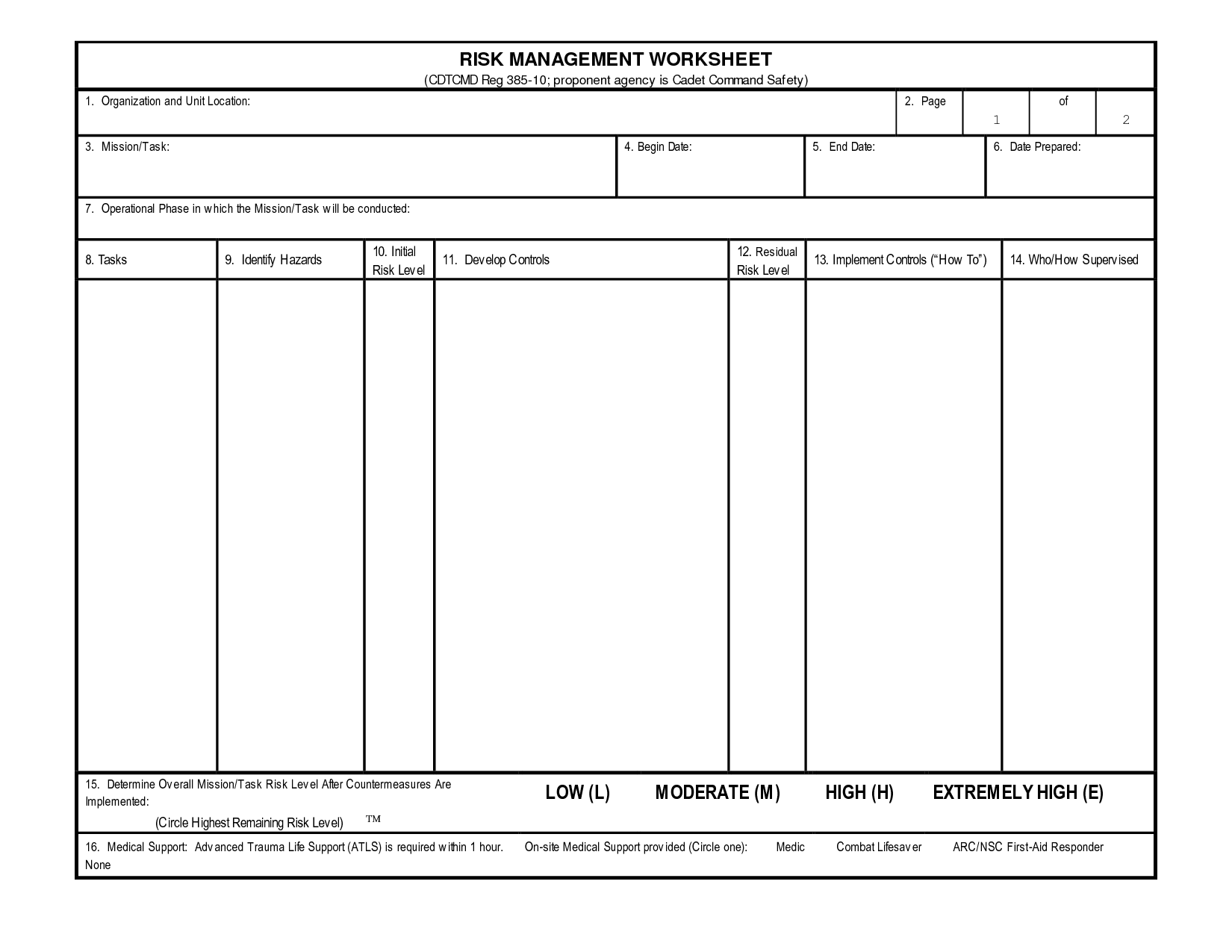

Risk Management Worksheet

The risk management worksheet is an essential tool for individuals and organizations seeking to identify, assess, and mitigate potential risks. This simple yet powerful document allows you to systematically analyze various factors that could impact your entity's operations, projects, or investments. By providing a structured framework to identify and evaluate risks, this worksheet enables you to make informed decisions and develop effective risk management strategies. Whether you are a business owner, project manager, or risk management professional, the risk management worksheet offers a comprehensive approach to ensuring the security and success of your endeavors.

Table of Images 👆

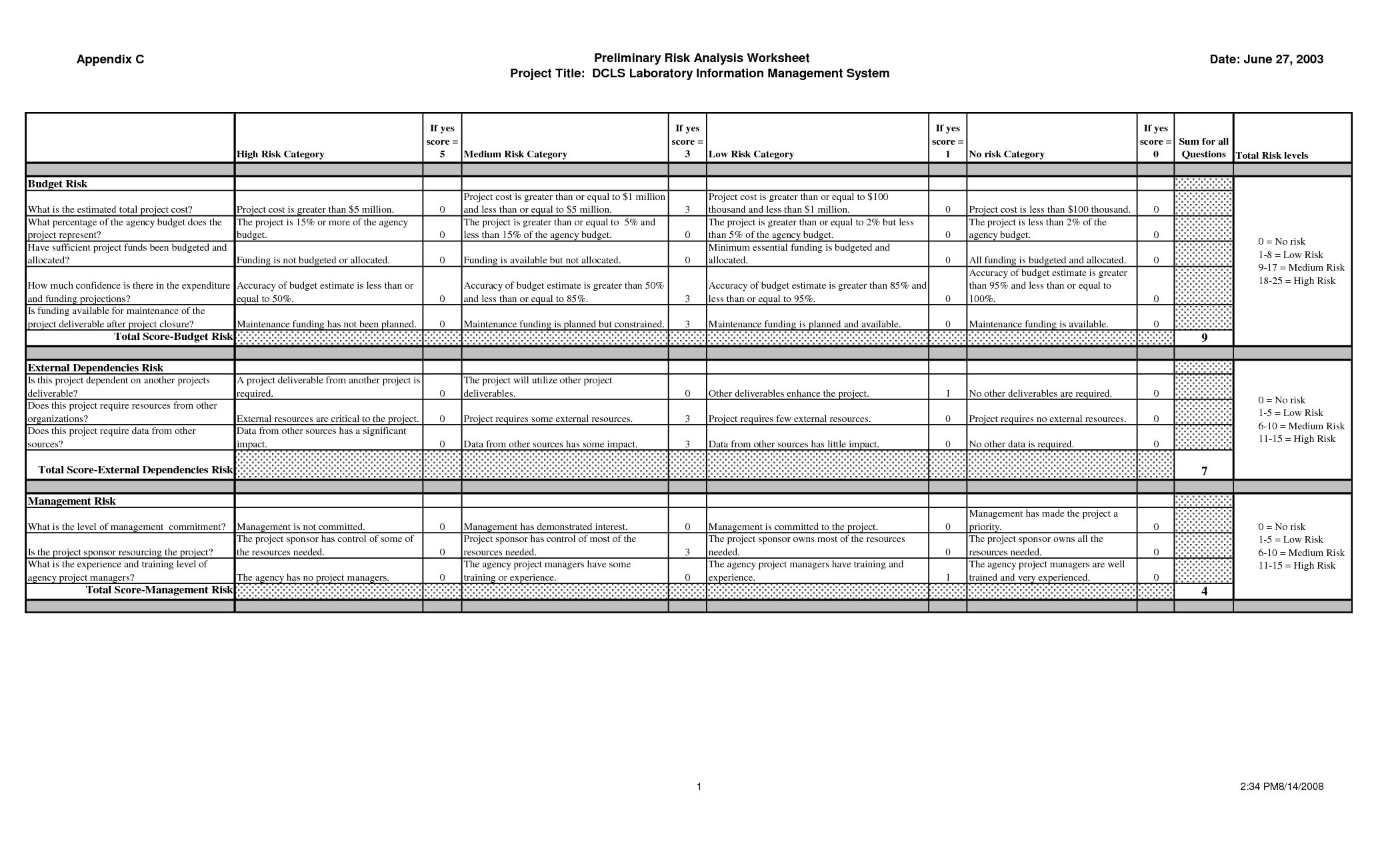

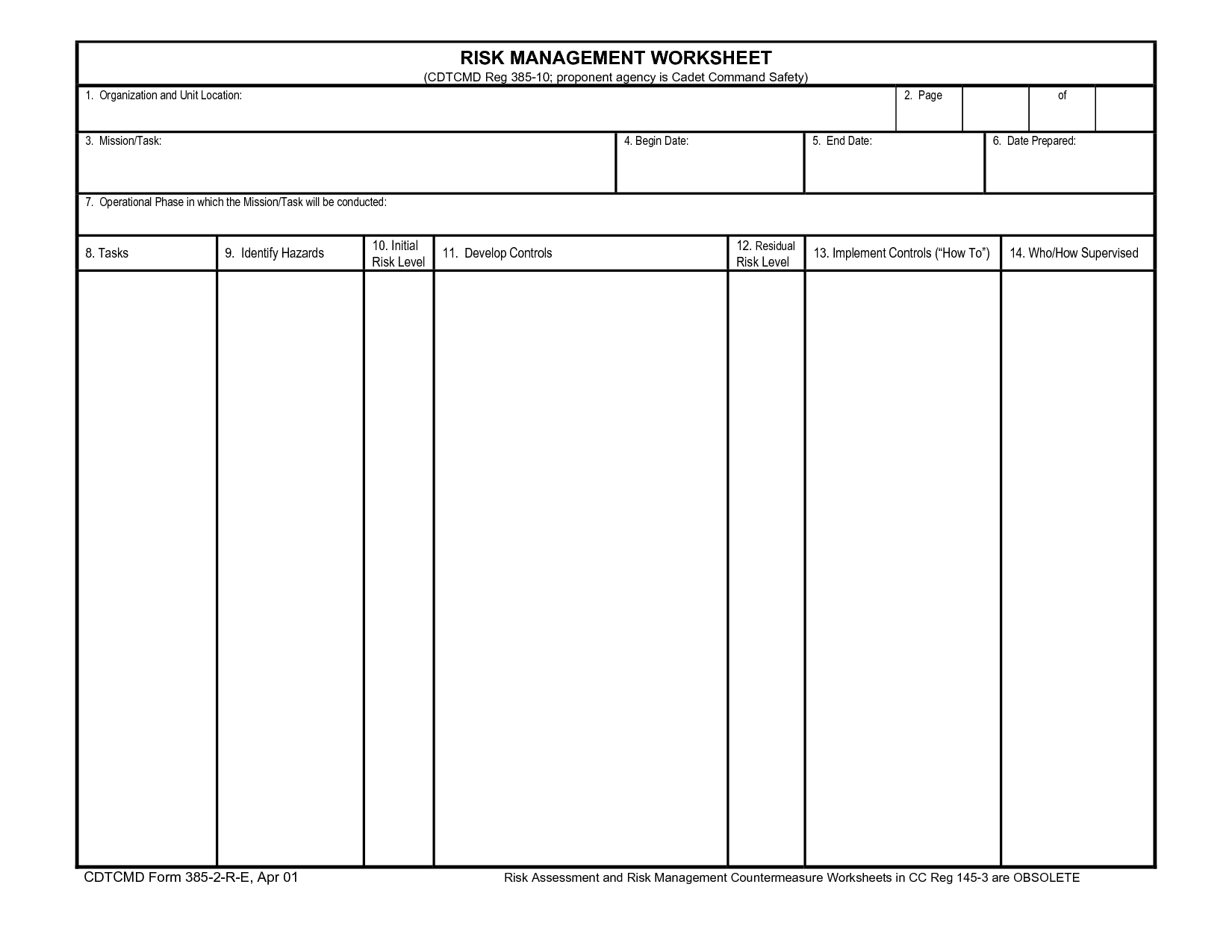

- Project Risk Assessment Worksheet

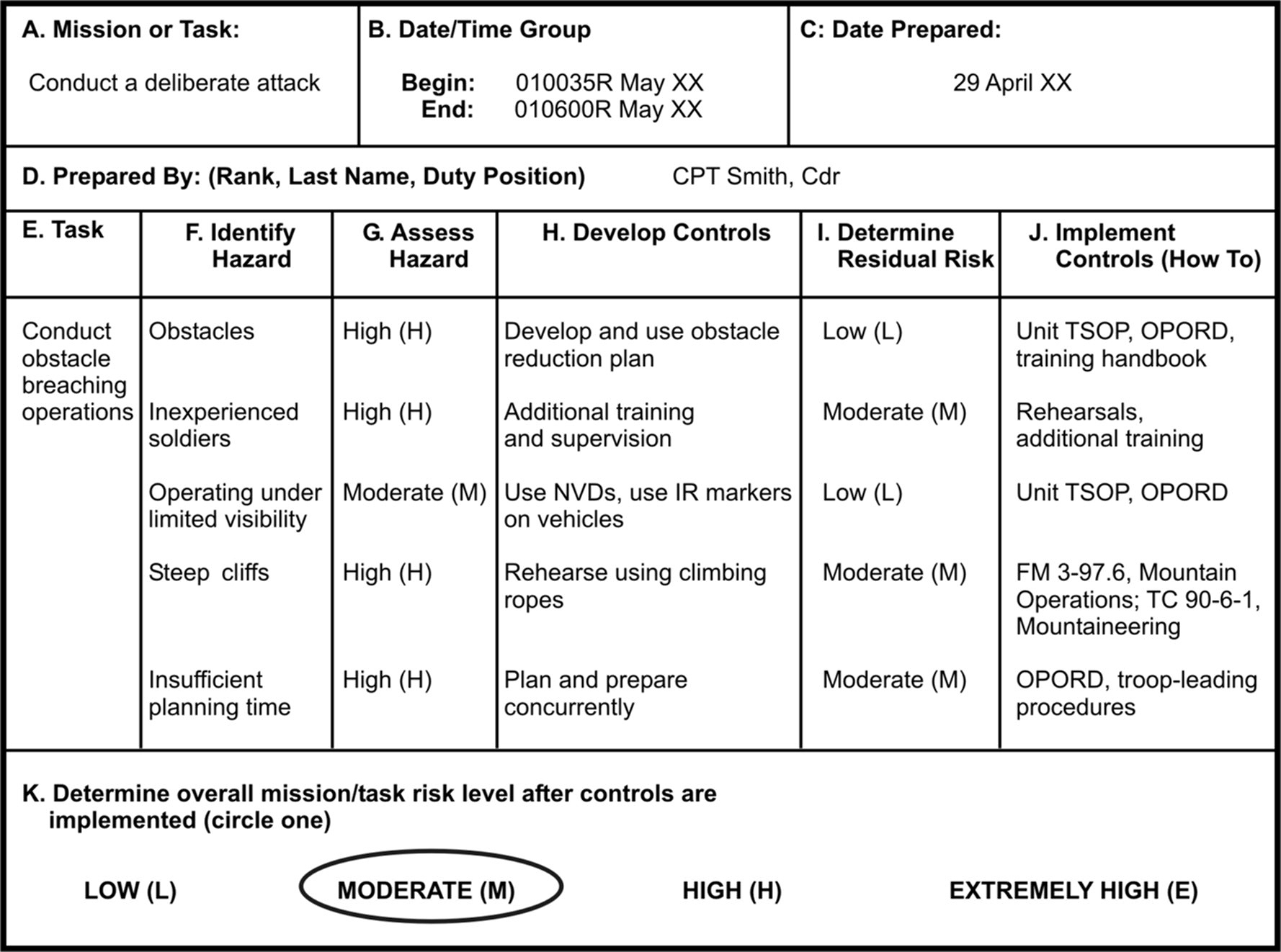

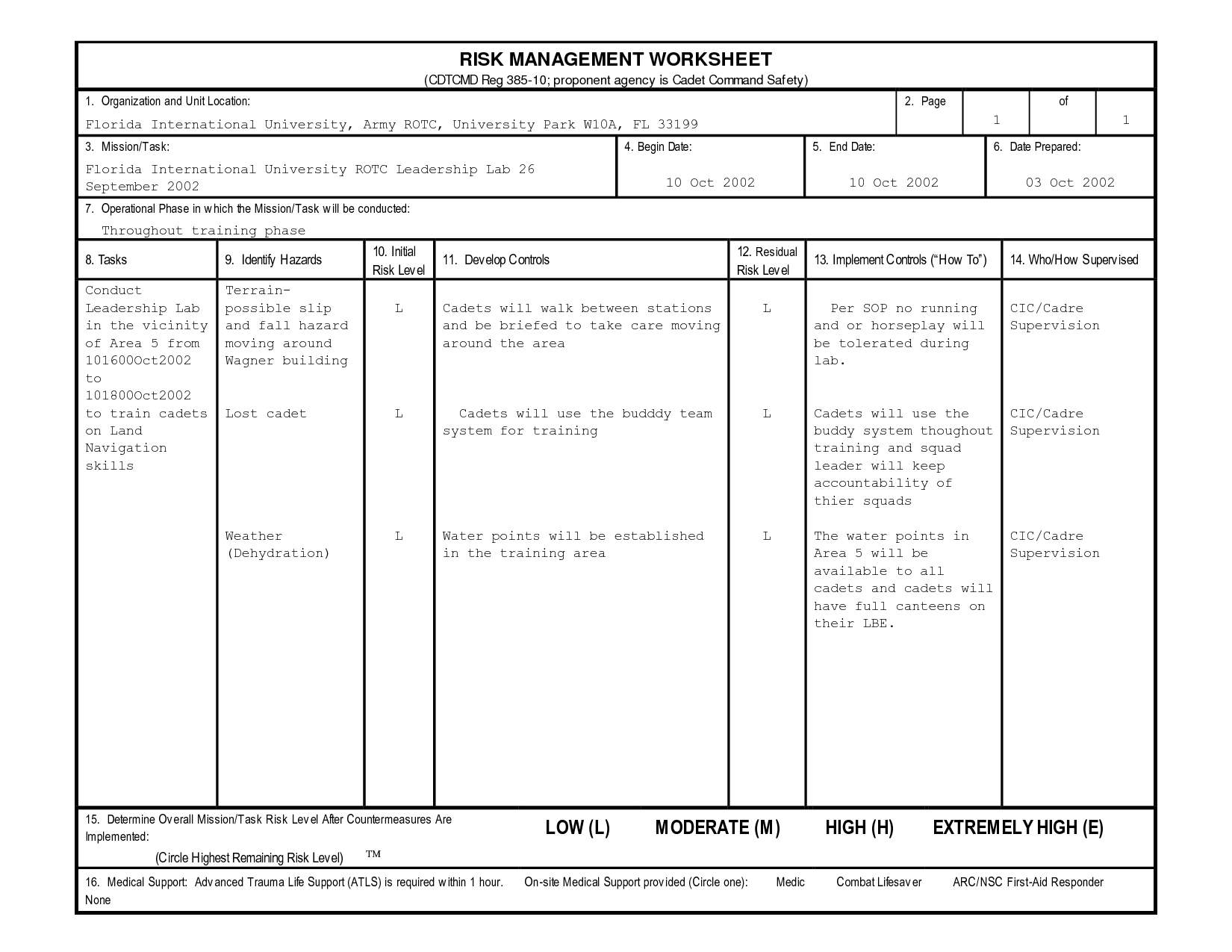

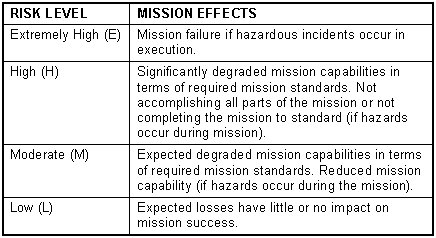

- Army Risk Management Worksheet

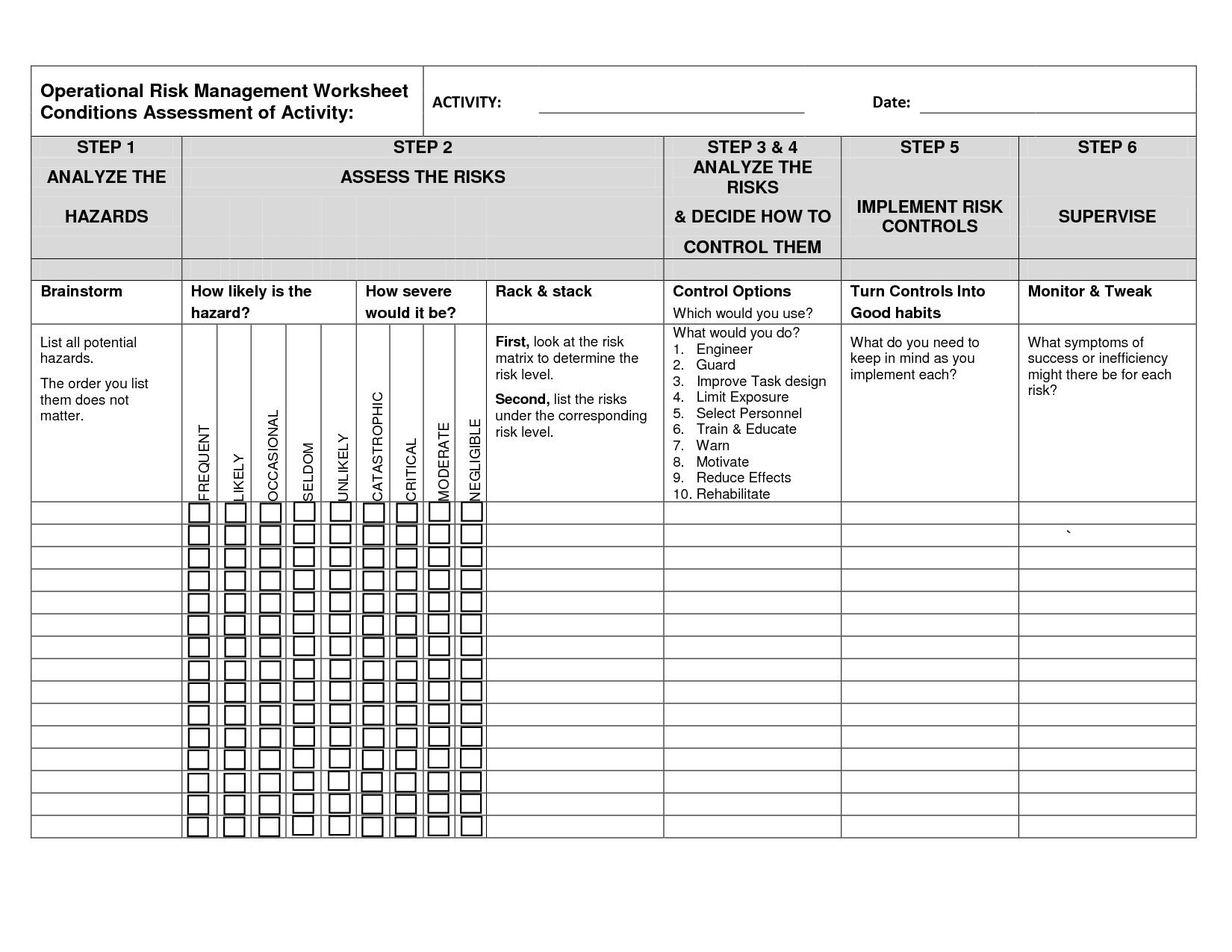

- Operational Risk Assessment Worksheet Example

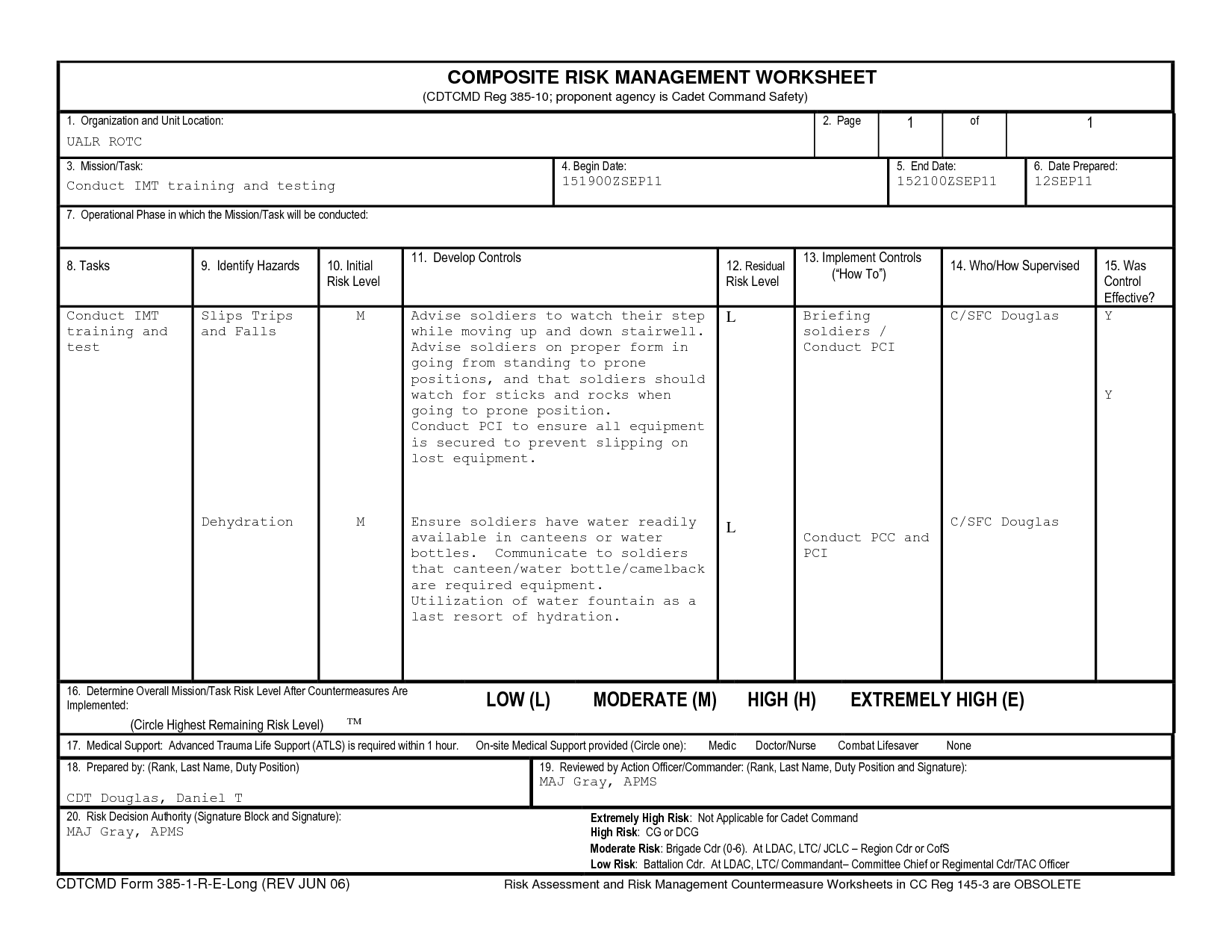

- Army Composite Risk Management Worksheet Example

- Blank Risk Management Worksheet

- Completed DA Form 7566 Examples

- Army Risk Assessment Form

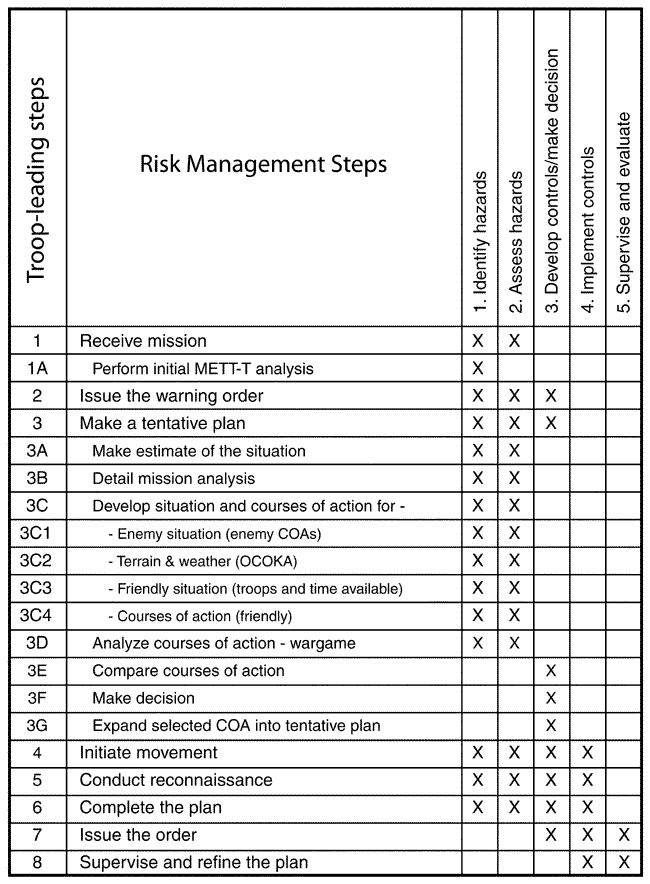

- Army Composite Risk Management

- Army Composite Risk Assessment

- Blank Risk Assessment Forms

- Operational Risk Assessment Worksheet Example

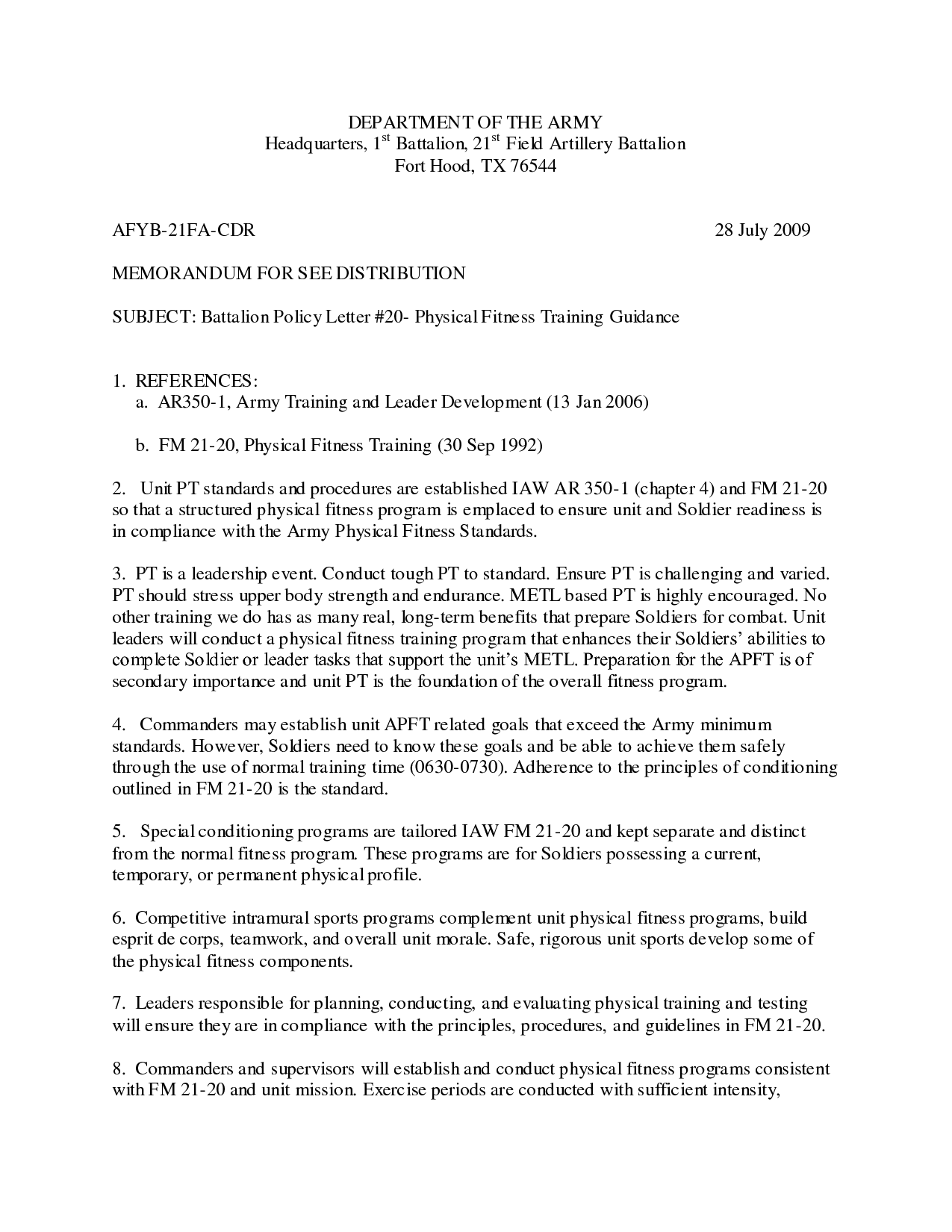

- Army Physical Training Risk Assessment Examples

- Army Physical Training Risk Assessment Examples

- Army Physical Training Risk Assessment Examples

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is risk management?

Risk management is the process of identifying, assessing, and prioritizing risks within an organization, and then implementing strategies to mitigate or control those risks. This involves analyzing potential threats or events that could negatively impact the objectives of the organization, and developing plans to address them in order to minimize potential damage or loss. It is a proactive approach to managing uncertainties and ensuring the long-term success and sustainability of a business.

Why is risk management important?

Risk management is important because it allows businesses to identify, assess, and mitigate potential threats that could harm their operations, finances, or reputation. By proactively managing risks, organizations can make informed decisions, increase resilience to unexpected events, comply with regulations, protect stakeholders, and ultimately increase their chances of achieving their goals and objectives.

What are the key steps in the risk management process?

The key steps in the risk management process include: identifying potential risks, analyzing and evaluating those risks, developing a plan to mitigate or manage those risks, implementing the plan, and monitoring the effectiveness of risk management strategies. Additionally, it is important to regularly review and update the risk management process to account for changes in the business environment or new potential risks.

What are the different types of risks that organizations need to consider?

Organizations need to consider various types of risks, including strategic risks related to achieving business objectives, operational risks stemming from internal processes and systems, compliance risks arising from legal and regulatory requirements, financial risks linked to managing financial resources, reputational risks impacting public perception, and security risks related to protecting information and assets. By identifying, assessing, and managing these risks effectively, organizations can enhance their resilience and achieve sustainable success.

How can organizations identify and assess risks?

Organizations can identify and assess risks by conducting comprehensive risk assessments, which involve identifying potential risks, evaluating the likelihood and impact of those risks, and prioritizing them based on their significance. This can be done through methods such as brainstorming sessions, risk workshops, risk registers, and scenario analysis. Additionally, organizations can use risk management frameworks and tools to systematically analyze and manage risks across different areas of their operations. Regular reviews and updates of risk assessments are essential to ensure that new risks are identified and existing risks are effectively managed.

What strategies can organizations use to mitigate risks?

Organizations can mitigate risks by implementing a comprehensive risk management plan that includes identifying potential risks, assessing their likelihood and impact, developing effective strategies to address and mitigate them, regularly monitoring and reviewing risk levels, and having appropriate contingency plans in place. Other strategies include fostering a culture of risk awareness and accountability among employees, establishing clear communication channels for reporting and addressing risks promptly, conducting regular training and education on risk management practices, and continuously improving processes based on lessons learned from previous incidents.

How can organizations monitor and evaluate risks?

Organizations can monitor and evaluate risks by conducting regular risk assessments to identify potential threats, vulnerabilities, and impacts on their operations. They can then implement risk management processes such as setting up early warning systems, establishing key risk indicators, and monitoring performance metrics to track risk exposure. It is also important to continuously review and update risk management strategies, engage stakeholders in risk discussions, and conduct scenario planning exercises to prepare for potential risks. Ultimately, organizations need to create a risk-aware culture where risk management is integrated into decision-making processes at all levels of the organization.

What are some common challenges in implementing effective risk management?

Some common challenges in implementing effective risk management include lack of resources and expertise, resistance to change within the organization, inadequate communication among stakeholders, difficulty in identifying and prioritizing risks, and inconsistent risk assessment processes. Additionally, external factors such as regulatory changes, economic fluctuations, and emerging risks can also pose challenges in managing risks effectively. It is crucial for organizations to address these challenges by developing a robust risk management framework, fostering a risk-aware culture, and continuously evaluating and adjusting their risk management strategies.

How does risk management contribute to overall organizational resilience?

Risk management contributes to overall organizational resilience by helping to identify, assess, and mitigate potential threats or challenges that could impede the organization's ability to function effectively. By proactively addressing risks, organizations can build a more robust foundation, enhance their ability to anticipate and respond to disruptions, and ultimately increase their capacity to adapt and recover from adverse events. This proactive approach fosters a culture of preparedness and agility, enabling the organization to navigate uncertainties and changes with greater confidence and resilience.

What are some best practices for developing and implementing a risk management program?

Some best practices for developing and implementing a risk management program include: conducting a thorough risk assessment to identify and prioritize potential risks, establishing clear risk management policies and procedures, ensuring strong leadership support and communication across all levels of the organization, regularly monitoring and evaluating risks, and adapting strategies as needed, providing comprehensive training and resources to staff on risk management practices, and fostering a culture that values and promotes proactive risk management efforts.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments