Personal Financial Planning Worksheets

Personal financial planning worksheets are essential tools for individuals who are seeking to take control of their financial well-being. These worksheets provide a structured way to track and organize various aspects of personal finances, enabling individuals to better understand and manage their income, expenses, savings, and investments. By allowing users to input relevant information and calculations, these worksheets help individuals visualize their financial situation, identify areas for improvement, and make informed decisions about their money.

Table of Images 👆

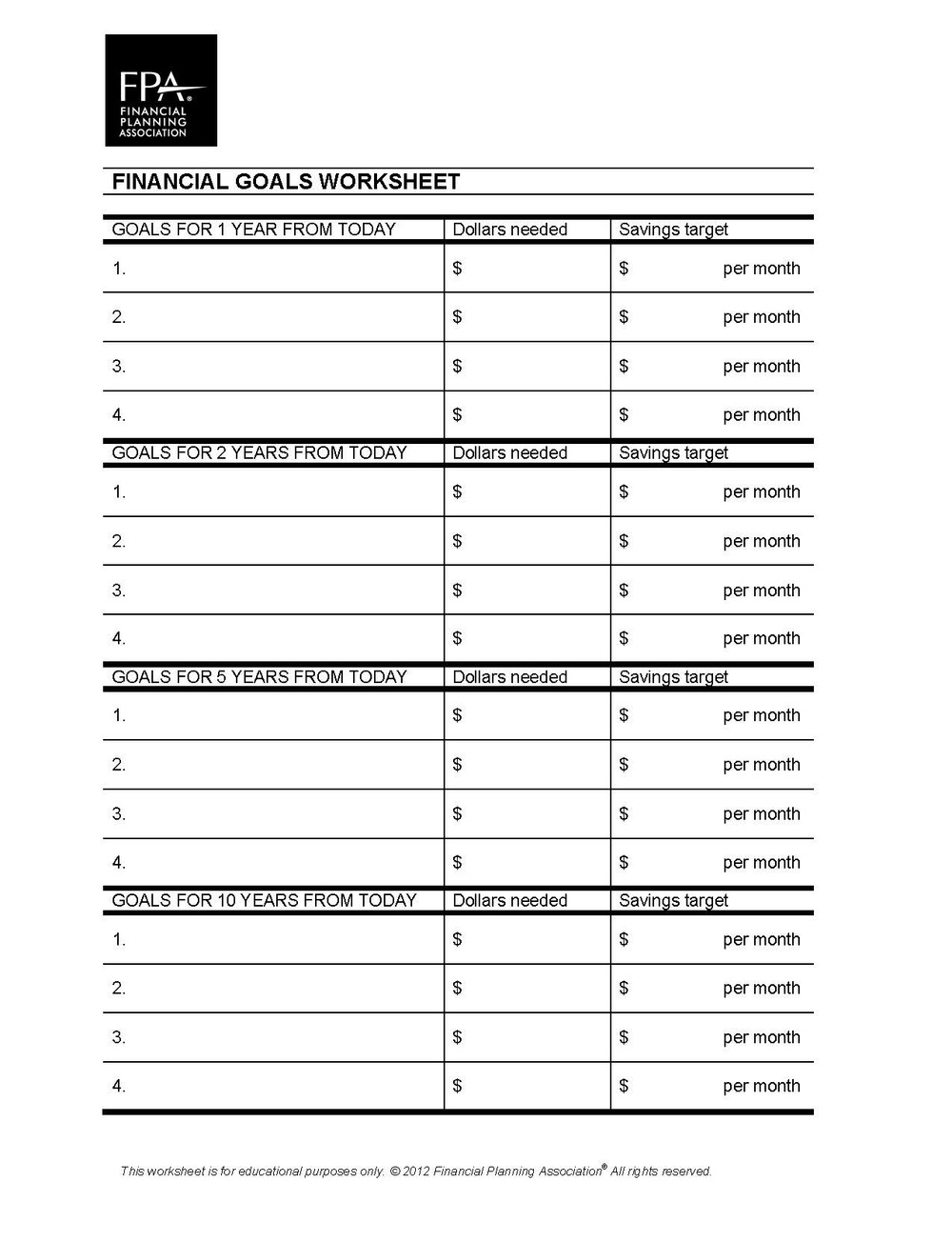

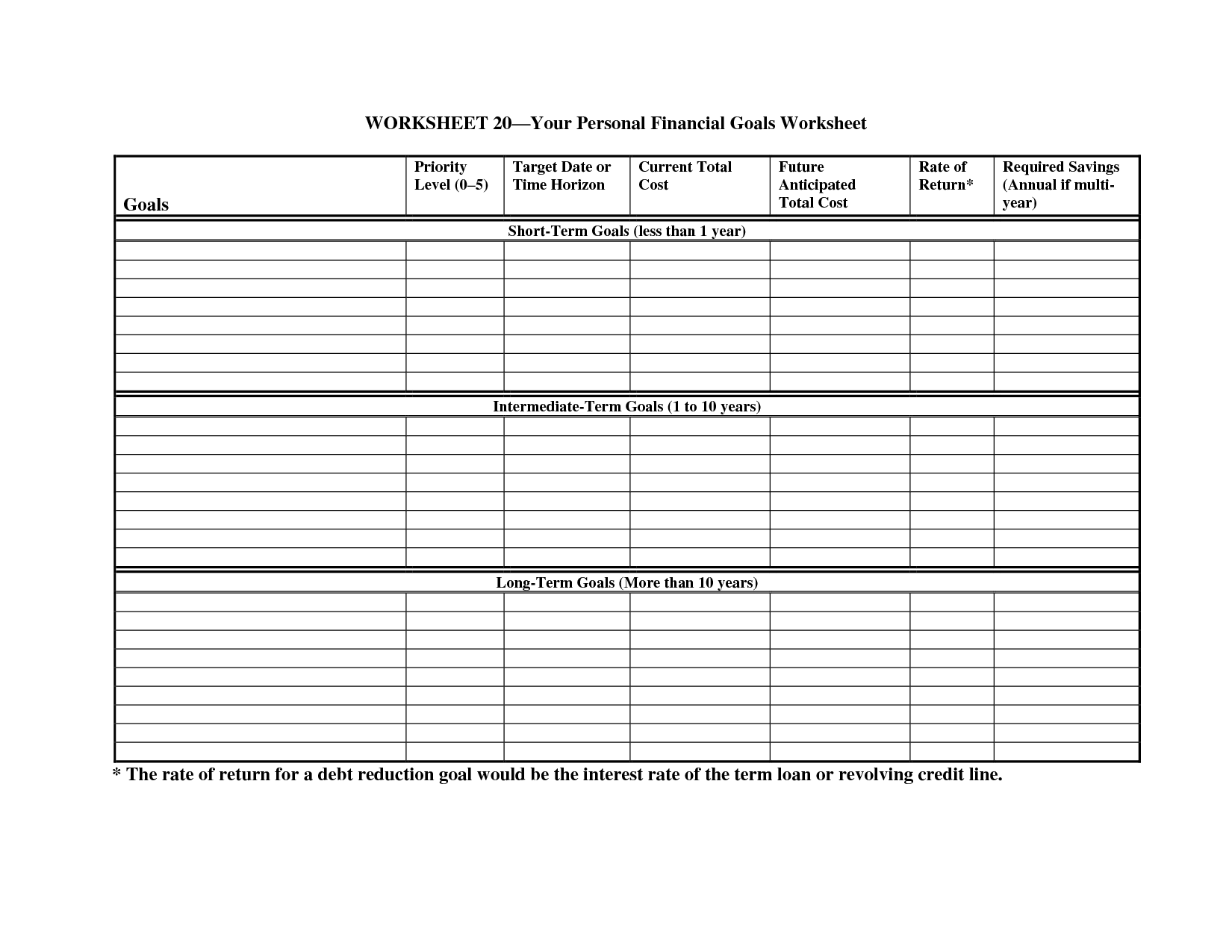

- Financial Planning Goals Worksheet

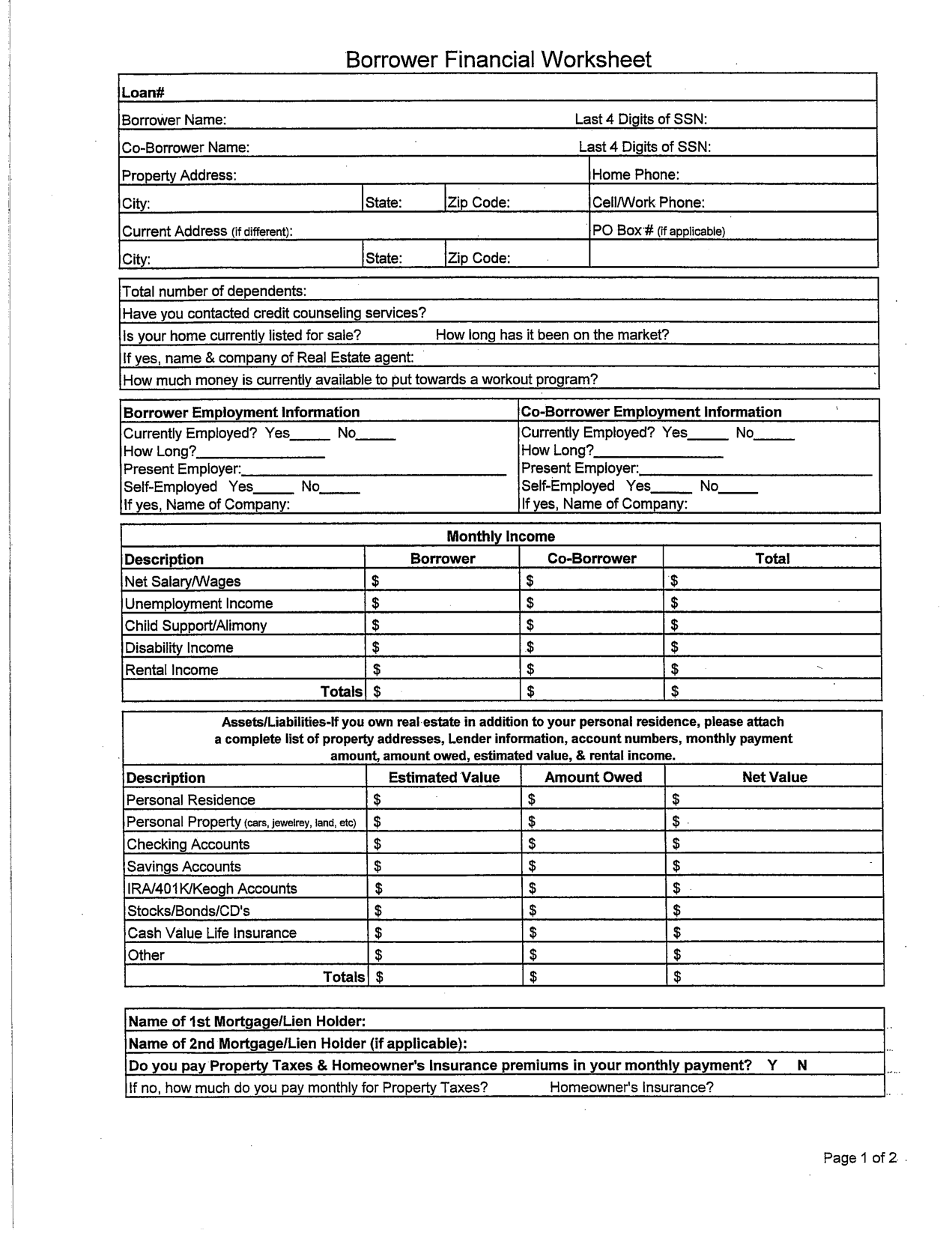

- Wells Fargo Financial Statement Worksheet

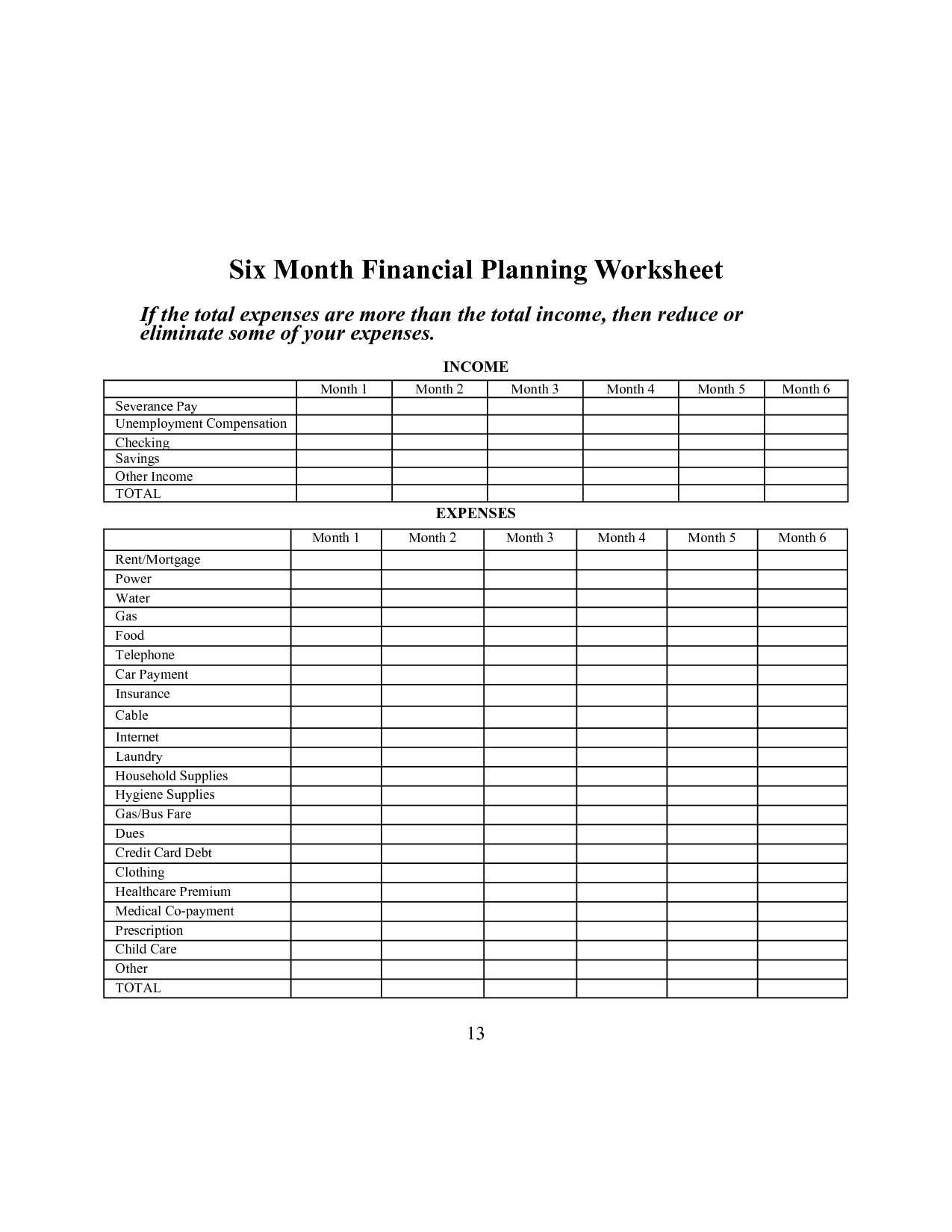

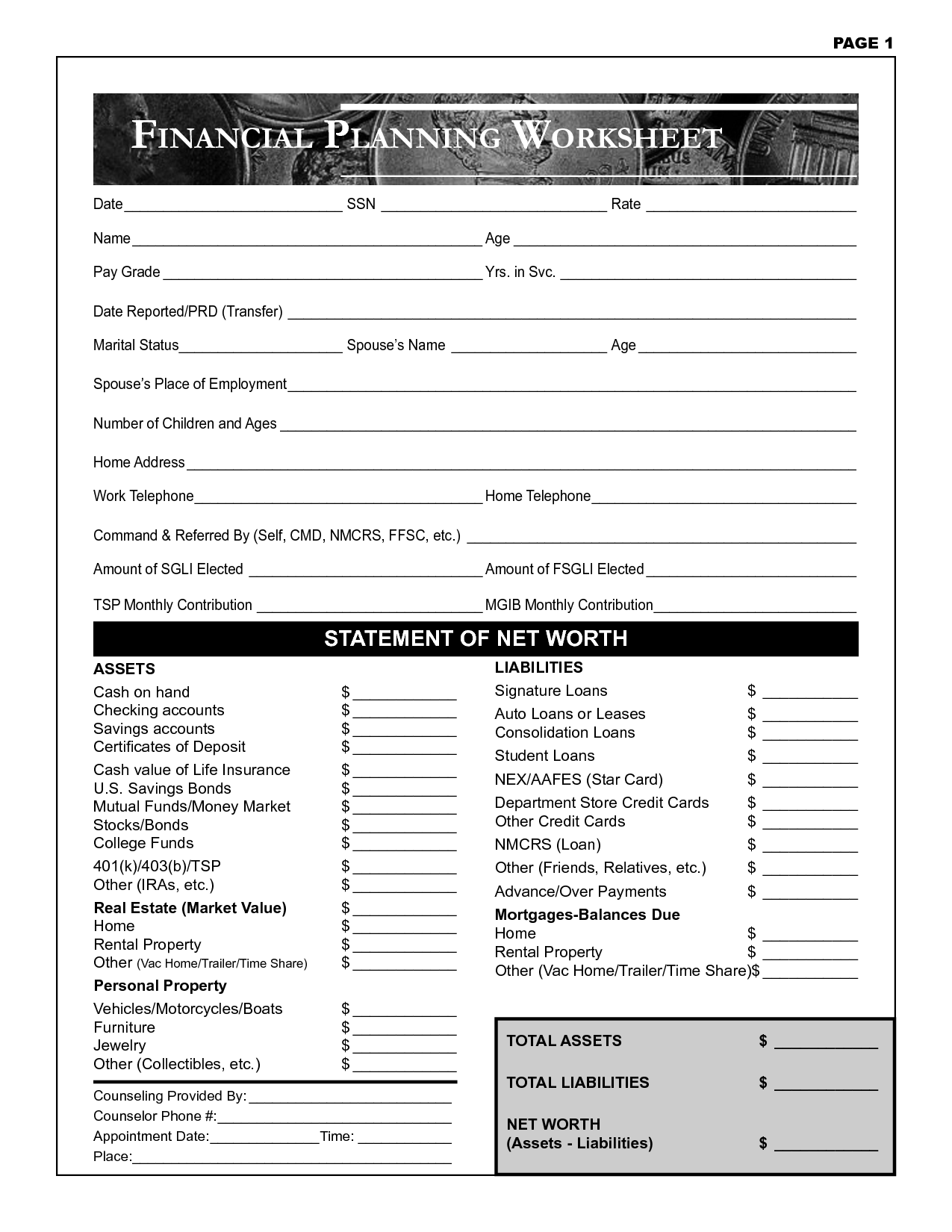

- Financial Planning Worksheets

- Financial Planning Worksheets

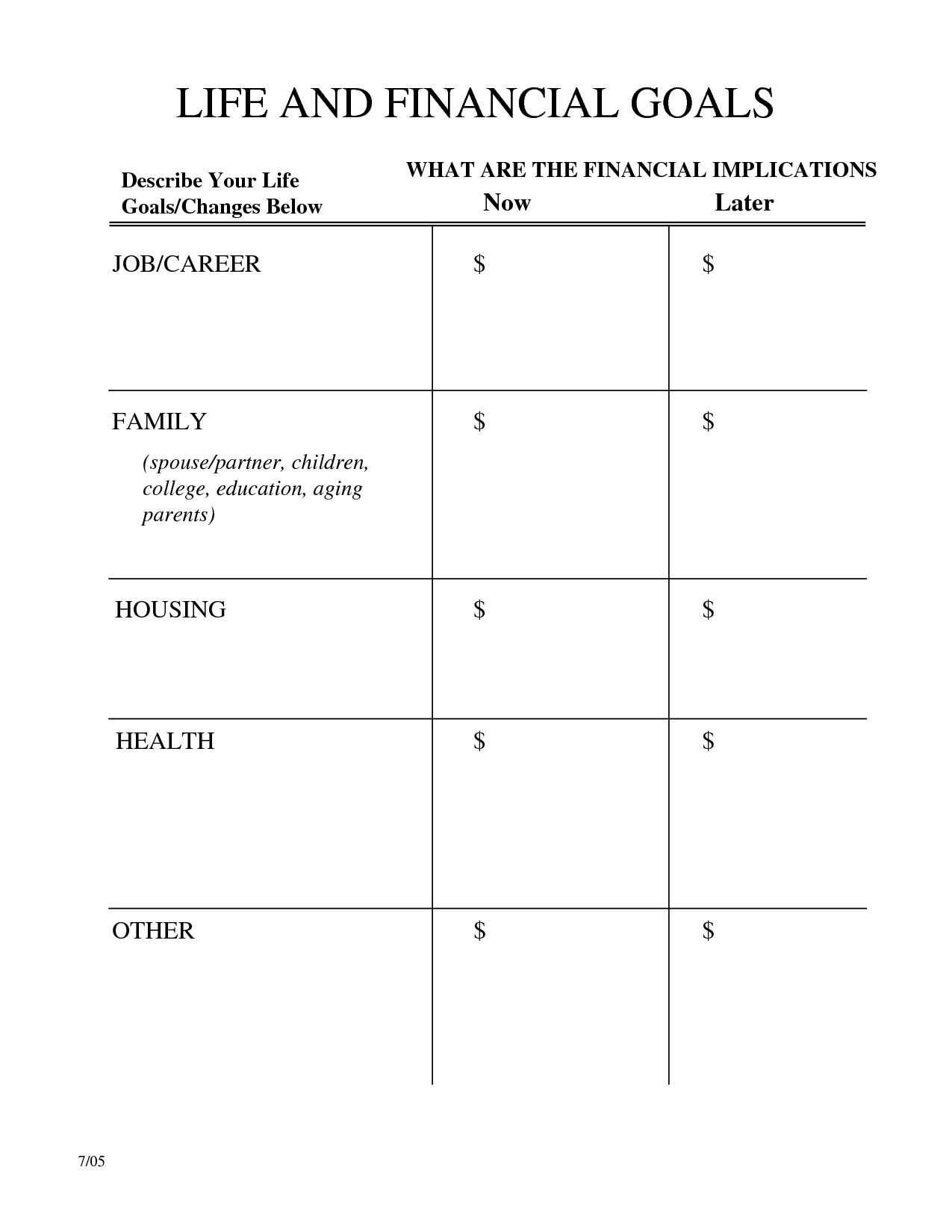

- Personal Financial Goals Worksheet

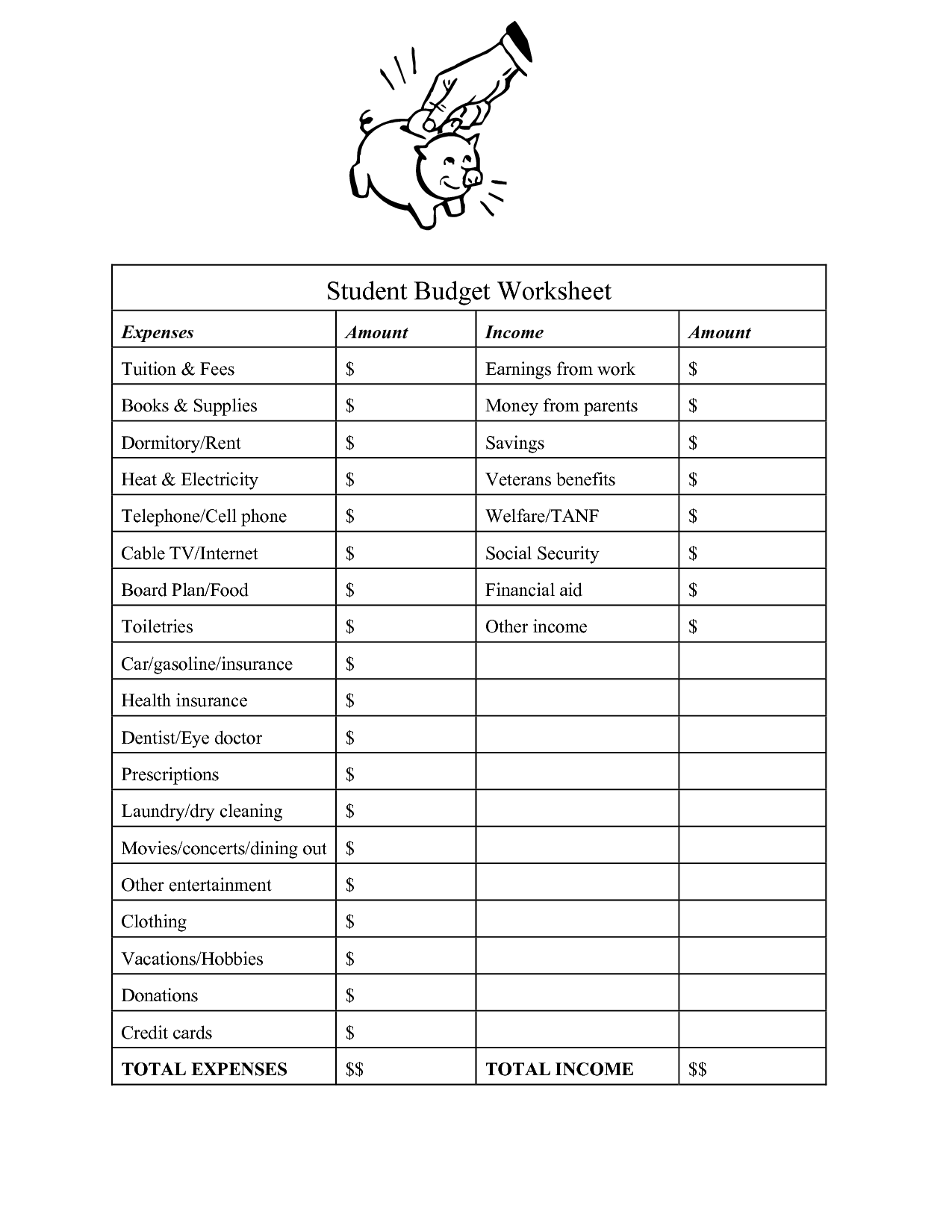

- College Student Budget Worksheet

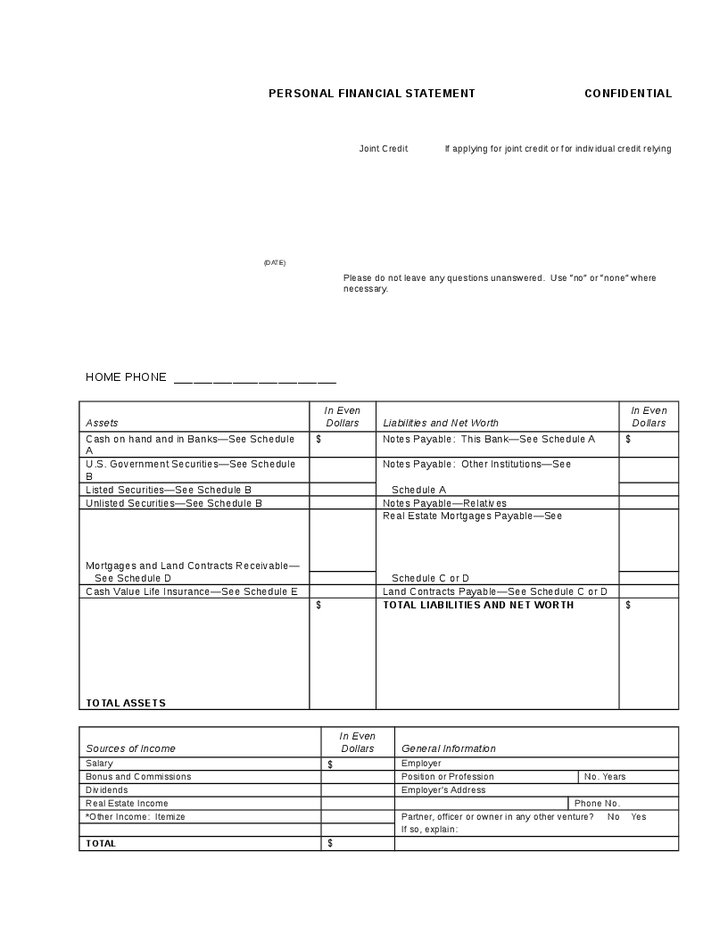

- Personal Financial Statement Template

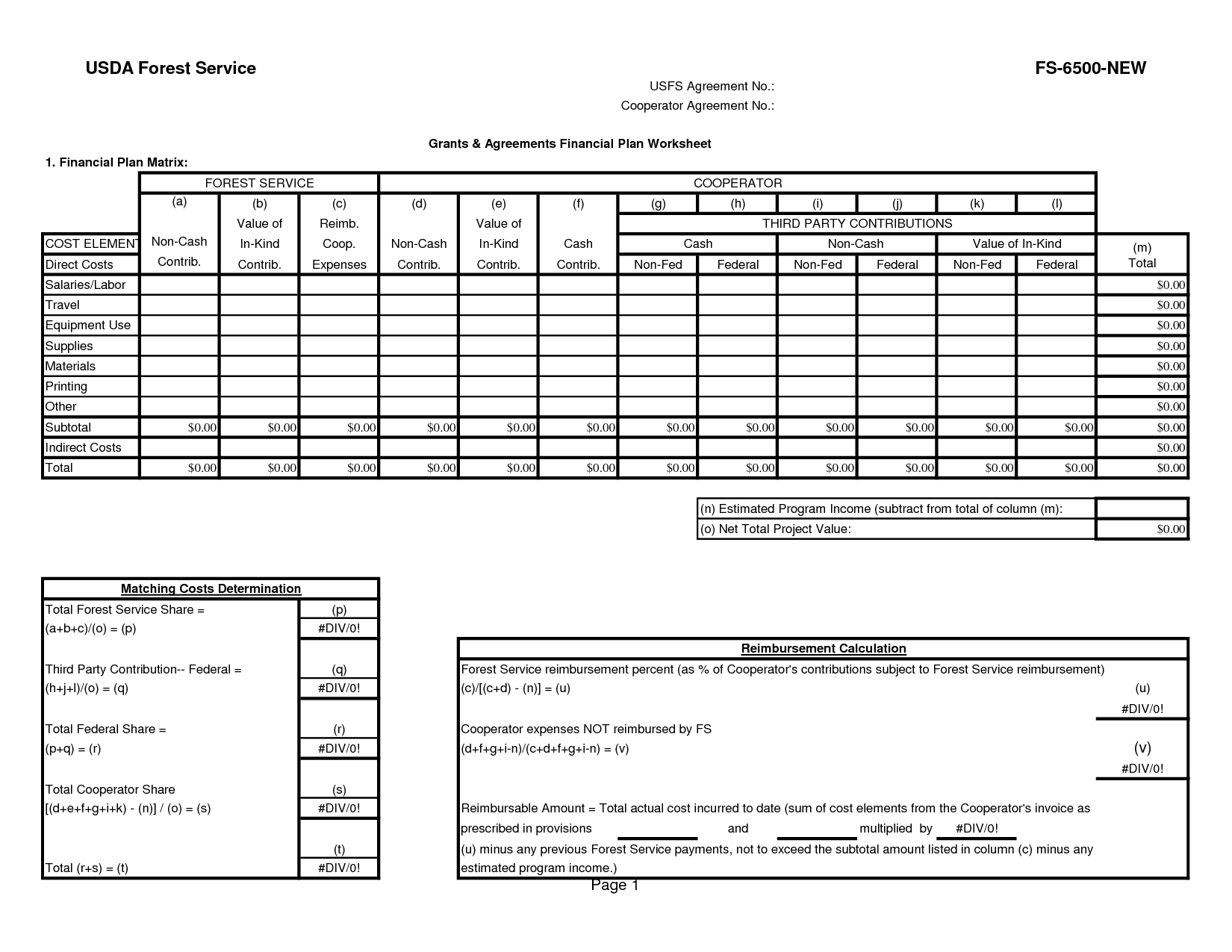

- Free Financial Planning Worksheets

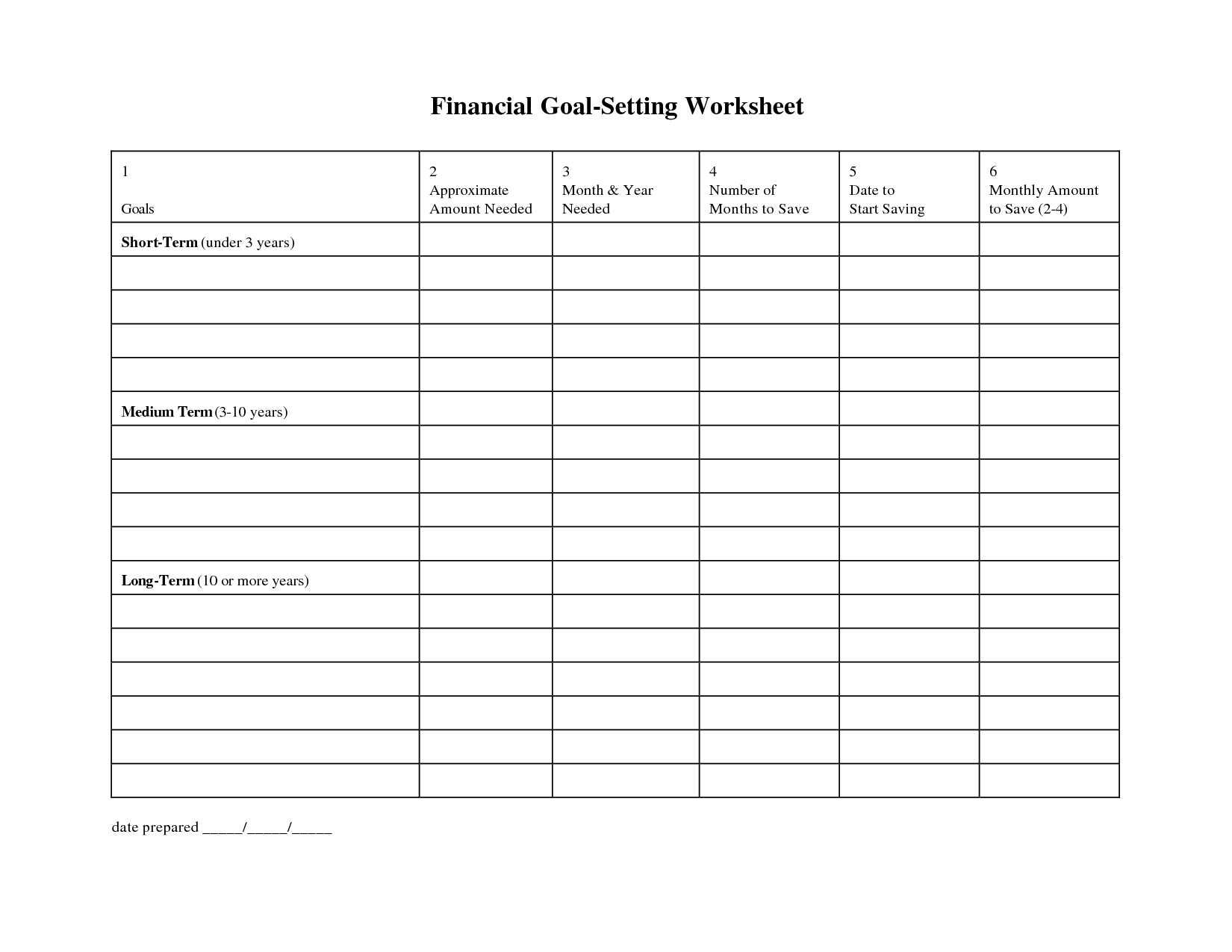

- Financial Goal Setting Worksheet

- Financial Planning Goals Worksheet

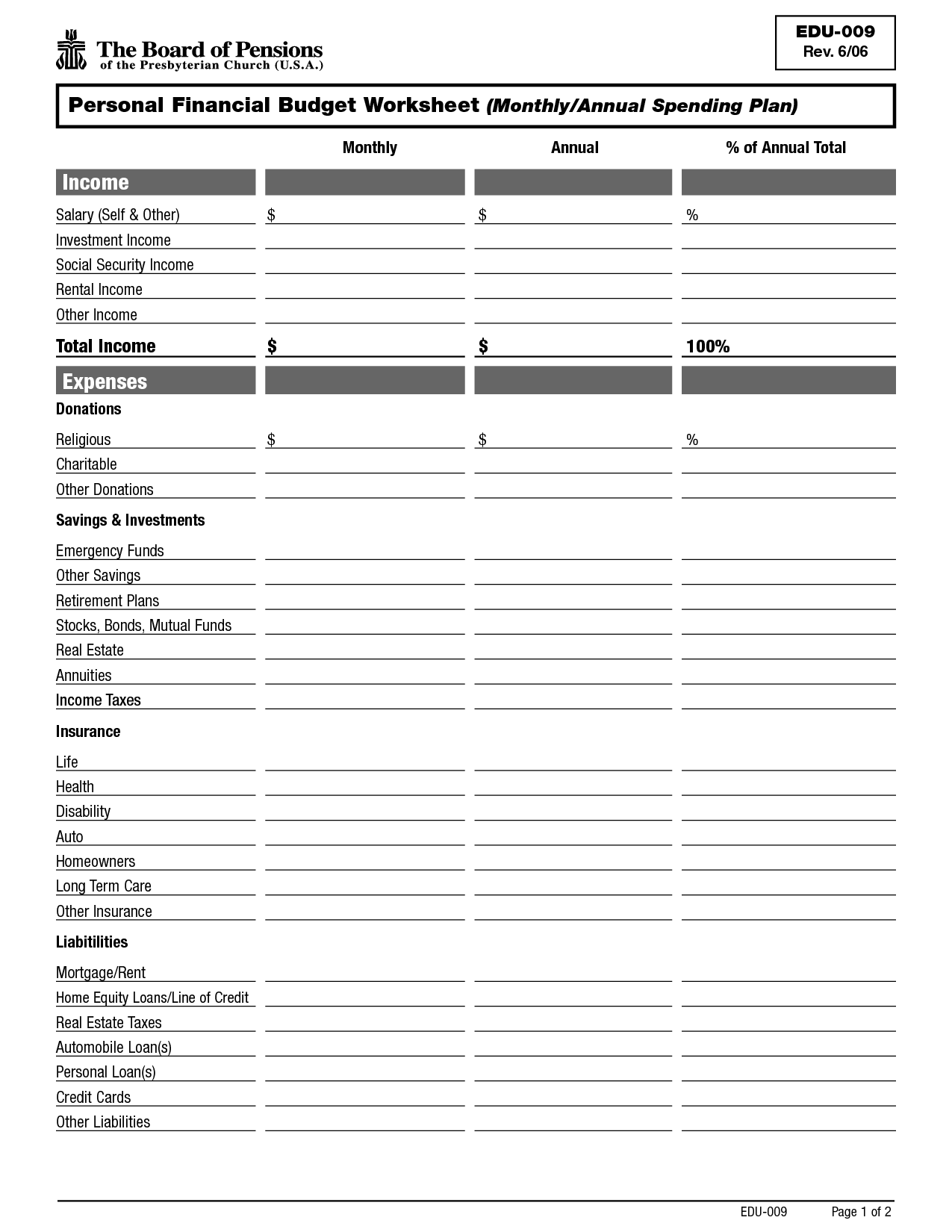

- Monthly Financial Budget Worksheet

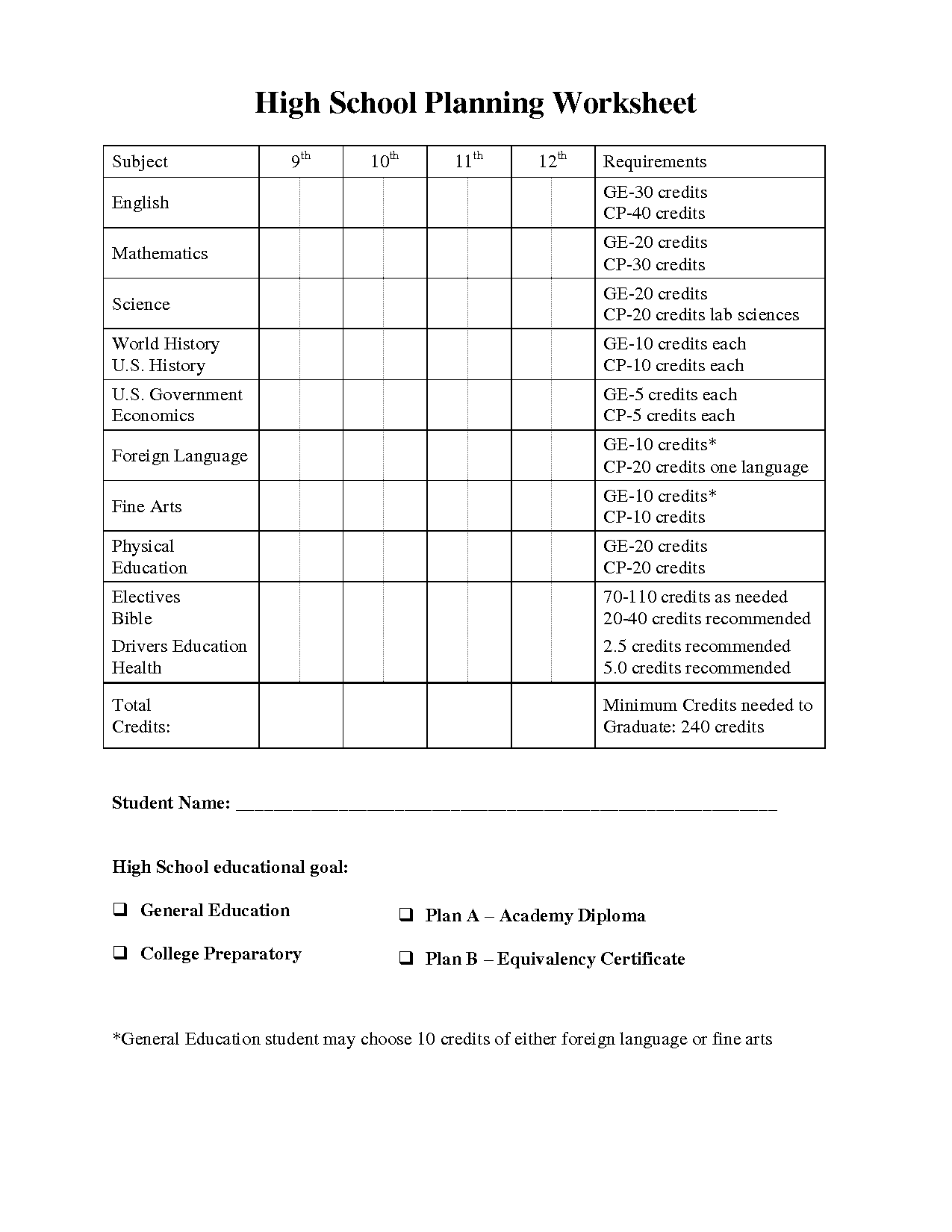

- High School Planning Worksheet

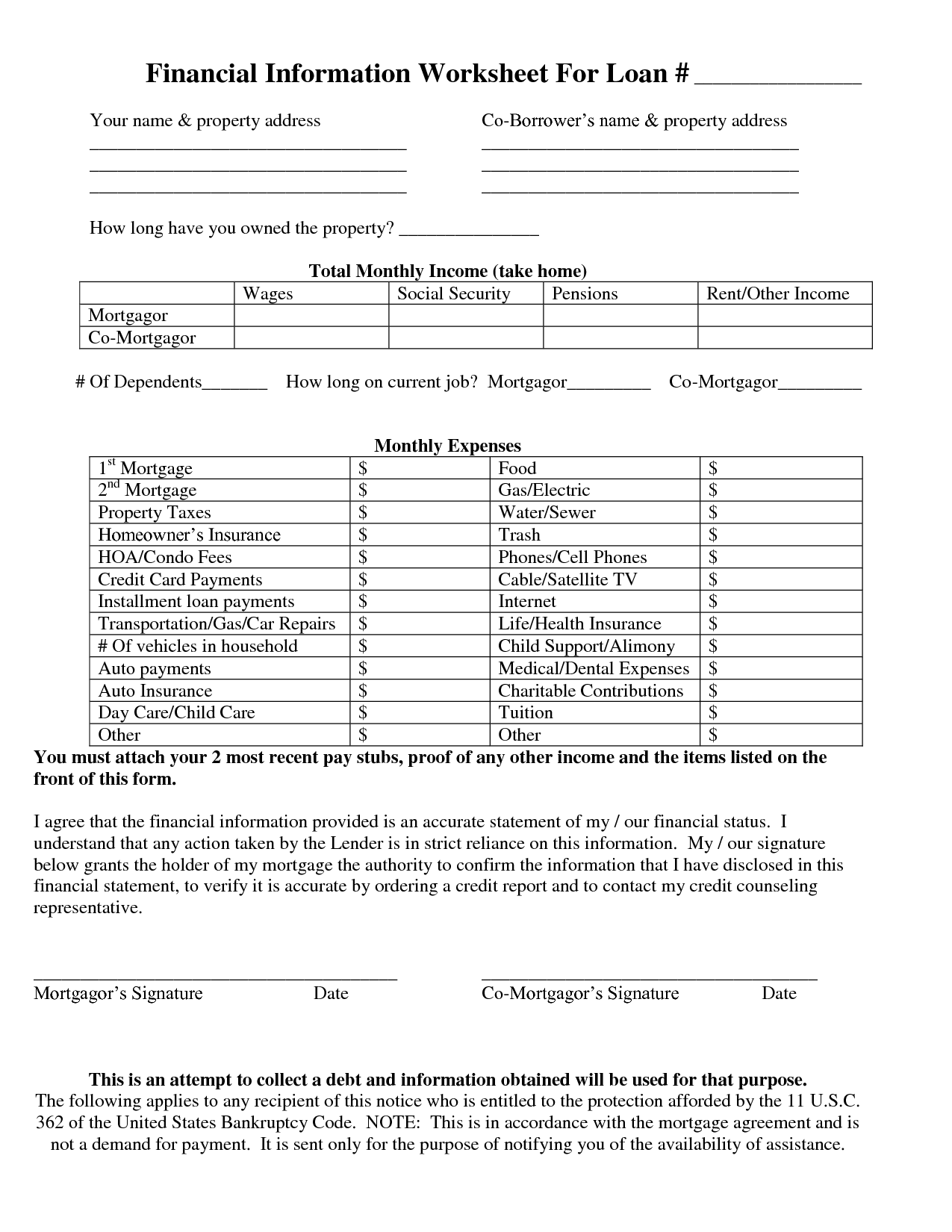

- Financial Information Worksheet

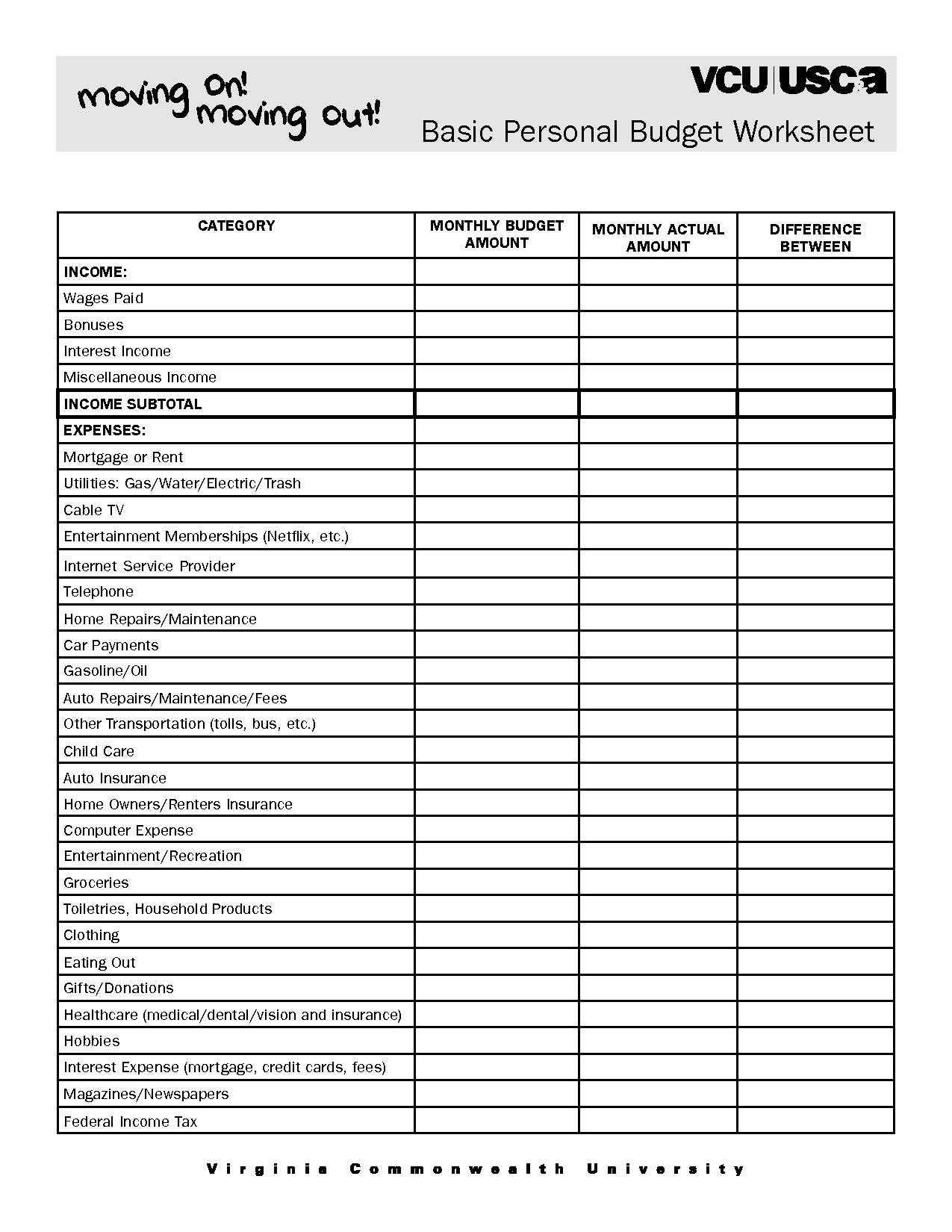

- Personal Budget Worksheet Template

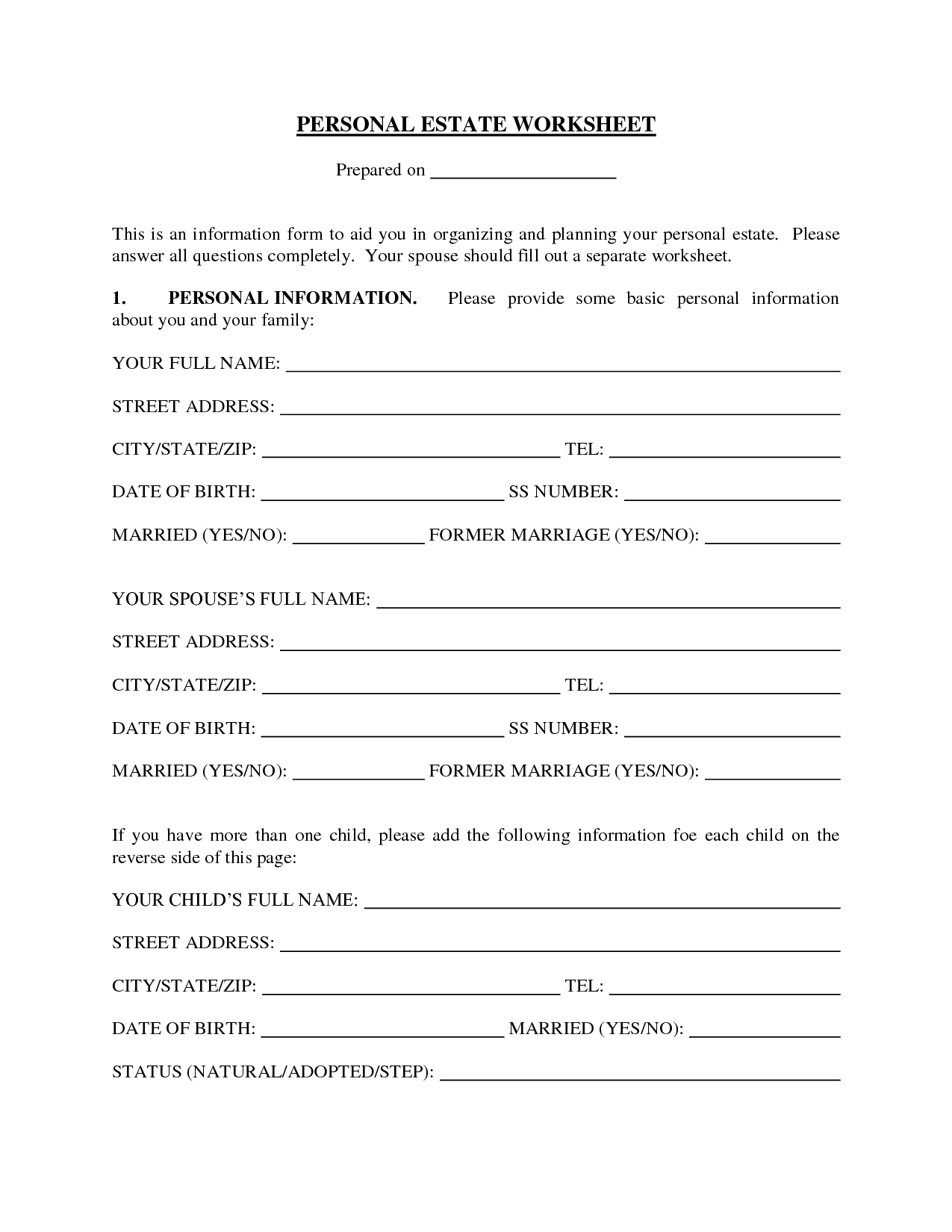

- Basic Personal Information Form

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a personal financial planning worksheet?

A personal financial planning worksheet is a document that helps individuals organize and track their financial information, goals, and strategies. It typically includes sections for income sources, expenses, savings goals, debt management, investments, insurance coverage, and long-term financial objectives. By using a financial planning worksheet, individuals can assess their current financial situation, identify areas for improvement, and create a roadmap to achieve their financial goals.

Why is it important to create a personal financial plan?

Creating a personal financial plan is important because it helps individuals set clear financial goals, track their spending, save for the future, manage debt, and build wealth. A financial plan provides a roadmap for achieving financial stability and security, helps to prioritize financial decisions, and allows for adjustments as circumstances change. It also helps to identify potential risks and develop strategies to mitigate them, ultimately leading to a more secure and successful financial future.

How can a financial planning worksheet help track income and expenses?

A financial planning worksheet can help track income and expenses by providing a structured format to input all sources of income and categories of expenses. By documenting and organizing these financial details, individuals can have a clear overview of their cash flow, identify any imbalances or areas where they can make adjustments, set financial goals, and ultimately make informed decisions on how to manage their money more effectively. Additionally, consistently updating the worksheet allows for monitoring financial progress, identifying trends, and making adjustments as needed to achieve financial stability and goals.

What are the key elements included in a personal financial planning worksheet?

A personal financial planning worksheet typically includes elements such as income sources, expenses, savings goals, debts, assets, insurance policies, investment portfolios, retirement planning, and emergency funds. It serves as a tool to organize and track personal finances, set financial goals, budget effectively, and make informed decisions to achieve financial stability and growth.

How can a worksheet help identify financial goals and priorities?

A worksheet can help identify financial goals and priorities by providing a structured format for individuals to organize and assess their current financial situation, track their income and expenses, and set specific, tangible goals. By filling out a worksheet, individuals can visually see where their money is going, understand their spending habits, and determine where they want to allocate their resources in the future. This can help prioritize financial goals, such as saving for emergencies, paying off debt, or investing for retirement, by providing a clear roadmap and actionable steps to achieve them.

What role does a personal financial planning worksheet play in budgeting?

A personal financial planning worksheet serves as a tool to organize and categorize different aspects of one's finances, such as income, expenses, savings, and debts. It helps individuals track their financial goals, identify areas where they can cut costs or save more, and create a realistic budget based on their current financial situation. By using a financial planning worksheet, individuals can better understand their cash flow, prioritize their spending, and make informed decisions to achieve their financial objectives.

How can a worksheet assist in monitoring debt and repayment strategies?

A worksheet can assist in monitoring debt and repayment strategies by providing a clear overview of outstanding debts, interest rates, minimum payments, and repayment schedules. By organizing this information in one place, individuals can track their progress in paying off debts, identify any trends or patterns in their repayment behavior, and make informed decisions on adjusting their repayment strategies if needed. Additionally, a worksheet can help individuals set specific goals for debt repayment, track their progress towards those goals, and stay motivated to pay off their debts effectively.

What types of financial resources and assets should be included in a personal financial planning worksheet?

A personal financial planning worksheet should include various types of financial resources and assets such as savings accounts, investments (stocks, bonds, mutual funds), retirement accounts (401(k), IRA), real estate properties (home, rental properties), valuable personal belongings (jewelry, artwork), cash reserves, and any other sources of income (salary, bonuses, rental income). It is important to have a comprehensive list of all your financial resources and assets to effectively plan and manage your personal finances.

How can a worksheet help analyze and evaluate investment options?

A worksheet can help analyze and evaluate investment options by organizing and comparing key information such as expected returns, risks, costs, and holding periods in a structured format. By inputting data into the worksheet, investors can easily calculate metrics like return on investment, net present value, and risk-adjusted returns to make informed decisions. Additionally, using a worksheet allows investors to model different scenarios, conduct sensitivity analysis, and track the performance of their investments over time, leading to more informed and strategic investment choices.

What are the benefits of regularly reviewing and updating a personal financial planning worksheet?

Regularly reviewing and updating a personal financial planning worksheet helps individuals stay on track with their financial goals, identify any changes in their income or expenses, track progress towards goals, and make adjustments as needed. It allows for better decision-making, helps to prioritize financial tasks, and ensures that financial goals are achievable and realistic. By maintaining an up-to-date financial plan, individuals can be better prepared for unexpected expenses, emergencies, and long-term financial security.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments