Financial Planning Worksheets

Financial planning worksheets are essential tools for anyone who wants to take control of their personal finances. These worksheets provide a systematic way to organize and track your income, expenses, and financial goals. By using these worksheets, you can gain a clear understanding of your financial situation, identify areas for improvement, and make educated decisions about your money. Whether you are just starting out on your financial journey or already have some experience, these worksheets can help you take your financial management to the next level.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

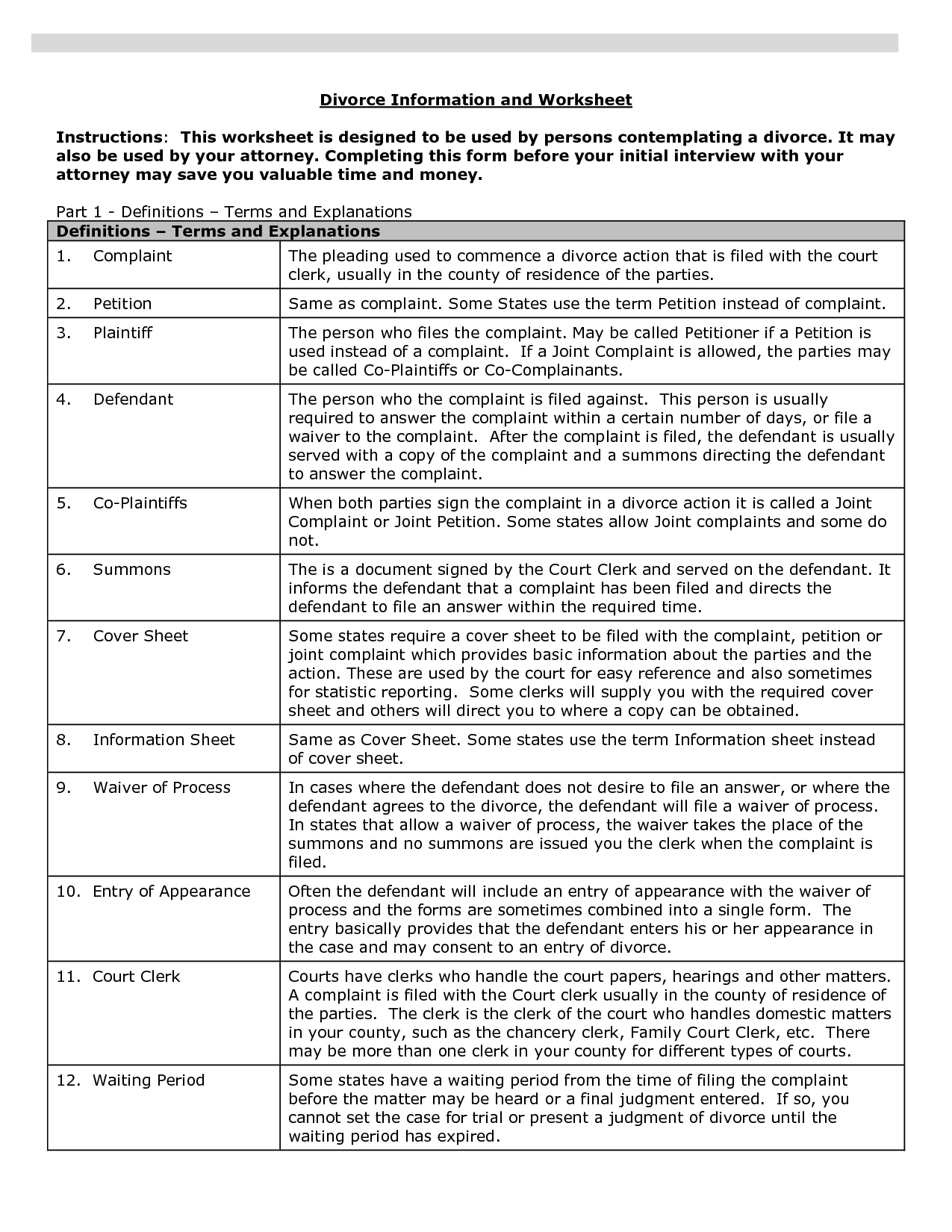

What is a financial planning worksheet?

A financial planning worksheet is a tool that individuals can use to organize and track their financial goals, income, expenses, debts, assets, and savings. It helps in creating a comprehensive financial plan by providing a clear picture of one's current financial situation and outlining steps to achieve financial objectives such as budgeting, saving for retirement, managing debt, or planning for major expenses.

What are the main components of a financial planning worksheet?

A financial planning worksheet typically includes sections for tracking income sources, expenses, savings and investments, debt obligations, financial goals, and a budget. It also often incorporates sections for emergency funds, retirement planning, insurance coverage, and estate planning. Overall, a comprehensive financial planning worksheet serves as a tool to help individuals organize their financial information, set goals, and track progress towards achieving their financial objectives.

How can a financial planning worksheet help individuals assess their current financial situation?

A financial planning worksheet can help individuals assess their current financial situation by providing a structured format to document and analyze their income, expenses, assets, liabilities, and financial goals. By organizing this information in one place, individuals can easily see their total financial picture, identify areas of strength and weakness, and pinpoint opportunities for improvement. This tool can also help track progress towards achieving financial goals and make informed decisions to effectively manage personal finances.

What role does goal-setting play in a financial planning worksheet?

Goal-setting is crucial in a financial planning worksheet as it helps individuals define their objectives, prioritize their financial needs, and create a roadmap for achieving their financial goals. By setting specific, measurable, achievable, relevant, and time-bound goals, individuals can track their progress, stay focused, and make informed financial decisions to reach their desired financial milestones. Ultimately, goal-setting in a financial planning worksheet serves as a guide to help individuals manage their finances effectively and work towards their long-term financial success.

How does a financial planning worksheet assist in tracking and organizing expenses?

A financial planning worksheet helps in tracking and organizing expenses by providing a structured template to record all income sources and expenditures in one place. It allows individuals to categorize their expenses, set budgets, and monitor their financial progress over time. By regularly updating the worksheet with accurate information, individuals can easily track where their money is going, identify areas where they can make cuts or improvements, and ultimately work towards achieving their financial goals.

What information should be included in the income section of a financial planning worksheet?

In the income section of a financial planning worksheet, you should include all sources of income such as salaries, wages, bonuses, rental income, dividends, interest, pensions, and any other forms of income. It is important to accurately list these sources and their corresponding amounts to have a clear understanding of your total income and to facilitate effective financial planning.

How can a financial planning worksheet help individuals create a budget?

A financial planning worksheet can help individuals create a budget by providing a structured format to list their income sources and expenses, track their spending habits, identify areas where they can potentially save money, set financial goals, and allocate resources accordingly. It helps individuals gain a clear understanding of their financial situation and enables them to make informed decisions to achieve their financial objectives.

What role does debt management play in a financial planning worksheet?

Debt management plays a crucial role in a financial planning worksheet as it helps individuals assess their current financial situation, plan for the future, and achieve their financial goals. By tracking and managing debt, individuals can make informed decisions about budgeting, saving, and investing, ultimately leading to improved financial stability and security. Proper debt management allows individuals to prioritize paying off high-interest debts, avoid accumulating unnecessary debt, and establish a sustainable financial plan to build wealth and achieve long-term financial success.

How does a financial planning worksheet help individuals plan for future financial goals?

A financial planning worksheet helps individuals plan for future financial goals by providing a structured framework to organize their income, expenses, assets, and liabilities. By mapping out their current financial situation and setting specific goals, individuals can create a roadmap to track progress, prioritize expenses, and make informed decisions to work towards achieving their financial objectives. Additionally, a financial planning worksheet can help individuals identify areas for improvement, build a budget, allocate resources effectively, and ultimately work towards building financial stability and security for the future.

What importance does regular review and updating of a financial planning worksheet hold?

Regular review and updating of a financial planning worksheet is crucial to ensure that your goals, income, expenses, and investments are aligned with your current financial situation. It allows you to track your progress, identify any necessary adjustments or potential risks, and make informed decisions to stay on track towards achieving your financial objectives. By keeping your financial planning worksheet up to date, you can adapt to changes in your life circumstances, financial goals, and economic conditions, ultimately improving your financial stability and success.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments