Financial Accounting Worksheet

A financial accounting worksheet is an essential tool for anyone tasked with managing a company's financial records and transactions. This worksheet serves as the centralized hub for recording and organizing financial data, allowing for efficient analysis and decision-making. Whether you are an accountant, business owner, or finance student, understanding how to effectively use a financial accounting worksheet is crucial for ensuring accurate and timely financial reporting.

Table of Images 👆

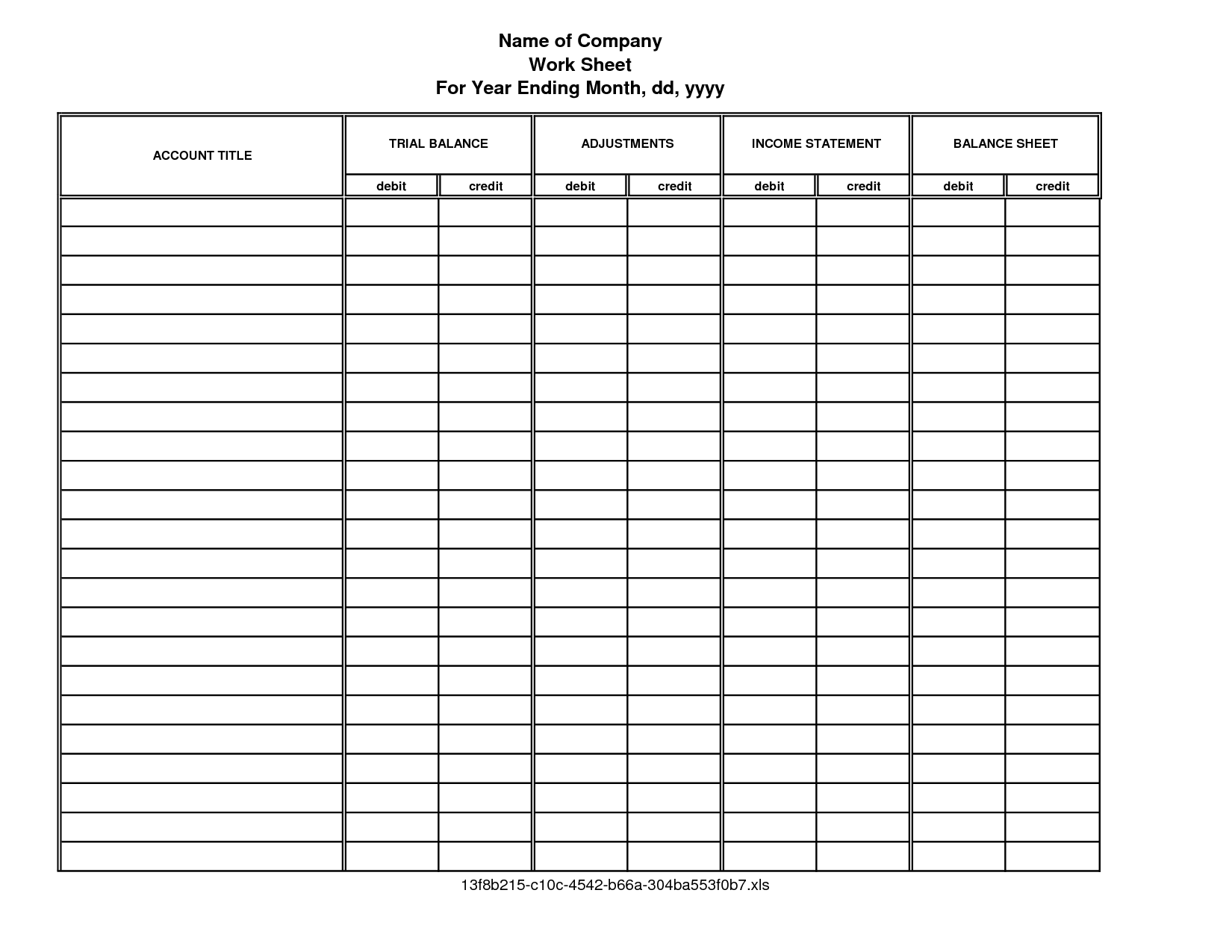

- Free Printable Accounting Ledger Sheets

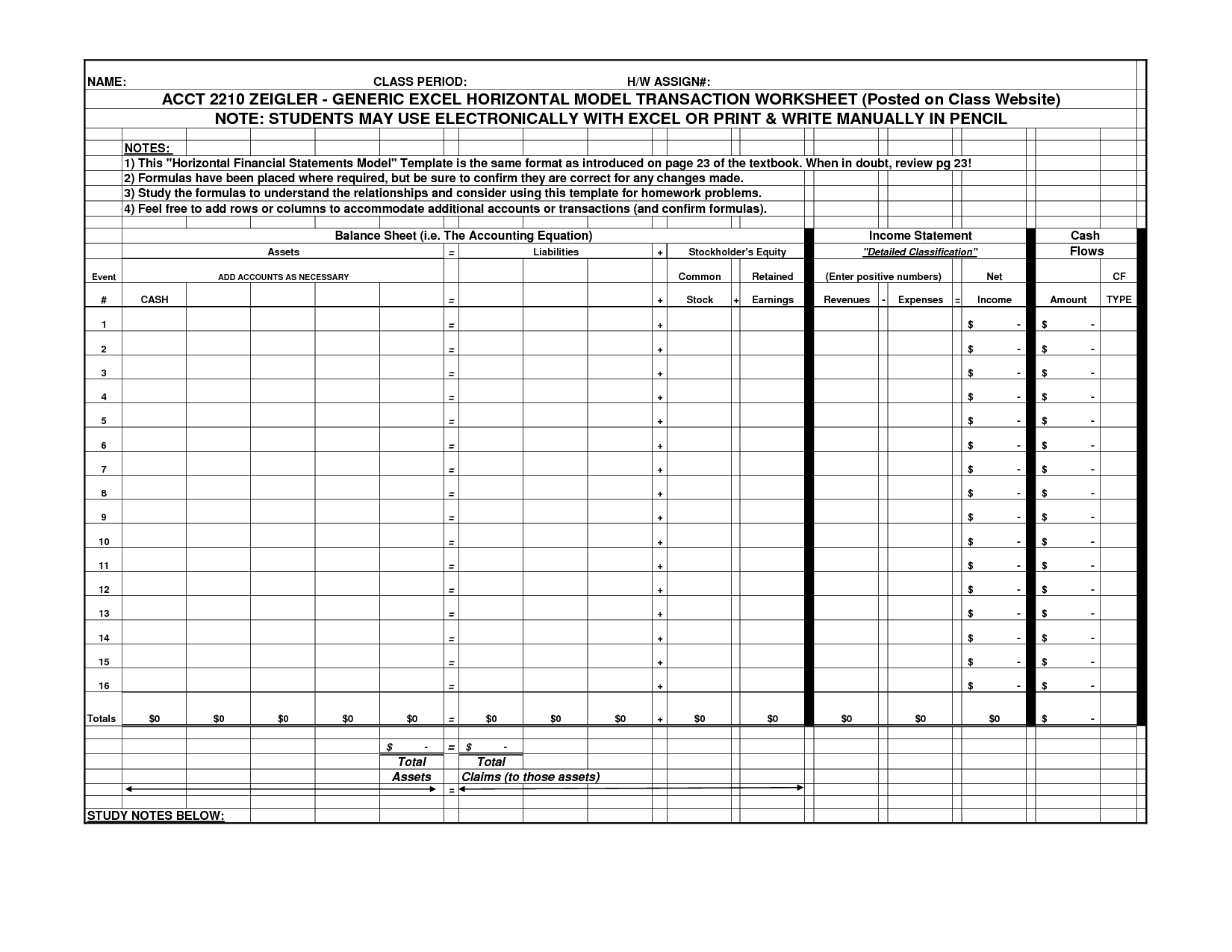

- Accounting Equation Worksheet Template

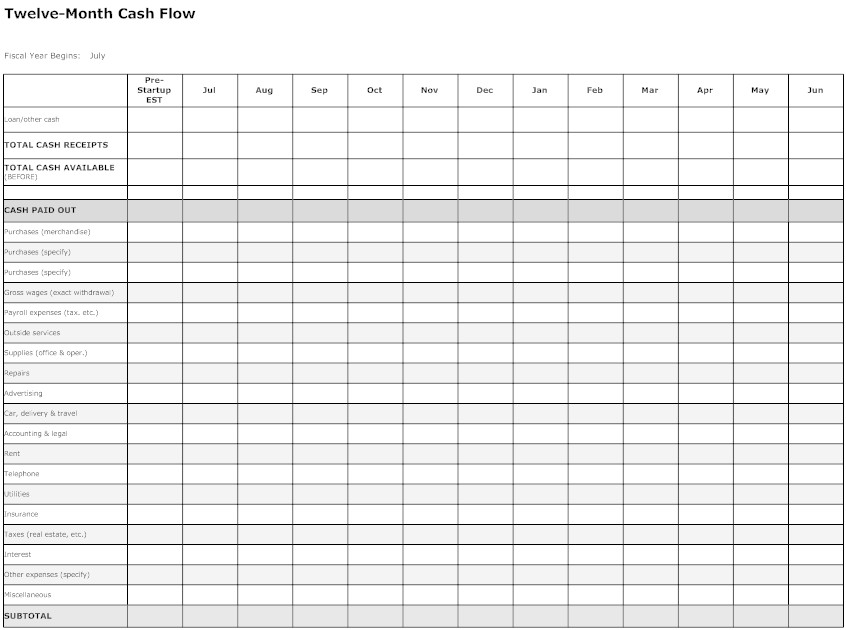

- Free Printable Cash Flow Sheets

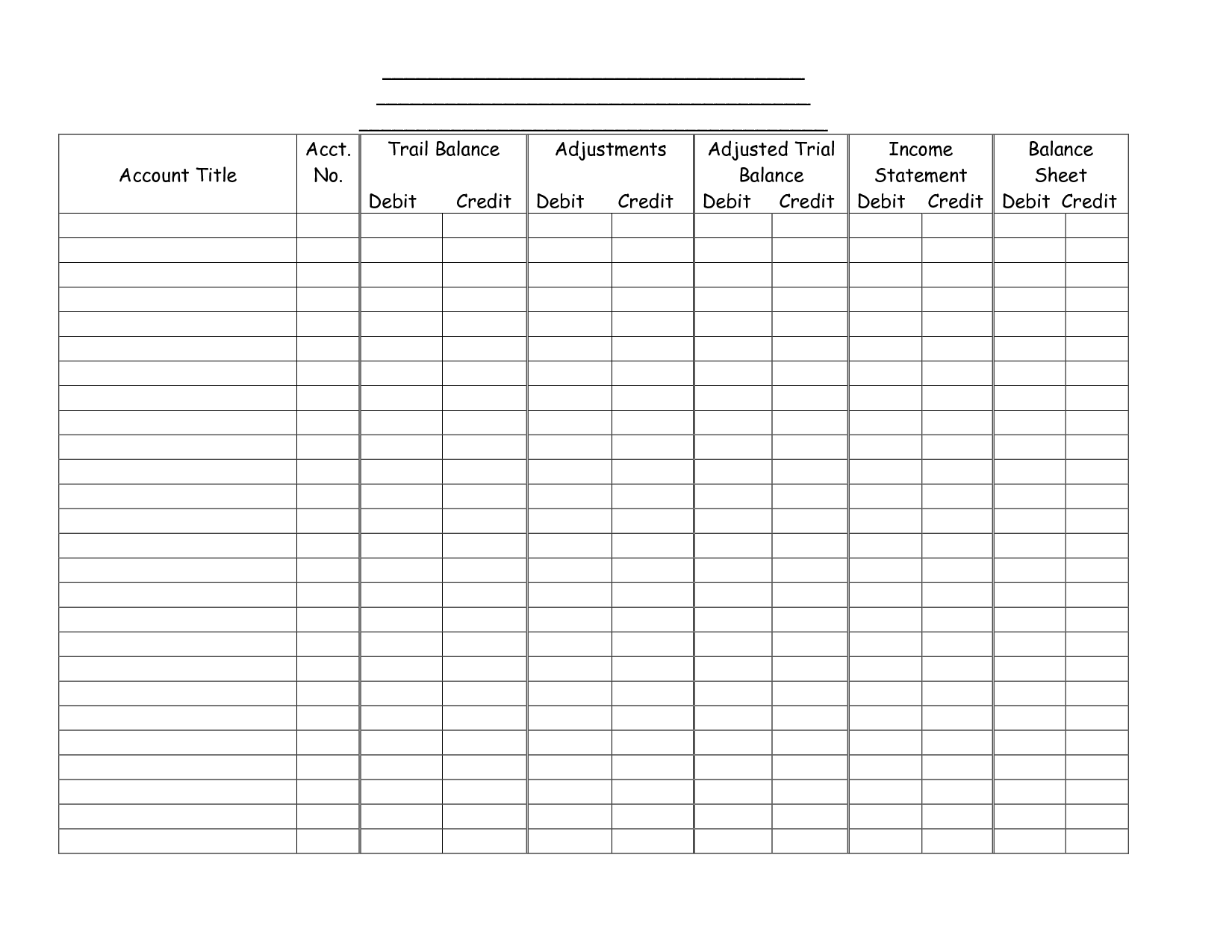

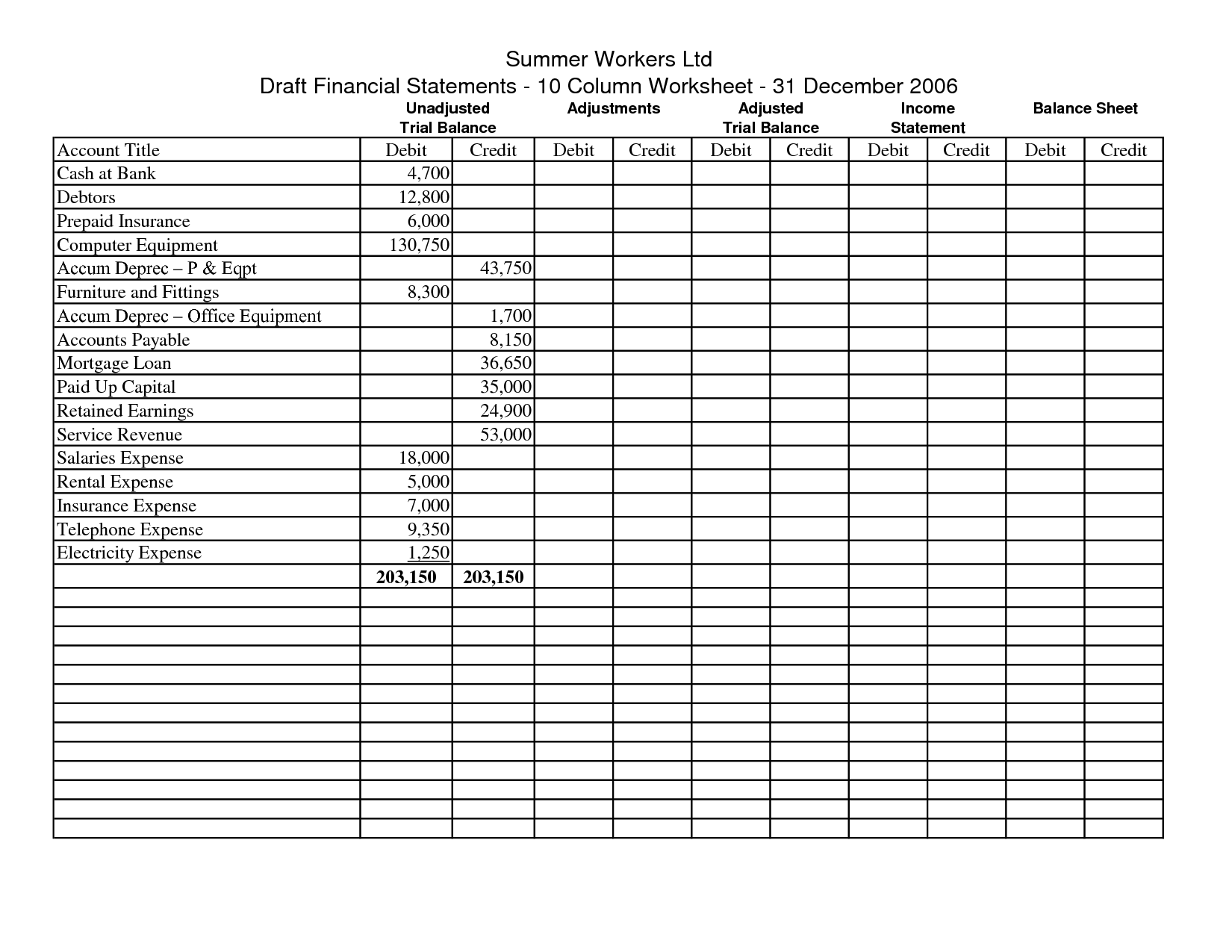

- 10 Column Worksheet Template

- Blank 10 Column Accounting Worksheet Template

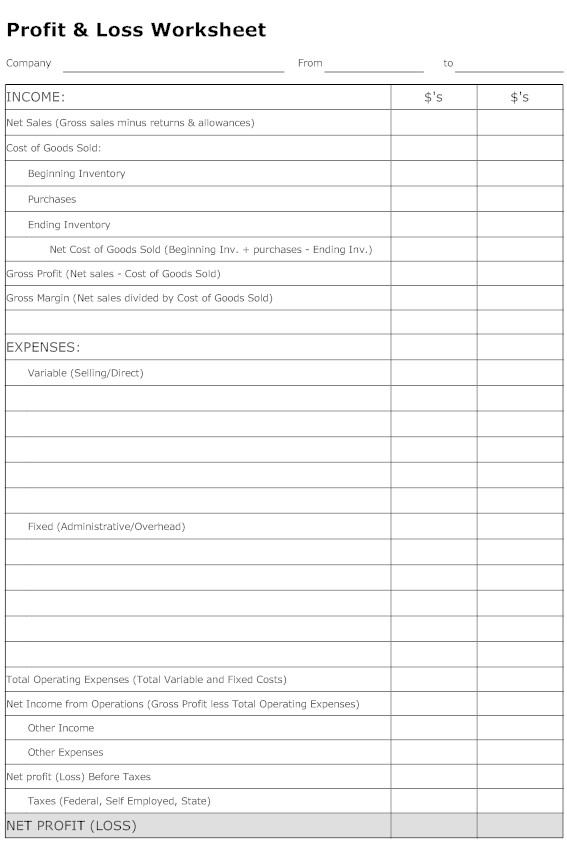

- Printable Profit and Loss Worksheet

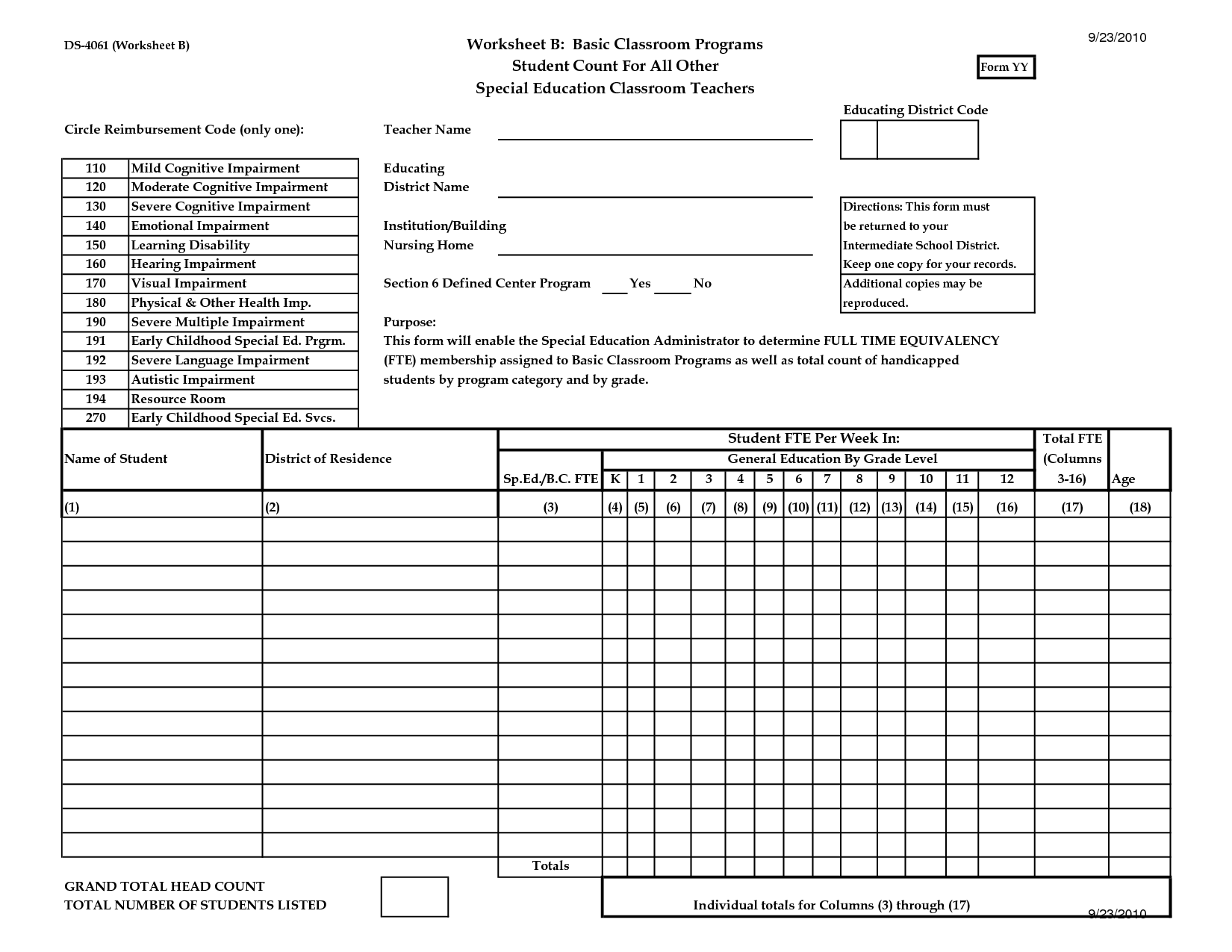

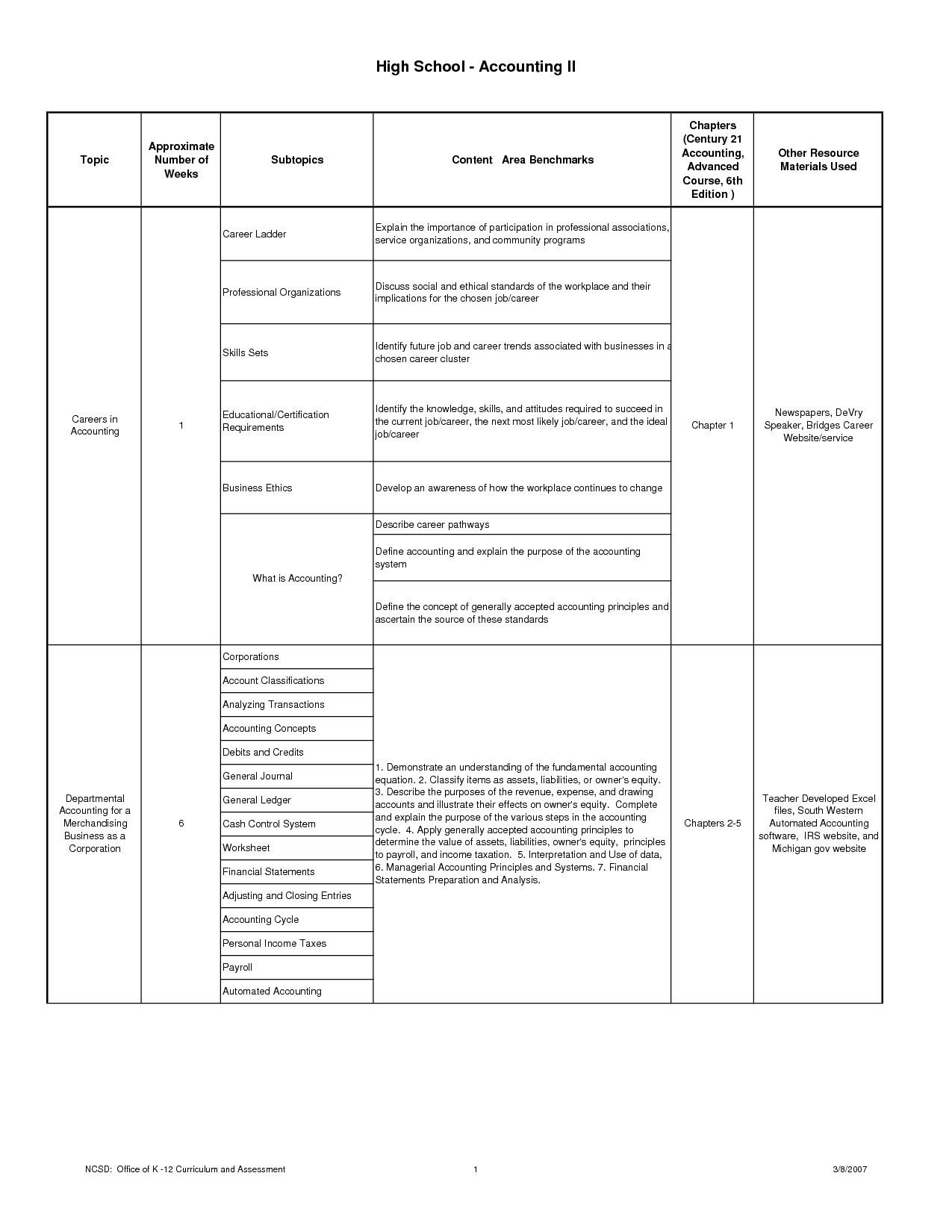

- Basic Accounting Worksheet Template

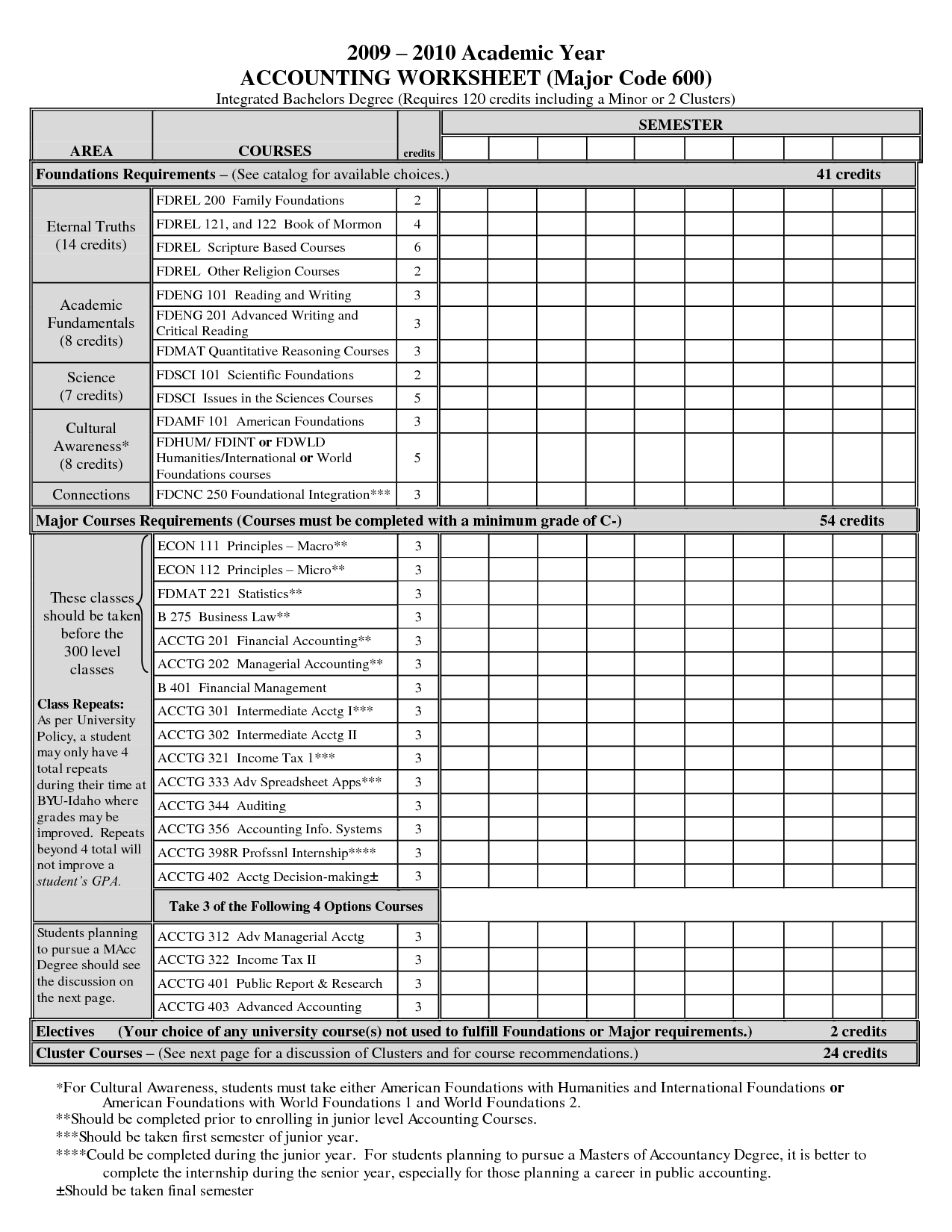

- Accounting Worksheet Template

- Blank Accounting Worksheets

- Free Printable Accounting Worksheets

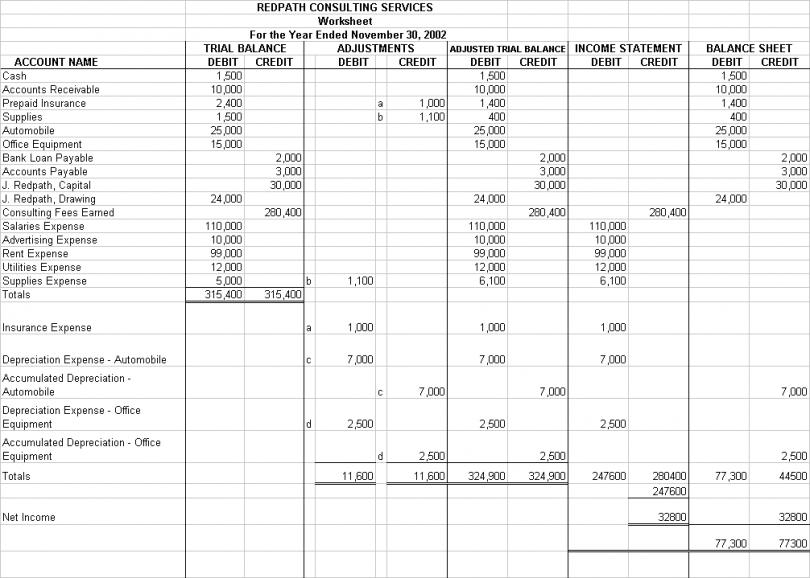

- Accounting Worksheet Example

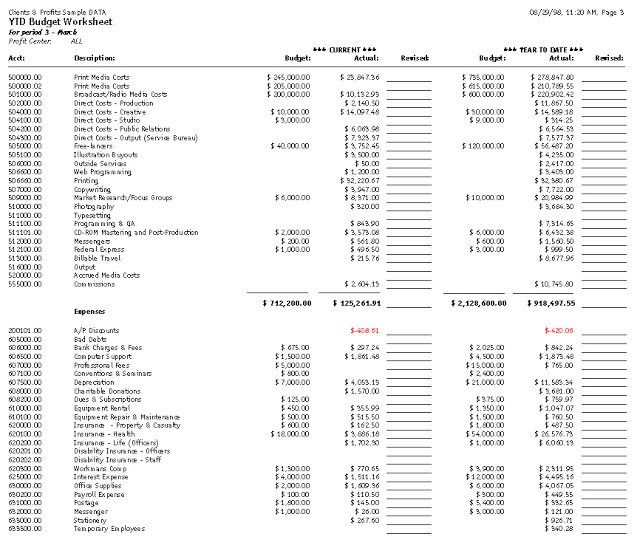

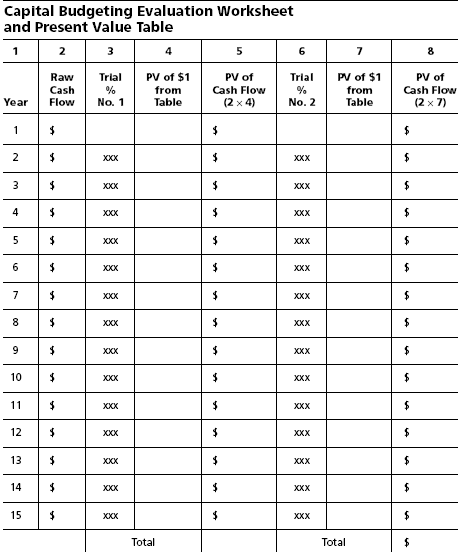

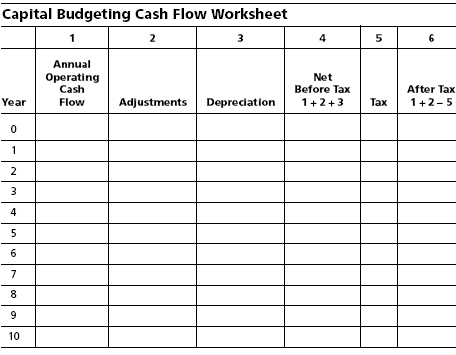

- Capital Budget Worksheet

- 10 Column Accounting Worksheet Example

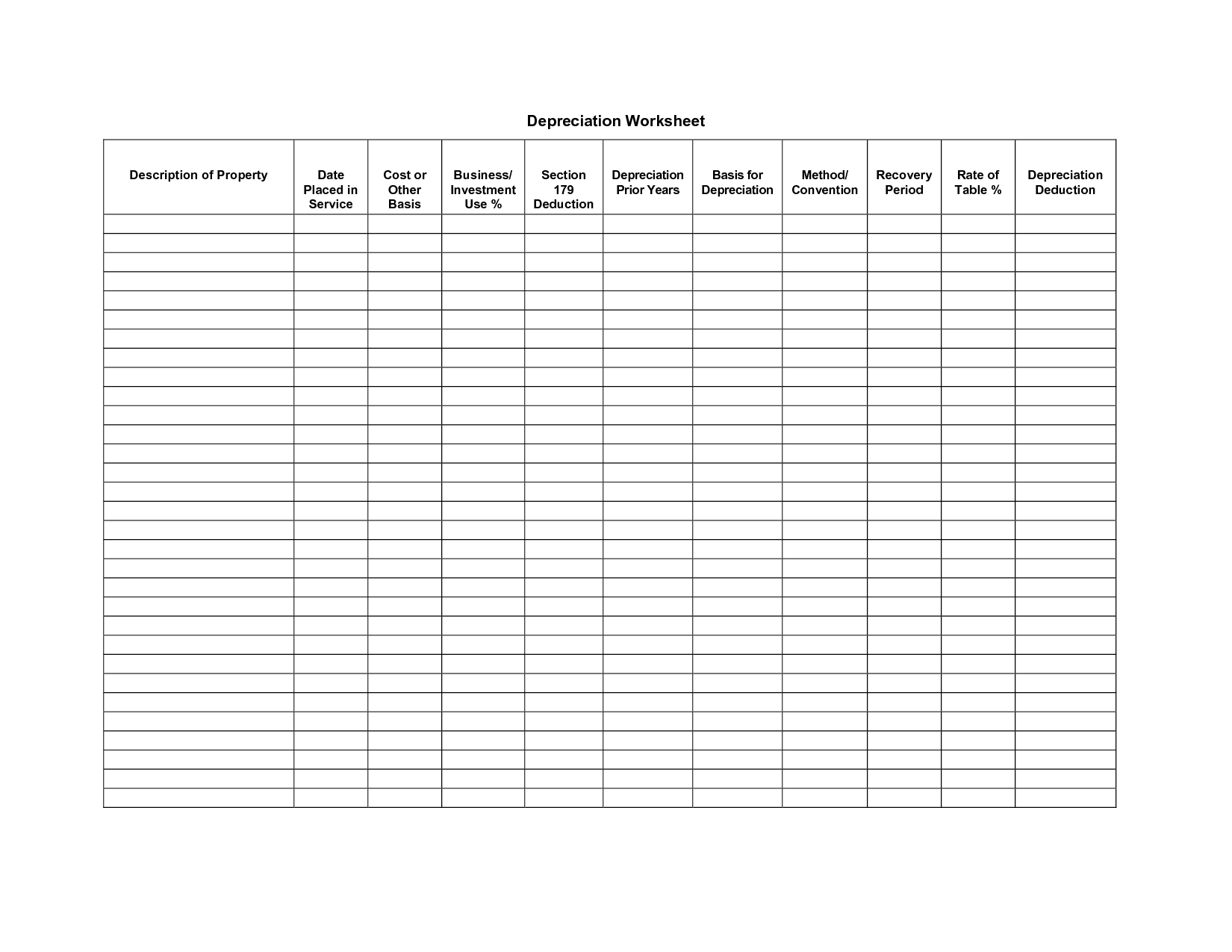

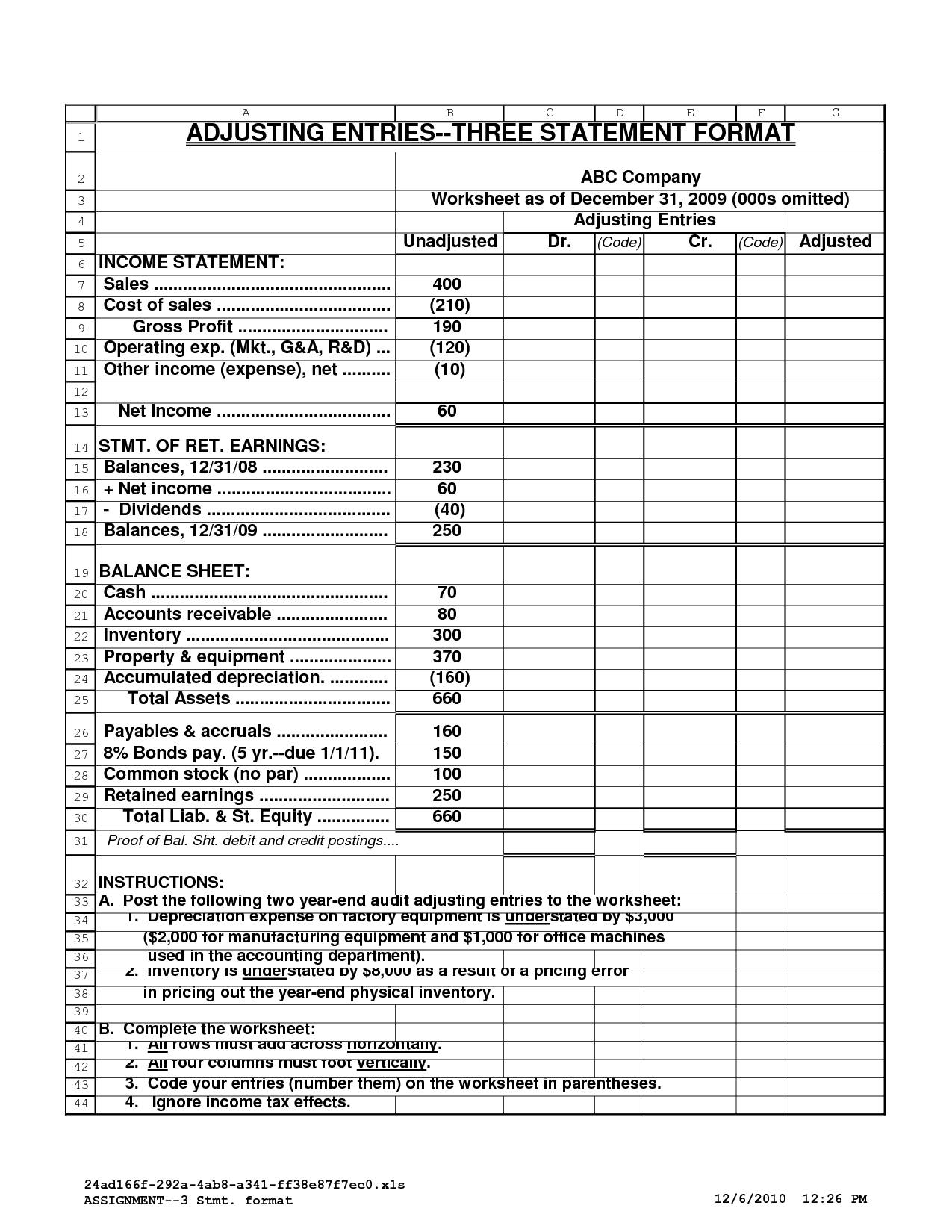

- Adjusting Entry Accounting Worksheet

- Cash Flow Capital Budgeting Worksheet

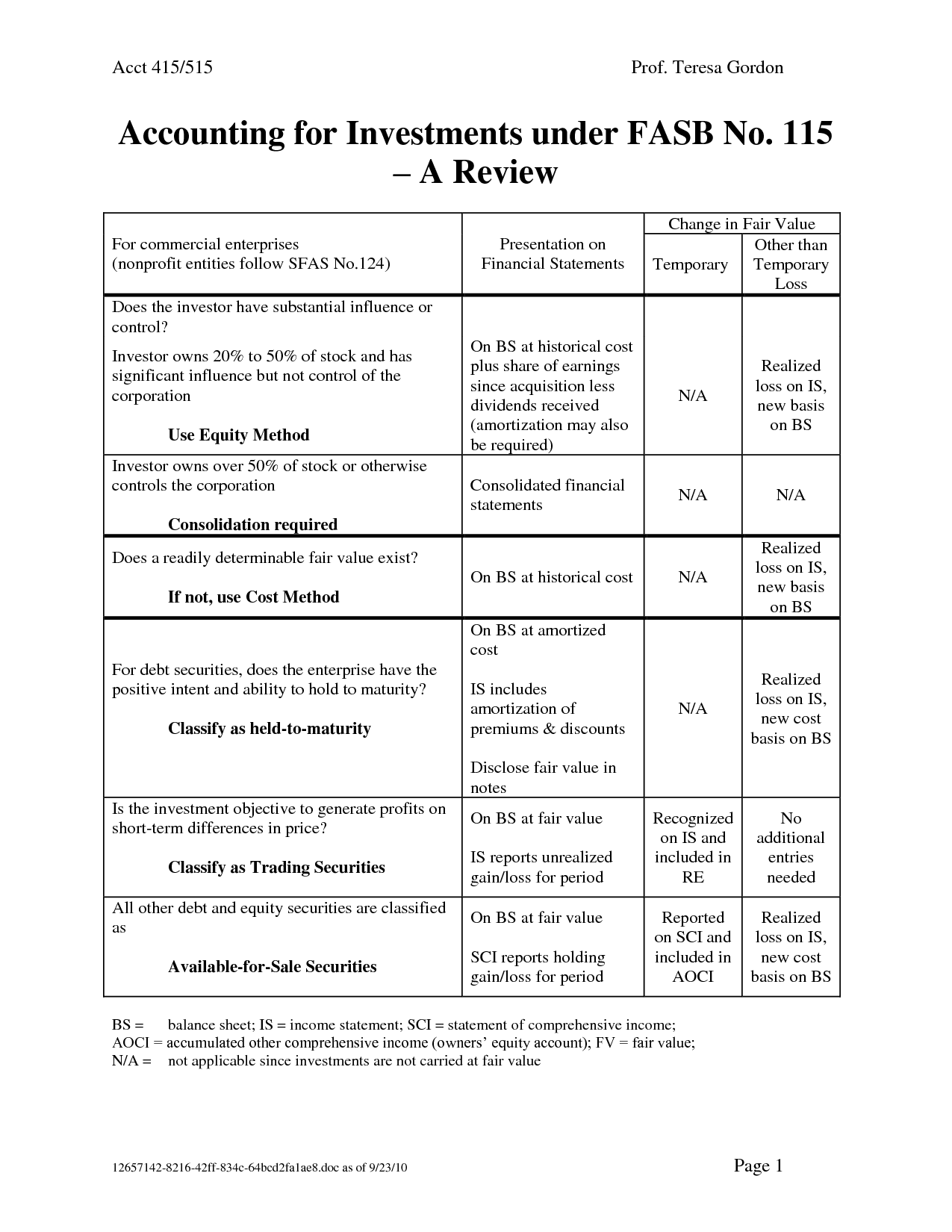

- Basic Accounting Balance Sheet Sample

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a financial accounting worksheet?

A financial accounting worksheet is a tool used by accountants to organize and summarize financial information for a specific accounting period. It typically includes columns for account names, trial balance amounts, adjustments, adjusted trial balance amounts, income statement amounts, and balance sheet amounts. The worksheet helps accountants ensure that all financial transactions are accurately recorded and that the financial statements are prepared correctly before finalizing them.

What is the purpose of a financial accounting worksheet?

A financial accounting worksheet is a tool used by accountants to organize and summarize the financial information needed for the preparation of financial statements. It helps in adjusting entries, ensuring accuracy of data, and assessing the financial health of a business before finalizing the financial statements. It serves as an intermediary step in the accounting process to ensure that all transactions are properly recorded and classified before they are transferred to the financial statements.

What components are typically included in a financial accounting worksheet?

A financial accounting worksheet typically includes a trial balance, adjusting entries, adjusted trial balance, income statement, balance sheet, and closing entries. These components help in organizing financial information and analyzing the financial position and performance of a business.

How is a financial accounting worksheet different from other financial statements?

A financial accounting worksheet is a tool used to prepare financial statements, while other financial statements such as the income statement, balance sheet, and cash flow statement are the end products that show the financial performance and position of a company. The worksheet is an internal document that helps organize and summarize accounting data before it is transferred to the financial statements, providing a detailed breakdown of account balances and adjustments that may not be directly reflected in the final statements themselves.

What are the benefits of using a financial accounting worksheet?

Financial accounting worksheets help businesses organize and summarize their financial information, making it easier to prepare financial statements, analyze performance, and make informed decisions. They provide a structured way to record transactions, track accounts, and ensure accuracy in financial reporting. Additionally, worksheets can help identify errors, monitor trends, and maintain a comprehensive financial record for auditing and regulatory compliance purposes.

How often should a financial accounting worksheet be prepared?

A financial accounting worksheet should typically be prepared on a monthly basis in order to track and analyze financial transactions, ensure accurate financial reporting, and make informed business decisions based on up-to-date financial data.

Who typically prepares a financial accounting worksheet?

A financial accounting worksheet is typically prepared by an accountant or a financial analyst within an organization. The purpose of this document is to summarize financial data, organize income and expenses, and calculate key financial metrics to aid in decision-making and financial reporting.

What types of transactions are recorded in a financial accounting worksheet?

In a financial accounting worksheet, various types of transactions are recorded, including sales revenue, expenses, assets purchases, liabilities, equity contributions or withdrawals, and overall changes in financial position. These transactions are crucial for accurately determining a company's financial health and generating financial statements such as the income statement, balance sheet, and cash flow statement.

How does a financial accounting worksheet help in financial analysis and decision-making?

A financial accounting worksheet helps in financial analysis and decision-making by providing a detailed overview of a company's financial data in a structured format. It allows for the comparison of different financial metrics, such as revenues, expenses, assets, and liabilities, which enables stakeholders to identify trends, patterns, and potential areas of improvement. This insight aids in making informed decisions about the financial health of the company, as well as determining strategies for future growth and investment opportunities.

Can a financial accounting worksheet be used for budgeting purposes?

While a financial accounting worksheet is typically used for organizing and analyzing financial information to prepare financial statements, it could also be adapted for budgeting purposes. By utilizing the worksheet's structure and categories, it is possible to track income, expenses, and projected amounts to create a budget. However, it may lack some specialized features found in budgeting tools, so it's important to ensure it meets the specific needs of budgeting before using it for this purpose.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments