Budget Worksheet Self-Employed

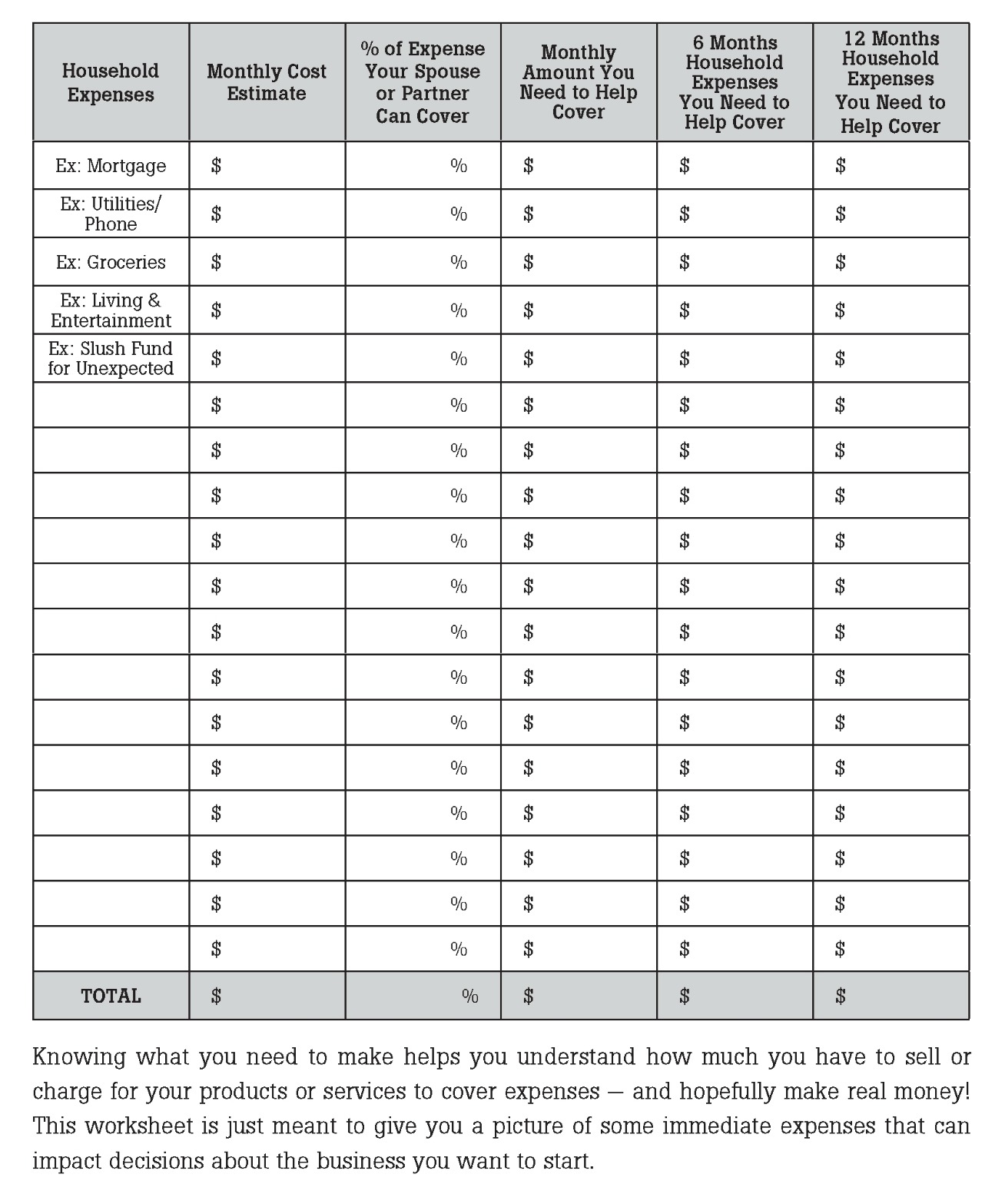

The budget worksheet is an essential tool for self-employed individuals seeking to gain control over their finances. With this simple and powerful entity, you can easily track your income and expenses in order to better manage your business's financial health. By providing a clear overview of your financial situation, this subject allows you to make informed decisions and allocate resources effectively. Whether you're just starting out or have been self-employed for years, the budget worksheet is an invaluable resource for managing your personal and business expenses.

Table of Images 👆

- Make a Budget Worksheet

- Hair Salon Business Worksheet

- Self-Employed Income Expense Worksheet

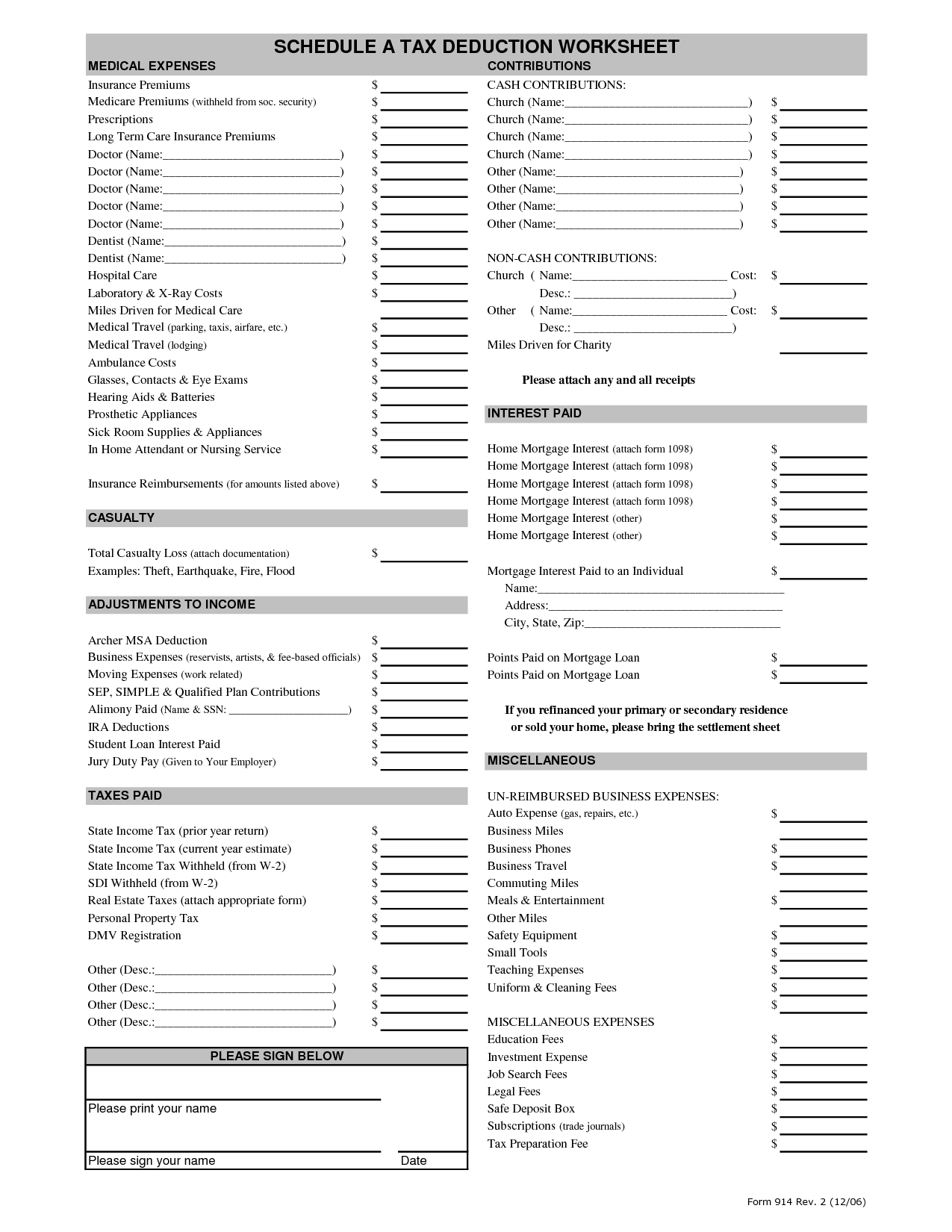

- Tax Deduction Worksheet

- Business Income and Expense Report Template

- Self Employment Income Worksheet Template

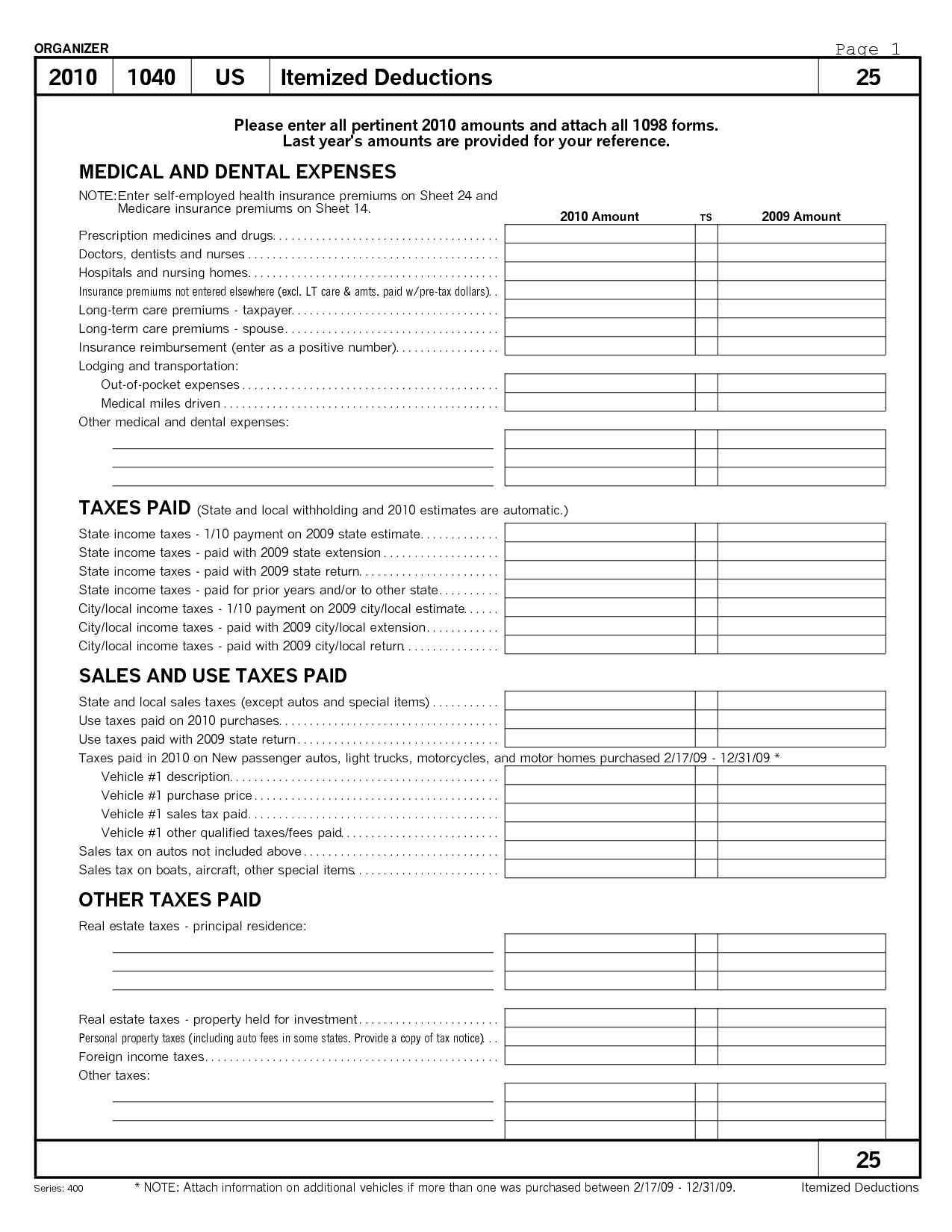

- 2015 Itemized Tax Deduction Worksheet Printable

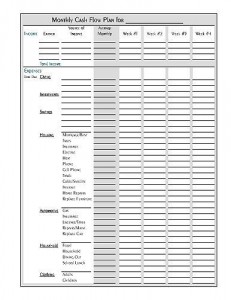

- Monthly Income Profit Loss Statement Worksheet

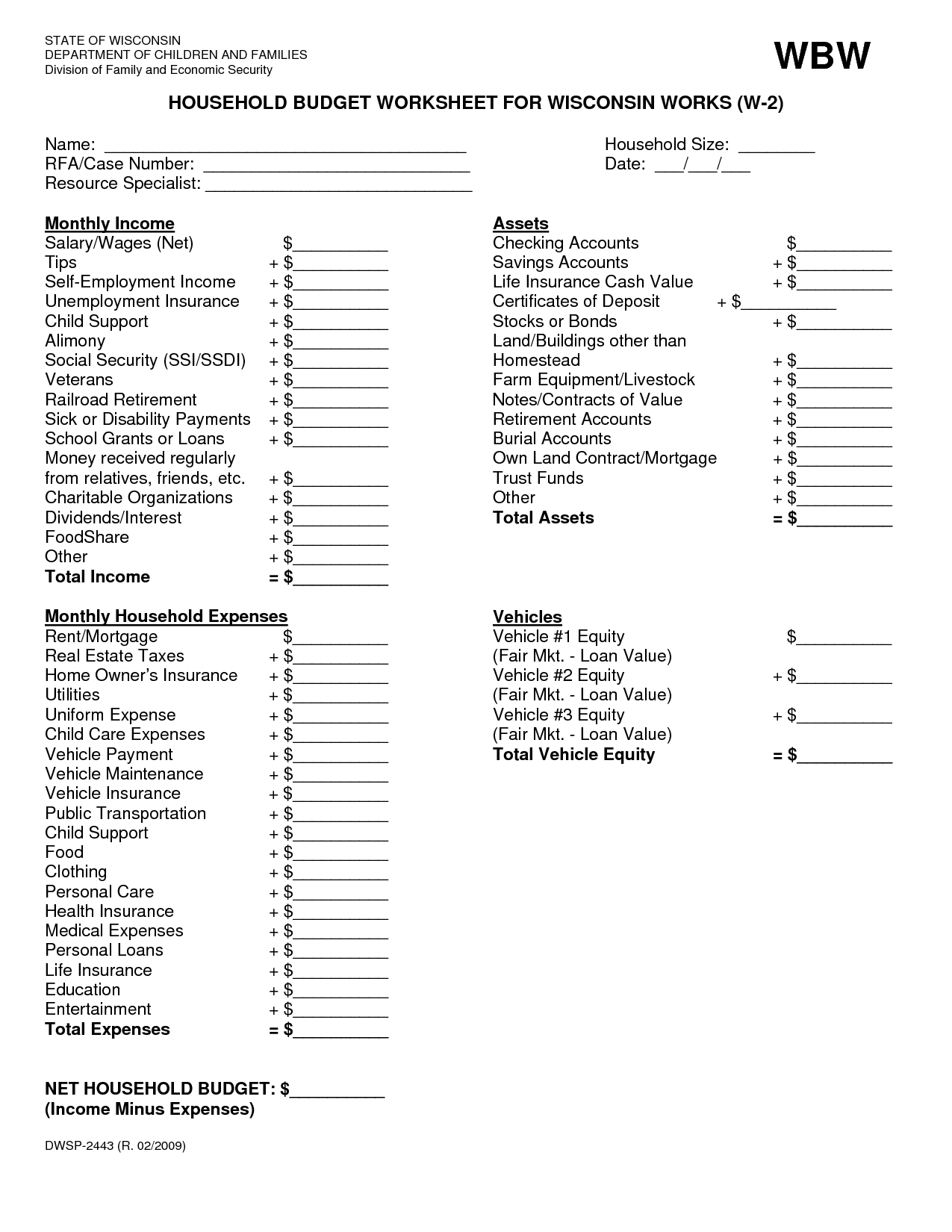

- Sample Household Budget Worksheet

- Printable Household Budget Worksheets

- Income Tax Self-Employed Expenses Template

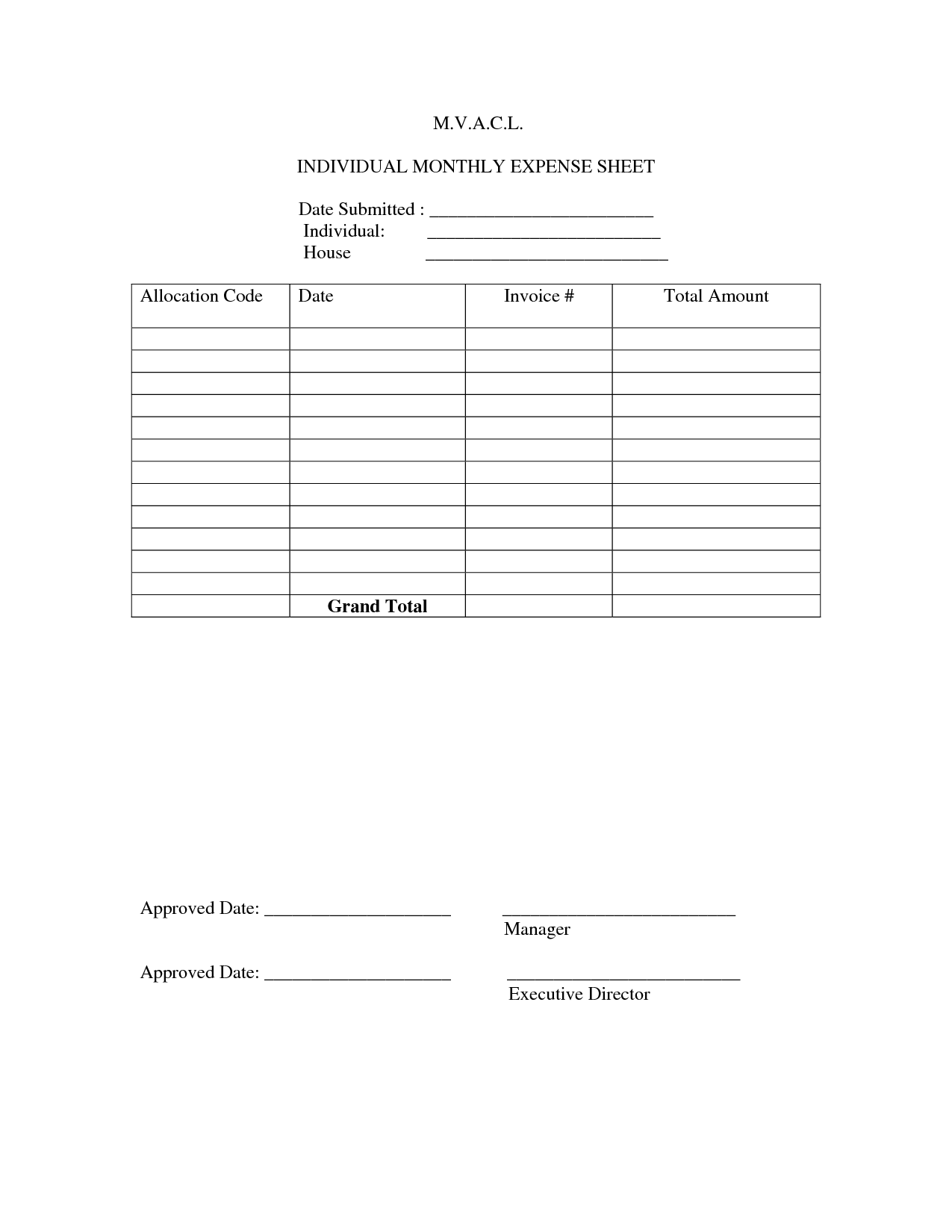

- Monthly Business Expense Sheet

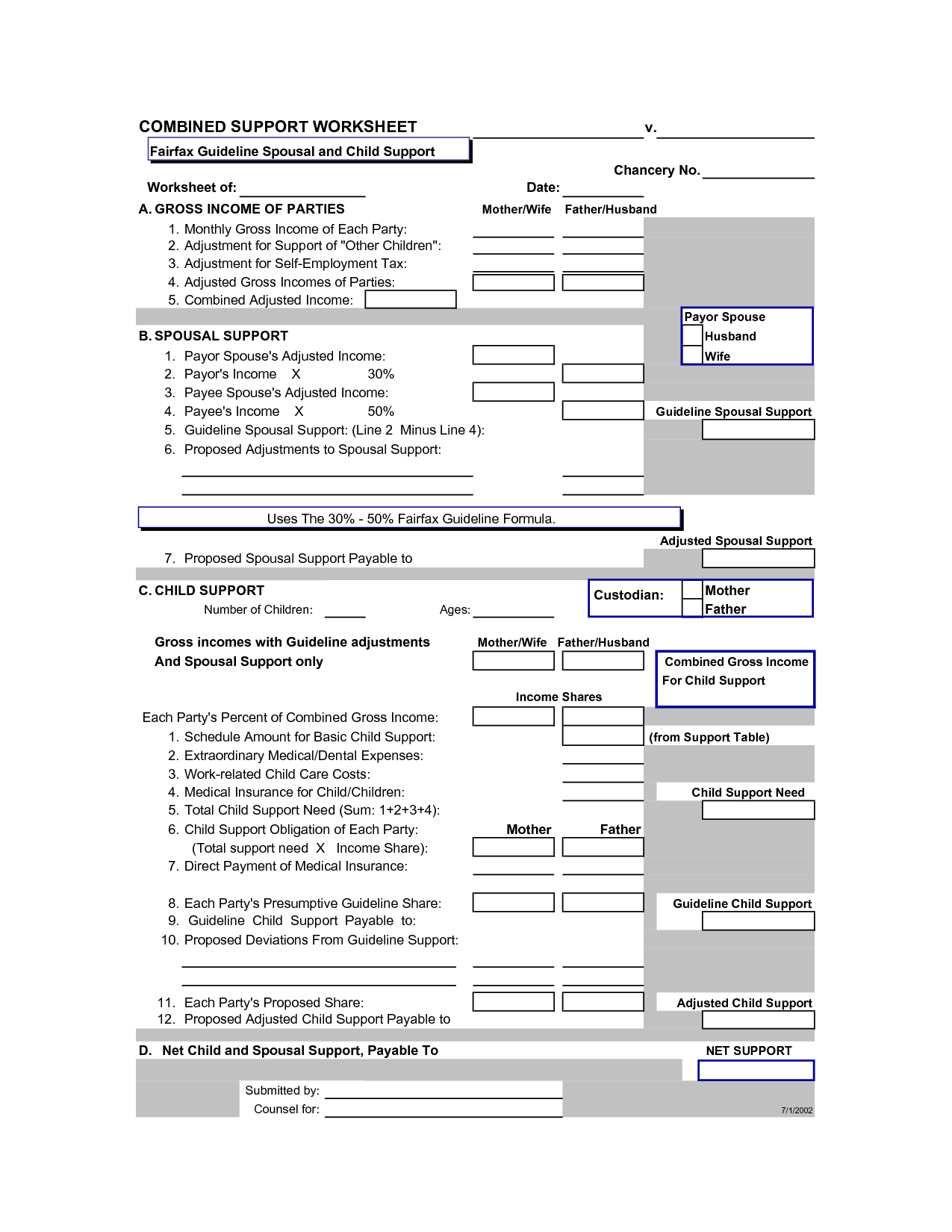

- Child Support Guidelines Worksheet

- Business Tax Deductions Worksheet

- Schedule C Worksheet

- Monthly Income and Expense Sheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a budget worksheet for self-employed individuals?

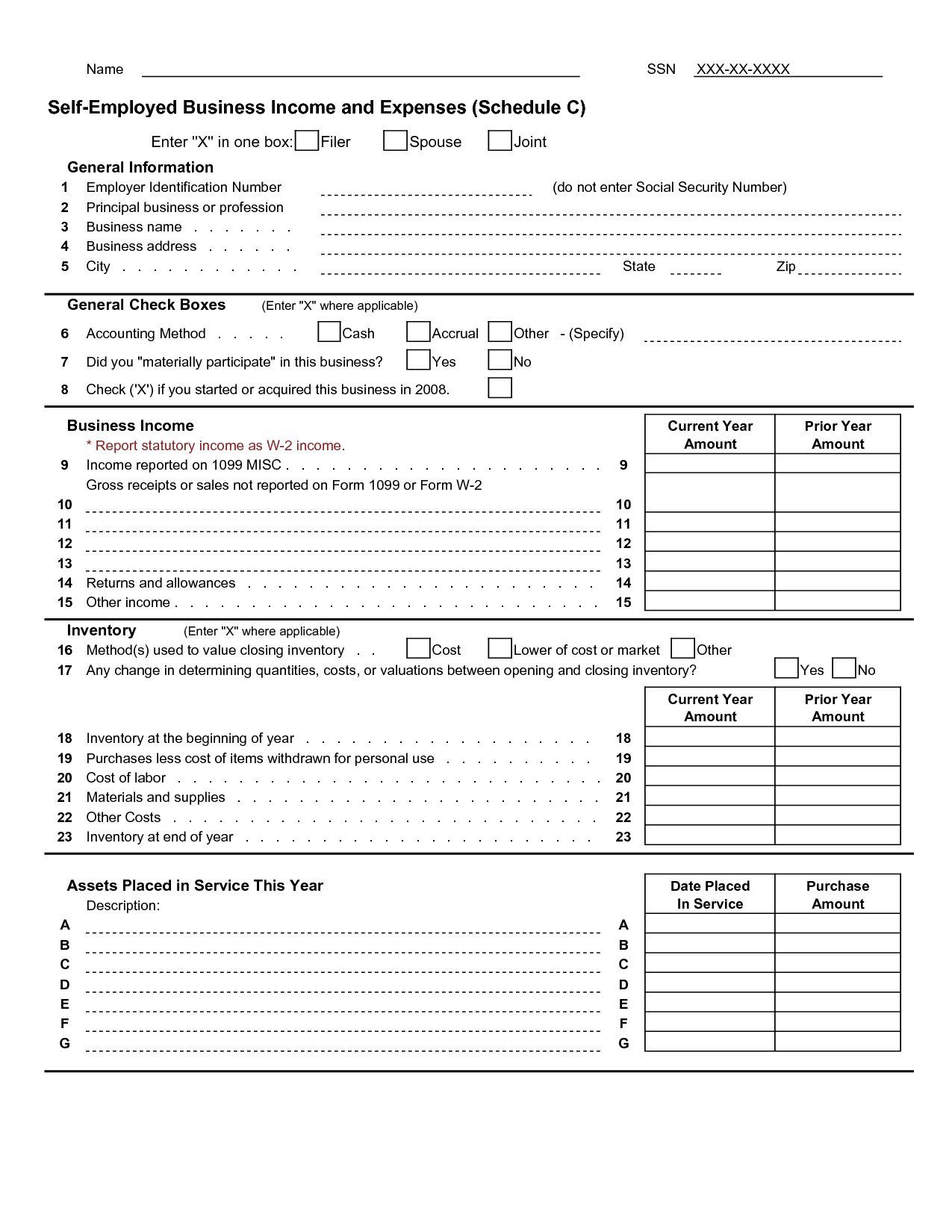

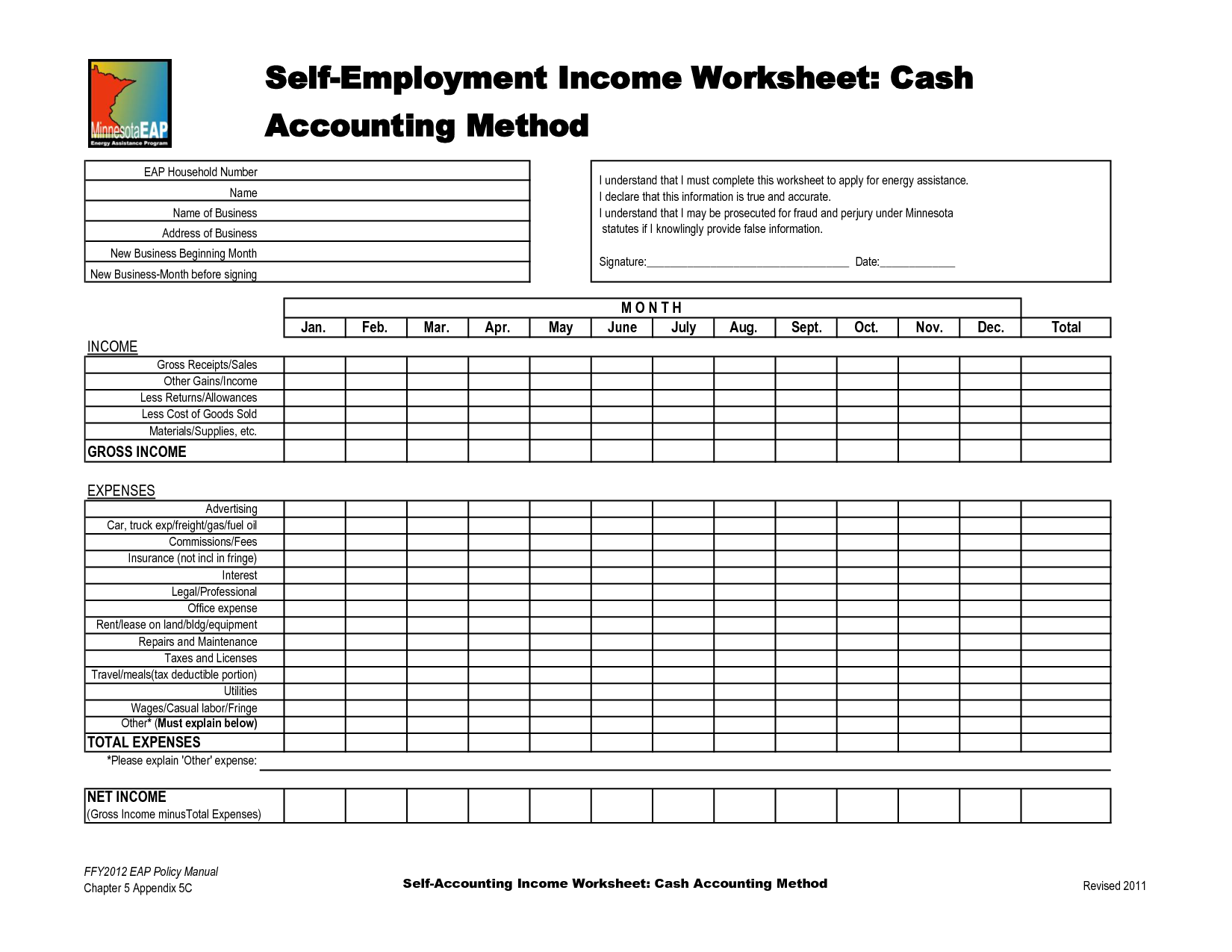

A budget worksheet for self-employed individuals is a tool to track income and expenses, plan for taxes, allocate funds for savings, and set financial goals. It typically includes sections for income sources, such as freelance work or business revenue, as well as expenses like office supplies, utilities, and self-employment taxes. By creating and using a budget worksheet, self-employed individuals can gain clarity on their finances, make informed decisions, and ensure they are managing their money effectively in their business endeavors.

How can a budget worksheet help self-employed individuals manage their finances?

A budget worksheet can help self-employed individuals manage their finances by providing a clear overview of their income and expenses, allowing them to track their cash flow, identify potential areas for cost savings, and make informed decisions on financial priorities. By utilizing a budget worksheet, self-employed individuals can set financial goals, maintain a structured financial plan, and ensure they are maximizing their earning potential while effectively managing their expenses. It serves as a tool to keep track of finances, make informed financial decisions, and achieve long-term financial stability.

What are some common categories included in a budget worksheet for self-employed individuals?

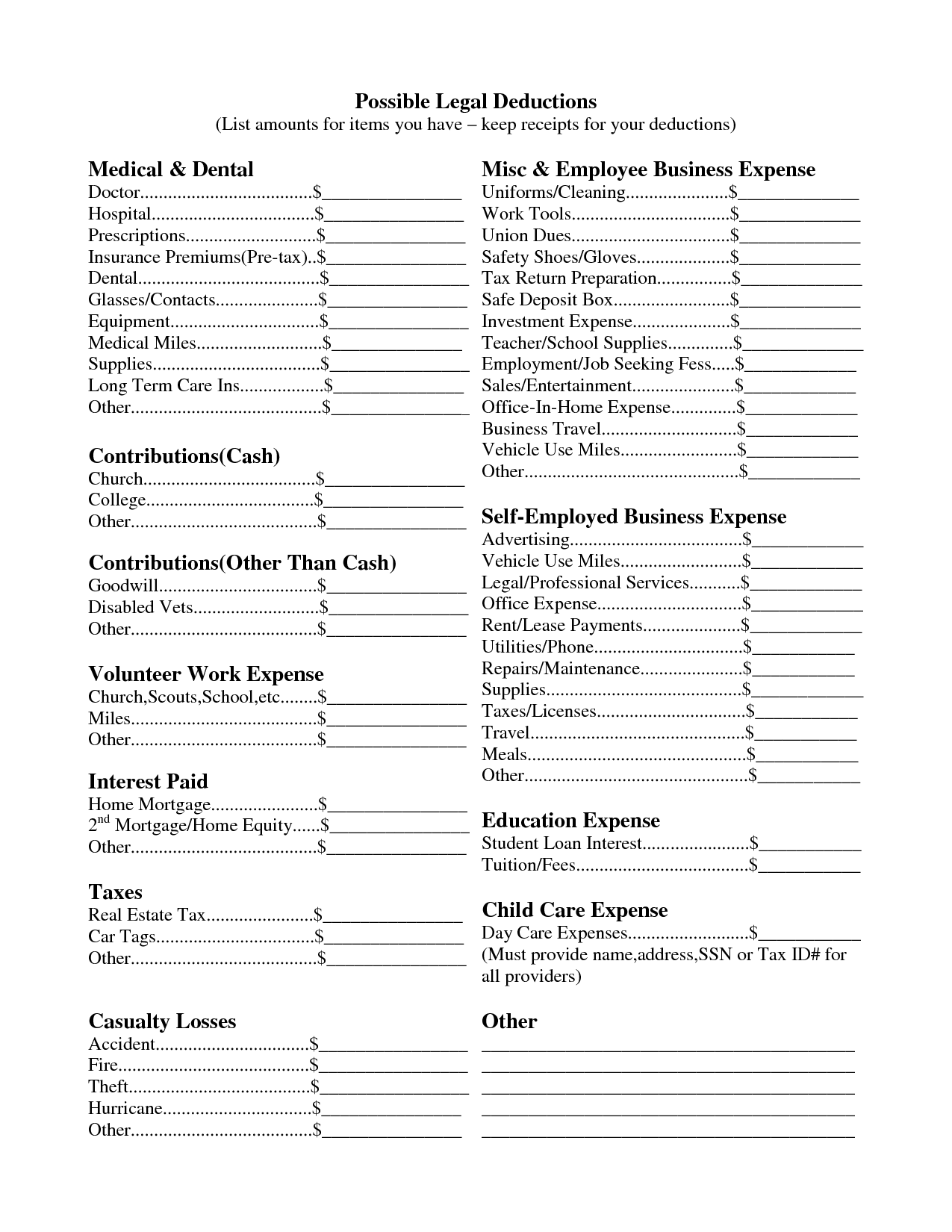

Common categories included in a budget worksheet for self-employed individuals typically consist of income sources, business expenses (such as supplies, equipment, marketing), home office expenses, business taxes, savings for emergencies or future investments, personal expenses (like housing, utilities, groceries), healthcare expenses, retirement contributions, and any other relevant categories specific to an individual's financial situation.

How often should self-employed individuals update their budget worksheet?

Self-employed individuals should ideally update their budget worksheet at least once a month to ensure accurate tracking of income and expenses. However, it is a good practice to review and adjust the budget whenever there are significant changes in income, expenses, or financial goals to stay on top of their finances effectively.

What are the benefits of tracking income and expenses on a budget worksheet?

Tracking income and expenses on a budget worksheet offers several benefits, such as providing a clear overview of financial inflows and outflows, enabling better financial decision-making, highlighting areas where spending can be reduced or optimized, helping to identify patterns or trends in financial behavior, and ultimately, empowering individuals to stay organized and in control of their finances for improved financial stability and long-term success.

How can a budget worksheet help self-employed individuals set financial goals?

A budget worksheet can help self-employed individuals set financial goals by providing a clear understanding of their current income, expenses, and cash flow. By tracking and categorizing their spending and revenue, self-employed individuals can identify areas where they can potentially cut costs or increase revenue. This information can then be used to create realistic financial goals, such as saving for retirement, investing in their business, or paying off debt. Additionally, a budget worksheet can help self-employed individuals monitor their progress towards their financial goals and make adjustments as needed to stay on track.

What information should be recorded in the income section of a budget worksheet for self-employed individuals?

In the income section of a budget worksheet for self-employed individuals, it is important to record all sources of income, such as revenue from clients or customers, project-based earnings, and any other forms of compensation. Additionally, include details on the frequency of payments and expected amounts to accurately track and plan for cash flow. Don't forget to account for taxes, deductions, and any fluctuating income streams to ensure a comprehensive and realistic representation of your financial situation.

What expenses should be included in a budget worksheet for self-employed individuals?

When creating a budget worksheet for self-employed individuals, it's essential to include all business-related expenses such as office rent, utilities, internet, advertising, marketing, supplies, equipment, insurance, travel expenses, professional fees, taxes, and any other costs directly related to running the business. Additionally, personal expenses like health insurance, retirement contributions, mortgage or rent, groceries, transportation, and any other personal costs should be factored in to ensure a comprehensive financial plan.

How can self-employed individuals use their budget worksheet to identify areas where they can reduce expenses?

Self-employed individuals can use their budget worksheet to identify areas where they can reduce expenses by analyzing their spending habits. They can start by categorizing all their expenses such as office rent, utilities, supplies, subscriptions, taxes, and marketing, and then comparing these expenses to their income. By pinpointing where the majority of their money is going, they can prioritize which expenses are necessary for their business and which ones can be reduced or eliminated. This process helps them make informed decisions about where to cut costs and identify areas where they can potentially save money.

What are some tips for effectively using a budget worksheet as a self-employed individual?

When using a budget worksheet as a self-employed individual, start by accurately tracking your income and expenses each month to understand your financial situation. Be sure to include all sources of income and categorize expenses such as business costs, taxes, and personal expenses. Regularly review and update your budget worksheet to ensure it aligns with your financial goals and adjust as necessary. Additionally, consider setting aside funds for savings and emergencies and prioritize paying yourself a salary from your earnings to avoid cash flow issues. Finally, utilize budgeting tools and resources available online to help streamline and simplify the budgeting process.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments