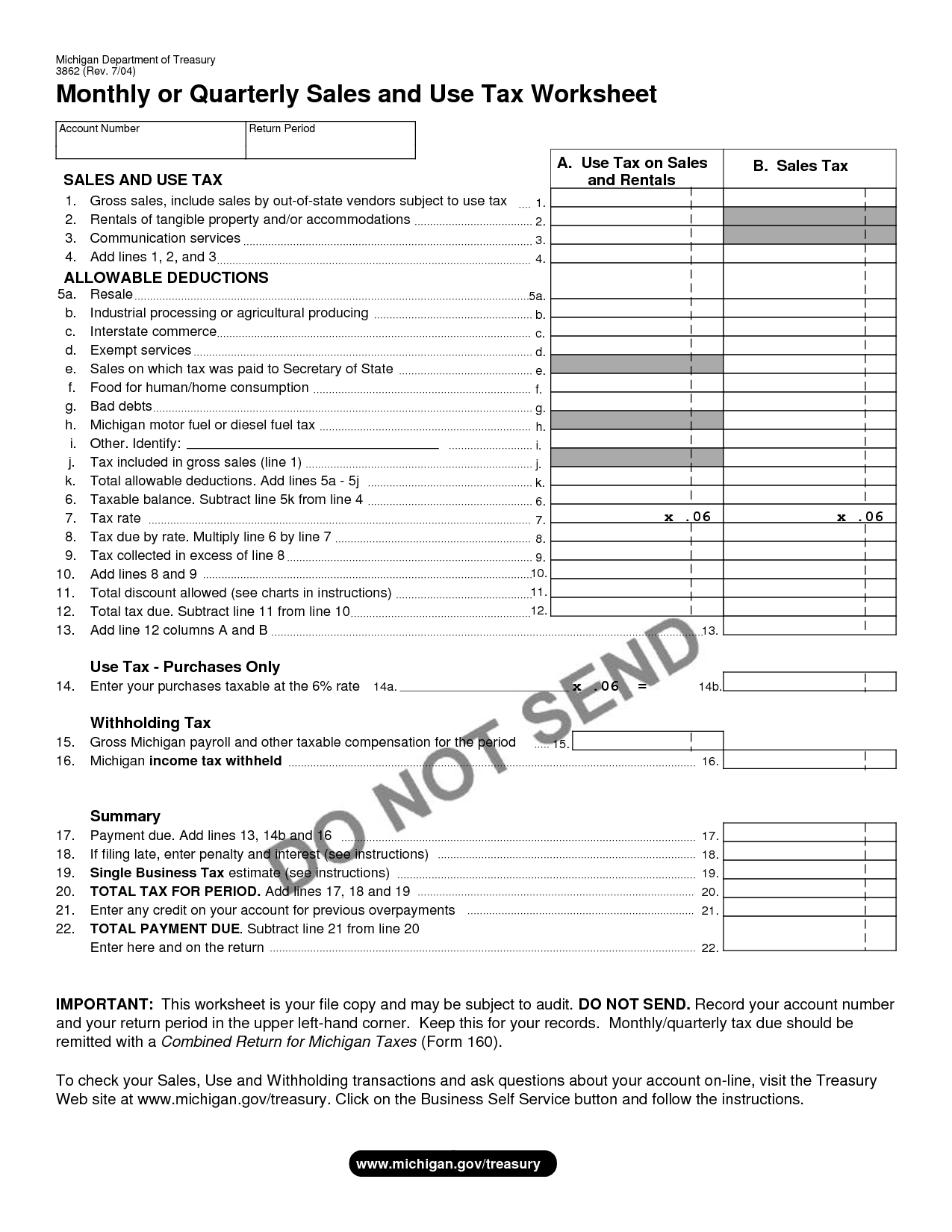

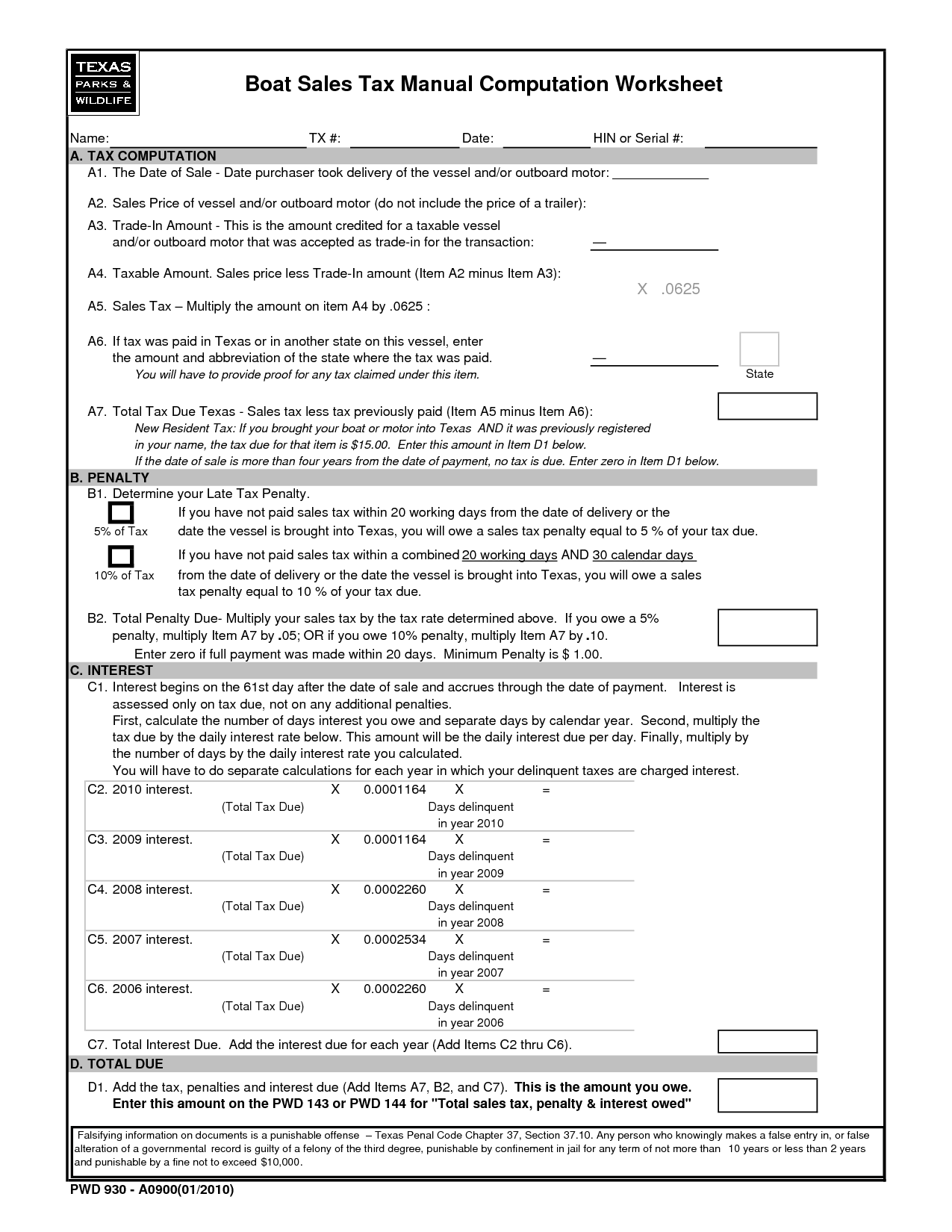

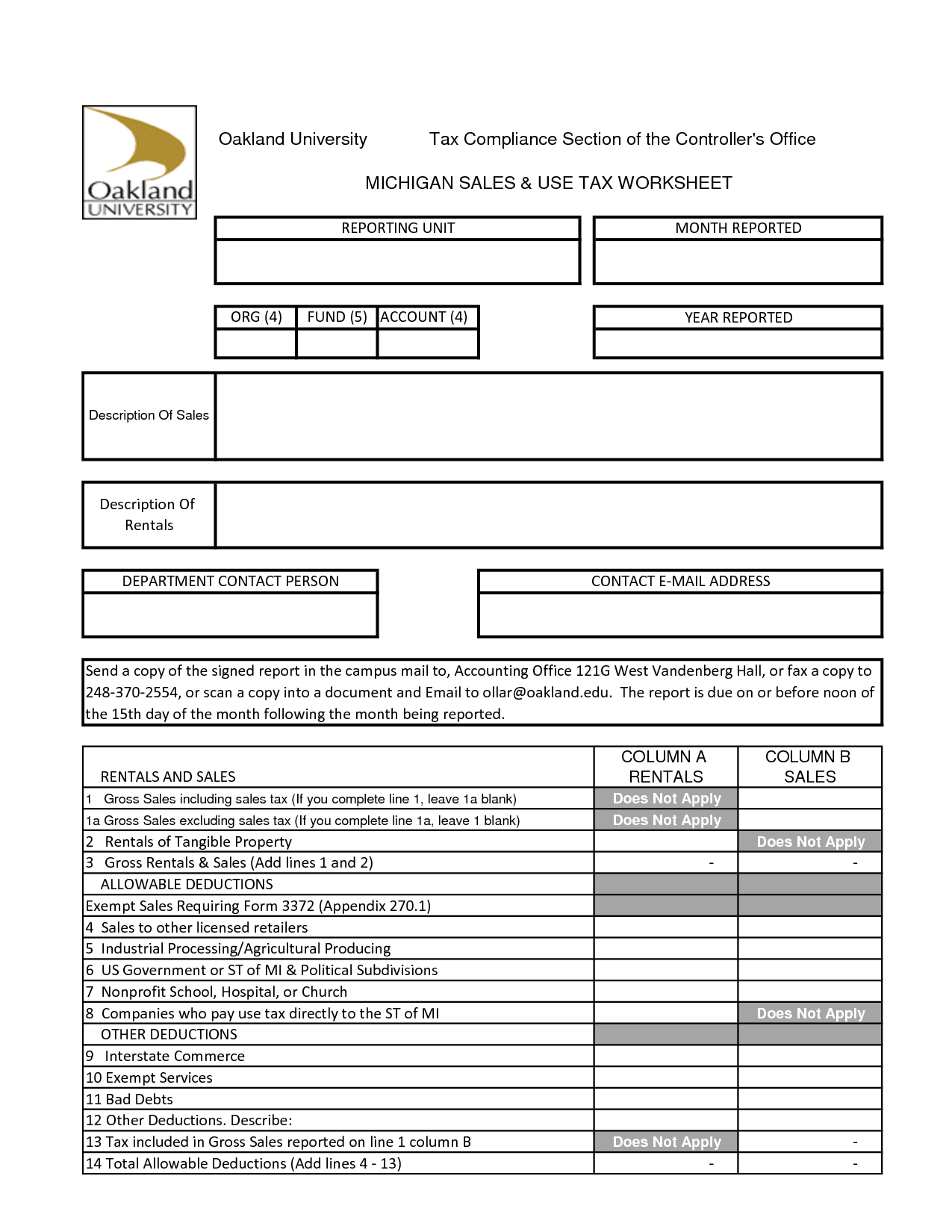

- Sales and Use Tax Worksheet

- Sales Tax Worksheets

- Tips Tax and Sales Discounts Worksheets

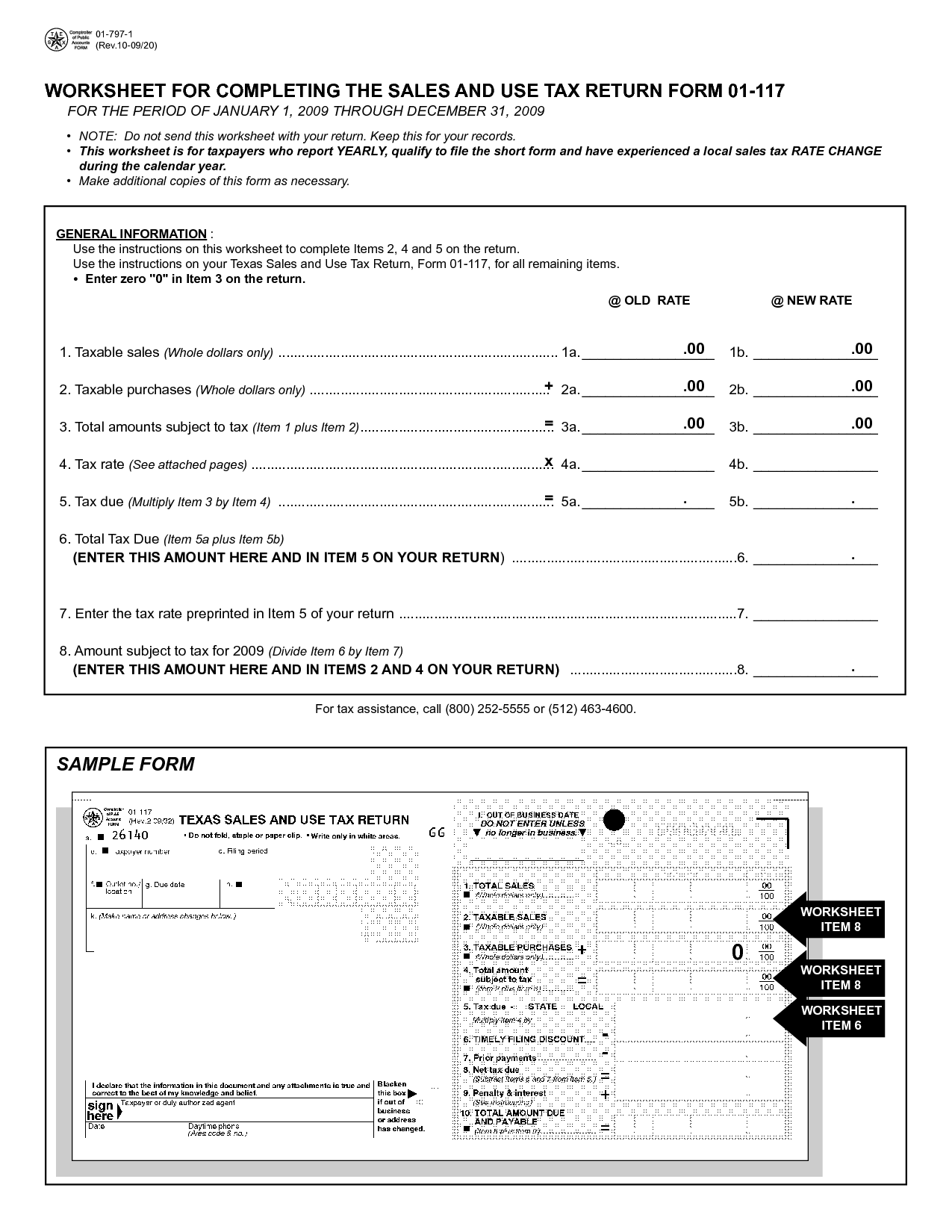

- Texas Sales and Use Tax Return

- Printable Sales Tax Worksheets

- Printable Sales Tax Worksheets

- Printable Sales Tax Worksheets

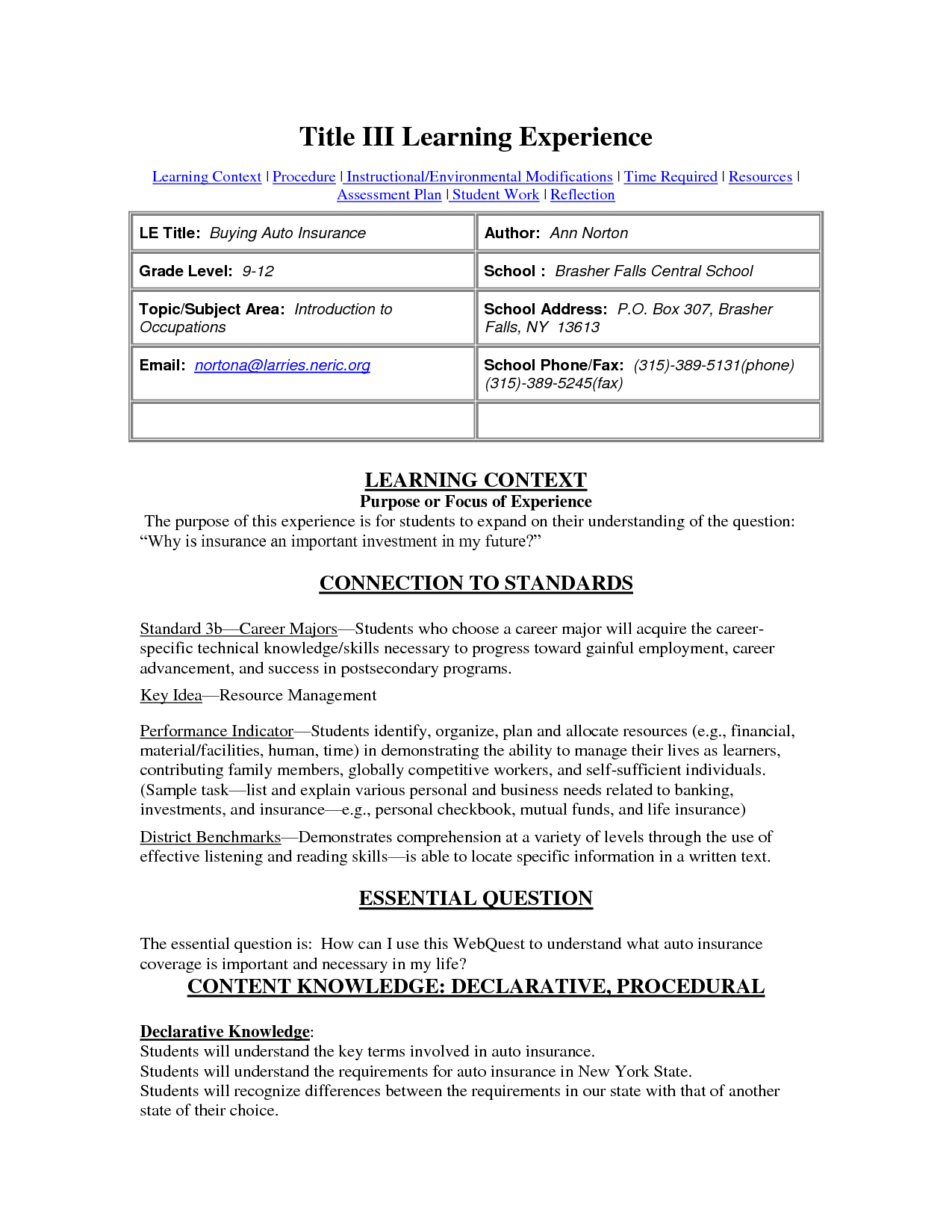

- Sales Tax Worksheets for Students

- Printable Sales Tax Worksheets

- Printable Sales Tax Worksheets

- Tips Tax and Sales Discounts Worksheets

- Sales Tax Worksheets 7th Grade

- Bacteria Worksheet and Answers

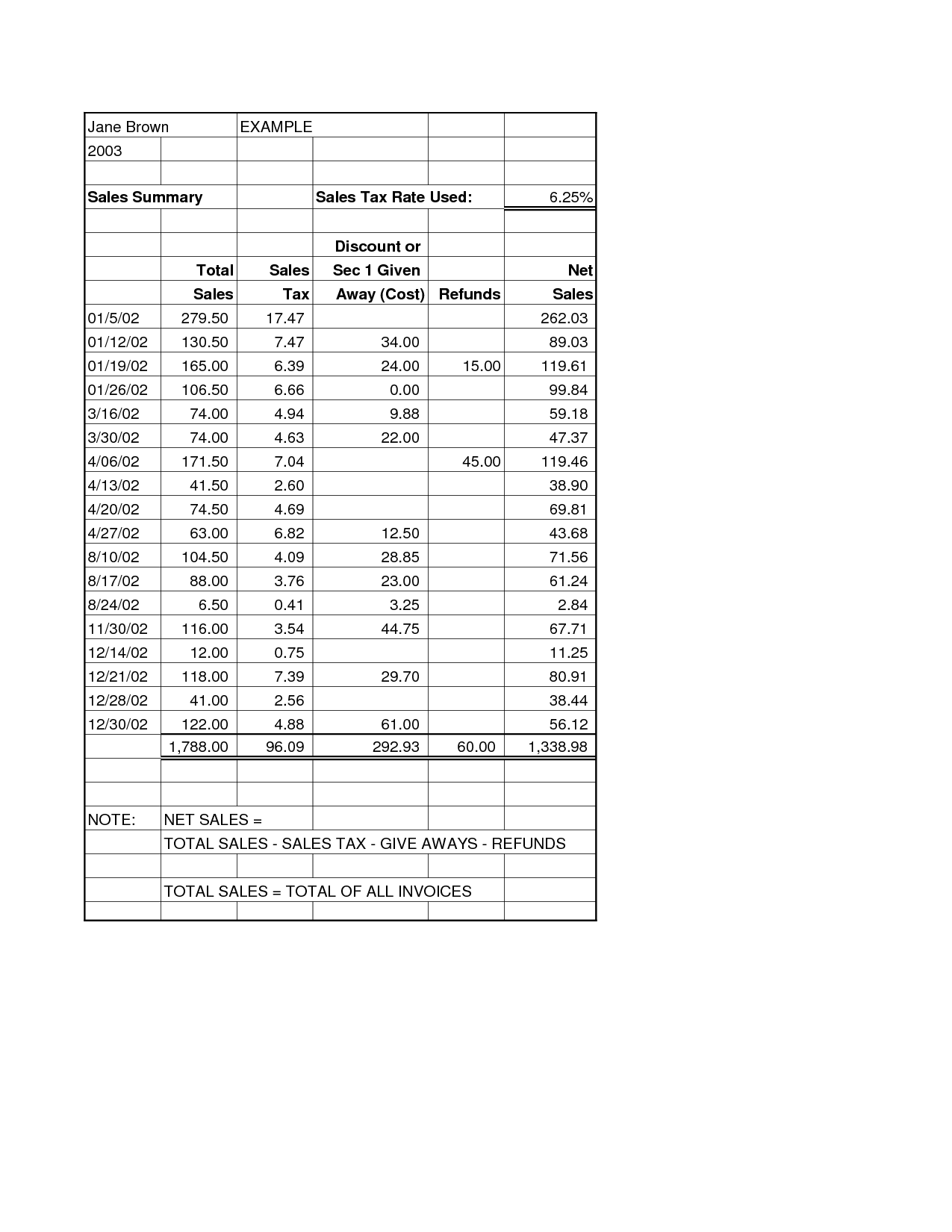

- Mary Kay Receipt Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a sales tax?

A sales tax is a consumption tax imposed by the government on the sale of goods and services. It is usually calculated as a percentage of the purchase price and is collected by the seller at the point of sale, then remitted to the government. The purpose of a sales tax is to generate revenue for the government to fund public services and projects.

How is sales tax calculated?

Sales tax is typically calculated as a percentage of the purchase price of a product or service. The specific rate varies by location, so it's important to know the applicable tax rate in the area where the purchase is being made. To calculate the sales tax amount, multiply the purchase price by the tax rate (expressed as a decimal). For example, if the tax rate is 8% and the purchase price is $100, the sales tax would be $100 x 0.08 = $8.

What is the purpose of a sales tax worksheet?

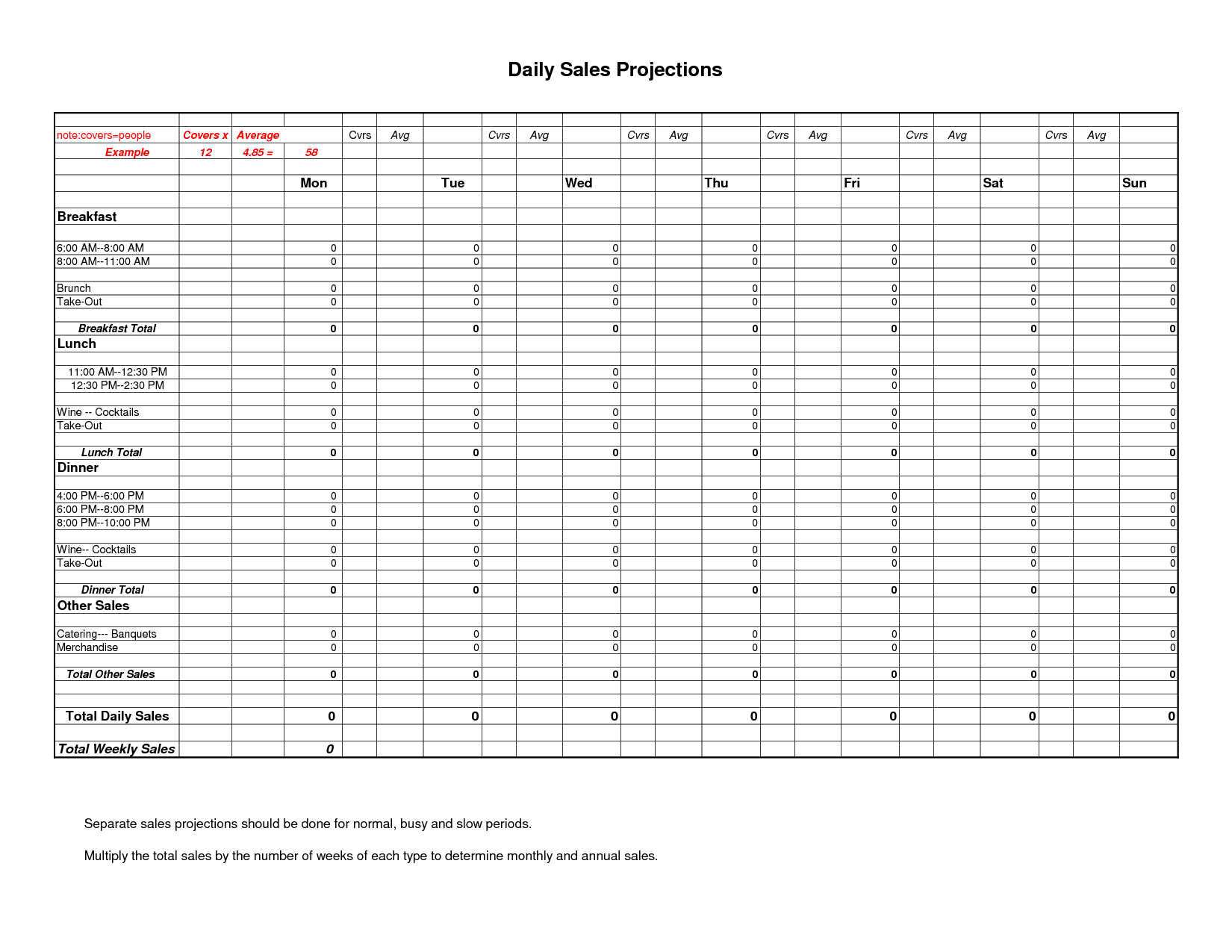

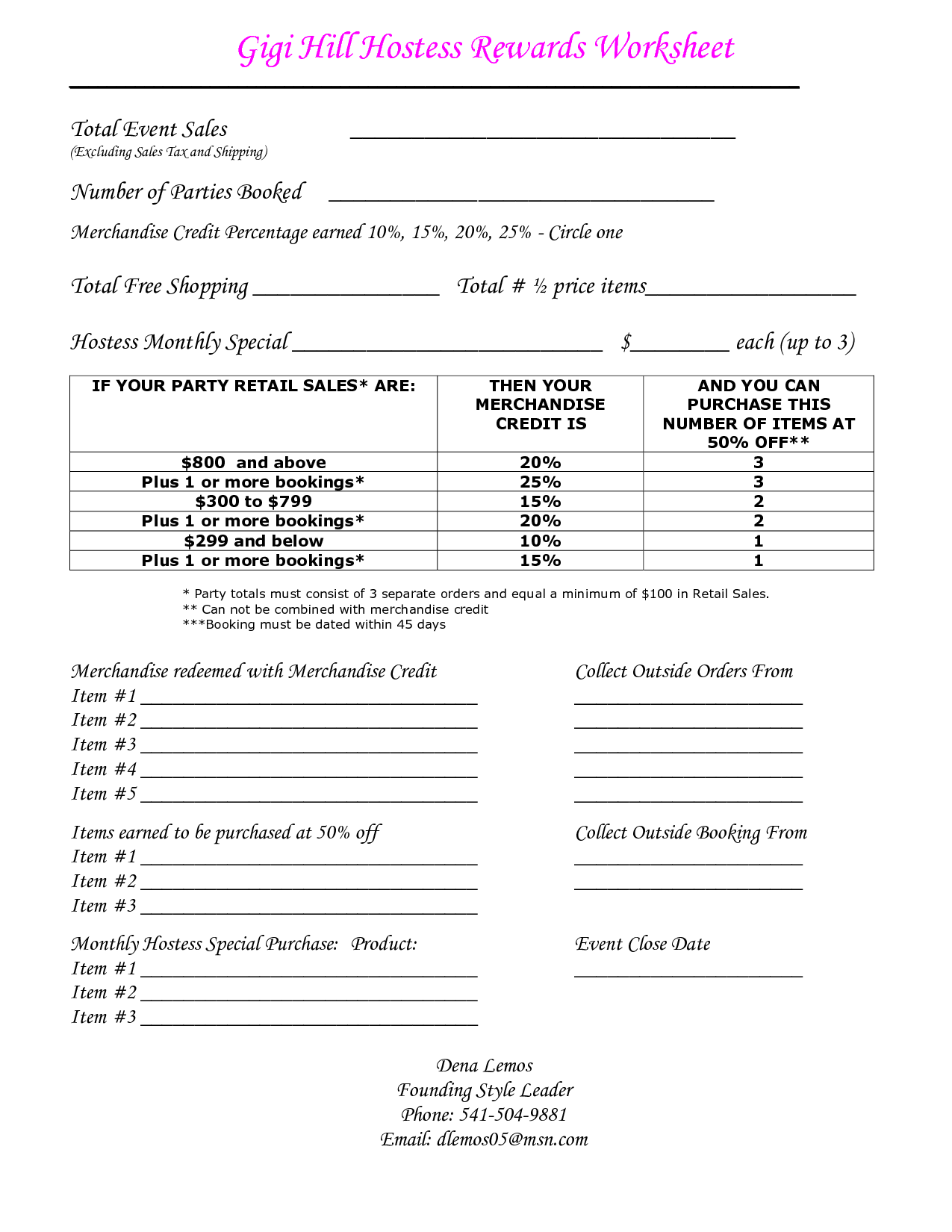

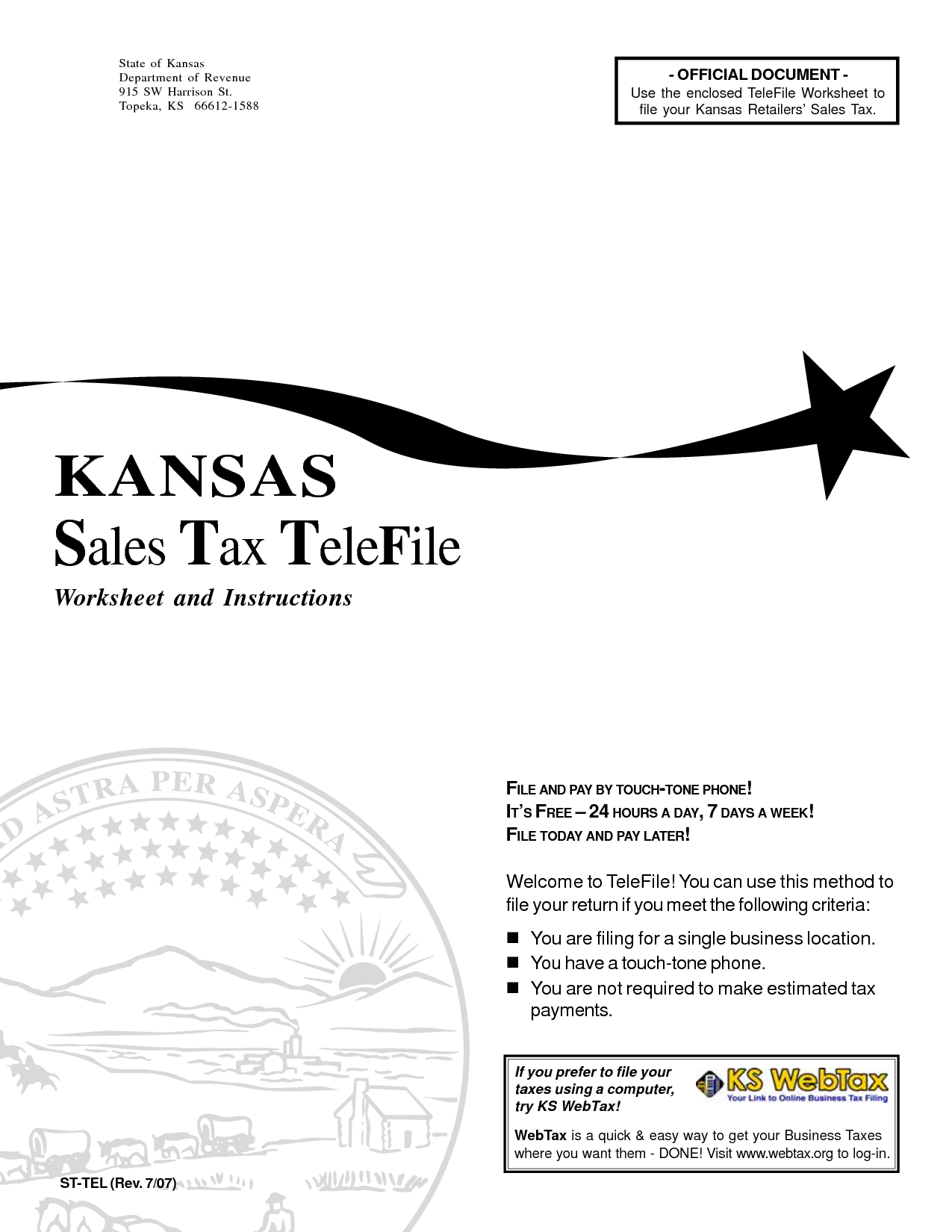

The purpose of a sales tax worksheet is to calculate the amount of sales tax owed on taxable goods or services. It helps individuals or businesses keep track of their taxable sales and determine the correct amount of tax to remit to the appropriate tax authority. The worksheet typically includes details such as the total sales amount, applicable tax rate, and the calculated tax due.

What information is typically included in a sales tax worksheet?

A sales tax worksheet typically includes details such as the total amount of taxable sales, the sales tax rate, the calculated amount of sales tax due, any exemptions or exclusions, and the total amount due after including sales tax. It helps businesses keep track of the sales tax collected and owed to ensure compliance with tax regulations.

How do you calculate the total amount of sales tax?

To calculate the total amount of sales tax, multiply the sales tax rate (typically given as a percentage) by the total cost of the items purchased. For example, if the sales tax rate is 8% and the total cost of the items is $100, you would calculate it as $100 x 0.08 = $8. Therefore, the total amount of sales tax on a purchase of $100 would be $8.

How can you determine the pre-tax price of an item using a sales tax worksheet?

To determine the pre-tax price of an item using a sales tax worksheet, you would first convert the sales tax rate from a percentage to a decimal. Then, divide the total amount paid (including tax) by 1 plus the decimal equivalent of the sales tax rate. This calculation will give you the pre-tax price of the item.

How is sales tax different from other types of taxes?

Sales tax is a consumption tax imposed on the sale of goods and services and is typically collected by businesses at the point of purchase. Unlike income tax, which is based on an individual's or business's earnings, sales tax is only paid when a consumer makes a purchase. Property taxes, on the other hand, are levied on the value of real estate owned by individuals or businesses. Additionally, sales tax is regressive in nature, meaning lower-income individuals may end up paying a larger proportion of their income towards sales tax compared to higher-income individuals.

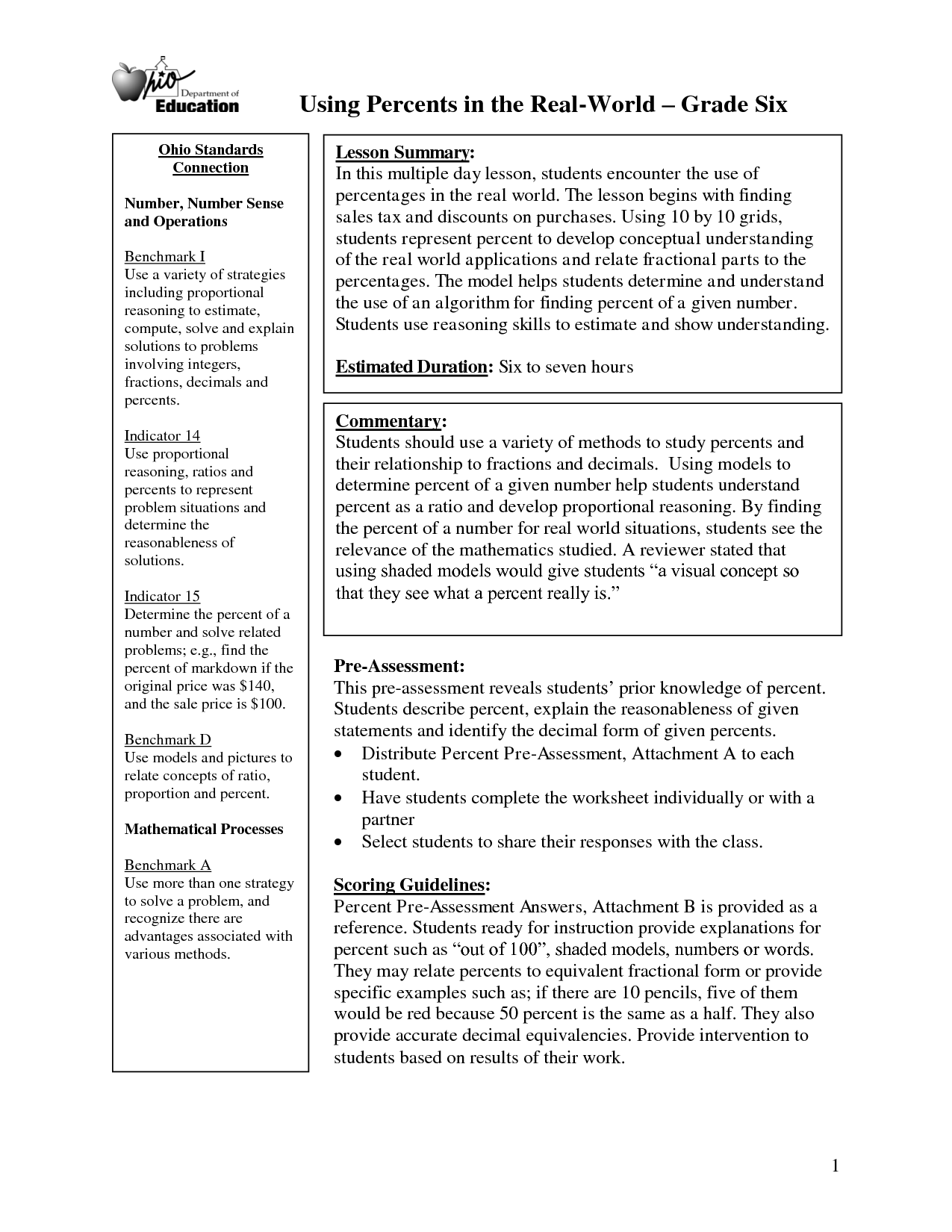

Why is understanding sales tax important for middle school students?

Understanding sales tax is important for middle school students because it teaches them about financial literacy and real-world math skills. It helps them grasp the concept of adding additional costs to purchases, calculating percentages, and budgeting their money effectively. This knowledge will prepare them to make informed financial decisions and understand the implications of taxes on their purchases as they grow older and become independent consumers.

How can sales tax worksheets teach financial literacy skills?

Sales tax worksheets can teach financial literacy skills by helping individuals understand how to calculate and apply sales tax to purchases, which in turn builds their basic math and calculation abilities. By working through these worksheets, individuals can also learn about the importance of budgeting and planning for taxes, as well as the impact of sales tax on the total cost of goods or services. Additionally, sales tax worksheets can provide real-world examples that illustrate the practical applications of math concepts in everyday financial transactions, helping individuals develop critical thinking and decision-making skills when managing their finances.

Can sales tax rates vary between different states or regions?

Yes, sales tax rates can vary between different states or regions. Each state in the United States has the authority to set its own sales tax rate, which can vary depending on the location and type of goods or services being purchased. Additionally, some local jurisdictions may also impose additional sales taxes on top of the state rate, leading to further variations in sales tax rates between different areas.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments