Living Expenses Budget Worksheet

Creating a well-organized living expenses budget is crucial for anyone looking to manage their finances effectively. Whether you are a college student trying to balance your income and expenses or a young professional trying to save for the future, a living expenses budget worksheet can be an invaluable tool in helping you track and control your spending habits.

Table of Images 👆

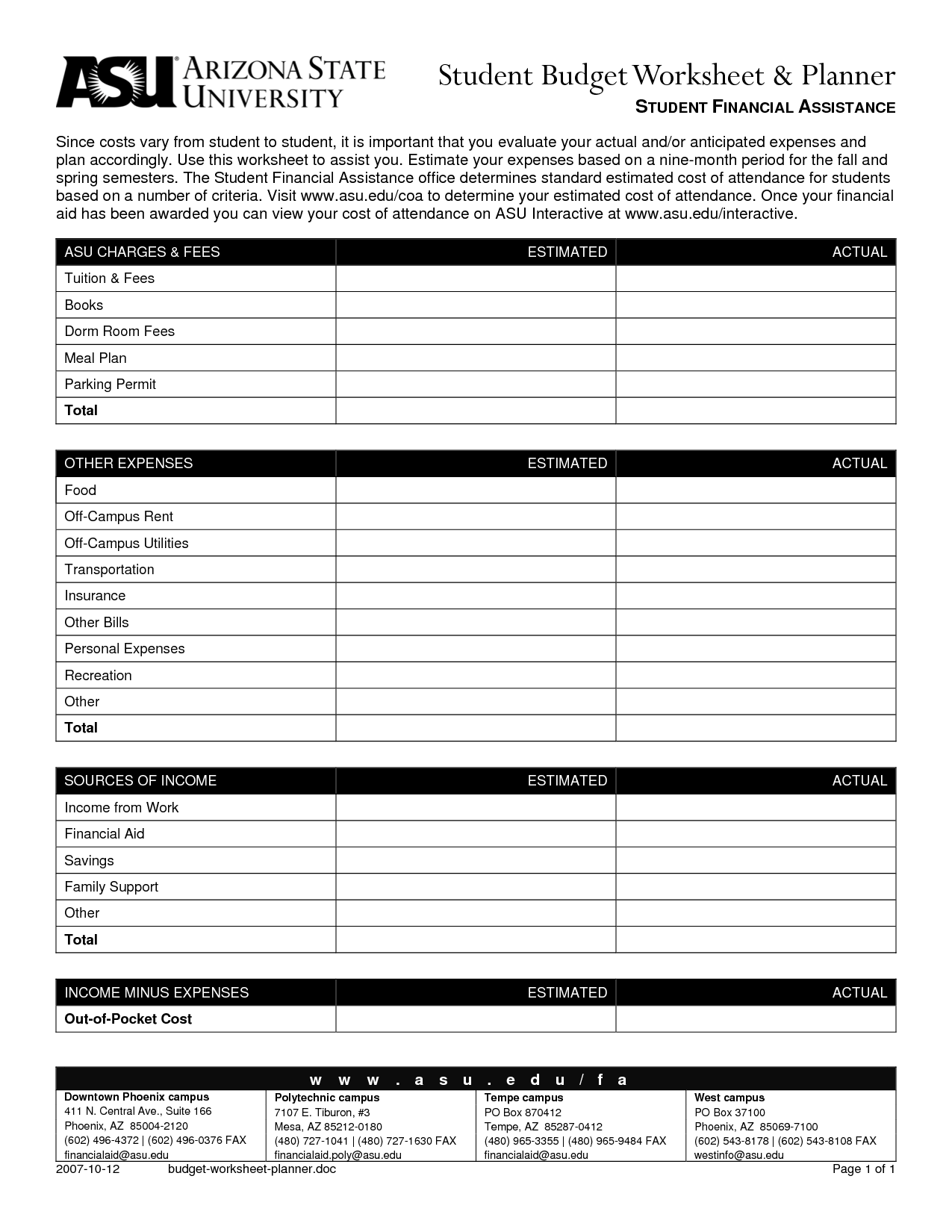

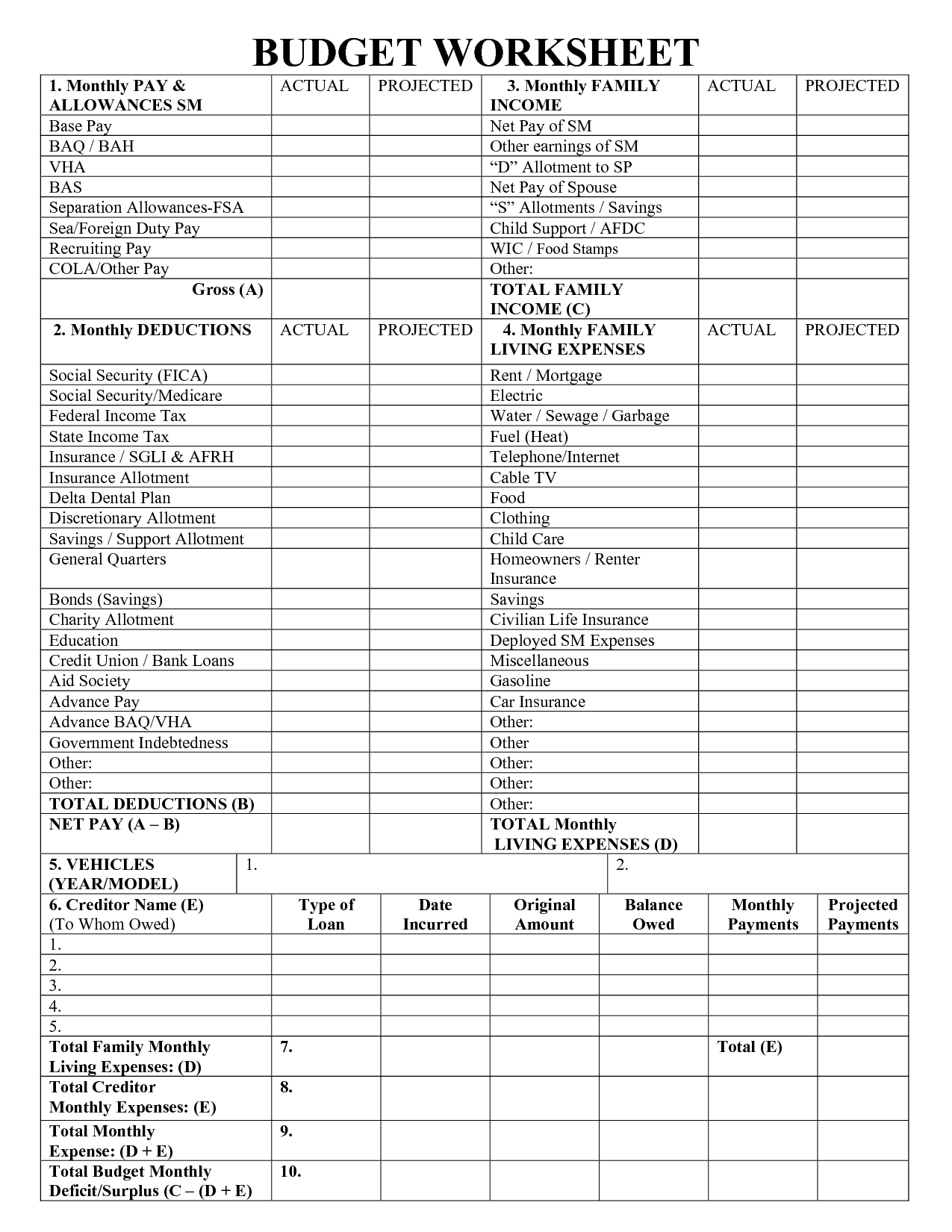

- College Student Budget Worksheet

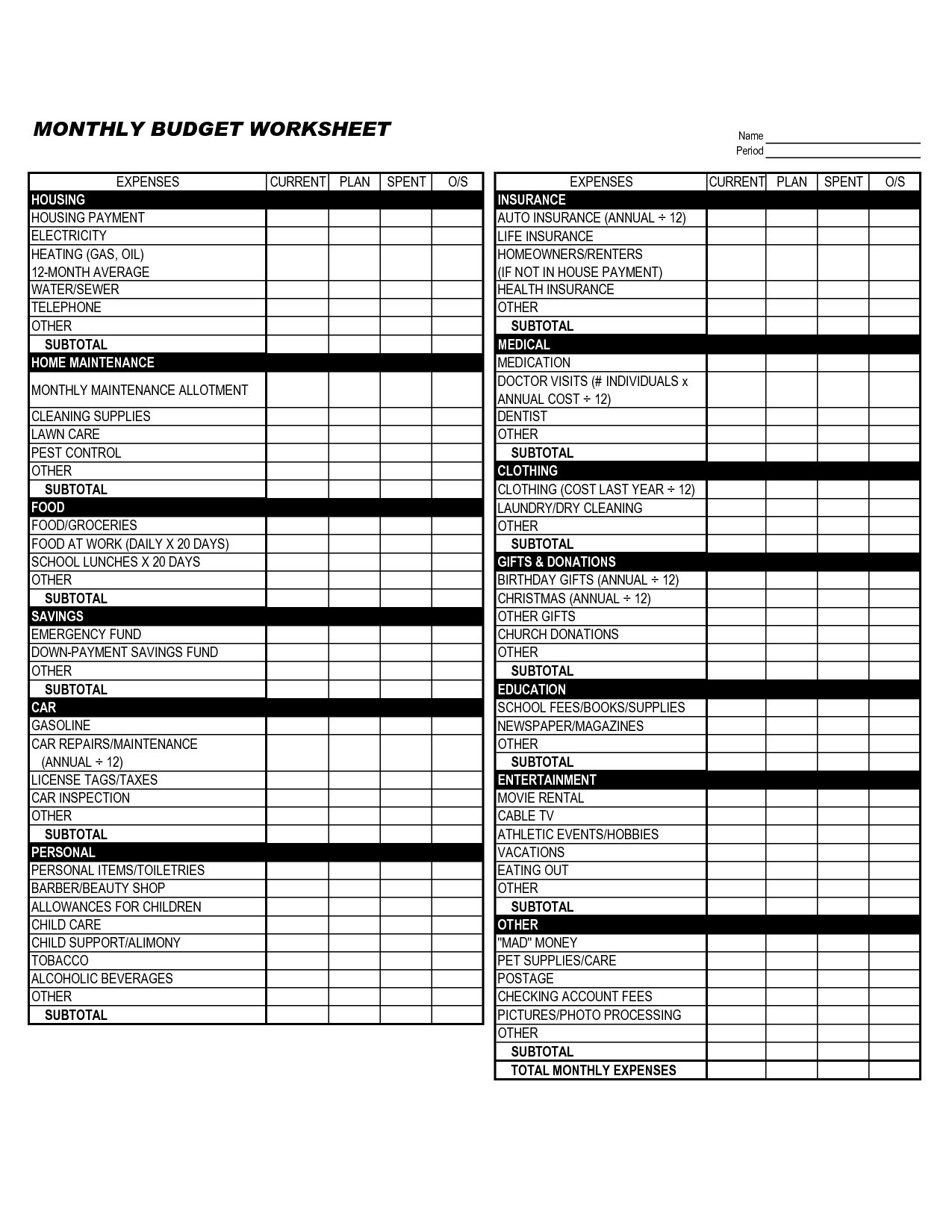

- Sample Monthly Budget Worksheet

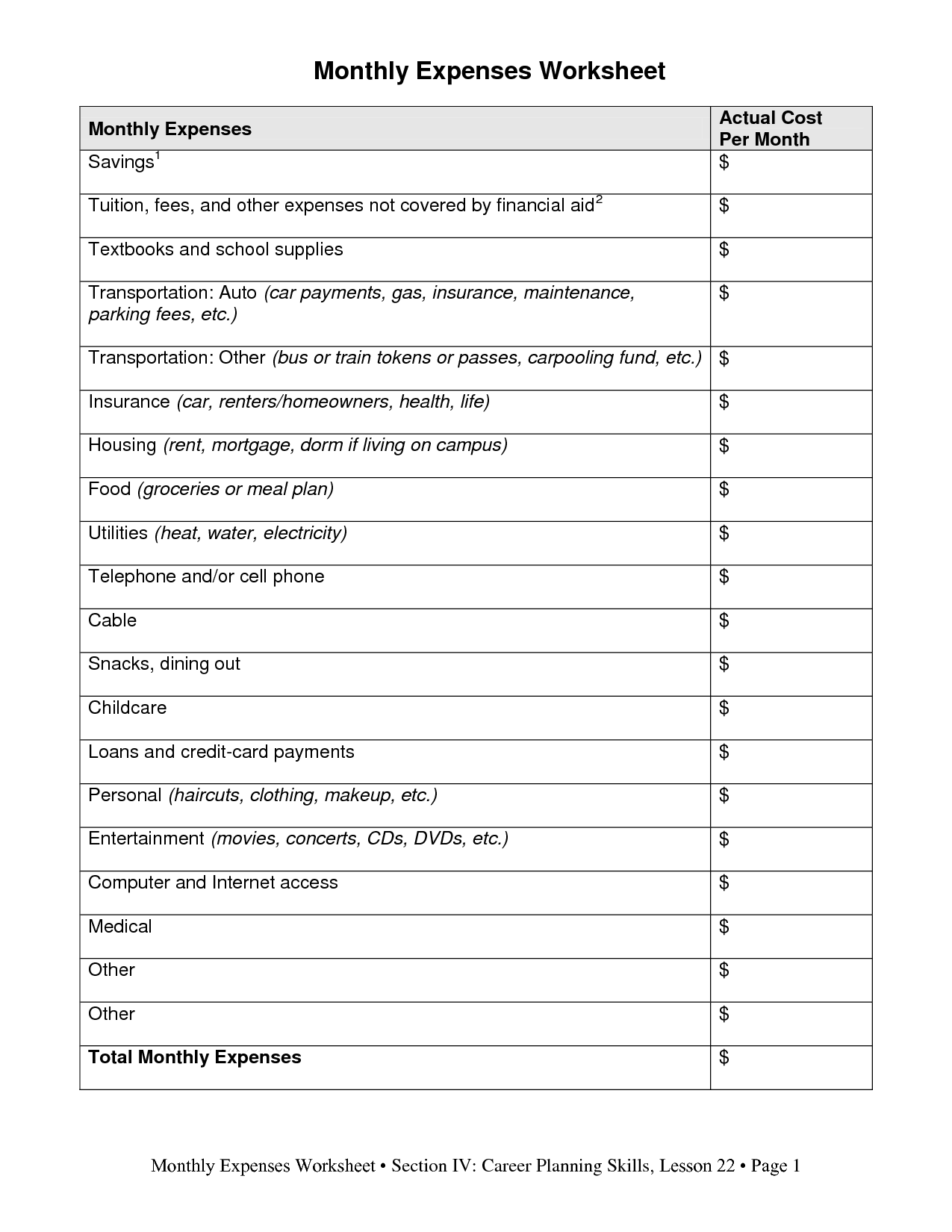

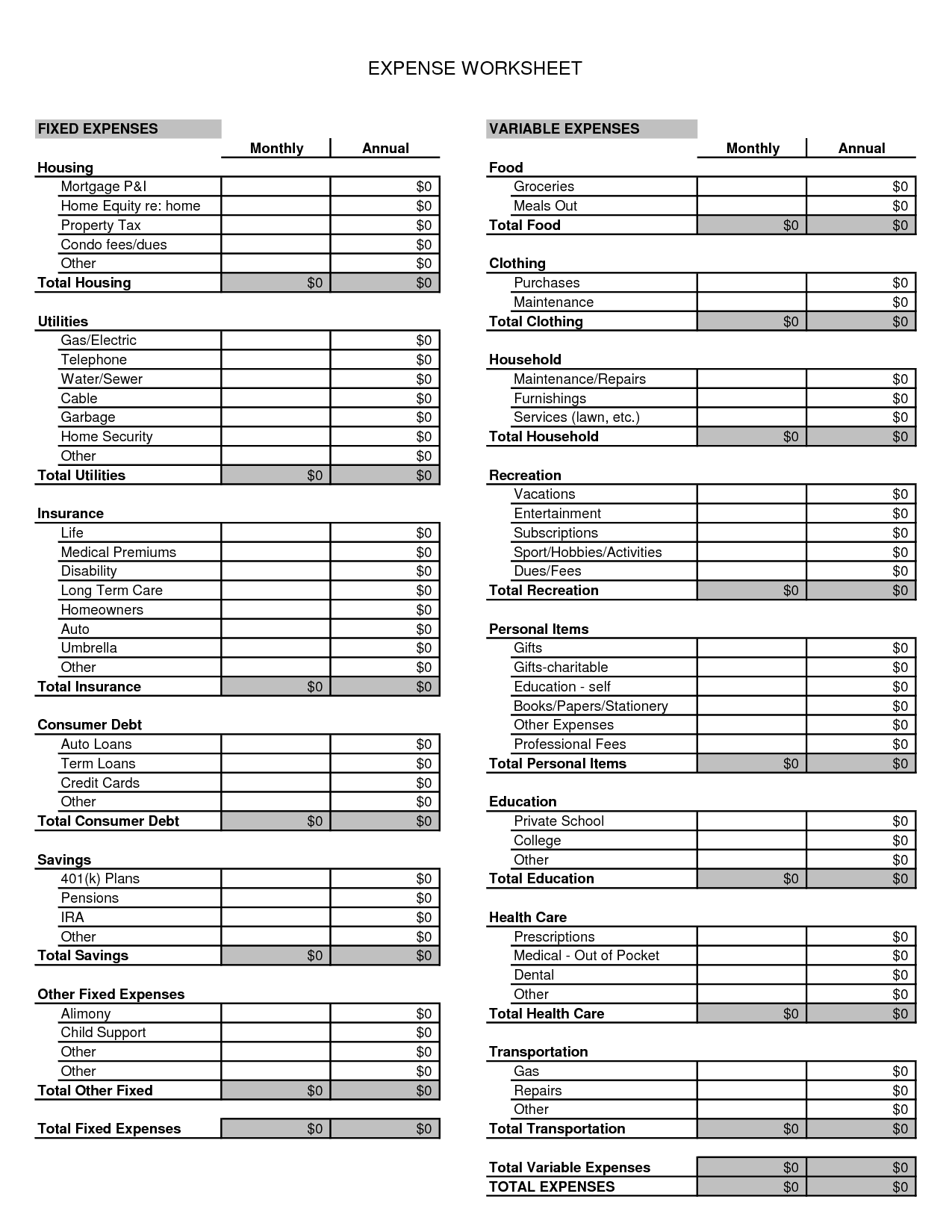

- Monthly Expense Worksheet

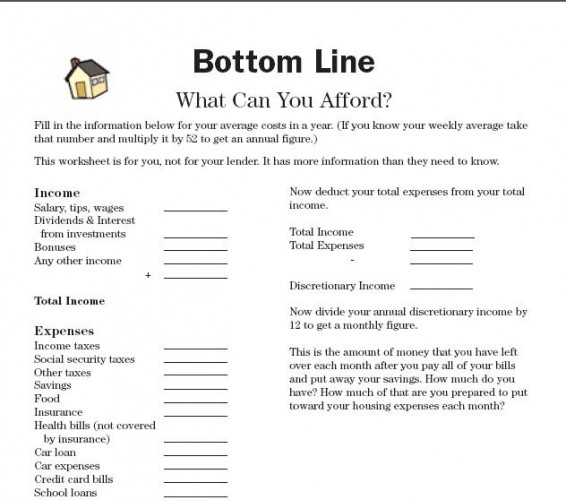

- Free Printable Dave Ramsey Budget Worksheets

- Printable Monthly Expense Worksheet Template

- Monthly Spending Plan Worksheet Printable

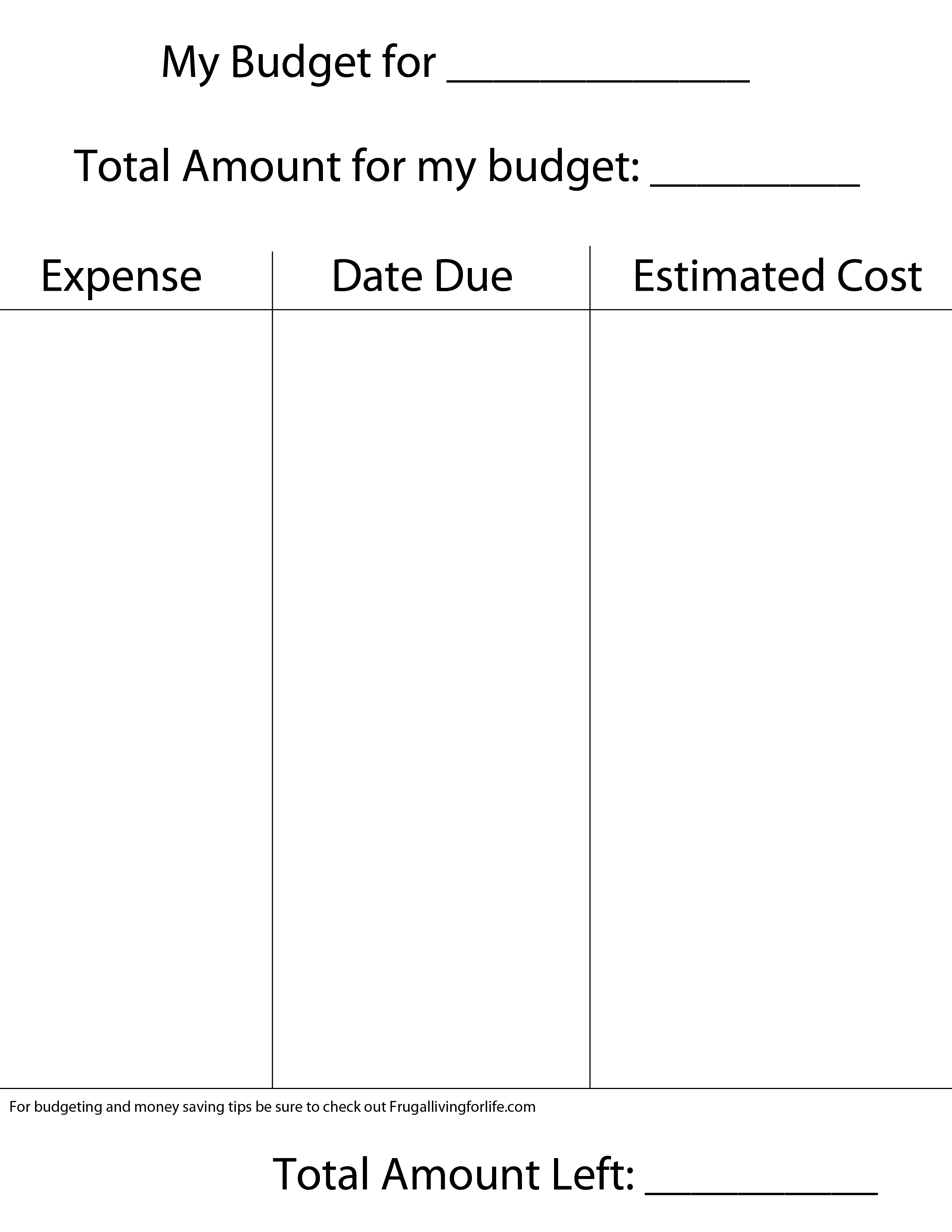

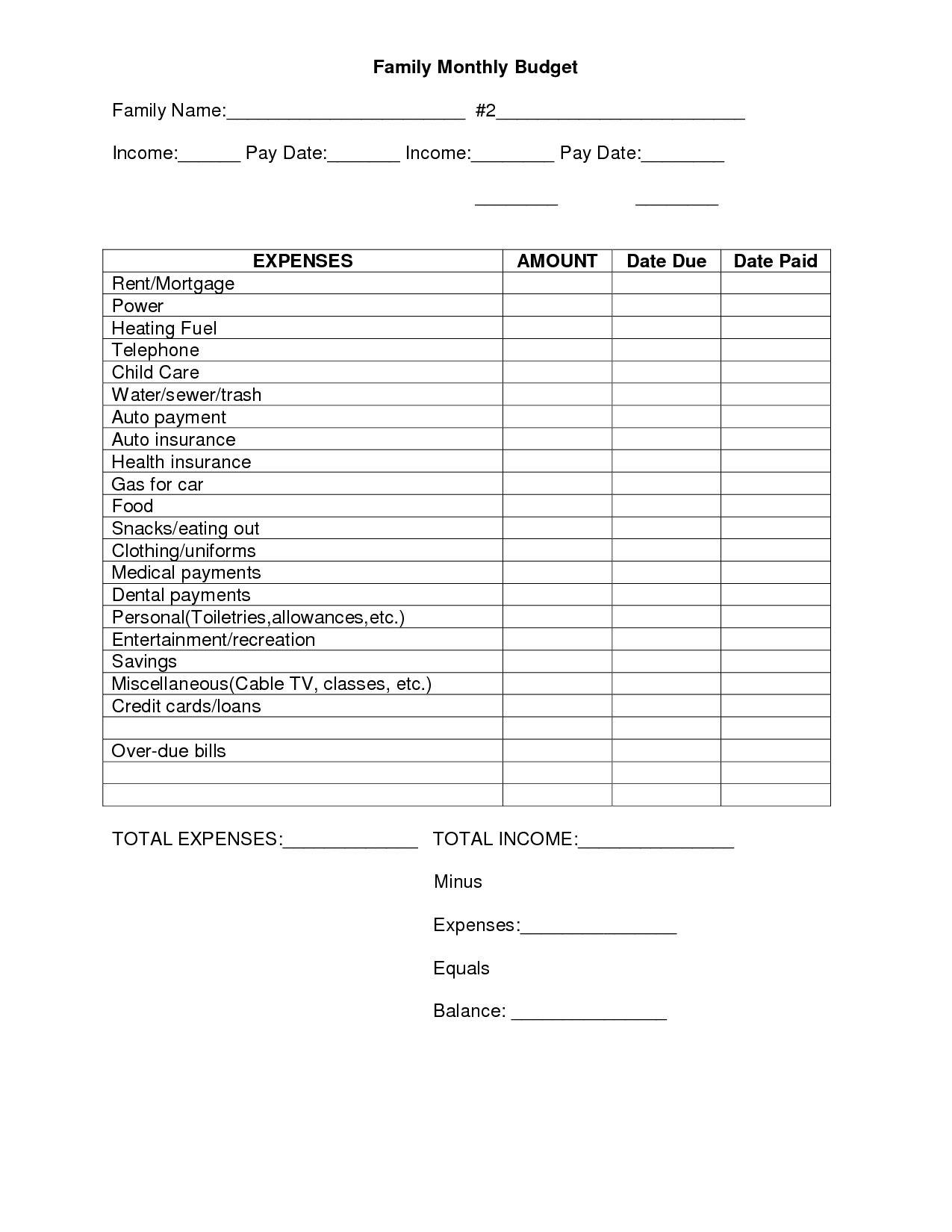

- Bill Budget Worksheet Template

- Blank Monthly Budget Worksheet

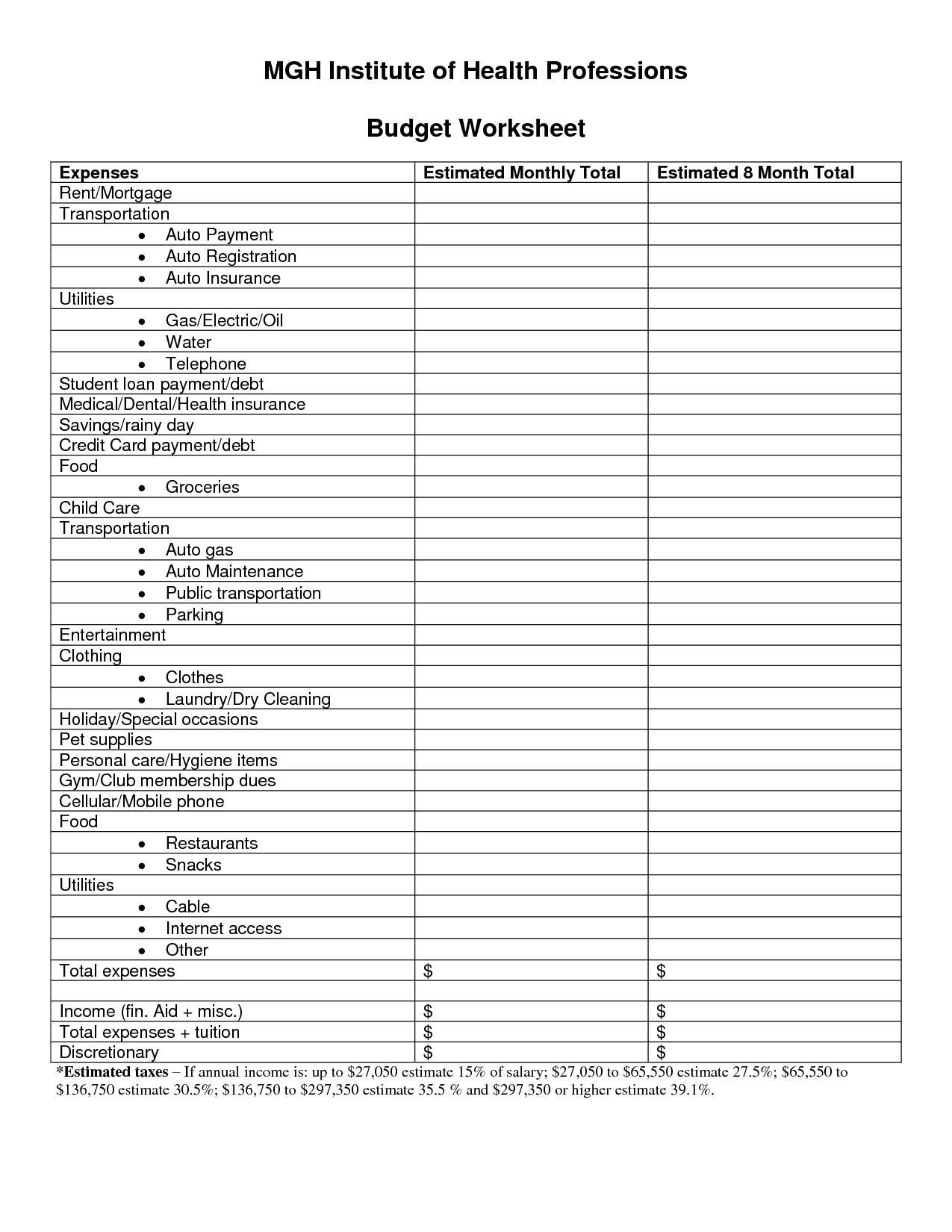

- Health Care Budget Worksheet

- Monthly Bill Budget

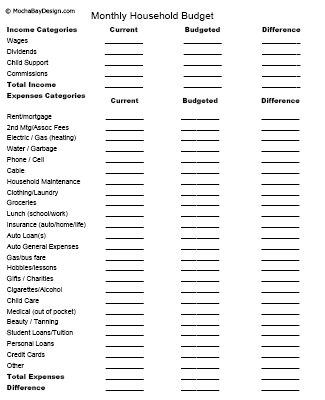

- Free Monthly Household Budget Worksheet Printable

- Income Calculation Worksheet

- Elementary PTA Budget Template

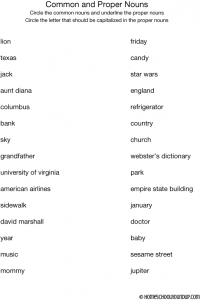

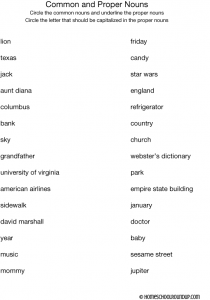

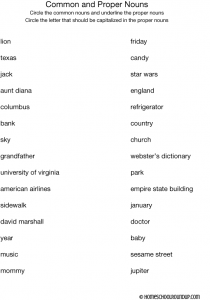

- Common vs Proper Noun Worksheet

- Common vs Proper Noun Worksheet

- Common vs Proper Noun Worksheet

- Common vs Proper Noun Worksheet

- Common vs Proper Noun Worksheet

- Common vs Proper Noun Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a Living Expenses Budget Worksheet?

A Living Expenses Budget Worksheet is a tool used to track and plan for all the necessary expenses needed to maintain a certain standard of living. It typically includes categories such as housing, utilities, transportation, groceries, insurance, and entertainment, among others. By listing out income sources and expenses, individuals can better understand their financial situation, prioritize spending, and adjust their budget as needed to ensure they are living within their means.

Why is a Living Expenses Budget Worksheet important?

A Living Expenses Budget Worksheet is important because it helps individuals track and plan for their monthly expenses, ensuring they can cover necessities such as rent, utilities, groceries, and transportation. By having a clear overview of their financial obligations and income, individuals can make informed decisions, set realistic financial goals, and avoid overspending, ultimately helping them stay on track with their budget and achieve financial stability.

How often should you update your Living Expenses Budget Worksheet?

It is recommended to update your Living Expenses Budget Worksheet at least once a month. This allows you to accurately track your expenses, make adjustments as needed, and stay on top of your financial goals. It is important to regularly review and update your budget to ensure that it reflects any changes in your income, expenses, or financial priorities.

What types of expenses should be included in a Living Expenses Budget Worksheet?

A Living Expenses Budget Worksheet should include expenses such as housing costs (rent or mortgage), utilities (electricity, water, gas), transportation (car payments, insurance, gas), groceries, dining out, healthcare (insurance, copays), personal care (toiletries, haircuts), entertainment, savings, debt payments, and any other monthly expenses essential for maintaining a comfortable standard of living. It is important to track all regular and occasional expenses to get a complete picture of one's financial health and make informed decisions about budgeting.

How do you calculate your monthly income for the Living Expenses Budget Worksheet?

To calculate your monthly income for the Living Expenses Budget Worksheet, add up all sources of income you receive in a typical month. This can include wages, salaries, bonuses, benefits, rental income, and any other sources of income. Keep in mind to only include regular, reliable sources of income when preparing your budget. Deduct taxes and other deductions to determine your net monthly income, which is the amount available for your living expenses.

How do you track your monthly expenses for the Living Expenses Budget Worksheet?

To track your monthly expenses for the Living Expenses Budget Worksheet, you can start by listing all your expenses such as rent/mortgage, utilities, groceries, transportation, entertainment, etc. Then, keep a record of each expense you incur throughout the month by saving receipts, using a budgeting app, or setting up a spreadsheet. At the end of the month, compare your actual spending against your budgeted amounts to see where you may need to adjust for the following month.

How can a Living Expenses Budget Worksheet help with financial planning?

A Living Expenses Budget Worksheet can help with financial planning by providing a clear overview of all income sources and expenses. By detailing all monthly living expenses such as rent, utilities, groceries, transportation, and other essentials, individuals can track their spending habits and identify areas where they can potentially save or cut costs. This tool helps create a realistic budget, monitor cash flow, set financial goals, prioritize expenses, and ultimately, achieve better financial health through effective planning and management of resources.

Can a Living Expenses Budget Worksheet help identify areas for saving money?

Yes, a Living Expenses Budget Worksheet can help identify areas for saving money by providing a detailed overview of where your expenses are going. By tracking your spending on necessities like rent, utilities, groceries, transportation, and other daily expenses, you can pinpoint areas where you may be overspending and find opportunities to cut back and save money. This tool allows you to see clearly where your money is going, making it easier to make informed decisions and adjustments to your budget to reach your savings goals.

Are there any common mistakes to avoid when creating a Living Expenses Budget Worksheet?

Some common mistakes to avoid when creating a Living Expenses Budget Worksheet include underestimating expenses, not accounting for irregular or unexpected expenses, forgetting to include all sources of income, not reviewing and adjusting the budget regularly, and being too rigid and not allowing for flexibility. It is important to be accurate and thorough in categorizing expenses, being realistic about the amounts, and being willing to make changes as needed to ensure the budget is effective in managing finances.

How can using a Living Expenses Budget Worksheet improve your overall financial well-being?

Using a Living Expenses Budget Worksheet can improve your overall financial well-being by helping you track and manage your expenses more effectively. By creating a detailed budget, you can identify areas where you may be overspending and make necessary adjustments to prioritize your spending, save more money, and reach your financial goals. This tool can also provide insights into your spending habits, allowing you to make informed decisions and gain better control over your finances, ultimately leading to improved financial stability and well-being.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments