Accounting Worksheet Paper

Designed specifically for tracking and analyzing financial data, this Accounting Worksheet Paper is an essential entity that provides a structured framework that allows for seamless recording and summarizing of transactions. Whether you're managing a business's financial statements or preparing for an upcoming exam, an accounting worksheet paper is a must-have resource that simplifies the process and ensures accuracy. So, accountants or people who are studying accounting need to use this worksheet as a template for calculating income statements, cash flow statements, equity, balance sheets, assets, and liabilities.

Table of Images 👆

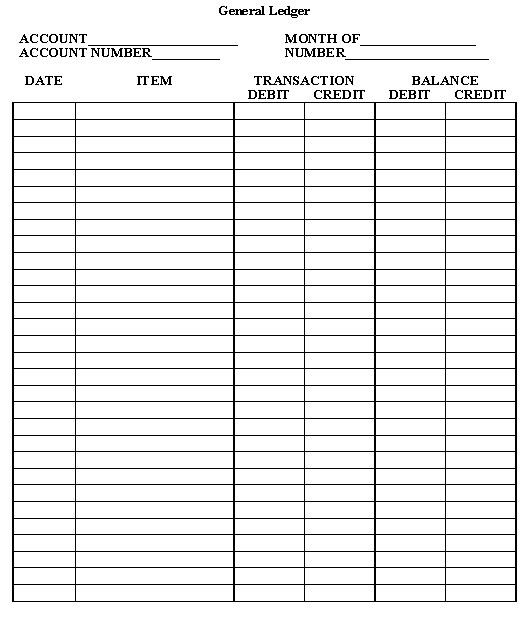

- Free Printable General Ledger Sheet

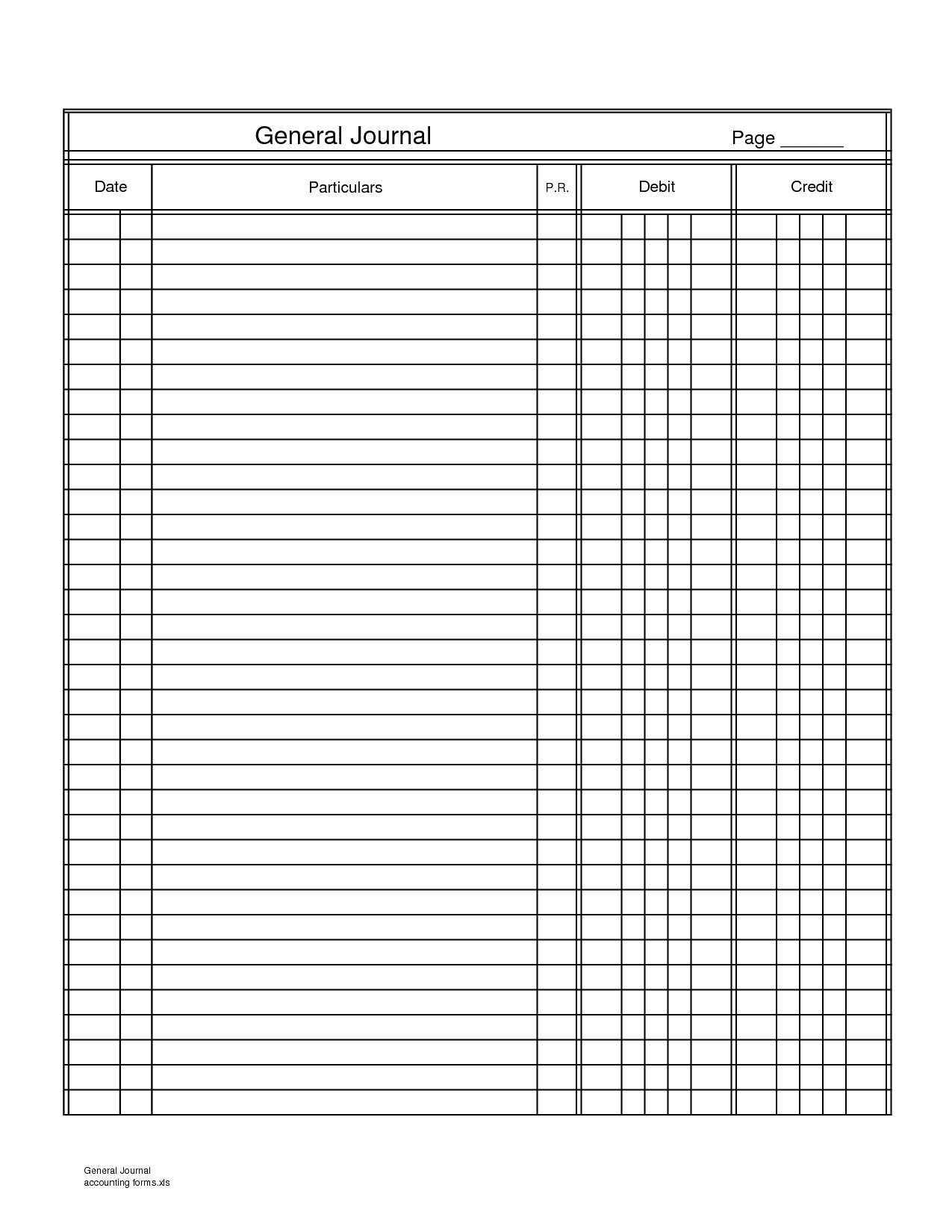

- Accounting General Journal Template

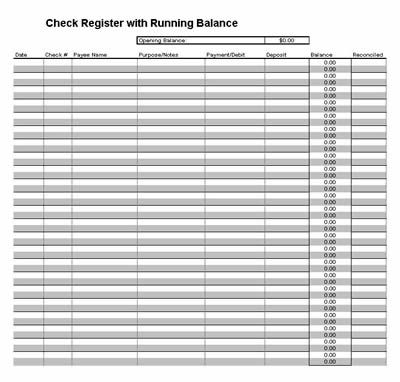

- Free Printable Check Registers Template

- Research Paper Outline Format Example

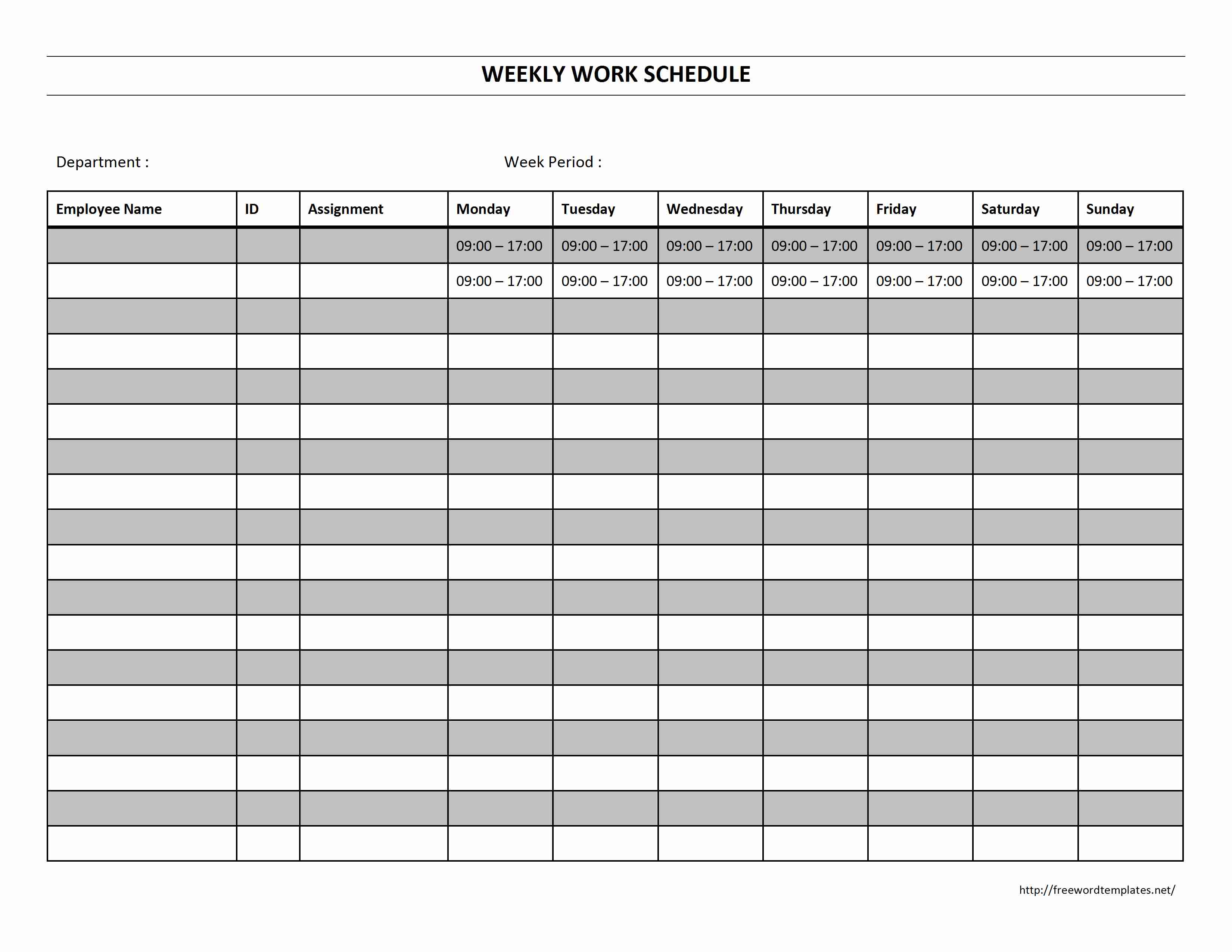

- Blank Weekly Work Schedule Template

- General Ledger Template Printable

- Grammar Worksheets Grade 5

- Free Printable Check Ledger Sheets

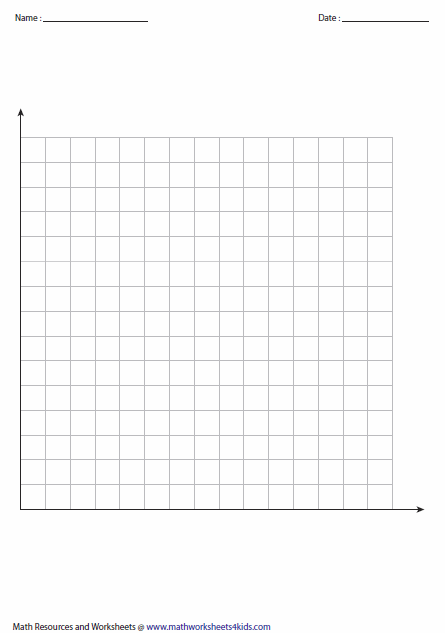

- Quadrant 1 Coordinate Graph Paper

- Loom Beading Graph Paper Printable

- Bullying Essay Examples

- Bullying Essay Examples

- Bullying Essay Examples

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

Record all financial data systematically using Accounting Worksheet Paper and make the best financial decisions!

What is Accounting?

Accounting is the process of recording, classifying, and analyzing all financial transactions in a business. The main purpose of accounting is to provide clear analysis results regarding the financial health of an organization and its financial performance. So, accounting serves as a tool for managing organizational resources and enhancing strategic growth.

In the accounting process, you must use raw data (numbers) and calculate it into data that can be analyzed. After analysis, the data must be written down in financial reports. Financial reports are used as material for making strategic decisions.

The information presented in financial reports is balance sheets, cash flows, financial forecasts, and income reports. All of this information is useful for business leaders to:

- Evaluate company performance

- Evaluating employee performance and payroll

- Analyze new business opportunities

- Manage cash flow

- Maximize profitability

- Analyze the company's financial health

Financial reports are not only used internally but can also be used externally. An example is a report to inform business performance to investors and auditors.

Why is Accounting Important?

There are several reasons why accounting is important in a business or organization.

- Record All Financial Transactions: Accounting is a way to keep all financial records, so you can detect financial problems and avoid fraud. For this reason, businesses must have an effective and efficient accounting system. Modern accounting systems use software that is integrated with other programs in the company.

- Budgeting: Budgeting is a key factor for business. Budgeting helps businesses to develop strategies, optimize profits, and manage expenses. This budgeting can be calculated if you have financial data.

- Decision Making: Another role of accounting is to help business owners to make decisions. The parties involved in business always use accounting to improve company performance. So, without accounting, it is difficult for businesses to achieve success.

- Compliance with Laws: Accounting can also help business owners to comply with legal regulations. This is because accounting can help business owners to calculate taxes. The inability to record and pay taxes will be detrimental to the business.

What are the Advantages of Mastering Accounting?

There are several advantages if you master accounting. Let's discuss these benefits one by one here!

- Your logic will be trained to be better. This is because accounting is related to numbers, so you will often practice solving various problems related to numbers.

- You can use your accounting skills in business and to manage personal finances. By mastering accounting, you can decide what types of expenses should not be made. So, you can manage your money wisely and avoid future risks.

- Mastering accounting also helps you to get better career opportunities. This is because accounting is needed in various fields. So, your skills allow you to achieve a good career in any industry.

- If you want to develop your skills, accounting also allows you to do it. You can get various certifications with your accounting skills. Examples are Certified Internal Auditor (CIA), Certified Management Accountant (CMA), and Financial Risk Manager (FRM).

- You can also have the opportunity to create a service business in the accounting field. An example is a tax recording service business.

- If you want to build your own business, you can also use your accounting skills to manage the business.

What are the Types of Accounts in Accounting?

In accounting, an account is defined as a record written on a financial balance sheet. Accounts are used to record important financial information. Accounts help companies to monitor their income and expenditure activities. 5 types of accounts are often used to track financial information.

- Assets: Assets are anything that provides value to your business. Examples are raw goods, office buildings, and company vehicles. Assets consist of intangible assets and tangible assets.

- Liability: Liability is anything that is owed by the business. An example is engine repair. Because the repairs are so expensive, your business hasn't paid for them and you're just getting an invoice. Subaccounts for liabilities are sales tax, payroll tax, and income tax.

- Equity: Equity is defined as the overall value of the company. Equity will increase if funds or investments are obtained and will decrease if there are expenses or losses. Examples of equity are shares and capital of business owners.

- Expenses: Expenses are anything purchased to run a business. Examples of expense accounts are COGS, insurance, salaries, rent, and maintenance or repair costs.

- Revenue: Revenue is money that comes into the company or profits for the business. Examples of revenue sub-accounts are interest and product sales.

What is Accounting Worksheet Paper?

Accounting Worksheet Paper is a worksheet used to help you record financial transactions. This worksheet can be used as a financial recording practice tool by accounting students. Through this worksheet, they can understand how to make various financial reports such as trial balances and adjusting entries.

For business owners, this worksheet can be used as a tool for recording daily financial data. Then, this data can be used to create financial reports which can be used as a tool for making strategic company decisions.

For those of you who are studying finance or have a business, accounting is an important concept that must be mastered because it is closely related to financial performance. For this reason, you need to use Accounting Worksheet Paper to calculate budgets and create financial reports. Through this worksheet, you can understand accounting principles and various important things related to accounting.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments