Monthly Spending Plan Worksheet

One essential tool for individuals seeking to take control of their finances is a monthly spending plan worksheet. This easy-to-use resource allows you to track, analyze, and make informed decisions about your expenses and income. Whether you are a recent graduate just starting to manage your finances or a seasoned professional looking to better understand your spending habits, a monthly spending plan worksheet provides a structured and organized way to monitor your financial well-being.

Table of Images 👆

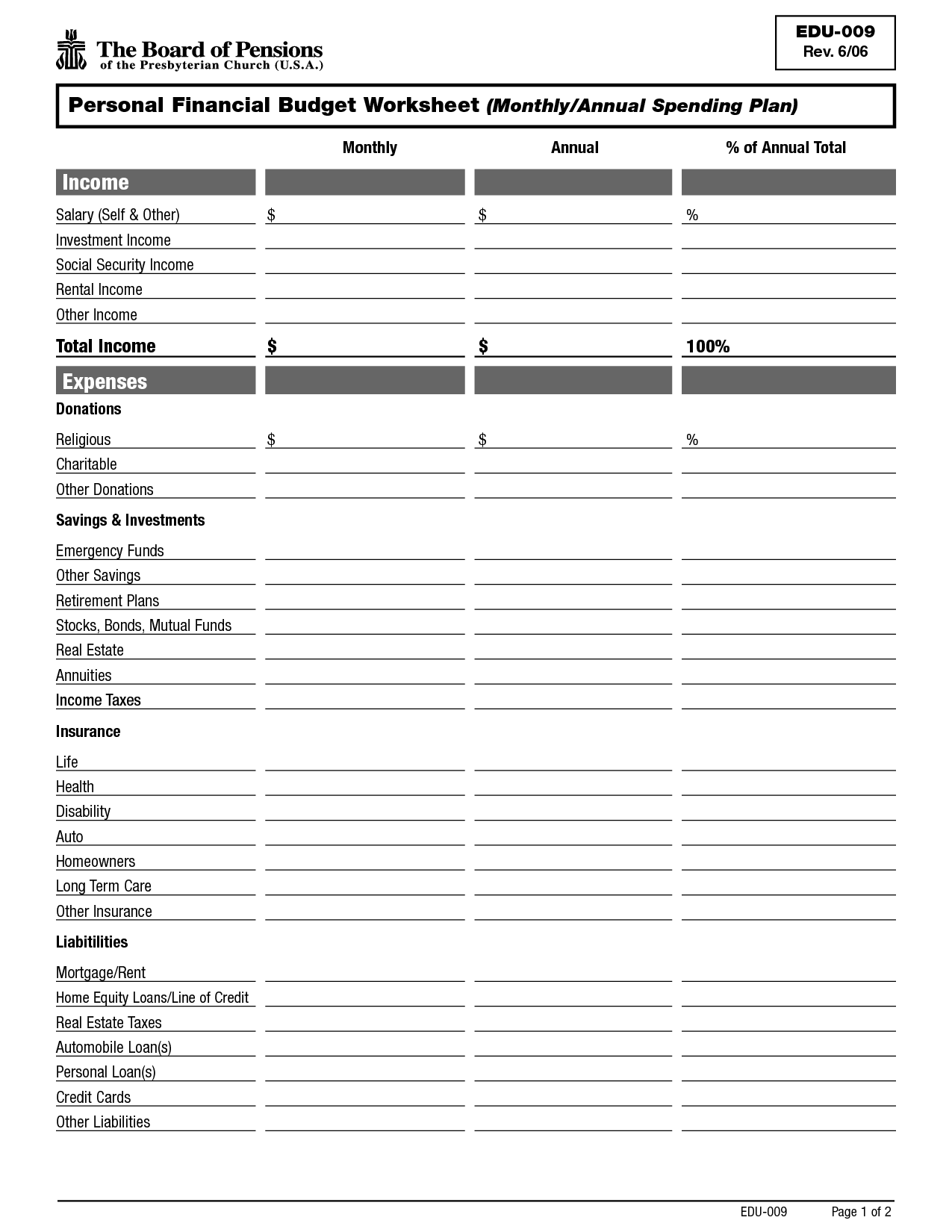

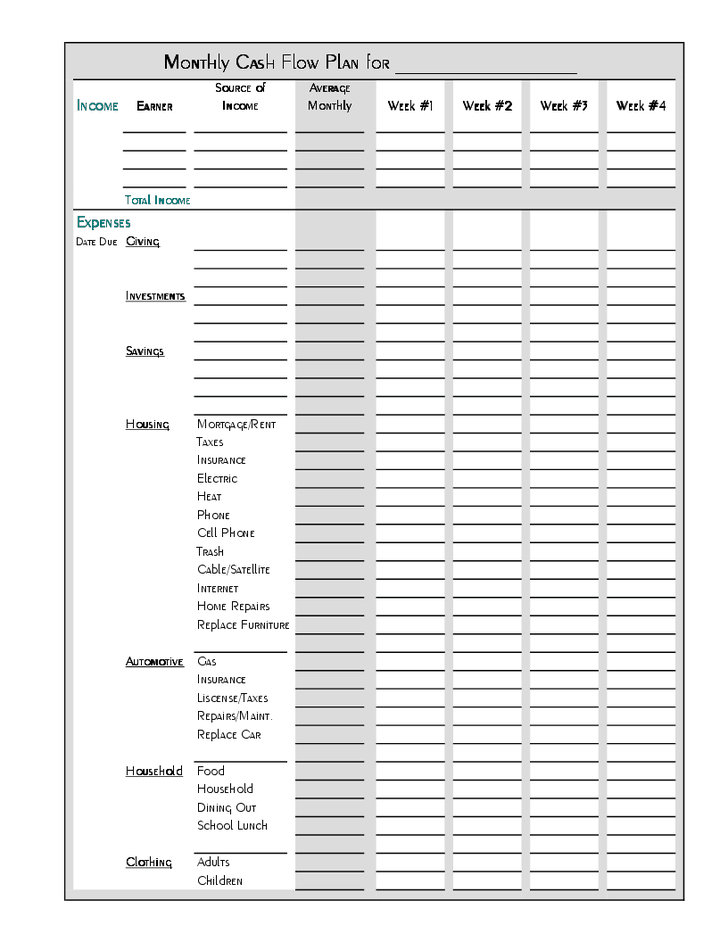

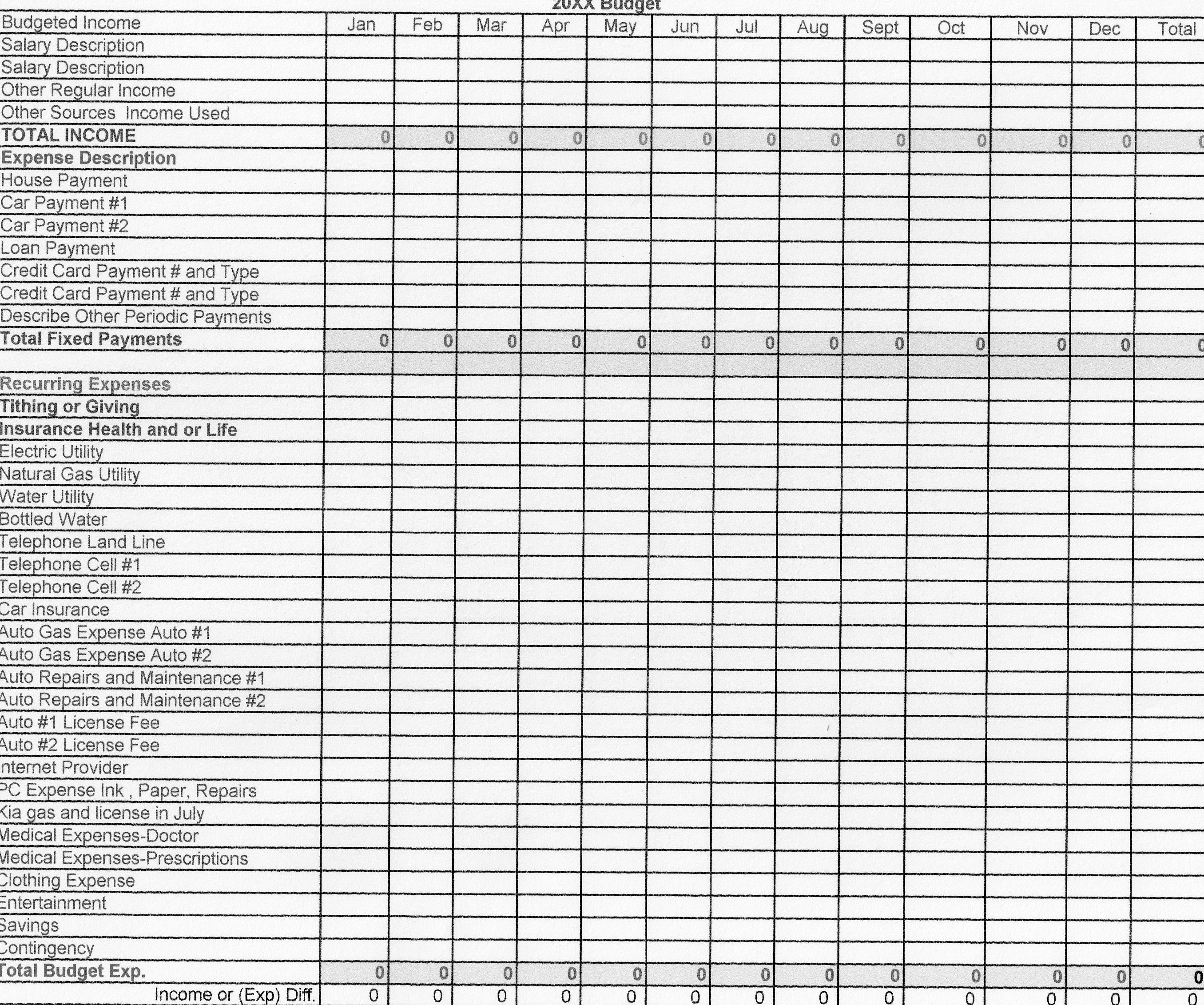

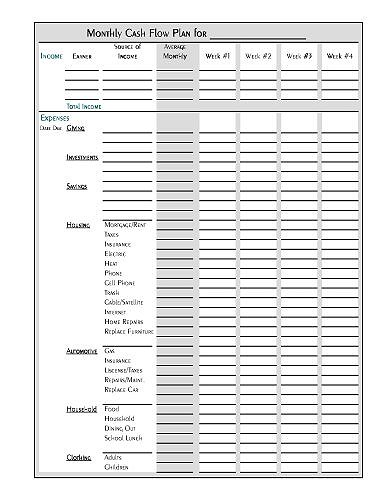

- Monthly Financial Budget Worksheet

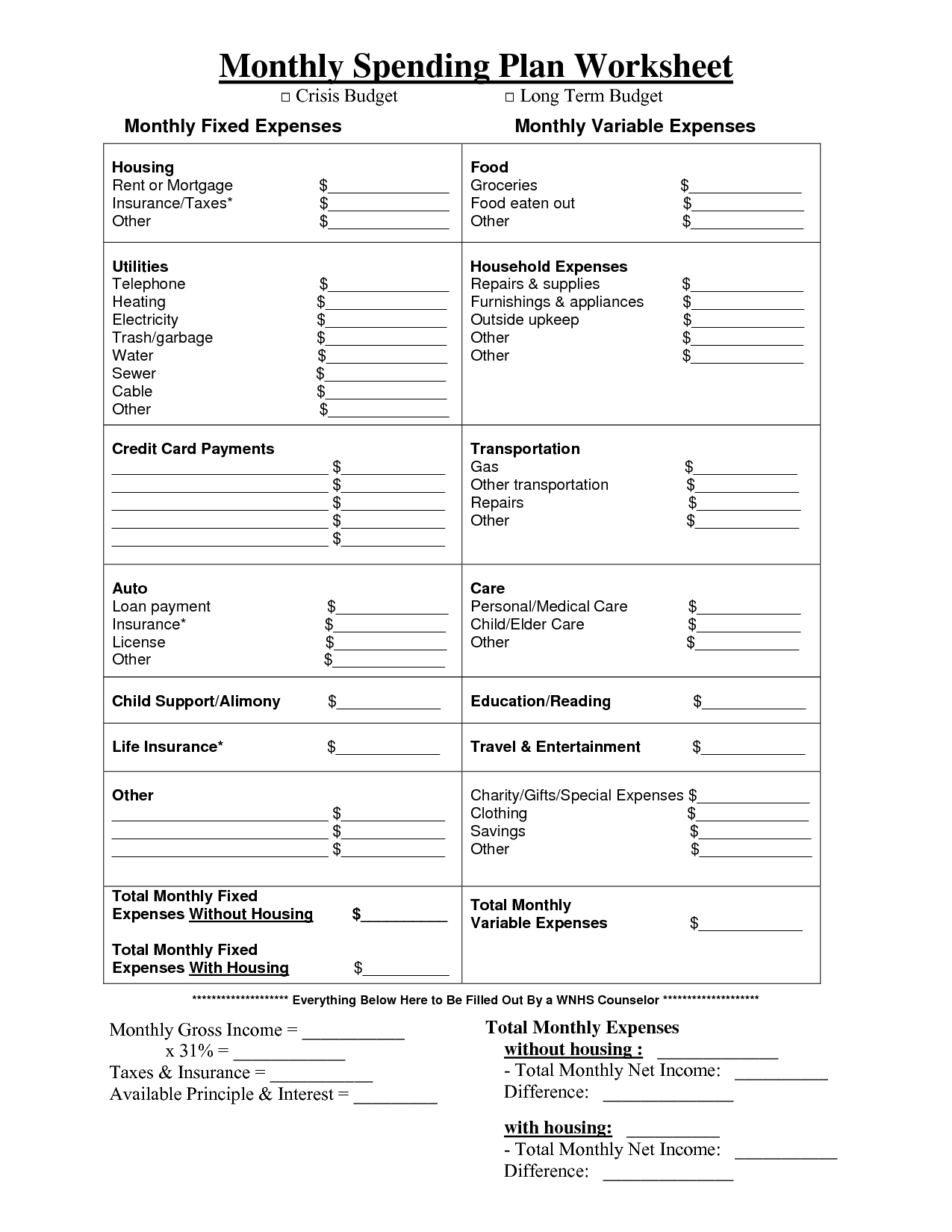

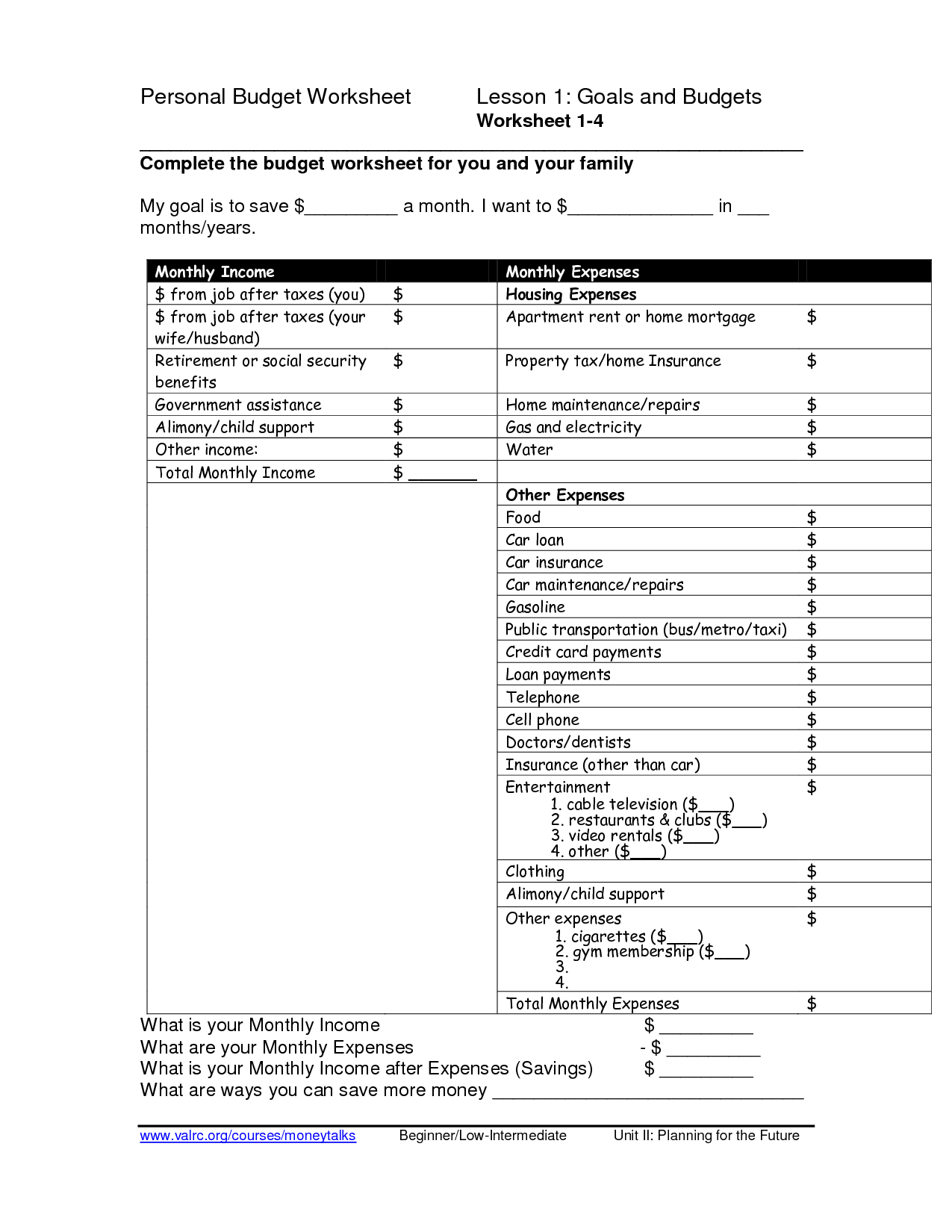

- Spending Plan Worksheet PDF

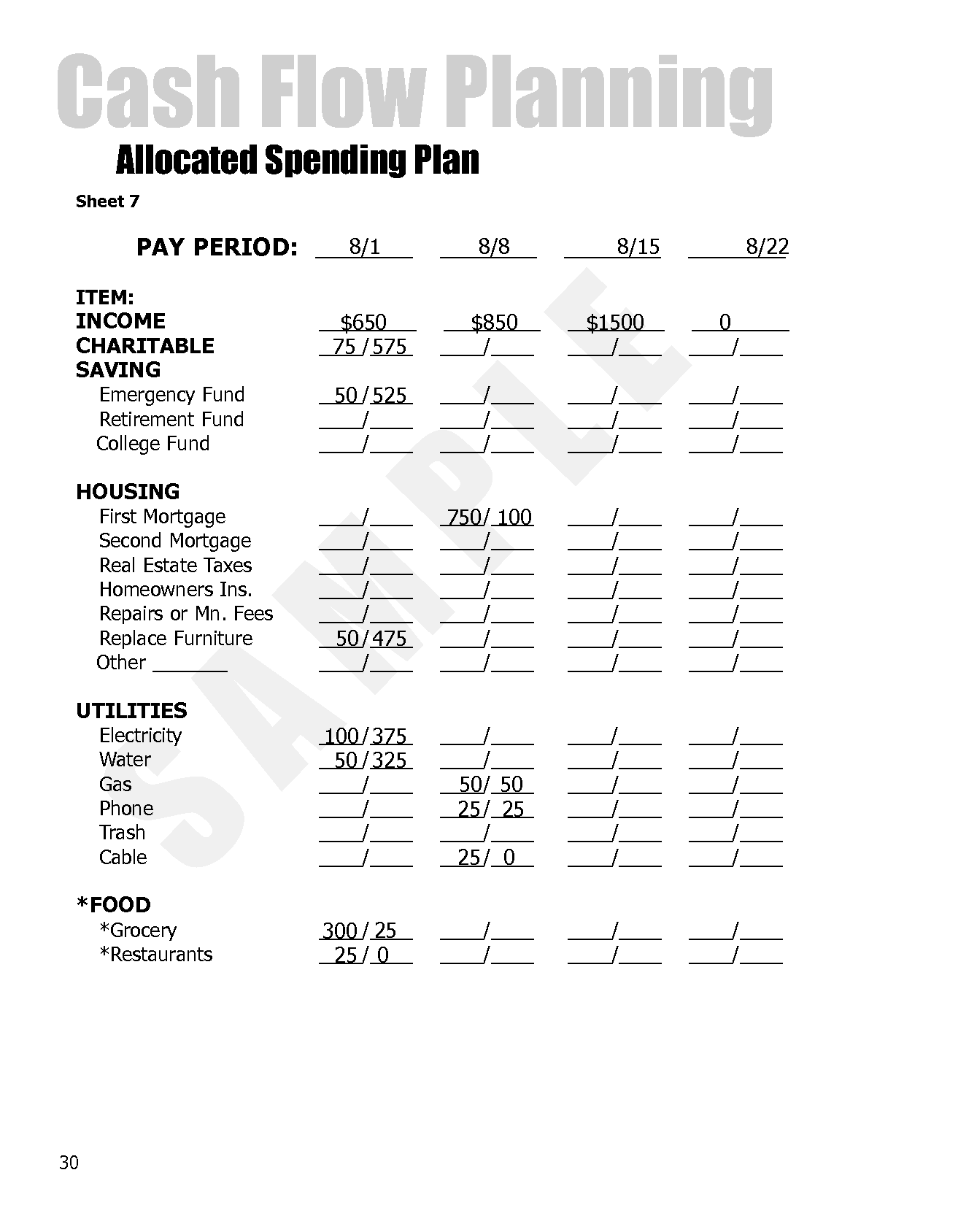

- Dave Ramsey Allocated Spending Plan Budget

- Free Printable Budget Worksheet Template

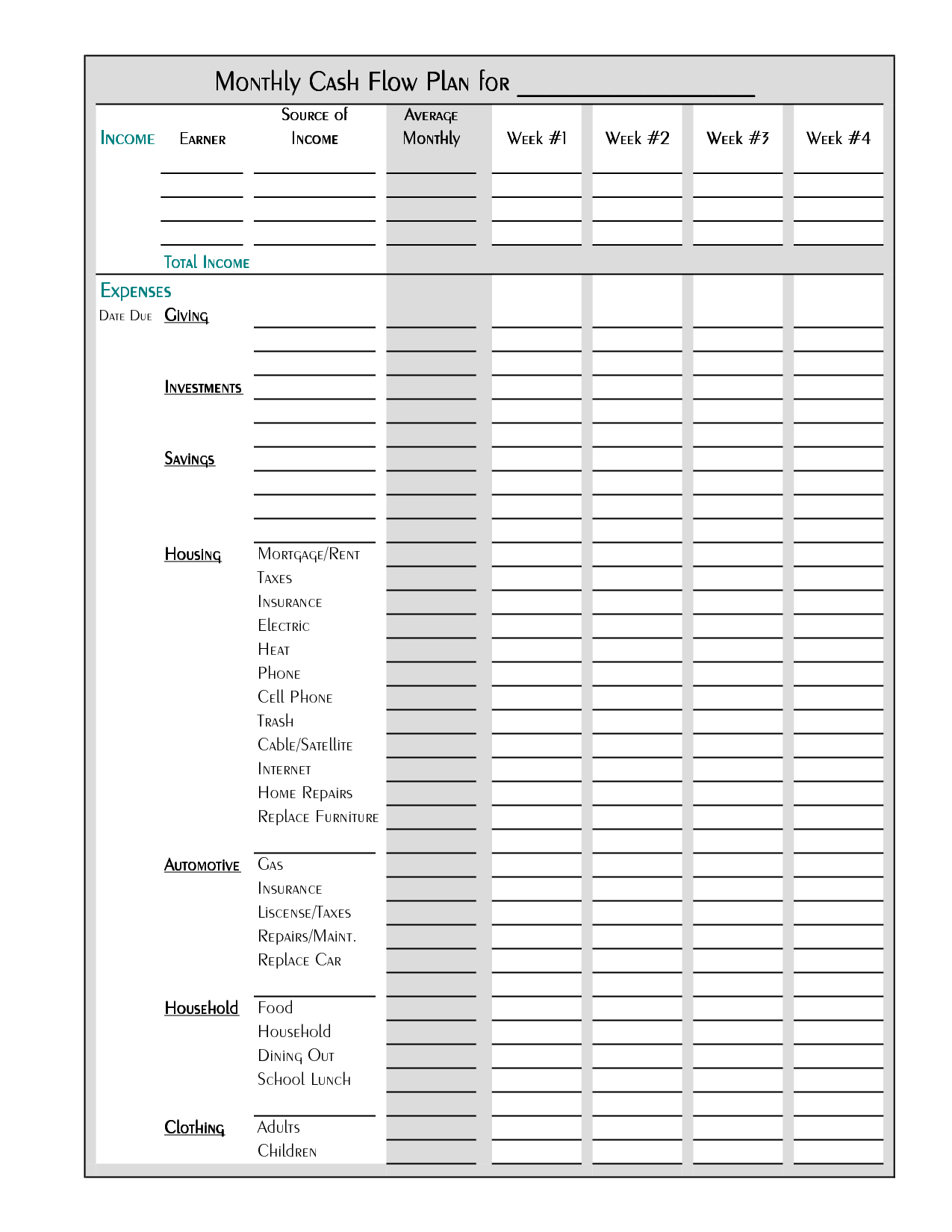

- Monthly Cash Flow Budget Template

- Personal Monthly Budget Worksheet

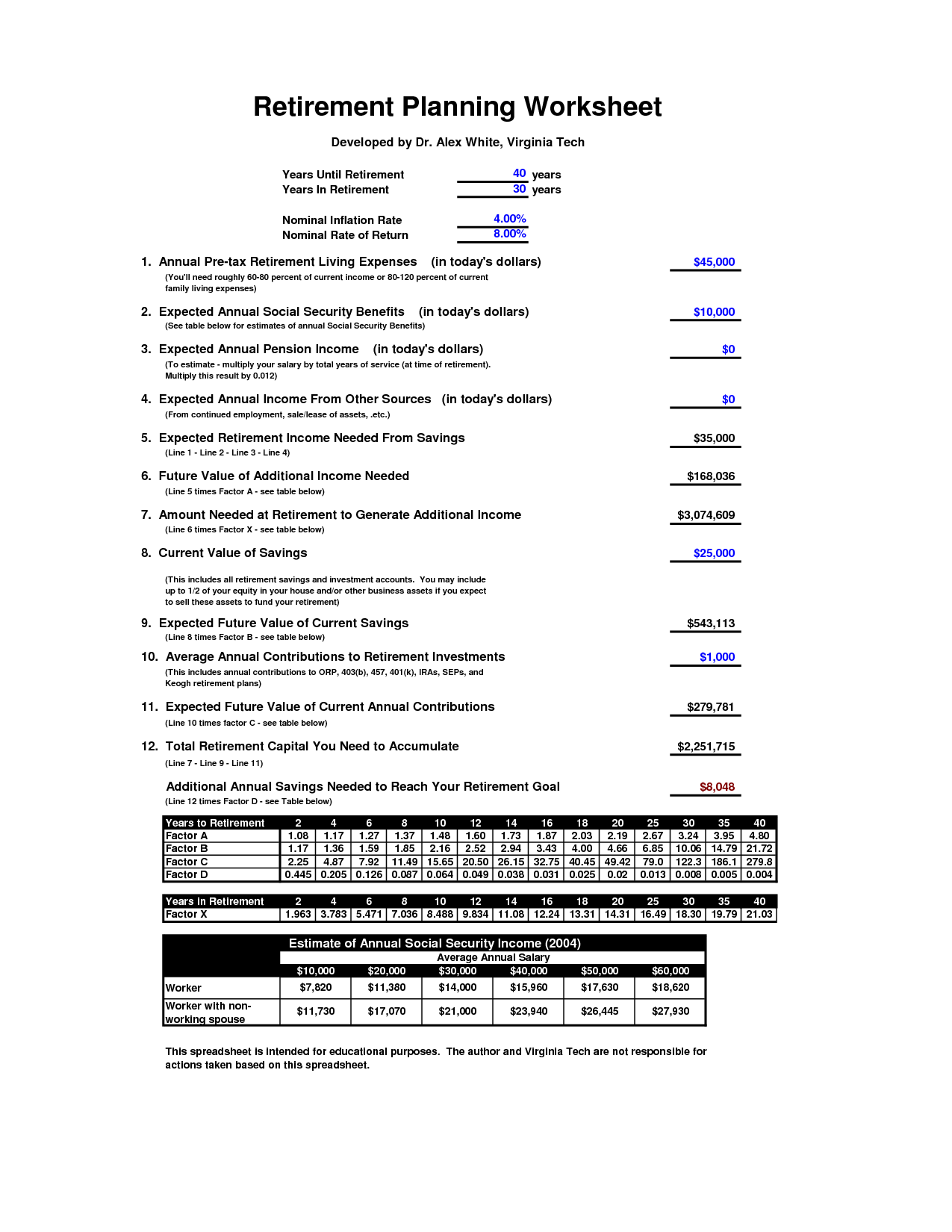

- Retirement Planning Worksheet Printable

- Personal Monthly Budget Form

- Free Printable Household Budget Worksheets

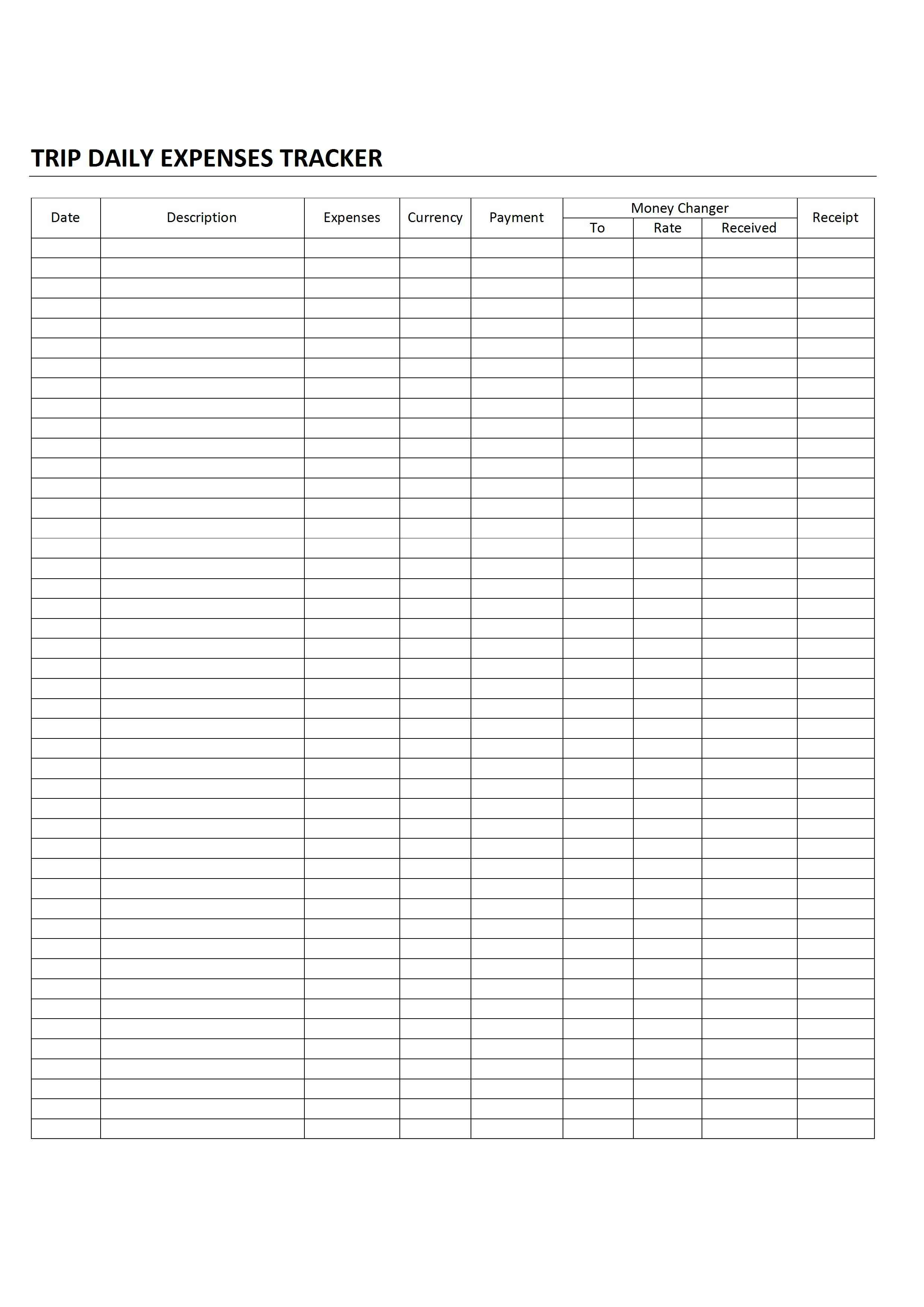

- Daily Spending Log Template

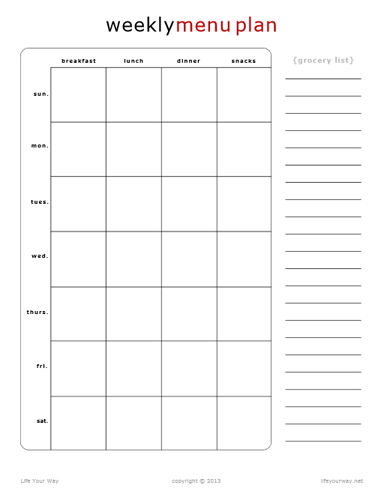

- Printable Weekly Menu and Shopping List

- Jesus and the Adulterous Woman

- Symptom Tracking Forms Printable

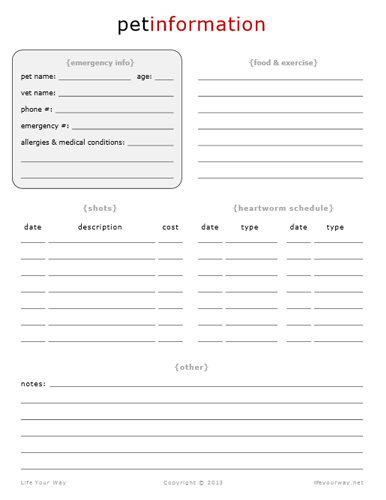

- Pet Information Sheet Printable

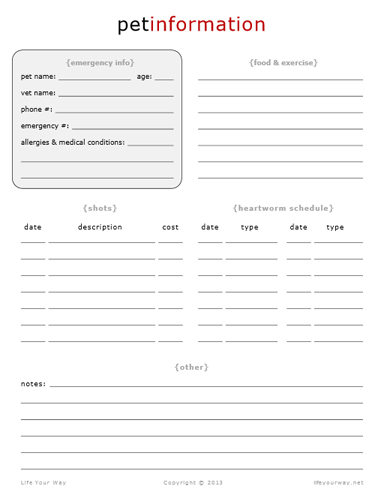

- Pet Information Sheet Printable

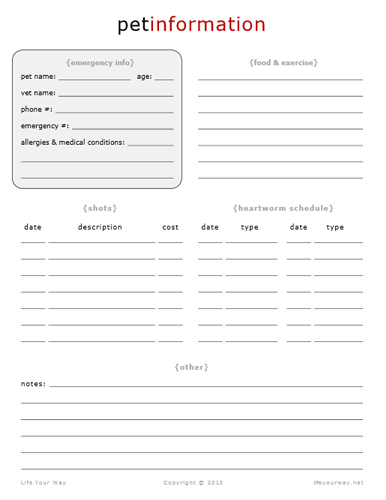

- Pet Information Sheet Printable

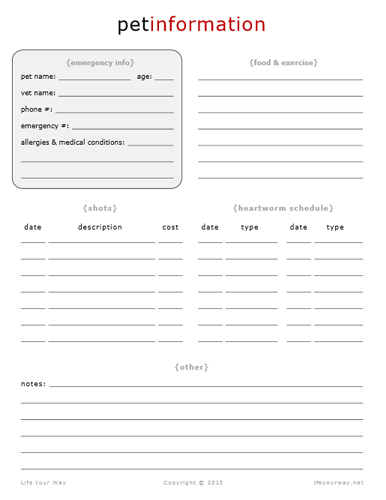

- Pet Information Sheet Printable

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a Monthly Spending Plan Worksheet?

A Monthly Spending Plan Worksheet is a tool used to track and plan personal finances on a monthly basis. It typically includes categories for income, expenses, and savings, allowing individuals to set financial goals, monitor their spending, and identify areas where they can make adjustments to their budget. This worksheet helps users take control of their finances, understand where their money is going, and work towards achieving their financial objectives.

Why is a Monthly Spending Plan Worksheet important?

A Monthly Spending Plan Worksheet is important because it helps track and manage expenses, create a budget, set financial goals, and identify areas where spending can be reduced. By using this tool, individuals can gain a better understanding of their financial habits, make informed decisions, and work towards achieving financial stability and success.

How do you create a Monthly Spending Plan Worksheet?

To create a Monthly Spending Plan Worksheet, start by listing all sources of income for the month. Next, categorize your expenses such as bills, groceries, entertainment, etc. Assign a budget to each category based on your income and financial goals. Track your actual spending throughout the month and compare it to your budgeted amounts regularly. Adjust your spending as needed to stay within your budget. Consider using spreadsheet software or budgeting apps to help organize and analyze your finances effectively.

What types of expenses should be included in a Monthly Spending Plan Worksheet?

In a Monthly Spending Plan Worksheet, all expenses should be included, such as fixed expenses like rent, utilities, and insurance premiums, variable expenses like groceries, dining out, and entertainment, as well as periodic expenses like car maintenance, medical expenses, and subscription services. It's also important to include savings contributions, debt repayments, and any miscellaneous expenses to accurately track and manage your finances effectively.

How often should you update your Monthly Spending Plan Worksheet?

It is recommended to update your Monthly Spending Plan Worksheet at least once a month. This will help you stay on top of your expenses, track any changes in your spending habits, and adjust your budget as needed to meet your financial goals. Frequent updates will ensure that you have an accurate representation of your financial situation and can make informed decisions about your budgeting and saving strategies.

What are the benefits of using a Monthly Spending Plan Worksheet?

Using a Monthly Spending Plan Worksheet can offer several benefits, such as helping you track and monitor your expenses, identify areas where you can cut back and save money, set financial goals, prioritize spending, and create a clearer picture of your financial situation. It can also assist in avoiding overspending, planning for future expenses, and ultimately, achieving better financial stability and peace of mind.

Can a Monthly Spending Plan Worksheet help with saving money?

Yes, a Monthly Spending Plan Worksheet can be a helpful tool in saving money by providing a clear overview of income and expenses, helping individuals track their spending habits, identify areas where they can cut back or save, set realistic budget goals, and prioritize saving for future financial goals. By diligently following and updating the spending plan, individuals can better manage their finances and work towards building savings.

How can a Monthly Spending Plan Worksheet help with identifying unnecessary expenses?

A Monthly Spending Plan Worksheet helps by outlining all expenses and income, making it easier to see where money is being spent each month. By comparing essential expenses to non-essential ones, such as eating out or shopping, individuals can identify unnecessary expenses that can be eliminated or reduced. This visual representation allows for better budgeting decisions and helps prioritize spending on items that align with financial goals.

Is it possible to adjust your Monthly Spending Plan Worksheet?

Yes, it is possible to adjust the Monthly Spending Plan Worksheet by making changes to the categories, amounts, or formulas to better suit your financial situation and goals. This allows you to customize the worksheet to fit your specific needs and track your expenses accurately to maintain control over your budget.

Can a Monthly Spending Plan Worksheet help improve financial decision-making?

Yes, a Monthly Spending Plan Worksheet can help improve financial decision-making by providing a clear overview of income and expenses, allowing individuals to track their spending patterns, identify areas where they can cut back or save more, and ultimately make more informed decisions about their finances. By creating and sticking to a monthly spending plan, individuals can better prioritize their spending, set financial goals, and work towards achieving long-term financial stability and success.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments