Business Tax Deductions Worksheet

Are you a small business owner who wants to maximize their tax deductions? Look no further than the Business Tax Deductions Worksheet. This comprehensive worksheet is designed to simplify the process of tracking and categorizing business expenses, ensuring that you capture every eligible deduction. Whether you're a sole proprietor or have a team of employees, this worksheet will help you organize your expenses and save money on your tax bill.

Table of Images 👆

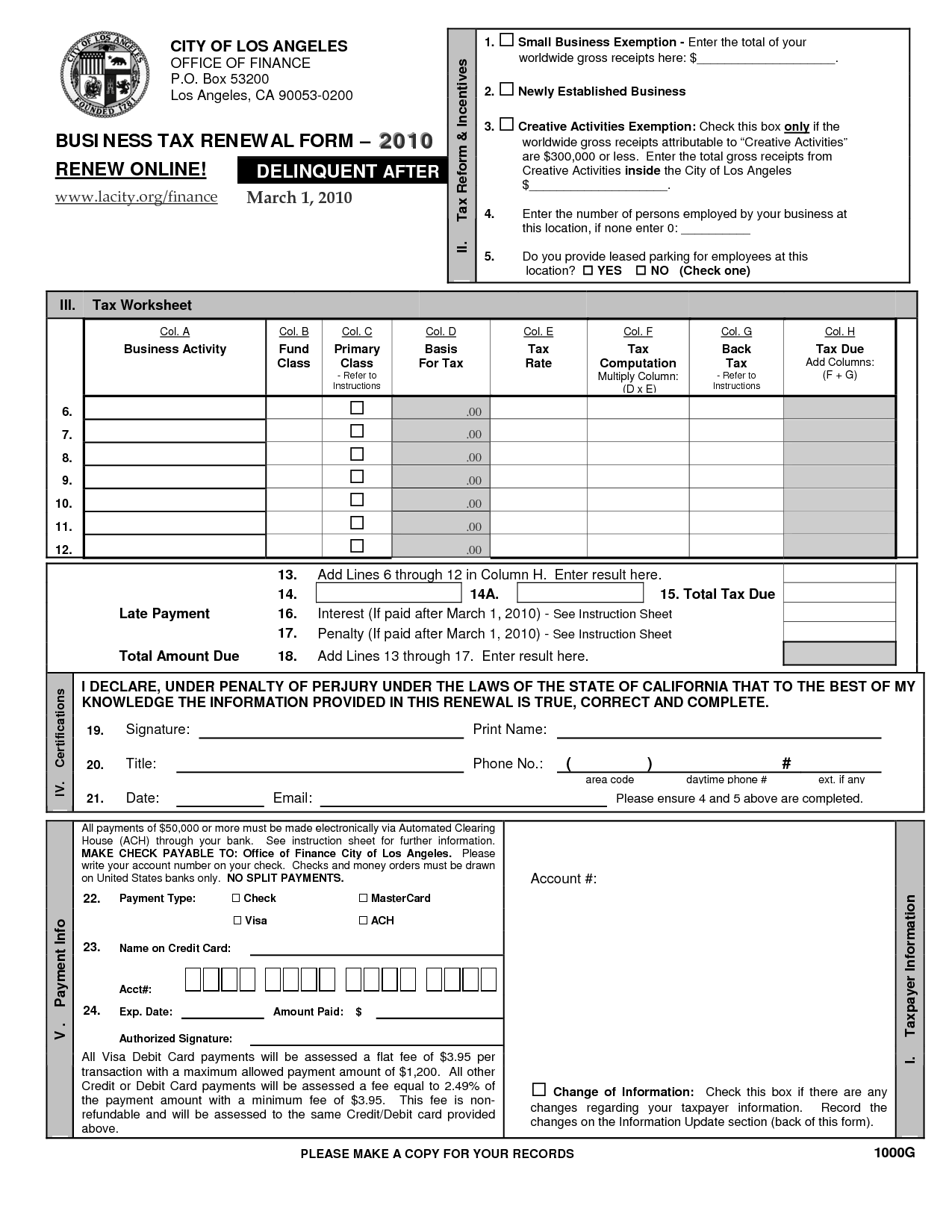

- Tax Itemized Deduction Worksheet

- Los Angeles Business Tax Registration Certificate

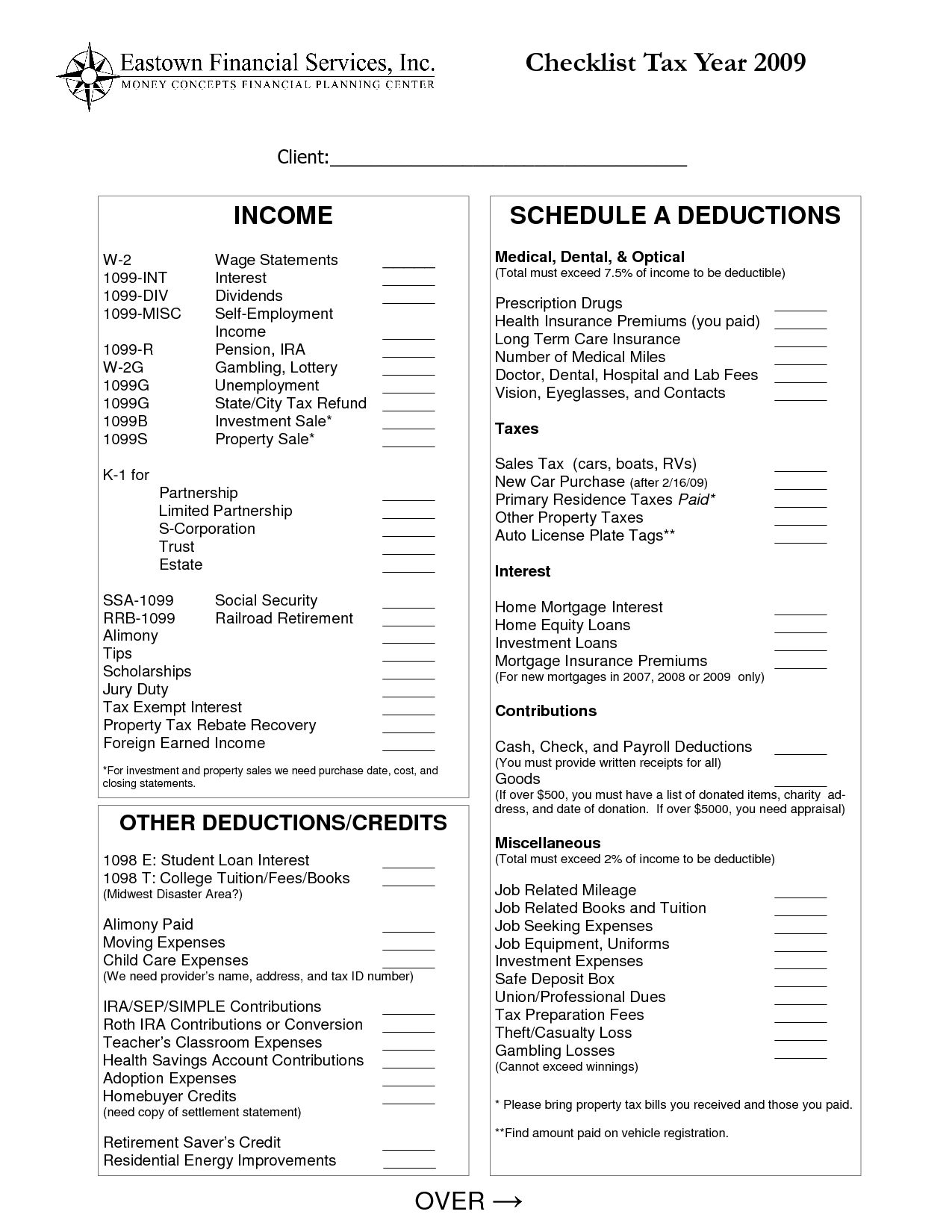

- Tax Preparation Information Sheet

- Printable Tax Deduction Checklist

- W 4 Federal Tax Form

- Budget Chart Examples

- Clothing Inventory Sheet Template

- Printable Log Sheet Template

- Printable Log Sheet Template

- Printable Log Sheet Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a business tax deduction?

A business tax deduction is an expense that a business can deduct from its taxable income, thereby reducing the amount of income that is subject to taxation. These deductions can include expenses such as rent, utilities, supplies, salaries, and other operational costs that are necessary for the business to operate. By claiming tax deductions, businesses can lower their overall tax liability and potentially increase their after-tax profits.

How can a business determine its eligible tax deductions?

A business can determine its eligible tax deductions by diligently tracking all business expenses throughout the year, categorizing them according to IRS guidelines, and keeping thorough records to substantiate each deduction claimed. It is essential for businesses to seek advice from a tax professional or accountant who can provide guidance on allowable deductions, as tax laws and regulations can be complex and subject to change. Additionally, staying informed about any tax incentives or credits that may apply to the specific industry or type of business can help maximize tax deductions.

What types of expenses are commonly deductible for businesses?

Commonly deductible expenses for businesses include employee wages, rent for business premises, supplies and materials, utilities, insurance premiums, advertising and marketing costs, travel expenses, professional fees for services such as accounting or legal advice, depreciation of assets, and interest on business loans. It is important for businesses to keep detailed records and consult with a tax professional to ensure that they are accurately claiming all eligible deductions.

Are there any specific requirements or rules for claiming tax deductions?

Yes, there are specific requirements and rules for claiming tax deductions. Some common requirements include having eligible expenses, keeping accurate records, meeting income thresholds, and using the correct deduction form. It is important to consult with a tax professional or the IRS guidelines to ensure compliance and maximize your potential deductions.

Can a business deduct expenses incurred before officially starting its operations?

Yes, a business can generally deduct expenses incurred before officially starting its operations as long as those expenses were incurred in the process of setting up the business. These expenses are considered "start-up costs" and may be eligible for deduction once the business is operational. It's important to keep detailed records of these expenses and consult with a tax professional to ensure proper documentation and deduction.

What is the difference between a business expense and a capital expense?

A business expense is a cost incurred in the normal course of operations to generate revenue and is typically deductible for tax purposes in the year it is incurred. On the other hand, a capital expense is an investment in assets that have a useful life beyond the current fiscal year and is usually not deducted in full in the year of purchase but is depreciated or amortized over time. In general, business expenses are related to day-to-day operations, while capital expenses are for long-term assets that provide future benefits.

Can a business deduct expenses related to employee salaries and benefits?

Yes, a business can generally deduct expenses related to employee salaries and benefits as they are considered ordinary and necessary for conducting business operations. These expenses are typically categorized as operating expenses and are deductible for tax purposes, subject to certain limitations and regulations. It is important for businesses to accurately track and document these expenses to ensure compliance with tax laws.

Are there any limitations on the amount of deductions a business can claim?

Yes, there are limitations on the amount of deductions a business can claim. The Internal Revenue Service sets rules and limits on the types and amounts of deductions that a business can claim, including restrictions on certain categories of expenses, limitations based on the business's income level, and regulations on what qualifies as a deductible business expense. It is important for businesses to understand these limitations and work with a tax professional to ensure compliance with the rules.

Can a business deduct expenses for travel and entertainment?

Yes, generally businesses can deduct expenses for travel and entertainment that are ordinary and necessary for carrying out their trade or business, as long as the expenses are directly related to or associated with the business. However, there are certain limitations and requirements set by the IRS for deducting these expenses, including keeping accurate records and receipts. Consulting with a tax professional or accountant can help ensure proper compliance with tax laws and regulations.

How does a business keep track of its tax deductions throughout the year?

A business can keep track of its tax deductions throughout the year by maintaining organized records of all expenses that are eligible for deductions, such as receipts, invoices, and financial statements. Utilizing accounting software or hiring a professional accountant can help track deductible expenses accurately and ensure compliance with tax regulations. Regularly reviewing financial records and consulting with a tax advisor can also help identify additional deductions and optimize tax savings for the business.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments