Budget Plan Worksheet

Are you struggling to manage your finances and create a successful budget plan? Look no further! We have a solution that can help you stay organized and on track with your expenses. Introducing the Budget Plan Worksheet - a simple and effective tool designed to assist individuals who want to take control of their financial situation. This worksheet is perfect for anyone who wants to track their income, expenses, and savings in a systematic and hassle-free manner. Whether you are a student, a working professional, or a homemaker, this tool will provide you with the entity and subject you need to manage your money effectively.

Table of Images 👆

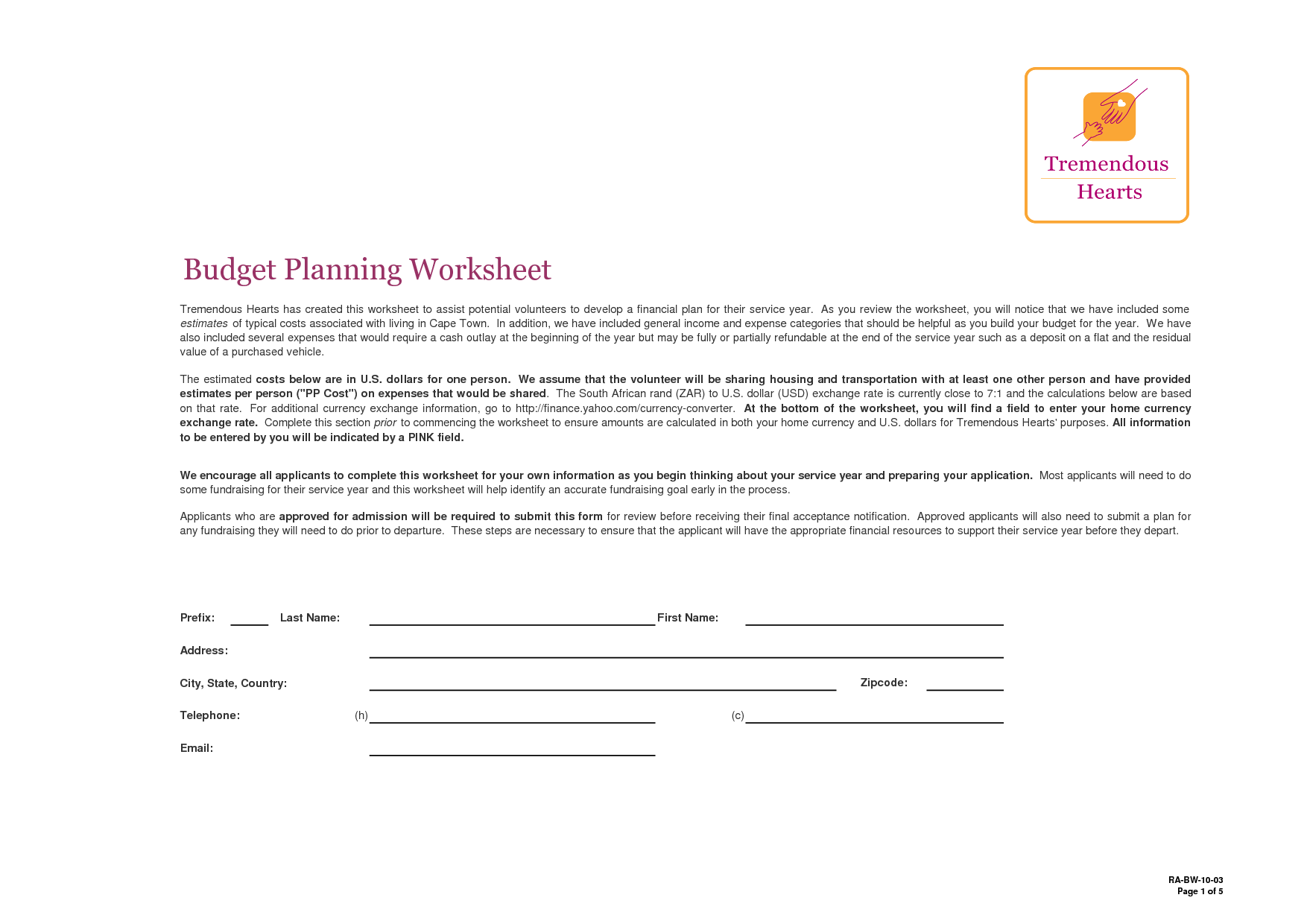

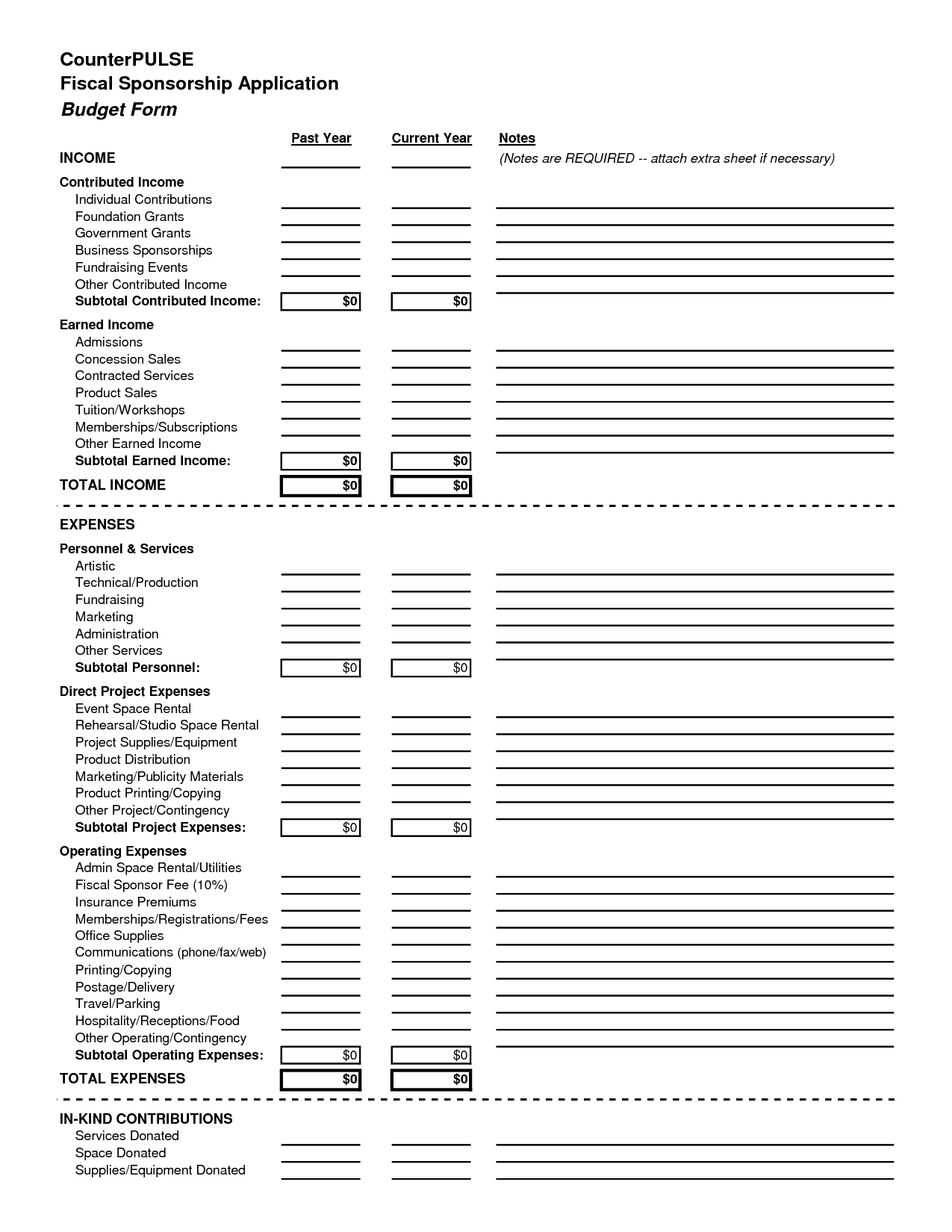

- Budget Planning Worksheet

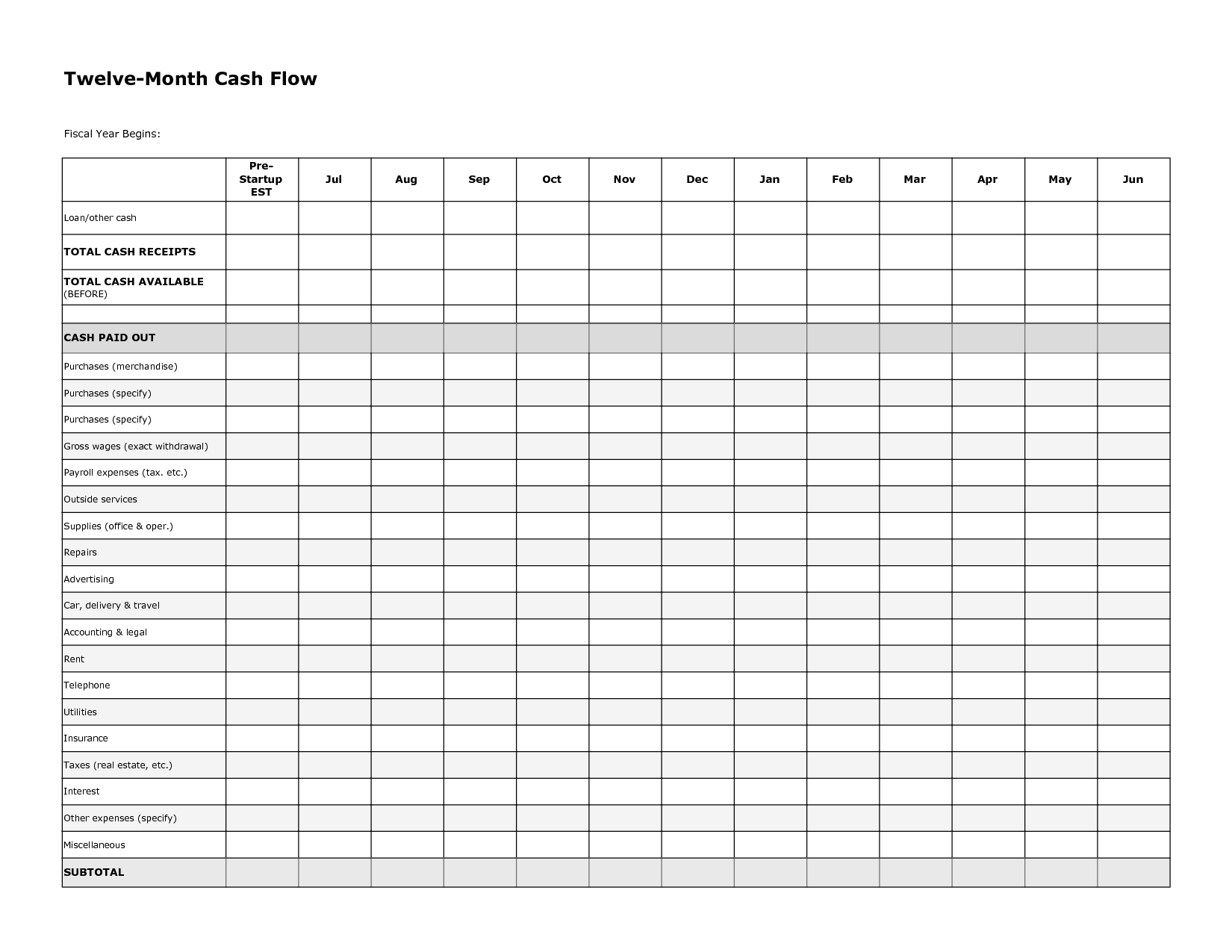

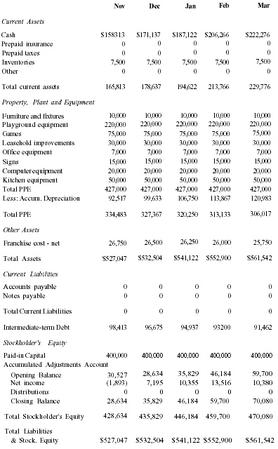

- 12 Month Cash Flow Worksheet

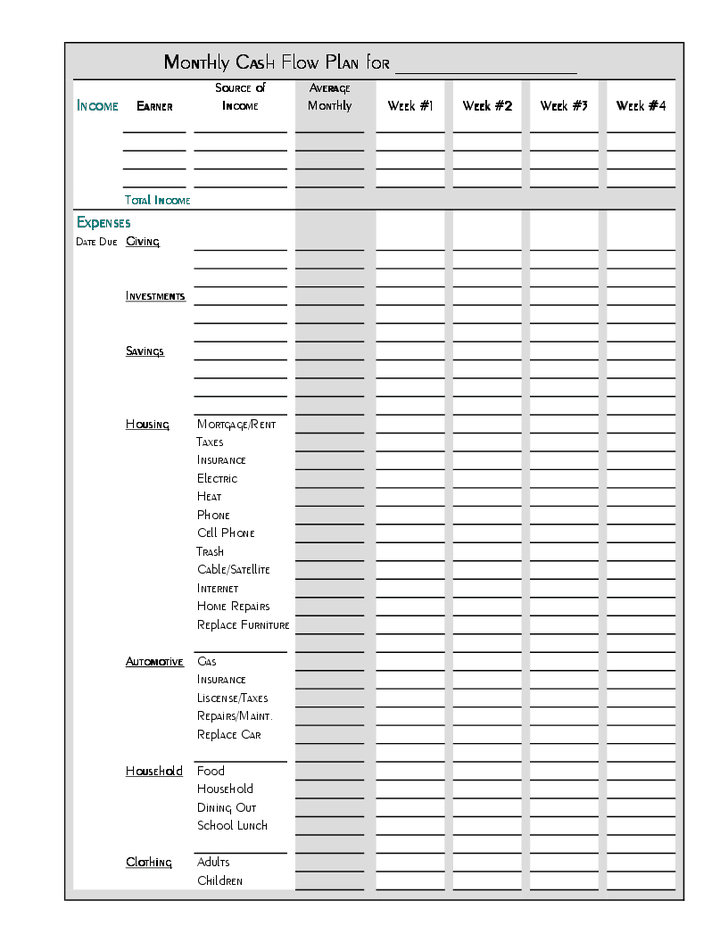

- Monthly Cash Flow Budget Template

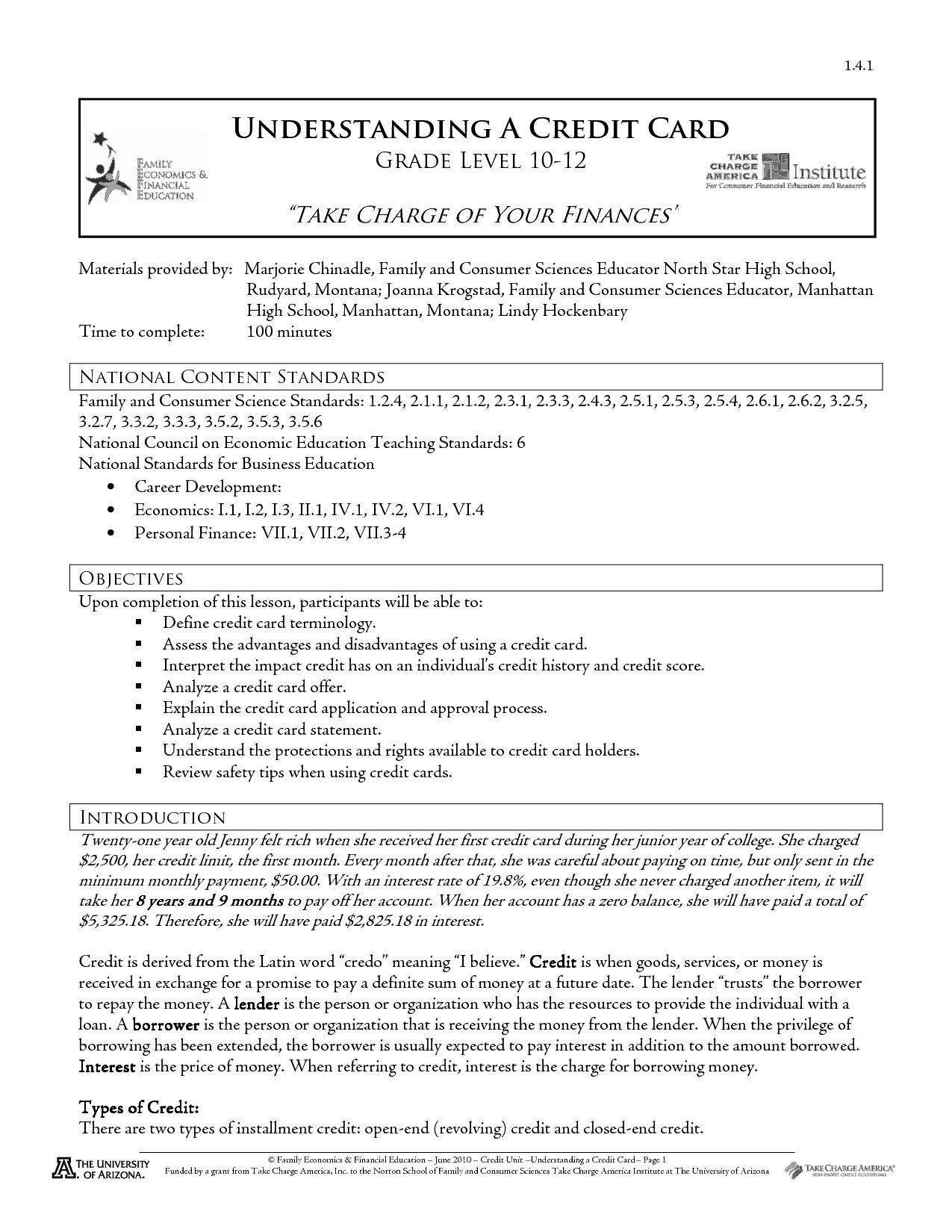

- Family and Consumer Science Worksheets

- Fitness Worksheets Elementary

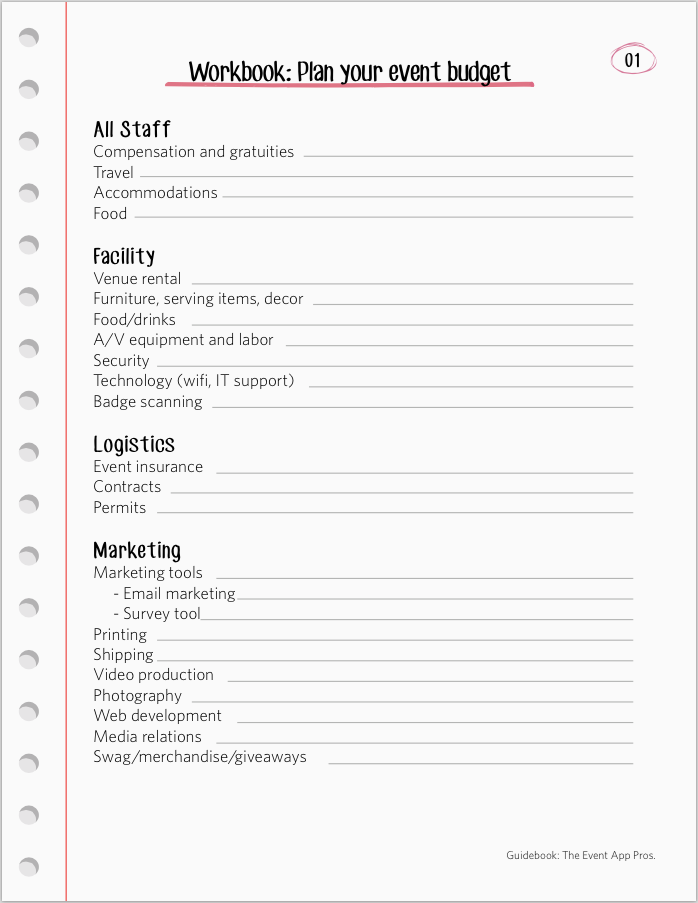

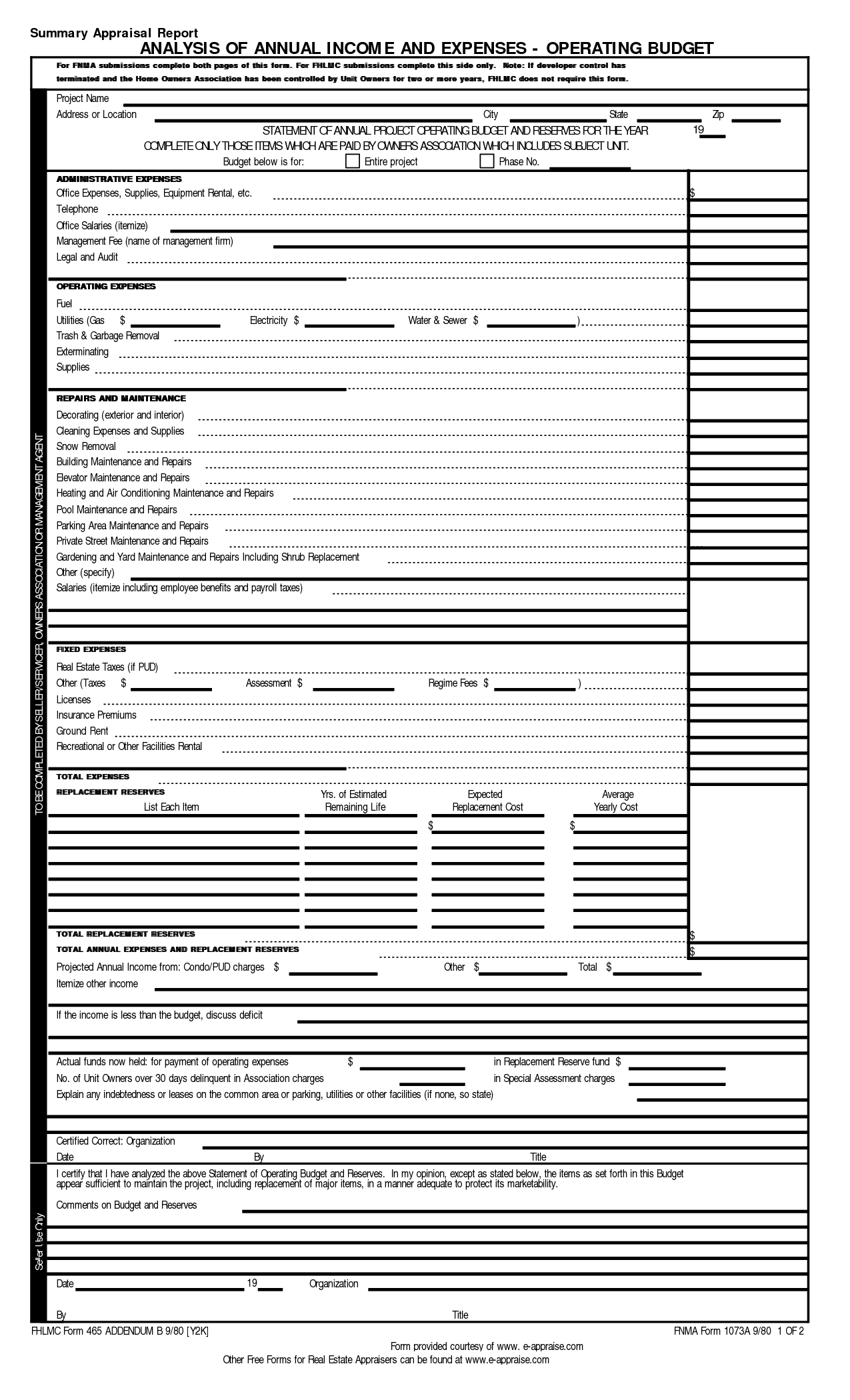

- Free Event Planning Budget Template

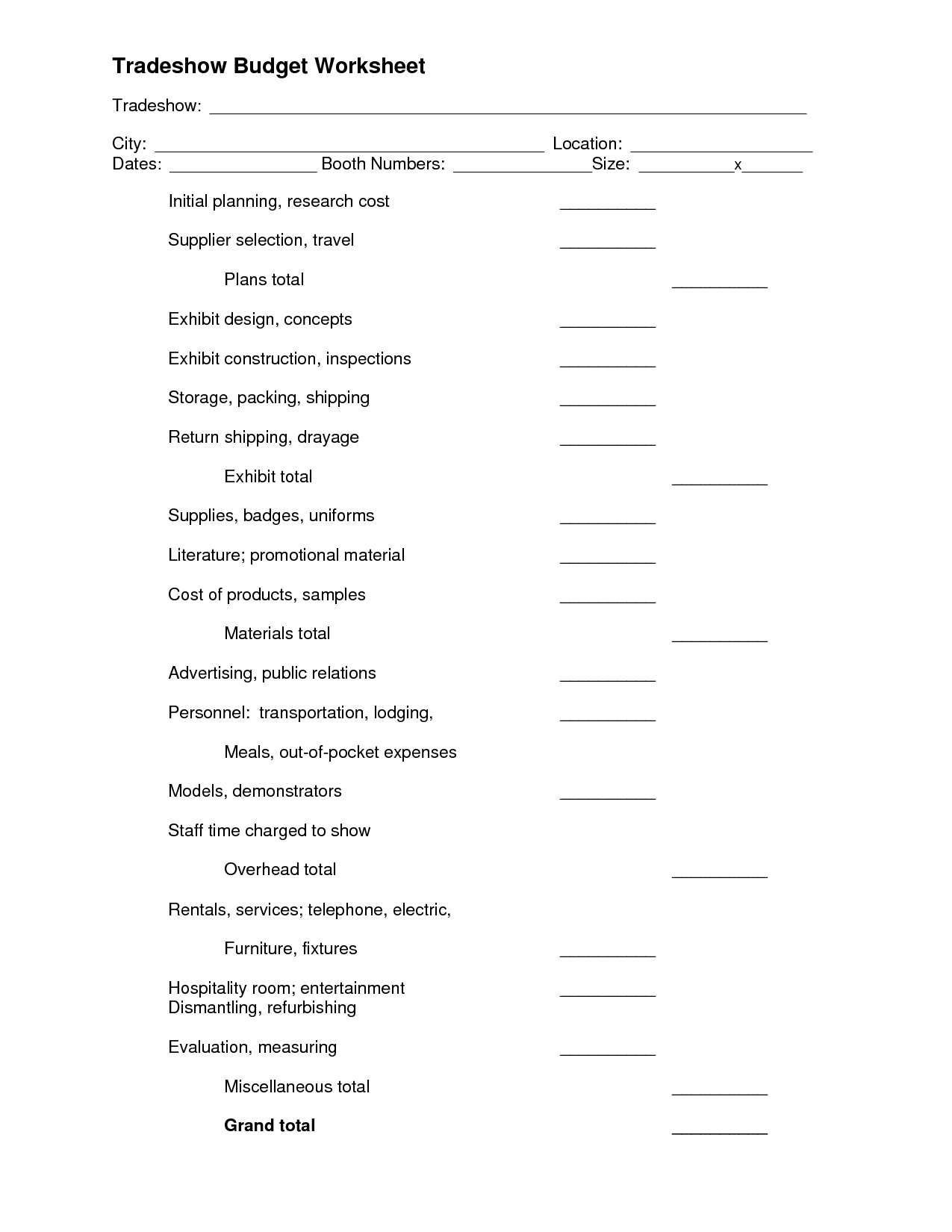

- Capital Budget Worksheet Samples

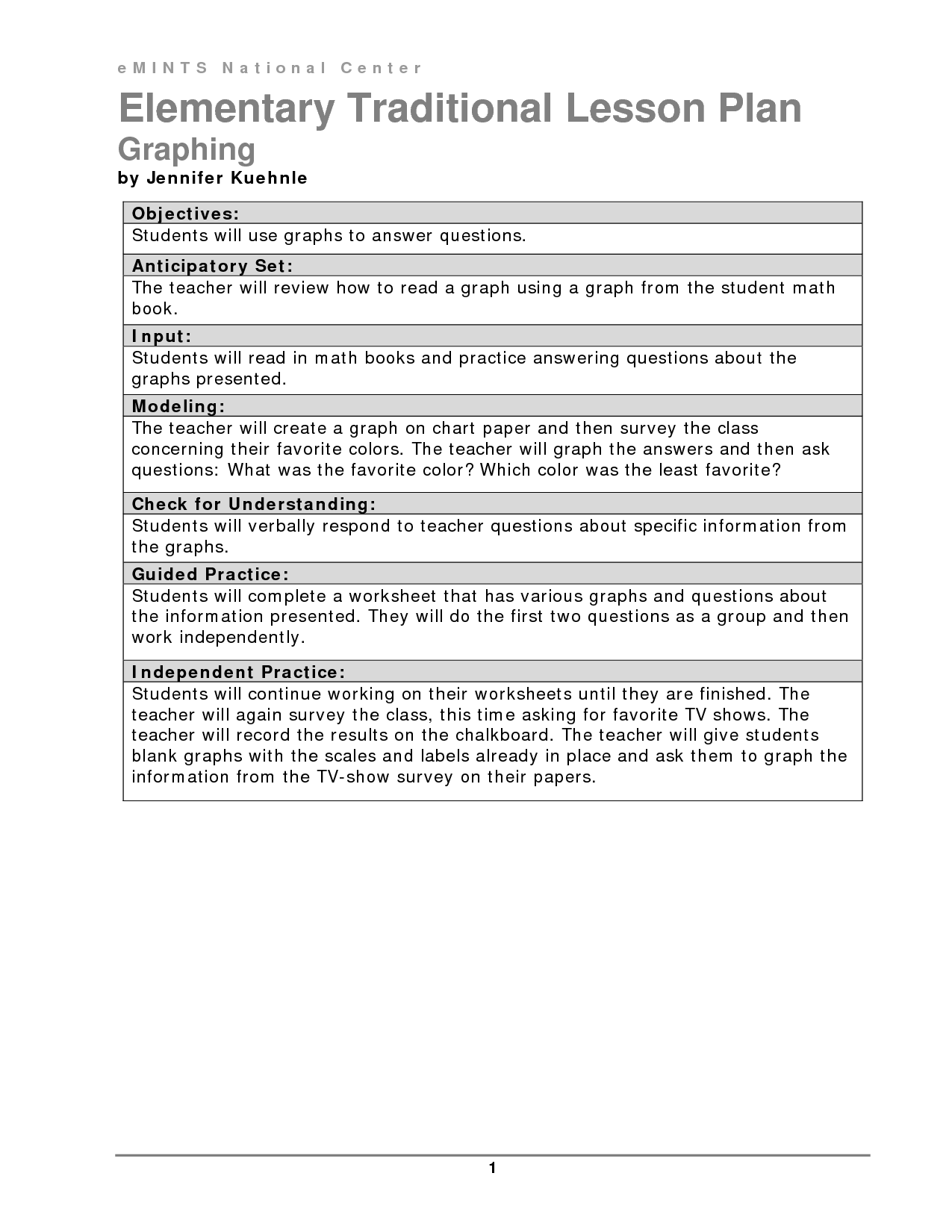

- Printable Weekly Lesson Plan Worksheet

- Marketing Promotion Plan Template

- Day Care Sample Business Balance Sheet Example

- Sample Annual Operating Budget

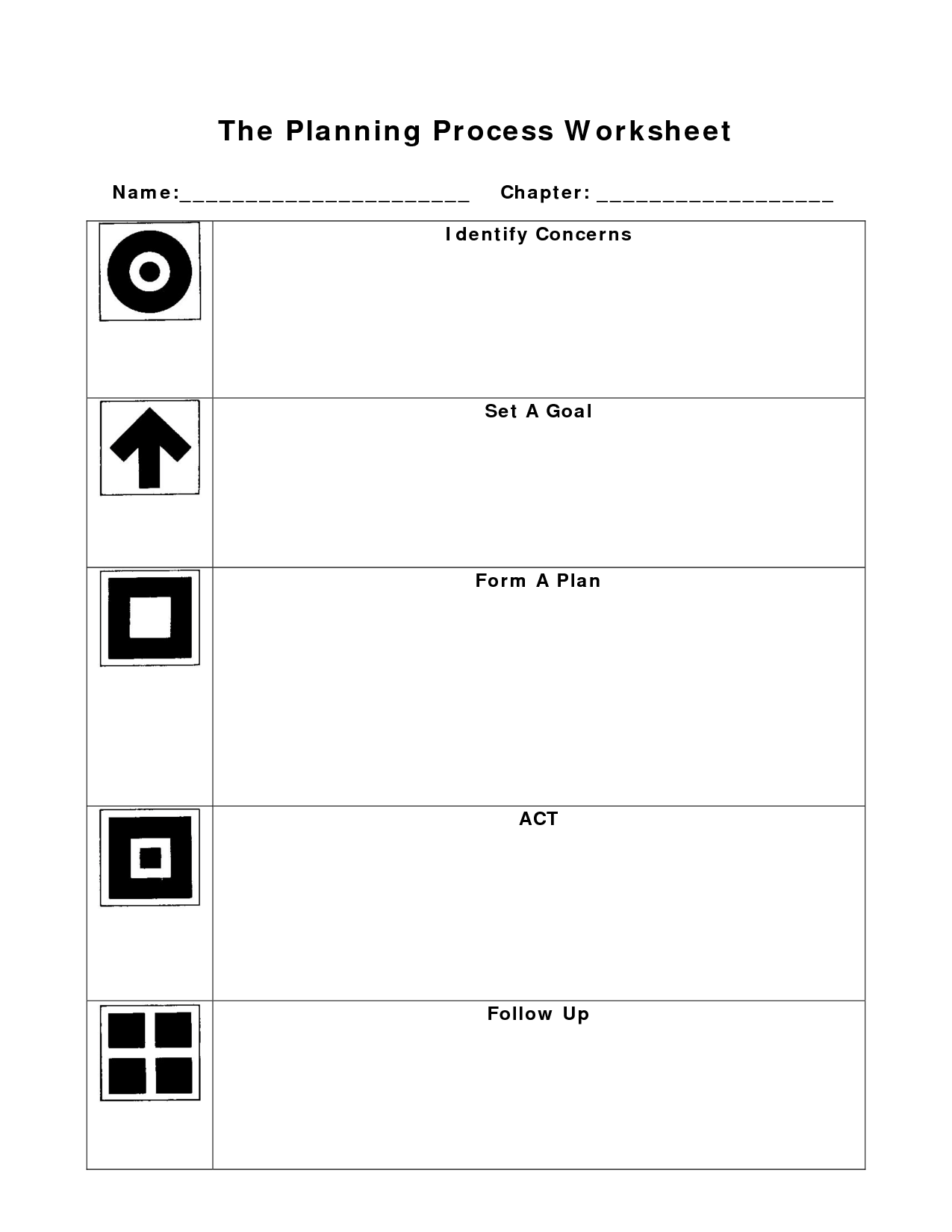

- FCCLA Planning Process Worksheet

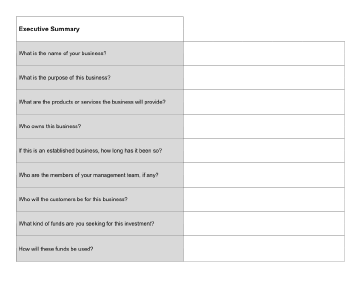

- Question and Answer Format Template

- Sample Non-Profit Budget Template Free

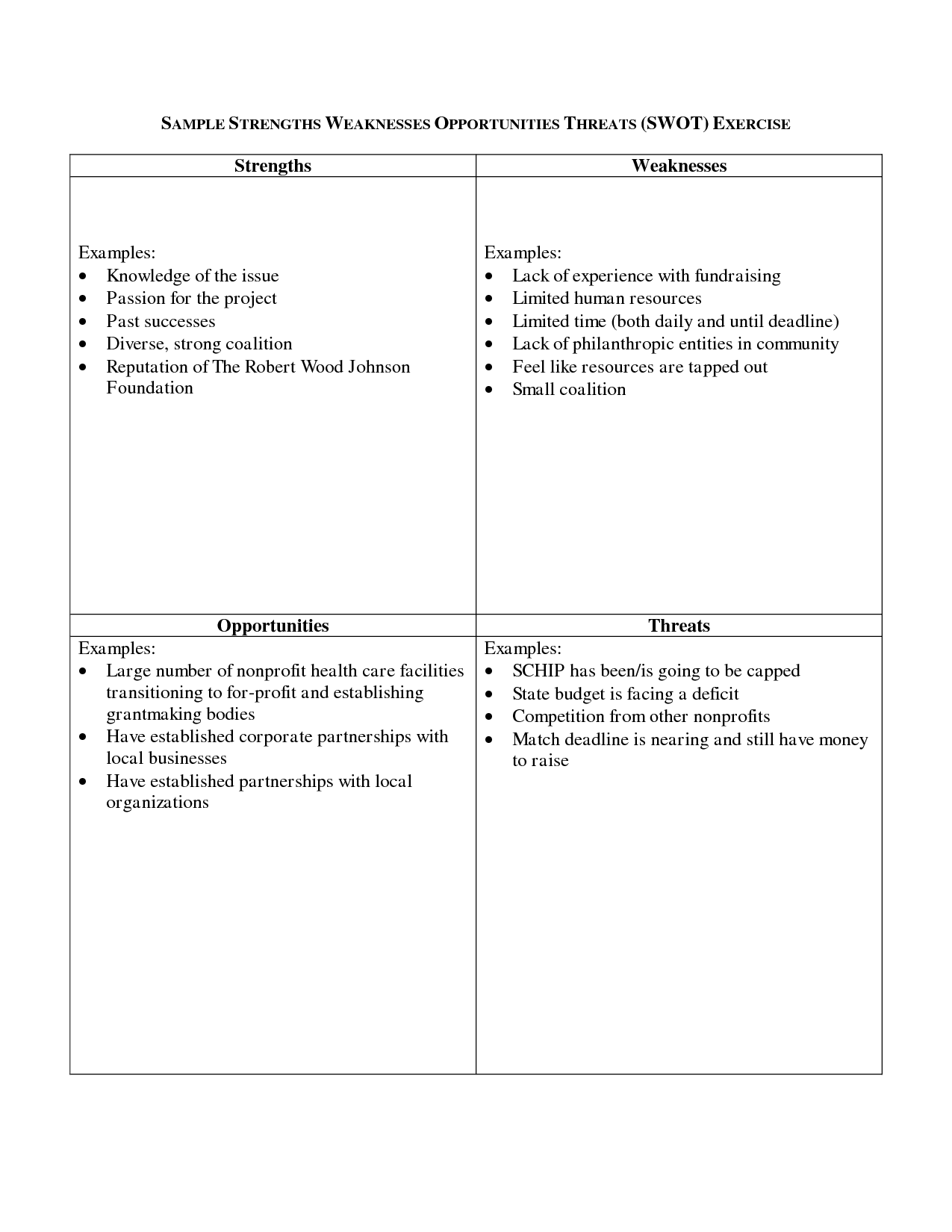

- SWOT Example Strengths and Weaknesses

- Research Paper Outline Worksheet

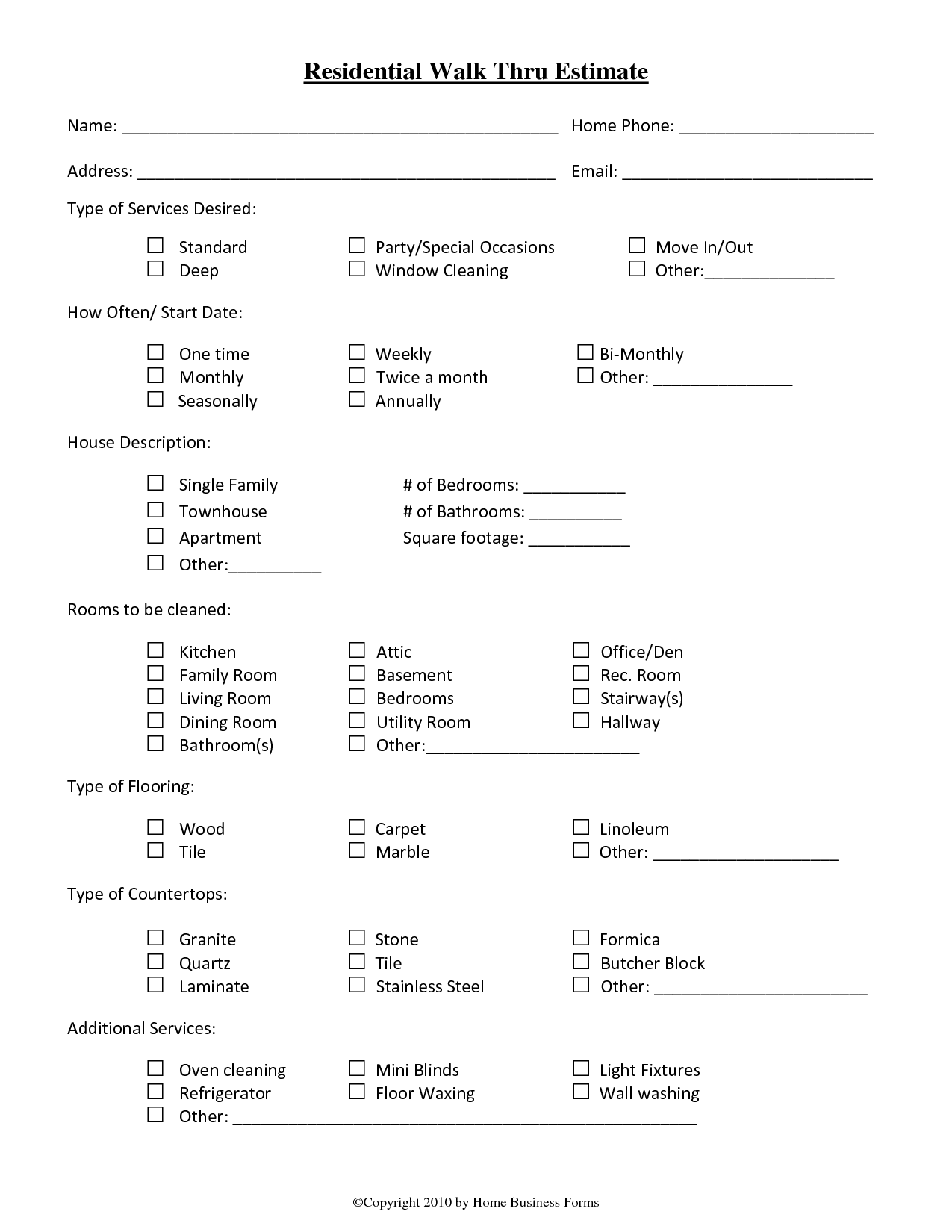

- Free House Cleaning Estimate Sheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a budget plan worksheet?

A budget plan worksheet is a tool that helps individuals track their income and expenses over a specific period of time, typically on a monthly basis. It allows users to organize their finances by listing all sources of income and itemizing all expenses in order to create a clear picture of their financial situation. This worksheet can help individuals set financial goals, prioritize spending, and identify areas where they can save money or cut costs.

Why should you use a budget plan worksheet?

Using a budget plan worksheet can help you track and manage your finances more effectively by providing a clear overview of your income and expenses. It allows you to set financial goals, identify areas where you can cut expenses, and ensure that you're not overspending. By using a budget plan worksheet, you can have better control over your money, reduce financial stress, and work towards achieving your long-term financial objectives.

What key components should be included in a budget plan worksheet?

A budget plan worksheet should include key components such as sources of income, fixed expenses (such as rent, utilities, and loan payments), variable expenses (such as groceries, entertainment, and transportation), savings goals, debt repayment plan, emergency fund allocation, and a section for tracking actual spending to compare against the budgeted amounts. It is important to have a clear and detailed breakdown of all financial aspects to effectively manage and track your finances.

How often should you review and update your budget plan worksheet?

It is recommended to review and update your budget plan worksheet at least once a month. This will help you track your expenses, make any necessary adjustments, and stay on top of your financial goals. Additionally, reviewing your budget regularly will allow you to identify any changes in your financial situation and make informed decisions to maintain a balanced budget.

What are the benefits of using a budget plan worksheet?

A budget plan worksheet helps to organize finances, track expenses, and set financial goals. It provides a clear overview of income, expenses, and savings, making it easier to manage money effectively and make informed decisions. By using a budget plan worksheet, individuals can identify areas where they can save money, prioritize spending, and work towards achieving financial stability and long-term objectives.

How can a budget plan worksheet help track your expenses?

A budget plan worksheet can help track expenses by providing a visual representation of your income and spending. By categorizing expenses and setting spending limits, you can easily see where your money is going and identify areas where you may need to cut back. This tracking can help you stay accountable, make better financial decisions, and ultimately reach your savings goals.

How do you set financial goals using a budget plan worksheet?

To set financial goals using a budget plan worksheet, start by identifying your short-term, medium-term, and long-term financial objectives. Then, create a budget that outlines your income sources and expenses. This will help you understand your current financial situation and identify areas where you can cut costs or increase savings to meet your goals. Set specific, measurable, achievable, relevant, and time-bound (SMART) goals in your budget plan worksheet to track progress and adjust as needed. Regularly review and update your budget to stay on track towards achieving your financial goals.

How can a budget plan worksheet help you save money?

A budget plan worksheet can help you save money by providing a clear overview of your income and expenses, allowing you to accurately track where your money is going and identify areas where you can cut back or make adjustments. By creating a budget plan and sticking to it, you can prioritize your spending, set savings goals, avoid overspending, and ultimately build a financial safety net for the future.

How can a budget plan worksheet help you prioritize your spending?

A budget plan worksheet can help prioritize spending by allowing you to clearly see your income and expenses in one place. By detailing all sources of income and itemizing all expenses, you can easily identify where your money is going and where you may need to cut back. This visual representation can help allocate funds to essential categories first, such as housing, groceries, and utilities, before considering optional expenses, ensuring that your money is prioritized effectively.

What are some tips for effective budgeting using a budget plan worksheet?

To effectively budget using a budget plan worksheet, start by tracking all sources of income and categorize expenses such as fixed costs (rent, bills) and variable expenses (food, entertainment). Set realistic financial goals, prioritize necessities, and allocate funds for savings and emergency funds. Regularly review and adjust the budget to ensure it aligns with your financial objectives. Lastly, be disciplined in sticking to the plan and avoid unnecessary spending to stay on track with your budget goals.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments