Blank Financial Worksheet Form

Are you in need of a helpful tool to track and manage your finances effectively? Look no further! We have the perfect solution - a blank financial worksheet form. This well-designed document is tailored to assist individuals, families, and small businesses in organizing and analyzing their financial data. Whether you want to track your monthly expenses, create a budget, or plan for future financial goals, this worksheet form offers an easy-to-use format that will streamline your financial management process.

Table of Images 👆

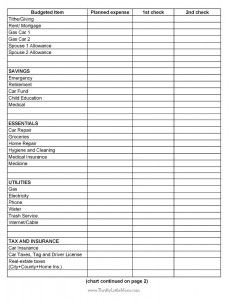

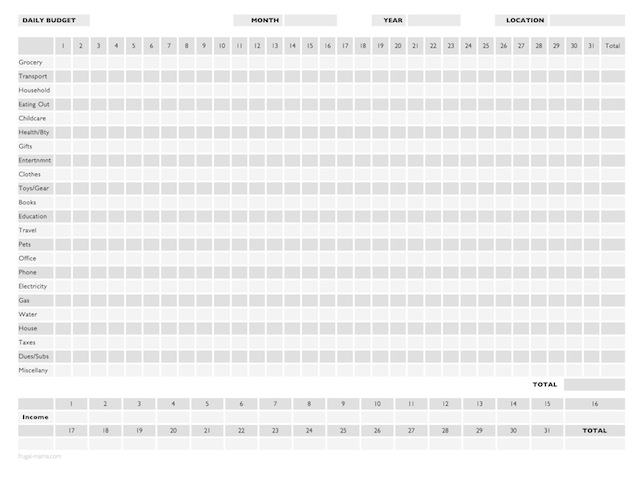

- Free Printable Household Budget Worksheets

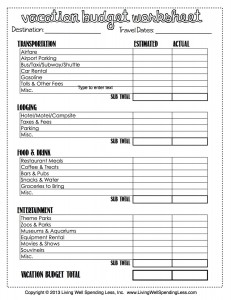

- Vacation Budget Worksheet Printable

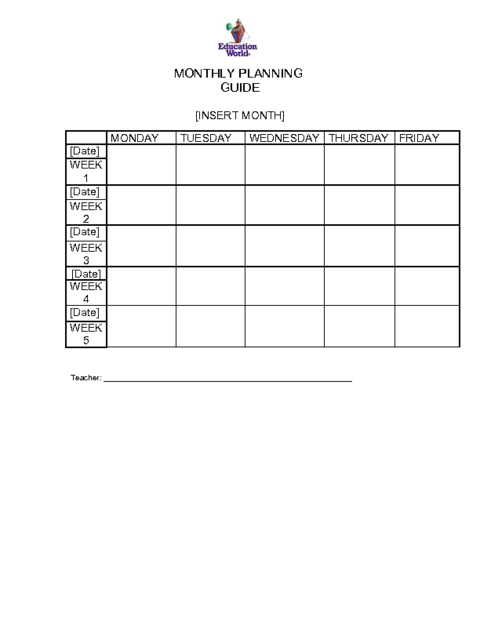

- Monthly Lesson Plan Template

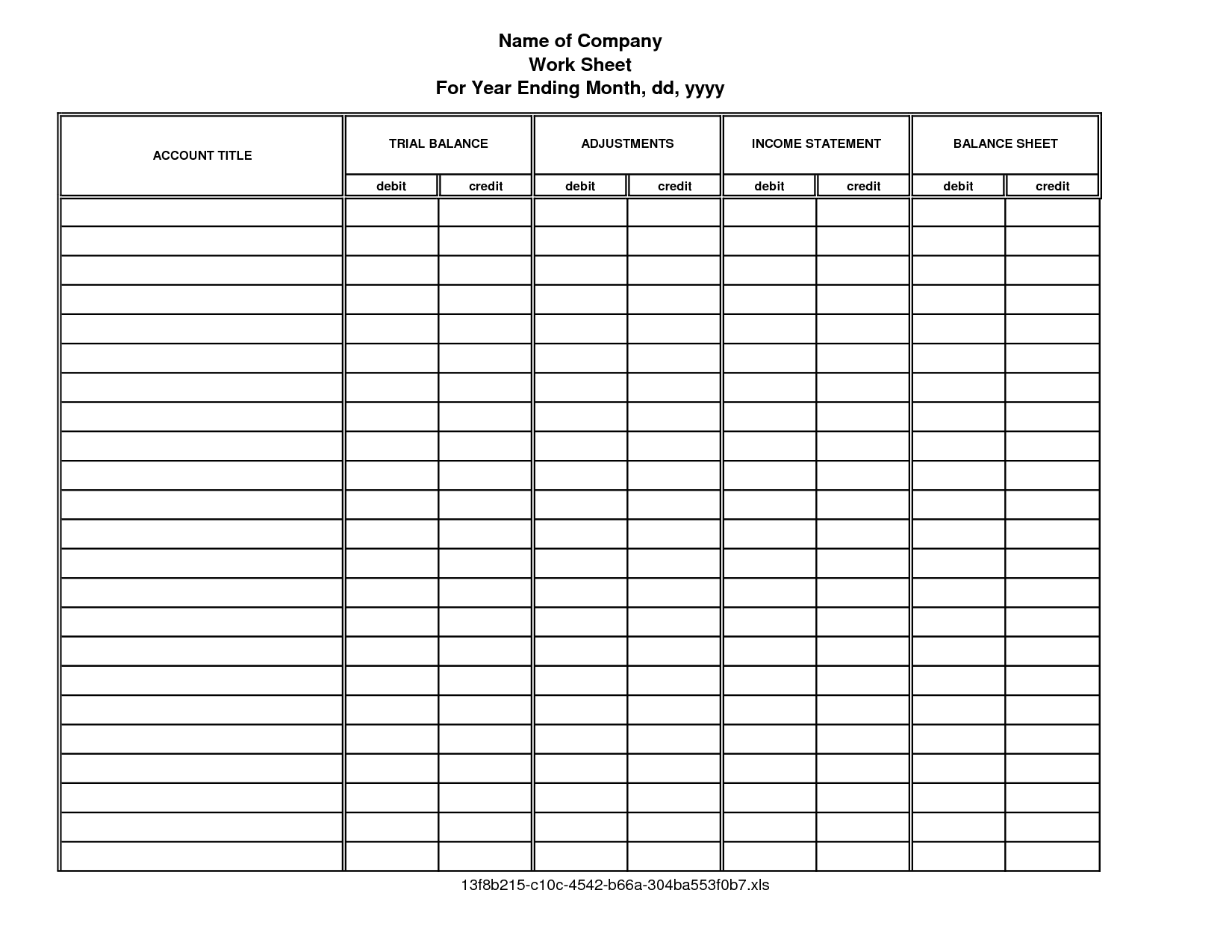

- Free Printable Accounting Ledger Sheets

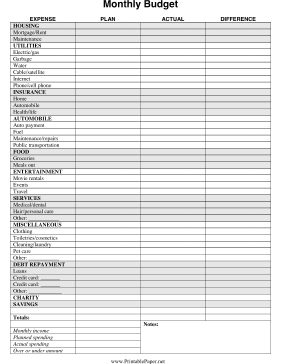

- Free Printable Monthly Budget Forms

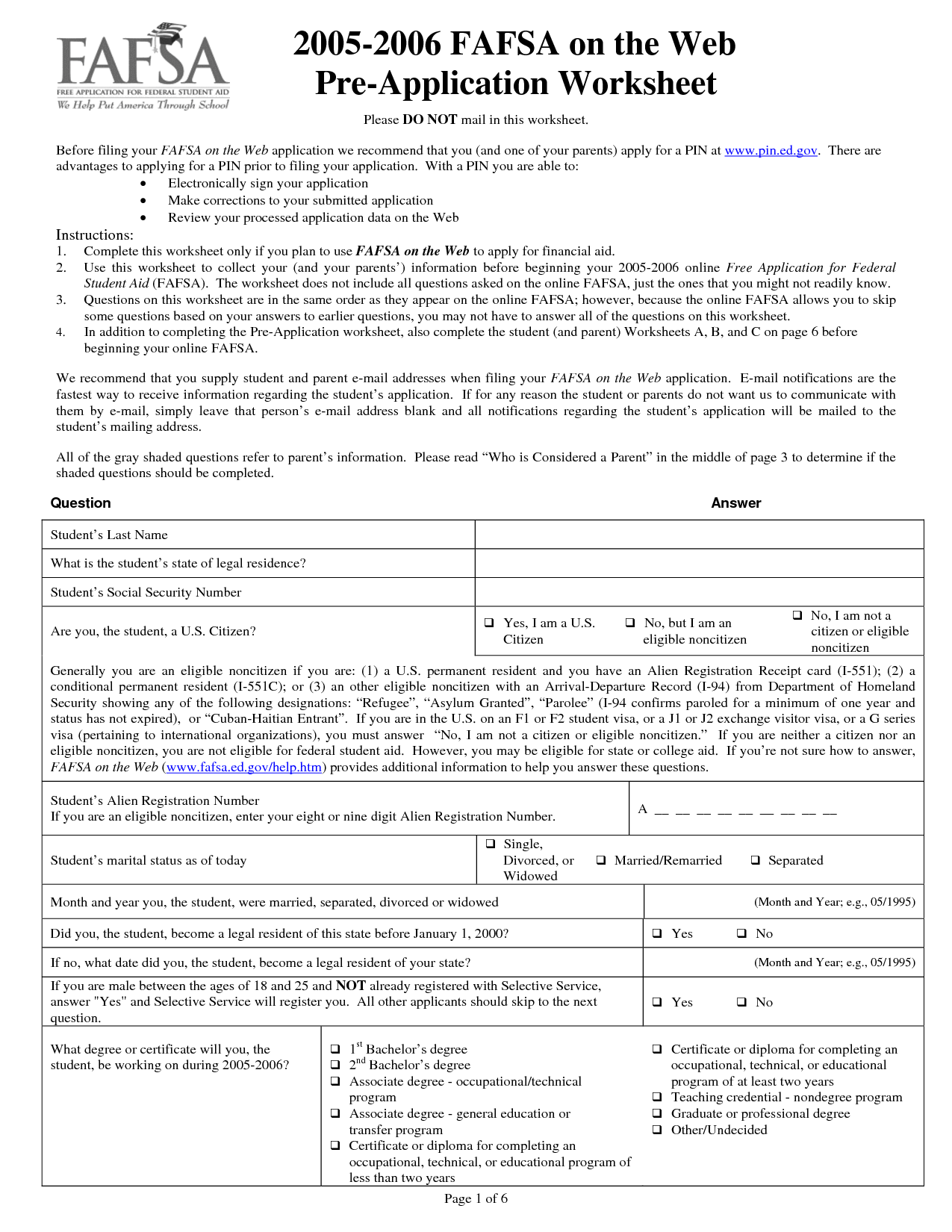

- Printable FAFSA Application

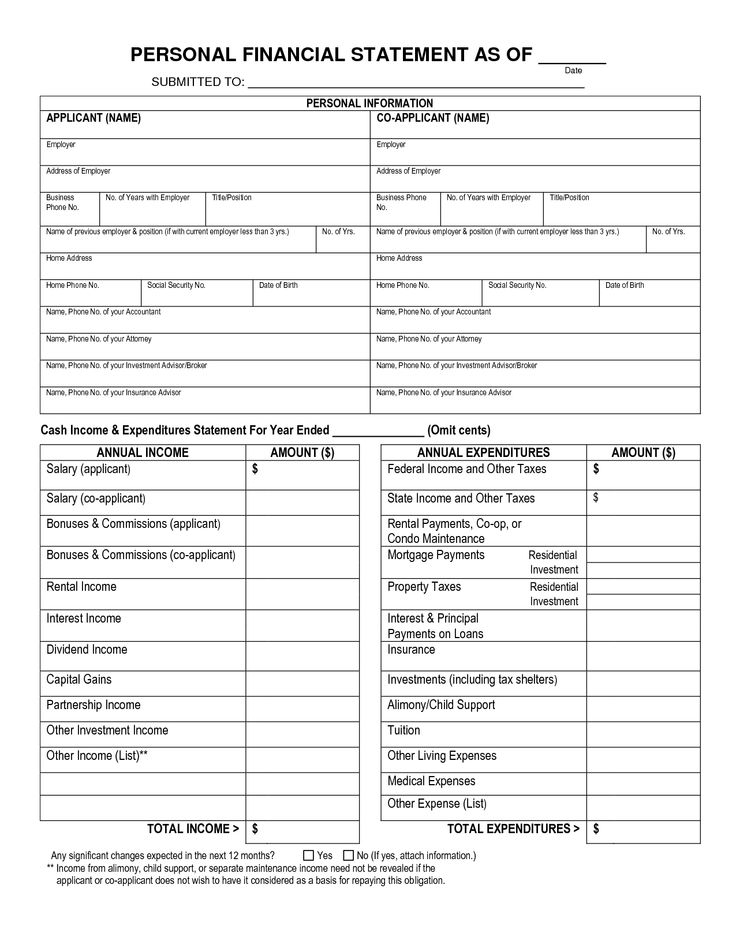

- Free Printable Personal Financial Statement Form

- Printable Monthly Budget Paper

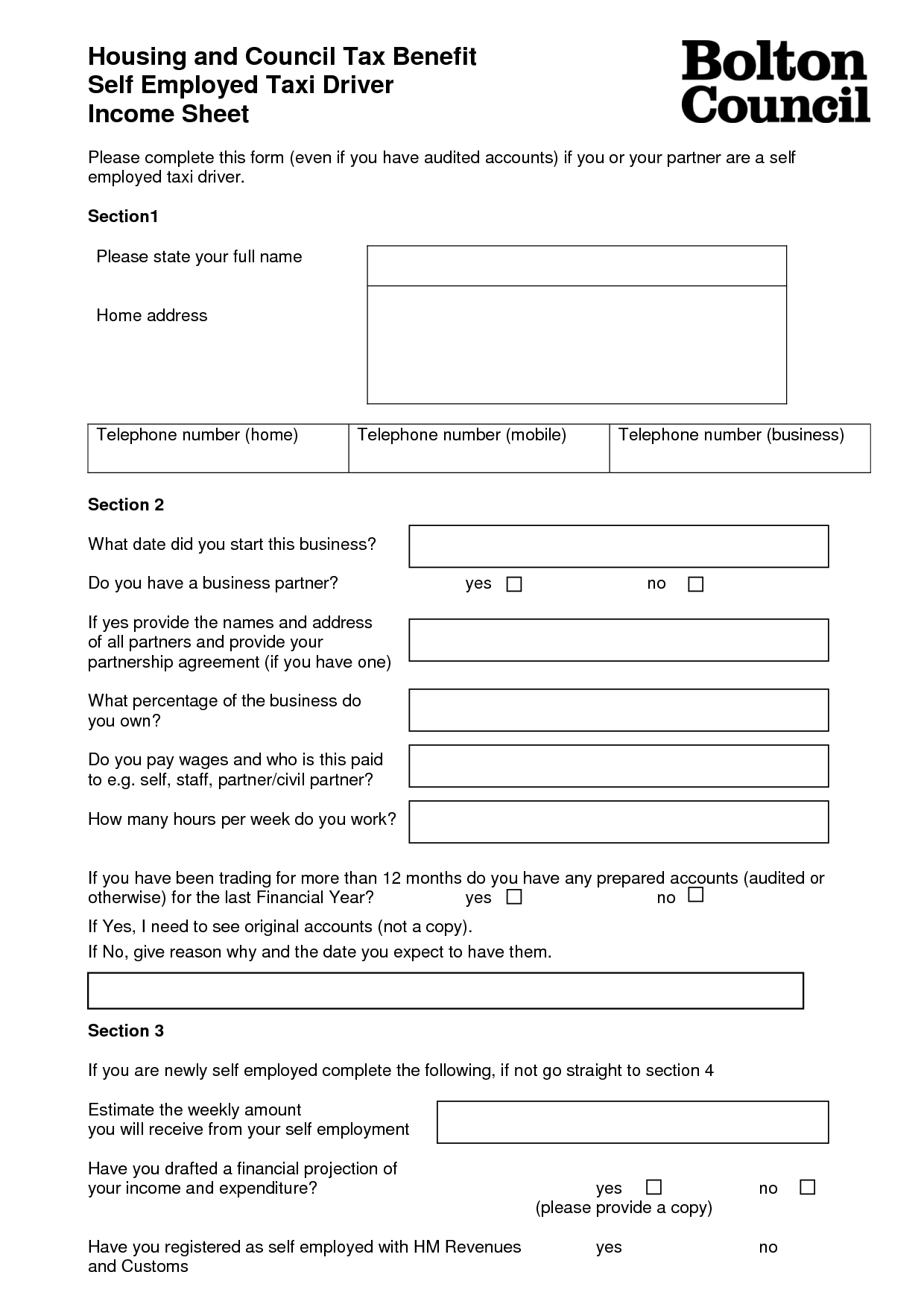

- Self-Employment Profit and Loss Statement

- Free Printable Budget Worksheets for Young Adults

- Daily Budget Worksheet Printable

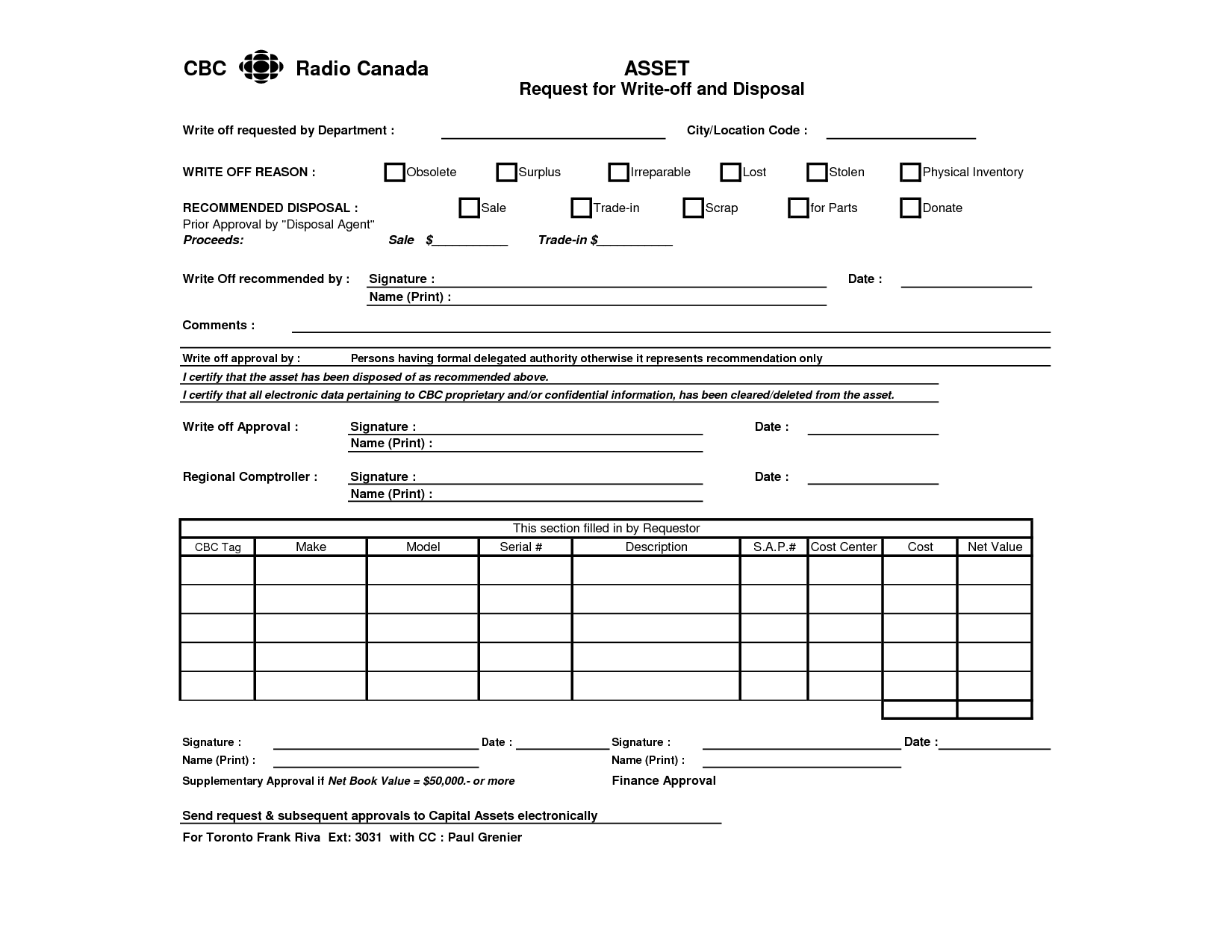

- Inventory Write Off Form Template

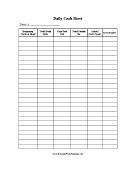

- Daily Cash Sheet Template

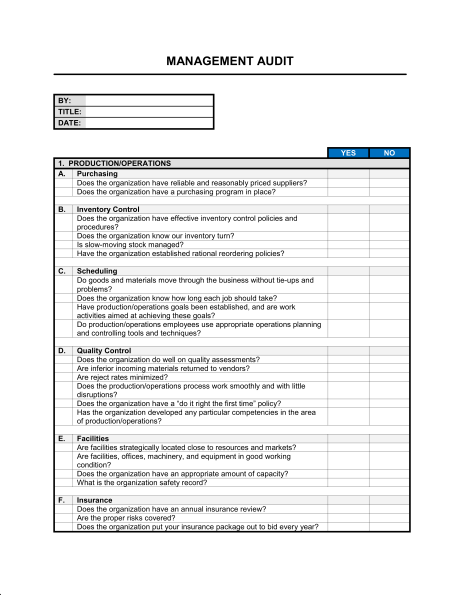

- Audit Checklist Template

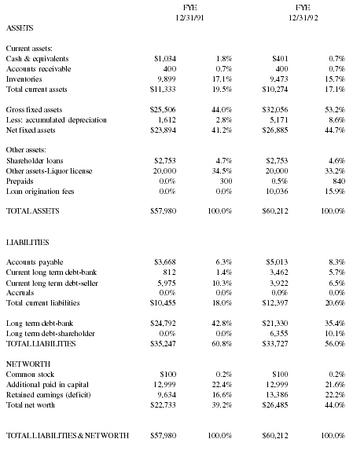

- Restaurant Balance Sheet

- Workers Compensation Insurance Waiver Letter Sample

- Student Organization Constitution Sample

- Example Promissory Note Template

- Example Promissory Note Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is the purpose of a financial worksheet form?

The purpose of a financial worksheet form is to help individuals or businesses organize and track their financial information. It typically includes sections for income, expenses, assets, liabilities, and other financial details that provide a clear picture of the current financial situation. By filling out a financial worksheet form, individuals can assess their financial health, create a budget, set financial goals, and make informed decisions about their money management.

How does a financial worksheet form help individuals in managing their finances?

A financial worksheet form helps individuals in managing their finances by providing a structured layout to organize and track their income, expenses, assets, and liabilities in one place. It allows individuals to create a budget, set financial goals, and monitor their progress towards achieving them. By inputting their financial information into the worksheet, individuals can gain a holistic view of their financial situation, identify areas for improvement, and make informed decisions about their money management. Ultimately, a financial worksheet form serves as a tool for individuals to take control of their financial health and make proactive choices to secure their financial future.

What are the key sections included in a blank financial worksheet form?

A blank financial worksheet form typically includes key sections such as income, expenses, assets, liabilities, and a summary section. The income section is for listing all sources of income, while the expenses section is for detailing all expenditures. The assets section captures all of the individual's owned resources, and the liabilities section lists debts owed. Finally, the summary section provides a total overview of the person's financial situation by calculating their net worth or financial position.

How can a financial worksheet form help in tracking income and expenses?

A financial worksheet form can help in tracking income and expenses by providing a structured way to record all sources of income and track expenditures. It allows individuals to see their financial situation at a glance, identify areas where expenses can be reduced or better managed, and ultimately helps in creating and sticking to a budget. By consistently updating the worksheet with accurate information, individuals can gain a clear understanding of their financial habits and make informed decisions to achieve their financial goals.

How does a financial worksheet form help in budget planning?

A financial worksheet form helps in budget planning by providing a structured framework to list and track income sources, expenses, savings, and debts. It enables individuals to organize their financial information in one place, identify areas where they can cut back on spending, create a realistic budget based on their financial goals, and monitor their progress towards achieving those goals. By having a clear overview of their financial situation through the worksheet, individuals can make informed decisions to better manage their money and work towards financial stability.

How can a financial worksheet form be used in setting financial goals?

A financial worksheet form can be instrumental in setting financial goals by providing a clear overview of a person's current financial situation, including income, expenses, debts, and savings. By using the form to track and organize this information, individuals can identify areas for improvement, set specific and realistic goals, and establish a plan for achieving these goals. The form can help create a roadmap for managing finances effectively, monitoring progress, and making informed decisions to reach financial milestones.

What types of financial information should be recorded on a blank financial worksheet form?

On a blank financial worksheet form, you should record various types of financial information such as income sources (e.g. salary, investments), expenses (e.g. rent, utilities, groceries), savings and investments accounts, debts and liabilities (e.g. loans, credit card balances), assets (e.g. real estate, vehicles, savings), and any other important financial information that contributes to your overall financial picture. This information is essential for budgeting, tracking financial progress, and making informed financial decisions.

How can a financial worksheet form assist in analyzing spending habits?

A financial worksheet form can assist in analyzing spending habits by providing a structured way to track and categorize expenses. By itemizing expenses in various categories such as housing, utilities, groceries, entertainment, etc., individuals can easily see where their money is going and identify areas where they may be overspending or where they could cut back. This form allows for a comprehensive overview of income and expenses, enabling users to create a budget, set financial goals, and make informed decisions about their spending habits.

How does a financial worksheet form help in determining net worth?

A financial worksheet form helps in determining net worth by listing all assets and liabilities in one place, allowing individuals to subtract total liabilities from total assets to calculate their net worth. Assets typically include savings, investments, and property, while liabilities encompass debts and financial obligations. By organizing and detailing these financial aspects, individuals can get a clearer picture of their overall financial standing and work towards improving their net worth by reducing debt and increasing savings and investments.

How can a blank financial worksheet form be customized to fit individual needs?

To customize a blank financial worksheet form to fit individual needs, you can: add or remove specific categories of income and expenses, adjust the layout and formatting to better suit personal preferences, include formulas for automatic calculations, and personalize the headers and titles to make them more relevant to your financial situation. Additionally, you can tailor the form to track specific financial goals or metrics that are important to you, such as savings targets or debt repayment progress. By making these adjustments, you can create a financial worksheet that is uniquely tailored to your individual needs and preferences.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments