Money Management Worksheets PDF

Managing your finances can be a daunting task, but with the help of money management worksheets, you can take control of your financial situation. These worksheets are designed to provide a structured format for organizing your income and expenses. Whether you are a college student learning to budget, a newlywed couple navigating shared finances, or a small business owner looking to track your expenses, these worksheets are a valuable tool to help you stay on top of your finances.

Table of Images 👆

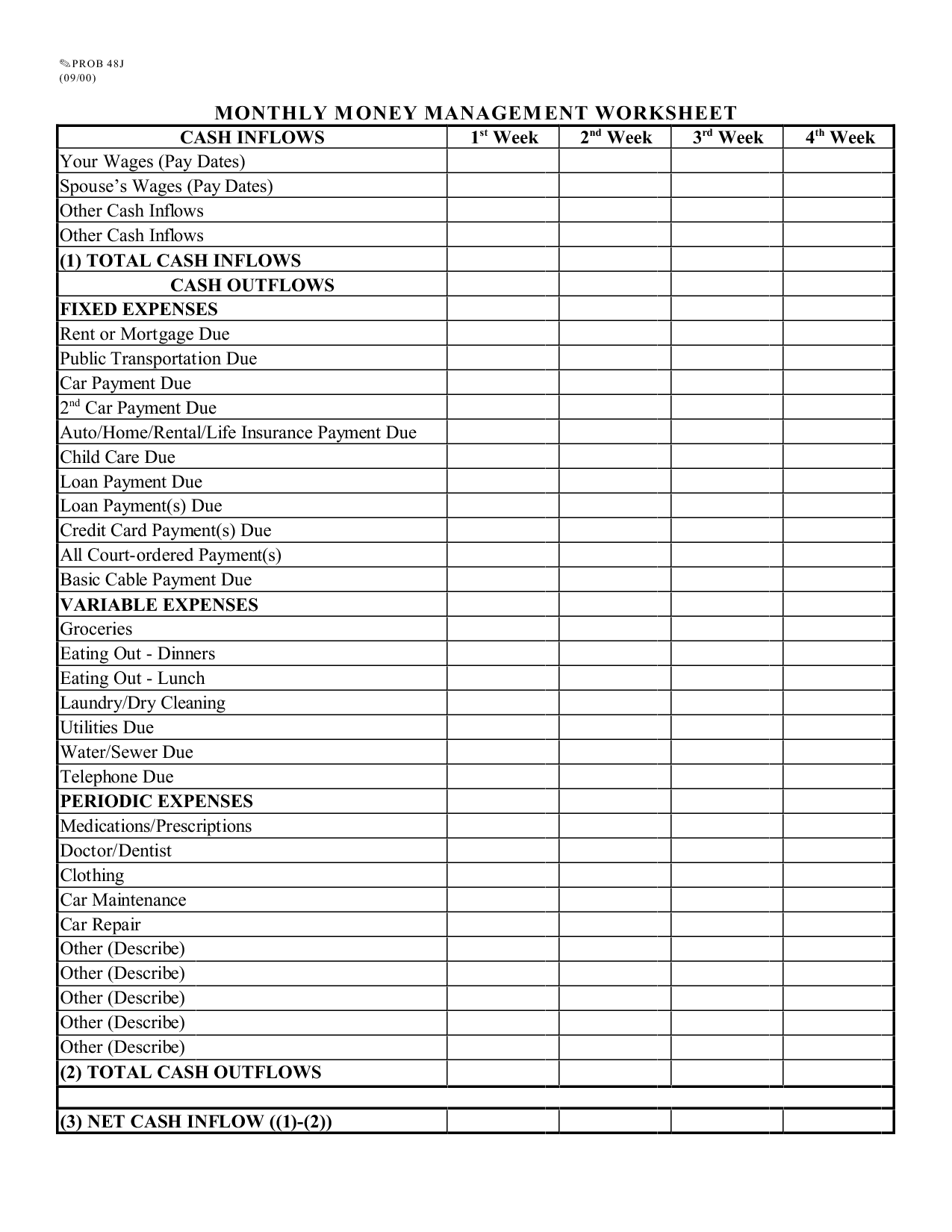

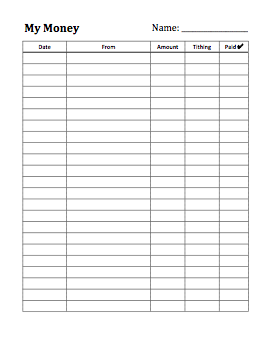

- Monthly Money Management Worksheet

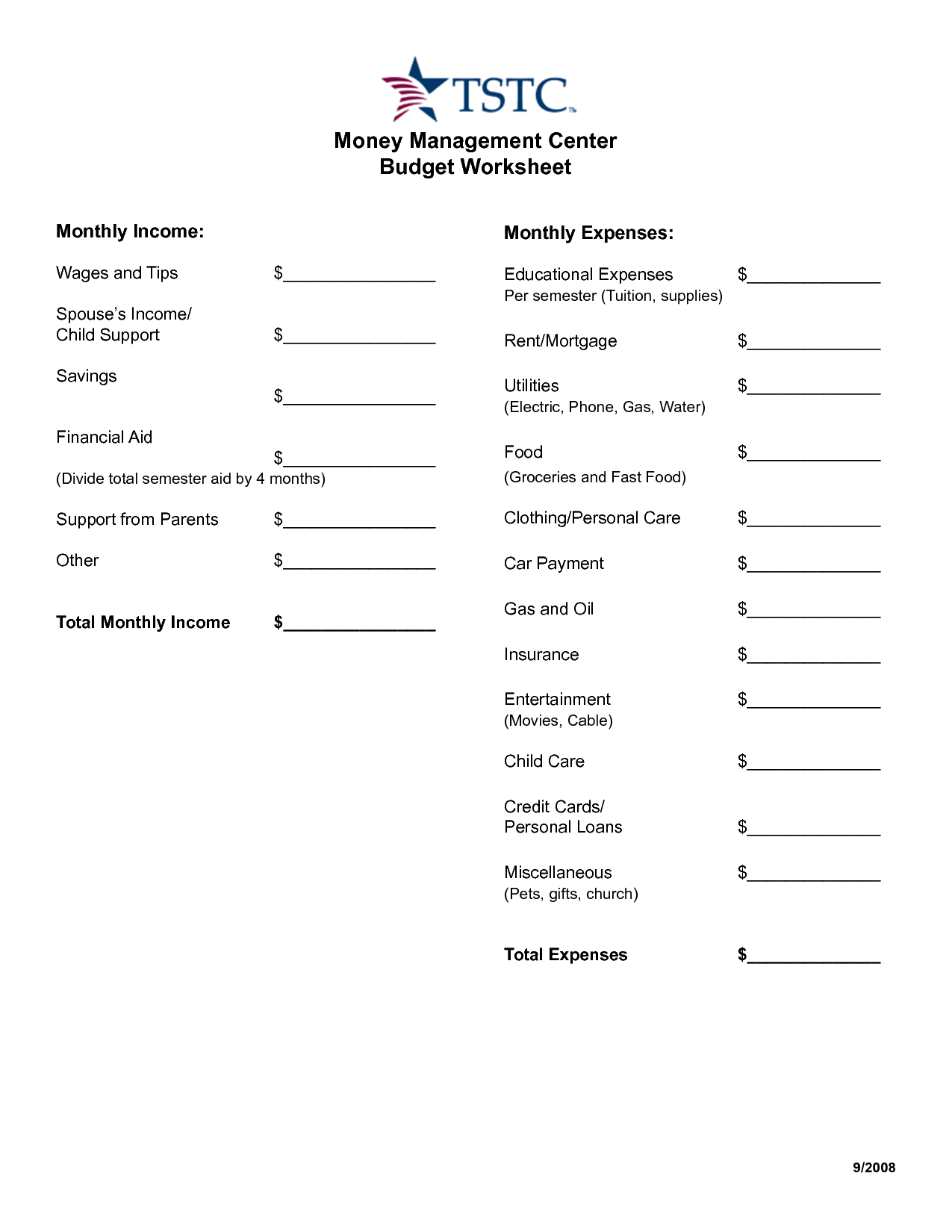

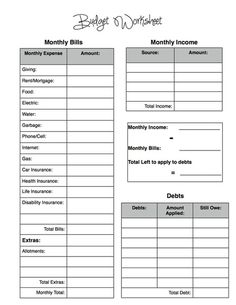

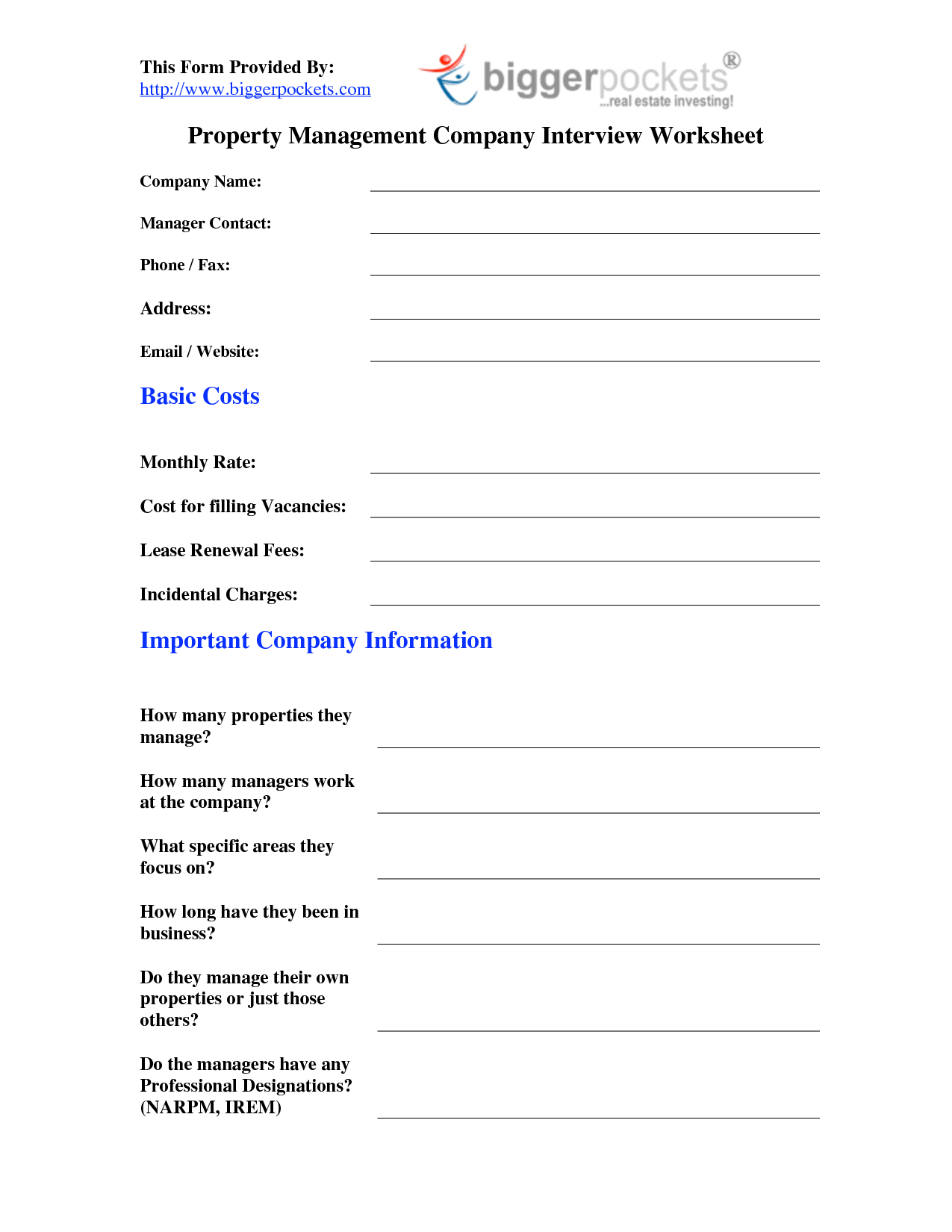

- Money Management Worksheets

- Money Management Worksheets

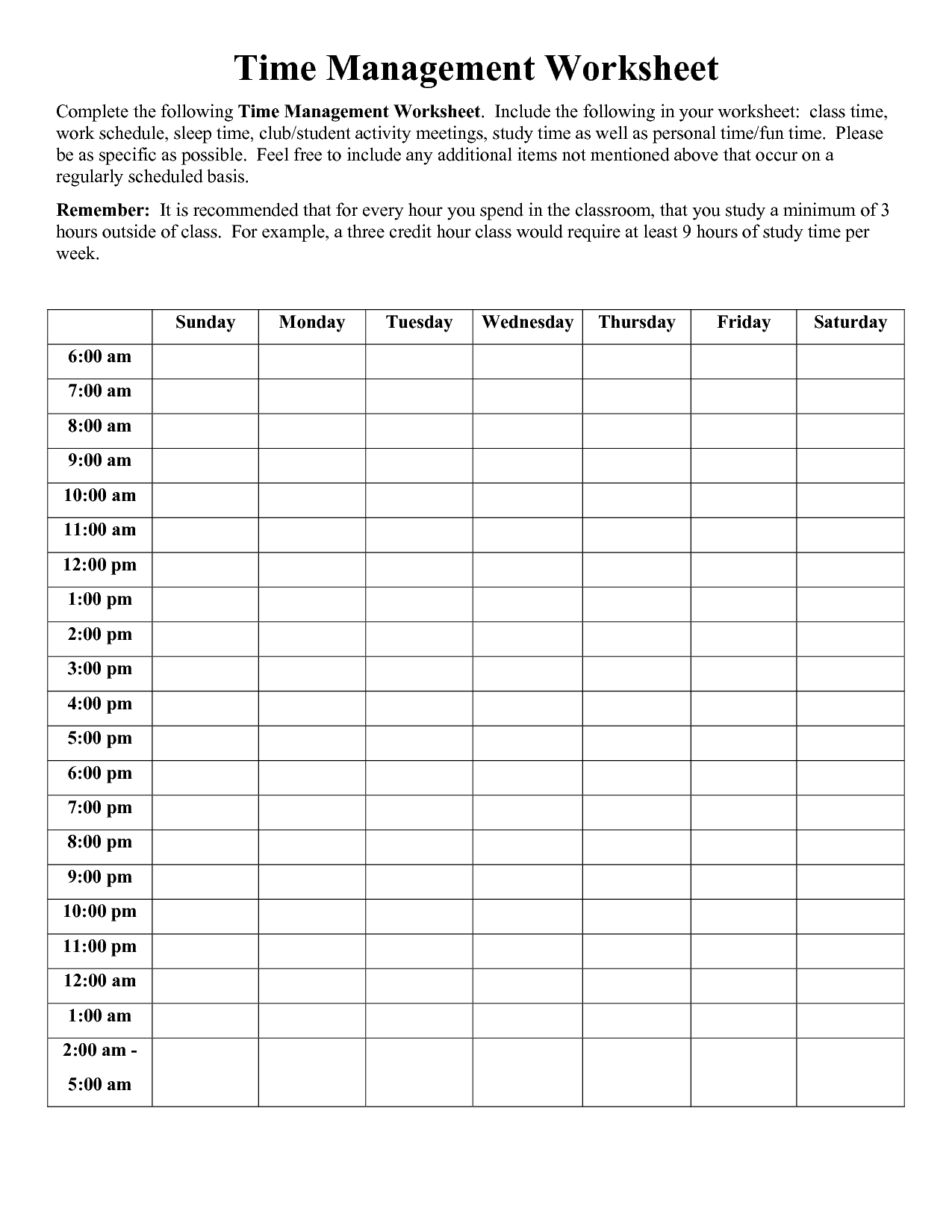

- Time Management Worksheet PDF

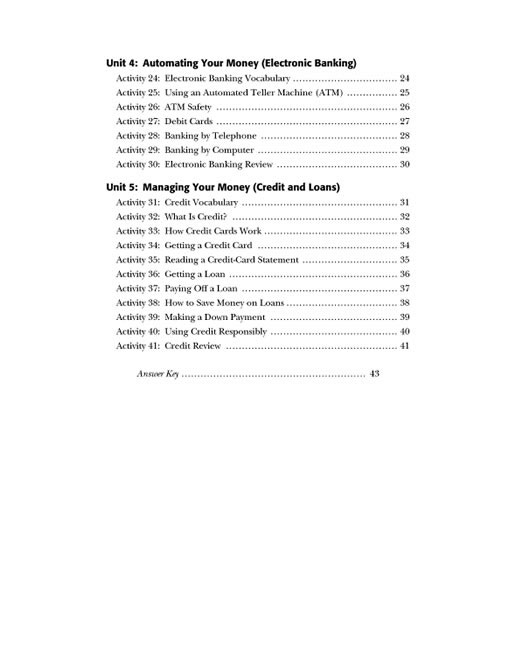

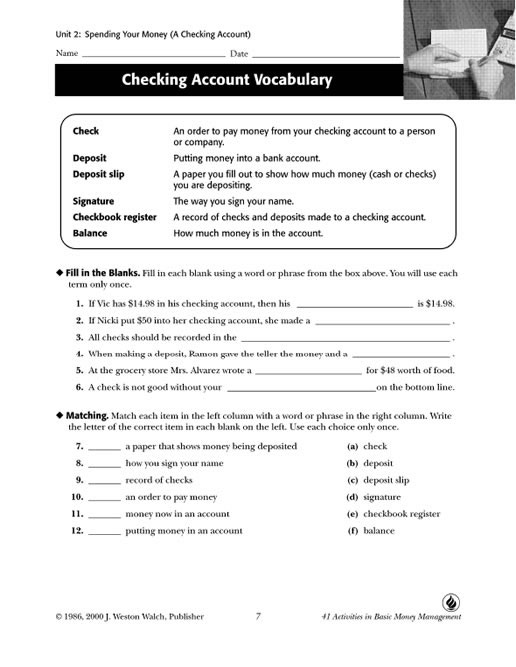

- Basic Money Management Worksheets

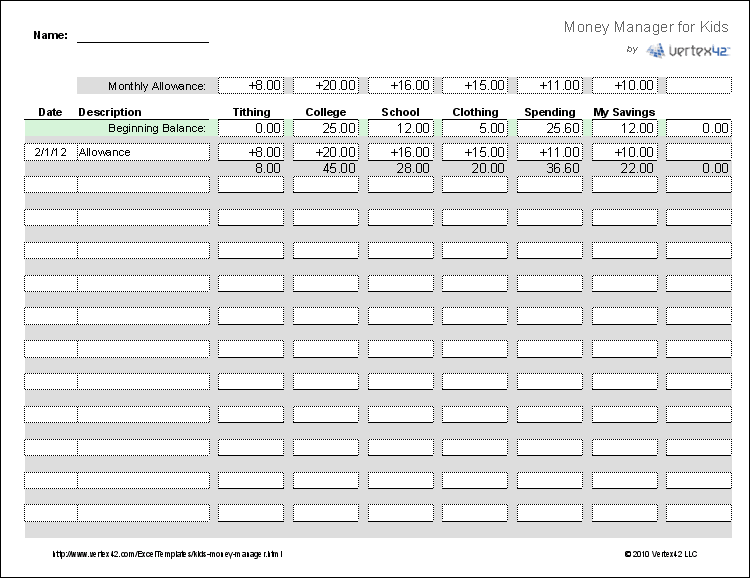

- Kids Saving Money Worksheet

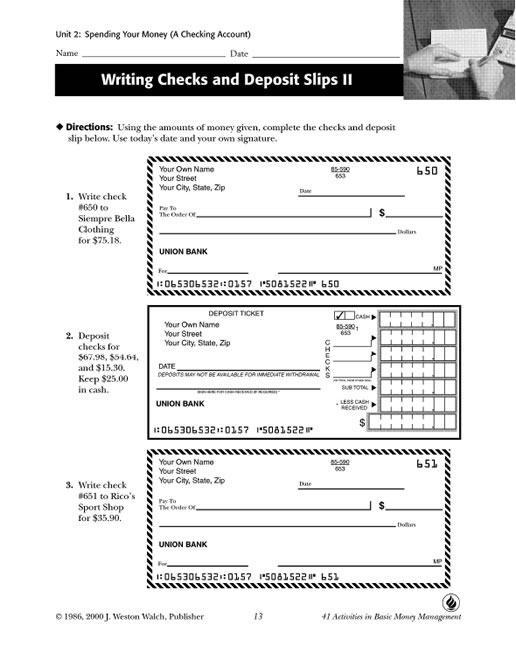

- Basic Money Management Worksheets

- Free Printable Dave Ramsey Budget Worksheets

- Basic Money Management Worksheets

- Basic Money Management Worksheets

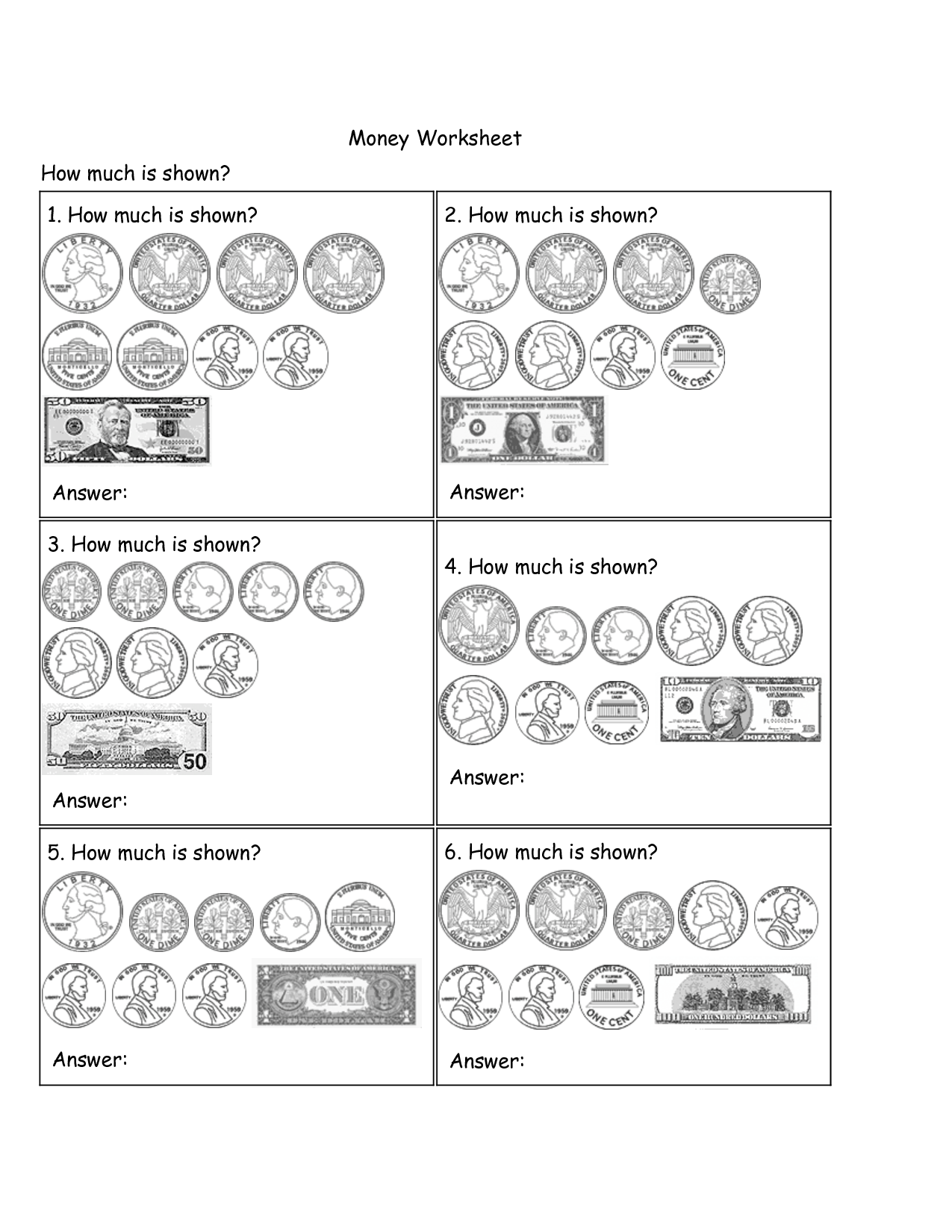

- How Much Money Worksheet

- Basic Money Management Worksheets

- Counting Coins Worksheets

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What are money management worksheets?

Money management worksheets are tools used to help individuals track their income, expenses, savings, and budget. These worksheets typically include sections to record sources of income, fixed expenses, variable expenses, savings goals, and debt payments. By filling out these worksheets, individuals can gain a better understanding of their financial situation and make more informed decisions about their spending habits and savings goals.

How can money management worksheets help improve financial planning?

Money management worksheets can help improve financial planning by providing a structured way to track income, expenses, savings, and investments. By using these worksheets regularly, individuals can gain a clearer understanding of their financial situation, identify areas where they can cut expenses or increase savings, and set specific financial goals. This can lead to better budgeting decisions, enhanced financial discipline, and ultimately, improved long-term financial stability.

What types of information should be included in a money management worksheet?

A money management worksheet should include details such as income sources (salary, investments), expenses (rent, utilities, groceries), debts (loans, credit card balances), savings goals, and any other financial obligations or commitments. Additionally, it should also track spending habits, budget allocations, and a clear overview of overall financial health to help individuals better manage and plan their finances effectively.

How often should money management worksheets be updated?

Money management worksheets should be updated regularly, ideally on a monthly basis. This allows you to track your expenses, income, savings, and debts accurately and make any necessary adjustments to your budget or financial goals. Regularly updating your money management worksheet also helps you stay organized and in control of your finances.

Are there different types of money management worksheets for individuals and businesses?

Yes, there are different types of money management worksheets designed specifically for individuals and businesses. For individuals, common types of worksheets include budget sheets, expense trackers, debt repayment plans, and savings trackers. For businesses, worksheets may include cash flow projections, profit and loss statements, balance sheets, and expense reports tailored to the needs and complexities of managing a business's finances. These worksheets help individuals and businesses track their income, expenses, and financial goals effectively.

Can money management worksheets help track and monitor expenses?

Yes, money management worksheets are a useful tool for tracking and monitoring expenses. By using these worksheets, you can create a detailed record of your income and expenses, helping you to identify areas where you can cut costs, save money, and improve your overall financial health. Tracking expenses through worksheets can also help you set financial goals and stay on track with your budget.

How can money management worksheets help identify areas of overspending?

Money management worksheets can help identify areas of overspending by providing a structured overview of income and expenses. By diligently tracking all expenses in different categories, such as groceries, entertainment, and utilities, individuals can visually see where their money is going. This allows them to pinpoint areas where they may be overspending and make necessary adjustments to their budget to ensure better financial control and decision-making.

Are there specific sections in a money management worksheet for savings and investments?

Yes, typically a money management worksheet will have separate sections dedicated to savings and investments. The savings section will usually include goals, amounts saved, and progress tracking, while the investments section will include details such as investment accounts, asset allocation, and performance monitoring. These sections are crucial for organizing and managing your finances effectively.

Can money management worksheets help create a budget?

Yes, money management worksheets can be a useful tool in creating a budget. By organizing your income, expenses, and savings goals in a structured format, these worksheets can provide a clear overview of your financial situation and help you track your money more effectively. They can also help you identify areas where you can cut back on spending and prioritize your financial goals. Overall, using money management worksheets can assist in creating a realistic and manageable budget that aligns with your financial objectives.

Are there any online resources or tools available for creating money management worksheets?

Yes, there are several online resources and tools available for creating money management worksheets. Some popular options include Microsoft Excel, Google Sheets, Canva, and Money Management International's budgeting tools. These platforms offer templates and customizable options to help you track income, expenses, savings goals, and more to better manage your finances.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments