4 Column Accounting Worksheet

A accounting worksheet is a common tool used by individuals and businesses to organize and analyze financial information. It serves as a clear and concise way to track and calculate balances, showing the entity's financial position at a specific point in time. Whether you are a small business owner managing your company's finances, a student studying accounting, or someone simply interested in learning more about financial management, utilizing an accounting worksheet can provide you with valuable insights and help you make informed financial decisions.

Table of Images 👆

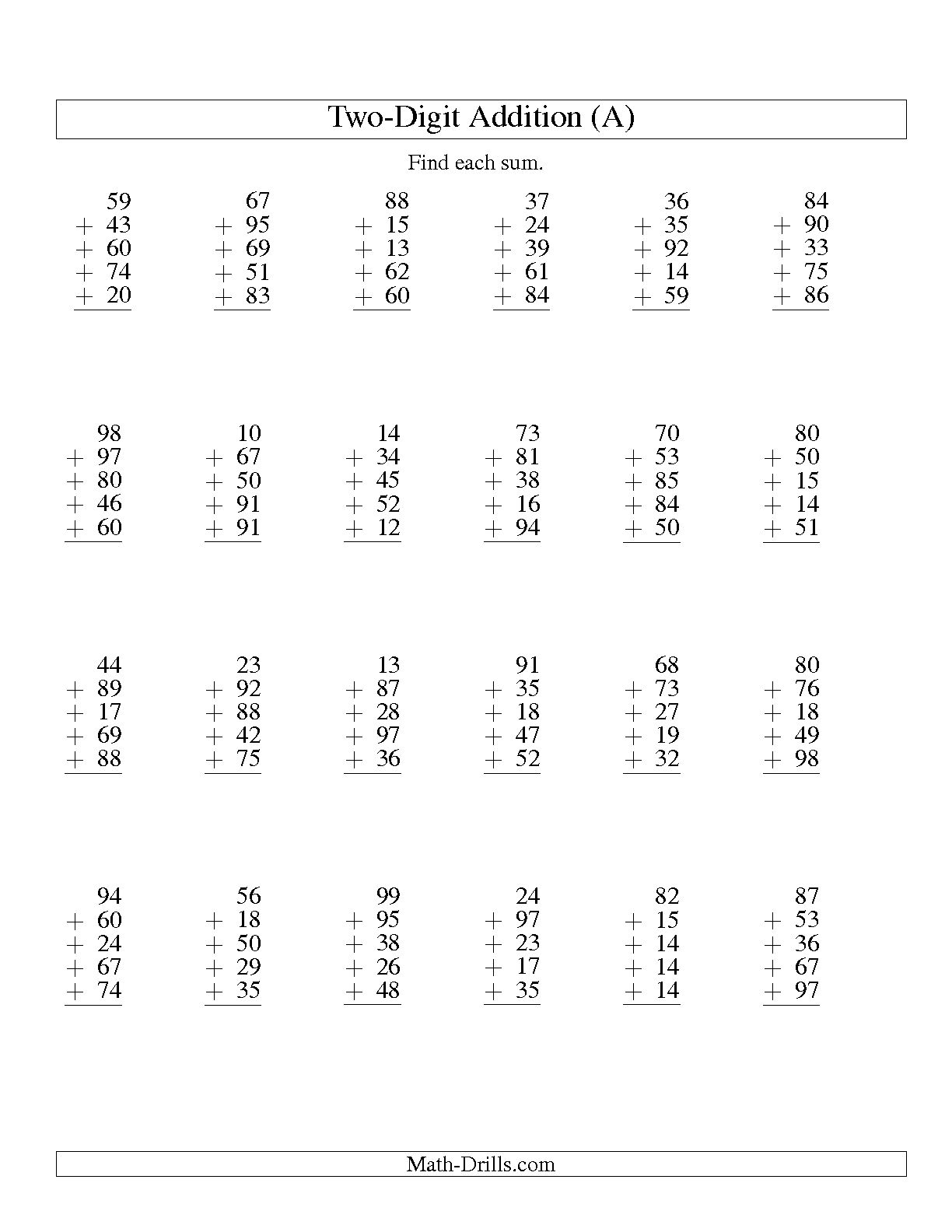

- Column Addition Worksheet

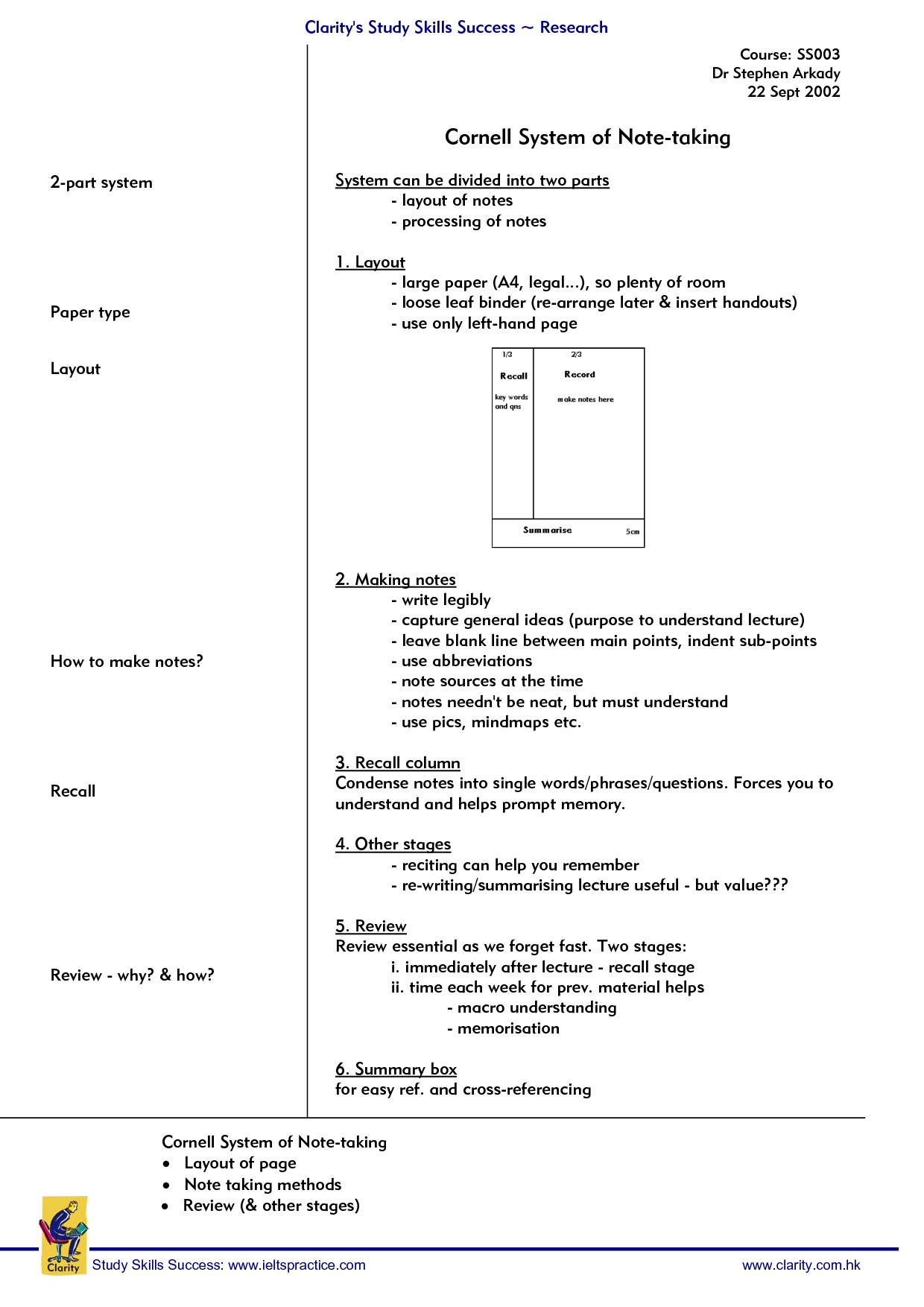

- Cornell Note Taking Template

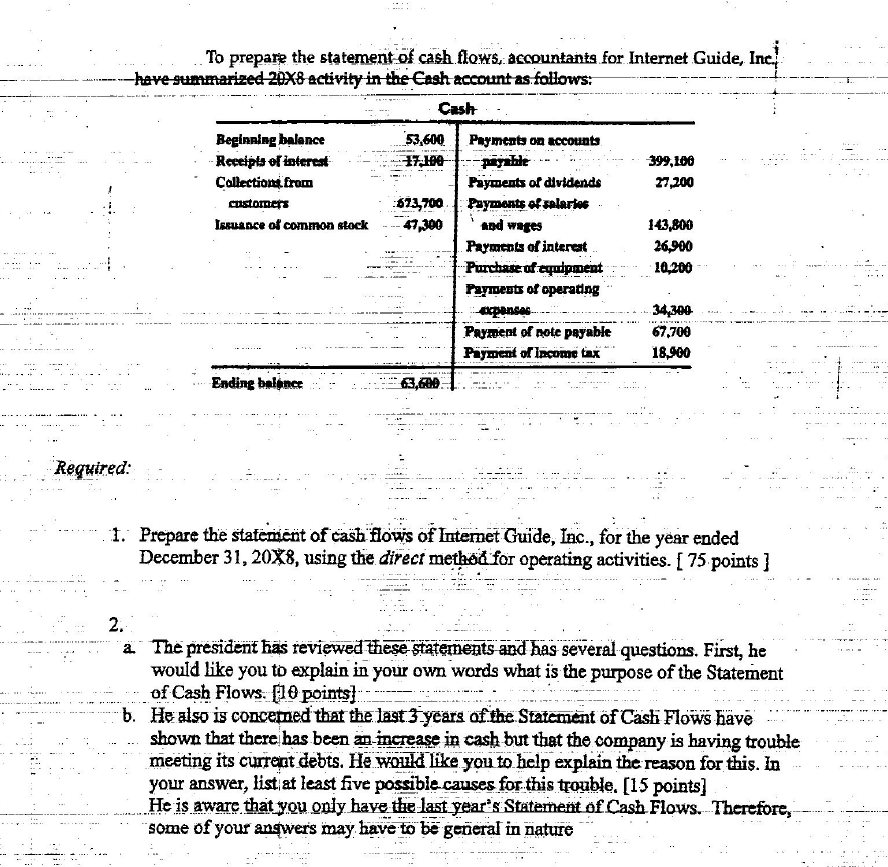

- December 31

- Blank 4 Column Spreadsheet Template

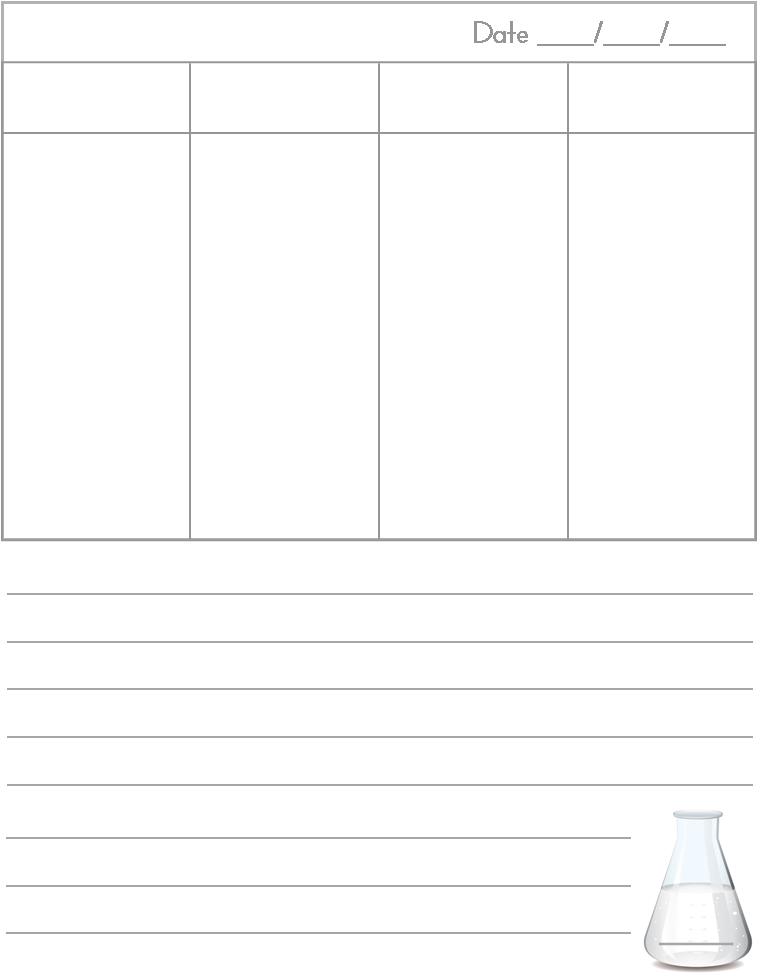

- Blank Accounting Ledger Template Printable

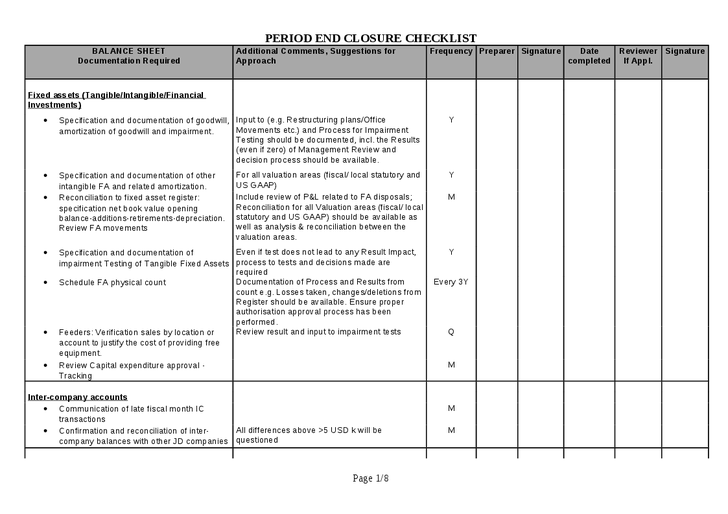

- Month-End Accounting Checklist Template

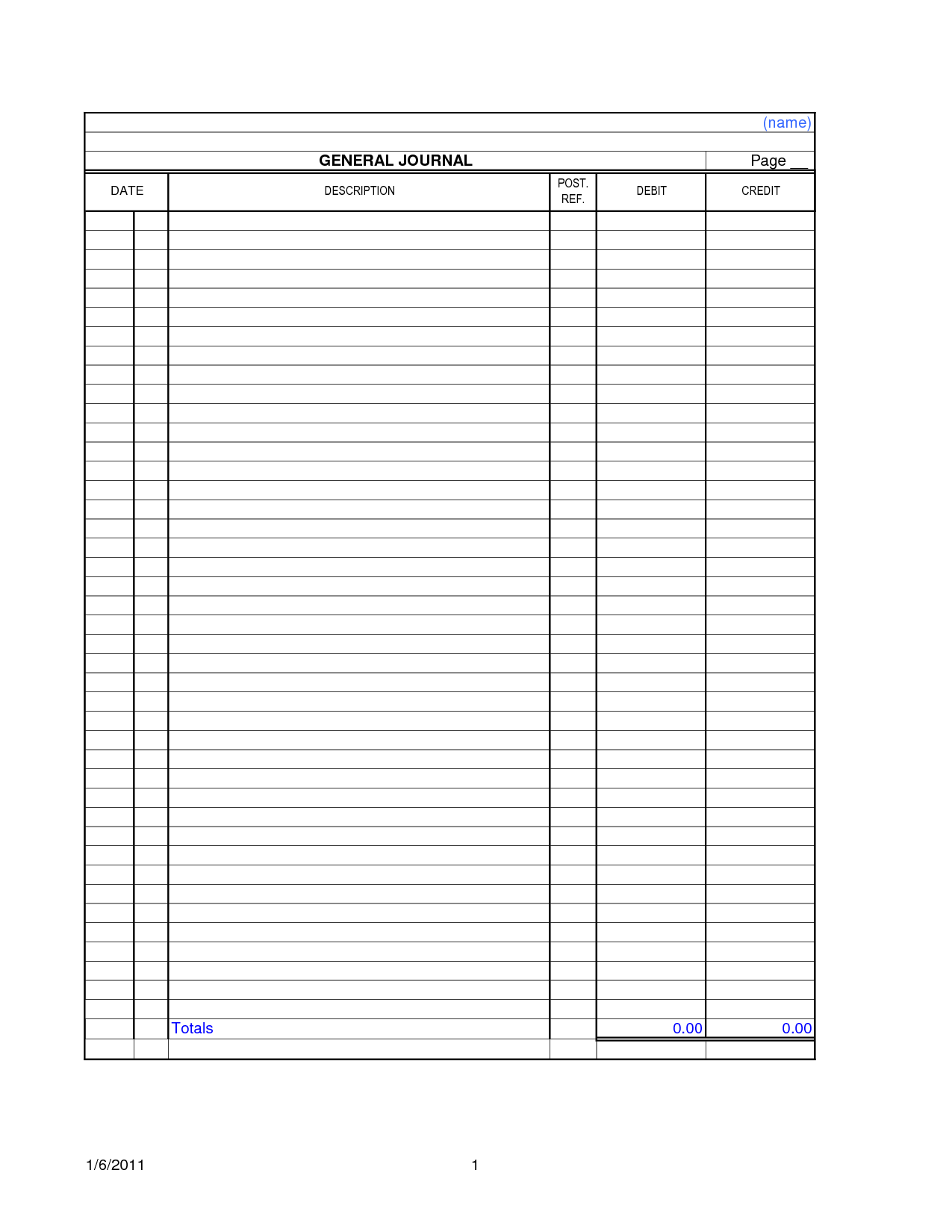

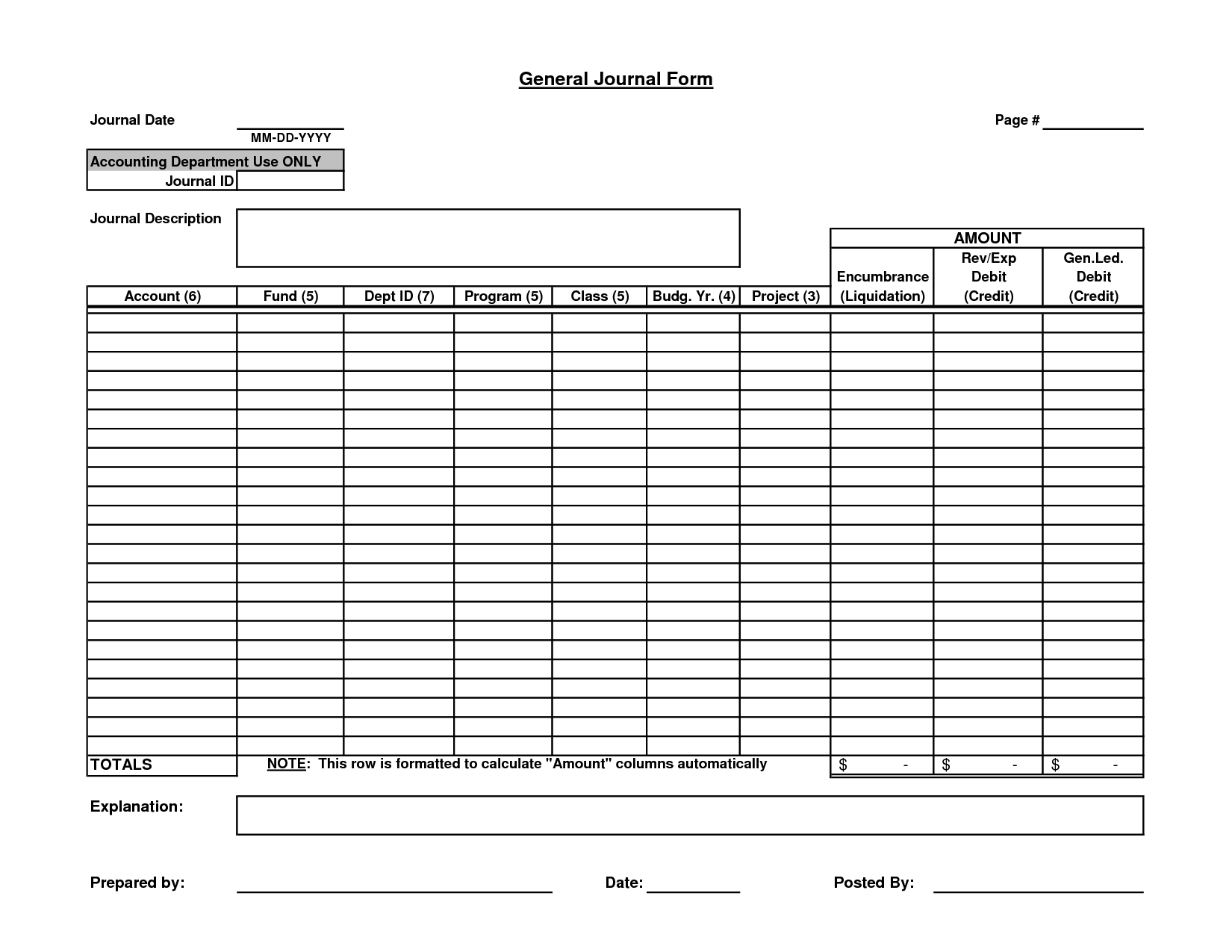

- Blank Journal Entry Form Template

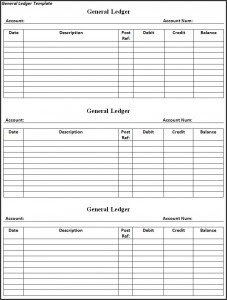

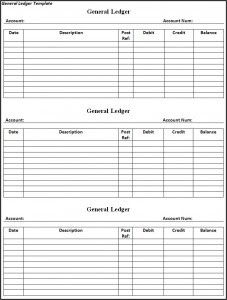

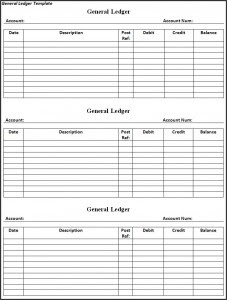

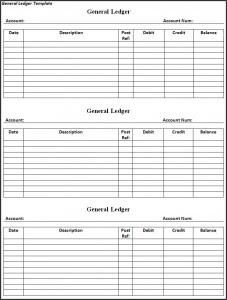

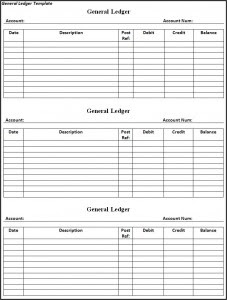

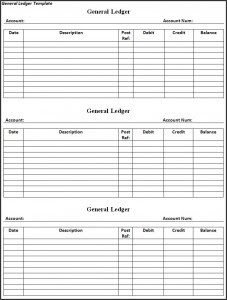

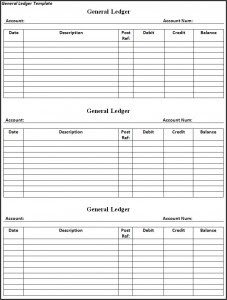

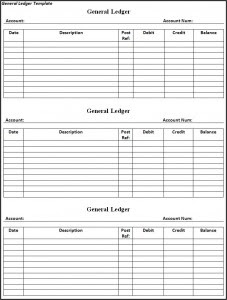

- Free General Ledger Template

- Free General Ledger Template

- Free General Ledger Template

- Free General Ledger Template

- Free General Ledger Template

- Free General Ledger Template

- Free General Ledger Template

- Free General Ledger Template

- Free General Ledger Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a 4 column accounting worksheet?

A 4-column accounting worksheet is a tool used by accountants to prepare adjusting entries and financial statements. It typically consists of four columns: Trial Balance, Adjustments, Adjusted Trial Balance, and Income Statement/Balance Sheet columns. The Trial Balance column lists all the account balances before adjustments, the Adjustments column is used to record adjusting entries, the Adjusted Trial Balance column shows the updated account balances after adjustments, and the last column combines information from the Adjusted Trial Balance to prepare the Income Statement and Balance Sheet.

What does the first column represent in a 4 column accounting worksheet?

The first column in a 4 column accounting worksheet represents the trial balance of the company's general ledger accounts before any adjustments have been made.

What does the second column represent in a 4 column accounting worksheet?

The second column in a 4 column accounting worksheet typically represents the debit amounts for each account, showing the amount of money that is being recorded as being received or spent from each account during the accounting period.

What does the third column represent in a 4 column accounting worksheet?

The third column in a 4-column accounting worksheet represents the debit amounts.

What does the fourth column represent in a 4 column accounting worksheet?

The fourth column in a 4 column accounting worksheet typically represents the Adjustments column. This column is used to record adjusting entries that are necessary to update account balances to reflect the accurate financial position of a company at the end of an accounting period. Adjusting entries are made for things such as prepaid expenses, accrued revenues, and depreciation to ensure that the financial statements provide a true and fair view of the company's financial performance.

What types of accounts are recorded in the first column?

The first column in account ledgers typically records the names of accounts such as assets, liabilities, owner's equity, revenues, and expenses.

What types of accounts are recorded in the second column?

The second column in accounting records typically includes the credits, which represent the source of funds or the liabilities within the business. This column usually records accounts such as accounts payable, loans payable, equity accounts, and revenues.

What types of accounts are recorded in the third column?

The third column in an accounting journal typically records the credit side of transactions, including any increases to liabilities, owners' equity or revenue accounts, as well as any decreases to asset accounts.

What types of accounts are recorded in the fourth column?

The fourth column typically records the credits or decreases to accounts, such as revenues, liabilities, and equity, in a journal or ledger.

What is the purpose of using a 4 column accounting worksheet?

The purpose of using a 4-column accounting worksheet is to facilitate the process of preparing financial statements by providing a structured format for recording and adjusting financial data. It helps in organizing trial balance, adjustments, adjustments' balances, and financial statement columns, allowing accountants to easily make changes, analyze accounts, and ensure accuracy before transferring data to the actual financial statements. The 4-column worksheet simplifies the process of creating the income statement, balance sheet, and other financial reports by displaying the necessary information in a clear and organized manner.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments