Profit Loss Statement Worksheet

A profit loss statement worksheet is a valuable tool for business owners and entrepreneurs to track and analyze their company's financial performance. This document acts as a comprehensive entity that allows you to systematically record revenue, expenses, and calculate the net income (or loss) of your business. Whether you are a small business owner seeking to evaluate profitability or a financial manager who needs to present financial data to stakeholders, the profit loss statement worksheet serves as an essential subject for managing and understanding your company's financial health.

Table of Images 👆

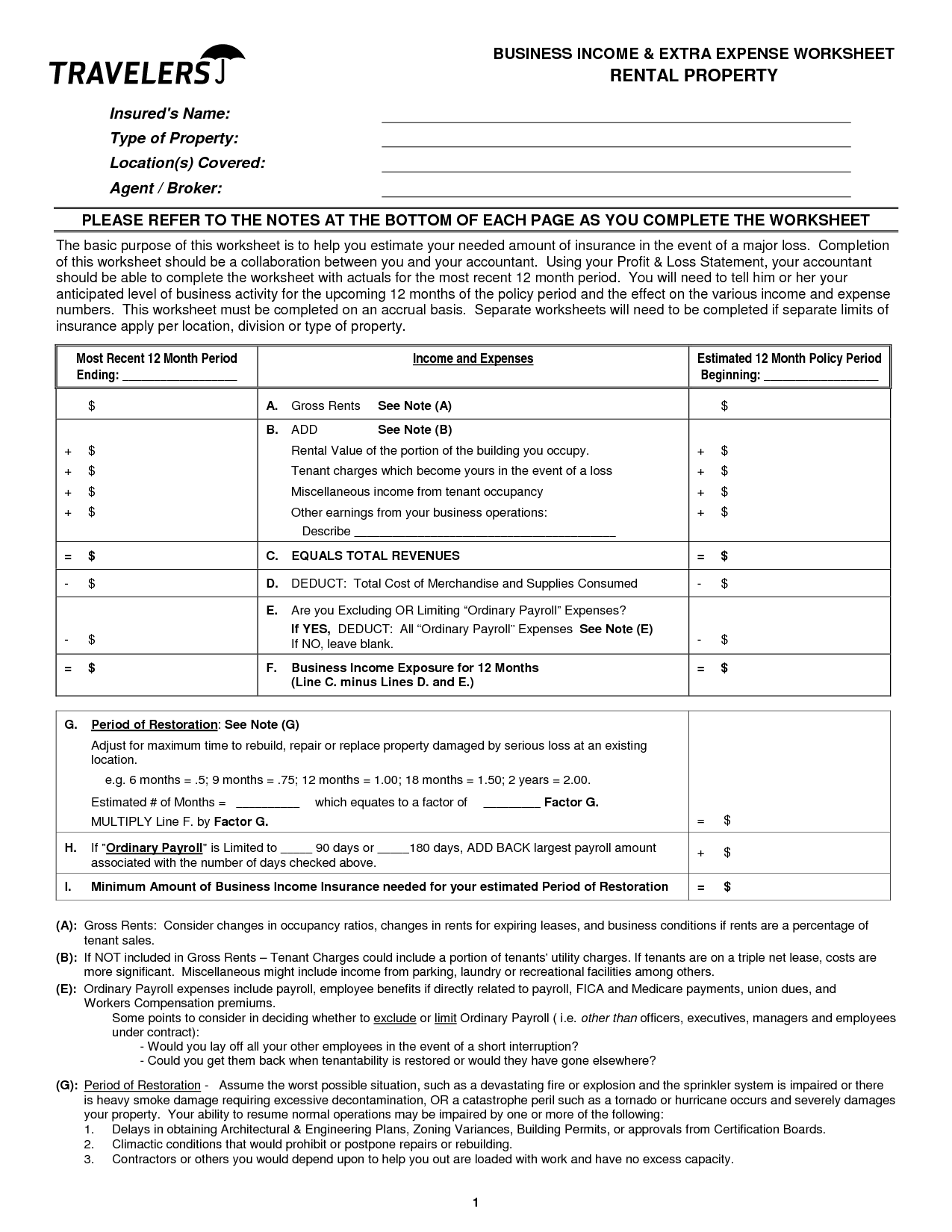

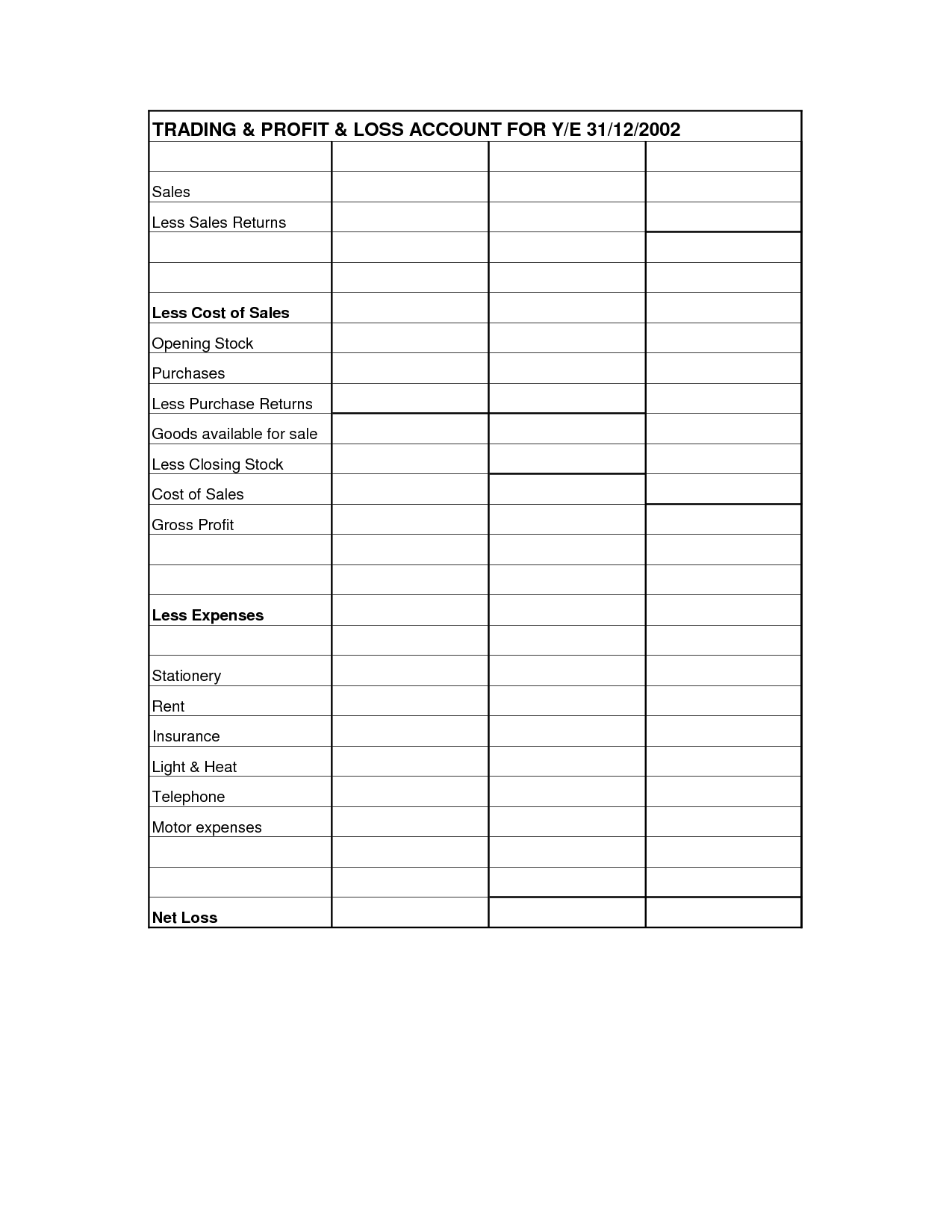

- Business Income Extra Expense Worksheet

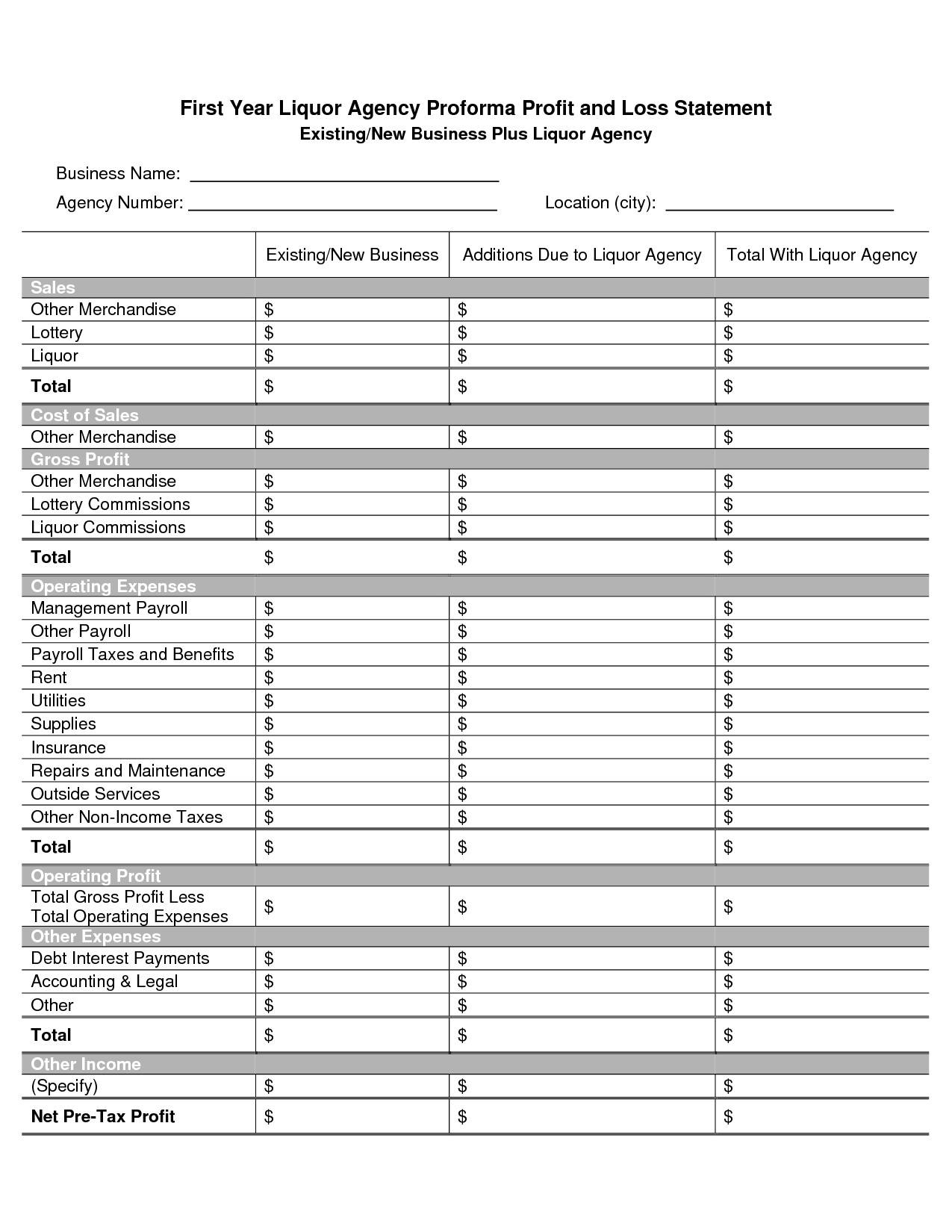

- Printable Profit and Loss Statement

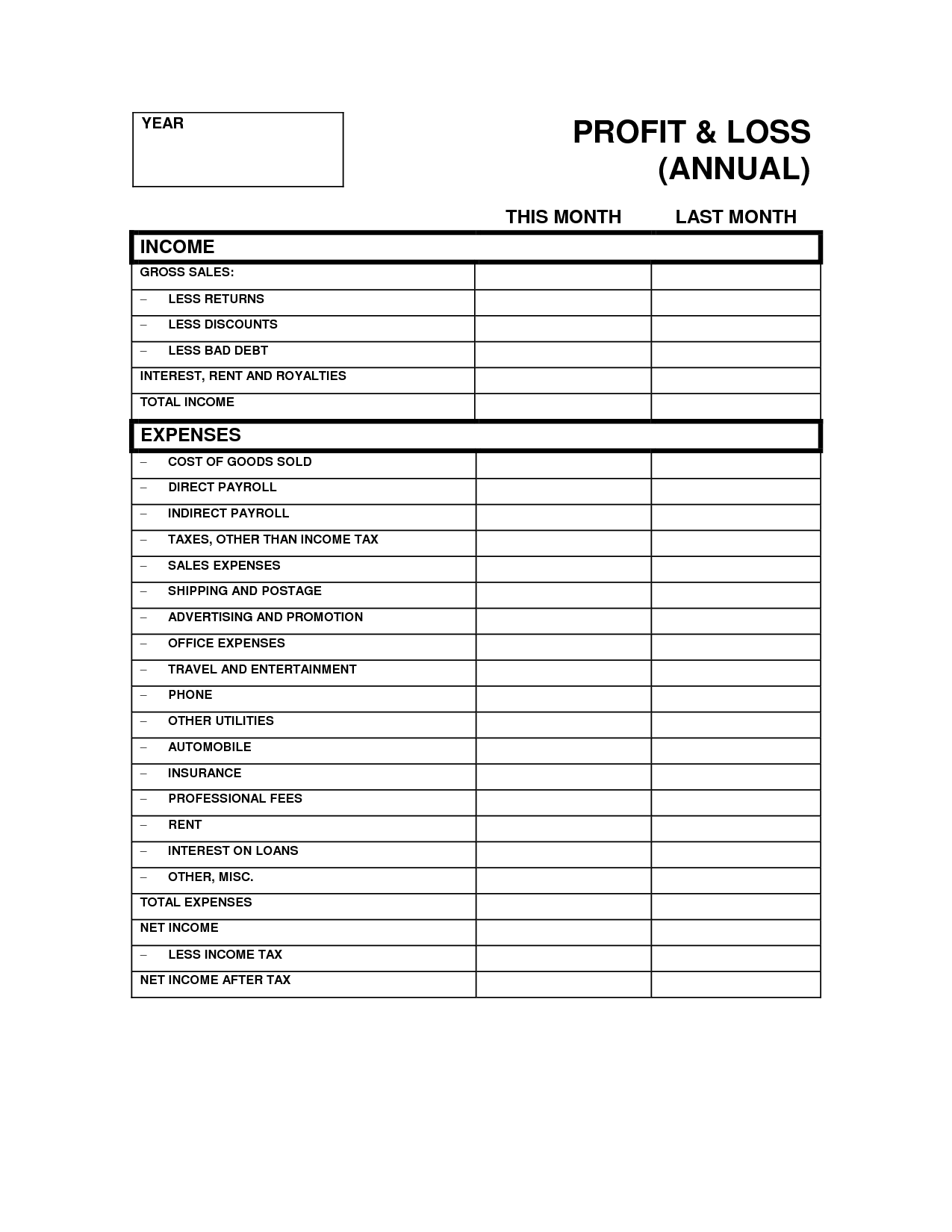

- Free Printable Profit Loss Forms

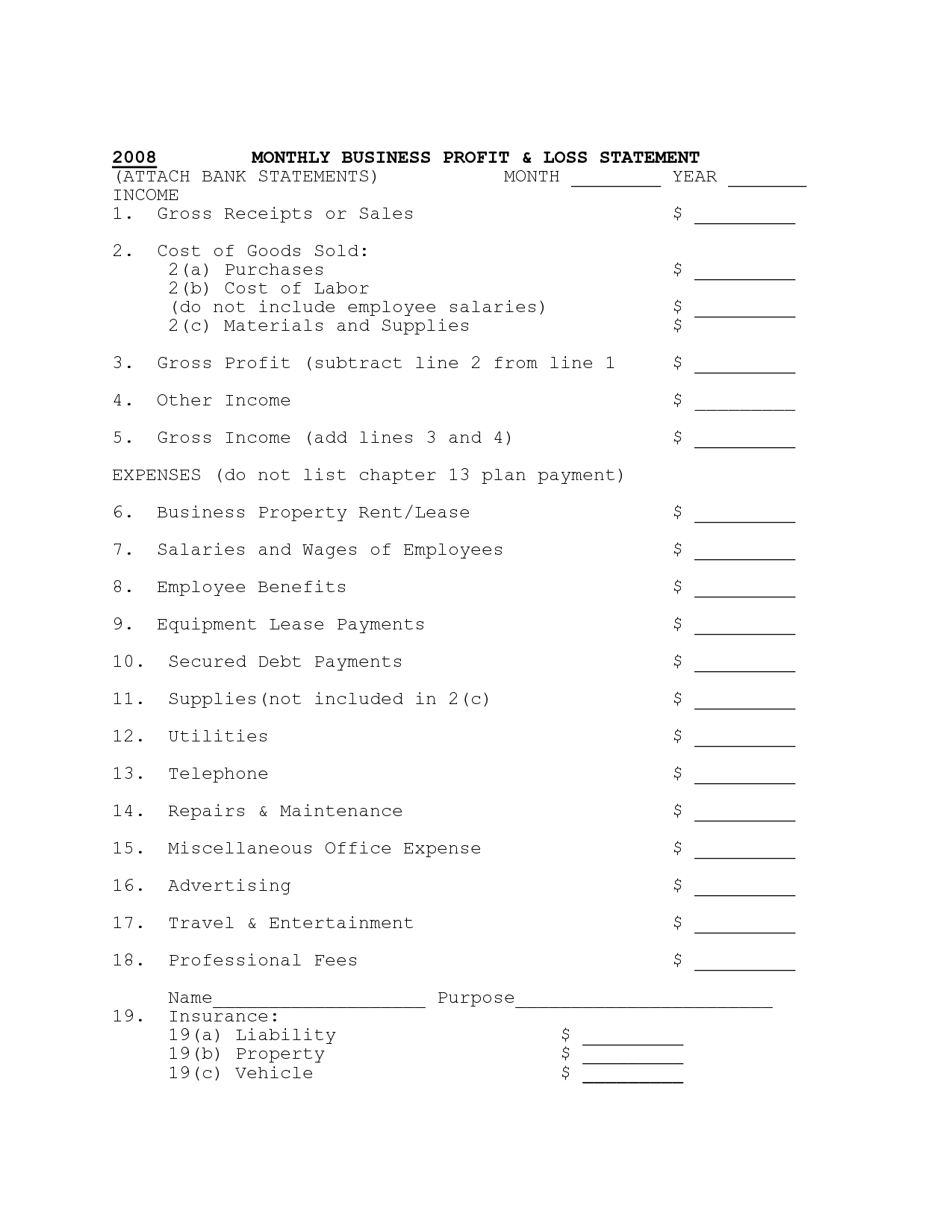

- Monthly Profit and Loss Statement

- Profit and Loss Statement Worksheet

- Blank Profit and Loss Statement Template

- Profit and Loss Statement Form Template

- Restaurant Profit and Loss Statement Template

- Sample Profit and Loss Worksheet

- Profit and Loss Balance Sheet

- Free Profit and Loss Worksheet

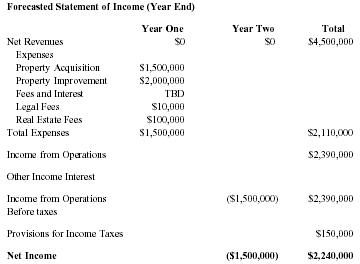

- Real Estate Profit and Loss Statement

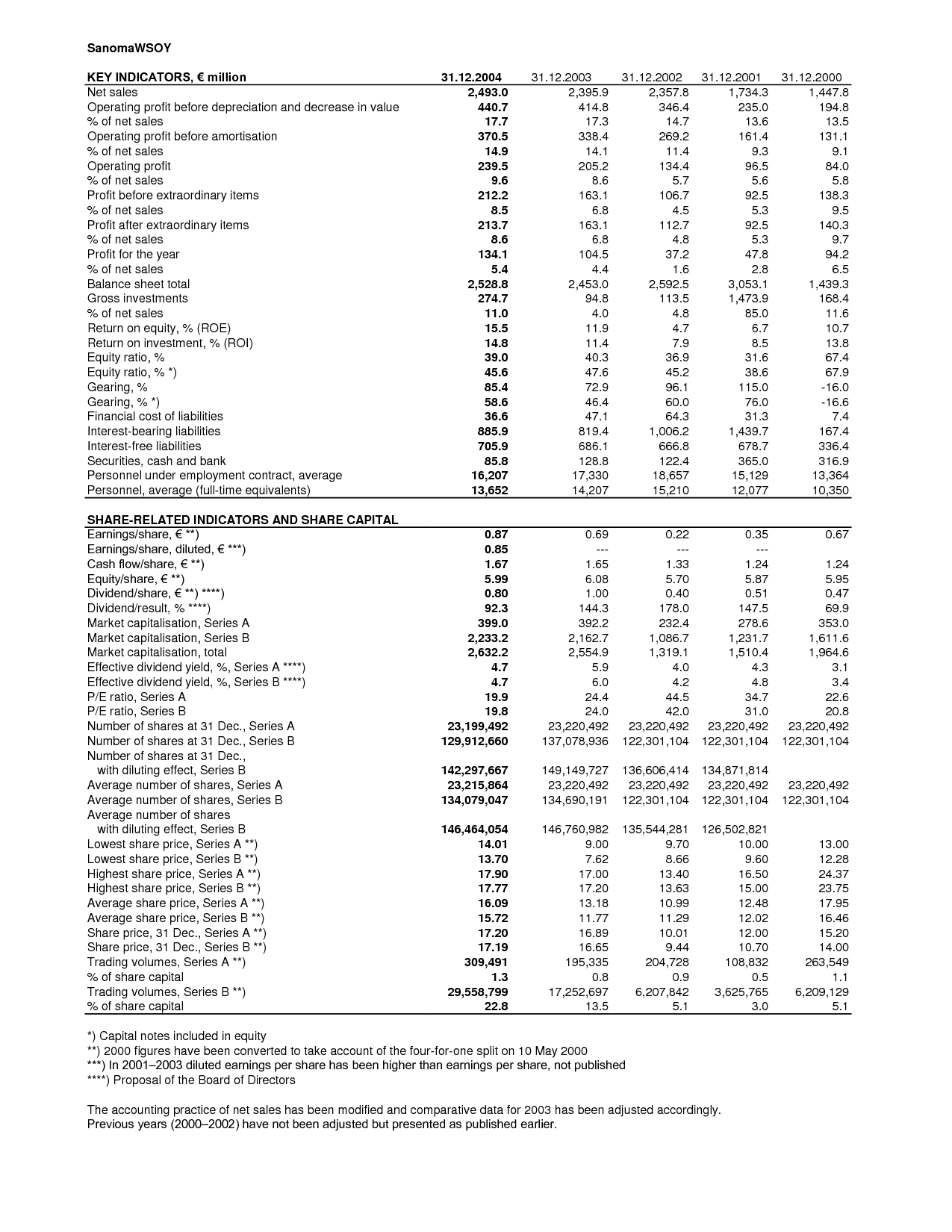

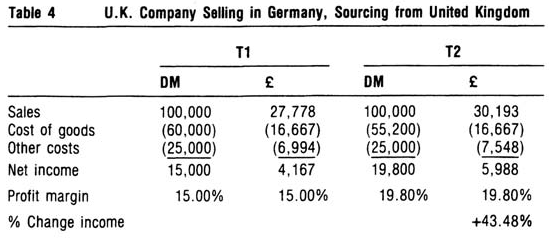

- Foreign Exchange Rates

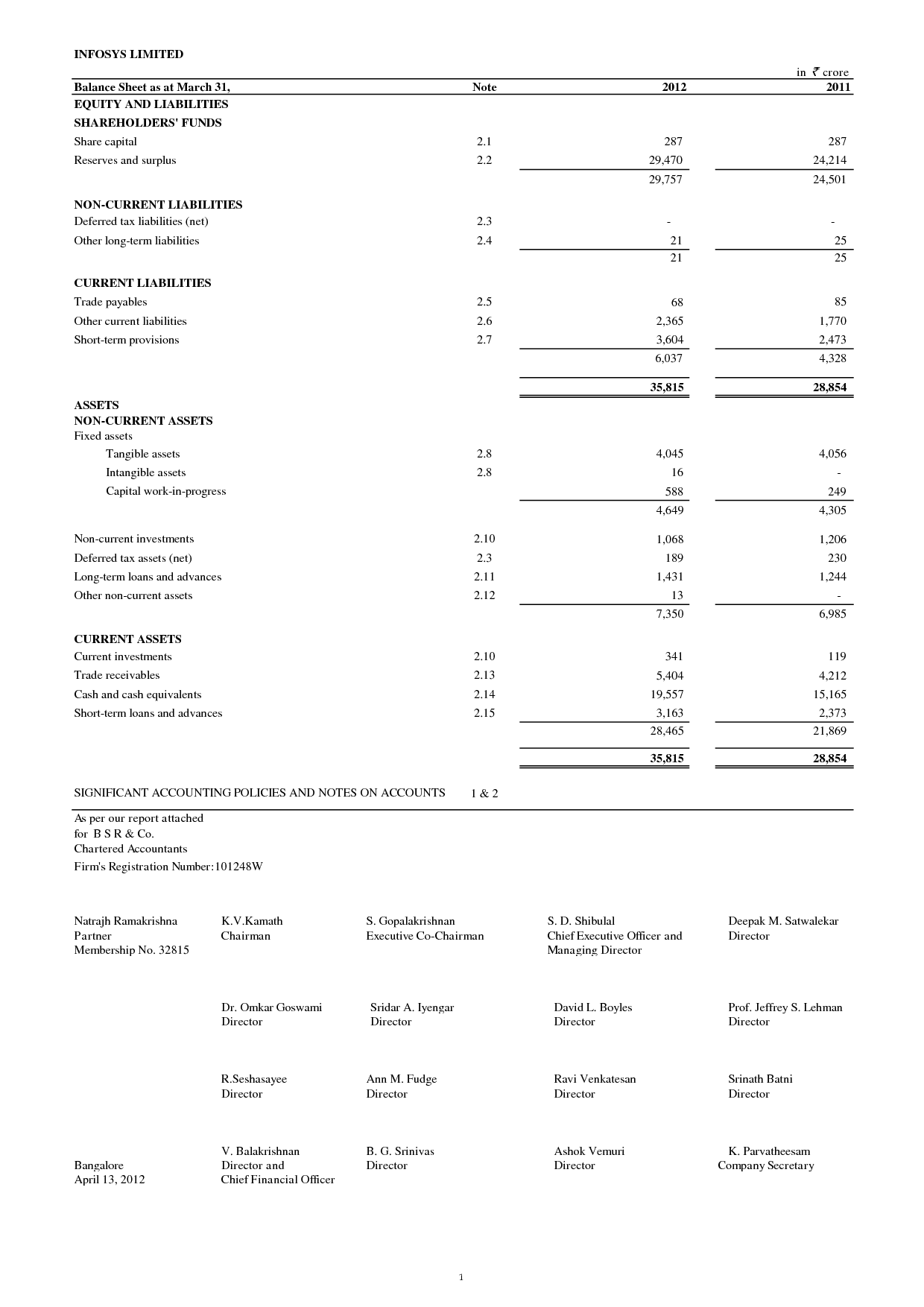

- Business Plan Balance Sheet Template

- Business Plan Balance Sheet Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a Profit Loss Statement Worksheet?

A Profit Loss Statement Worksheet is a tool used by businesses to summarize their revenues and expenses and calculate their net income or loss within a specific period, typically monthly, quarterly, or annually. It provides a snapshot of the financial performance of a company and helps in analyzing its profitability by comparing revenues against expenses. This document is crucial for evaluating the financial health of a business and making informed decisions to improve its bottom line.

What information does a Profit Loss Statement Worksheet typically include?

A Profit Loss Statement Worksheet typically includes information on a company's revenue, expenses, and net income over a specific period, such as a month, quarter, or year. It provides a breakdown of the various sources of revenue and categories of expenses, allowing businesses to track their financial performance and assess their profitability. The statement helps in analyzing the company's financial health and making informed decisions about cost management and revenue generation strategies.

How can a Profit Loss Statement Worksheet help a business owner?

A Profit Loss Statement Worksheet can help a business owner by providing a clear and organized summary of their revenues, costs, and expenses over a specific time period. It allows the business owner to analyze their financial performance, identify areas of profitability or loss, make informed decisions on budgeting, pricing, and investments, and track progress towards financial goals. Additionally, a Profit Loss Statement Worksheet can be used for tax purposes, obtaining financing, and demonstrating the overall health and viability of the business to stakeholders.

What are the main sections or categories in a Profit Loss Statement Worksheet?

A Profit and Loss Statement Worksheet typically includes sections such as revenue or sales, cost of goods sold, gross profit, operating expenses, net income before taxes, income tax expense, and net income after taxes. Each section provides a breakdown of the financial performance of a business during a specific period, helping to analyze its profitability and financial health.

How is revenue or income typically recorded in a Profit Loss Statement Worksheet?

Revenue or income is typically recorded as the top line item in a Profit Loss Statement Worksheet. It represents the total amount of money generated from sales of goods or services. This figure is essential as it sets the foundation for calculating the company's gross profit and ultimately the net income or profit after all expenses have been deducted.

How are expenses recorded in a Profit Loss Statement Worksheet?

Expenses are recorded in a Profit Loss Statement Worksheet by categorizing them according to different expense types such as cost of goods sold, operating expenses, interest expenses, and taxes. The total expenses incurred during a specific period are subtracted from the total revenue generated to calculate the net income or loss. This provides a comprehensive overview of the financial performance of a business and helps in analyzing its profitability and identifying areas for improvement.

How is net profit or loss calculated in a Profit Loss Statement Worksheet?

Net profit or loss in a Profit Loss Statement Worksheet is calculated by subtracting the total expenses from the total revenue. Total revenue includes all the income generated from sales, services, and other sources. Total expenses include costs related to production, operations, and other necessary expenditures. Subtracting the total expenses from the total revenue gives the net profit if it is a positive number, and net loss if it is a negative number.

Why is it important to regularly review and update a Profit Loss Statement Worksheet?

Regularly reviewing and updating a Profit Loss Statement Worksheet is crucial because it provides insights into the financial health of a business. By analyzing the revenues and expenses, business owners can identify trends, make informed decisions, and adjust strategies to improve profitability. It also helps in tracking performance over time, highlighting areas that may need attention or improvement. Overall, staying informed with up-to-date financial data allows for proactive management and better decision-making within the business.

What can a business owner learn about their financial performance from a Profit Loss Statement Worksheet?

A business owner can learn a lot about their financial performance from a Profit and Loss Statement Worksheet. This type of financial document provides a breakdown of a company's revenues, costs, and expenses over a specific period of time, allowing the owner to assess the business's profitability. By analyzing the information in the Profit and Loss Statement, a business owner can identify trends, pinpoint areas of success or concern, make strategic decisions, and ultimately improve the overall financial health and performance of the business.

How can a Profit Loss Statement Worksheet be used to make informed financial decisions for a business?

A Profit Loss Statement Worksheet can be used to make informed financial decisions for a business by providing a clear overview of the company's financial performance over a specific period. By analyzing revenues, expenses, and ultimately the profit or loss generated, business owners can pinpoint areas of strength and weakness in their operations. This information can help in identifying opportunities for cost-cutting, revenue growth, or strategic investments to improve overall profitability. Additionally, the statement can aid in assessing the effectiveness of past financial decisions and setting realistic goals for the future, enabling proactive and informed decision-making to drive the business towards financial success.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments