Financial Organizer Worksheet

Managing personal finances can be a complex task, especially when it comes to keeping track of expenses, budgets, and savings. To help simplify this process, utilizing a financial organizer worksheet can be a game-changer. These worksheets serve as a valuable tool for individuals who are seeking a well-organized method to track their income, expenses, and financial goals.

Table of Images 👆

- Free Printable Bill Organizer Form

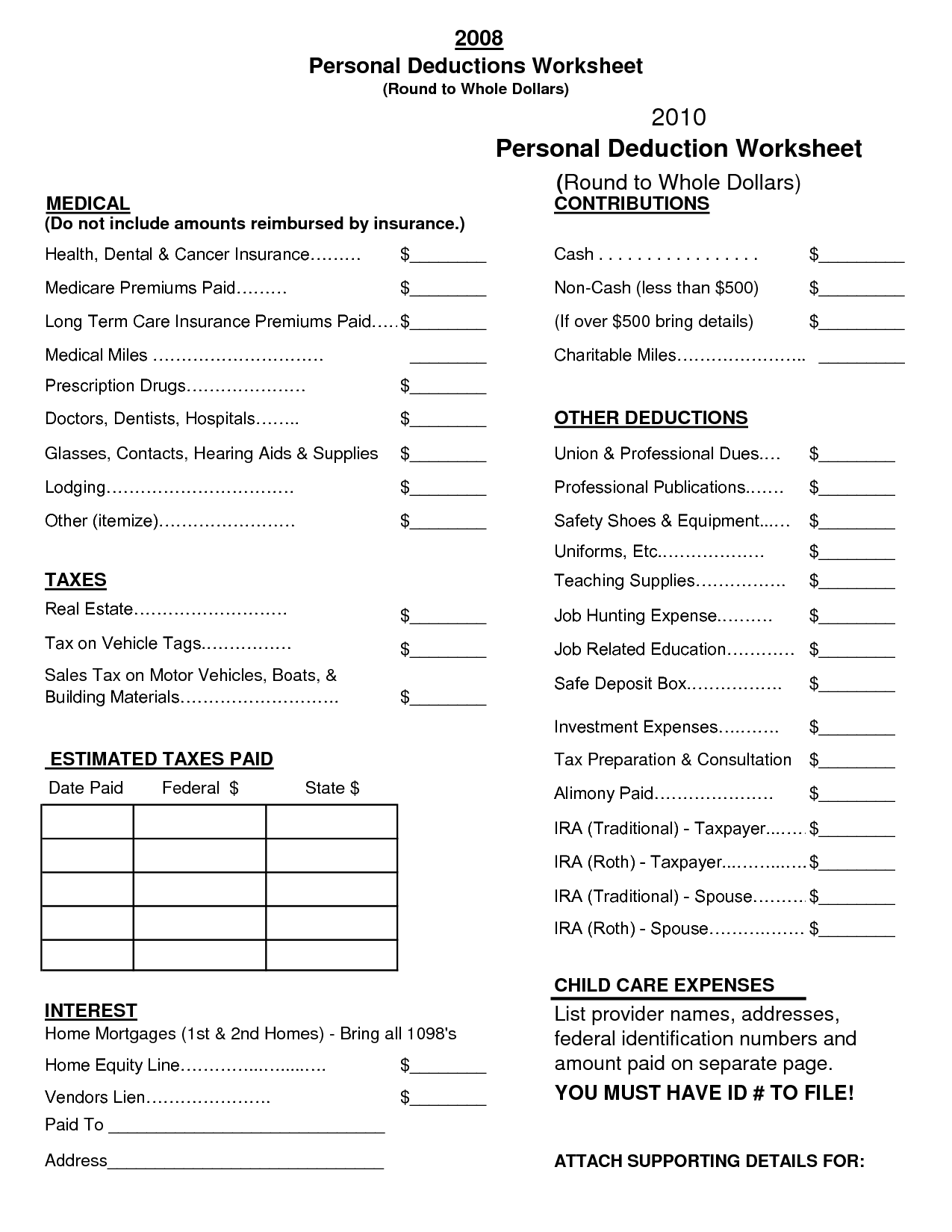

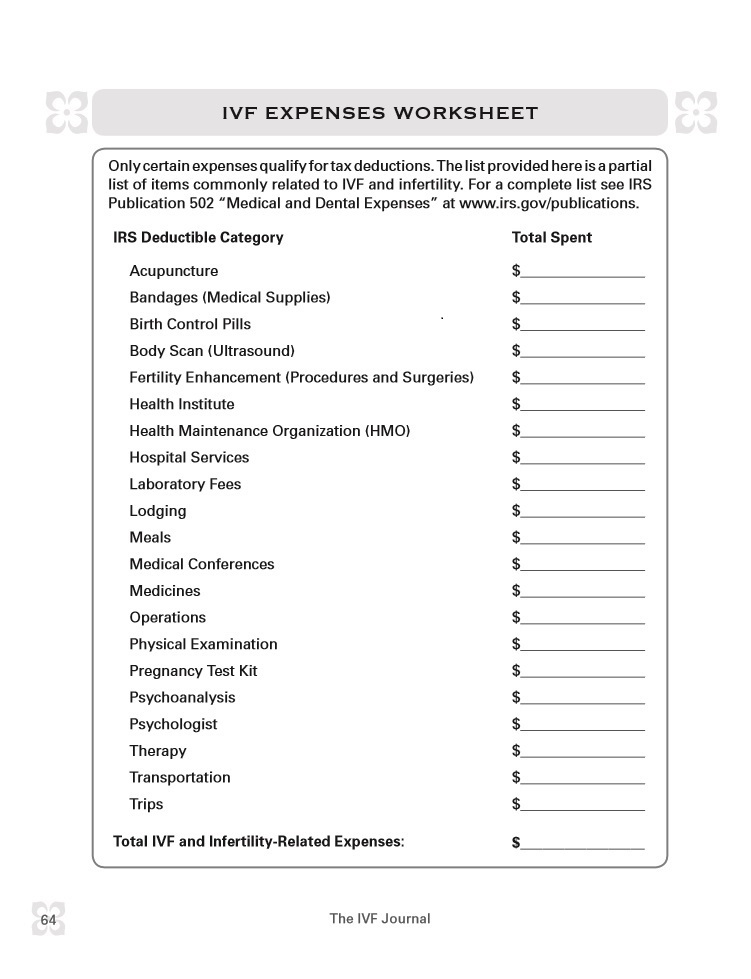

- Standard Deduction Worksheet

- 2014 Tax Deduction Worksheet

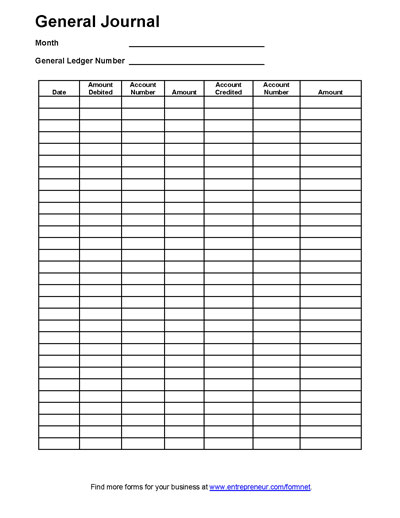

- Free Printable Accounting Journal Forms

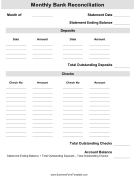

- Blank Bank Reconciliation Form

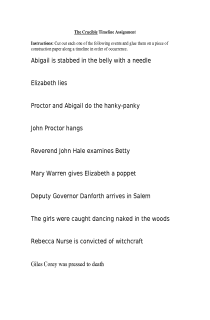

- The Crucible Event Timeline

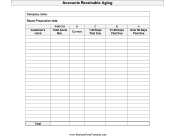

- Accounts Receivable Aging Template

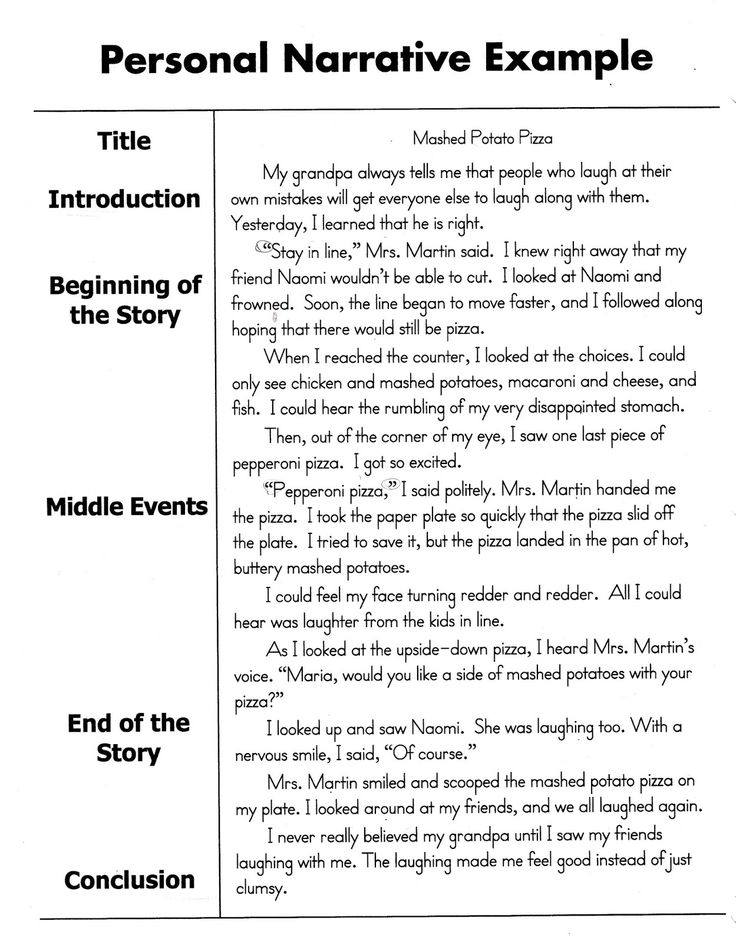

- Personal Narrative Essay

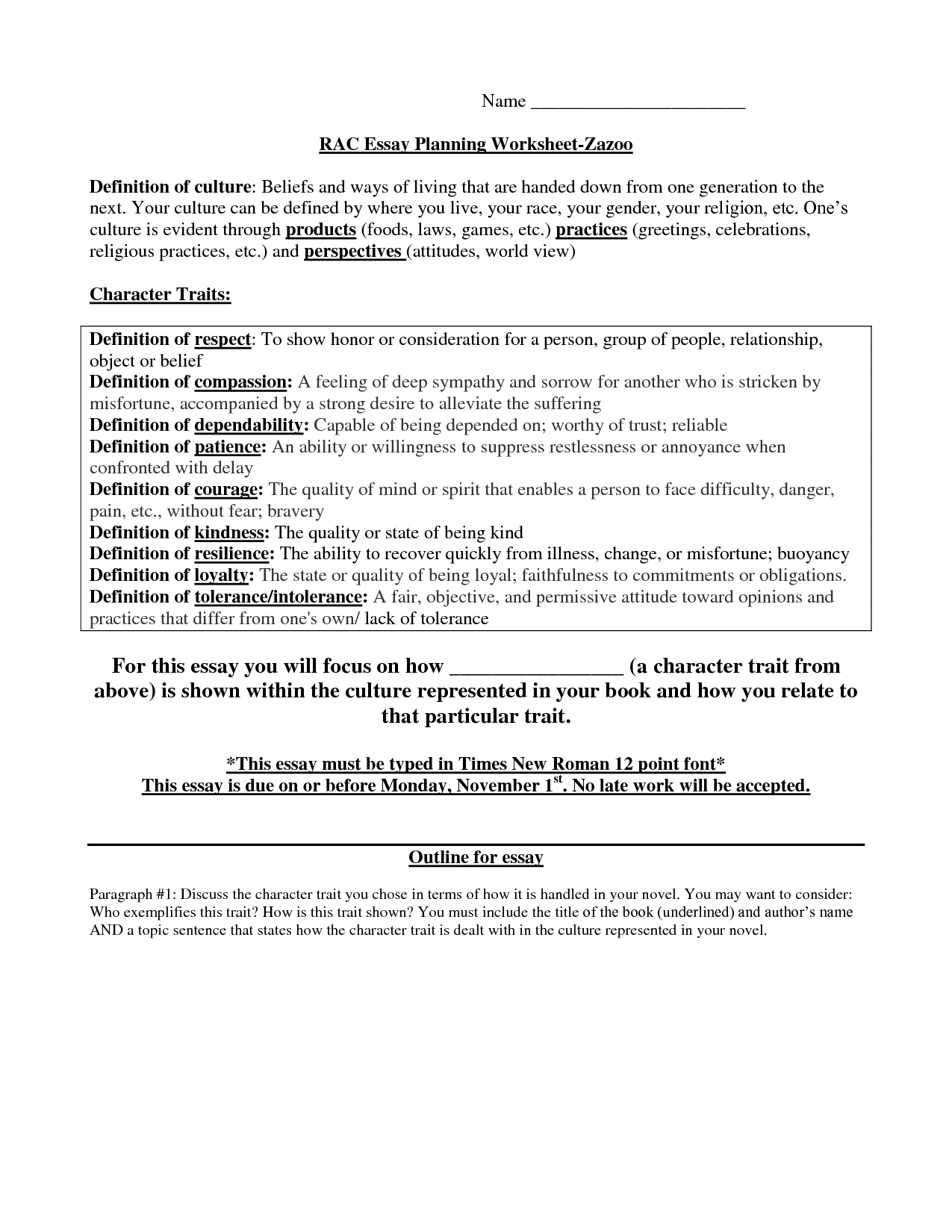

- Essay Planning Worksheet

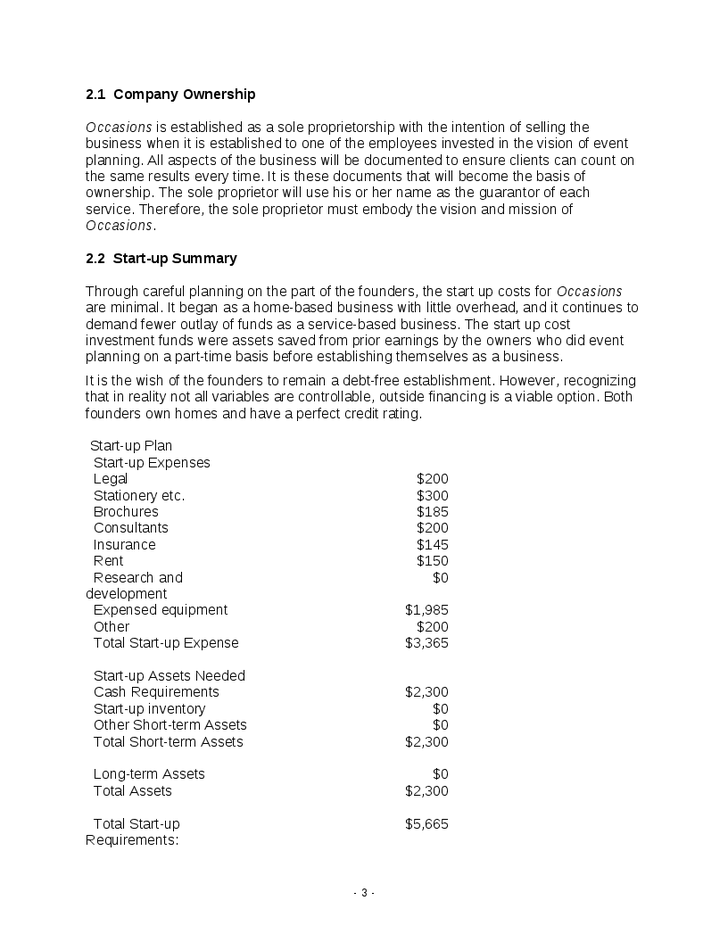

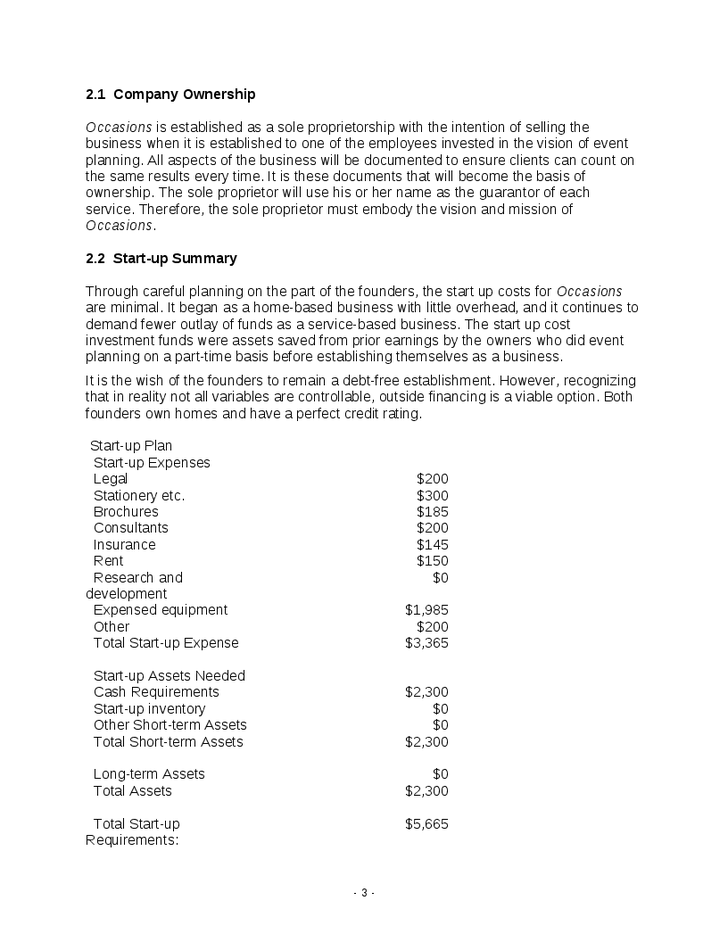

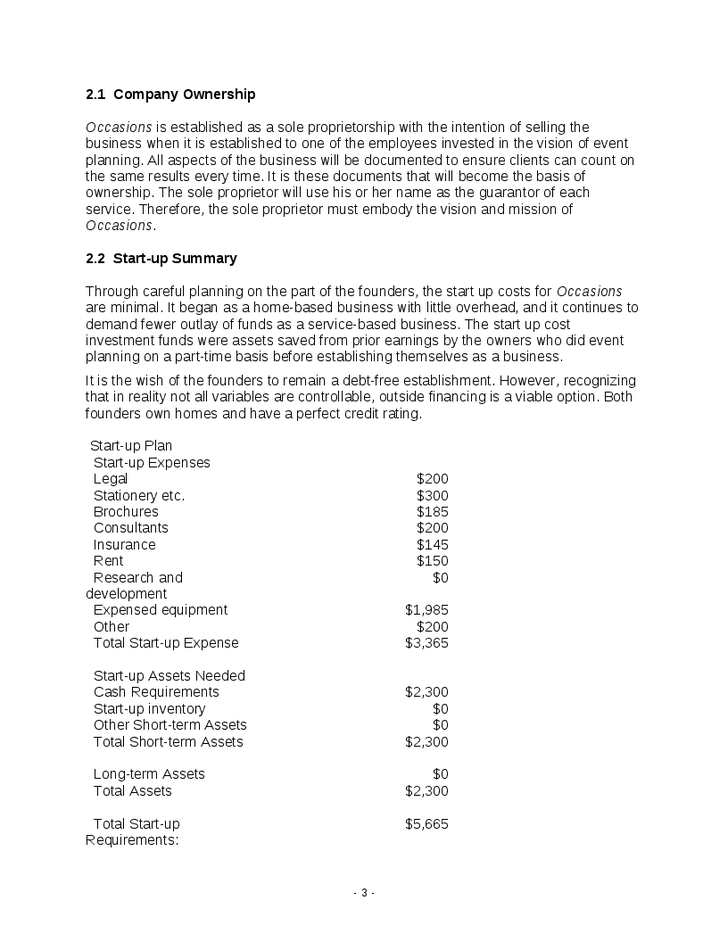

- Event Planning Business Plan

- Event Planning Business Plan

- Event Planning Business Plan

- Event Planning Business Plan

- Event Planning Business Plan

- Event Planning Business Plan

- Event Planning Business Plan

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a financial organizer worksheet?

A financial organizer worksheet is a tool used to help individuals or families organize their financial information in one central document. This worksheet typically includes sections for listing assets, liabilities, income sources, expenses, insurance policies, estate planning documents, and other important financial details. By consolidating all financial information in one place, individuals can gain a better understanding of their financial situation, track progress towards financial goals, and make informed decisions about budgeting, investments, and financial planning.

What are the main components of a financial organizer worksheet?

A financial organizer worksheet typically includes sections for personal information such as name, contact details, and financial goals, as well as sections for income and expenses, assets and liabilities, budget planning, savings goals, investment accounts, and insurance coverage. It may also include sections for retirement planning, estate planning, and other financial aspects to provide a comprehensive overview of an individual's financial situation.

How can a financial organizer worksheet help with budgeting?

A financial organizer worksheet can help with budgeting by providing a structured format to track income, expenses, and savings goals. It allows individuals to clearly see their financial situation at a glance, enabling them to prioritize spending, identify areas where they can cut back, and set realistic budgeting targets. By consistently updating and utilizing the worksheet, individuals can stay organized, monitor their progress, and make informed financial decisions to achieve their financial goals.

What information should be included in the income section of a financial organizer worksheet?

In the income section of a financial organizer worksheet, you should include sources of income such as wages/salary, bonuses, rental income, dividends, interest, retirement/pension payments, and any other regular income streams. Additionally, you should specify the frequency of each income source (e.g., monthly, quarterly), the amounts received, and the total income for each period. It is also helpful to include any other sources of variable income or one-time payments to provide a comprehensive view of your financial situation.

What types of expenses should be considered when filling out a financial organizer worksheet?

When filling out a financial organizer worksheet, it is important to consider various types of expenses such as monthly bills (rent, mortgage, utilities), transportation costs (car payments, gas, insurance), food and grocery expenses, healthcare expenses, entertainment and leisure costs, debt payments (loans, credit cards), savings contributions, and miscellaneous expenses (clothing, haircuts, subscriptions). Additionally, it is crucial to account for irregular expenses like annual memberships, vacations, or home repairs to have a comprehensive overview of your financial situation.

How can a financial organizer worksheet help with tracking monthly payments?

A financial organizer worksheet can help with tracking monthly payments by providing a detailed overview of all expenses and income in one centralized location. By inputting each payment due, its due date, and the amount, individuals can easily monitor and manage their cash flow, ensuring that all bills are paid on time and identifying any discrepancies. Additionally, having this visual representation of monthly payments can help individuals budget effectively, plan for upcoming expenses, and prioritize where their money goes each month.

What are the benefits of using a financial organizer worksheet for financial goal setting?

A financial organizer worksheet can help individuals clarify their financial goals, prioritize them, and create a structured plan to achieve them. It allows for a comprehensive overview of their current financial situation, helps track progress towards goals, and identifies areas for improvement. By consolidating all financial information in one place, it simplifies the goal-setting process and serves as a visual guide to stay focused and motivated on reaching financial milestones.

How can a financial organizer worksheet help with tracking debt and loans?

A financial organizer worksheet can help with tracking debt and loans by providing a centralized platform to list all debts and loans, including details such as the creditor, outstanding balance, interest rate, minimum payment, and due dates. By having this information in one place, individuals can easily track their debt obligations, prioritize repayments, and develop a strategy for paying off loans efficiently. This tool can also serve as a visual aid to keep individuals mindful of their financial commitments and progress towards debt reduction goals.

What information should be included in the savings and investment section of a financial organizer worksheet?

In the savings and investment section of a financial organizer worksheet, you should include details such as the account types (e.g., savings, retirement, brokerage), account numbers, financial institution names, current balances, interest rates, and any important notes or milestones related to these accounts. Additionally, you may also want to include information on investment portfolios, such as asset allocation, diversified holdings, investment goals, and any performance metrics where applicable. This section helps to track and manage your savings and investment accounts effectively.

How can a financial organizer worksheet help with identifying areas for potential cost savings?

A financial organizer worksheet can help with identifying areas for potential cost savings by providing a detailed breakdown of expenses across different categories such as utilities, groceries, transportation, and entertainment. By tracking and analyzing spending habits through the worksheet, individuals can pinpoint areas where they may be overspending or could cut back on expenses. This process allows for a clear visualization of where money is being allocated, making it easier to identify opportunities for cost savings and create a realistic budget that aligns with financial goals.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments