Monthly Budget Calculator Worksheet

Are you tired of feeling overwhelmed when it comes to managing your finances? Look no further! Introducing the Monthly Budget Calculator Worksheet, your ultimate tool for taking control of your money. This user-friendly worksheet is designed for individuals who want to track their income and expenses to better understand their financial standing.

Table of Images 👆

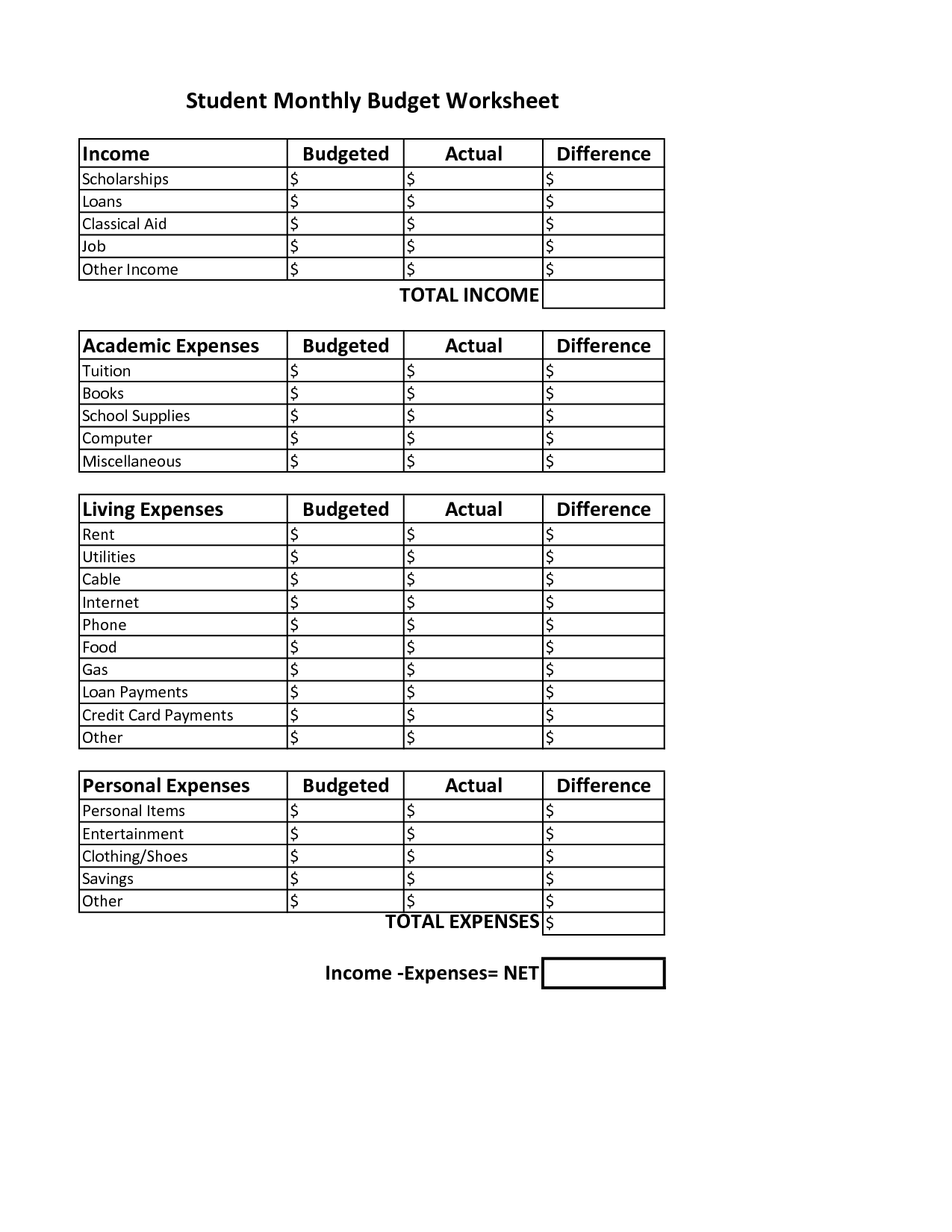

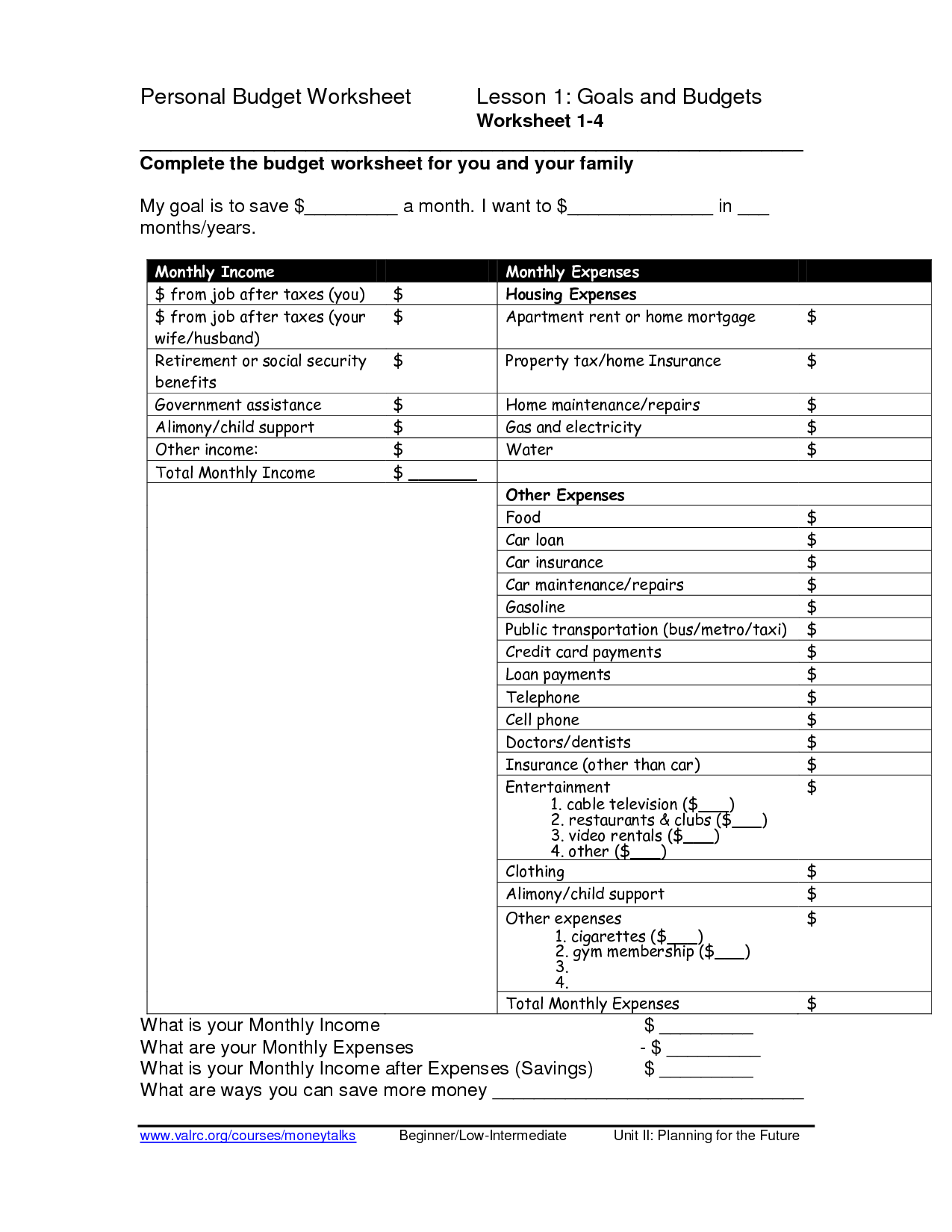

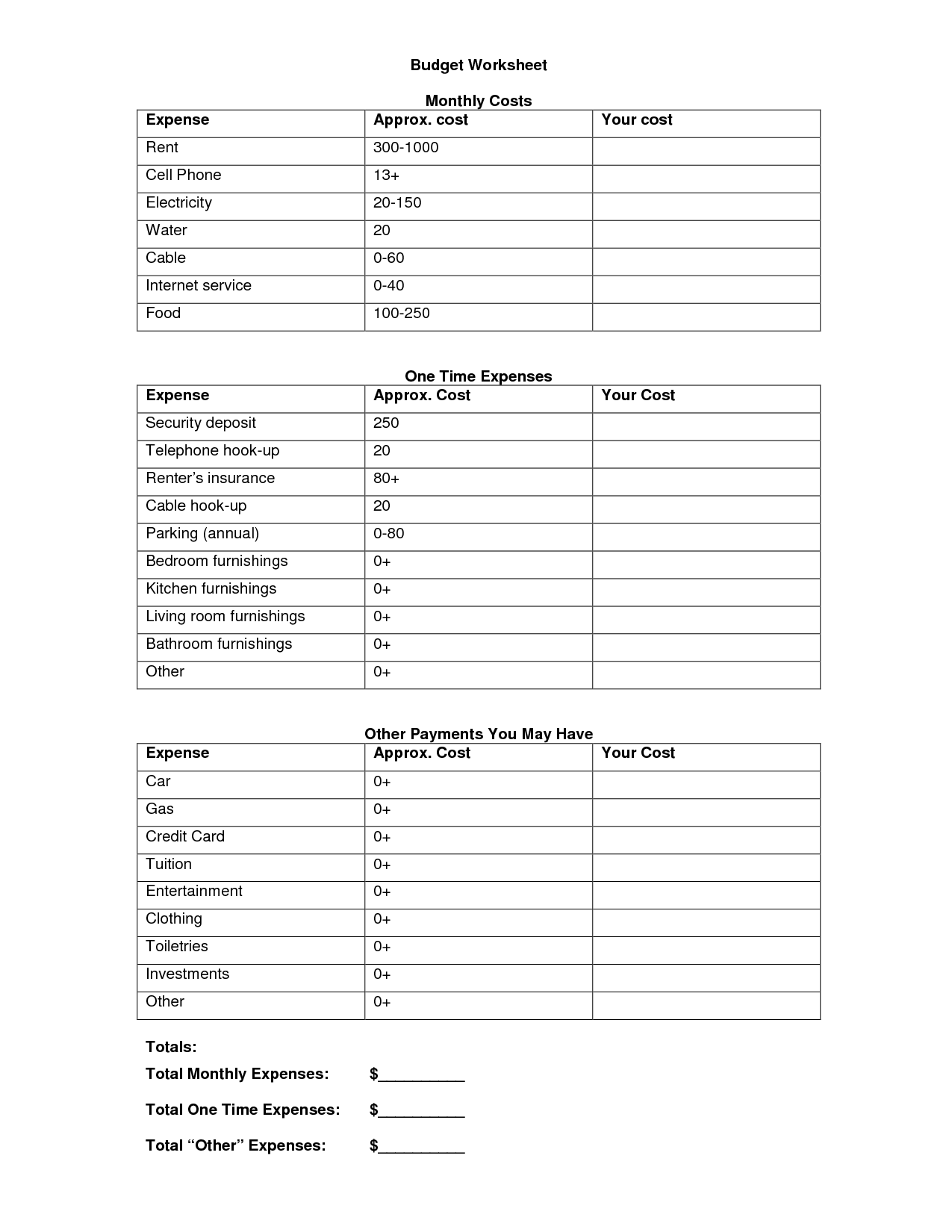

- Student Monthly Budget Worksheet

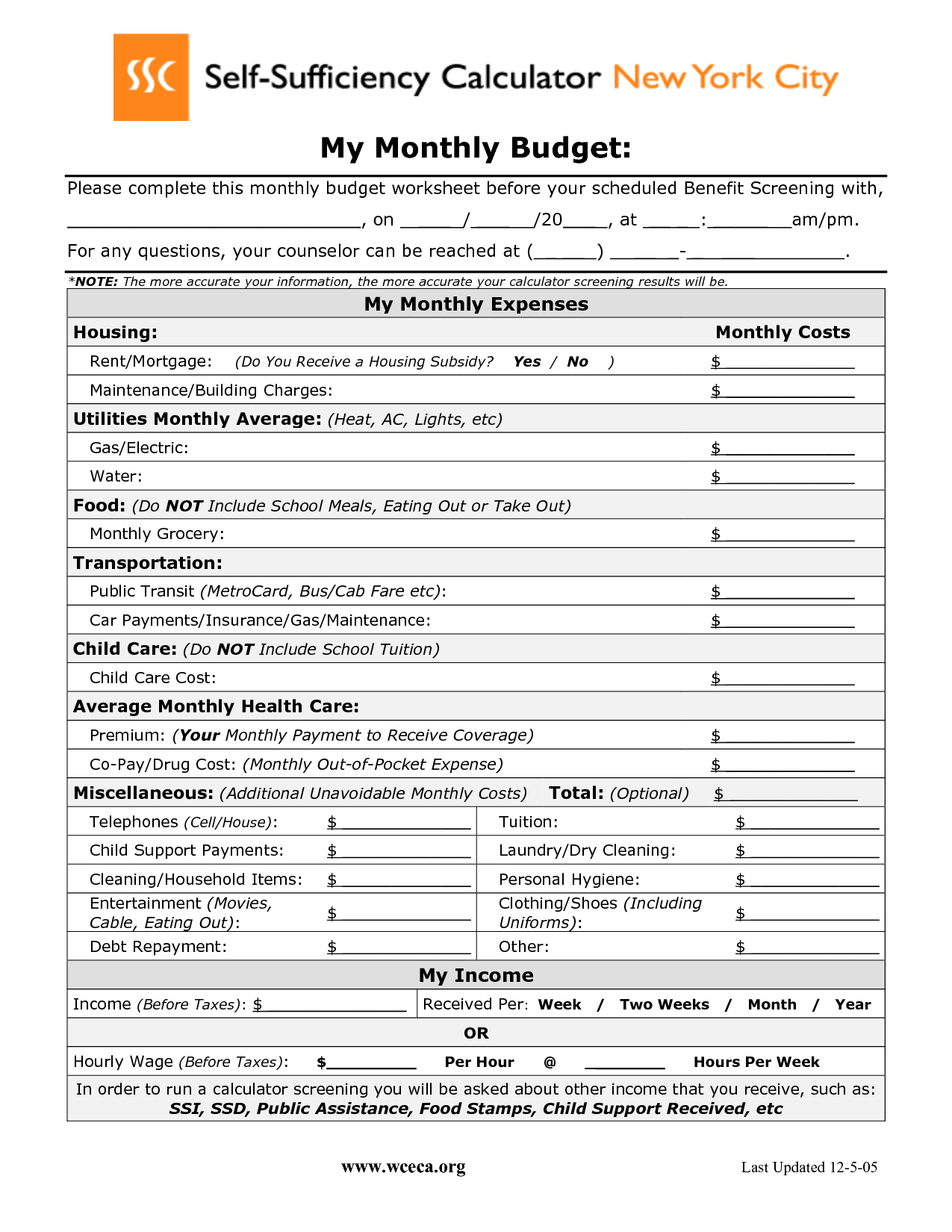

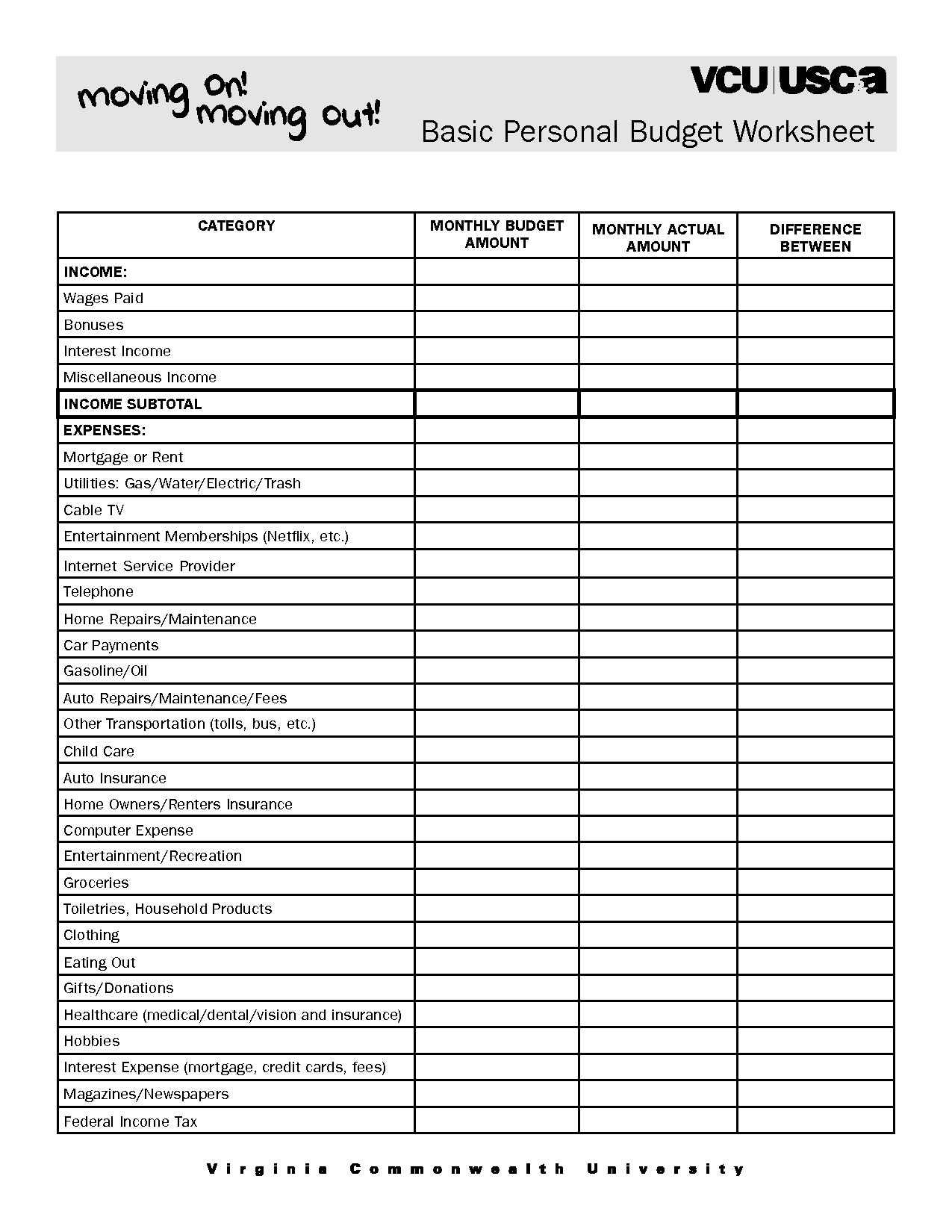

- My Monthly Budget Worksheet

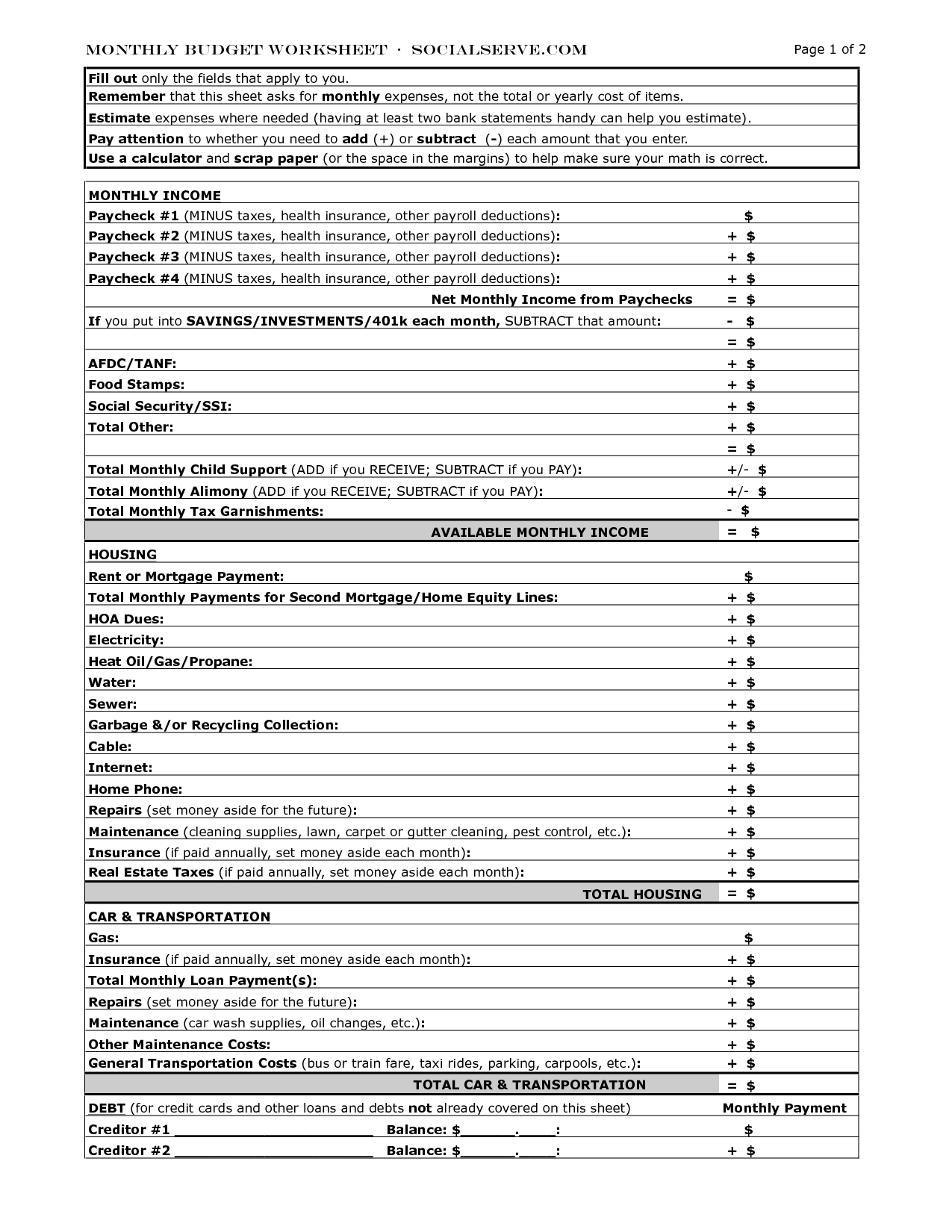

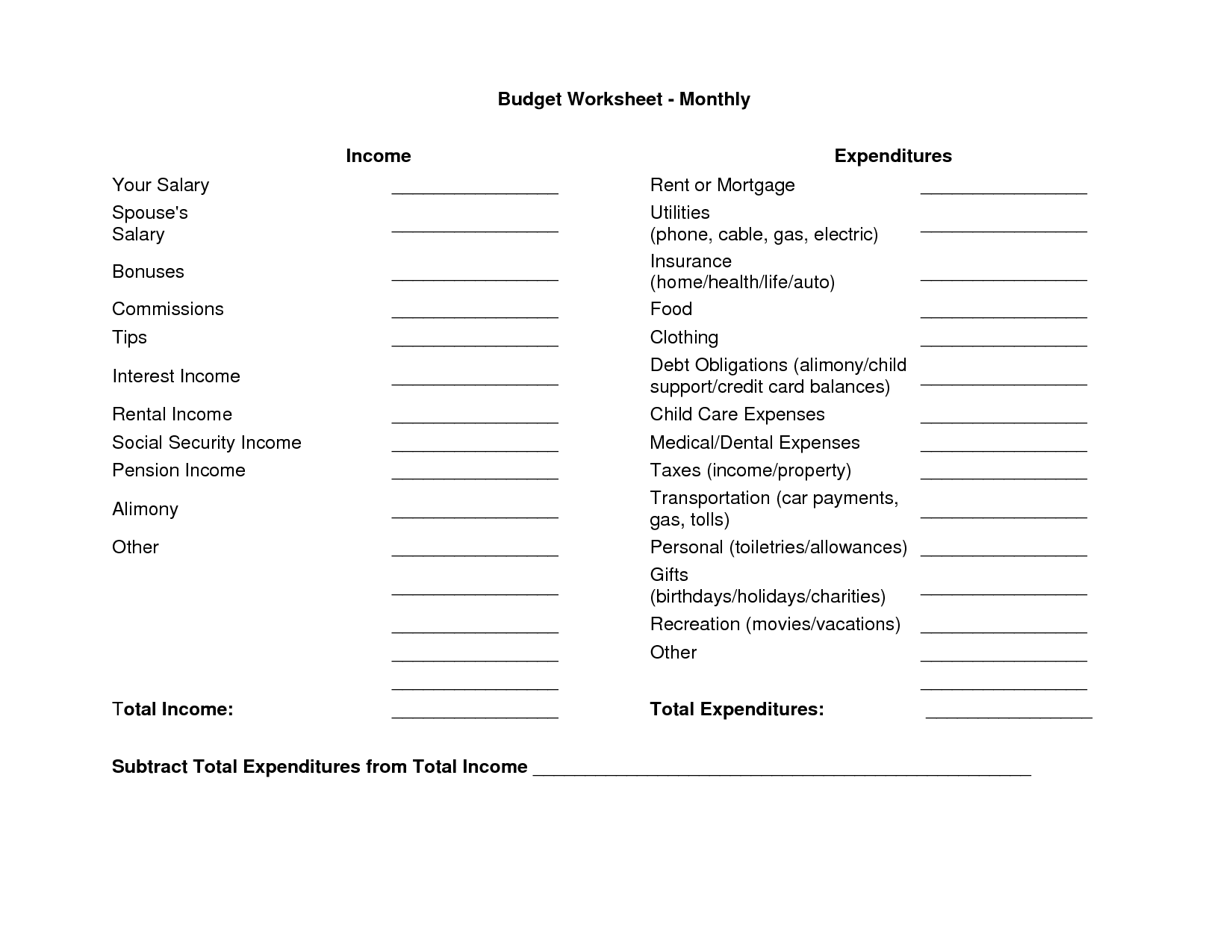

- Monthly Budget Worksheet

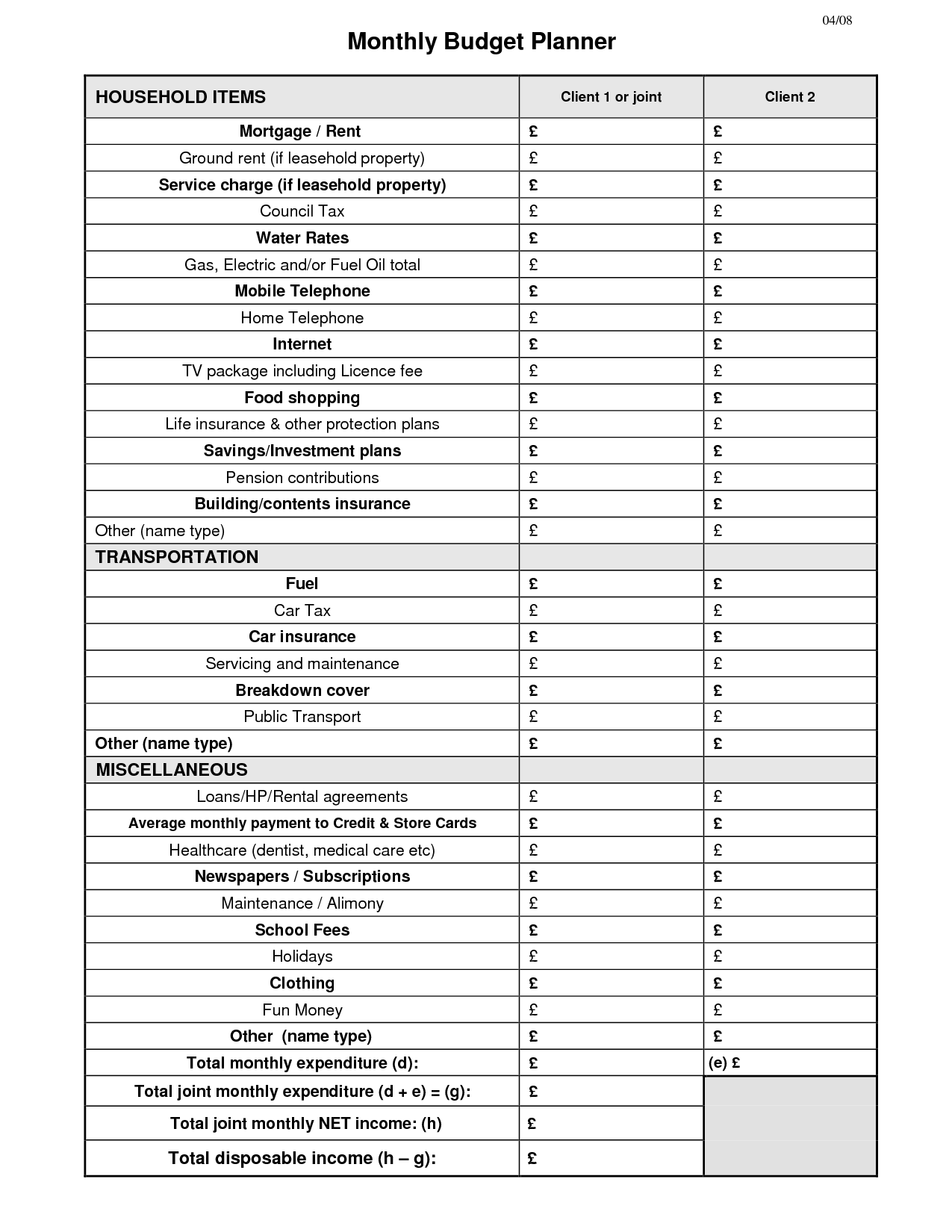

- Household Monthly Budget Planner

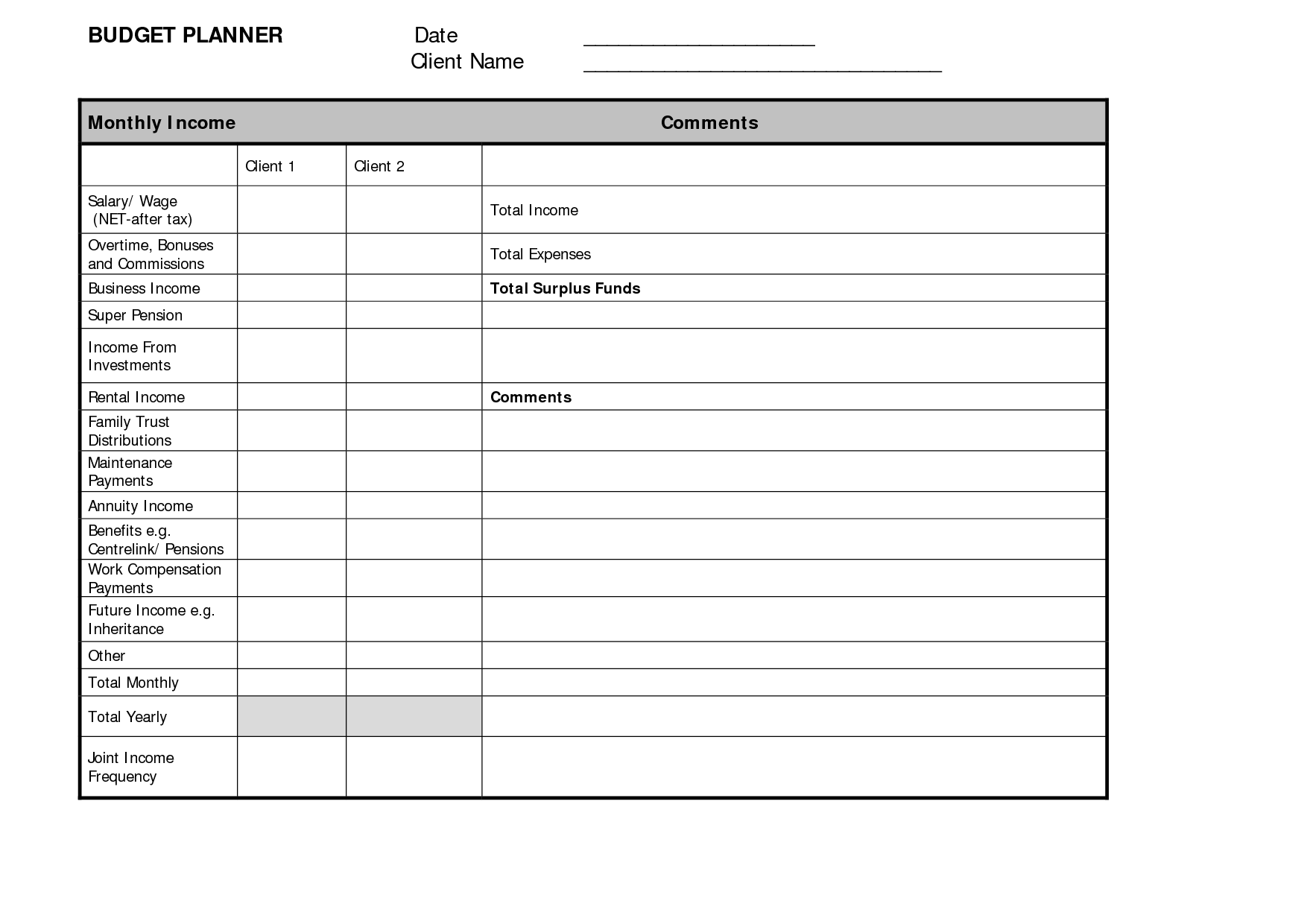

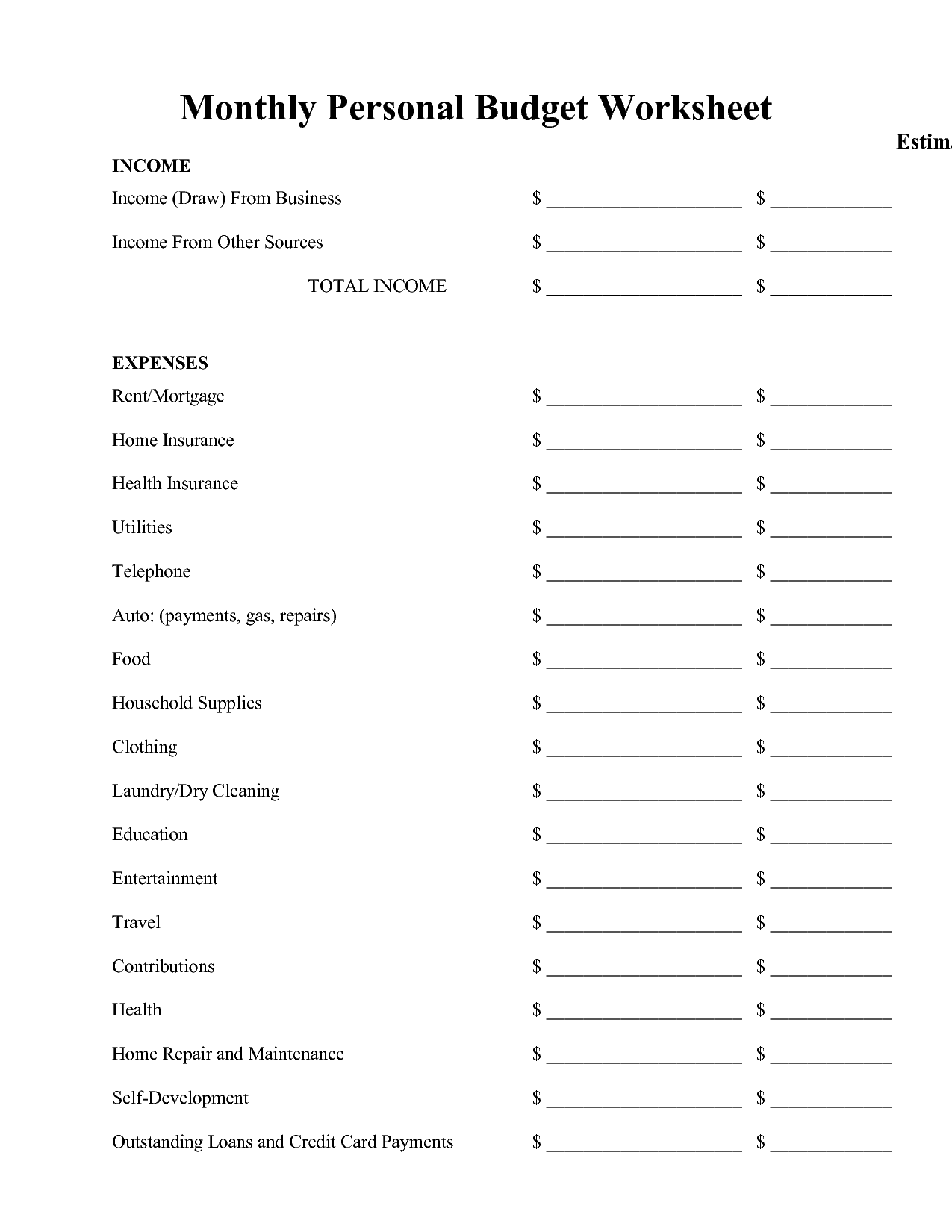

- Monthly Income Budget Worksheet

- Free Monthly Budget Planner Template

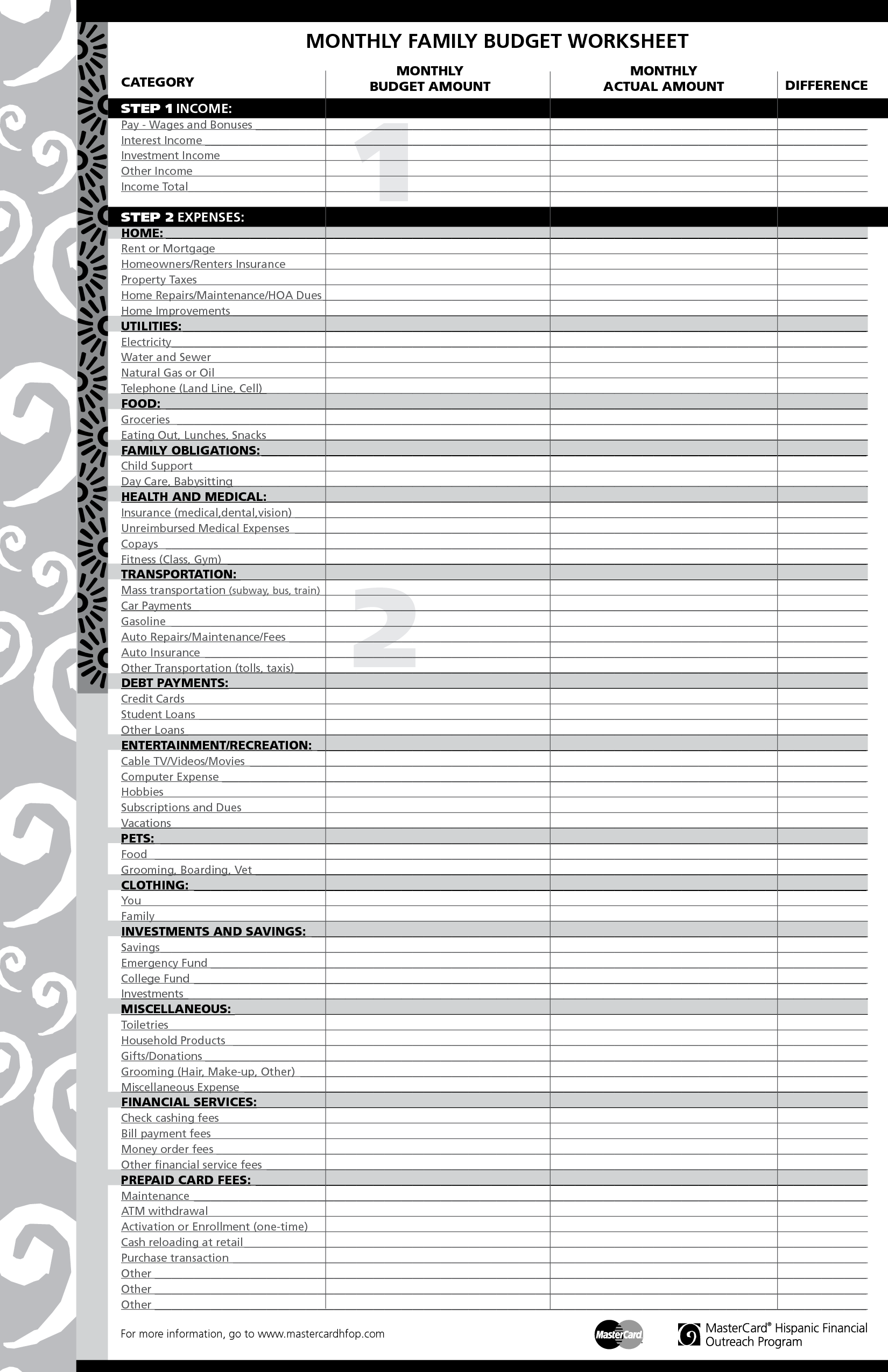

- Family Monthly Budget Worksheet

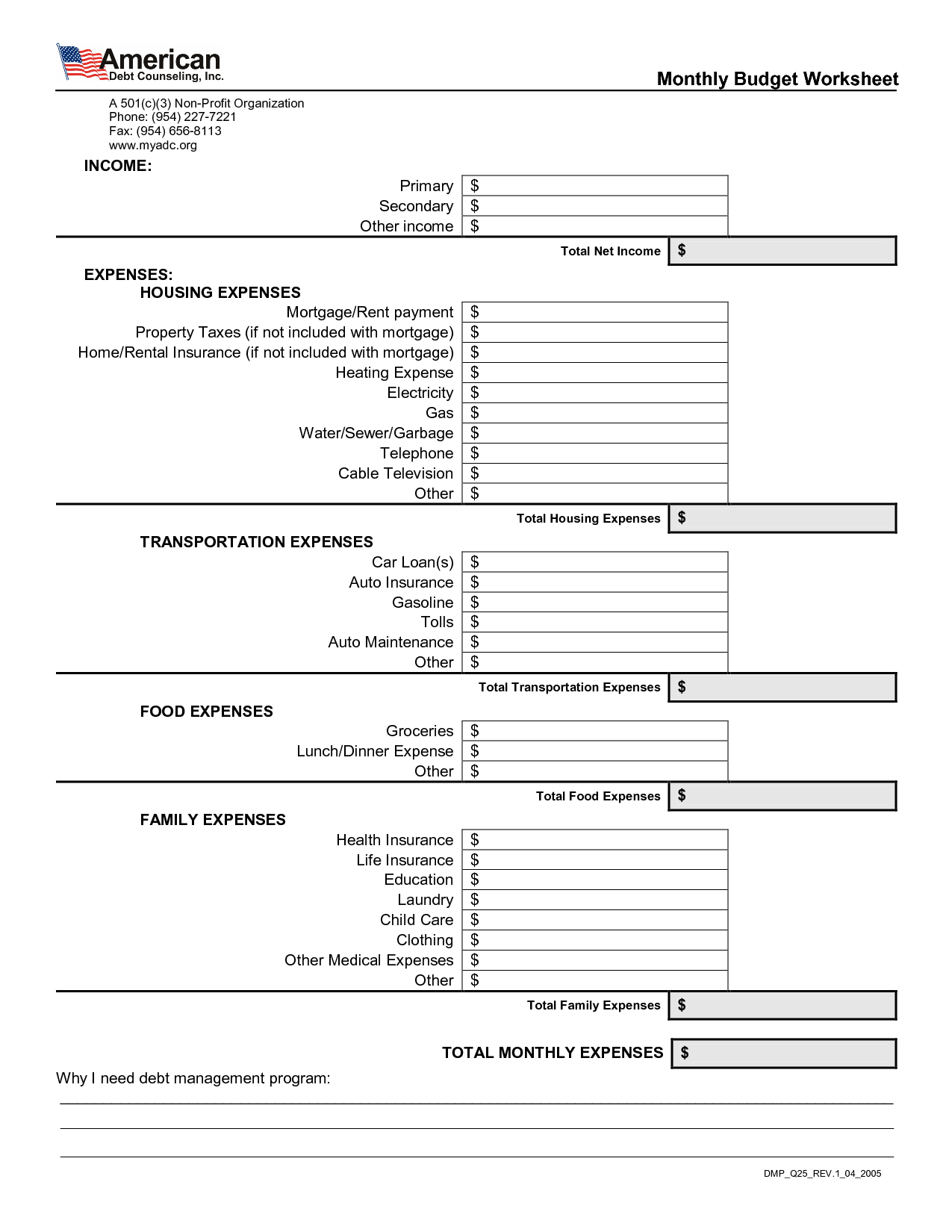

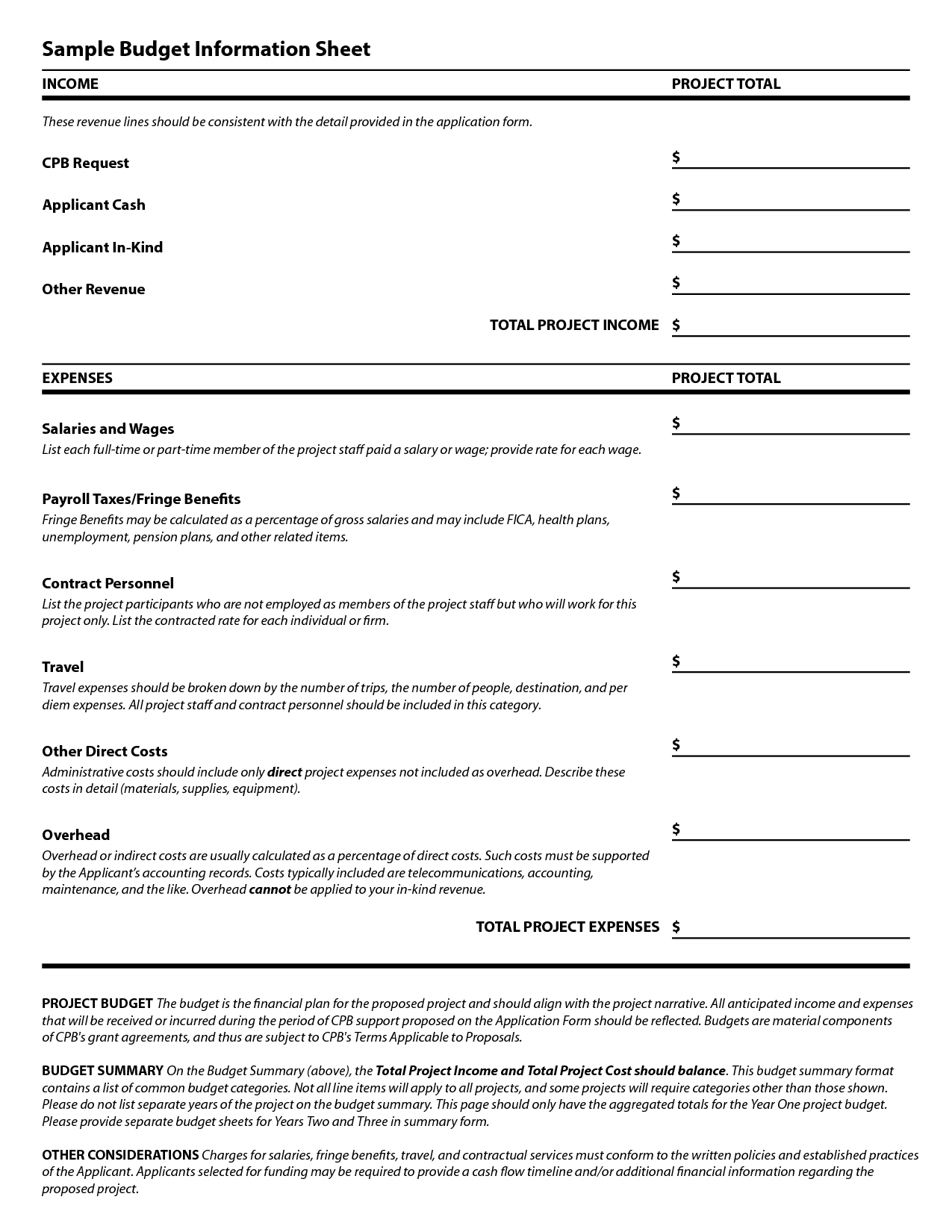

- Non-Profit Budget Worksheet

- Personal Monthly Budget Worksheet

- Personal Budget Worksheet Template

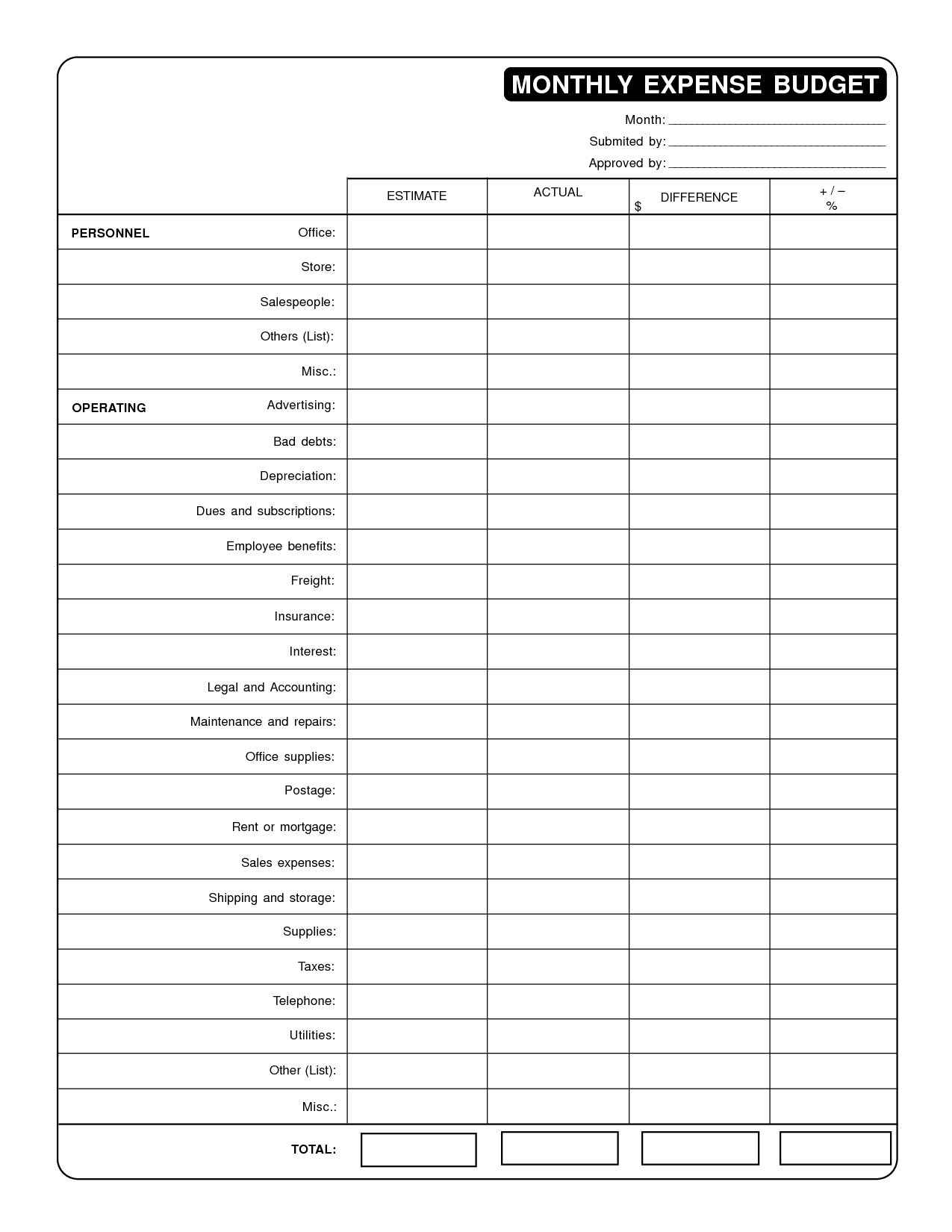

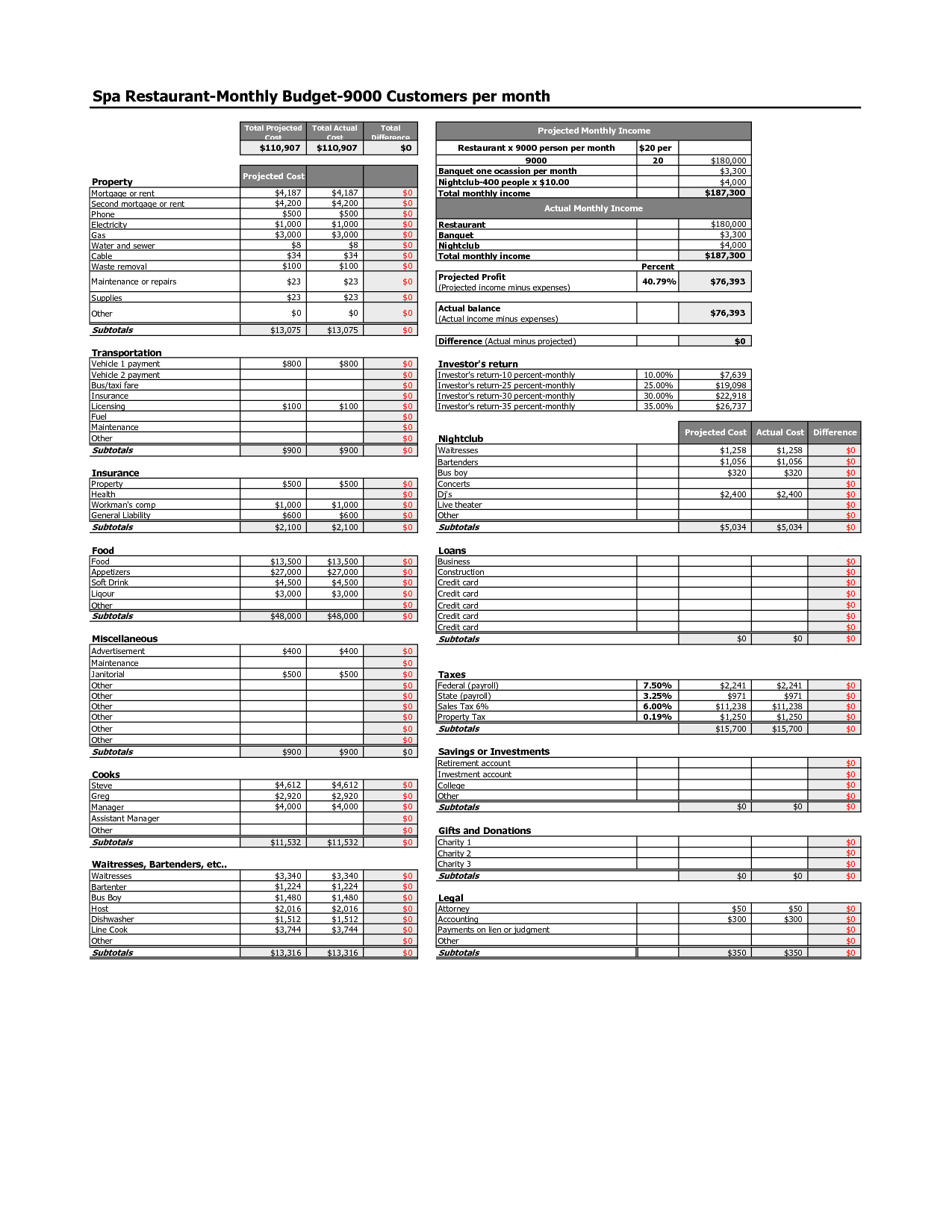

- Monthly Budget Expense Worksheet

- Household Financial Budget Worksheet

- Personal Monthly Budget Worksheet Printable

- Monthly Budget Expense Worksheet

- Budget and Debt Worksheet

- Free Printable Financial Budget Worksheet

- Monthly Budget Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a Monthly Budget Calculator Worksheet?

A Monthly Budget Calculator Worksheet is a tool used to track and manage monthly expenses and income. It typically includes sections to input various sources of income, fixed expenses (such as rent or loan payments), variable expenses (like groceries or entertainment), and savings goals. The worksheet helps individuals or households plan ahead, allocate funds appropriately, and identify areas where adjustments may be needed to achieve financial goals.

How can a Monthly Budget Calculator Worksheet help with financial planning?

A Monthly Budget Calculator Worksheet can help with financial planning by allowing you to track your income and expenses, identify areas where you may be overspending, set financial goals, and ultimately create a budget that aligns with your financial objectives. By having a clear understanding of your income and expenditures, you can make more informed decisions about how to allocate your money each month, prioritize saving and investing, and work towards achieving financial security and stability in the long term.

What specific categories are included in a Monthly Budget Calculator Worksheet?

A Monthly Budget Calculator Worksheet typically includes categories such as income sources, expenses (such as rent/mortgage, utilities, groceries, transportation, etc.), savings, debts, and miscellaneous expenses. This allows individuals to track their income and expenses, allocate funds accordingly, and monitor their overall financial health each month.

How can you determine your monthly income using a Monthly Budget Calculator Worksheet?

To determine your monthly income using a Monthly Budget Calculator Worksheet, you would need to input all sources of income for the month such as wages, salaries, bonuses, or any other earnings. Once you have listed all sources of income, sum them up to get your total monthly income. The worksheet will help you track your income and expenses, giving you a clear picture of your financial situation and helping you stay on top of your budgeting goals.

What expenses should be considered when using a Monthly Budget Calculator Worksheet?

When using a Monthly Budget Calculator Worksheet, it is important to consider all potential expenses including fixed expenses such as rent or mortgage payments, utilities, insurance, transportation costs, groceries, and debt repayments, as well as variable expenses like entertainment, dining out, shopping, and unforeseen expenses for emergencies. It is crucial to accurately track and account for all expenditures to create a realistic and effective budget that aligns with your financial goals.

Can a Monthly Budget Calculator Worksheet help track savings and investments?

Yes, a Monthly Budget Calculator Worksheet can definitely help track savings and investments. By including categories for savings goals and investment accounts, you can allocate a portion of your income towards these areas each month and track your progress over time. This can help you stay on track towards your financial goals and make adjustments as needed to ensure you are meeting your saving and investment targets.

How can a Monthly Budget Calculator Worksheet help identify areas of overspending?

A Monthly Budget Calculator Worksheet can help identify areas of overspending by clearly laying out all income and expenses in one place. By inputting actual numbers, it enables users to see a clear picture of where their money is going each month. By comparing actual spending to a predetermined budget, it becomes evident which categories are being overspent on. This analysis allows individuals to pinpoint specific areas where adjustments can be made to better manage their finances and avoid overspending in the future.

What are some advantages of using a Monthly Budget Calculator Worksheet?

Using a Monthly Budget Calculator Worksheet helps to track expenses, set financial goals, identify areas for potential savings, and prioritize spending. It provides a clear overview of income and expenses, promotes financial discipline, helps in monitoring progress towards financial goals, and allows for adjustments to be made as needed. Additionally, it can also aid in avoiding overspending, reducing debt, and building a savings buffer for unforeseen expenses or emergencies.

Are there any limitations to using a Monthly Budget Calculator Worksheet?

Yes, there are limitations to using a Monthly Budget Calculator Worksheet. These limitations can include oversimplification of financial situations, variability in expenses from month to month, lack of customization for specific financial goals or circumstances, and the need for regular updates and adjustments to accurately reflect changing financial situations. It is important to supplement the use of a budget calculator with mindful tracking, evaluation, and adjustments to ensure the budget remains effective and aligned with financial goals.

How often should you update and review your Monthly Budget Calculator Worksheet?

It is recommended to update and review your Monthly Budget Calculator Worksheet at least once a month. This will help you track your expenses accurately, identify any changes in your financial situation, and adjust your budget as needed to stay on track with your financial goals. Regularly reviewing your budget can also help you make timely decisions to optimize your spending and savings.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments