Low-Income Budget Worksheet

Are you searching for a helpful tool to manage your finances effectively? Look no further! Introducing the Low-Income Budget Worksheet, a practical and user-friendly resource designed specifically for individuals with limited financial means. This worksheet will provide you with a clear and organized way to track your income, expenses, and savings, allowing you to take control of your money and make informed financial decisions. Say goodbye to financial stress and hello to financial stability with the Low-Income Budget Worksheet.

Table of Images 👆

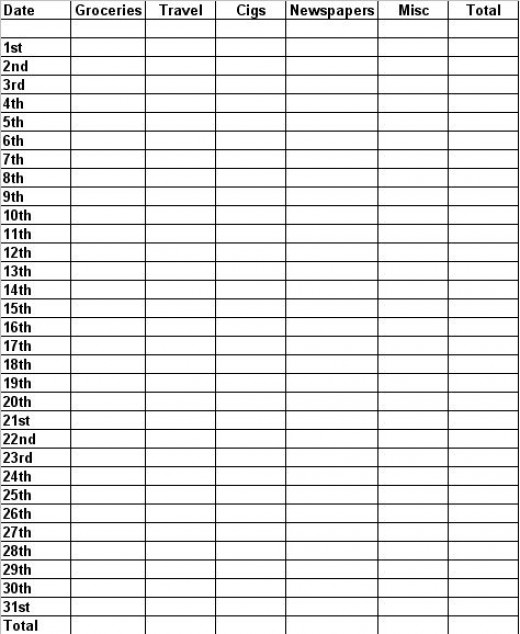

- 4 Column Spreadsheet Template

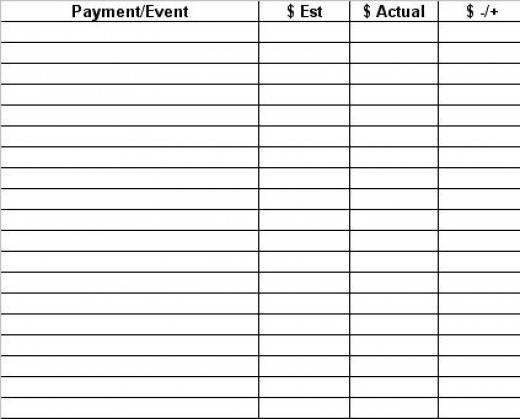

- Printable Blank 4 Column Chart Templates

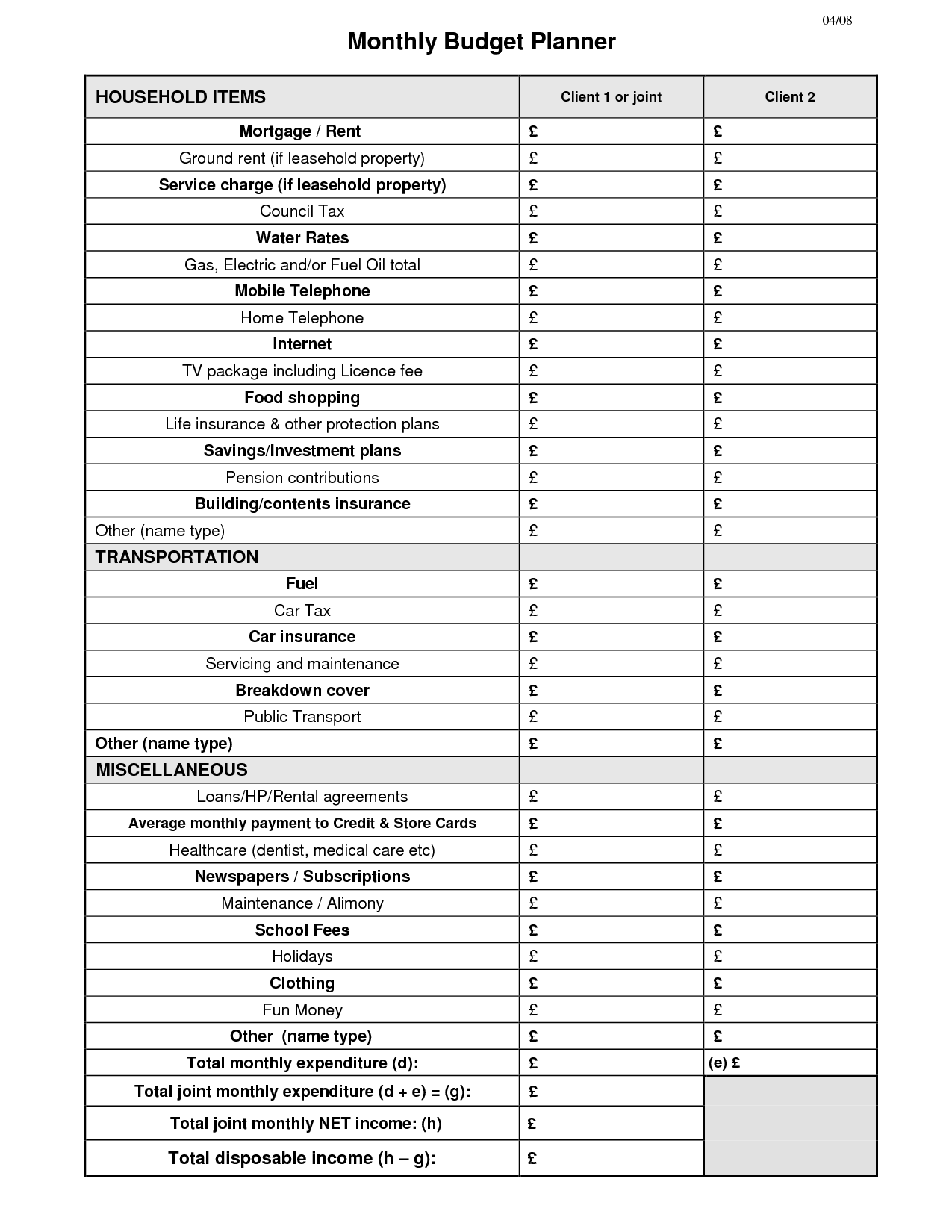

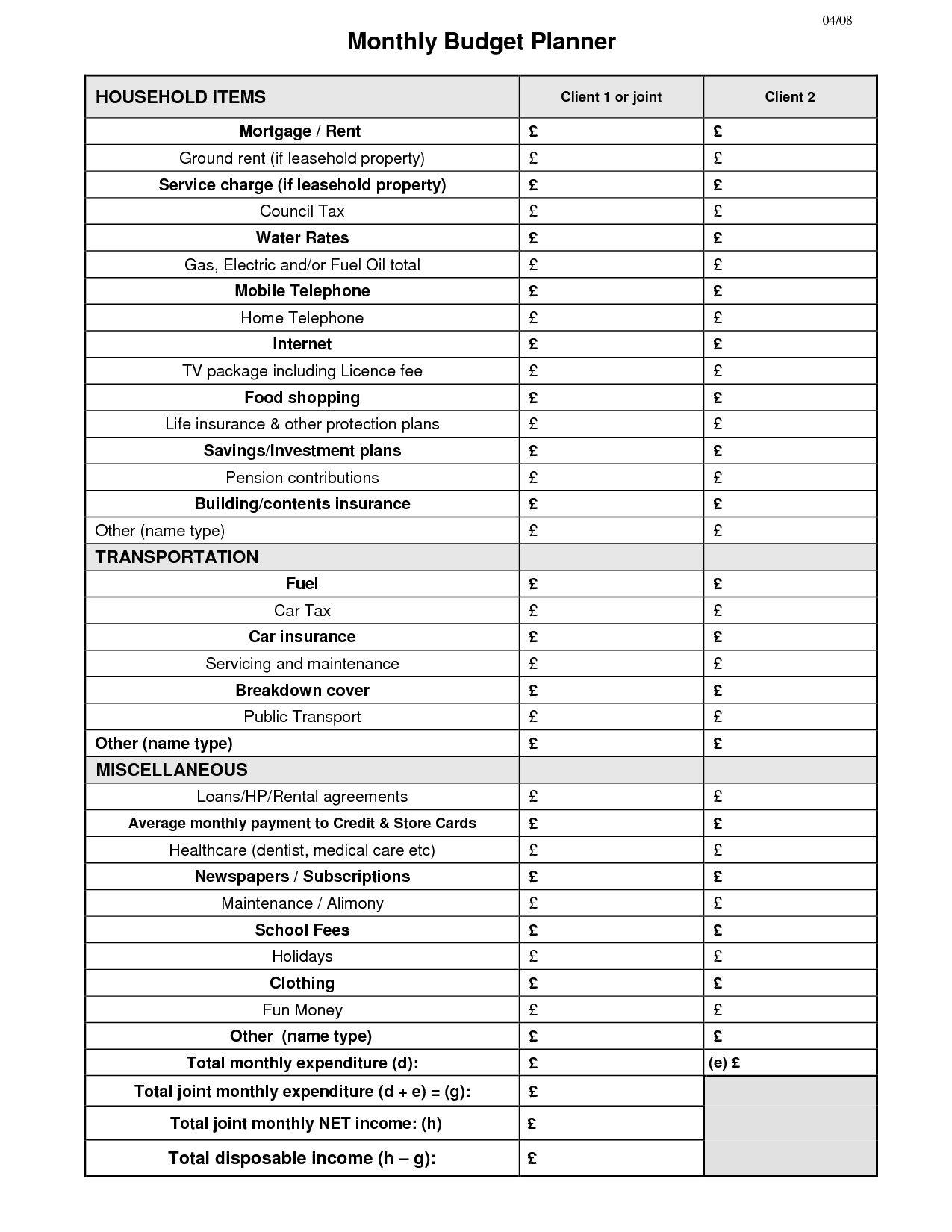

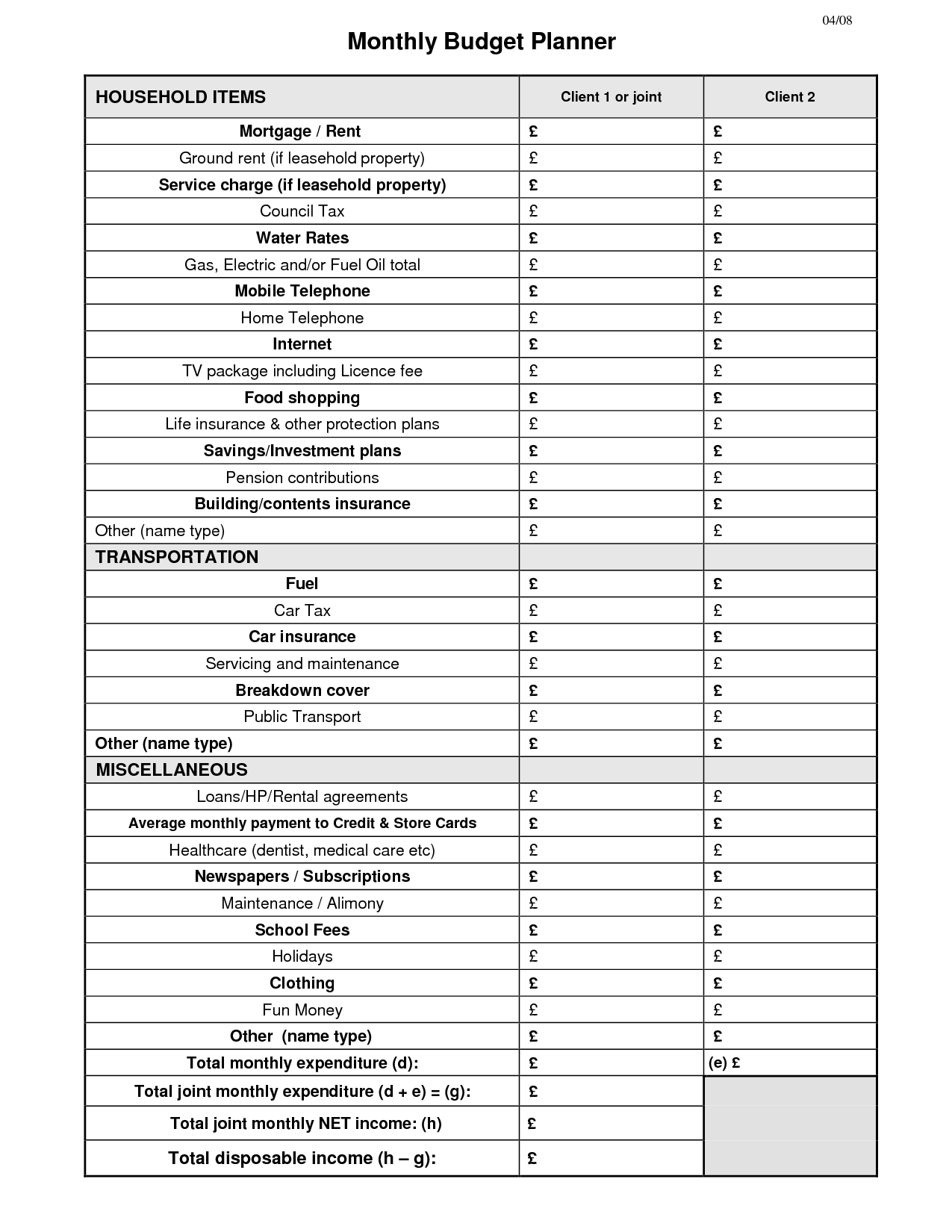

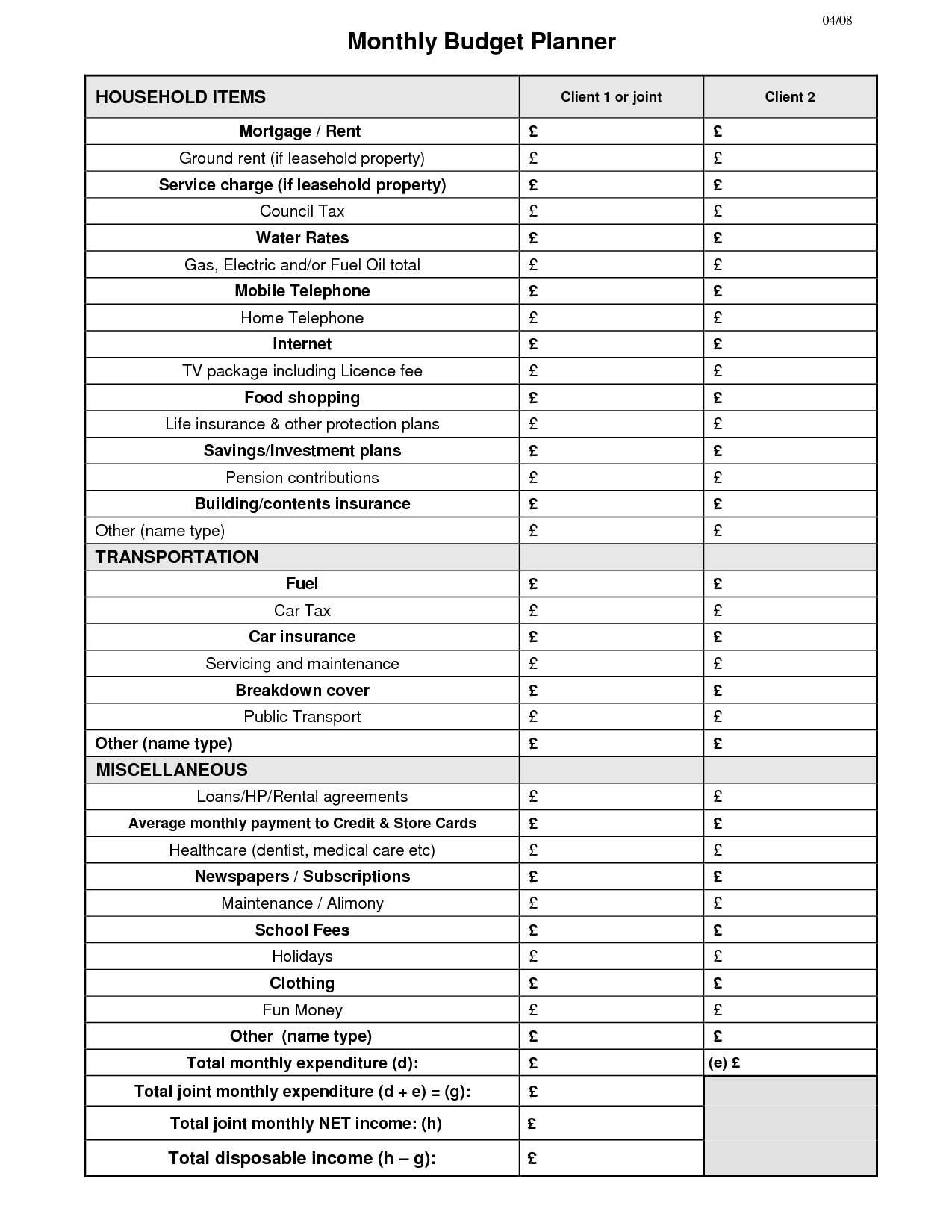

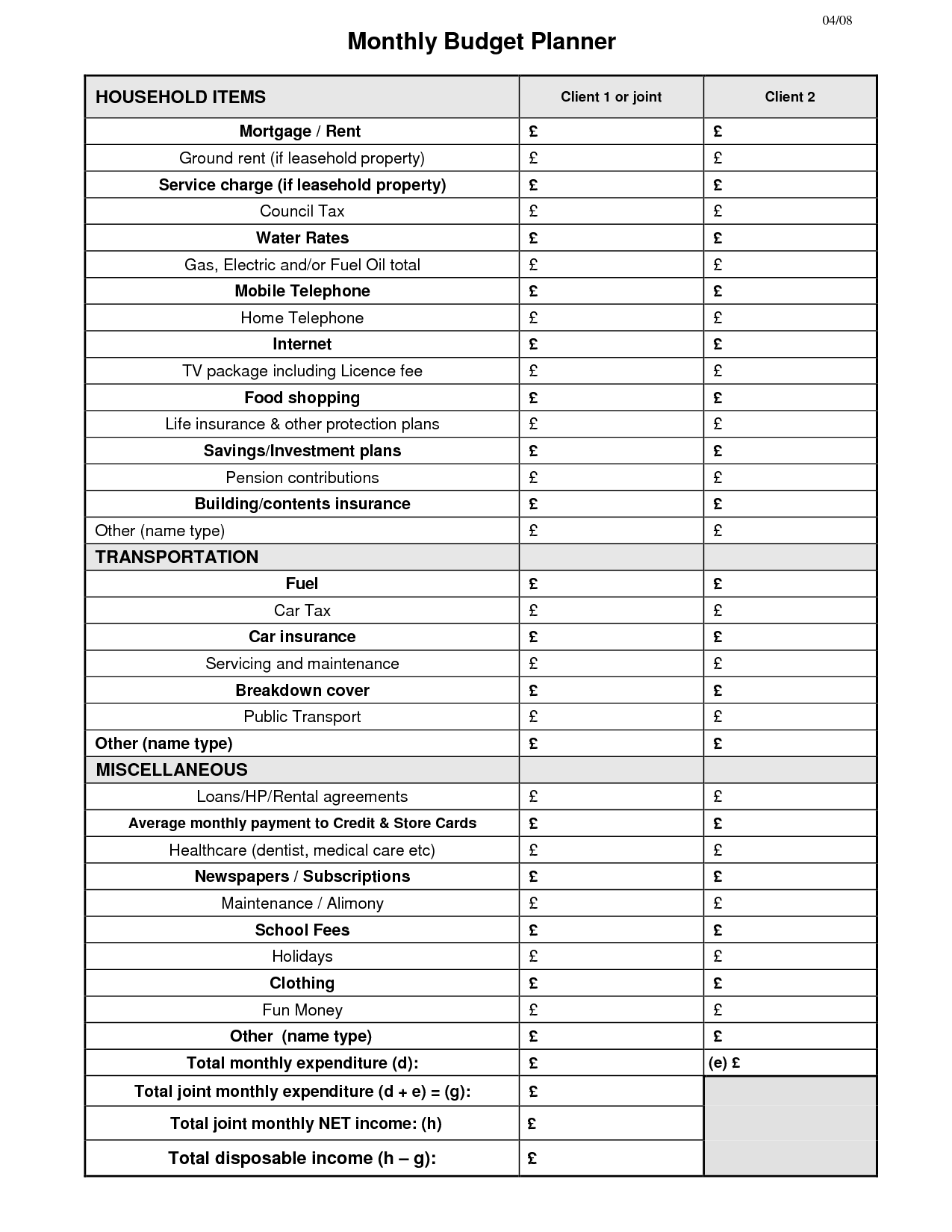

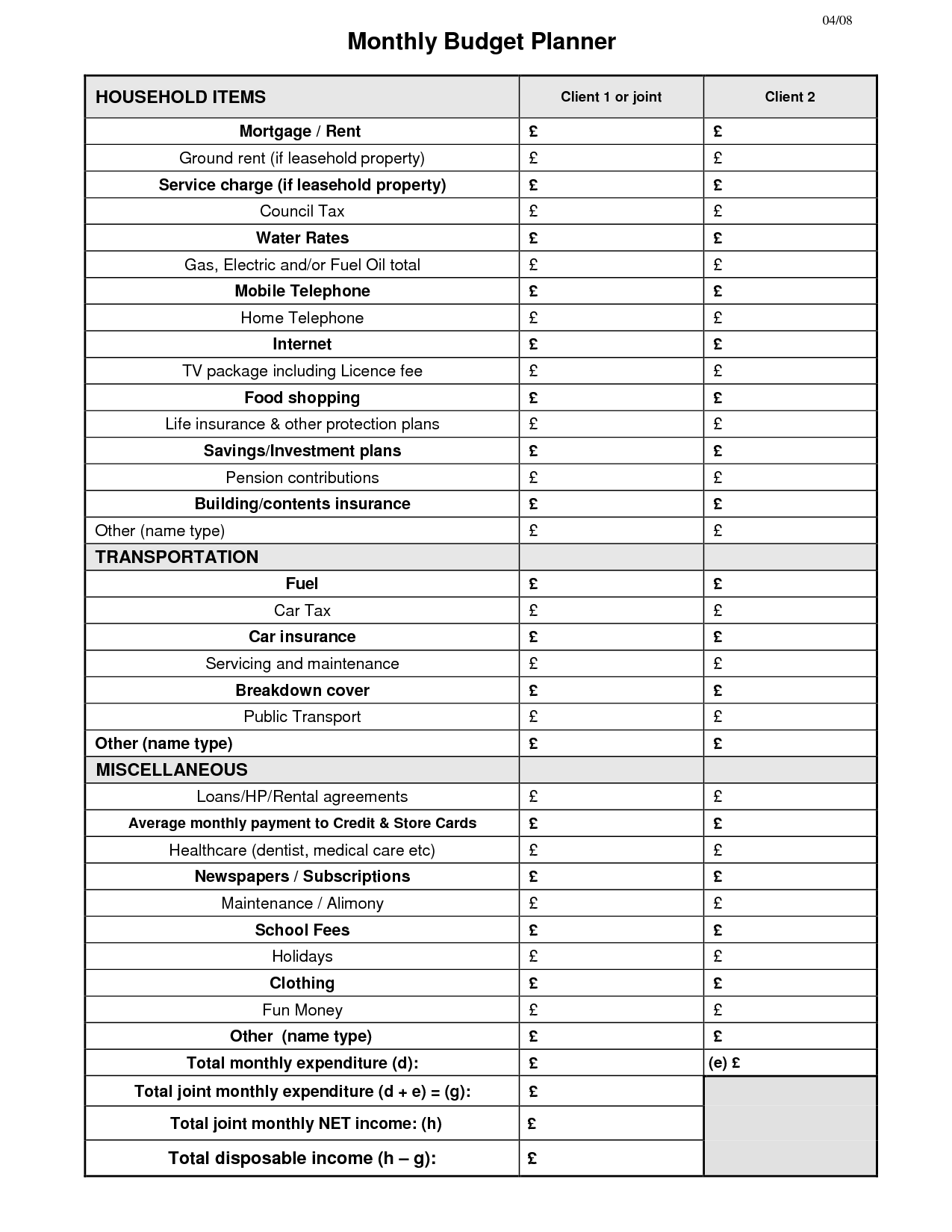

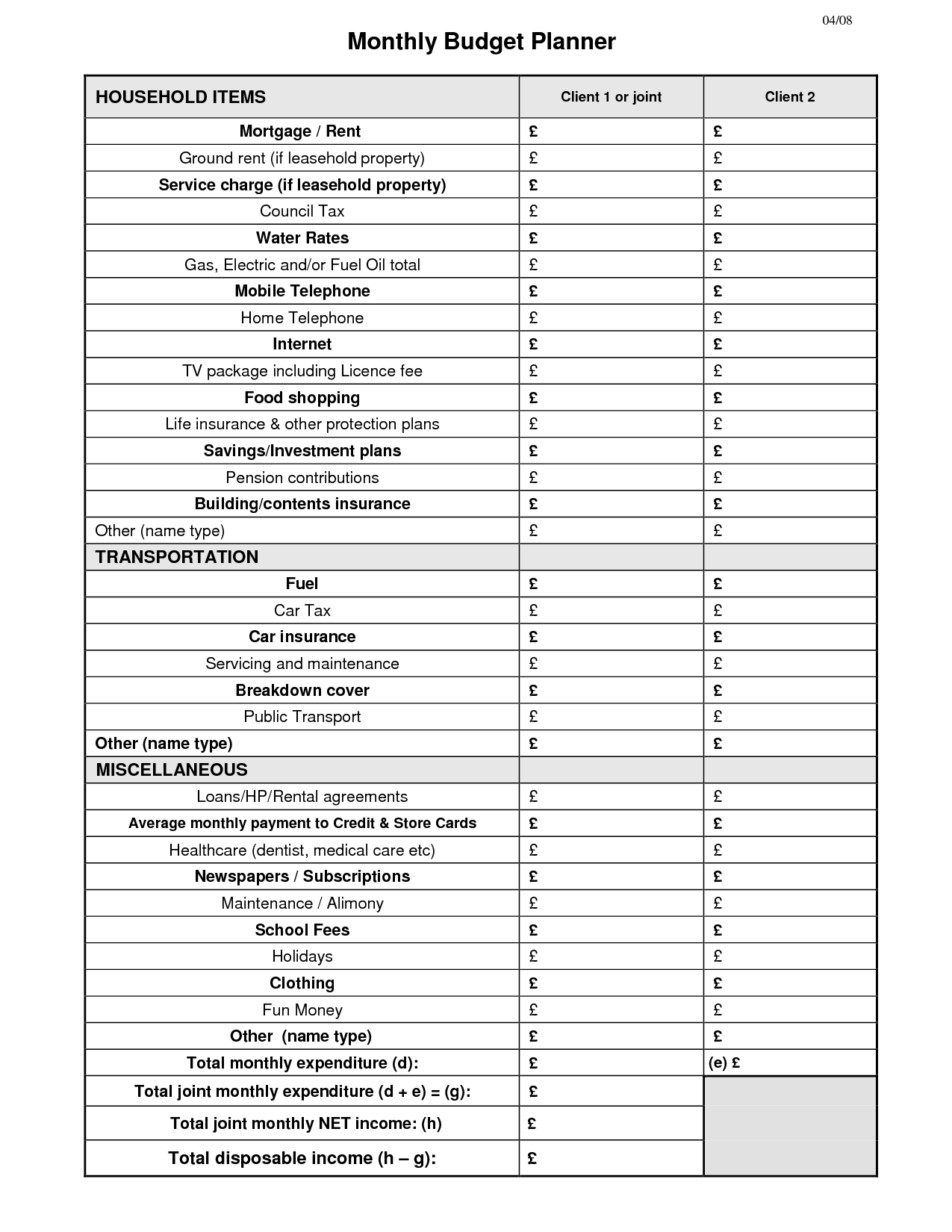

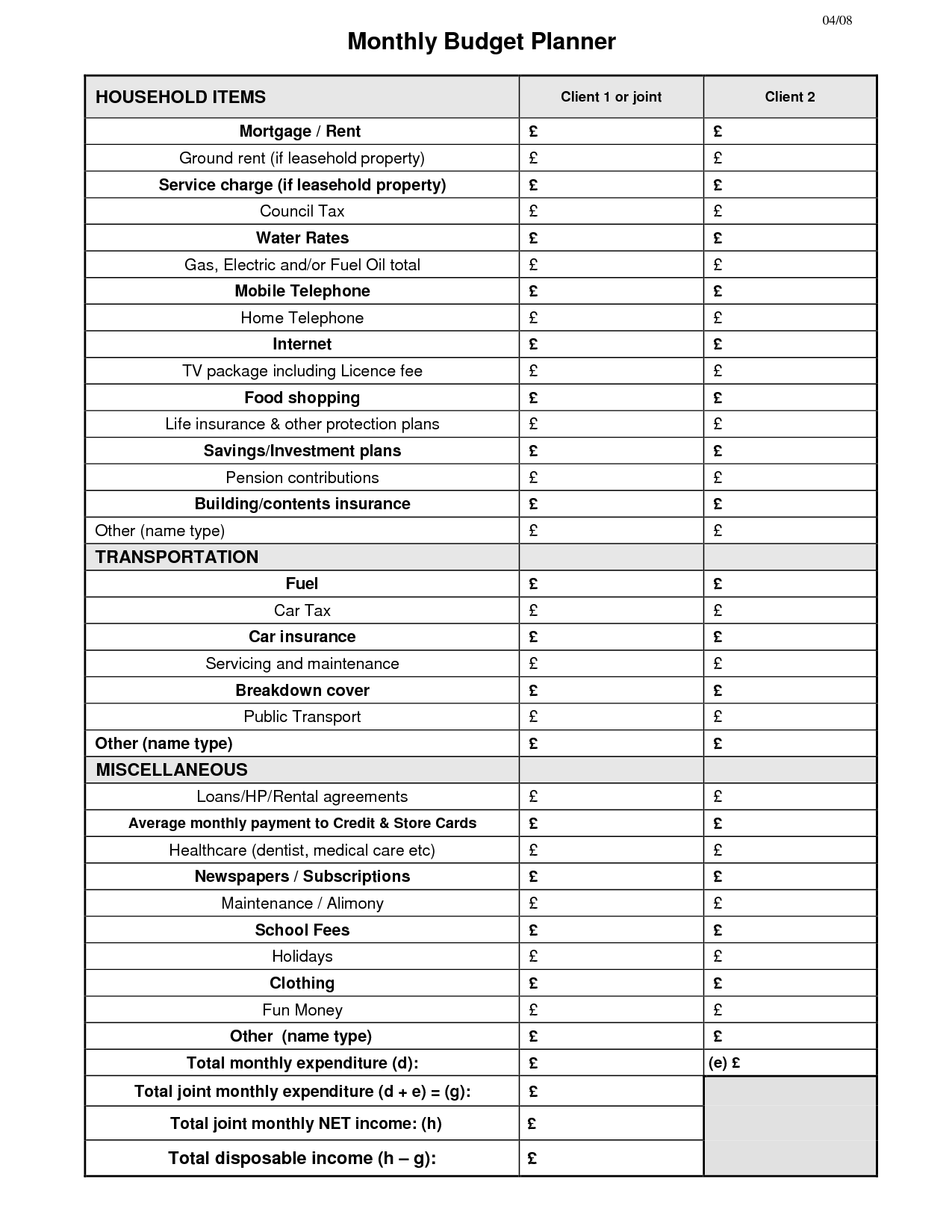

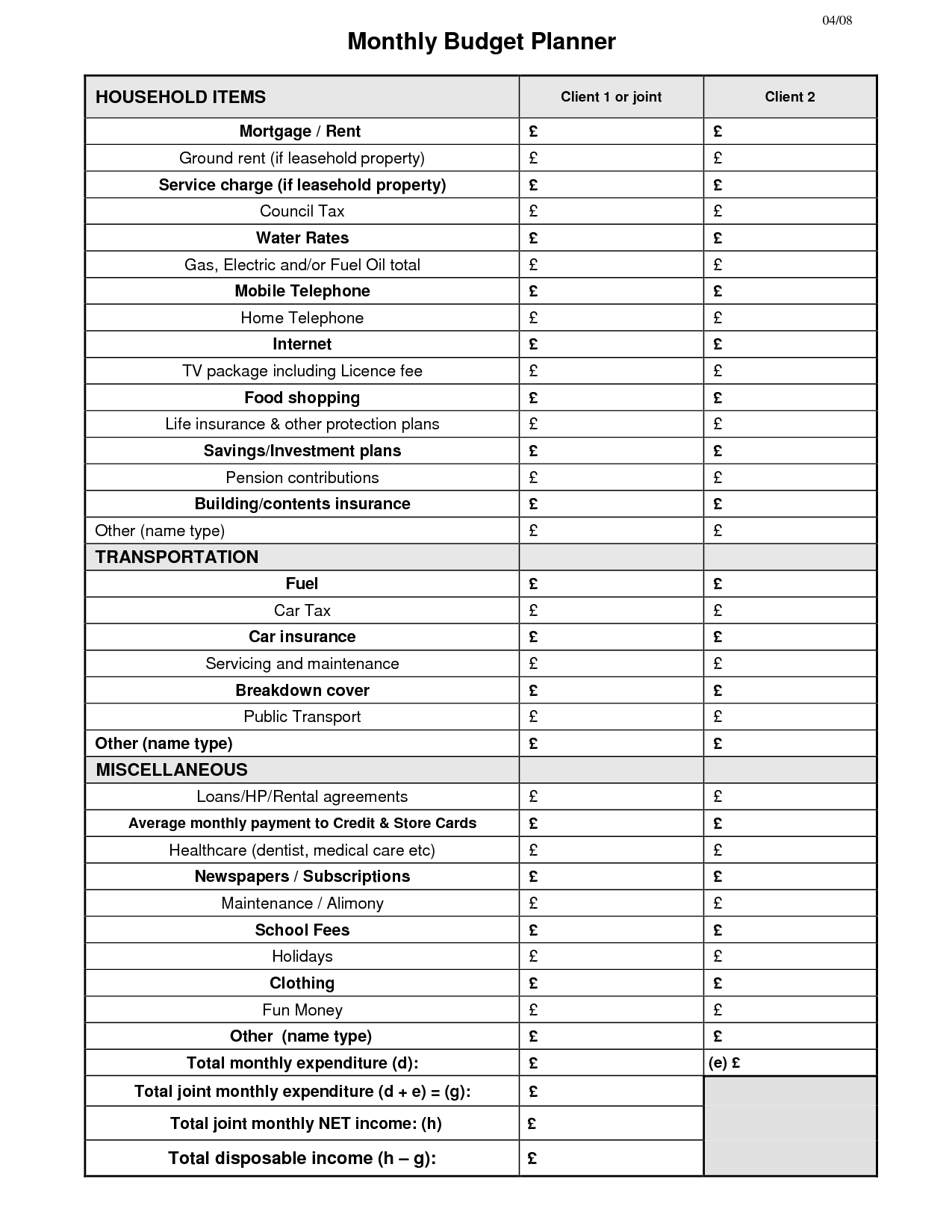

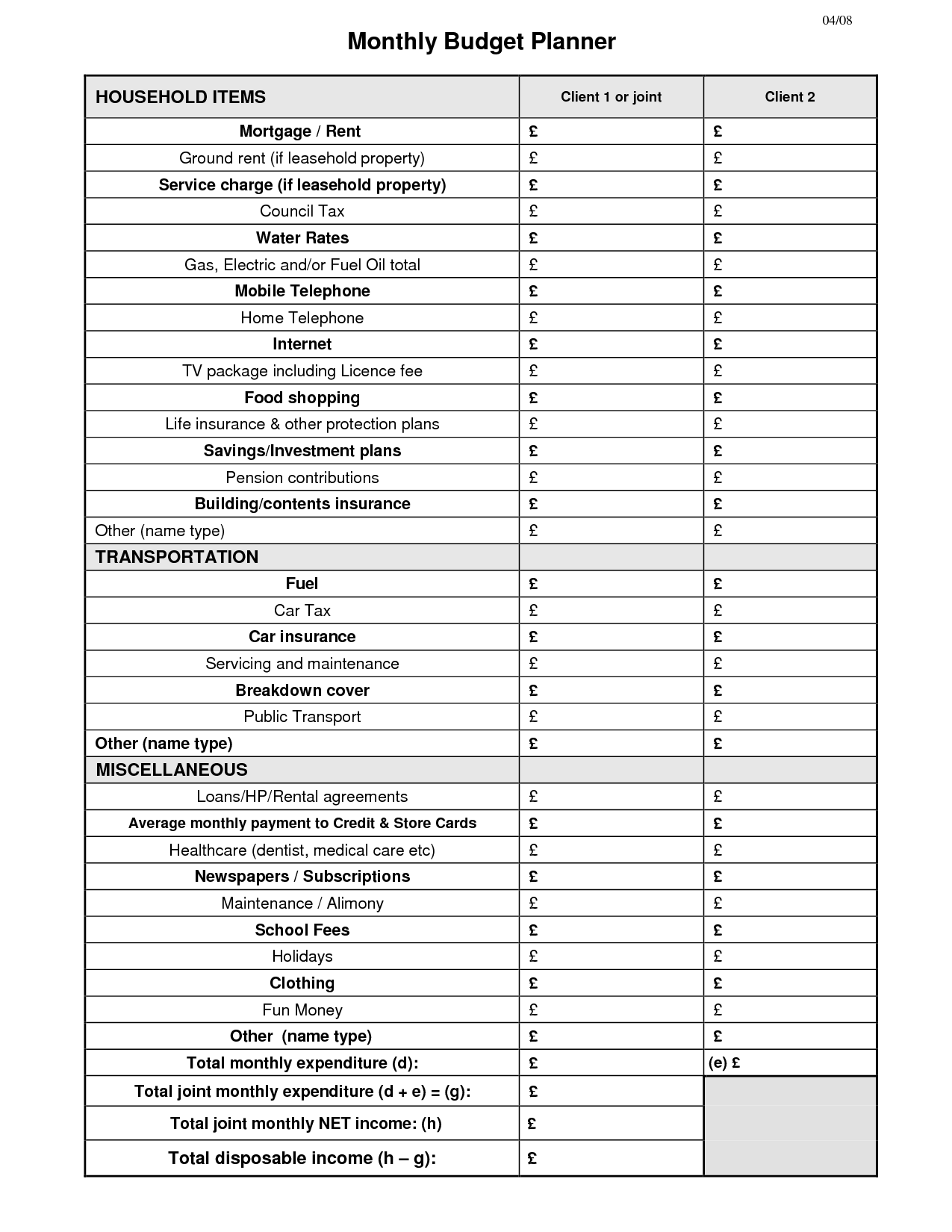

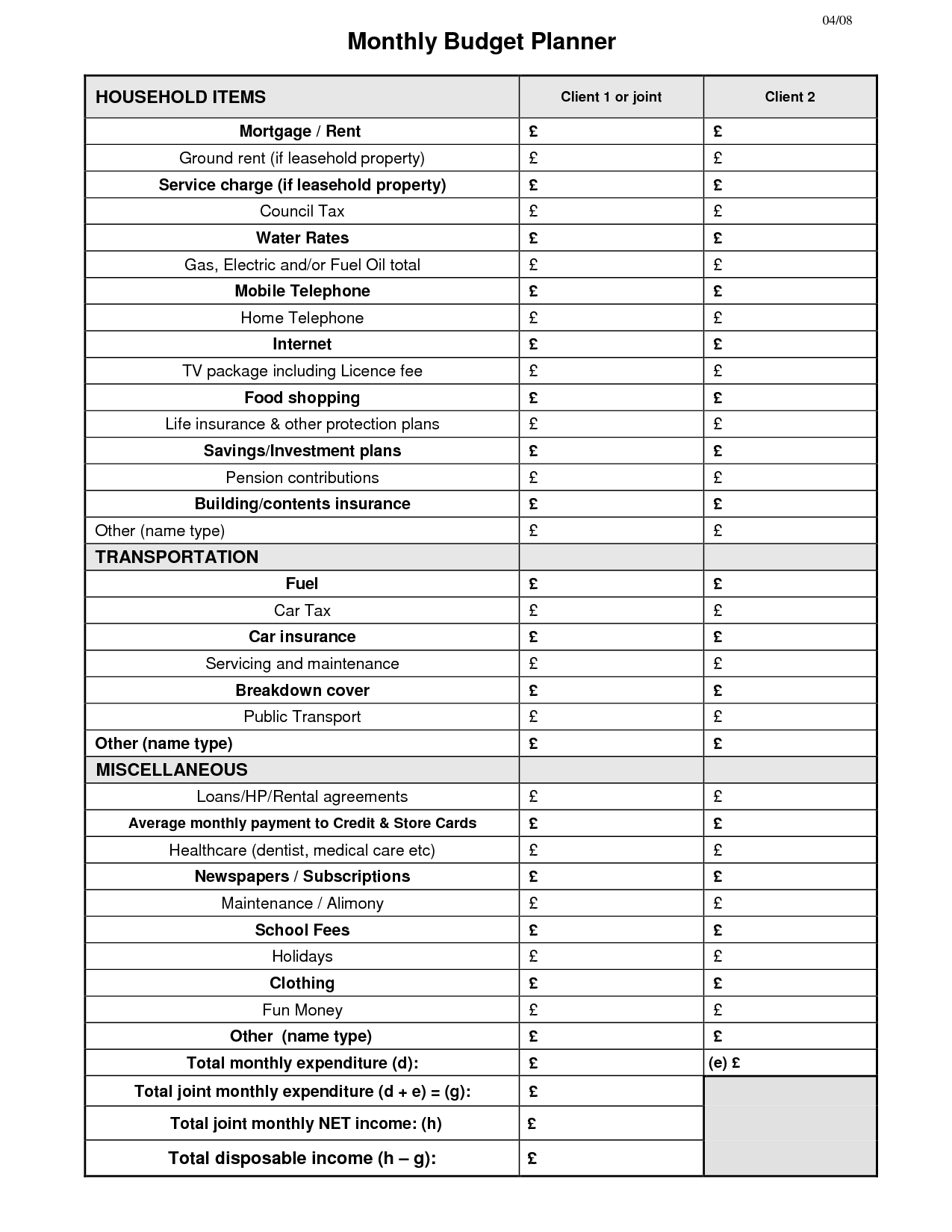

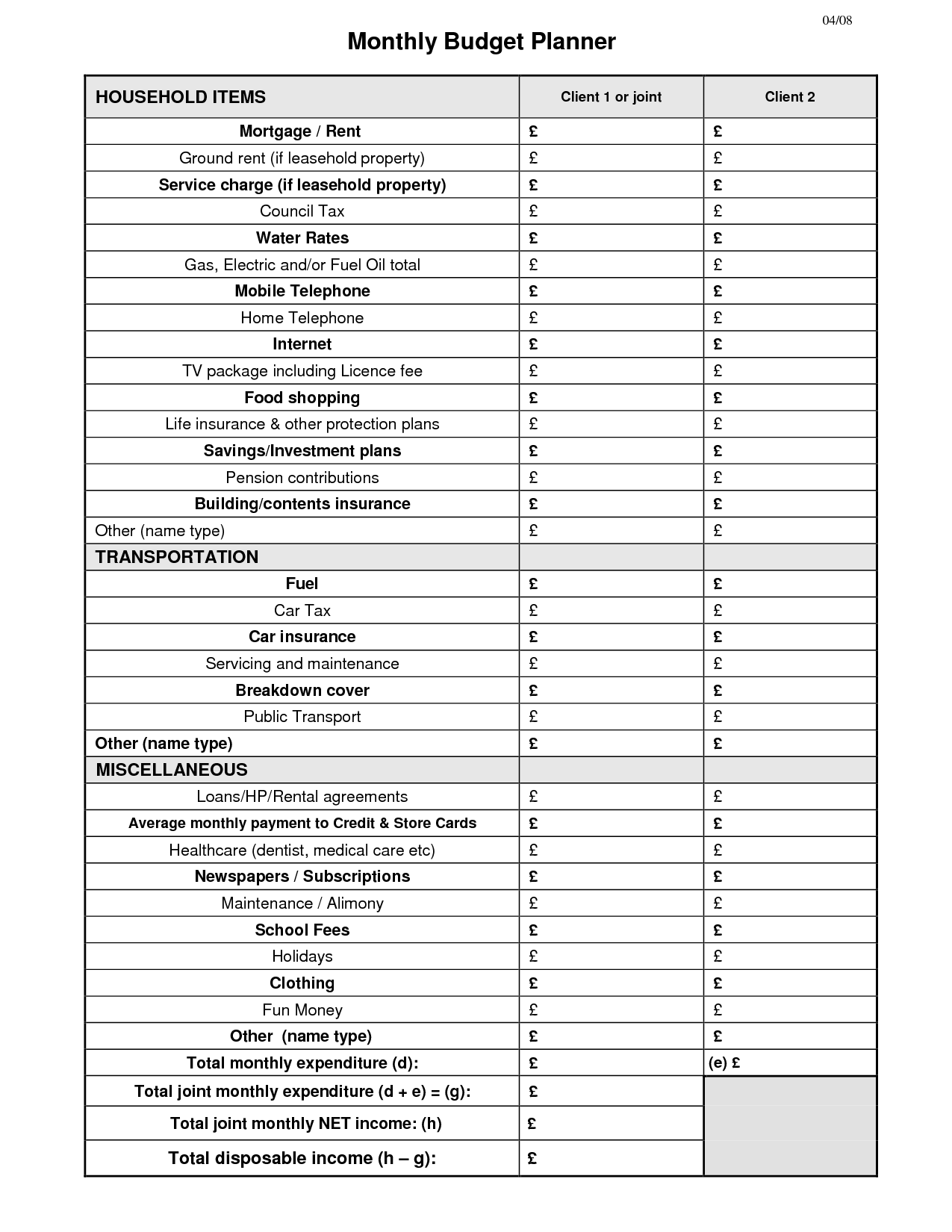

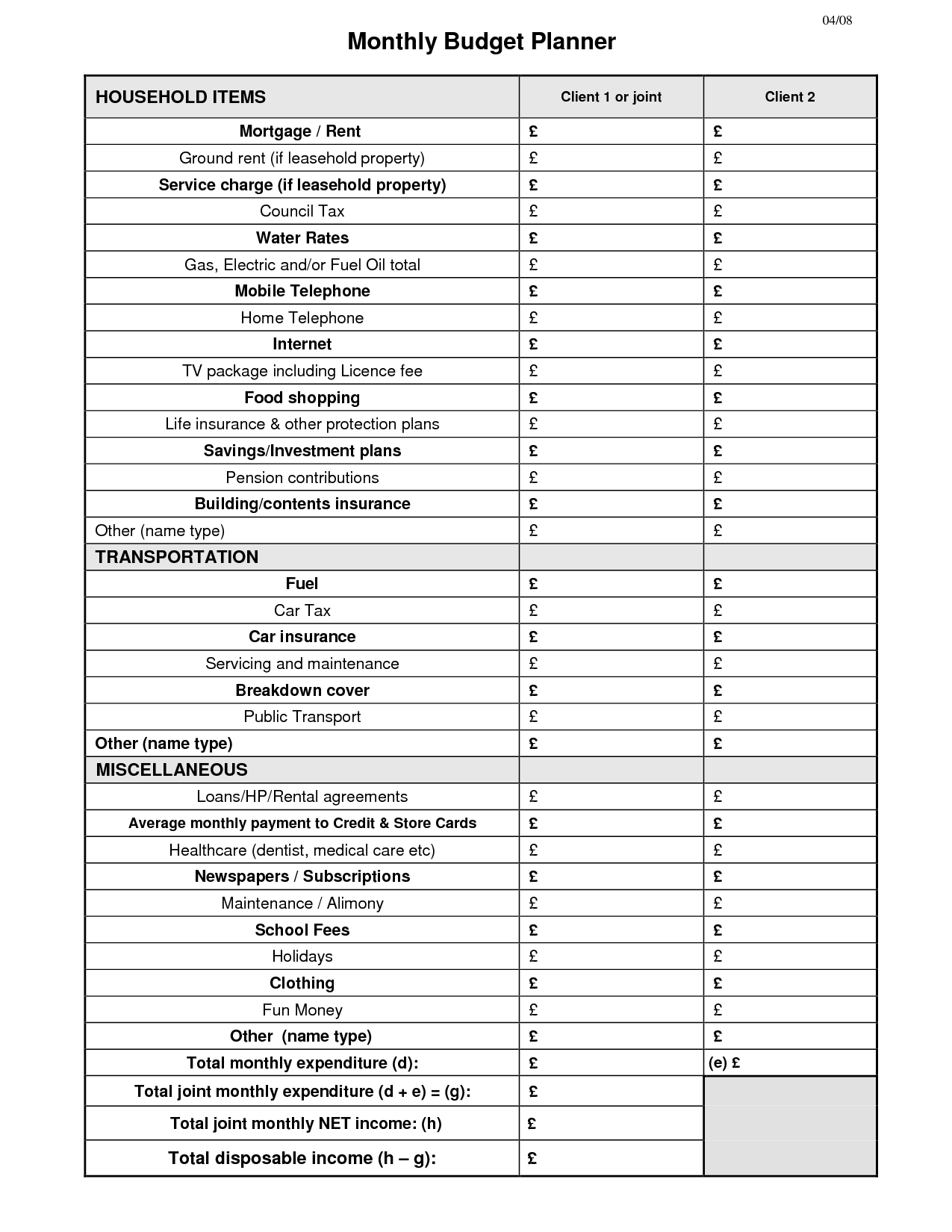

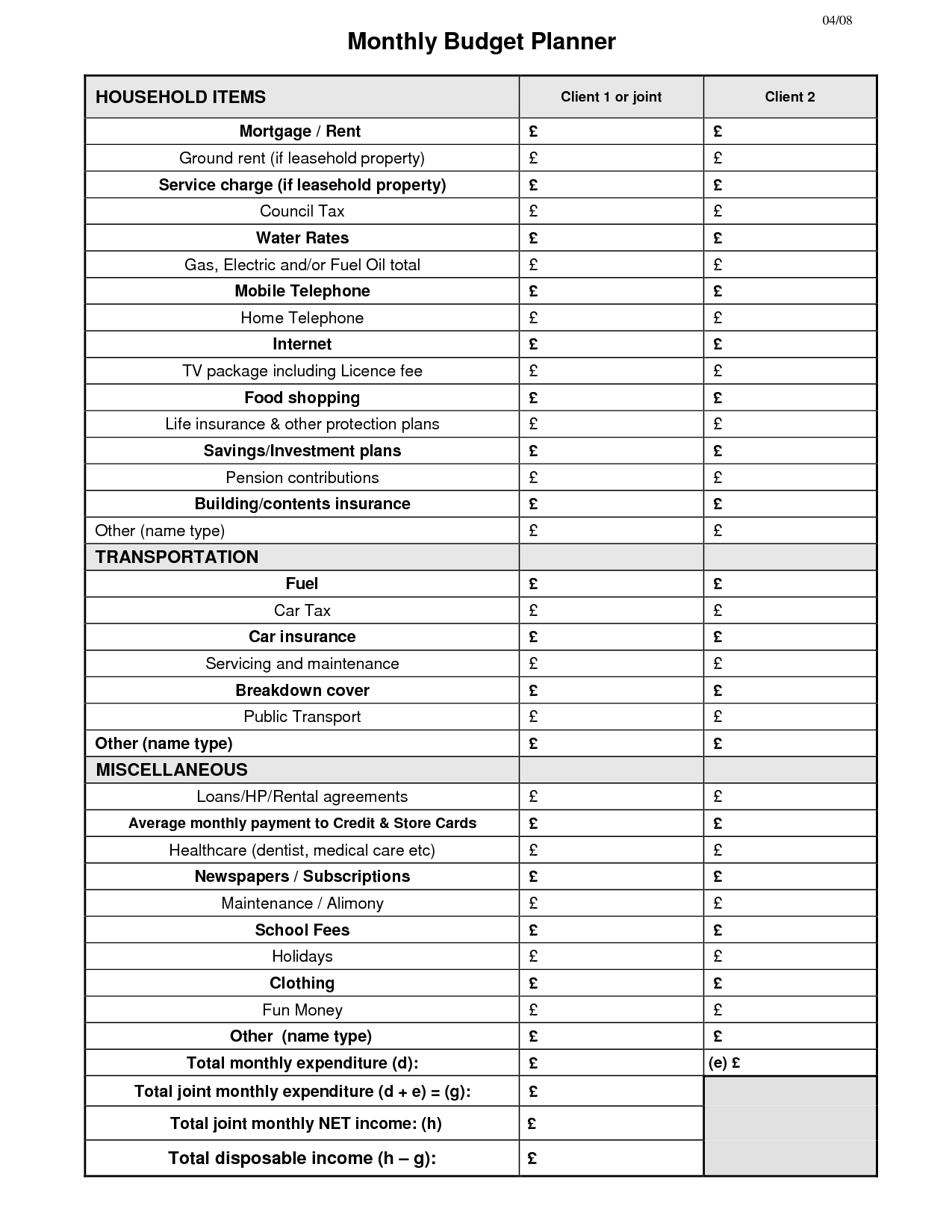

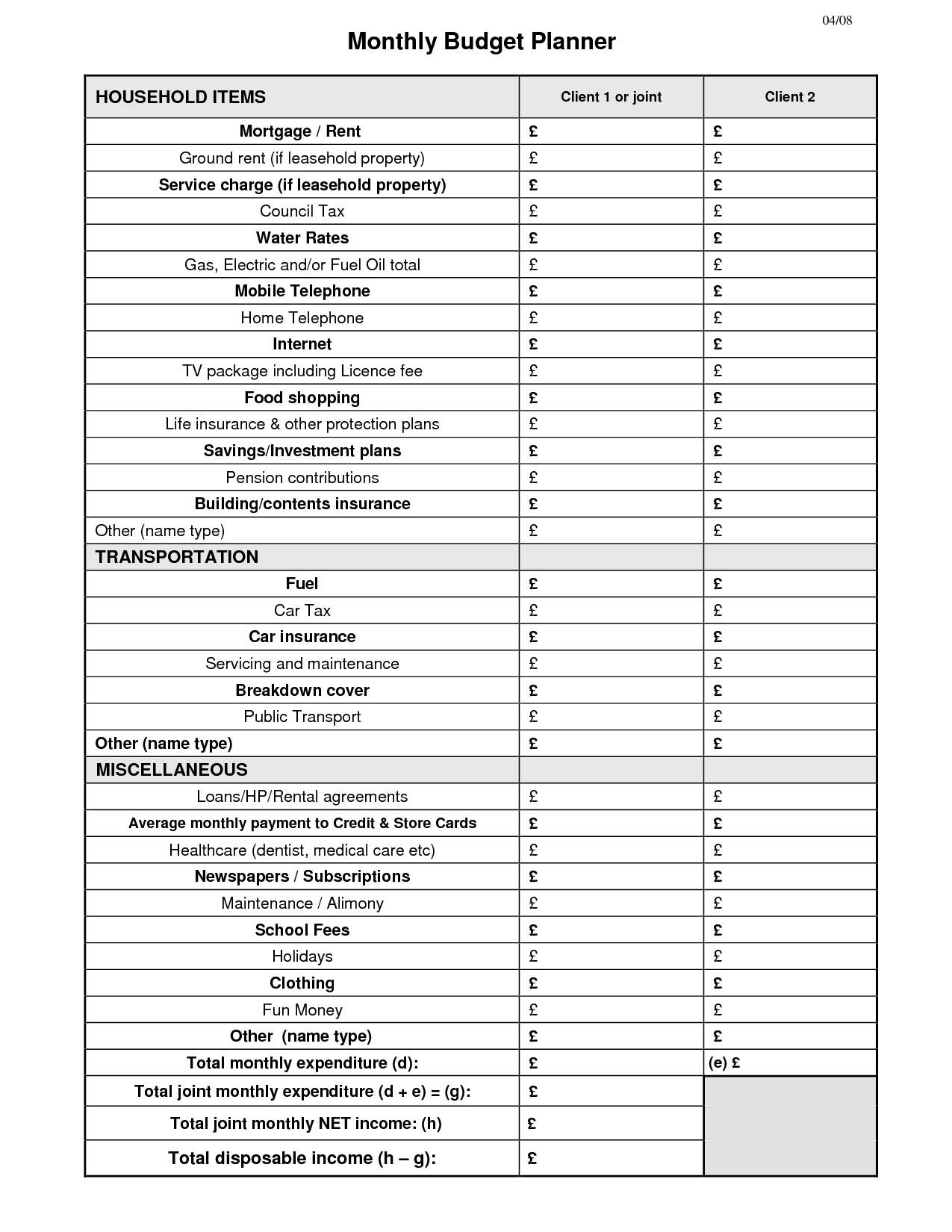

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

- Household Monthly Budget Planner

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a Low-Income Budget Worksheet?

A Low-Income Budget Worksheet is a tool used to help individuals or families with limited financial resources to track their income and expenses in a systematic way. This worksheet typically includes categories such as rent, utilities, groceries, transportation, and other essential expenses to ensure that every dollar is allocated wisely. By using a Low-Income Budget Worksheet, individuals can better manage their finances, prioritize their spending, and make adjustments as needed to stay within their budget constraints.

How can a Low-Income Budget Worksheet be helpful for individuals or families?

A Low-Income Budget Worksheet can be extremely helpful for individuals or families by providing a clear breakdown of their income and expenses. It allows them to see where their money is going, identify areas where they can cut costs or make adjustments, prioritize essential expenses, and save for future goals. By creating and following a budget using the worksheet, individuals or families can better manage their finances, avoid overspending, and work towards financial stability and security.

What are the main categories included in a Low-Income Budget Worksheet?

A Low-Income Budget Worksheet typically includes categories such as housing expenses (rent, mortgage), utilities (electricity, water, gas), groceries, transportation (public transport, gas), healthcare (prescriptions, insurance premiums), debt payments (credit cards, loans), personal expenses (clothing, grooming), and savings (emergency fund, retirement). These categories help individuals or families with low income to prioritize expenses, track spending, and manage their finances within their limited budget.

How can someone accurately calculate their monthly income for the worksheet?

To accurately calculate your monthly income for the worksheet, you should add up all sources of income received within a month. This includes salaries, wages, bonuses, commissions, tips, rental income, dividends, and any other sources of regular income. Deduct any taxes or deductions that are taken out before you receive your income to get your net income. Make sure to account for any fluctuating or irregular income by averaging them out over several months. Once you have a total figure, you can input this into your worksheet as your monthly income.

What expenses should be listed under the "Housing" category in a Low-Income Budget Worksheet?

Expenses listed under the "Housing" category in a Low-Income Budget Worksheet typically include rent or mortgage payments, property taxes, homeowners or renters insurance, maintenance and repairs, utilities such as electricity, water, and gas, internet, and phone bills, as well as any homeowner association fees. Additionally, expenses related to household supplies and groceries can also be included under this category.

What are some common monthly transportation expenses that can be included in the worksheet?

Common monthly transportation expenses that can be included in a worksheet are car loan payments, insurance premiums, fuel costs, public transportation fees, parking fees, tolls, maintenance and repairs, and any other related expenses such as registration fees or car washes.

Why is it important to budget for food expenses and how can it be done effectively?

Budgeting for food expenses is important because it allows you to track and control your spending, ensuring that you allocate enough funds for necessary groceries and avoid overspending. To do this effectively, start by creating a detailed list of your weekly or monthly food needs, consider meal planning to reduce food waste and save money, use cash envelopes or budgeting apps to keep track of your spending, and regularly review and adjust your food budget based on your actual expenses. Monitoring your food expenses closely can help you make more informed choices and ensure that you are prioritizing your spending on essential items.

What other categories should be considered when creating a Low-Income Budget Worksheet?

When creating a Low-Income Budget Worksheet, consider including categories for basic necessities such as housing (rent/mortgage), utilities (electricity, water, gas), groceries, transportation (public transit, car maintenance), healthcare (insurance, prescriptions), and personal care items. Additionally, it can be helpful to allocate funds for emergency savings, debt repayment, and any other regular expenses such as phone bills or internet service. Finally, don't forget about budgeting for non-essential expenses like entertainment and dining out, as taking care of mental well-being is also important.

How can someone prioritize their expenses when working with a low income?

To prioritize expenses with a low income, it is crucial to focus on covering essentials first such as rent, utilities, and groceries. Cut out any unnecessary expenses like dining out or subscription services. Creating a budget and tracking expenses can help identify areas where costs can be reduced. Look for ways to increase income, such as taking on a side job or selling items you no longer need. Consider seeking assistance from community resources or government programs for additional support. Prioritizing needs over wants is key to managing a limited income effectively.

What are some strategies for finding savings or cutting back on expenses when using a Low-Income Budget Worksheet?

Some strategies for finding savings or cutting back on expenses when using a Low-Income Budget Worksheet include identifying non-essential expenses that can be reduced or eliminated, finding alternative ways to save on necessities such as finding discounts or buying in bulk, exploring options for reducing recurring expenses such as negotiating bills or switching to cheaper providers, prioritizing needs over wants, and seeking out community resources or assistance programs that can help alleviate financial strain. Additionally, creating a realistic budget and tracking expenses closely can help identify areas where adjustments can be made to save money.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments