Printable EIC Worksheet

Are you in search of a reliable and convenient tool to assist you in calculating your Earned Income Credit? Look no further! Printable EIC worksheets are here to make the process easier for you. Designed with simplicity and accuracy in mind, these worksheets provide individuals and families with a user-friendly format to calculate their EIC eligibility and amount. Whether you are a taxpayer or a tax professional, these printable EIC worksheets are the perfect entity for anyone looking to simplify their tax filing process.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

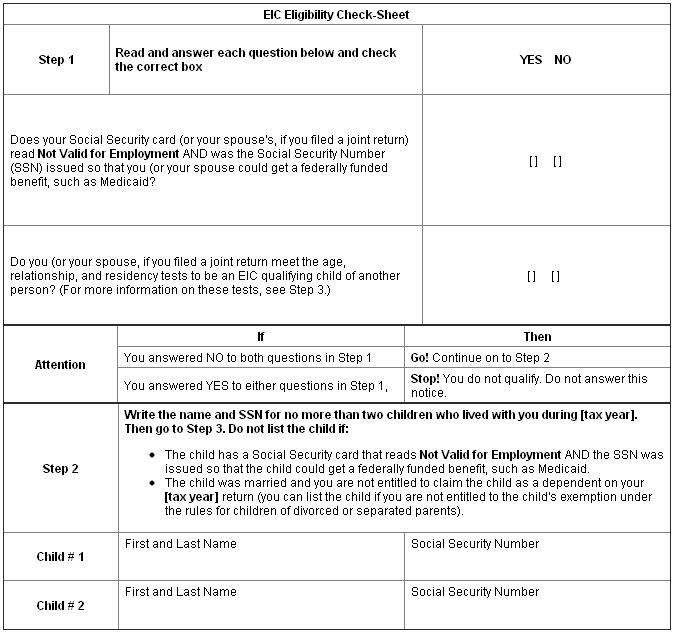

What is a Printable EIC Worksheet?

A Printable EIC Worksheet is a form used to calculate the Earned Income Credit (EIC) that eligible taxpayers can claim on their tax return. It helps individuals determine if they qualify for the EIC based on their earned income, filing status, and number of qualifying children. The worksheet provides step-by-step instructions and tables to help taxpayers figure out the amount of EIC they are eligible to receive.

Where can I find a Printable EIC Worksheet?

You can find a Printable EIC Worksheet on the official Internal Revenue Service (IRS) website. The EIC (Earned Income Credit) is a tax credit for low to moderate-income individuals and families, and the worksheet helps you determine if you qualify for this credit. Simply visit the IRS website and search for "EIC Worksheet" to access and print the necessary form for your tax filing needs.

What information is required to fill out a Printable EIC Worksheet?

To fill out a Printable Earned Income Credit (EIC) Worksheet, you will need information such as your earned income amount, your adjusted gross income (AGI), the number of qualifying children you have and their ages, your filing status, and whether you are a US citizen or resident alien. This form helps determine if you are eligible for the EIC tax credit based on your income and family situation.

How can a Printable EIC Worksheet be used to calculate the Earned Income Credit?

A Printable EIC Worksheet can be used to calculate the Earned Income Credit by following the step-by-step instructions provided on the worksheet. It will typically guide you through determining your eligibility for the credit, calculating your earned income, and determining the amount of the credit based on your income level and number of qualifying children, if applicable. By filling out the worksheet accurately and completely, you can ensure that you claim the correct amount of Earned Income Credit on your tax return.

Are there different versions or formats of Printable EIC Worksheets available?

Yes, there are various versions and formats of printable EIC (Earned Income Credit) worksheets available online that can be used to calculate eligibility for the tax credit. These worksheets may vary based on the tax year, filing status, number of qualifying children, and income level. It is recommended to use the IRS-provided worksheets or those from reputable tax preparation software to ensure accurate calculations.

Can a Printable EIC Worksheet be completed by hand, or does it need to be filled out electronically?

A Printable EIC Worksheet can be filled out by hand or electronically, depending on individual preference and convenience. It is not mandatory to complete it electronically, as manually filling out the worksheet is also acceptable and valid for calculating the Earned Income Credit (EIC).

What should I do if I make a mistake on my Printable EIC Worksheet?

If you make a mistake on your Printable EIC Worksheet, cross out the error neatly and then make the correction. Ensure that the correct information is clearly visible, and do not use correction fluid or obscure the mistake in any way. It's important to maintain the integrity of the information on the worksheet.

Is a Printable EIC Worksheet applicable for all taxpayers, or are there eligibility requirements?

The Printable EIC (Earned Income Credit) Worksheet is applicable for taxpayers who are eligible for the Earned Income Credit. To qualify, taxpayers must meet specific income limits, have earned income from employment or self-employment, meet certain filing status requirements, and have a valid Social Security Number. Eligibility for the EIC can vary based on income and family size, so it is important for taxpayers to review the eligibility criteria outlined by the IRS before using the EIC Worksheet.

Are there any income limitations for claiming the Earned Income Credit using a Printable EIC Worksheet?

Yes, there are income limitations for claiming the Earned Income Credit (EIC) using a Printable EIC Worksheet. To be eligible for the EIC, your earned income and adjusted gross income (AGI) must fall below certain thresholds set by the IRS each year. The exact income limits vary depending on your filing status and the number of qualifying children you have. It is important to review the current IRS guidelines or consult with a tax professional to determine if you qualify for the EIC using a Printable EIC Worksheet.

Will using a Printable EIC Worksheet impact the speed or likelihood of receiving a tax refund?

Using a printable Earned Income Credit (EIC) worksheet will not directly impact the speed or likelihood of receiving a tax refund. The worksheet helps better understand if you qualify for the EIC and the amount you may be eligible for, but the processing time and refund amount primarily depend on the accuracy of the information provided on your tax return and the IRS processing times.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments