Personal Management Merit Badge Worksheet

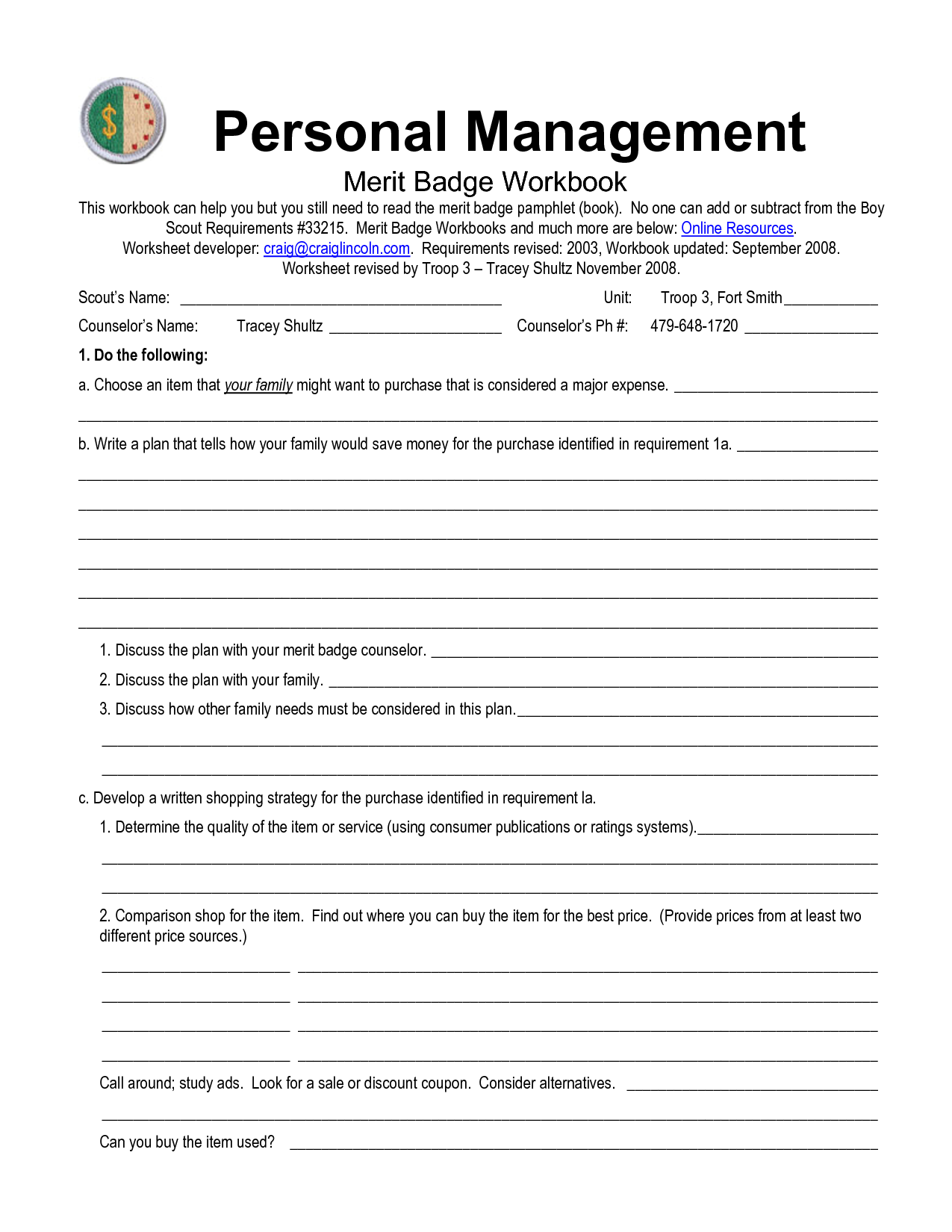

Are you a scout interested in earning the Personal Management merit badge? Look no further than the Personal Management Merit Badge Worksheet, a helpful resource designed to assist you in tracking your progress and completing the requirements for this badge. With a focus on personal finance, goal setting, and time management, this worksheet will guide you through the steps necessary to achieve success in managing your own personal finances.

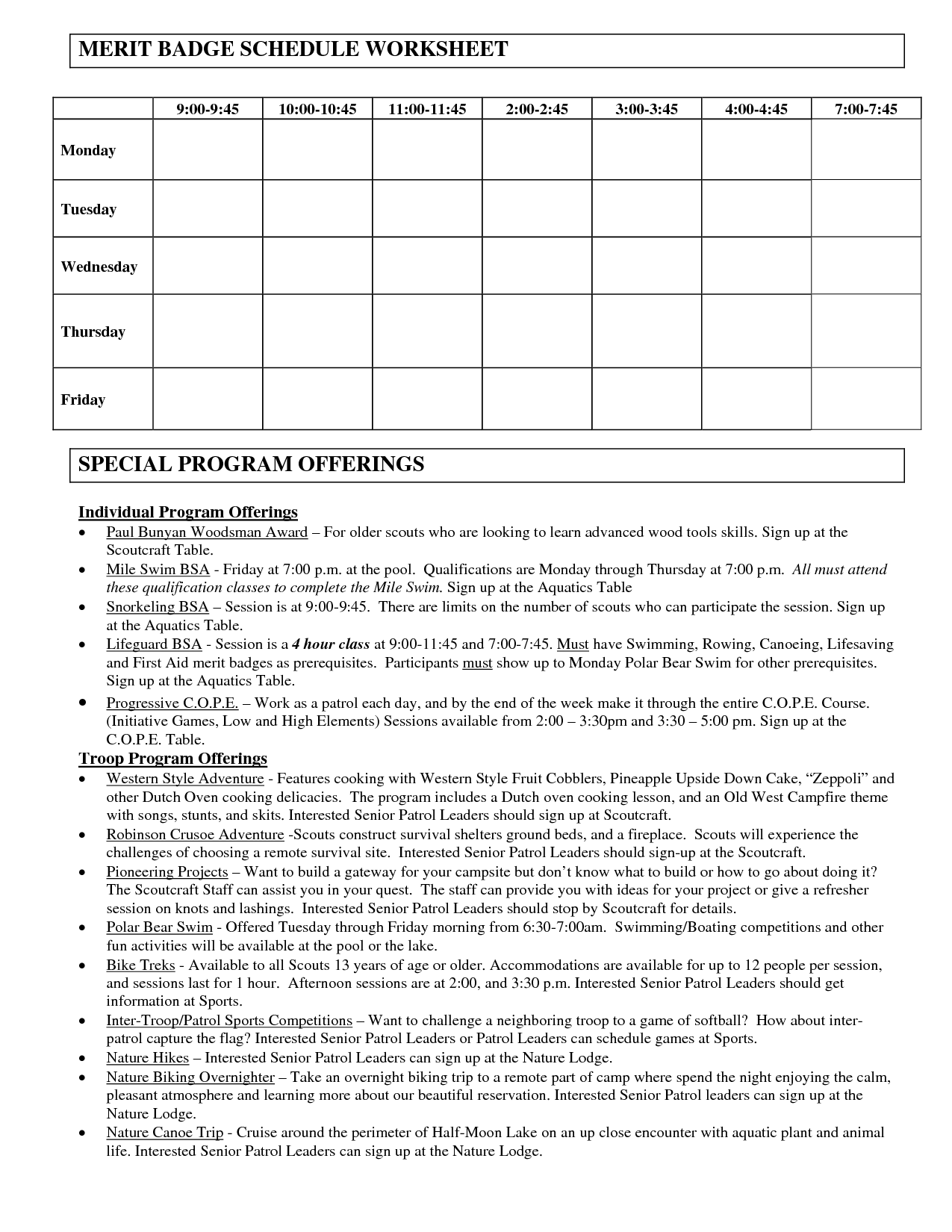

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is the purpose of the Personal Management Merit Badge Worksheet?

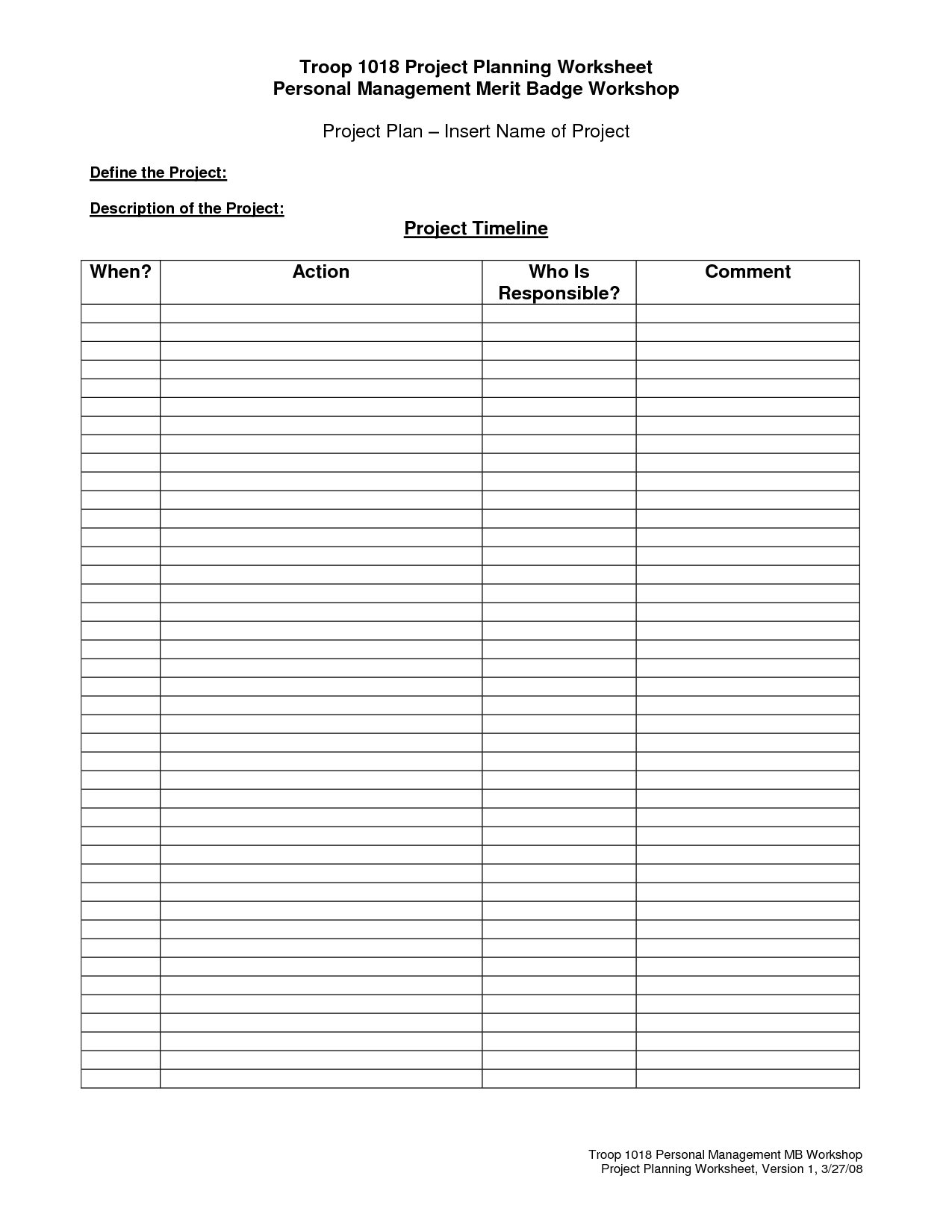

The purpose of the Personal Management Merit Badge Worksheet is to help scouts organize and track their progress as they work towards earning the Personal Management Merit Badge. It includes various activities and tasks that scouts must complete to demonstrate their understanding of personal finance, goal setting, budgeting, and other essential life skills. The worksheet serves as a guide and tool to assist scouts in completing the requirements of the merit badge.

How can you effectively manage and make the most of your time?

To effectively manage and make the most of your time, prioritize tasks based on importance and deadlines, break work into smaller, manageable chunks, delegate tasks when possible, minimize distractions by setting boundaries, utilize tools like calendars and to-do lists, take regular breaks to maintain focus and avoid burnout, and practice time management techniques such as the Pomodoro technique or the Eisenhower Matrix to increase productivity. Consistently reviewing and adjusting your time management strategies will help you optimize your schedule and achieve your goals efficiently.

Describe the steps involved in creating and managing a personal budget.

To create and manage a personal budget, start by tracking your income and expenses to understand your financial situation. Then, categorize your expenses into fixed (e.g., rent, utilities) and variable (e.g., dining out, shopping) to see where your money is going. Next, set financial goals and prioritize them based on your needs and wants. Create a budget by allocating your income towards these categories, making sure to leave room for savings and unexpected expenses. Finally, monitor your budget regularly, adjust as needed, and be disciplined in sticking to it to achieve your financial goals.

How can you set and achieve personal financial goals?

To set and achieve personal financial goals, start by clearly defining your objectives, whether it's saving for a house or paying off debt. Create a detailed budget, track expenses, and identify areas to cut back or save. Set specific, measurable, achievable, relevant, and time-bound (SMART) goals to help you stay focused. Break down larger goals into smaller milestones to track progress and stay motivated. Regularly review and adjust your financial plan as needed, and seek guidance from a financial advisor if necessary. Lastly, maintain discipline, consistency, and commitment to reach your financial goals.

Explain the importance of saving, investing, and understanding interest rates.

Saving is important to build an emergency fund and achieve financial goals, while investing helps grow wealth over time. Understanding interest rates is crucial as they affect both saving and borrowing costs, influencing one's ability to achieve financial goals. By knowing how interest rates impact investments and savings, individuals can make informed decisions that help secure their financial future and optimize their financial well-being.

Describe the potential benefits and risks of credit cards and loans.

Credit cards and loans can offer the benefit of providing individuals with the financial flexibility and convenience to make purchases or investments that they may not be able to afford upfront. They can also help build credit history and improve credit scores when used responsibly. However, the risks associated with credit cards and loans include accumulating debt, high-interest rates leading to increased debt burden, potential damage to credit scores when payments are missed, and the temptation to overspend. It is crucial for individuals to manage their finances wisely and be disciplined in their spending habits to avoid falling into debt traps with credit cards and loans.

How can you evaluate and compare prices before making a purchase?

To evaluate and compare prices before making a purchase, you can start by conducting research online to compare prices across multiple retailers. Look for discounts, promotions, and sales. Utilize price comparison websites and apps to easily compare prices for the same product. Consider factors such as shipping costs, return policies, and overall value for money. Additionally, reading reviews and ratings can help gauge the quality of the product and determine if it's worth the price. Remember to also factor in any additional costs such as taxes or fees to get a more accurate comparison.

Explain the importance of insurance and the types of coverage available.

Insurance is crucial as it provides financial protection against unexpected events and risks. Types of coverage include health insurance for medical expenses, auto insurance for vehicle damages, home insurance for property damage, life insurance for financial security of dependents, and liability insurance for legal claims. Additionally, there is also disability insurance for income protection in case of inability to work, and business insurance for safeguarding assets and liabilities. Having insurance coverage ensures peace of mind and mitigates financial losses in times of need, be it personal or professional.

Describe the process of preparing for and finding employment.

Preparing for finding employment involves updating your resume, writing a compelling cover letter, and practicing interview skills. Researching companies, networking, and maintaining a professional online presence on platforms like LinkedIn are also important. Once prepared, actively seeking job opportunities through job boards, company websites, and recruitment agencies can help find suitable employment. Engaging in informational interviews and attending job fairs can also enhance your chances of landing a job that aligns with your skills and interests.

How can you develop and maintain positive relationships with people at work and in your personal life?

To develop and maintain positive relationships at work and in personal life, it is essential to communicate openly and honestly, show empathy and understanding towards others, respect boundaries and differences, actively listen, offer support, and be reliable and trustworthy. Building trust, recognizing and appreciating each other's efforts, and resolving conflicts peacefully are also key to fostering strong and harmonious relationships. Regularly checking in, spending quality time together, and showing appreciation and kindness will help to strengthen bonds and create a positive and supportive environment both at work and in personal life.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments