Insurance Comparison Worksheet

Are you in need of an effective tool to help you organize and compare insurance options? Look no further than the Insurance Comparison Worksheet. This helpful resource is designed to assist individuals and families who are seeking to make informed decisions about their insurance coverage. With a focus on the entity and subject of insurance, this worksheet offers a simple and straightforward way to assess different policies and determine which one best suits your needs and budget.

Table of Images 👆

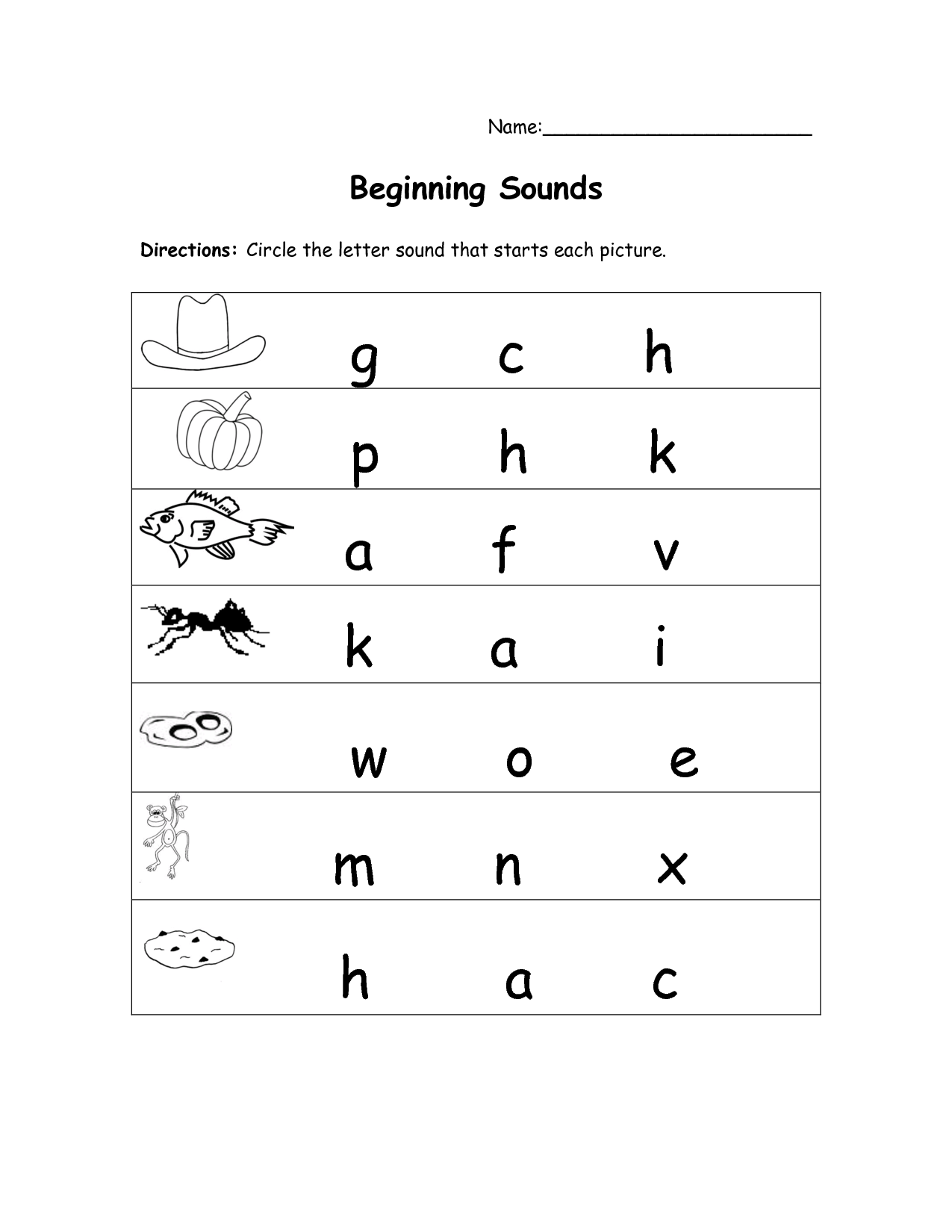

- Beginning Letter Sounds Worksheets Kindergarten

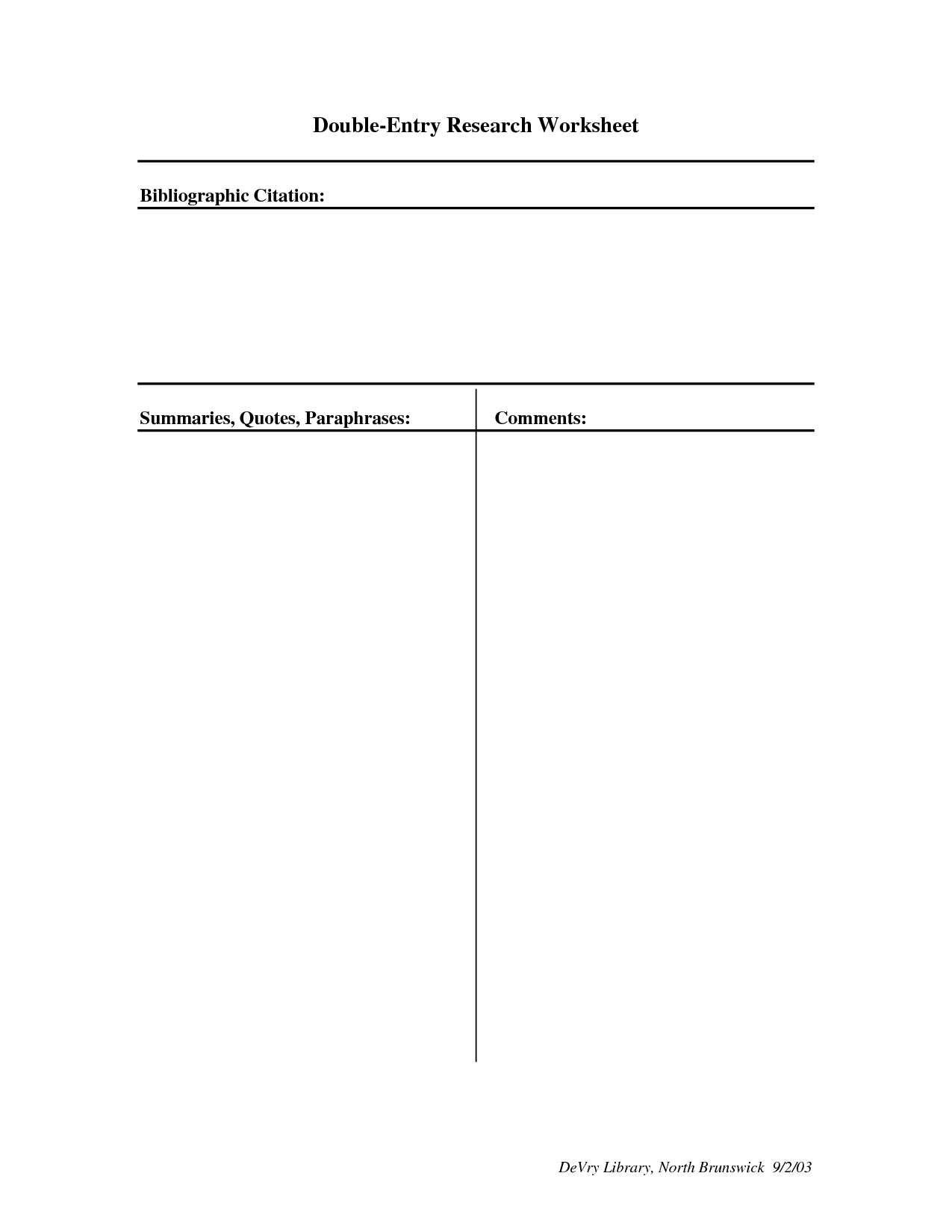

- Journal Entry Worksheet Template

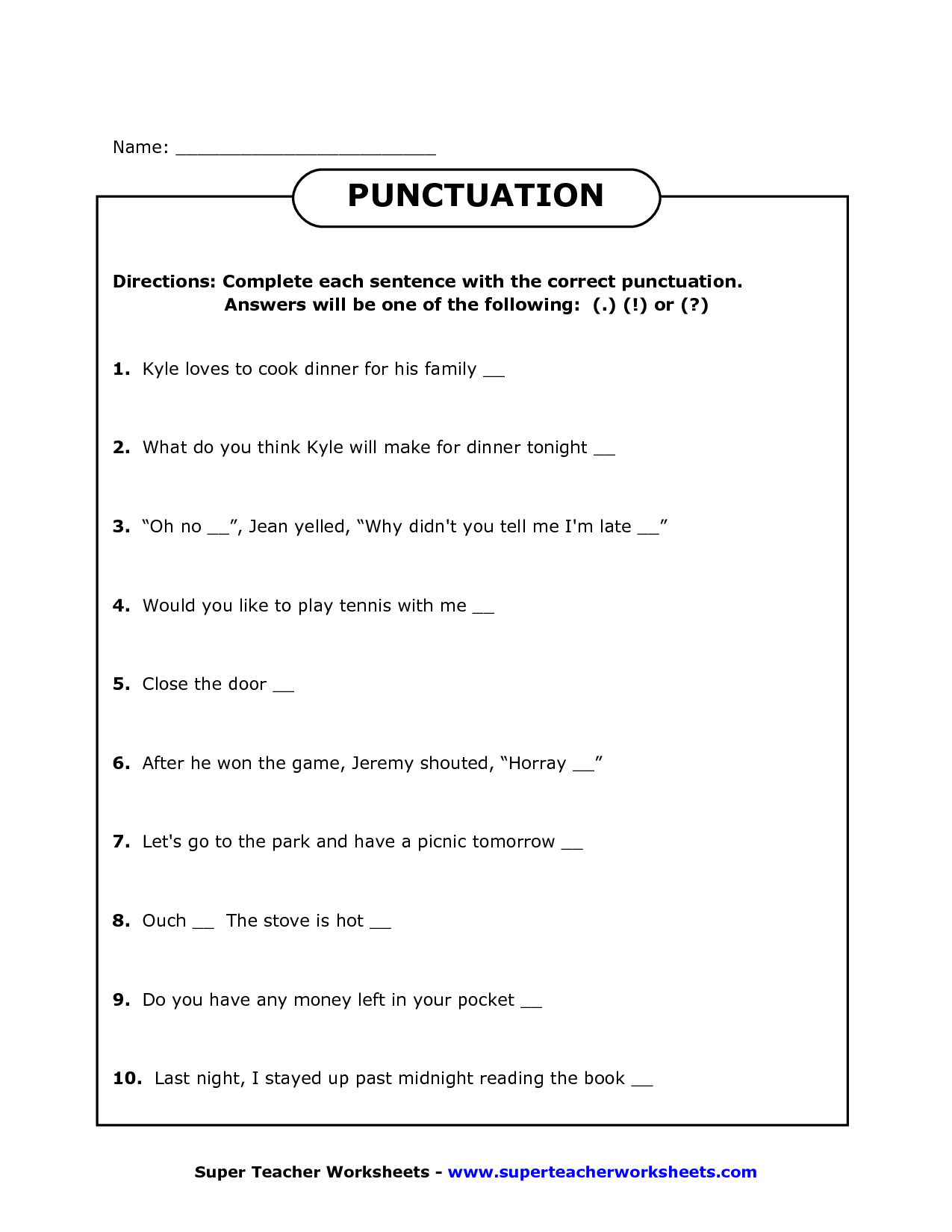

- 2nd Grade Writing Worksheets Sentences

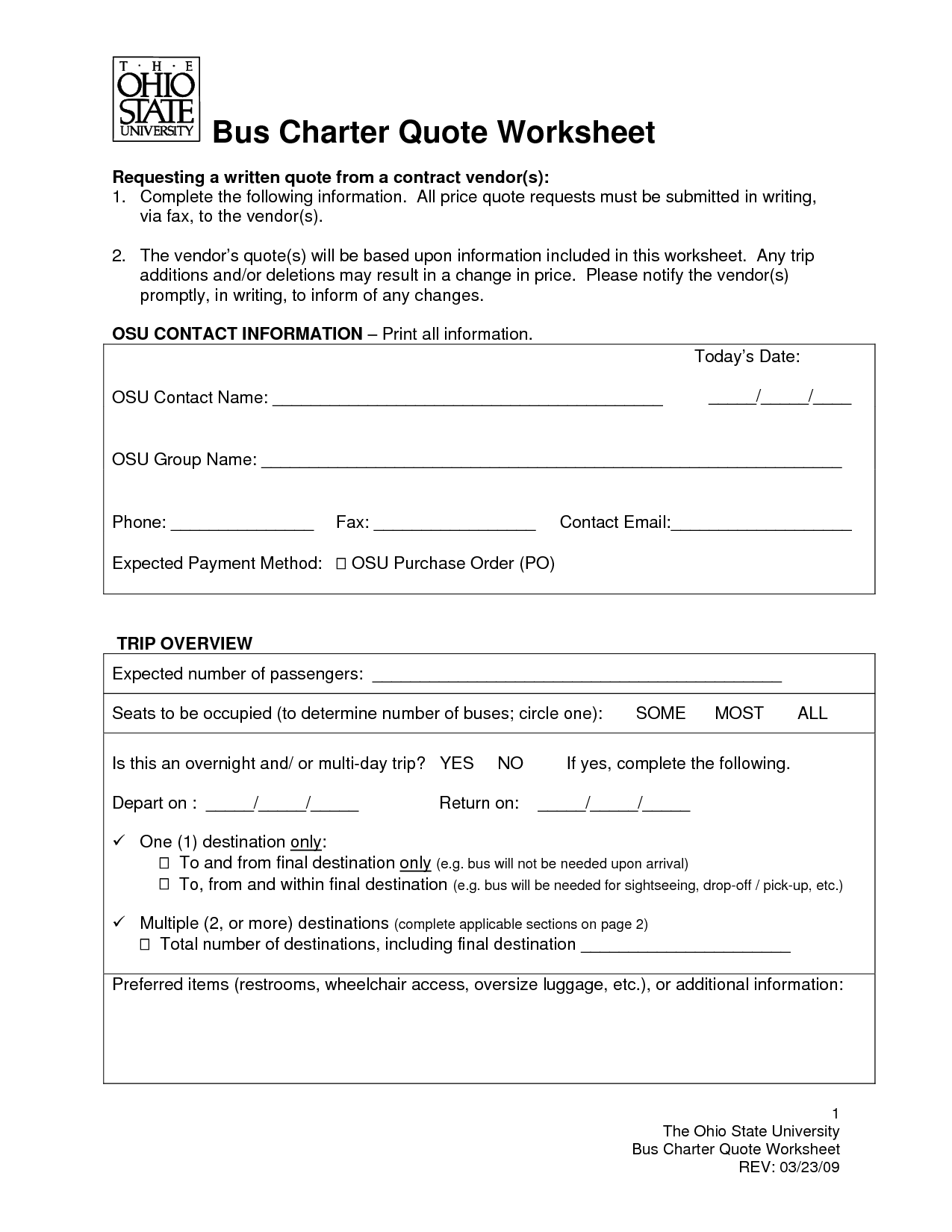

- Insurance Claim Adjuster Reports

- Chemistry Lab Report Sample

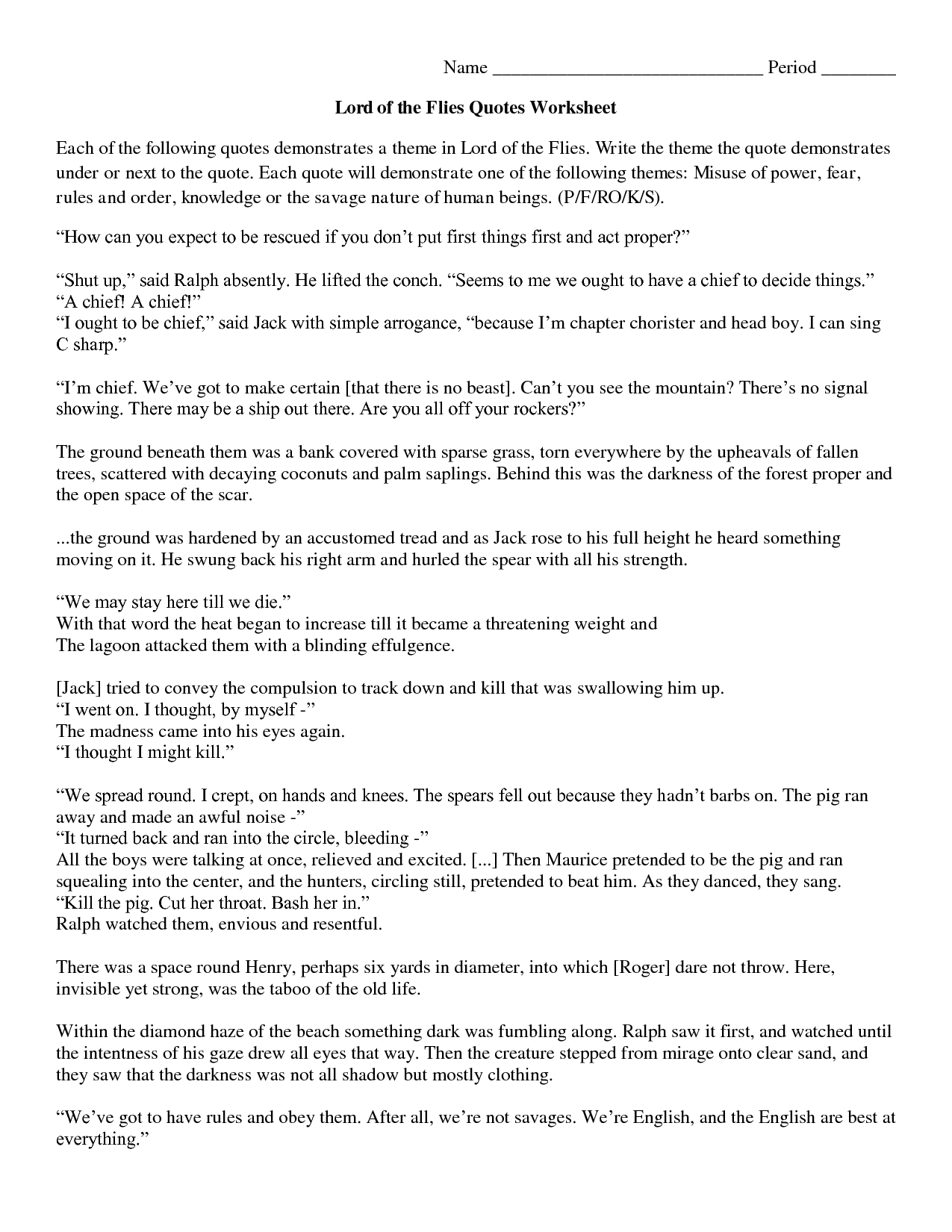

- Quotes Lord of the Flies Worksheets

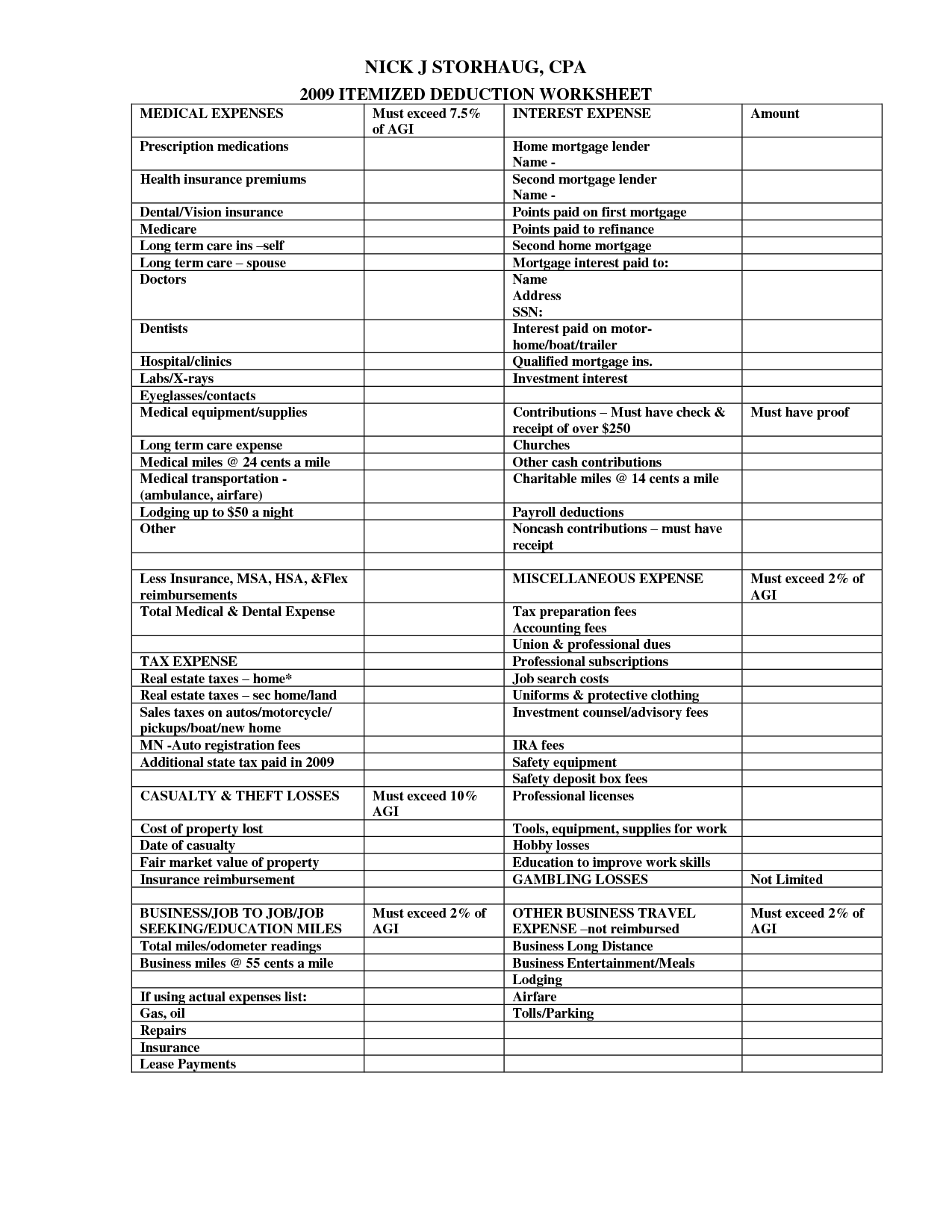

- Tax Itemized Deduction Worksheet

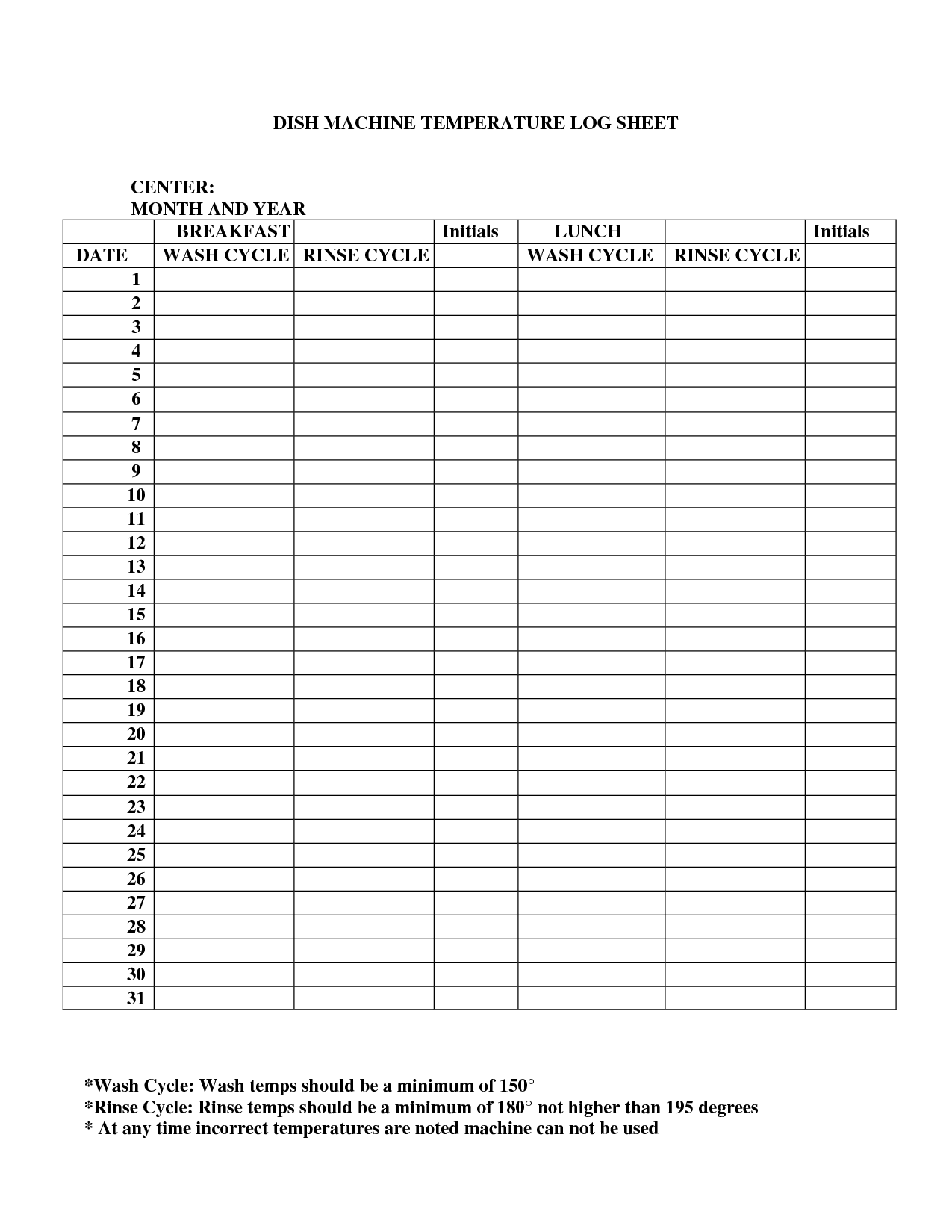

- Dishwasher Temperature Log Sheet

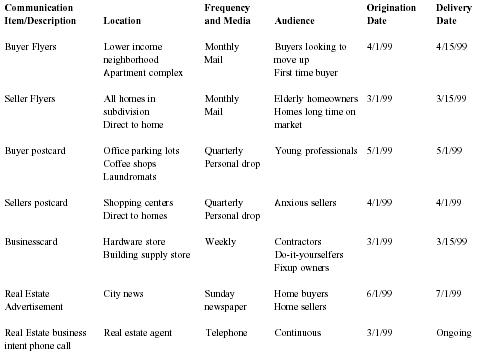

- Real Estate Business Plan Template

- Insurance Credentialing Letter Sample

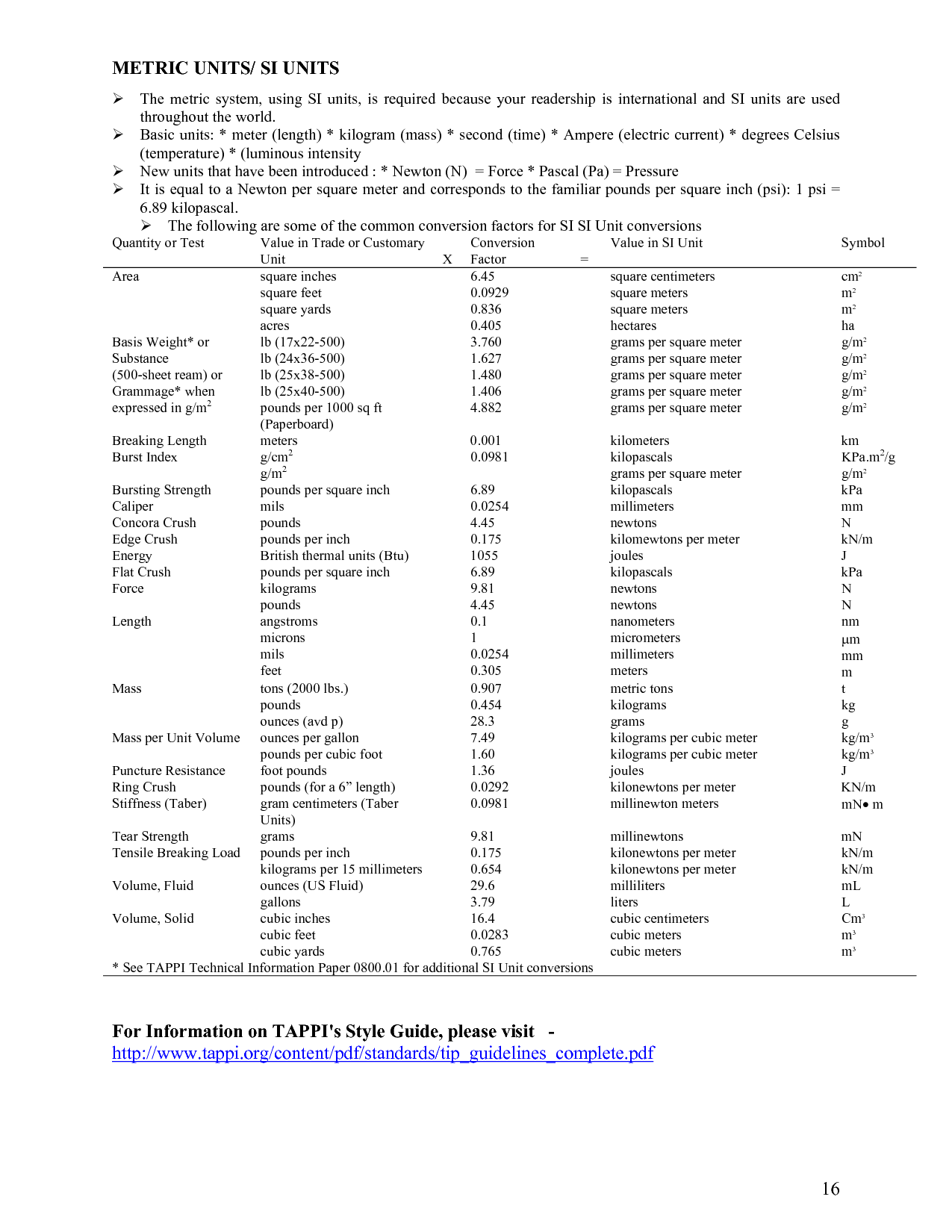

- Metric System Units

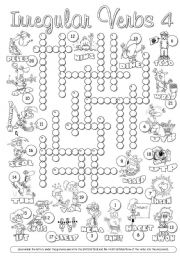

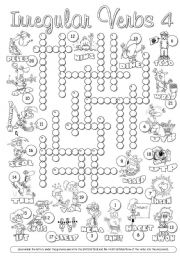

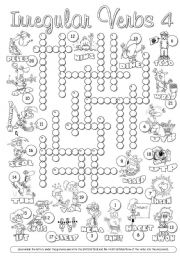

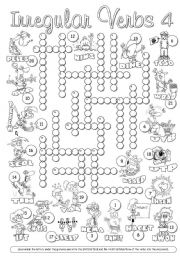

- Spanish Irregular Verbs Crossword Puzzle

- Spanish Irregular Verbs Crossword Puzzle

- Spanish Irregular Verbs Crossword Puzzle

- Spanish Irregular Verbs Crossword Puzzle

- Spanish Irregular Verbs Crossword Puzzle

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is an Insurance Comparison Worksheet?

An Insurance Comparison Worksheet is a document used to compare and contrast various insurance policies from different providers. It typically includes details such as coverage limits, premiums, deductibles, and any additional benefits offered by each policy. By using this worksheet, individuals can easily compare the features and cost of different insurance options to make an informed decision on which policy best meets their needs.

How can an Insurance Comparison Worksheet help me choose the right insurance policy?

An Insurance Comparison Worksheet can help you choose the right insurance policy by allowing you to easily compare key features such as coverage, limits, deductibles, premiums, and additional benefits across different insurance options. By filling out the worksheet with details from various policies, you can visually see the differences and similarities, which will enable you to make an informed decision based on your specific needs and budget. This tool can simplify the process and help you select the most suitable insurance policy for your circumstances.

What information should I include in an Insurance Comparison Worksheet?

When creating an Insurance Comparison Worksheet, you should include key details such as the name of the insurance provider, type of coverage offered, deductibles, premiums, policy limits, benefits, exclusions, customer reviews, and any additional features or discounts. This comprehensive information will allow you to easily compare different insurance options and make an informed decision based on your specific needs and budget.

What are the key factors to consider when comparing insurance policies?

When comparing insurance policies, it is important to consider coverage options, premiums, deductibles, limits, exclusions, and additional benefits. Analyzing these key factors will help determine the overall value and suitability of the policy for your specific needs and circumstances. Pay attention to the terms and conditions, customer reviews, reputation of the insurance provider, as well as the ease of filing claims and customer service support. Comparing all these elements will enable you to make an informed decision and choose the insurance policy that best fits your requirements.

How can an Insurance Comparison Worksheet help me prioritize my insurance needs?

An Insurance Comparison Worksheet can help you prioritize your insurance needs by allowing you to list and compare different types of insurance coverage, such as health, auto, home, and life insurance, along with their costs, coverage limits, deductibles, and benefits. By visually comparing these details side by side, you can evaluate which insurance policies are essential for your current situation and which ones you may want to prioritize based on your budget, risk tolerance, and overall financial goals. This comparison tool enables you to make informed decisions about your insurance coverage and tailor it to meet your specific needs and priorities.

How can I use an Insurance Comparison Worksheet to evaluate the coverage and limits of different policies?

To use an Insurance Comparison Worksheet to evaluate the coverage and limits of different policies, first list all the policies you want to compare. Then, identify and list the key elements of coverage and limits for each policy, such as deductibles, coverage types, limits per category, and any exclusions. Fill in the worksheet with this information for each policy to easily compare and contrast their offerings. Consider factors like premiums, coverage breadth, and limits to determine which policy best suits your needs and budget.

What types of insurance can be compared using an Insurance Comparison Worksheet?

An Insurance Comparison Worksheet can be used to compare various types of insurance, such as auto insurance, home insurance, health insurance, life insurance, and even pet insurance. By using the worksheet, individuals can assess and compare different aspects of these insurance policies, including coverage options, premiums, deductibles, limits, exclusions, and other key factors to make an informed decision on choosing the right insurance coverage that meets their needs and budget.

How can an Insurance Comparison Worksheet help me identify potential gaps in coverage?

An Insurance Comparison Worksheet can help you identify potential gaps in coverage by allowing you to systematically compare the coverage features and limits of different insurance policies side by side. By reviewing each policy's details in one place, you can easily see where there may be variations in coverage or where certain risks may not be adequately addressed. This comparison process can highlight areas where additional coverage may be needed to ensure you have comprehensive protection across all your insurance needs.

What role does cost play in an Insurance Comparison Worksheet?

Cost plays a significant role in an Insurance Comparison Worksheet as it helps individuals evaluate and compare the financial aspect of different insurance policies. By comparing costs such as premiums, deductibles, and coverage limits, individuals can make informed decisions about which insurance policy best fits their needs and budget. Additionally, cost comparison allows individuals to identify any potential savings or additional benefits that different insurance policies may offer.

Can an Insurance Comparison Worksheet assist me in contacting insurance providers for quotes?

Yes, an Insurance Comparison Worksheet can be a helpful tool in contacting insurance providers for quotes as it allows you to organize and compare the information provided by different insurers. By filling out the worksheet with details about your needs and preferences, you can easily identify the key information required for obtaining quotes and streamline the process of communicating with multiple insurance providers. This can help you make more informed decisions and potentially save time and effort in the insurance shopping process.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments