Profit and Loss Worksheet

Managing personal finances can sometimes feel overwhelming, but with the help of worksheets, you can easily keep track of your income and expenses. Whether you're a budget-conscious individual trying to save money or a small business owner monitoring your profits, a profit and loss worksheet is a valuable tool that provides a clear overview of your financial situation. By accurately recording all sources of income and expenditures, this worksheet helps you analyze your financial health and make informed decisions.

Table of Images 👆

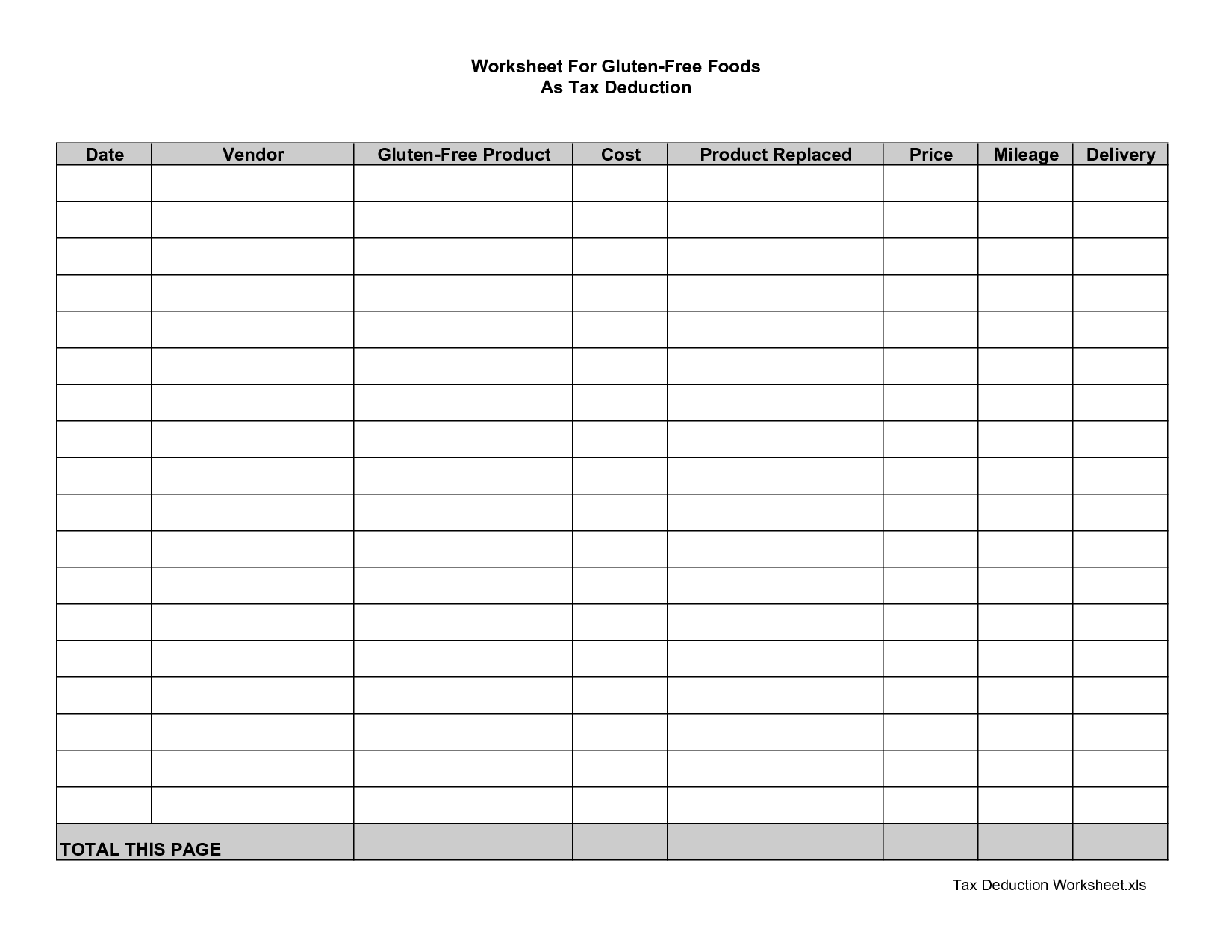

- Business Tax Deductions Worksheet

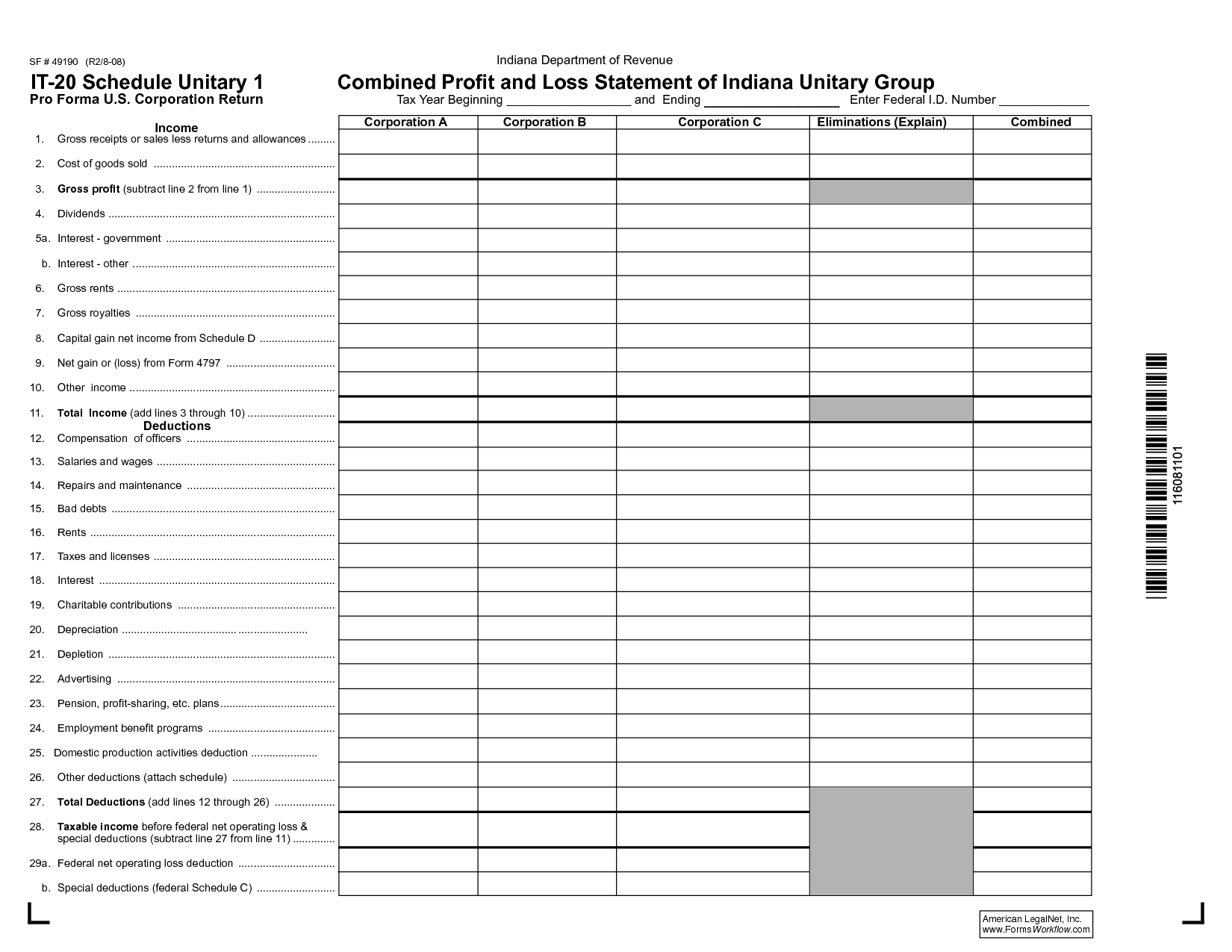

- Profit and Loss Statement Form

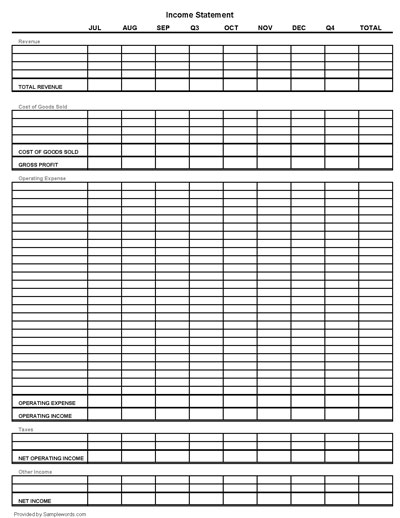

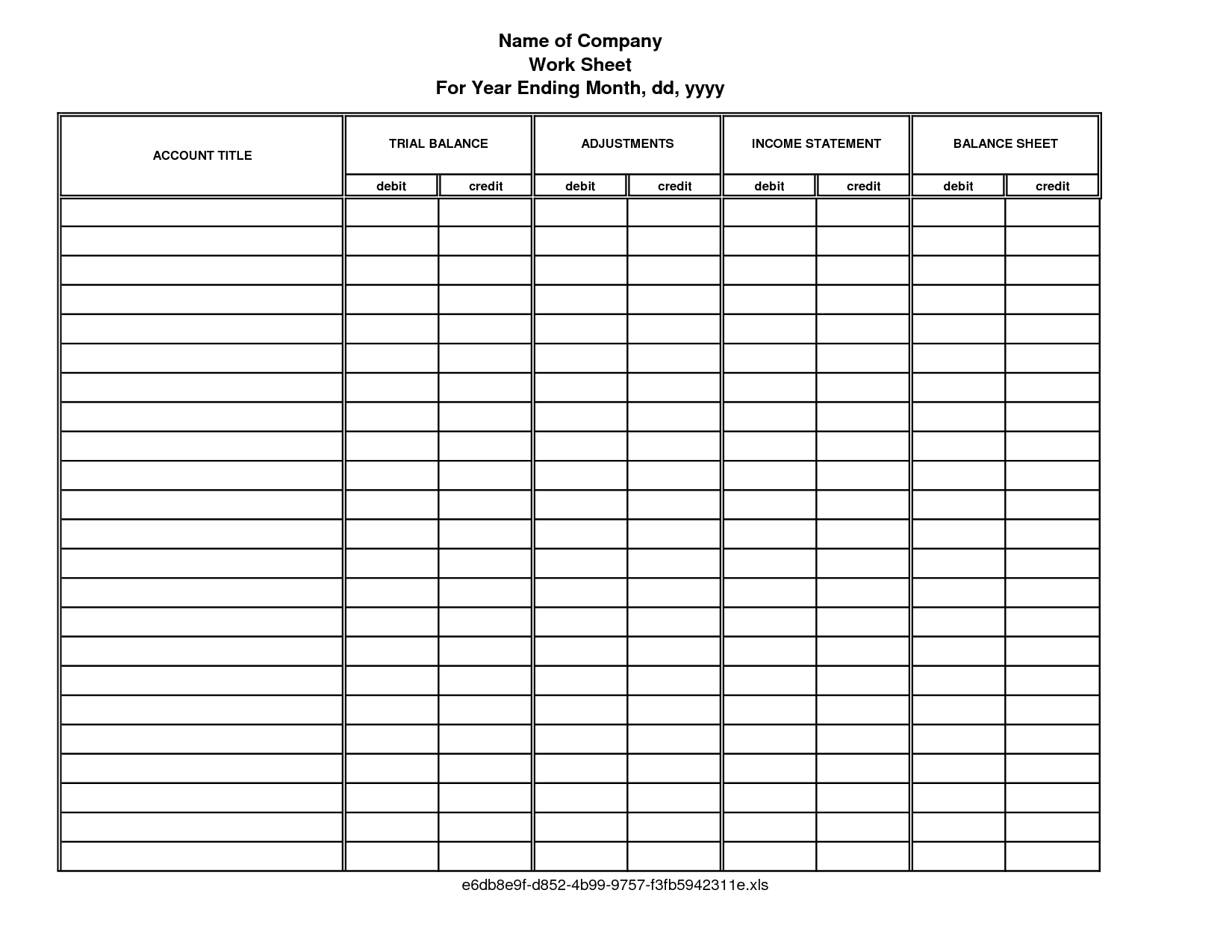

- Free Blank Spreadsheets

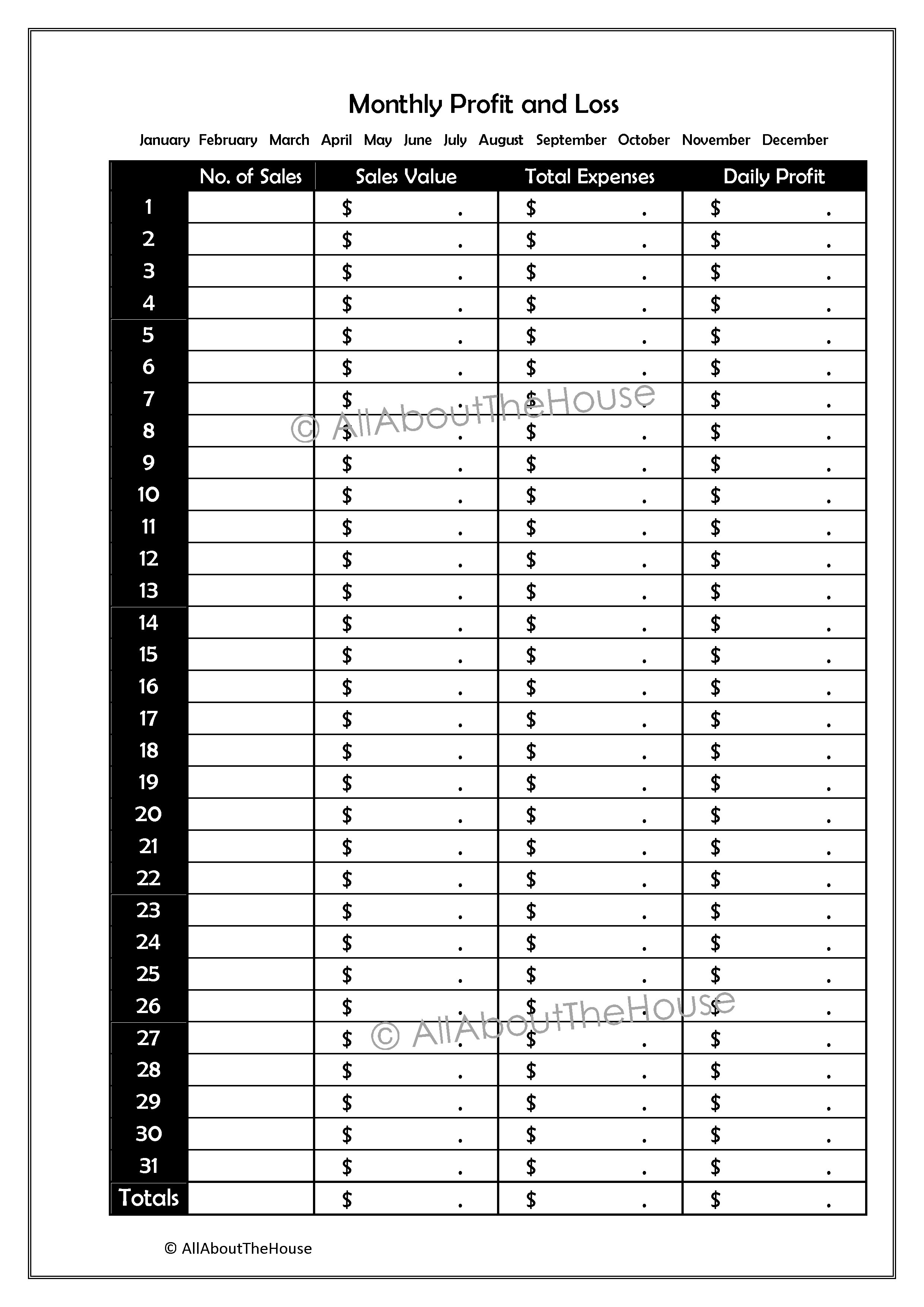

- Monthly Profit and Loss Statement Form Printable

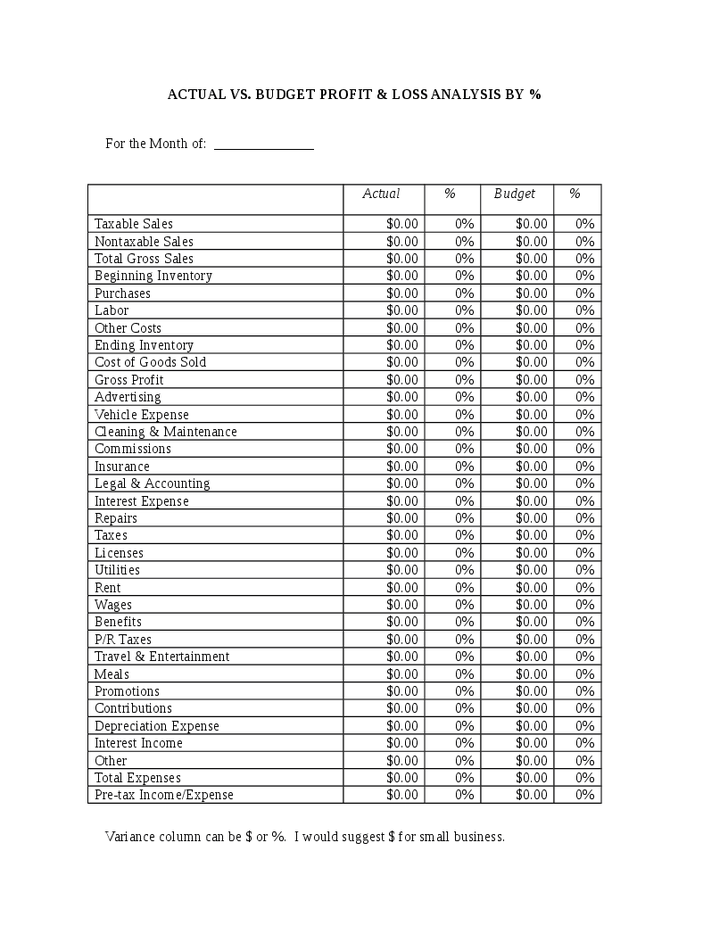

- Profit and Loss Analysis Template

- Free Printable Accounting Ledger Sheets

- Small Business Profit and Loss Form

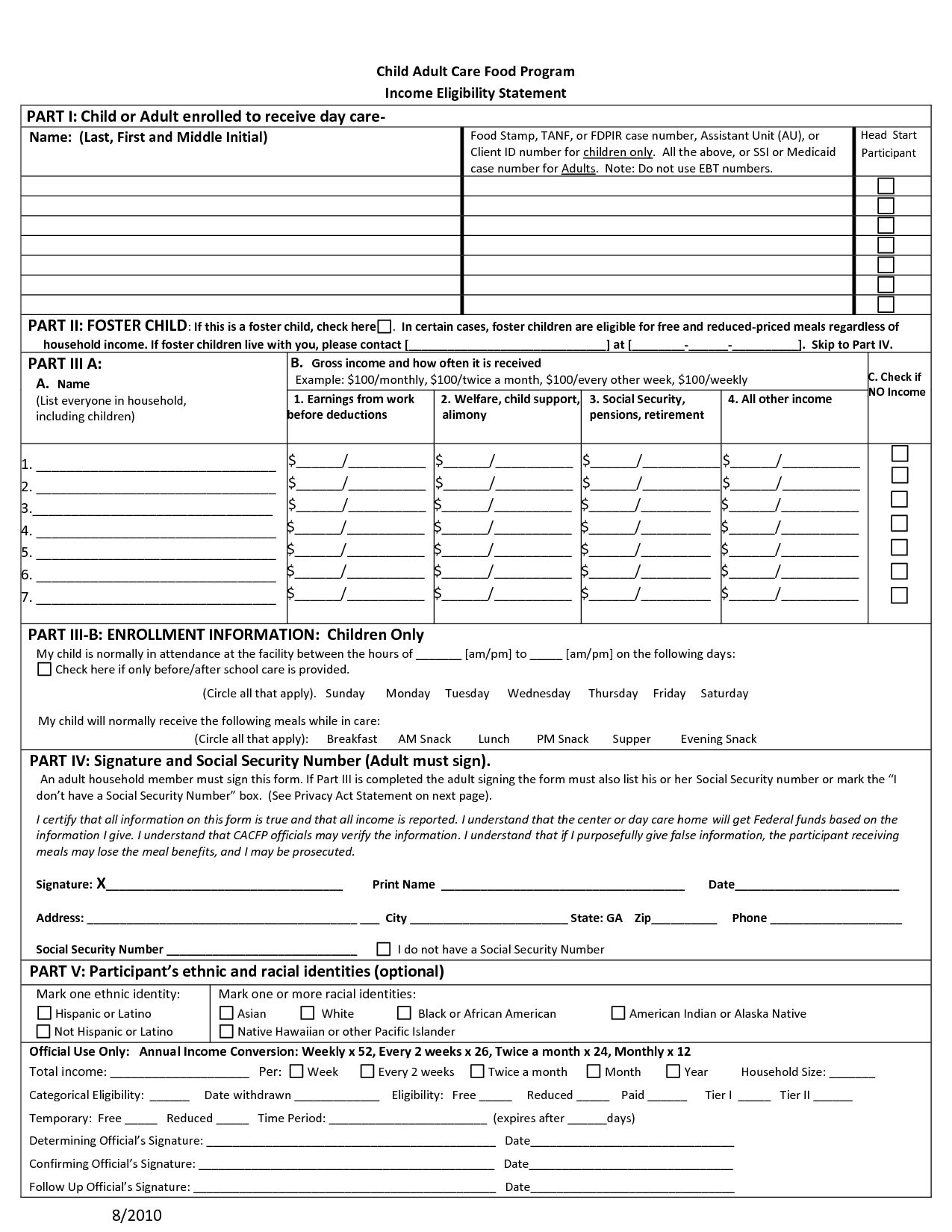

- Day Care Profit and Loss Statement Template

- Blank Monthly Receipt Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a profit and loss worksheet?

A profit and loss worksheet, also known as an income statement, is a financial document that summarizes a company's revenues, expenses, and profits (or losses) over a specific period of time. It provides a snapshot of a business's financial performance and helps in determining whether the company is making a profit or incurring a loss.

How is a profit and loss worksheet used in business?

A profit and loss worksheet is used in business to track and analyze a company's financial performance over a specific period of time. It helps in calculating the total revenue generated, total expenses incurred, and ultimately the net profit or loss earned by the business. By examining the numbers on the worksheet, businesses can identify areas of strength or weakness, make informed decisions regarding budgeting, pricing, and resource allocation, and track progress towards financial goals. This tool is essential for financial planning, forecasting, and overall business strategy.

What are the key components of a profit and loss worksheet?

A profit and loss worksheet typically includes key components such as total revenue, cost of goods sold (COGS), gross profit, operating expenses, net income, and taxes. These components help calculate and analyze the financial performance of a business by determining its profitability and identifying areas where costs can be reduced or revenue can be increased.

How do you calculate gross profit on a profit and loss worksheet?

To calculate gross profit on a profit and loss worksheet, subtract the cost of goods sold (COGS) from the total revenue generated. The formula for calculating gross profit is: Gross Profit = Total Revenue - Cost of Goods Sold. Total Revenue is the sum of all income earned from sales, while Cost of Goods Sold is the sum of all costs directly associated with producing the goods or services sold. Subtracting COGS from total revenue gives you the gross profit, which represents the profit earned from core business activities before deducting other operating expenses.

What is the significance of net profit on a profit and loss worksheet?

Net profit on a profit and loss worksheet is significant as it represents the overall financial performance of a company over a specific period. It shows the amount of money that remains after deducting all expenses from the total revenue generated. A positive net profit indicates that the company is operating efficiently and generating a surplus, while a negative net profit signals that the company is incurring losses. Ultimately, net profit is a key metric for investors, stakeholders, and management to assess the financial health and sustainability of a business.

How can a profit and loss worksheet help analyze the financial health of a business?

A profit and loss worksheet can help analyze the financial health of a business by providing a clear overview of the company's revenues, expenses, and ultimately, its profitability. By examining the revenue sources and expenses in detail, it becomes easier to identify areas of strength and weakness within the business. This analysis can help in making informed decisions to improve efficiency, reduce costs, increase revenue, and ultimately drive the business towards sustainable growth and financial success.

What are some common expenses included in a profit and loss worksheet?

Common expenses included in a profit and loss worksheet typically consist of cost of goods sold, operating expenses such as rent, utilities, salaries, marketing and advertising costs, depreciation, interest payments, and taxes. These expenses are deducted from revenue to calculate the net profit or loss of a business over a specific period of time.

What are some typical revenue streams included in a profit and loss worksheet?

Some typical revenue streams included in a profit and loss worksheet are sales revenue, service revenue, interest income, and any other sources of income generated by the business operations. These revenue streams are essential to calculating the total income earned by the company before deducting expenses to determine the overall profitability.

How does a profit and loss worksheet contribute to financial planning and decision-making?

A profit and loss worksheet helps in financial planning and decision-making by providing a snapshot of a business's revenue, expenses, and overall profitability. By analyzing the data on the worksheet, businesses can identify areas of strength and weakness, set realistic financial goals, track performance against targets, and make informed decisions on operational improvements or cost-cutting measures. This tool also enables businesses to forecast future financial outcomes and assess the viability of potential projects or investments, ultimately contributing to a more strategic and effective financial management approach.

How often should a profit and loss worksheet be updated or reviewed?

A profit and loss worksheet should ideally be updated and reviewed on a monthly basis to ensure that financial performance is accurately tracked and analyzed in a timely manner. This frequent review allows for the identification of any trends, patterns, or variances that may require adjustments to business strategies or operations to maintain profitability.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments