Budget Worksheet Dave Ramsey

Dave Ramsey Budget Worksheet is a helpful tool designed to assist individuals in effectively managing their finances. It provides a structured format for organizing expenses, income, and financial goals. This worksheet is especially beneficial for those who are looking to take control of their money and work towards financial freedom.

Table of Images 👆

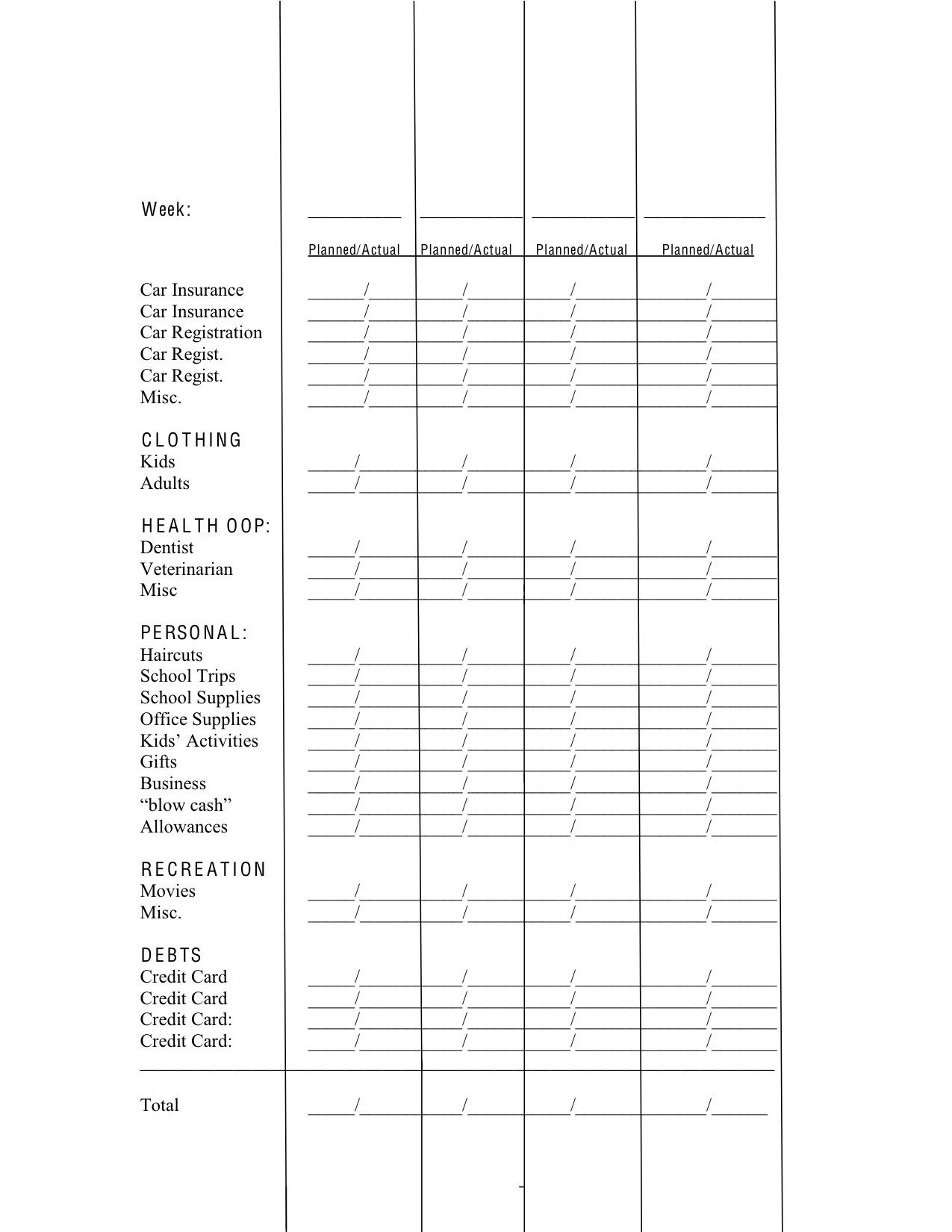

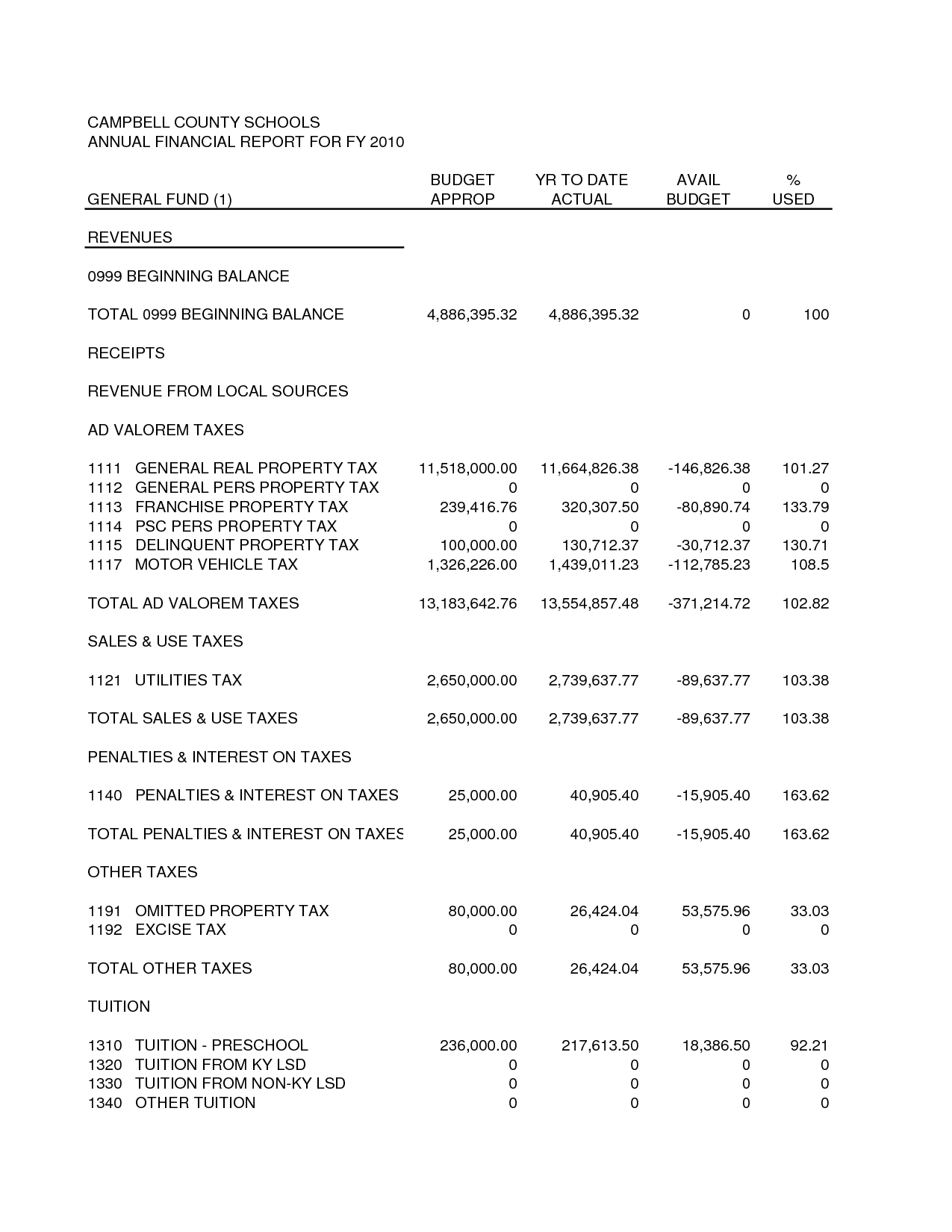

- Dave Ramsey Budget Worksheet PDF

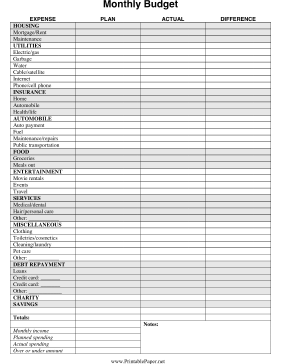

- Printable Monthly Budget Paper

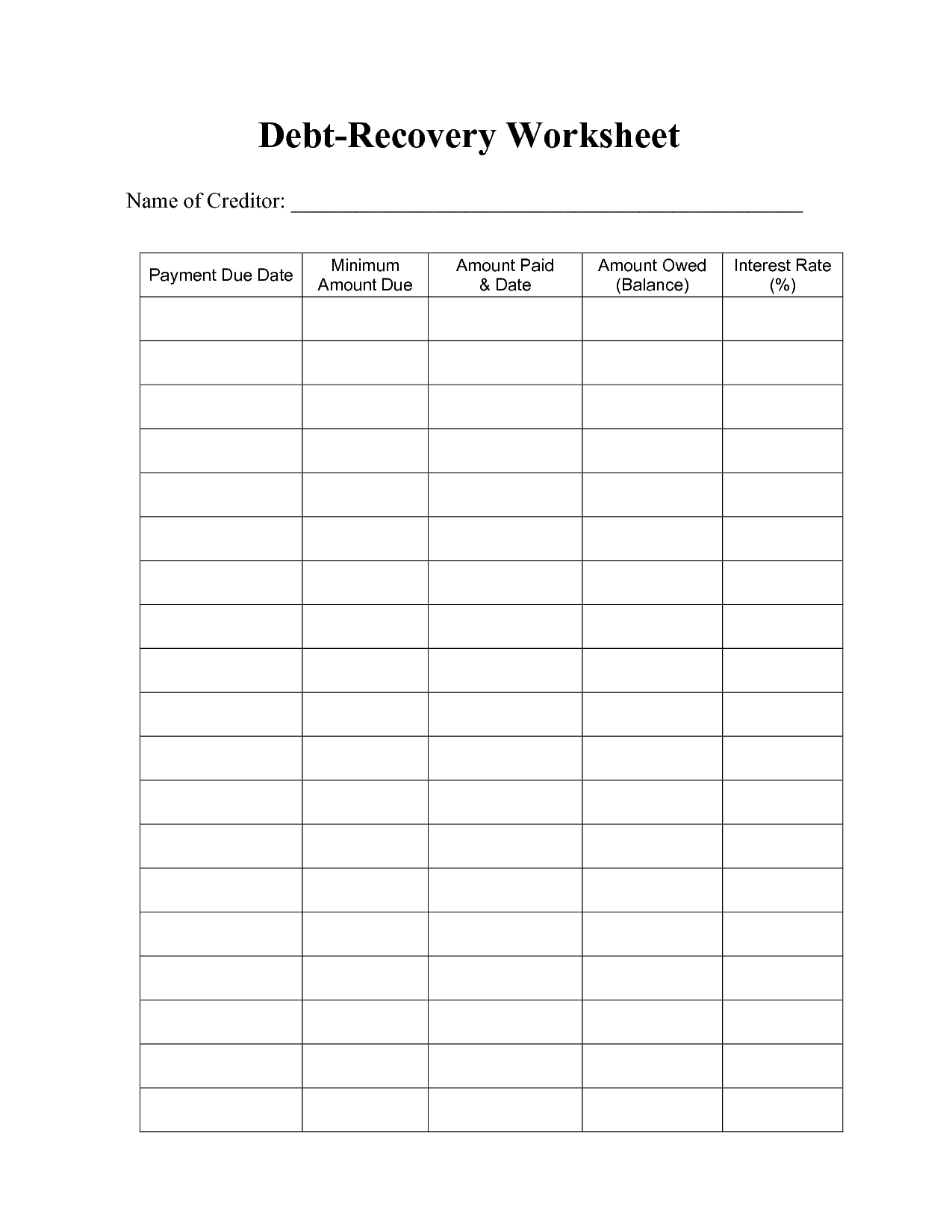

- Debt Snowball Worksheet Printable

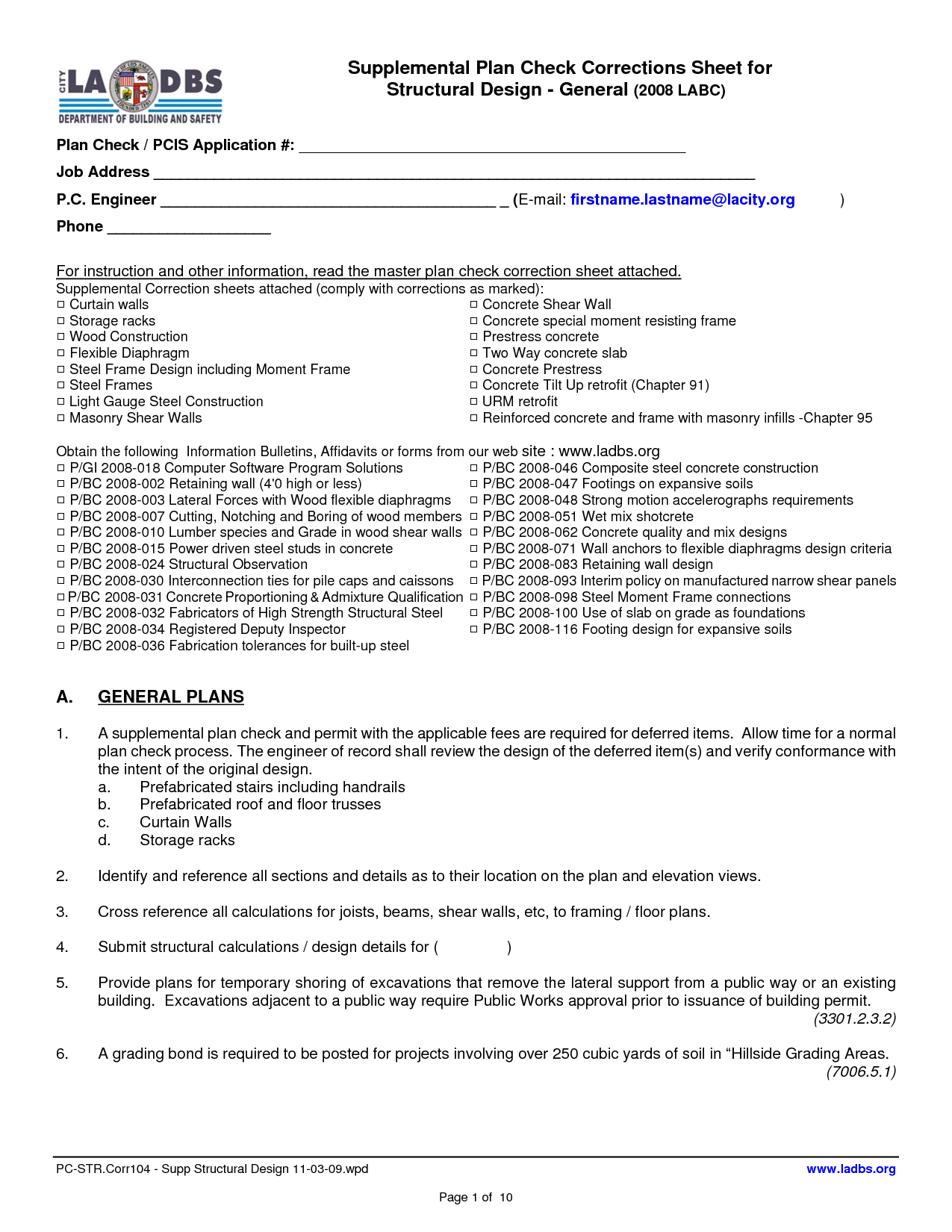

- Sample Plan of Corrections

- Dave Ramsey Budget Forms Templates

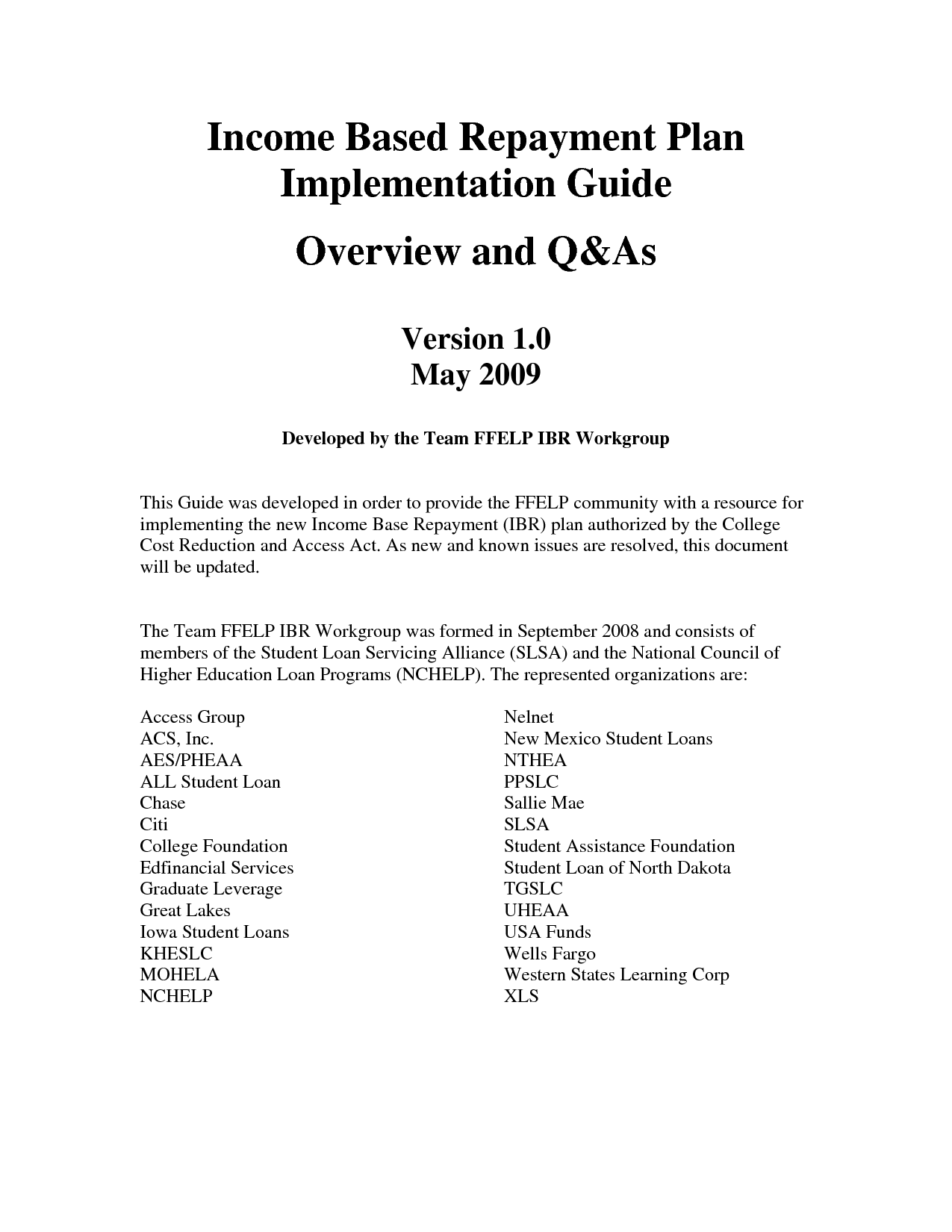

- Income Based Repayment Plan

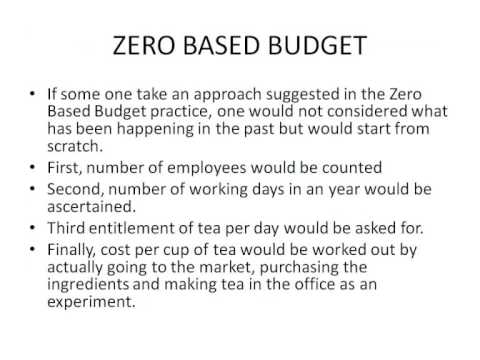

- Zero-Based Budget Spreadsheet

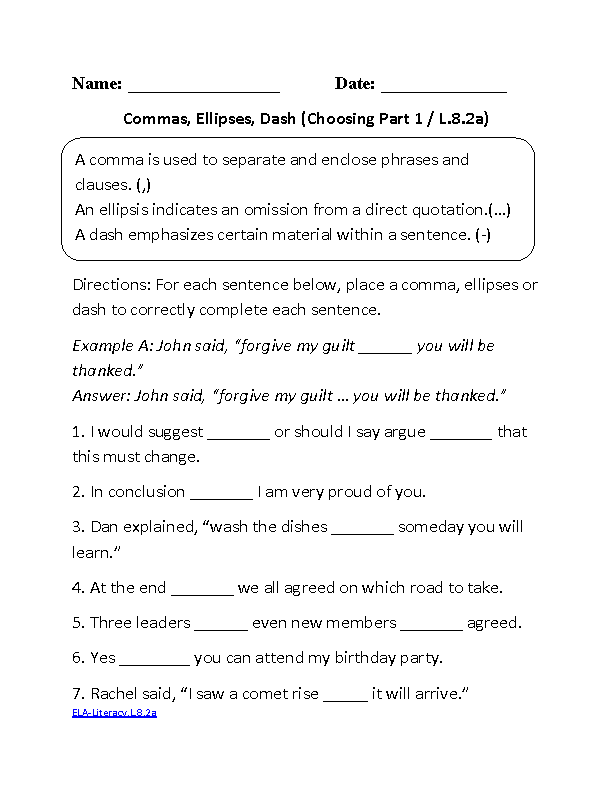

- 8th Grade Common Core Worksheets

- 6th Grade Math Worksheets Fractions Decimals

- 6th Grade Math Worksheets Fractions Decimals

- 6th Grade Math Worksheets Fractions Decimals

- 6th Grade Math Worksheets Fractions Decimals

- 6th Grade Math Worksheets Fractions Decimals

- 6th Grade Math Worksheets Fractions Decimals

- 6th Grade Math Worksheets Fractions Decimals

- 6th Grade Math Worksheets Fractions Decimals

- 6th Grade Math Worksheets Fractions Decimals

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a Budget Worksheet Dave Ramsey?

A Budget Worksheet from Dave Ramsey is a tool designed to help individuals create a detailed plan for their finances. It typically includes sections for income, expenses, savings, and debt repayment, guiding users to allocate their money effectively and track their progress towards financial goals. Dave Ramsey's budgeting approach focuses on living on less than you earn, avoiding debt, and building wealth over time through practical budgeting techniques.

How does a Budget Worksheet help with financial planning?

A Budget Worksheet helps with financial planning by providing a clear overview of income and expenses, allowing individuals to track where their money is being spent and identify areas for potential savings or adjustments. By creating a realistic budget based on accurate information, individuals can prioritize their spending, set clear financial goals, and make informed decisions about their finances to ultimately achieve financial stability and success.

What are the common sections included in a Budget Worksheet Dave Ramsey?

A Budget Worksheet by Dave Ramsey typically includes common sections such as income, expenses (divided into categories like utilities, groceries, transportation, etc.), debt payments, savings goals, and a space for tracking actual expenses to compare against budgeted amounts. It may also include sections for emergency fund contributions, irregular expenses, and a total at the end to show the overall financial picture.

How does Dave Ramsey's Budget Worksheet promote financial freedom?

Dave Ramsey's Budget Worksheet promotes financial freedom by helping individuals track their income and expenses, create a plan for managing their money, and set specific financial goals. By using the worksheet to budget effectively, individuals can prioritize their spending, eliminate unnecessary expenses, and allocate funds towards building an emergency fund, paying off debt, and saving for the future. This proactive approach to managing money empowers individuals to take control of their finances, avoid debt, and work towards achieving financial stability and freedom.

How can you track and organize your income on a Dave Ramsey Budget Worksheet?

To track and organize your income on a Dave Ramsey Budget Worksheet, start by listing all sources of income, such as salary, bonuses, or side hustle earnings. Then, allocate this income into different categories, such as giving, saving, and spending. Be sure to accurately categorize every income source to have a clear picture of where your money is coming from and how it should be allocated. Update the worksheet regularly to ensure accurate tracking of your income and expenses, helping you stay on top of your financial goals and budget.

How does the Budget Worksheet help monitor and categorize expenses?

The Budget Worksheet helps monitor and categorize expenses by providing a structured format to list all income sources and expense categories. It allows individuals to track their spending habits by breaking down expenses into specific categories such as groceries, utilities, transportation, etc. By continuously updating the worksheet with actual expenses, one can easily compare it to the budgeted amounts, identify any discrepancies, and make adjustments to ensure better financial management and control over spending.

What steps can you take to prioritize debt payments using a Budget Worksheet?

To prioritize debt payments using a Budget Worksheet, start by listing all your debts, including the amount owed, interest rates, and minimum monthly payments. Next, compare your total debt to your monthly income to determine how much you can allocate to debt repayment. Rank your debts from highest to lowest interest rate or smallest to largest balance. Allocate more funds to the highest interest rate or smallest balance debt while making minimum payments on others. Track your progress regularly by updating your budget worksheet and adjusting your payments as needed to accelerate debt repayment.

How does a Budget Worksheet Dave Ramsey assist in setting financial goals?

Using a Budget Worksheet by Dave Ramsey helps in setting financial goals by providing a structured framework to track income, expenses, and savings. By detailing all financial transactions, individuals can clearly see where their money is going and identify areas where they can cut costs or increase savings. This tool helps create a realistic budget that aligns with financial priorities and goals, such as saving for emergencies, paying off debt, or investing for the future. Ultimately, the Budget Worksheet serves as a visual guide to monitor progress towards financial objectives and make necessary adjustments to achieve long-term financial success.

What other benefits can be obtained from regularly using a Budget Worksheet?

Regularly using a budget worksheet can provide several benefits beyond just tracking expenses, such as gaining better visibility and control over your finances, identifying spending patterns and areas where you can cut costs, setting and achieving financial goals, reducing unnecessary expenses, and ultimately, helping you to save more money and build a healthier financial future. It can also help in creating a sense of accountability and discipline when it comes to managing your money effectively.

How can a Budget Worksheet Dave Ramsey be adjusted and modified to fit individual financial needs?

To adjust and modify a Budget Worksheet from Dave Ramsey to fit individual financial needs, you can customize categories and amounts according to your income, expenses, and financial goals. Add or remove categories, adjust the amounts allocated to each category based on your priorities, and include any specific income sources or expenses unique to your situation. Essentially, tailor the budget to align with your specific financial circumstances, but uphold the core principles of budgeting that Dave Ramsey advocates, such as giving every dollar a purpose and prioritizing saving and debt repayment.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments