Money Management Worksheets Printable

Are you searching for a practical and effective way to manage your finances? Look no further! With printable money management worksheets, you can take control of your personal or household budget and start making smarter financial decisions. These worksheets provide a structured and organized framework for tracking income, expenses, savings, and debt repayment. Whether you're a young adult looking to build financial literacy or a seasoned individual seeking to improve money management skills, these worksheets are designed to help you keep a clear picture of your finances and set achievable goals.

Table of Images 👆

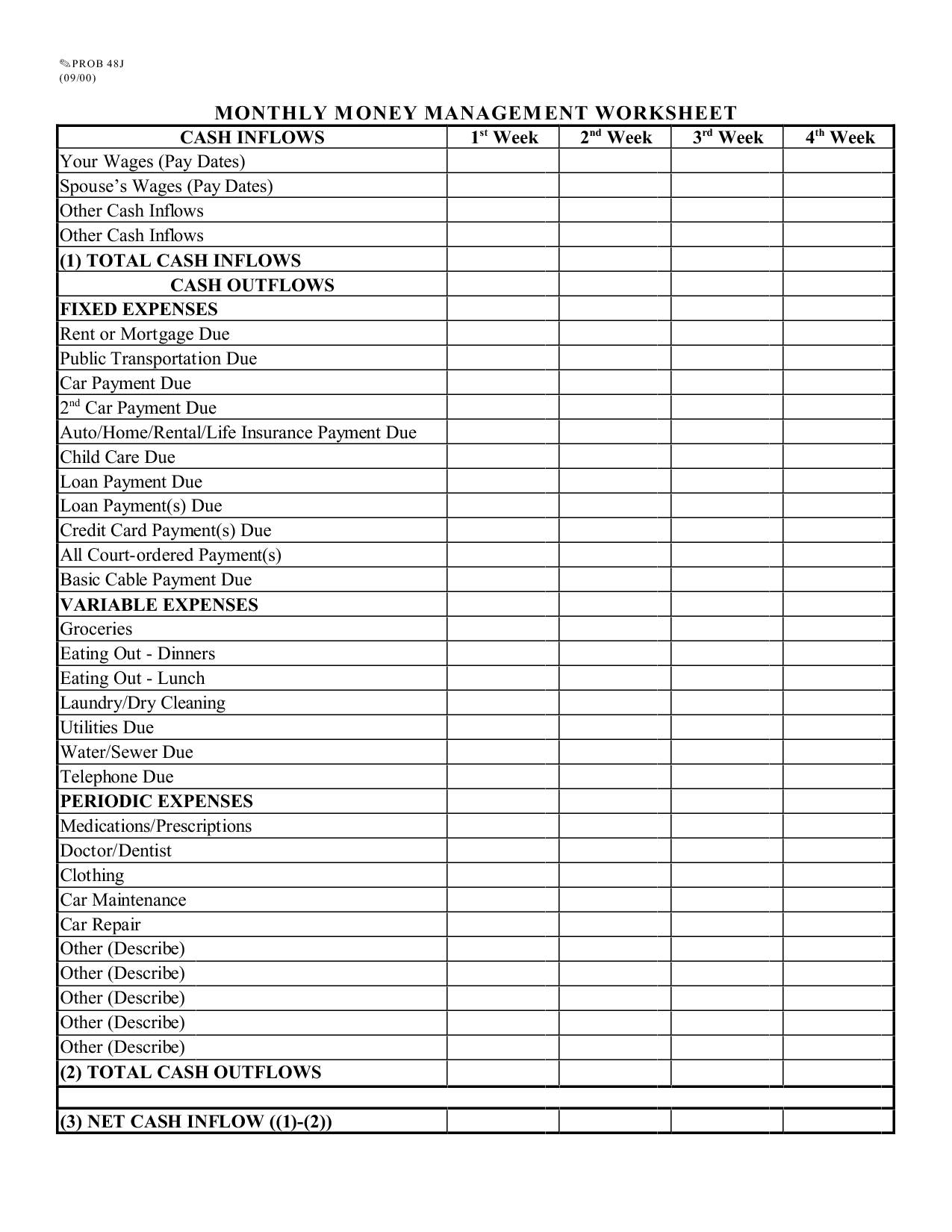

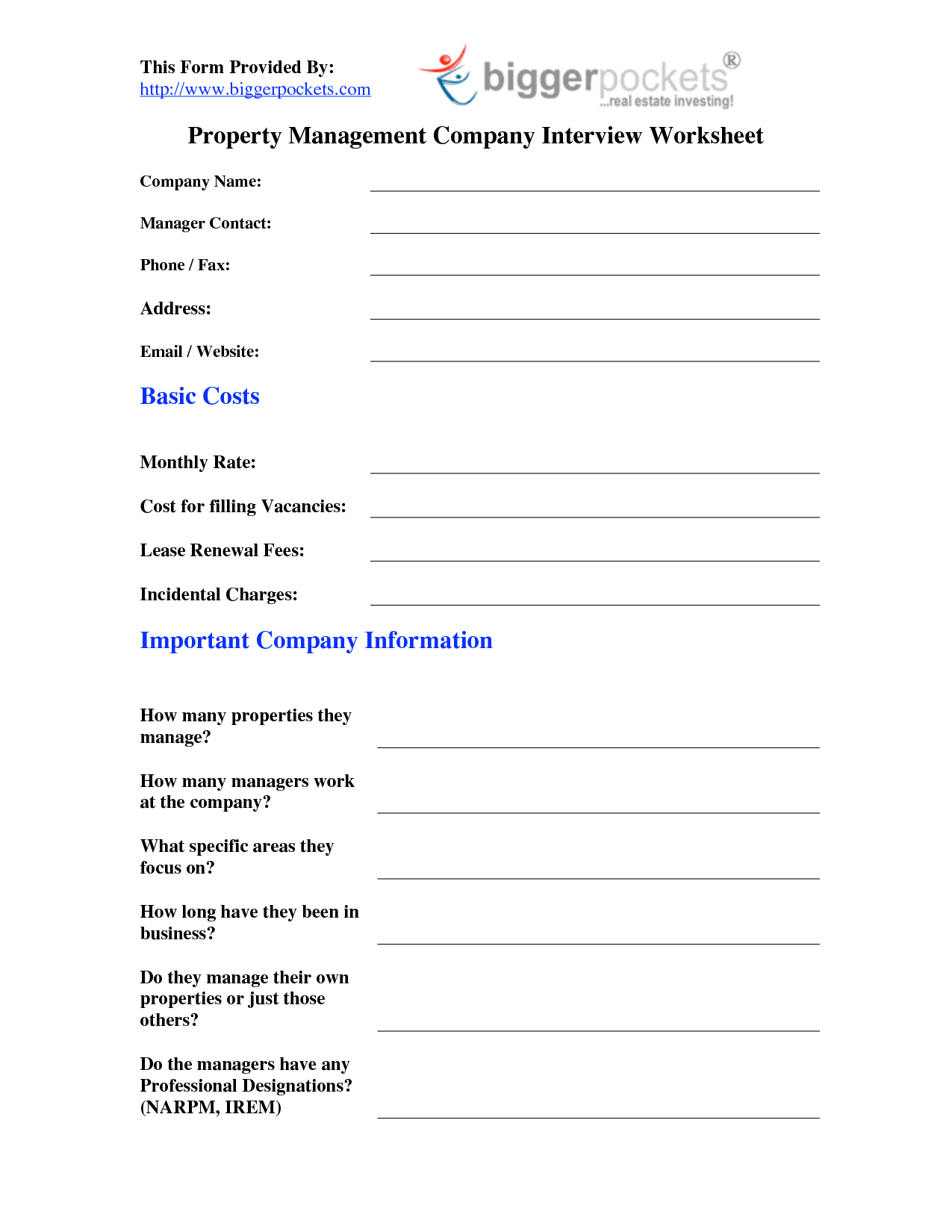

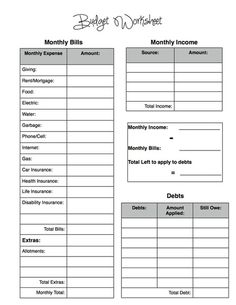

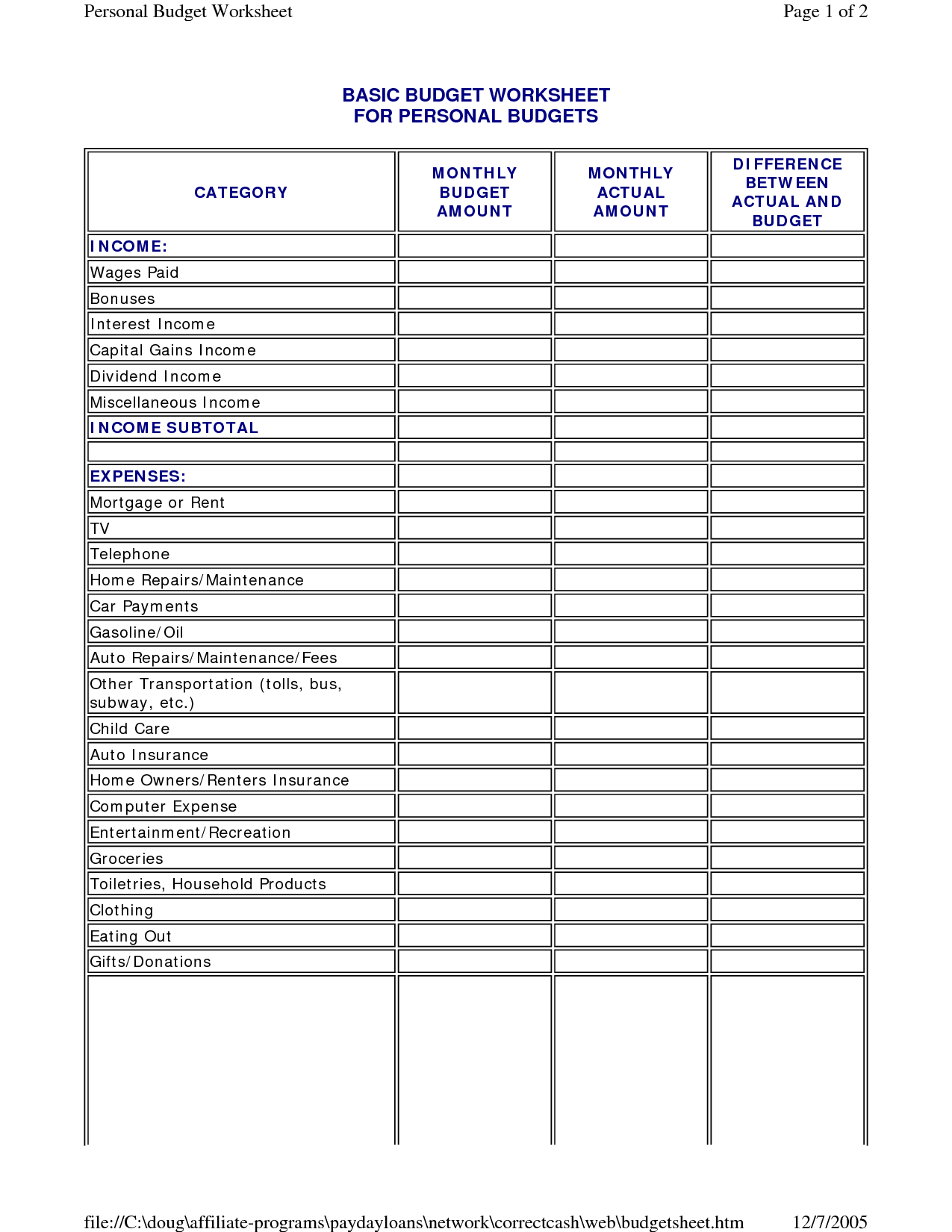

- Monthly Money Management Worksheet

- Money Management Worksheets

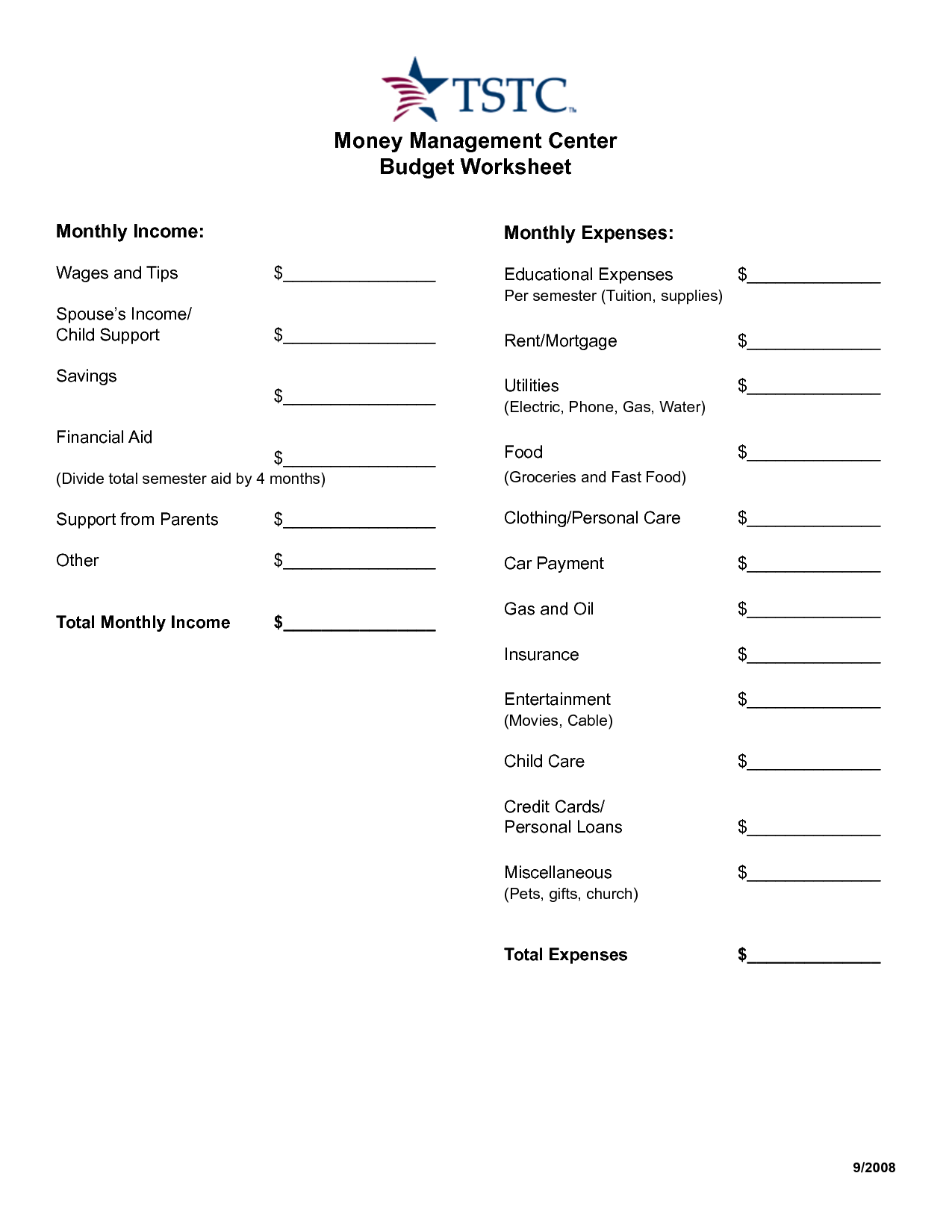

- Money Management Worksheets

- Money Budget Worksheet

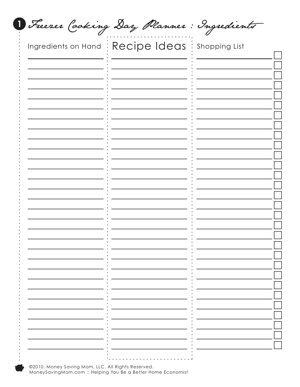

- Freezer Cooking Planner Printables

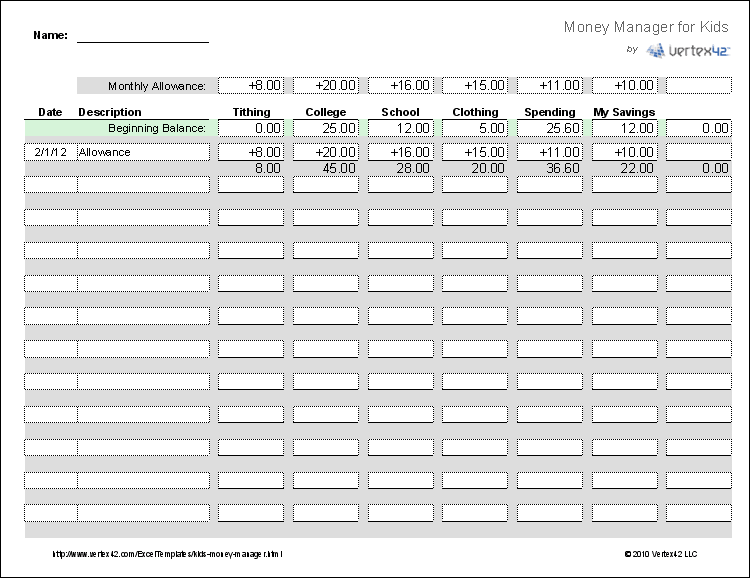

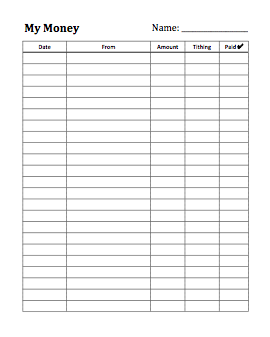

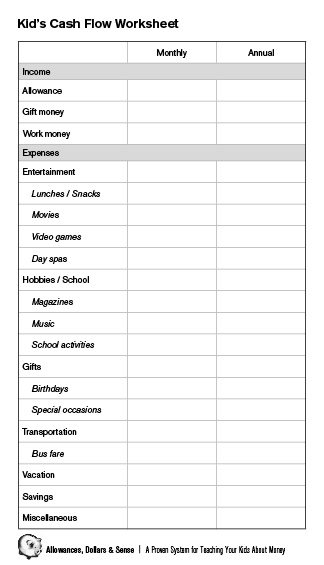

- Kids Saving Money Worksheet

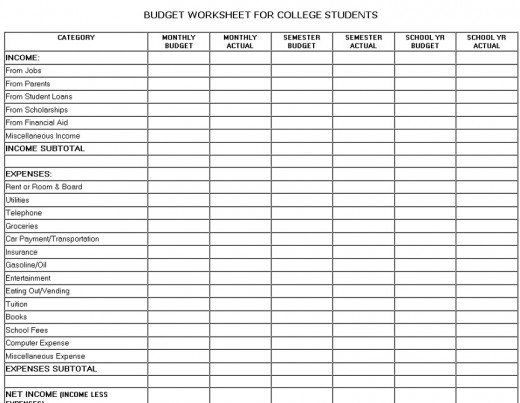

- Budget Worksheet Template for Young Adults

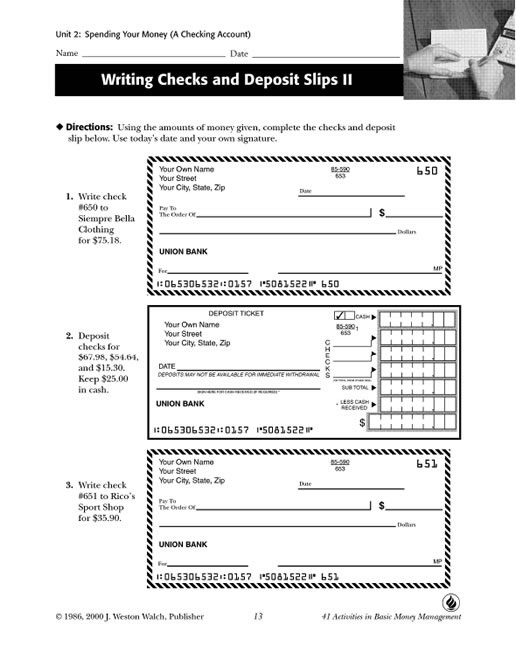

- Basic Money Management Worksheets

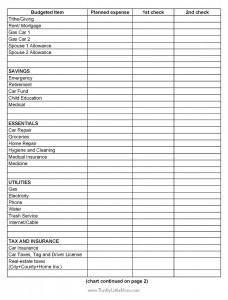

- Free Printable Dave Ramsey Budget Worksheets

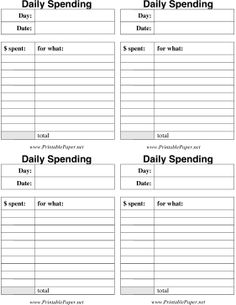

- Daily Budget Tracking Worksheet

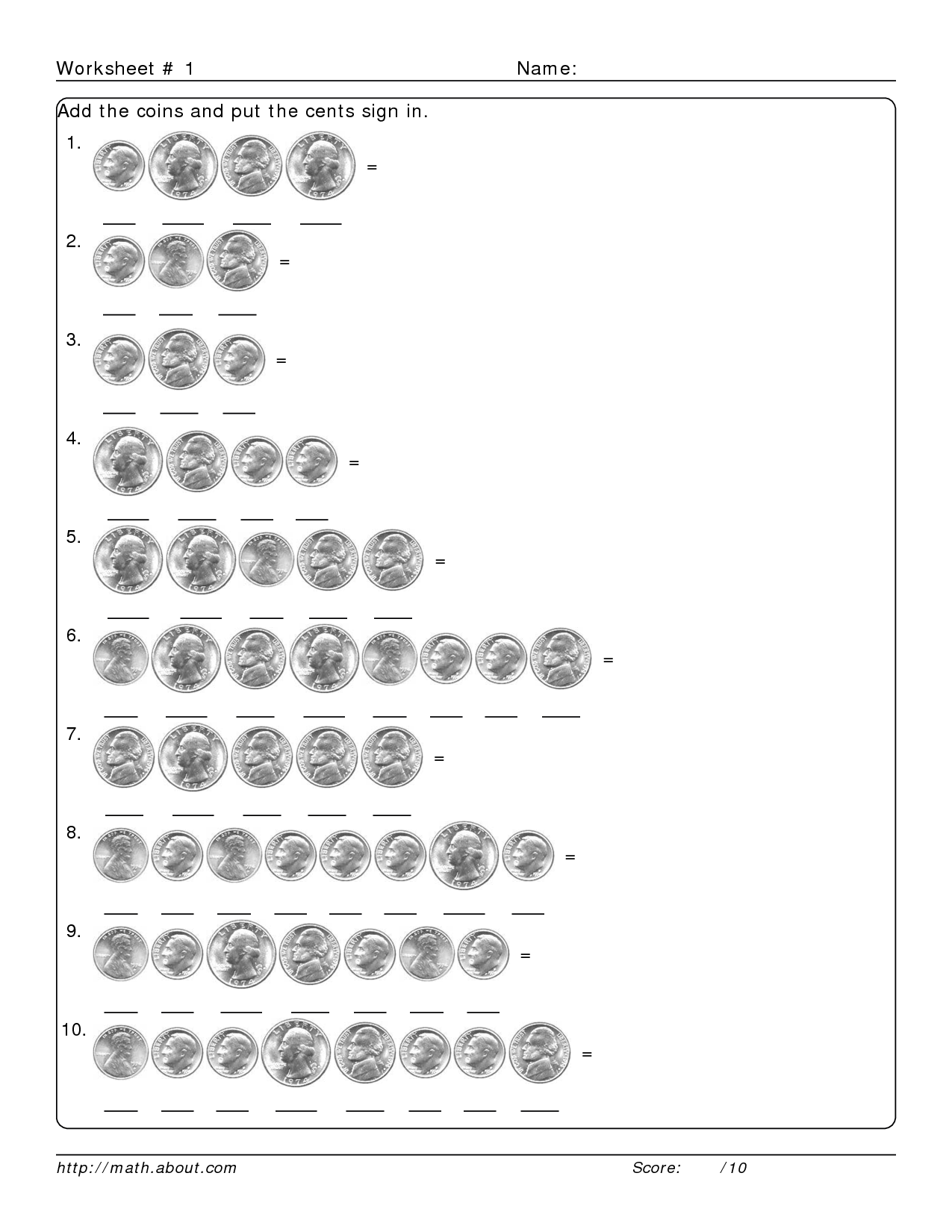

- Counting Coins Worksheets

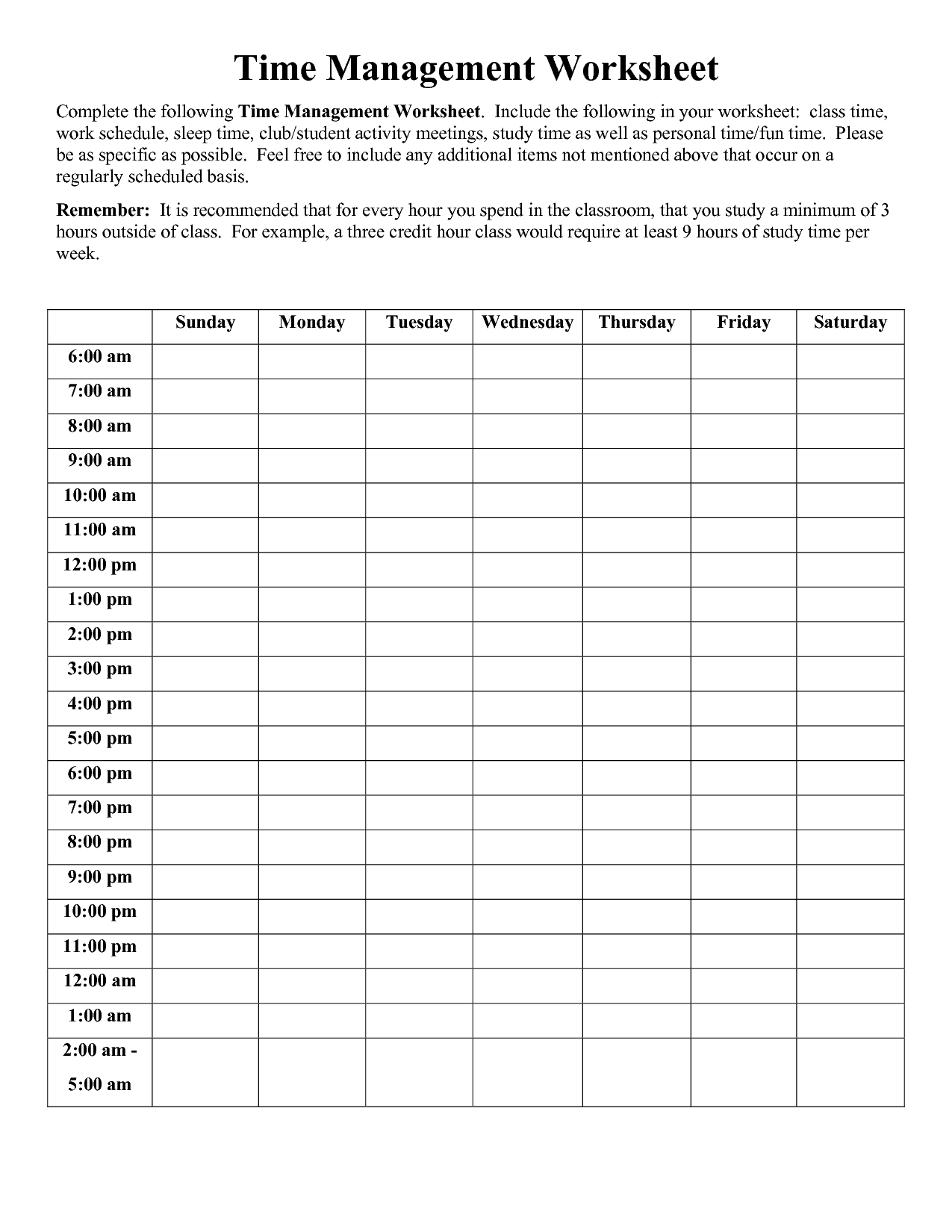

- Time Management Worksheet PDF

- Daily Spending Budget Worksheet

- Basic Money Management Worksheets

- Money Math Worksheets

- Free Printable Stress Management Worksheets

- Basic Budget Worksheet Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What are money management worksheets?

Money management worksheets are tools that help individuals track their income, expenses, savings goals, and investments in a structured manner. These worksheets typically include sections for recording financial transactions, setting budgeting goals, identifying areas for saving money, and organizing financial information for easy reference. By using money management worksheets, individuals can gain a better understanding of their financial situation, make informed decisions, and work towards achieving their financial goals.

Why are printable money management worksheets useful?

Printable money management worksheets are useful because they provide a tangible and organized way for individuals to track their income, expenses, savings, and financial goals. By filling out these worksheets, users can gain a clear understanding of their financial situation, identify areas for improvement, set realistic budgets, and ultimately work towards achieving financial stability and success. Additionally, the act of physically writing down and visually seeing their financial information can help individuals stay accountable and motivated to make positive changes in their finances.

How do money management worksheets help in budgeting?

Money management worksheets help in budgeting by providing a clear overview of incomings and outgoings, allowing individuals to track their expenses, identify areas where they can cut costs or save money, and allocate funds to different categories such as groceries, bills, savings, and entertainment. By using these worksheets, people can better plan and allocate their money, see their financial situation more clearly, and work towards achieving their financial goals effectively.

What types of financial information should be included in money management worksheets?

Financial information that should be included in money management worksheets includes income sources, expenses, debts, savings accounts, investment accounts, insurance policies, and any other financial assets or liabilities. It is essential to have a comprehensive overview of all financial aspects to effectively manage money and make informed decisions regarding budgeting, saving, investing, and debt management.

How can money management worksheets assist in tracking expenses?

Money management worksheets can assist in tracking expenses by providing a structured format to input and categorize expenses, making it easier to see where money is being spent and identify any spending patterns or areas of overspending. By regularly updating and reviewing the worksheet, individuals can gain a clearer understanding of their financial habits, set realistic budgets, and make informed decisions on where to adjust their spending to meet their financial goals.

What are the benefits of using printable money management worksheets compared to digital tools?

Printable money management worksheets offer a tangible, visual representation of one's financial situation that can help with setting goals, tracking expenses, and budgeting. They provide a hands-on approach that can be convenient for some people who prefer physical tools over digital ones. Additionally, printable worksheets can be customized and personalized easily to suit individual preferences and financial needs without the need for internet access or specialized software.

How can money management worksheets help in setting financial goals?

Money management worksheets can help in setting financial goals by providing a clear overview of income, expenses, debts, and savings. By using these worksheets, individuals can track their financial habits and identify areas where adjustments can be made to align with their goals. These tools also offer a visual representation of their financial situation, making it easier to prioritize goals, create actionable plans, and monitor progress towards achieving them. Overall, money management worksheets serve as a practical tool to organize finances effectively and make informed decisions that lead to the attainment of financial goals.

How does utilizing money management worksheets improve overall financial organization?

Utilizing money management worksheets improves overall financial organization by providing a structured system to track income, expenses, and savings goals. These worksheets help individuals accurately assess their financial situation, identify areas where money is being spent unnecessarily, and create a budget to prioritize expenses. By consistently using money management worksheets, individuals can better manage their finances, stay on track with their financial goals, and make informed decisions to improve their overall financial well-being.

What can money management worksheets teach about saving and investing?

Money management worksheets can teach individuals about the importance of setting financial goals, creating a budget, tracking expenses, and prioritizing saving and investing. By completing these worksheets, one can understand the impact of small savings over time, learn various investment strategies, assess their risk tolerance, and develop a disciplined approach to wealth-building. Overall, these worksheets serve as a practical tool to help individuals plan for their future, make informed financial decisions, and achieve their long-term financial objectives through disciplined saving and investing.

How can printable money management worksheets be customized to suit personal financial needs?

Printable money management worksheets can be customized to suit personal financial needs by adjusting categories and descriptions to align with individual financial goals and priorities. Personalize the budget categories to include specific expenses or income sources relevant to your situation. Modify the amounts allocated to each category based on your income and spending patterns. Additionally, you can tailor the worksheets to reflect any debt repayment plans or savings goals you have in mind. By making these adjustments, you can create a personalized money management tool that effectively tracks and manages your finances according to your unique needs.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments