Balance Checkbook Worksheet Practice

Are you looking to improve your financial management skills? Look no further than a balance checkbook worksheet practice. It is a valuable tool that helps individuals understand how to properly manage their personal finances and keep track of their expenses. By focusing on the entity and subject of balancing a checkbook, this worksheet is suitable for anyone who wants to gain better control over their finances and achieve financial stability.

Table of Images 👆

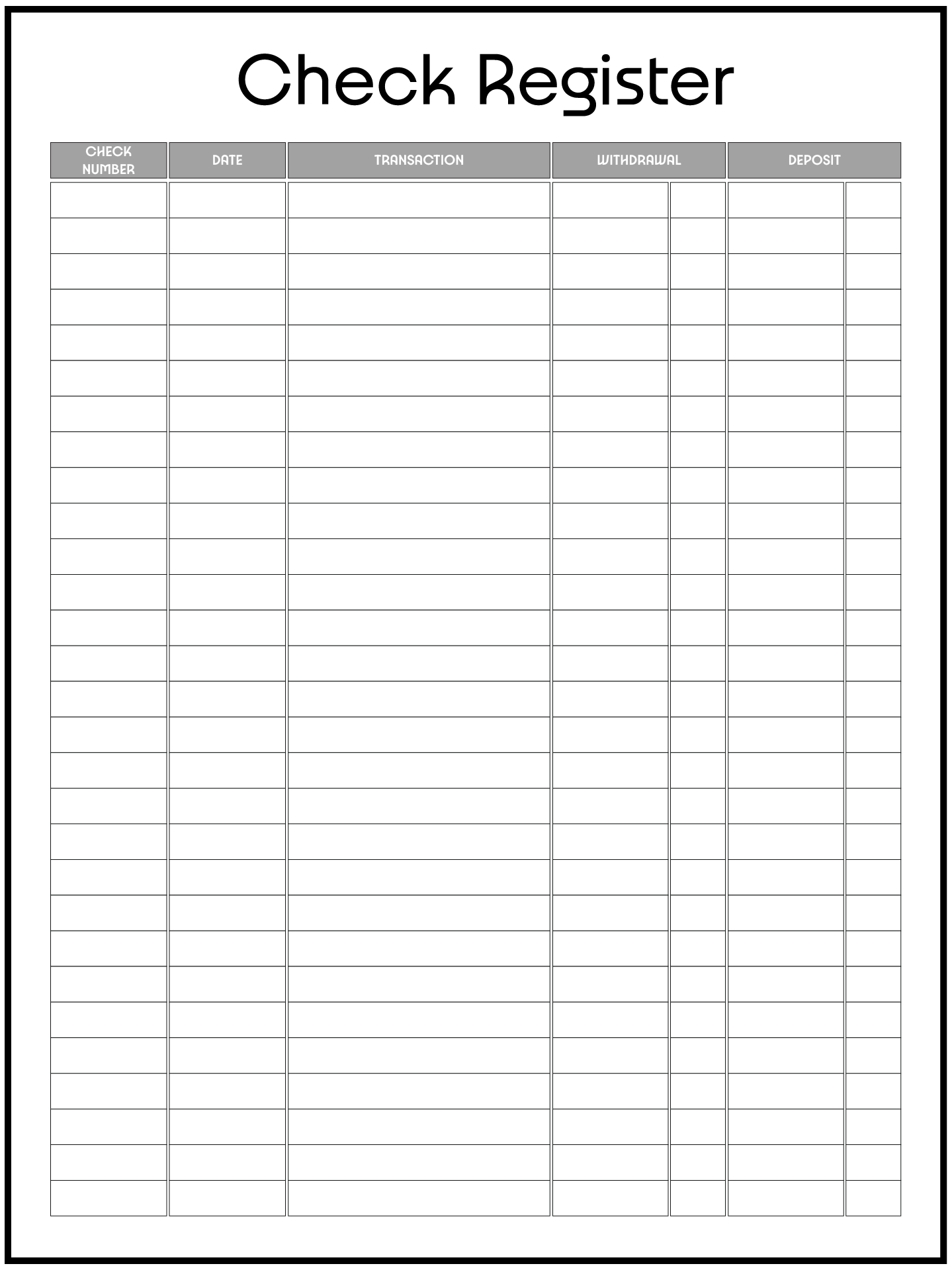

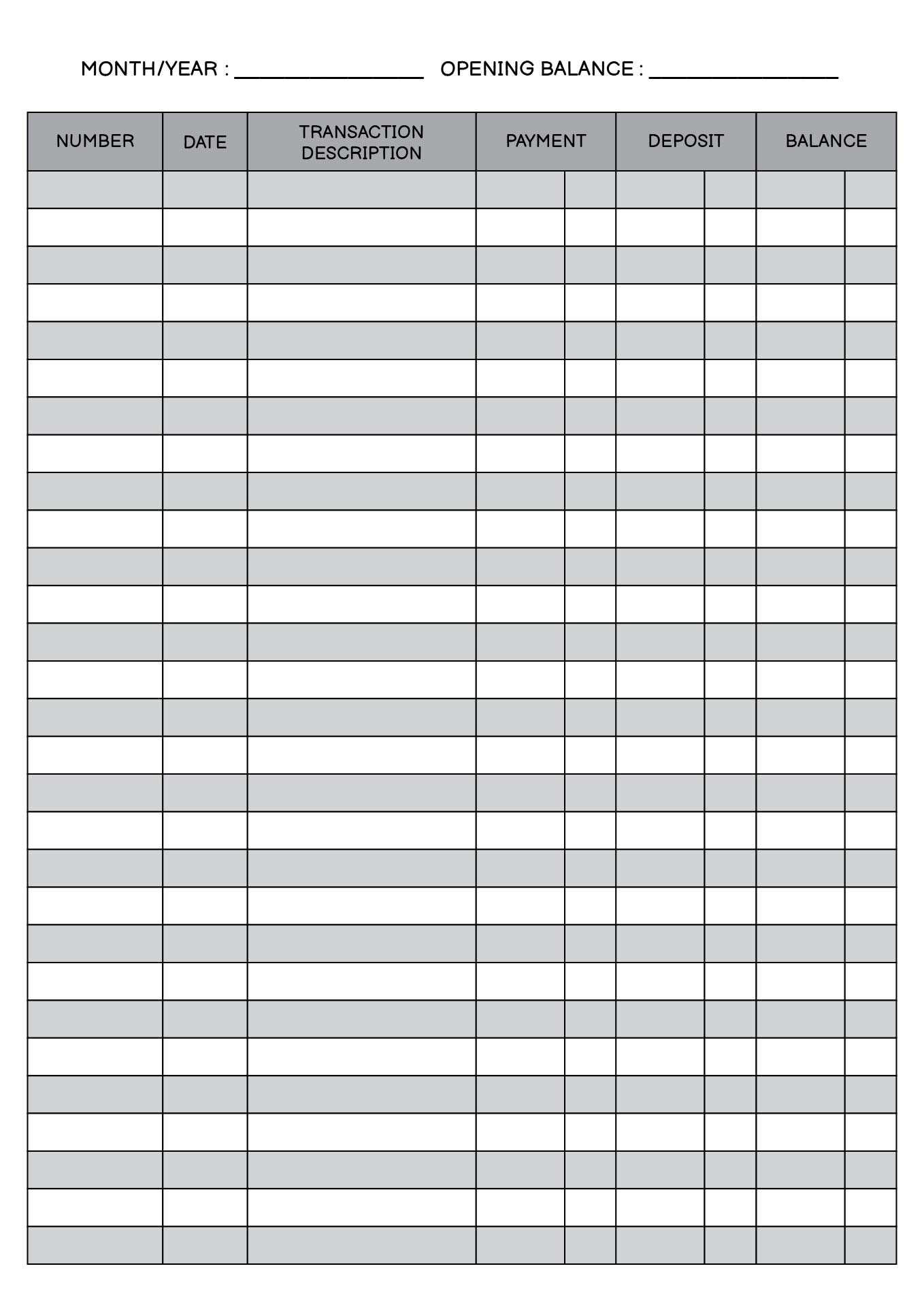

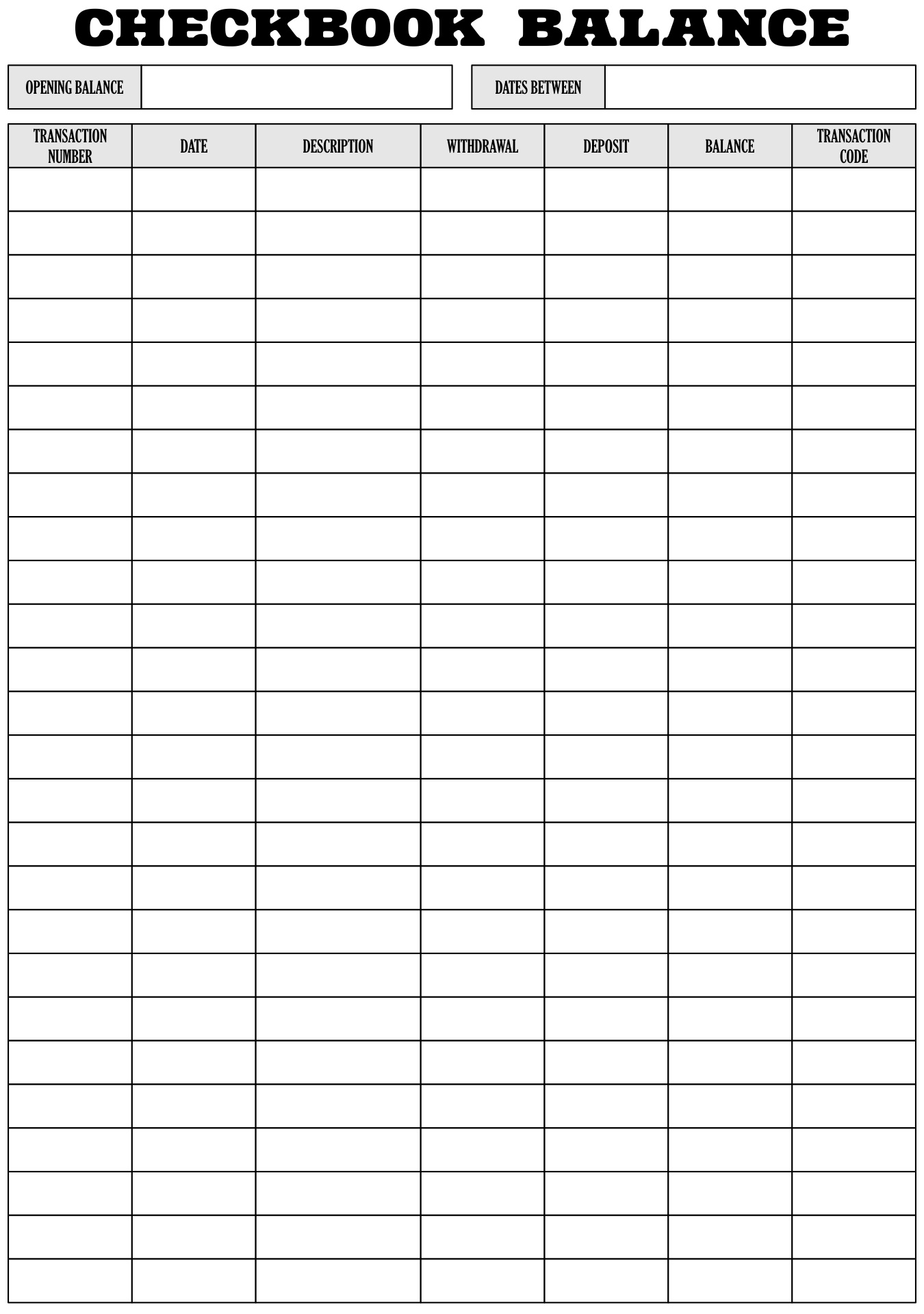

- Free Printable Checkbook Balance Worksheet

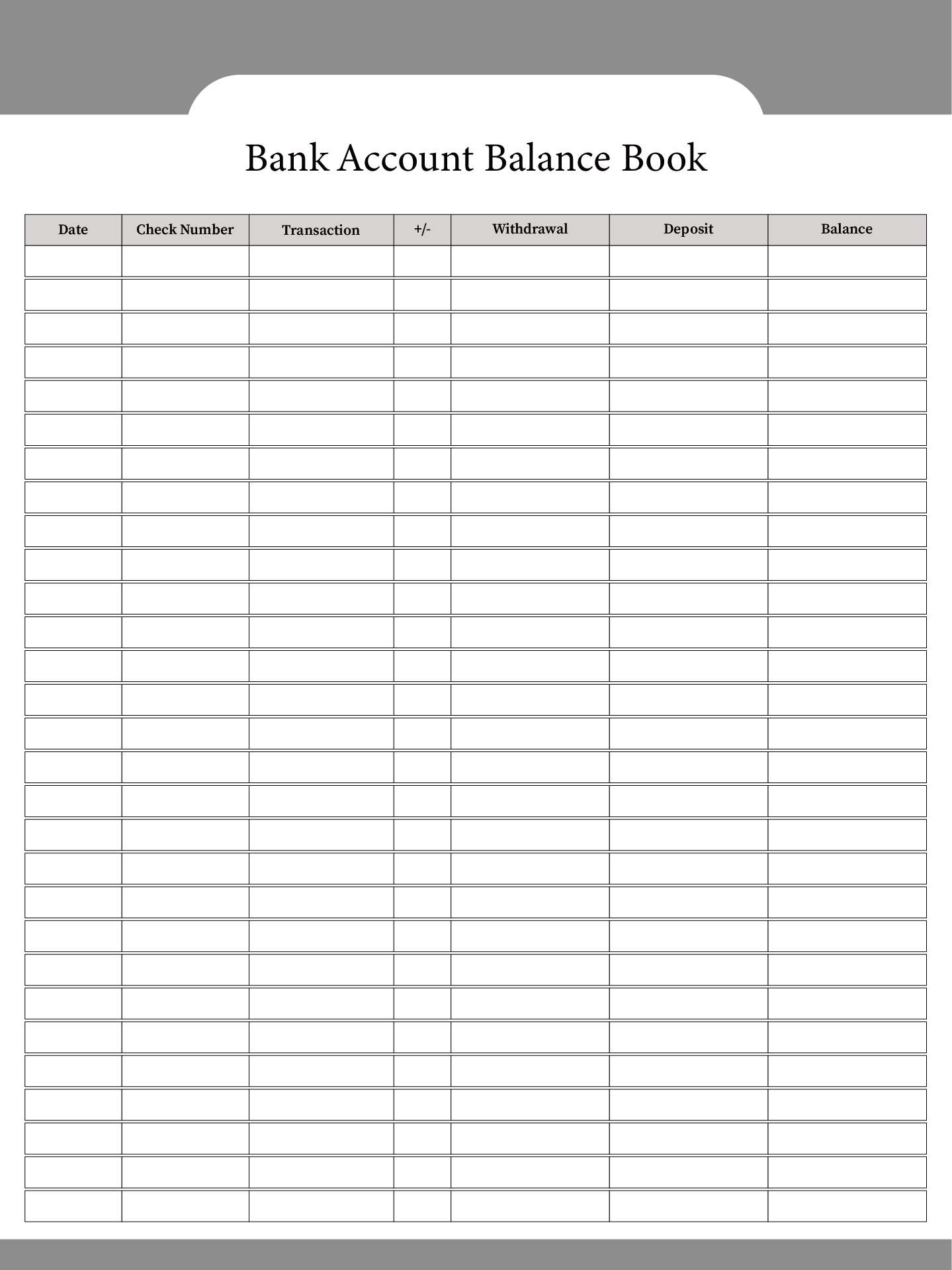

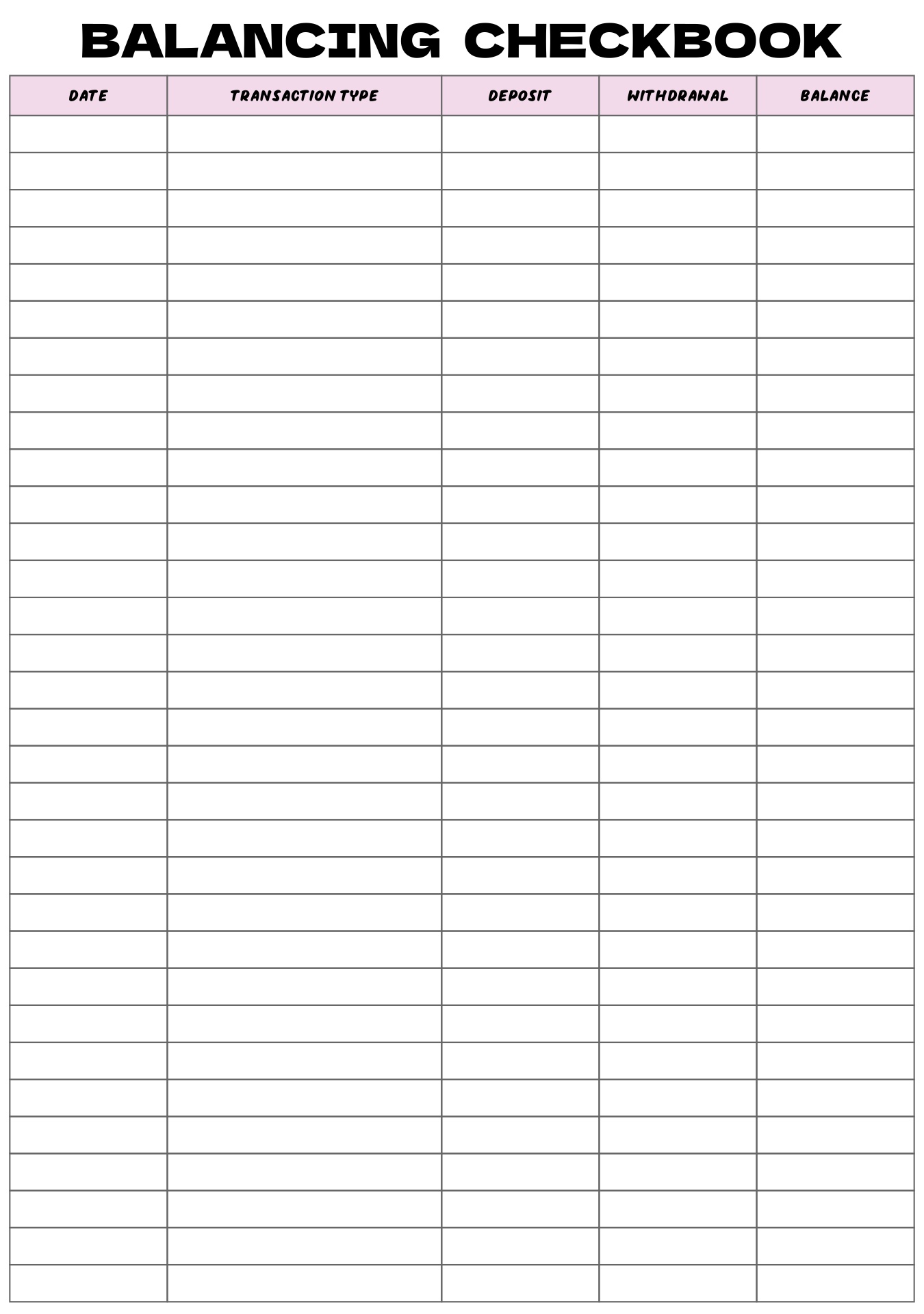

- Printable Balancing Checkbook Worksheet

- Blank Checkbook Balance Sheet

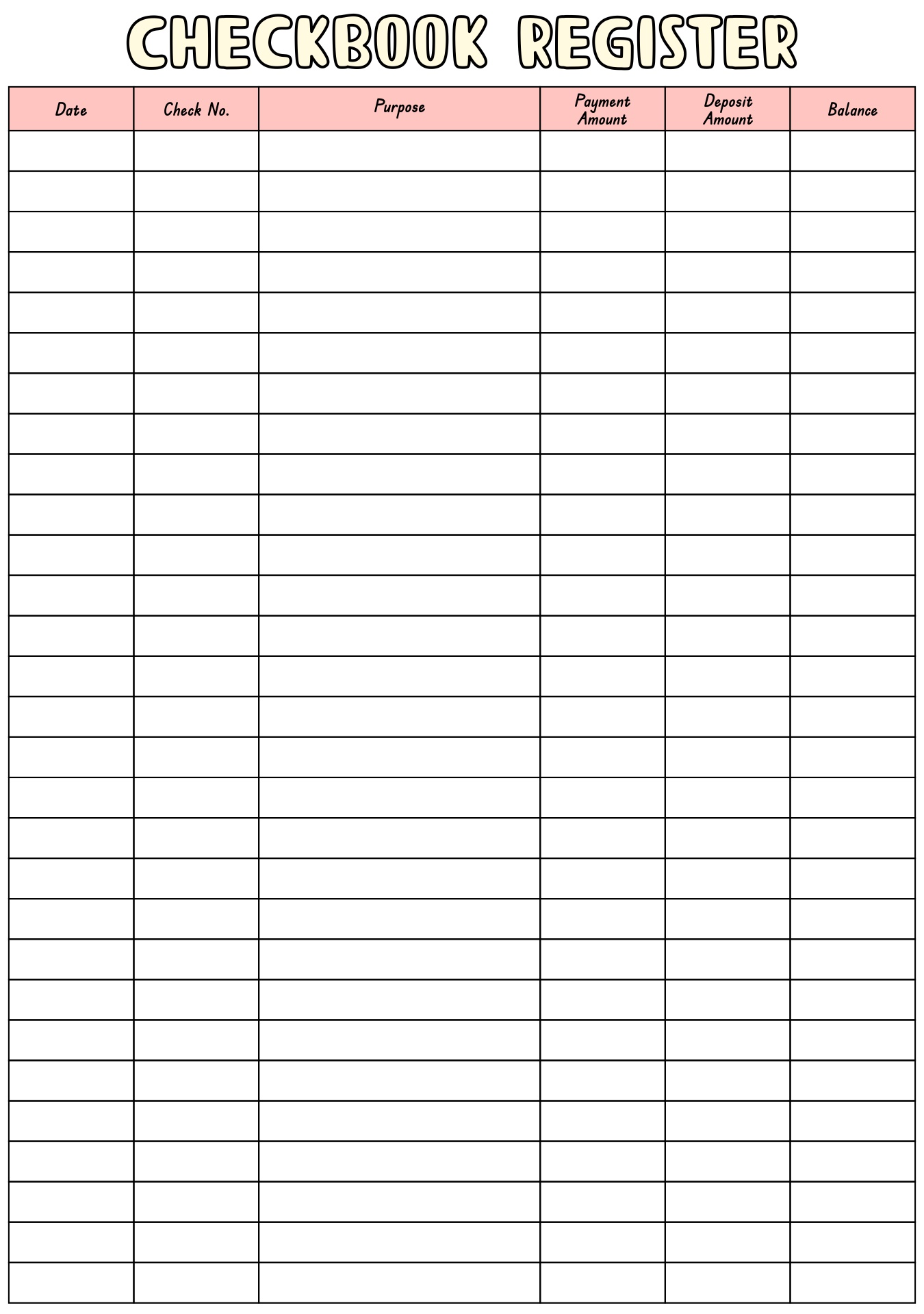

- Printable Checkbook Balance Sheet

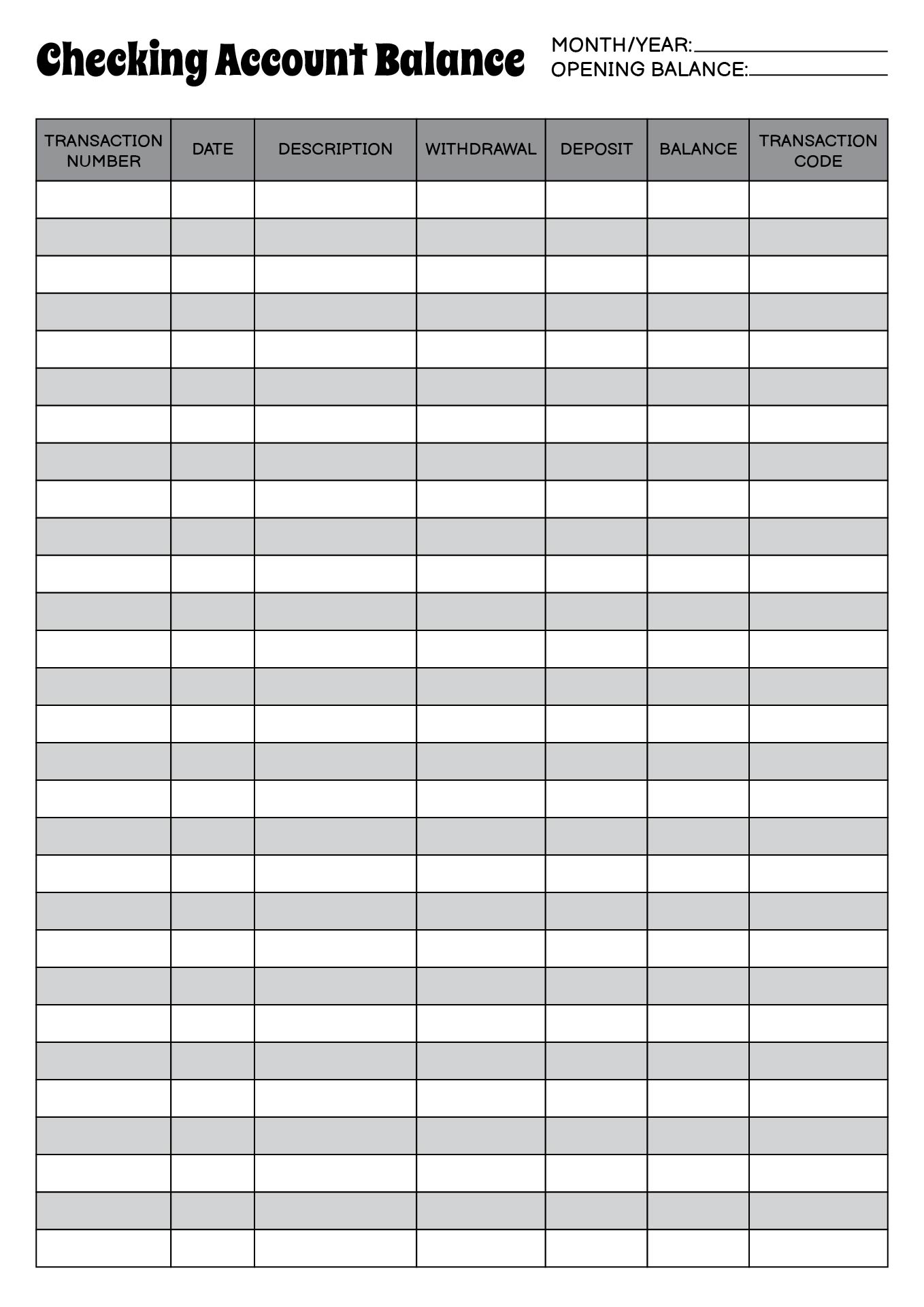

- Checking Account Balance Worksheet

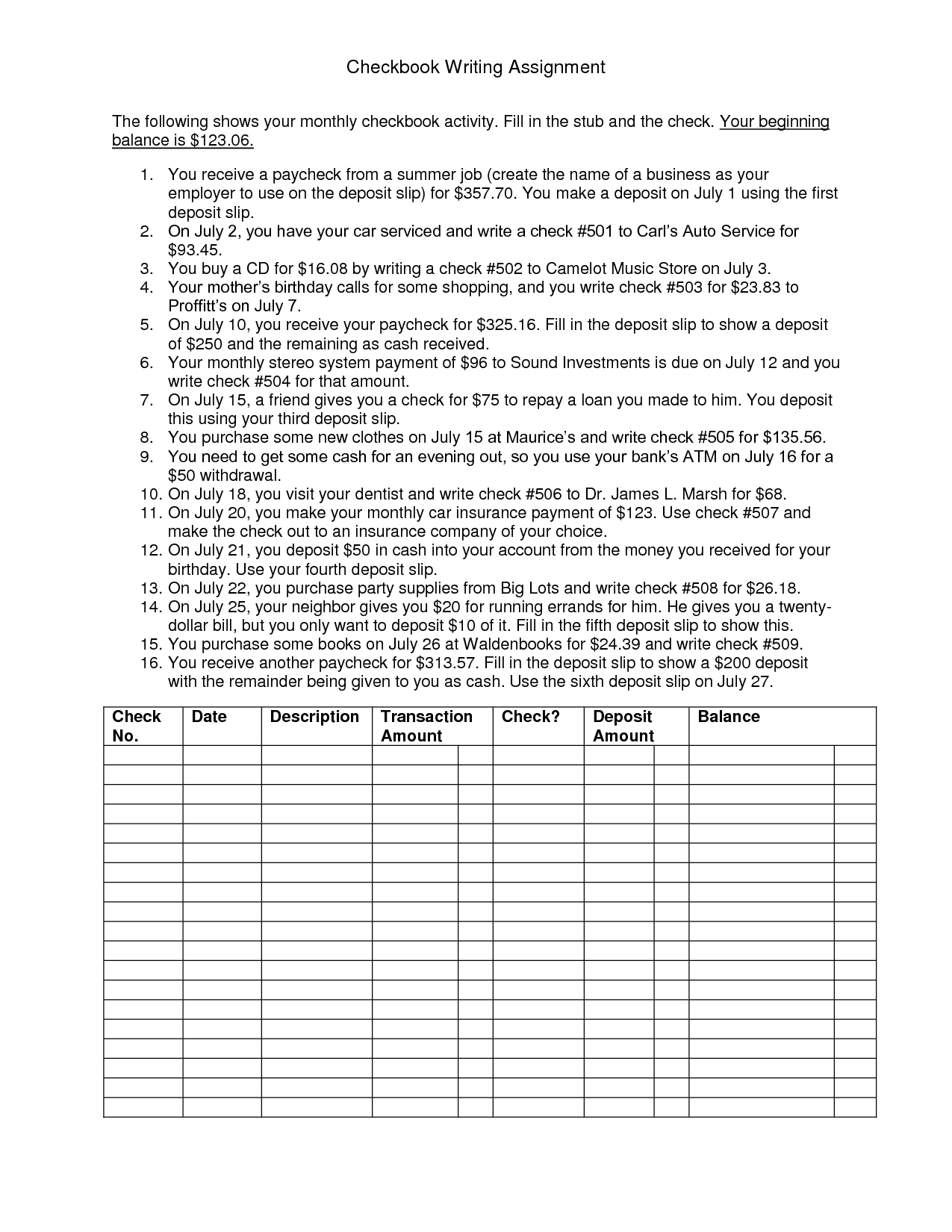

- Balancing Checkbook Worksheets for Students

- Checking Account Balance Worksheet Printable

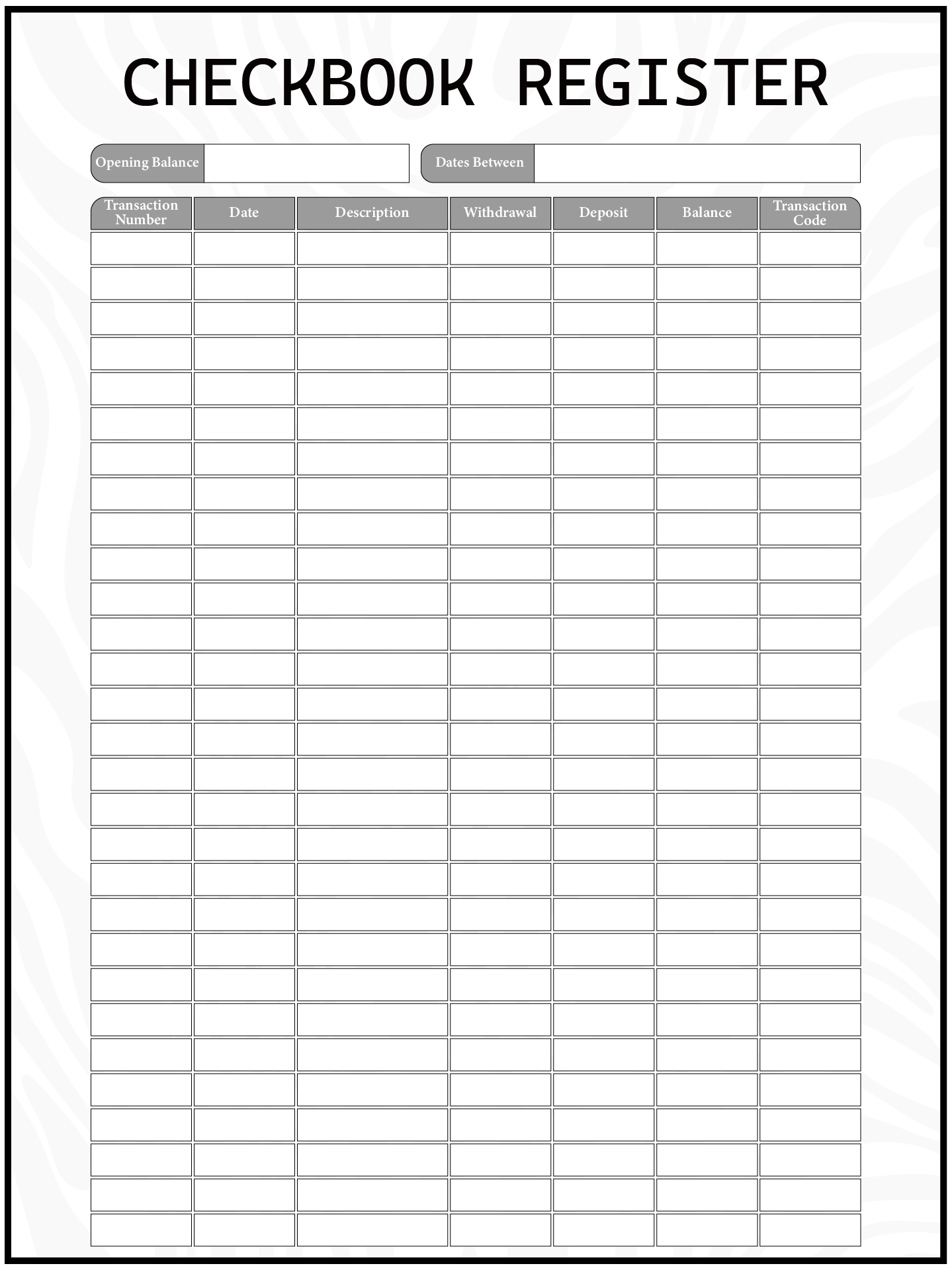

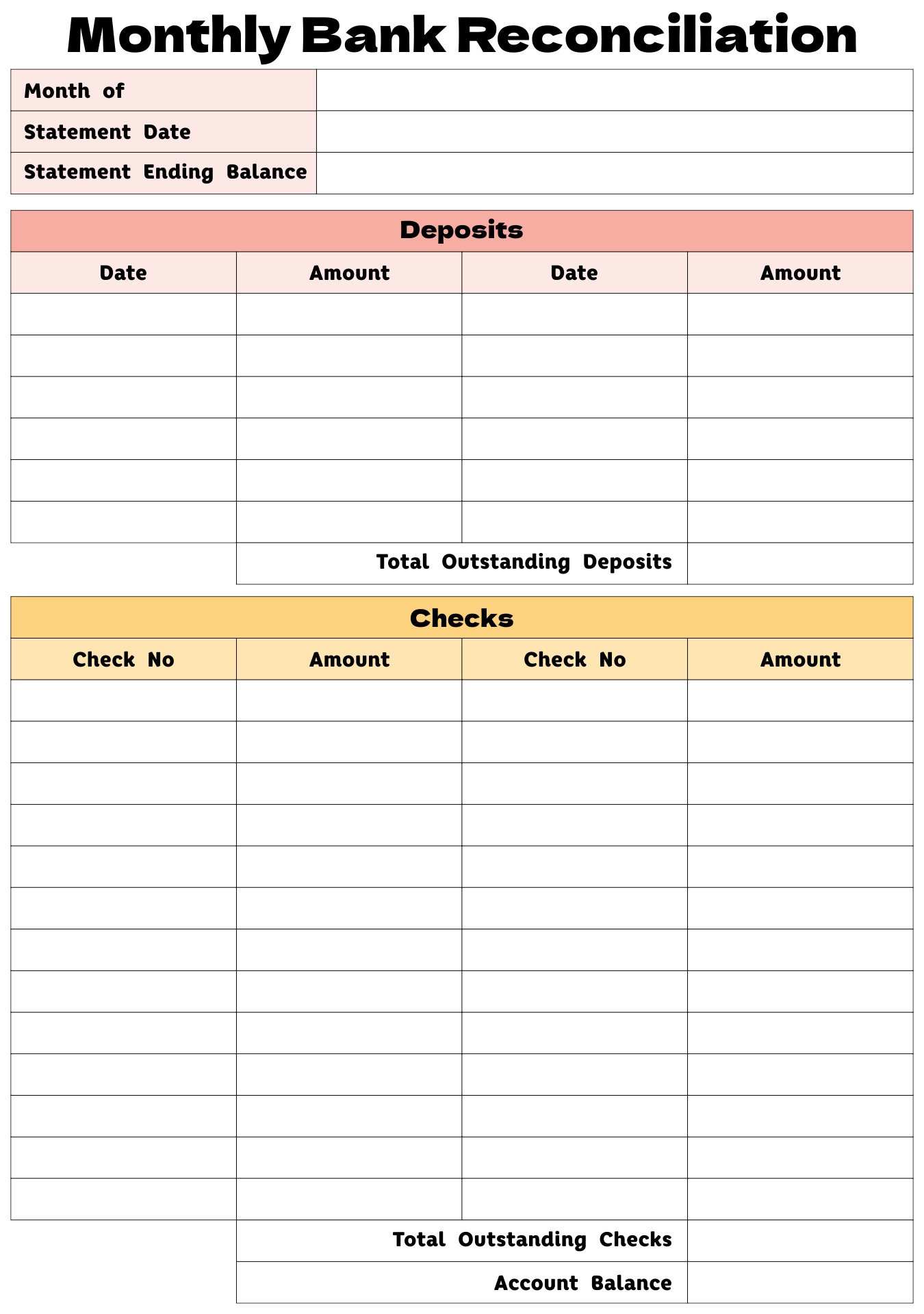

- Monthly Balance Checkbook Worksheet

- Personal Finance Checkbook Balancing Sheet

- Small Business Checkbook Reconciliation Worksheet

- Printable Checkbook Balance Practice Sheet

- Daily Checkbook Management Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

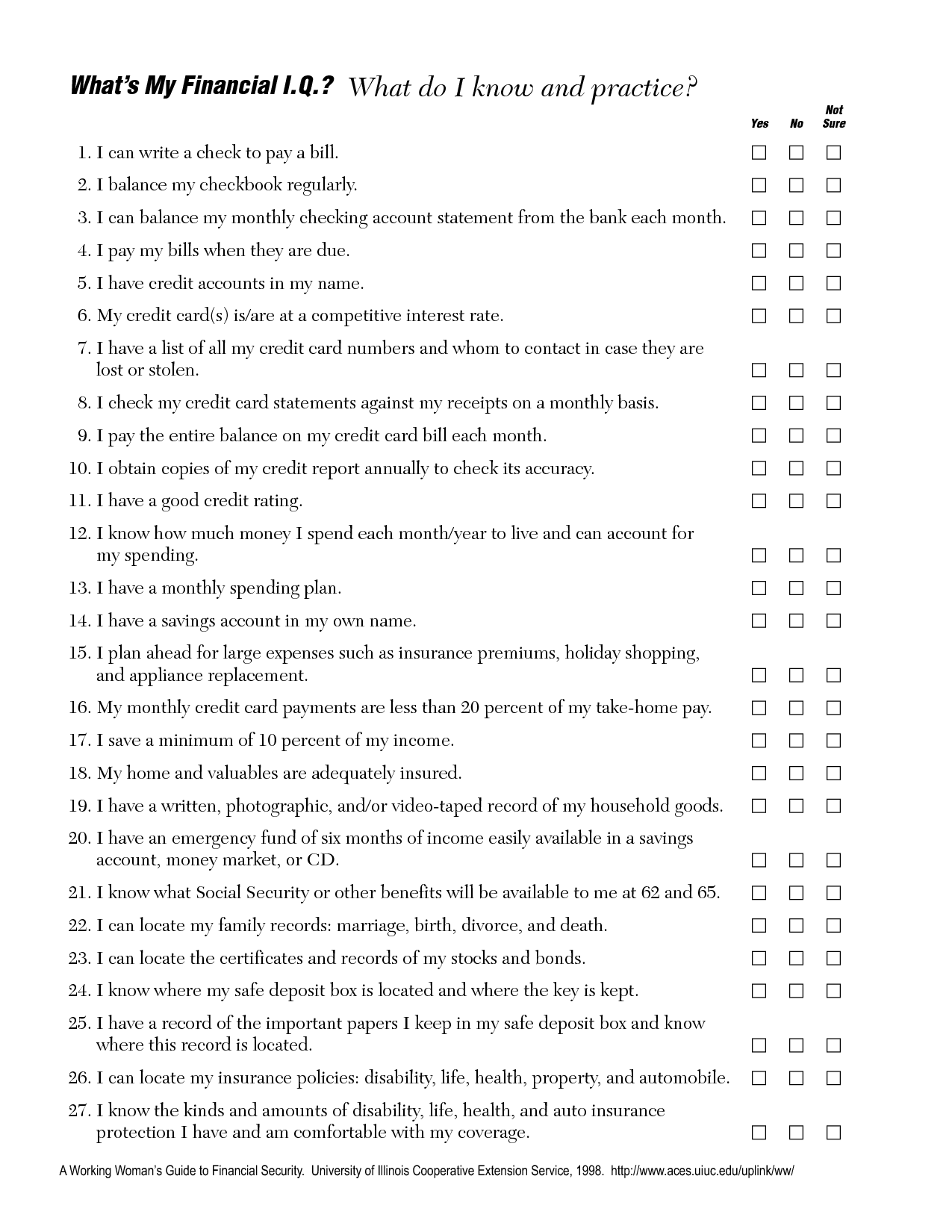

What is a balance checkbook worksheet?

A balance checkbook worksheet is a tool used to track and record financial transactions in a checkbook register, helping users keep track of their bank account balance. It includes columns to input the date, description of transaction, debit or credit amount, and the resulting balance after each transaction. By comparing this balance with the actual bank statement, users can ensure that their records match the bank's records and identify any discrepancies.

Why is it important to practice balancing your checkbook regularly?

Practicing balancing your checkbook regularly is important because it helps you keep track of your finances, ensures that your records match the bank's records to detect any discrepancies or errors, helps prevent overdrawing your account, and allows you to monitor your spending patterns to stick to your budget and financial goals. By staying on top of your checkbook balancing, you can maintain financial stability and make informed decisions about your money management.

How do you use a balance checkbook worksheet to track your expenses?

To use a balance checkbook worksheet to track your expenses, start by recording all your transactions in the worksheet, including deposits and withdrawals. Make sure to categorize each transaction (e.g. groceries, utilities, entertainment) and keep a running total of your balance. Regularly reconcile the worksheet with your actual bank statement to ensure accuracy. By consistently updating the worksheet with your expenses, you can stay organized, monitor your spending habits, and have a clear overview of your financial situation.

What information do you need to fill out a balance checkbook worksheet?

To fill out a balance checkbook worksheet, you will need details of all your transactions such as deposits, withdrawals, checks written, and any other fees or charges associated with your account. This includes the date of each transaction, the amount, a brief description of the transaction, and whether it was a deposit or a withdrawal. You also need the starting balance of your checking account and any interest earned or accrued on the account.

How often should you update your balance checkbook worksheet?

It is recommended to update your balance checkbook worksheet at least once a week to ensure accurate financial records. This practice can help you stay organized, monitor your spending habits, and avoid any potential errors or discrepancies in your finances.

What are the benefits of using a balance checkbook worksheet compared to online banking?

A balance checkbook worksheet provides a tangible record of your finances that you can easily reference without needing internet access, allowing for greater control and visibility over your spending habits. Additionally, manually recording transactions can help you develop a more conscious awareness of your financial activities and promote better money management skills. In contrast, online banking offers real-time updates and convenience for monitoring transactions, making it easier to track spending and identify any discrepancies quickly. Ultimately, a balance checkbook worksheet can serve as a helpful complement to online banking by providing a hands-on approach to managing your finances.

What steps should you take if your balance checkbook worksheet does not match your bank statement?

If your balance checkbook worksheet does not match your bank statement, the first step is to carefully review all the transactions in your checkbook against the transactions on your bank statement. Look for any discrepancies or missing transactions that could explain the difference in balance. Make sure to account for any outstanding checks or deposits that may not have cleared yet. If you still can't find the discrepancy, consider reaching out to your bank to request assistance in reconciling your account.

How can a balance checkbook worksheet help you identify any errors or discrepancies in your transactions?

A balance checkbook worksheet can help you identify errors or discrepancies in your transactions by allowing you to compare your recorded transactions with your bank statement. By entering all your deposits and withdrawals into the worksheet and verifying them against your bank statement, you can quickly spot any discrepancies such as missing transactions, duplicate entries, or incorrect amounts. This process helps ensure that your records accurately reflect your financial activity and can help prevent overdrafts or other costly mistakes.

What strategies can you use to ensure accuracy and avoid mistakes when completing a balance checkbook worksheet?

To ensure accuracy and avoid mistakes when completing a balance checkbook worksheet, you can use strategies such as double-checking each entry, reconciling your transactions regularly with your bank statements, organizing receipts and documents properly, tracking all expenses and deposits in real-time, and seeking help or guidance from a financial advisor or bookkeeping professional when needed. Additionally, utilizing technology such as accounting software or mobile apps can also help streamline the process and reduce errors in balancing your checkbook.

How can the information from a balance checkbook worksheet be useful in creating a monthly budget?

The information from a balance checkbook worksheet can be useful in creating a monthly budget by providing an accurate record of income and expenses. By analyzing the transactions recorded in the checkbook, one can identify patterns in spending, track where money is being allocated, and determine areas where adjustments can be made to align with financial goals. This data can help in setting realistic budget limits for various categories, prioritizing expenses, and ensuring that income covers all necessary costs while also allowing for saving and future planning.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments