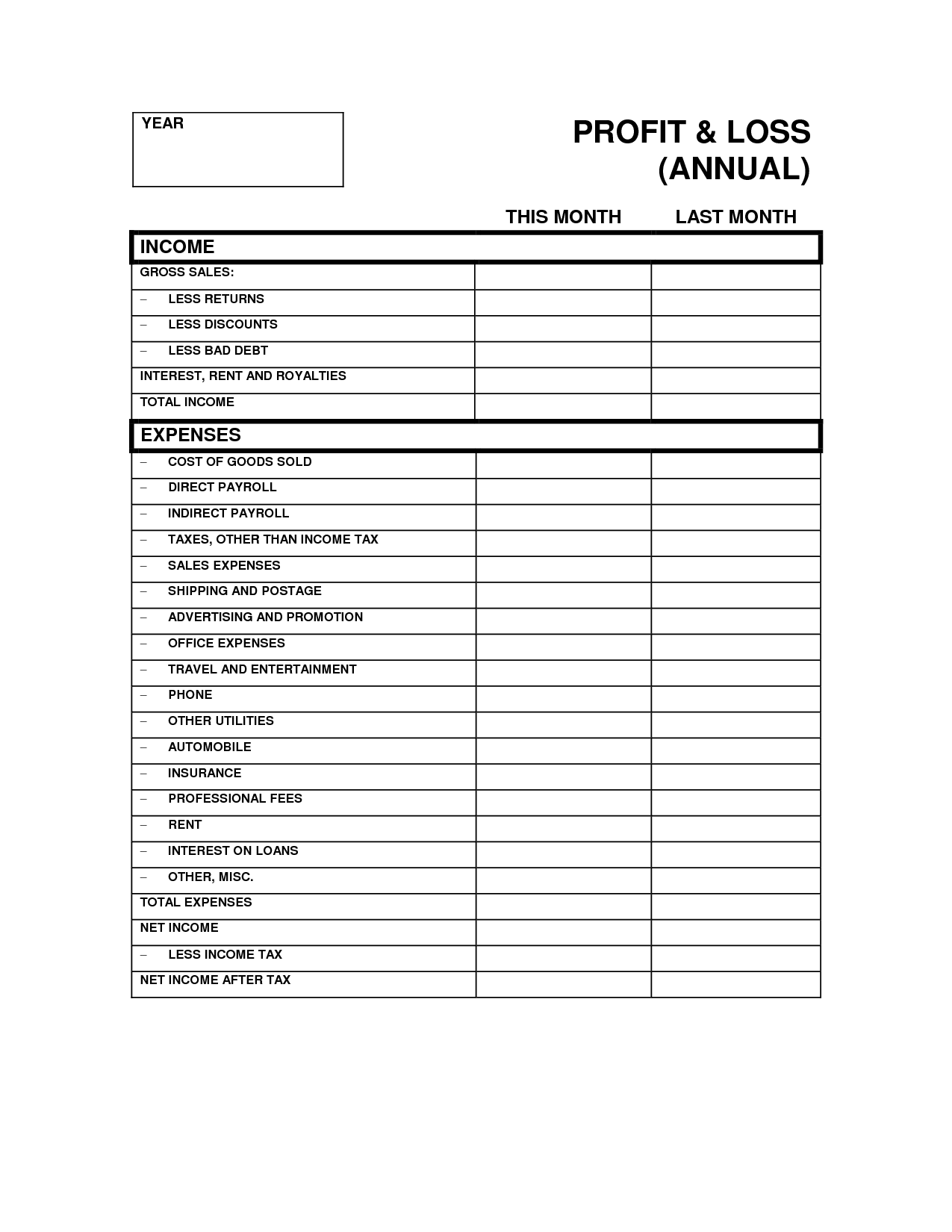

Printable Profit and Loss Worksheet

Are you a small business owner looking for a convenient way to track your company's financial performance? Look no further than the printable Profit and Loss Worksheet. This easy-to-use tool allows you to easily input your expenses, income, and calculate your net profit or loss. With its simple layout and clear sections, this worksheet is perfect for business owners who want to effectively manage their financial data and make informed decisions.

Table of Images 👆

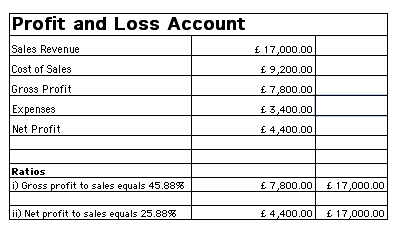

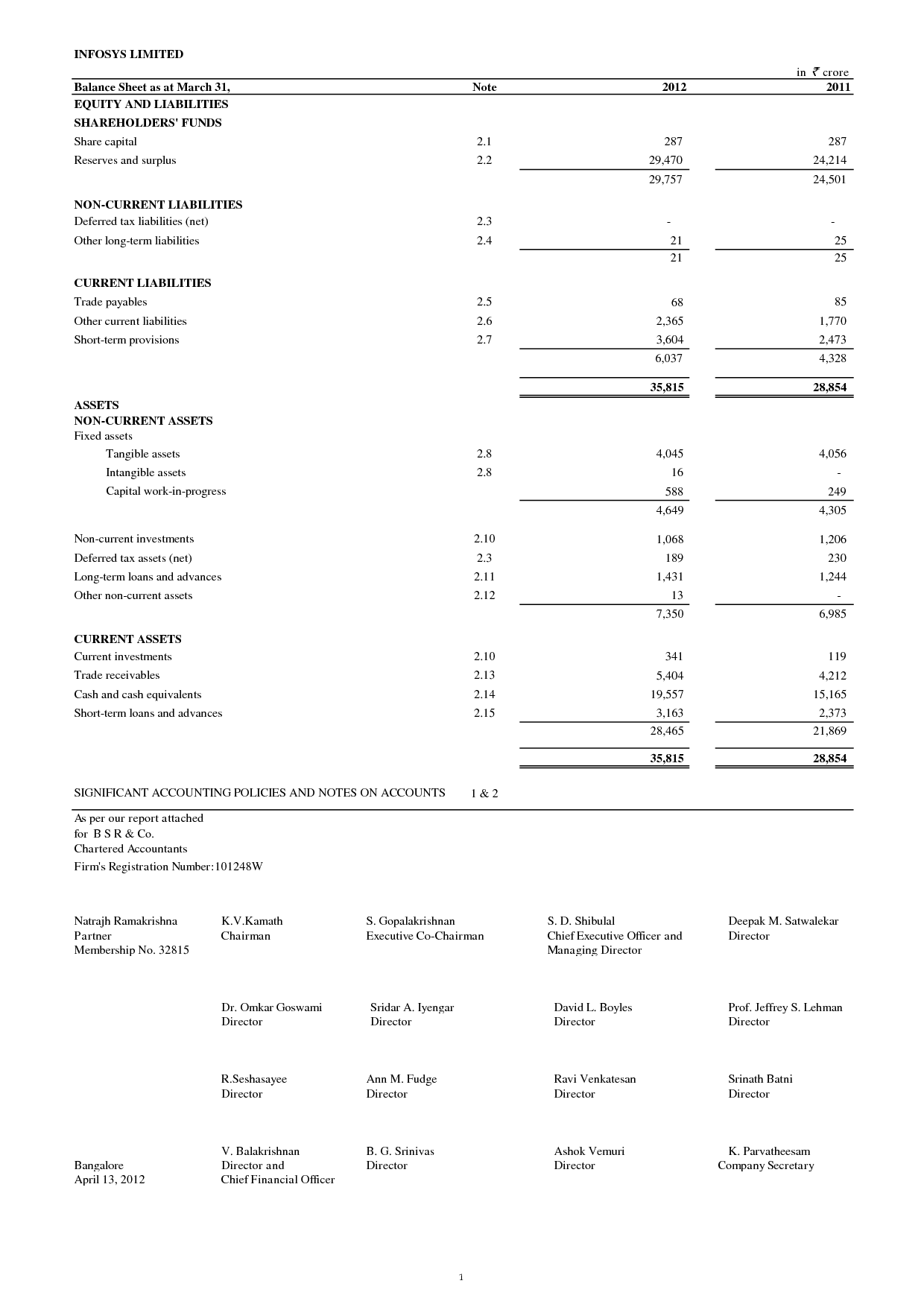

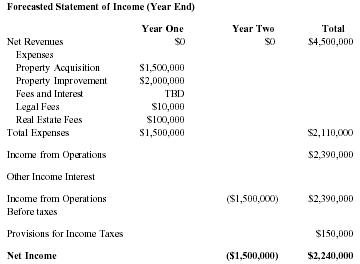

- Profit and Loss Account Example

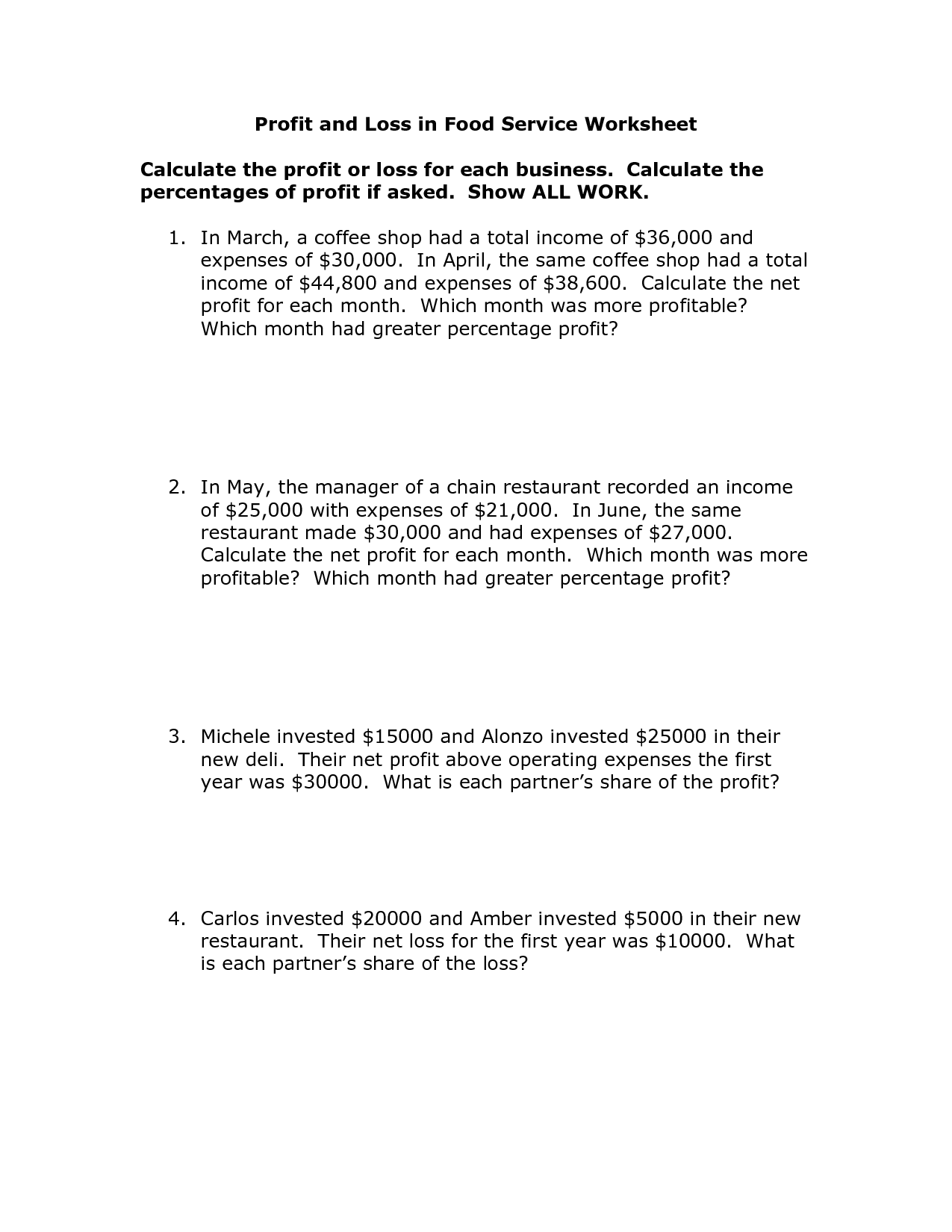

- Business Profit and Loss Worksheet Printable

- Profit and Loss Worksheet

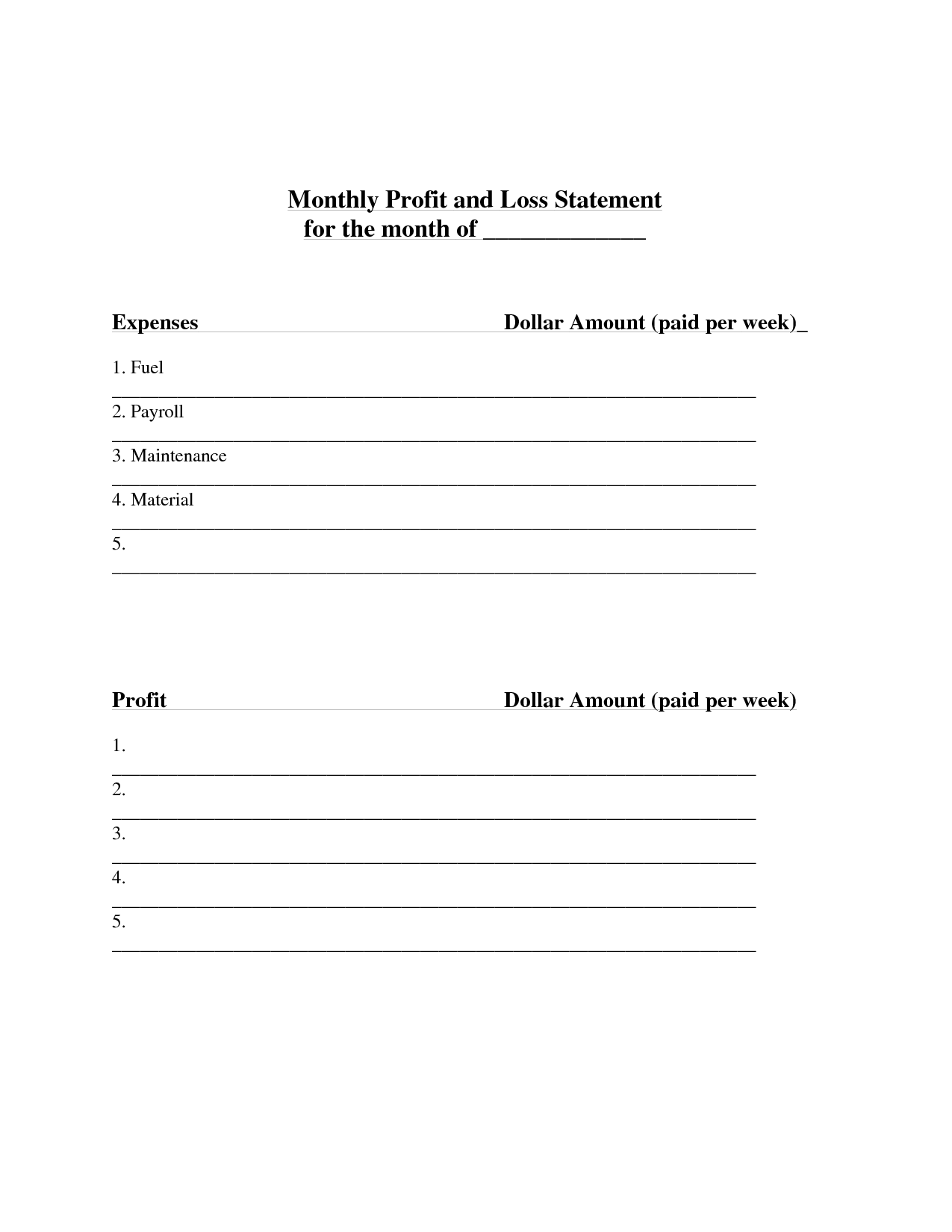

- Monthly Profit and Loss Statement

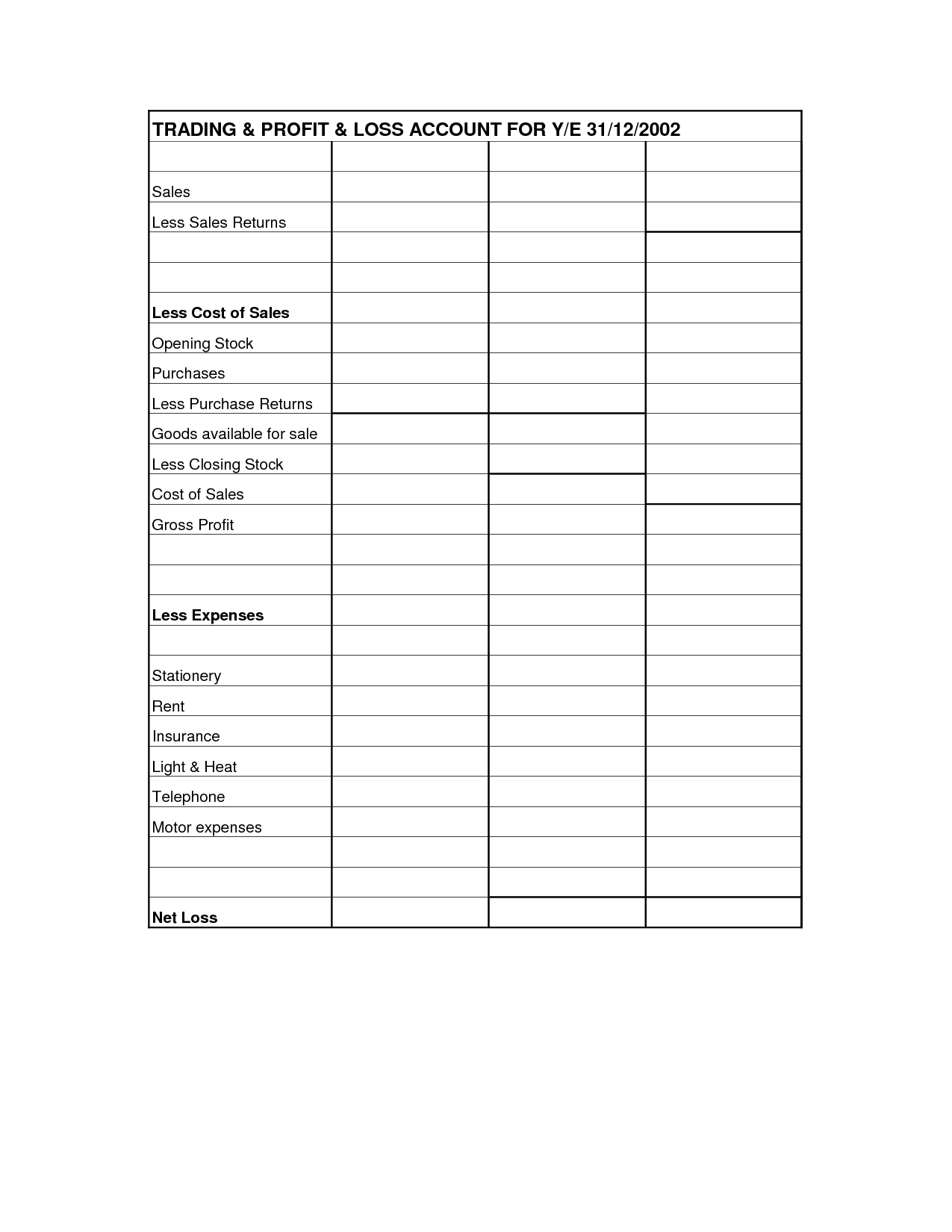

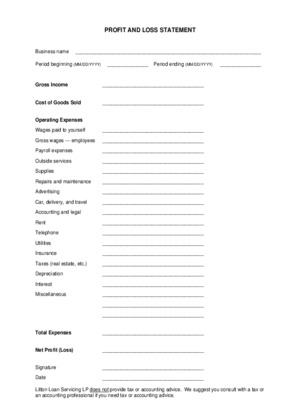

- Blank Profit and Loss Statement Template

- Free Printable Profit Loss Forms

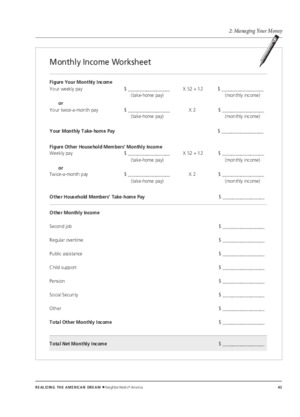

- Monthly Income Profit Loss Statement Worksheet

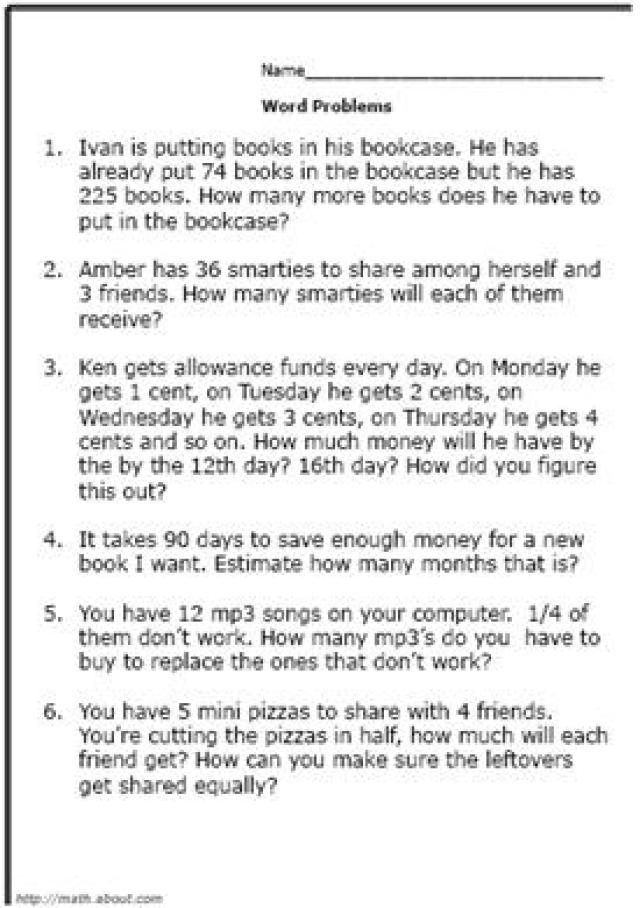

- 3rd Grade Math Word Problems Worksheets

- Restaurant Profit and Loss Statement Template

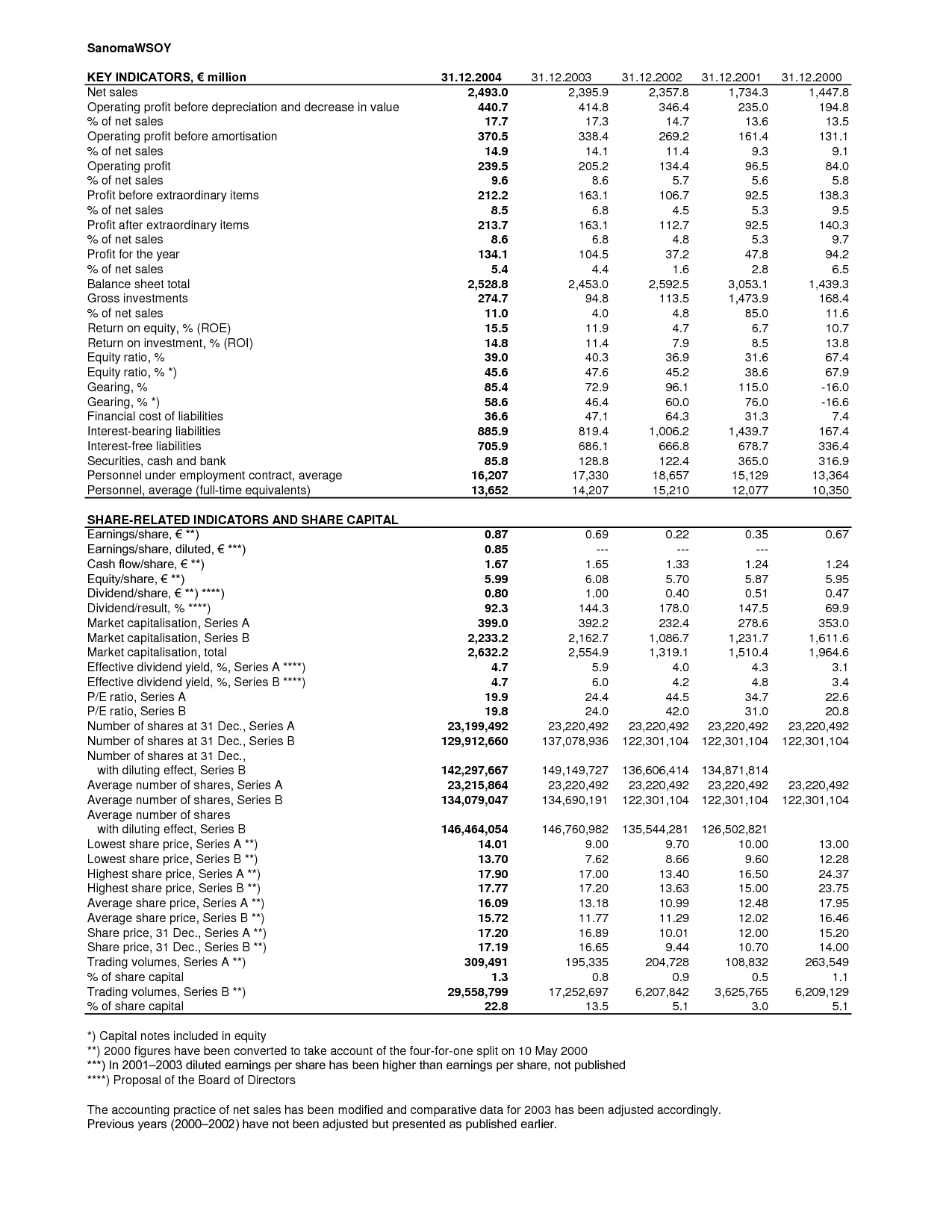

- Profit and Loss Balance Sheet

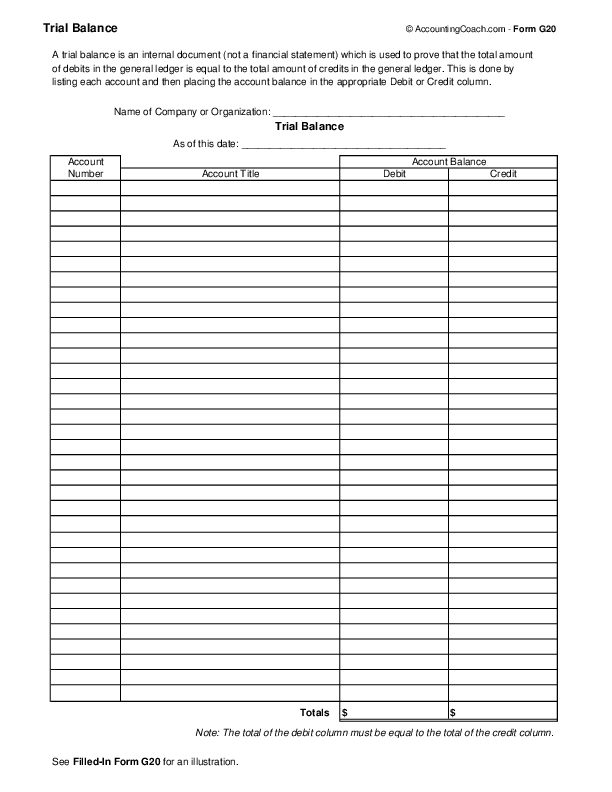

- Trial Balance Sheet Template

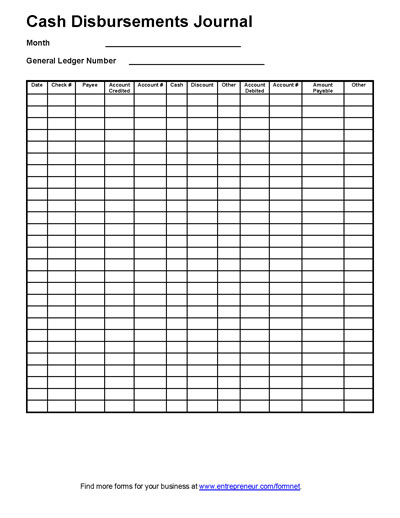

- Cash Disbursement Form Template

- Blank Profit and Loss Statement Form

- Real Estate Profit and Loss Statement

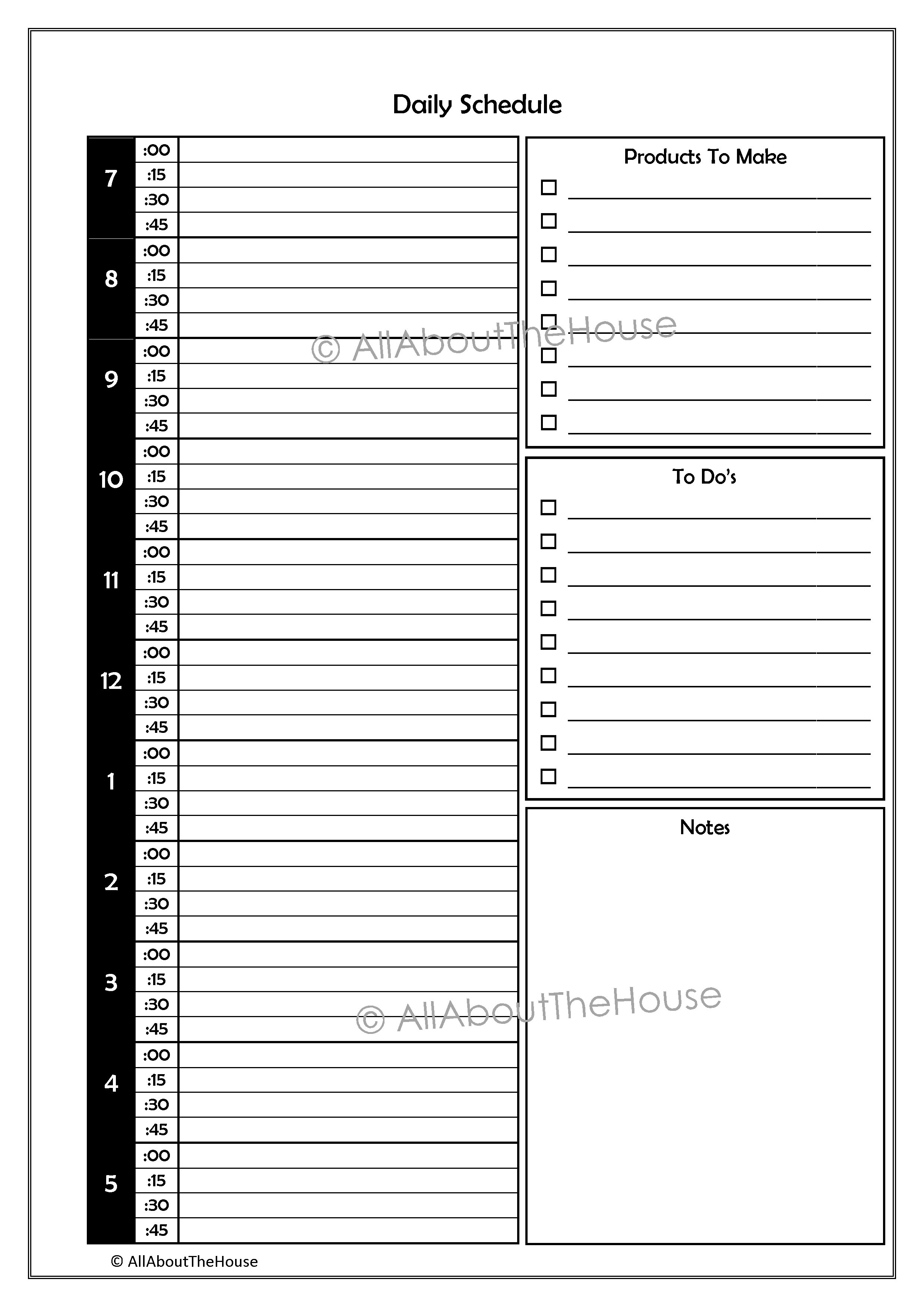

- Printable Daily Time Log

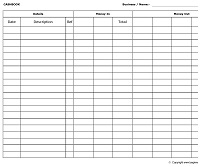

- Free Printable Accounting Spreadsheet Template

- Free Printable Accounting Spreadsheet Template

- Free Printable Accounting Spreadsheet Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a printable profit and loss worksheet?

A printable profit and loss worksheet is a document that helps businesses track and analyze their financial performance by listing all revenues, expenses, and net income over a specific period of time. This worksheet typically includes sections to input sales, cost of goods sold, operating expenses, taxes, and other relevant financial data to calculate the profit or loss generated by the business. It serves as a valuable tool for businesses to assess their financial health and make informed decisions for the future.

How can a printable profit and loss worksheet help in financial analysis?

A printable profit and loss worksheet can help in financial analysis by providing a clear overview of a company's revenues, expenses, and ultimately its profitability. By organizing and categorizing financial data in a structured format, such a worksheet allows for easy comparison of different periods or categories, identification of trends, and analysis of key performance indicators. This tool can enable stakeholders to make informed decisions, identify areas for improvement, and assess the financial health and performance of the business.

What are the key components typically included in a profit and loss worksheet?

A profit and loss worksheet typically includes key components such as revenues, expenses, cost of goods sold, gross profit, operating expenses, net income, and taxes. Revenues represent the total income generated from sales, while expenses encompass all costs associated with running the business. Cost of goods sold specifically refers to the expenses directly related to producing or purchasing the products sold. Gross profit is calculated by subtracting the cost of goods sold from revenues. Operating expenses cover all other costs necessary to operate the business, while net income is the final profit after all expenses have been deducted. Taxes are also included to calculate the final profit or loss.

How do you calculate gross profit using a profit and loss worksheet?

To calculate gross profit using a profit and loss worksheet, you would subtract the cost of goods sold (COGS) from the total revenue. Total revenue is the amount earned from selling goods or services, while COGS is the direct costs incurred in producing those goods or services, such as materials and labor. The difference between total revenue and COGS gives you the gross profit, which is a key indicator of a company's profitability before accounting for other expenses.

What role does the profit and loss worksheet play in determining net profit?

The profit and loss worksheet, also known as an income statement, plays a crucial role in determining net profit by summarizing a company's revenues and expenses over a specific period. By deducting the total expenses from the total revenues, the worksheet calculates the net profit or net loss. This net profit figure is essential for businesses as it reflects their overall financial performance and helps in making informed decisions for future growth and sustainability.

How can a profit and loss worksheet help identify areas of financial strength or weakness?

A profit and loss worksheet can help identify areas of financial strength or weakness by clearly showing where a company is generating revenue and incurring expenses. By analyzing the data on the worksheet, one can see which products, services, or departments are driving profits and which ones are causing losses. This information can then be used to make informed decisions on where to allocate resources, make improvements, or cut costs to improve overall financial performance.

What are some common expenses one would include in a profit and loss worksheet?

Some common expenses that would be included in a profit and loss worksheet are cost of goods sold, operating expenses (such as rent, utilities, salaries, and marketing expenses), interest payments on loans, taxes, and depreciation of assets. These expenses are deducted from the revenue earned by a business to calculate its net profit or loss for a specific period.

How does a profit and loss worksheet contribute to budgeting and planning?

A profit and loss worksheet plays a crucial role in budgeting and planning by providing a clear overview of a company's financial performance. It tracks the revenue earned and expenses incurred over a specific period, helping businesses analyze their profitability. By reviewing this worksheet, organizations can identify areas where costs can be reduced, revenue can be increased, or resources can be reallocated, thus enabling better-informed decision-making for future budgeting and planning strategies.

Can a profit and loss worksheet be used for personal financial tracking?

Yes, a profit and loss worksheet can be adapted for personal financial tracking by using it to track income and expenses on a regular basis. By inputting revenues (income) and costs (expenses) into the worksheet, individuals can monitor their financial performance over a specific period of time, helping them analyze their spending habits, identify areas for improvement, and make informed decisions to achieve their financial goals.

What are the benefits of using a printable profit and loss worksheet instead of a digital version?

Using a printable profit and loss worksheet can offer benefits such as ease of customization to fit specific business needs, portability for offline access or sharing, and the tactile aspect of pen and paper which some find helpful for organization and clarity. Additionally, it can serve as a physical record that is easily visible and may help with better understanding and analysis of the financial data.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments