New Home Budget Worksheet

Are you in need of a practical tool to help you manage your finances and stay on top of your home budget? Look no further than a well-designed home budget worksheet. This essential entity provides a clear and organized way to track your income and expenses, making it perfect for individuals and families who are looking to take control of their finances and achieve their financial goals. By using a home budget worksheet, you can easily identify where your money is being spent, make adjustments as needed, and ensure that your spending aligns with your priorities.

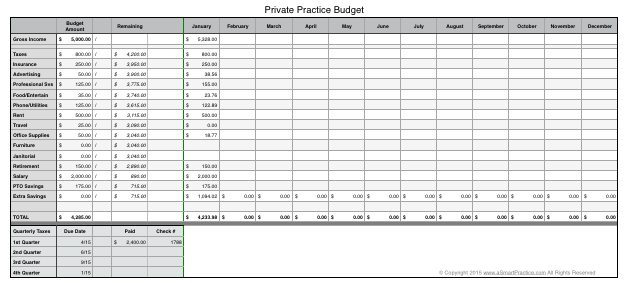

Table of Images 👆

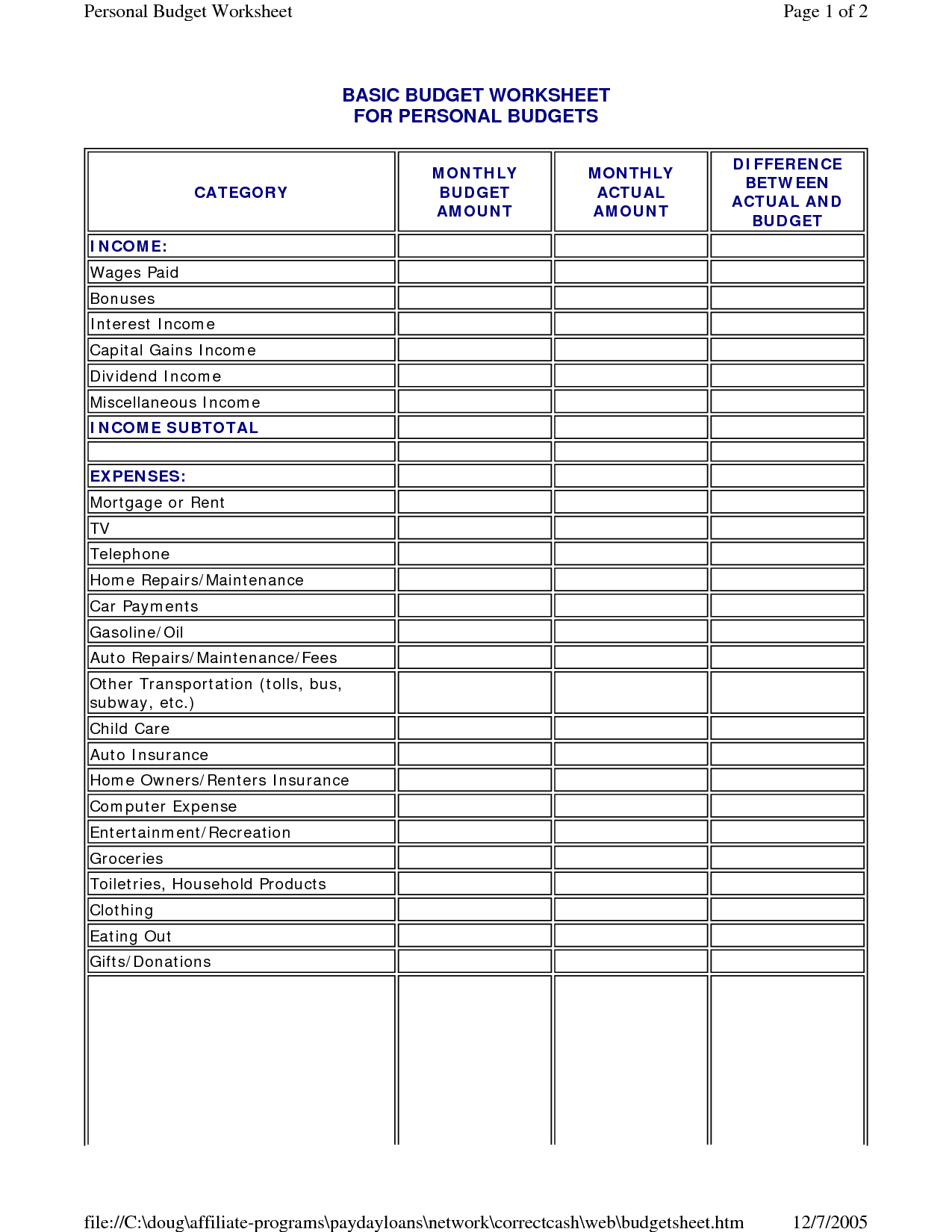

- Basic Budget Worksheet Template

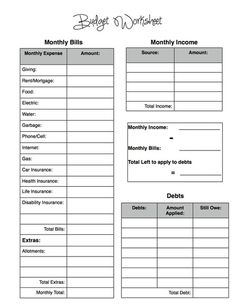

- Dave Ramsey Budget Worksheet Printable

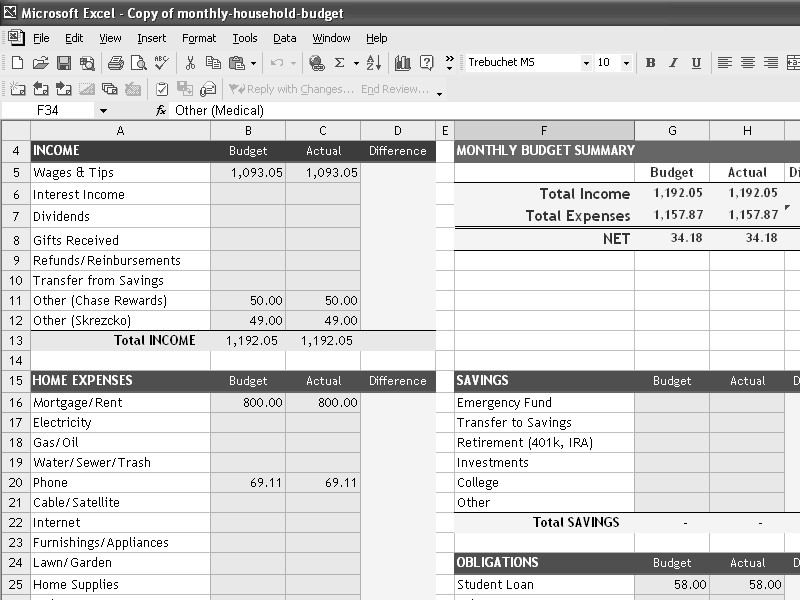

- Monthly Home Budget Worksheet Excel

- Young Adult Budget Worksheet

- Day Care Sample Business Balance Sheet Example

- Project Budget Template Excel

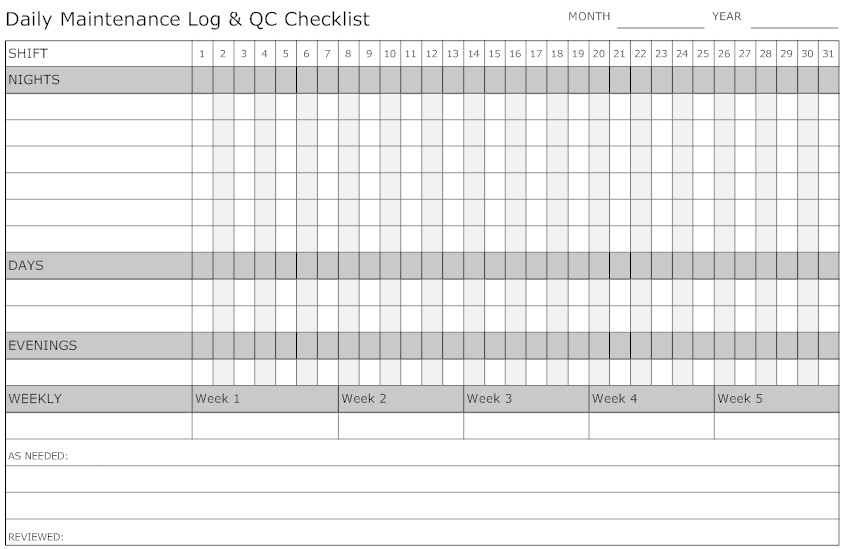

- Maintenance Daily Log Sheet Template

- Business Forms Templates

- Construction Scope of Work Template Excel

- Printable Blank Time Sheet Template

- Sample 1200 Calorie Diet Plan

- Free House Cleaning Estimate Sheet

- Harry Truman S Worksheet

- Wedding Etiquette Cash Bar

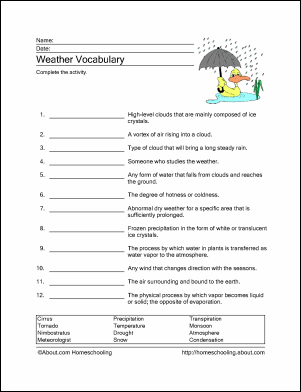

- Weather and Climate Worksheets Printable

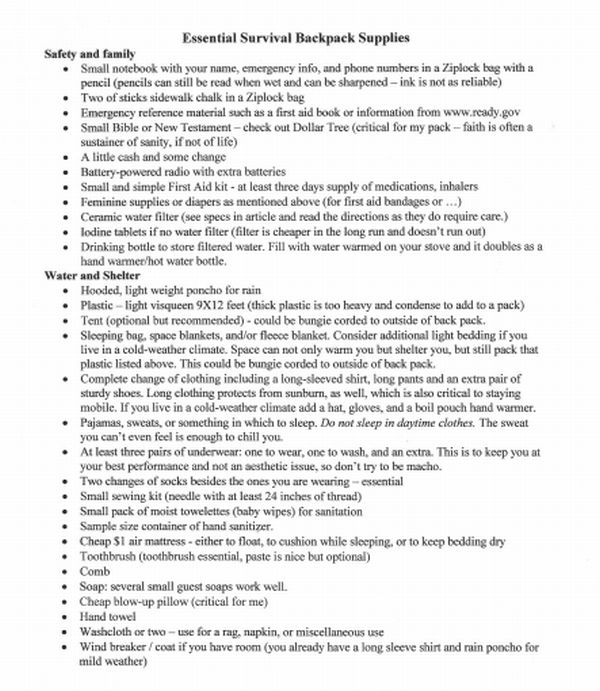

- Emergency Supply List Backpack

- Accounting Client Intake Form

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a New Home Budget Worksheet?

A New Home Budget Worksheet is a document or spreadsheet that helps individuals or families plan and track the expenses associated with purchasing a new home. It typically includes categories such as down payment, closing costs, moving expenses, furniture and home decor, renovations or repairs, and ongoing monthly costs like mortgage payments, utilities, and maintenance. By detailing all anticipated costs and comparing them to available funds, the worksheet can guide individuals in making informed financial decisions throughout the home-buying process.

How can a New Home Budget Worksheet help in the process of buying a new home?

A New Home Budget Worksheet can help in the process of buying a new home by providing a clear overview of all expenses involved, such as down payment, closing costs, moving costs, and potential renovations or upgrades. By organizing and tracking expenses, it can help potential homebuyers understand their financial position, set realistic budget targets, identify areas where costs can be reduced, and ultimately make informed decisions throughout the home buying process to ensure they stay within their financial means and avoid any unexpected financial burdens.

What categories should be included in a New Home Budget Worksheet?

A New Home Budget Worksheet should include categories such as mortgage or rent, utilities, insurance, property taxes, home maintenance and repairs, furniture and decor, moving expenses, landscaping and outdoor maintenance, home improvement projects, emergency fund for unexpected costs, and ongoing monthly expenses such as groceries and transportation. Additionally, it can be beneficial to include categories for savings goals, such as a down payment for future housing investments.

How can a New Home Budget Worksheet help in tracking expenses related to a new home?

A New Home Budget Worksheet can help in tracking expenses related to a new home by providing a structured way to list all anticipated costs and allocate funds accordingly. By organizing expenses such as down payment, closing costs, moving expenses, furniture, renovations, and ongoing monthly bills, the worksheet helps individuals or families understand their financial commitments and stay on track with their budget. It allows for better planning, monitoring of spending, and adjustment of priorities to ensure that all costs associated with the new home are accounted for and managed effectively.

How frequently should a New Home Budget Worksheet be updated?

A New Home Budget Worksheet should be updated regularly, ideally on a monthly basis. This ensures that you track your expenses accurately, monitor your spending patterns, and make necessary adjustments to stay within your budget. By reviewing and updating your budget frequently, you can stay on top of your financial goals and make informed decisions about your finances.

How can a New Home Budget Worksheet help in identifying areas where costs can be reduced?

A New Home Budget Worksheet can help in identifying areas where costs can be reduced by providing a clear overview of all expenses related to owning or renting a new home. By detailing expenses such as utilities, transportation, groceries, and miscellaneous costs, individuals can visualize where their money is going and pinpoint areas where cutbacks or adjustments can be made. Analyzing the budget worksheet enables individuals to see potential areas for cost-saving measures, such as reducing unnecessary expenses, finding cheaper alternatives, or cutting back on non-essential items to free up funds or optimize spending.

What are some common expenses to consider when creating a New Home Budget Worksheet?

Some common expenses to consider when creating a New Home Budget Worksheet include mortgage or rent payments, utilities such as electricity, water, and gas, home insurance, property taxes, maintenance costs, homeowners association fees, home furnishings and decor, appliances and electronics, landscaping and gardening supplies, cleaning supplies, groceries, transportation expenses for commuting to and from your new home, and possible renovations or repairs.

What are some tips for accurately estimating expenses on a New Home Budget Worksheet?

To accurately estimate expenses on a new home budget worksheet, start by researching and gathering information on all potential costs related to purchasing and owning a home, including mortgage payments, property taxes, insurance, utilities, maintenance, and repair costs. Break down these expenses into categories and use past bills or quotes for reference. Be thorough and include all possible costs to get a realistic budget. It's also a good idea to leave room for unexpected expenses by setting aside a contingency fund. Regularly review and adjust your budget as needed to ensure it remains accurate.

How can a New Home Budget Worksheet help in saving for future home-related expenses?

A New Home Budget Worksheet can help in saving for future home-related expenses by creating a clear overview of current and projected expenses related to owning a home. By accurately tracking income, expenses, savings, and investments, individuals can establish a realistic budget that allocates funds for home maintenance, repairs, upgrades, and unexpected costs. This proactive approach allows for better financial planning and saving for future home-related expenses, ensuring that individuals are prepared and able to cover any unforeseen costs that may arise.

Are there any tools or resources available to help create a New Home Budget Worksheet?

Yes, there are various tools and resources available online to help create a New Home Budget Worksheet. You can use budgeting templates and worksheets provided by financial websites, budgeting apps, or software that can help you track your income, expenses, and savings specific to managing a new home budget. Additionally, you can customize these tools to suit your financial goals and specific needs when creating your home budget worksheet.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments