2016 Financial Goal Worksheet

Are you searching for a practical and effective tool to help you stay on track with your financial goals? Look no further, because we have just what you need! Introducing the 2016 Financial Goal Worksheet, a comprehensive and user-friendly resource designed to help individuals and families take control of their finances and achieve their financial milestones. Whether you're saving for a down payment on a house, paying off debt, or planning for retirement, this worksheet is the perfect entity to guide you through the process.

Table of Images 👆

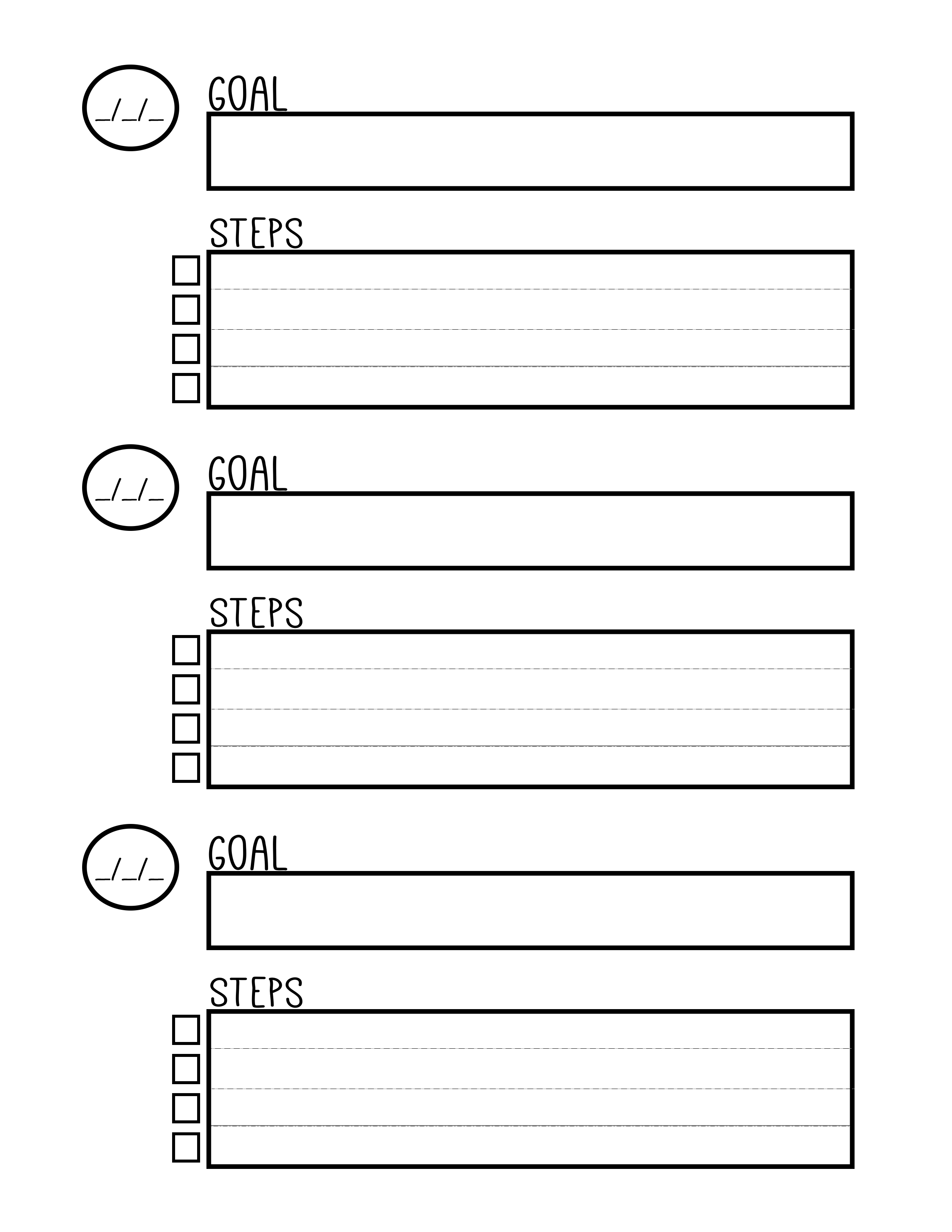

- Goal Setting Worksheet

- Templates for Goal Setting Worksheets

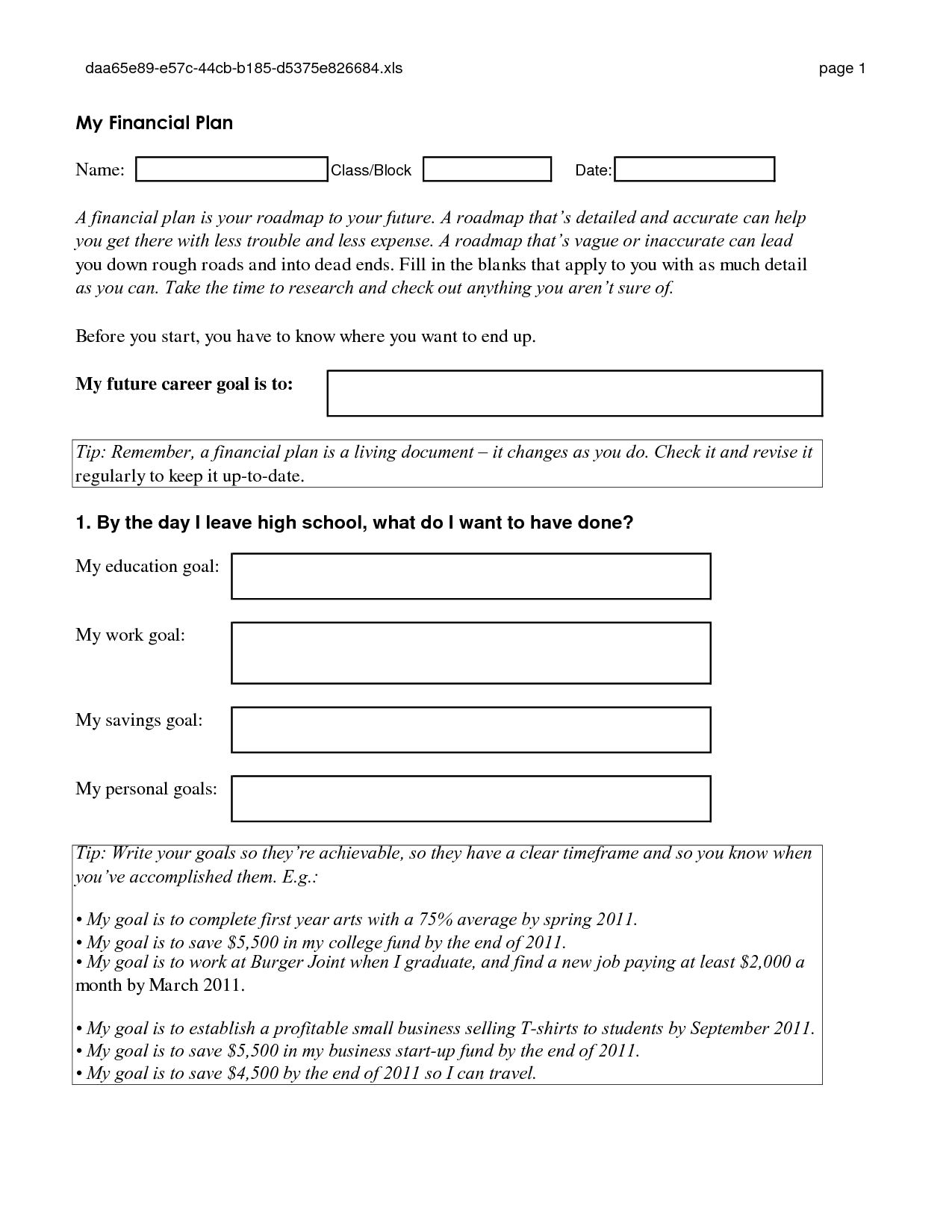

- Long-Term Financial Goal Worksheet

- Smart Goal Worksheet Template

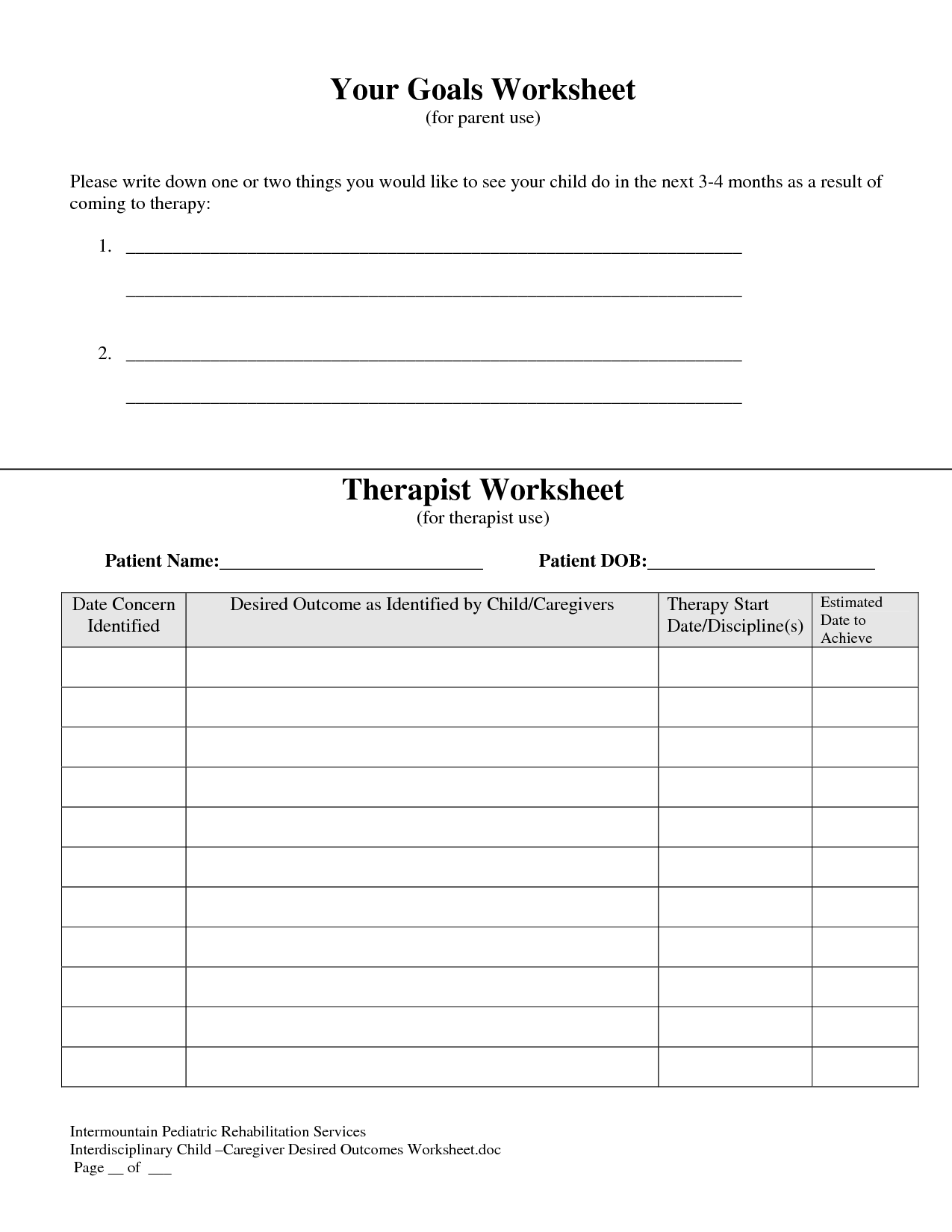

- Therapy Goal Setting Worksheet

- School Goal Setting Worksheet

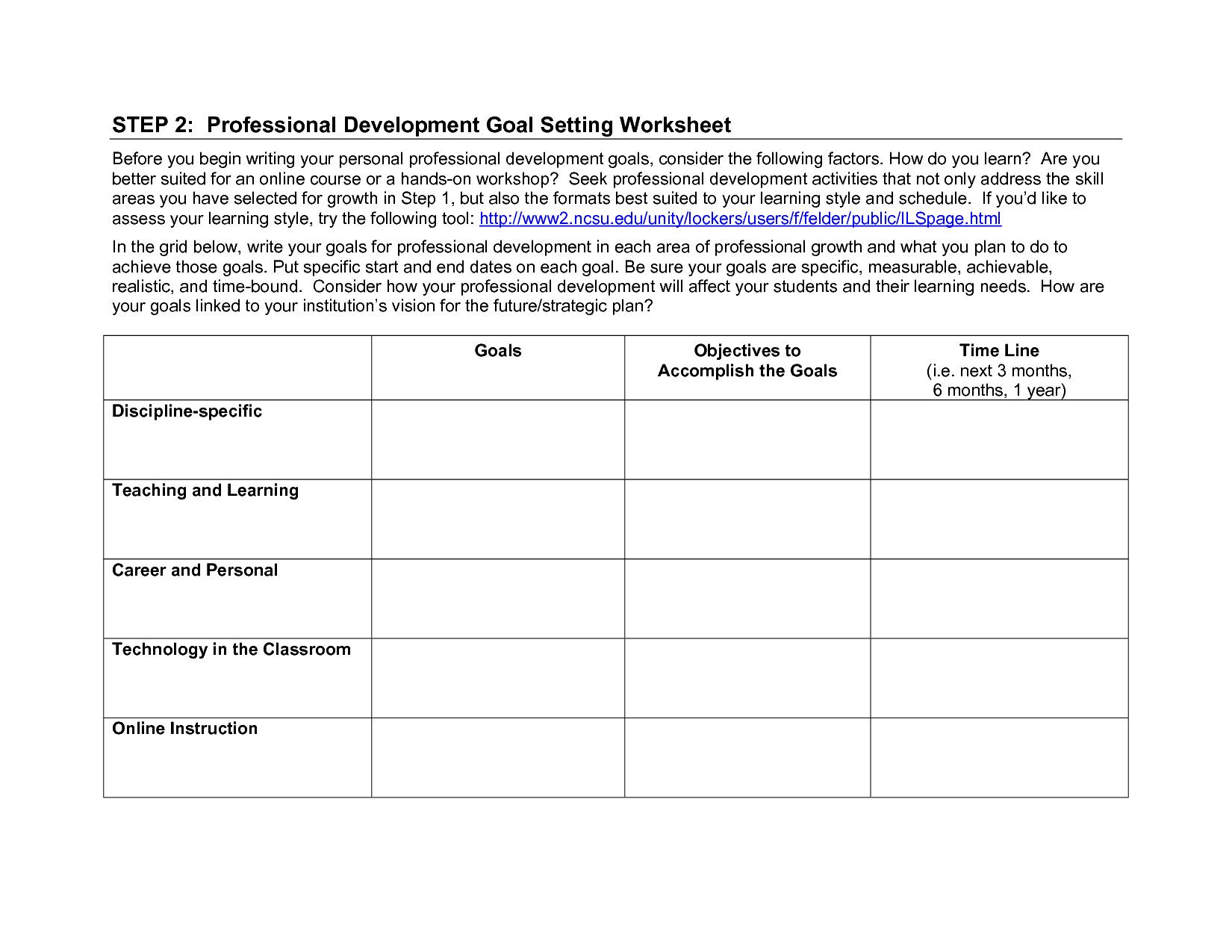

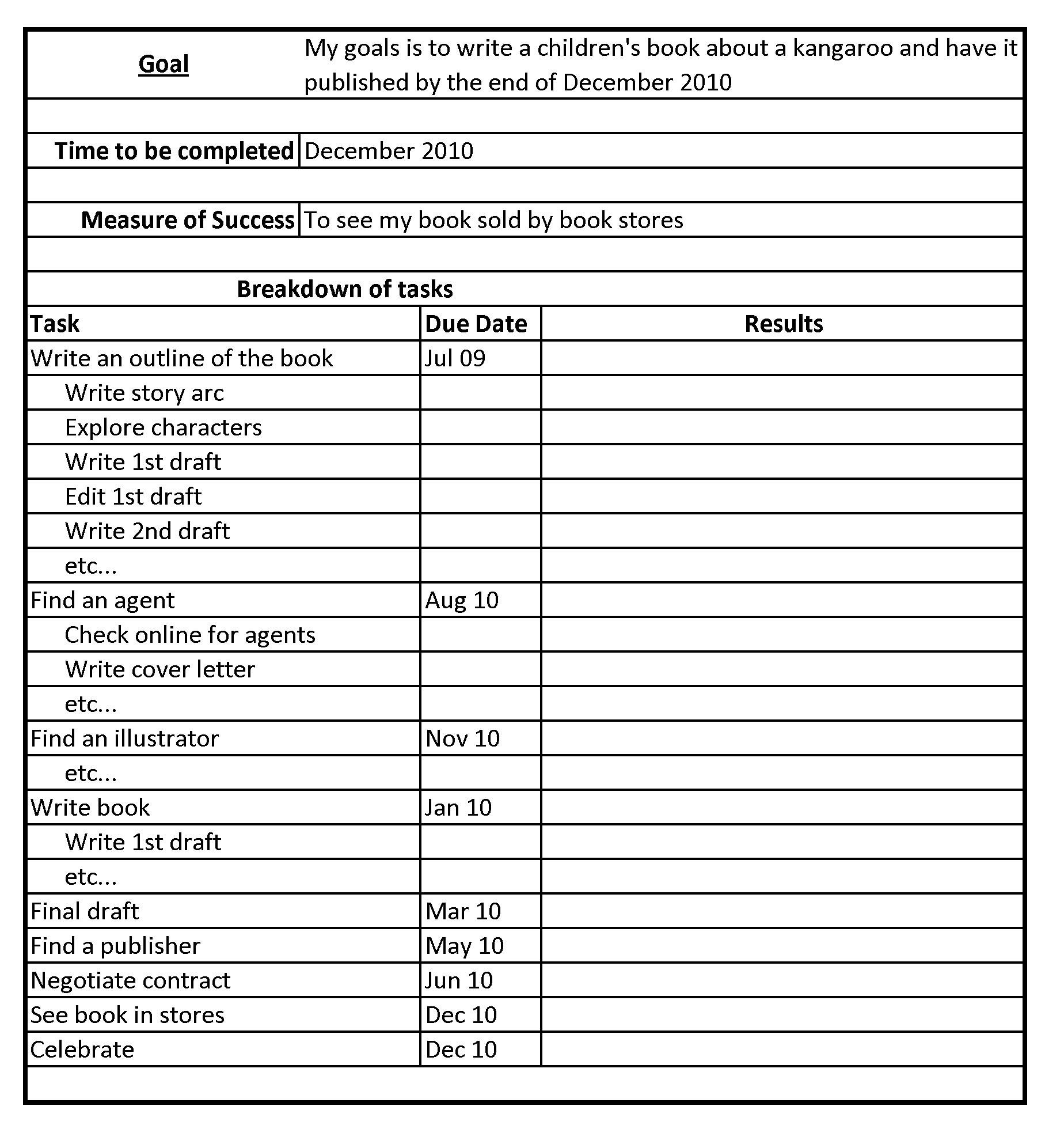

- Professional Goal Setting Worksheet

- Student Goal Setting Worksheet

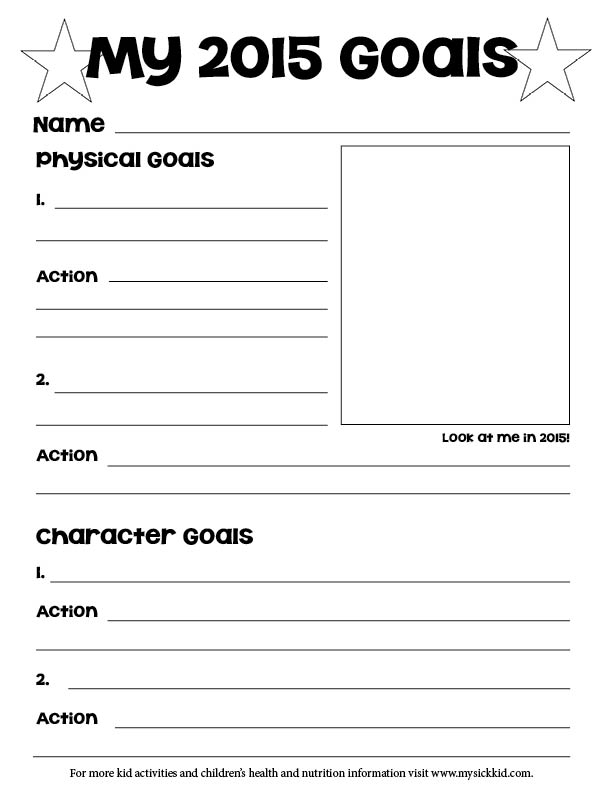

- Printable Goal Setting Worksheet

- Personal Financial Goals Worksheet

- Goal Setting Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a financial goal worksheet?

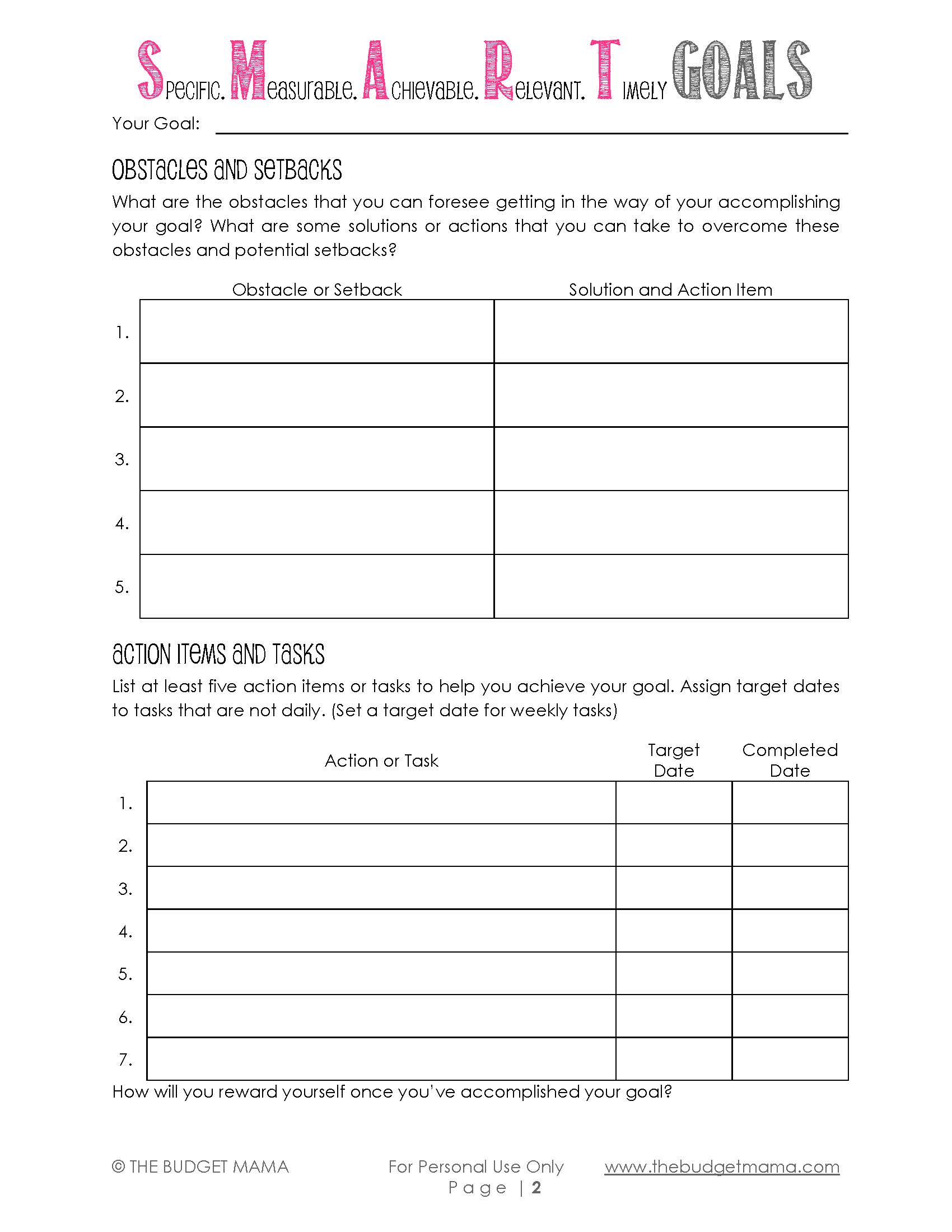

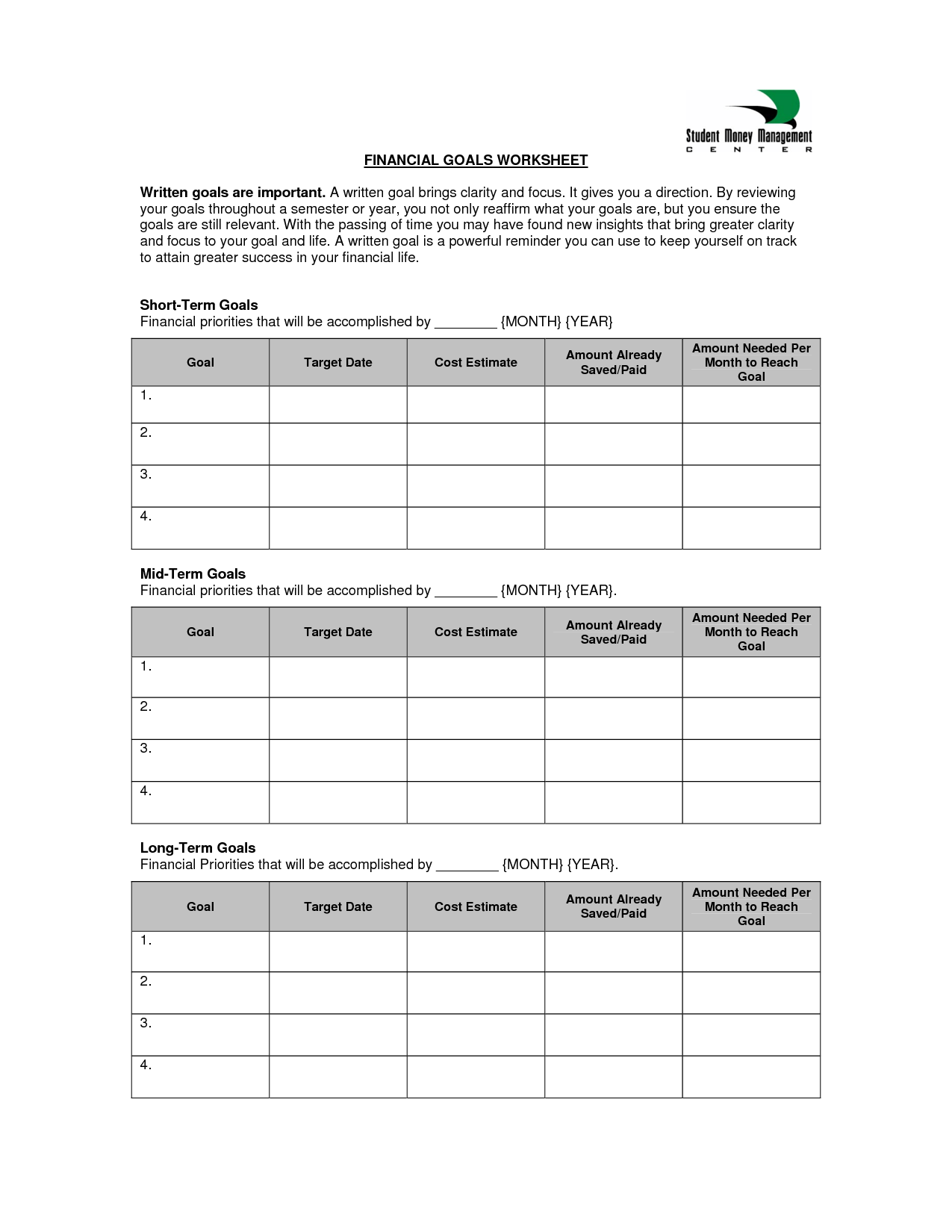

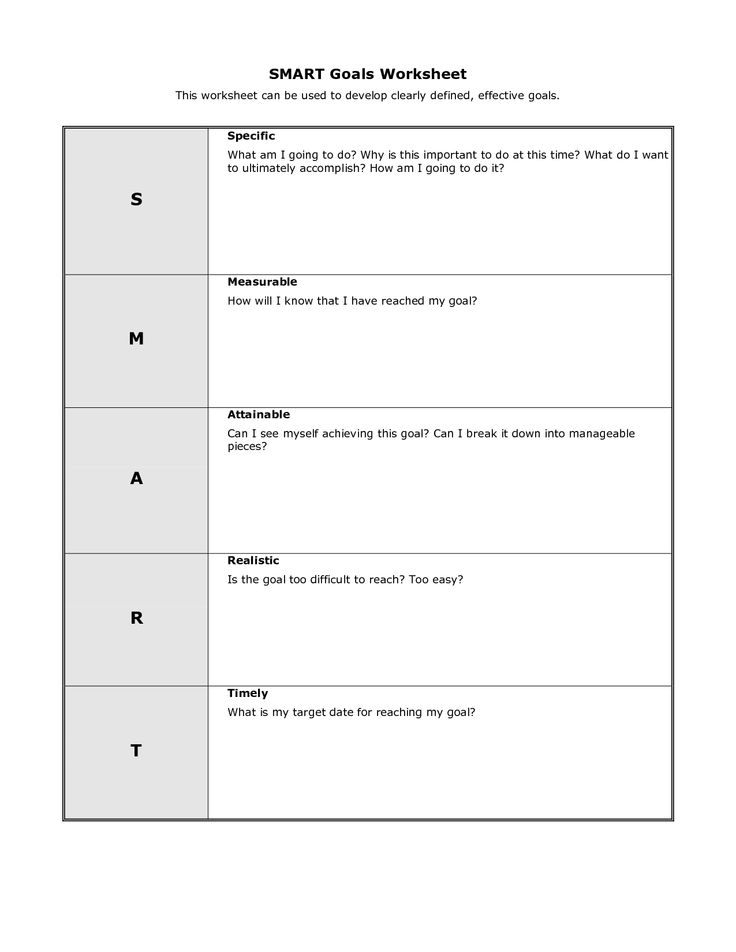

A financial goal worksheet is a tool used to outline and track specific financial objectives that one wants to achieve over a set period of time. It typically includes sections for setting goals, identifying the steps needed to reach those goals, estimating costs or savings required, and tracking progress towards achieving them. This worksheet helps individuals or households prioritize their financial aspirations, develop a plan to attain them, and stay on track towards financial success.

What is the purpose of a 2016 financial goal worksheet?

The purpose of a 2016 financial goal worksheet is to help individuals or businesses set specific and measurable financial goals for the year ahead. It allows them to track their progress, monitor their expenses, and make adjustments as needed to reach their financial targets by the end of the year.

How does a financial goal worksheet help individuals plan for the future?

A financial goal worksheet helps individuals plan for the future by providing a structured way to identify and prioritize their financial objectives, such as saving for retirement, buying a home, or paying off debt. By breaking down these goals into specific, measurable targets, individuals can create a roadmap for achieving them, which includes setting deadlines and outlining the actions needed to reach each goal. This tool encourages financial discipline and accountability, helping individuals stay on track with their long-term financial plans and ultimately work towards a more secure and stable future.

What types of financial goals can be included in a 2016 financial goal worksheet?

Some examples of financial goals that can be included in a 2016 financial goal worksheet are saving a certain amount of money, paying off a specific debt, increasing retirement contributions, creating an emergency fund, setting a budget and sticking to it, investing in stocks or other assets, and improving credit score. Each goal should be specific, measurable, achievable, relevant, and time-bound to effectively track progress throughout the year.

How can a 2016 financial goal worksheet help individuals track their progress?

A 2016 financial goal worksheet can help individuals track their progress by providing a clear structure to set specific goals, outline action steps to achieve those goals, and track their income and expenses over time. By regularly updating the worksheet with financial information, individuals can see how they are progressing towards their goals, identify areas where they may need to adjust their spending or saving habits, and stay motivated to continue working towards financial well-being.

What are some common sections or categories in a financial goal worksheet?

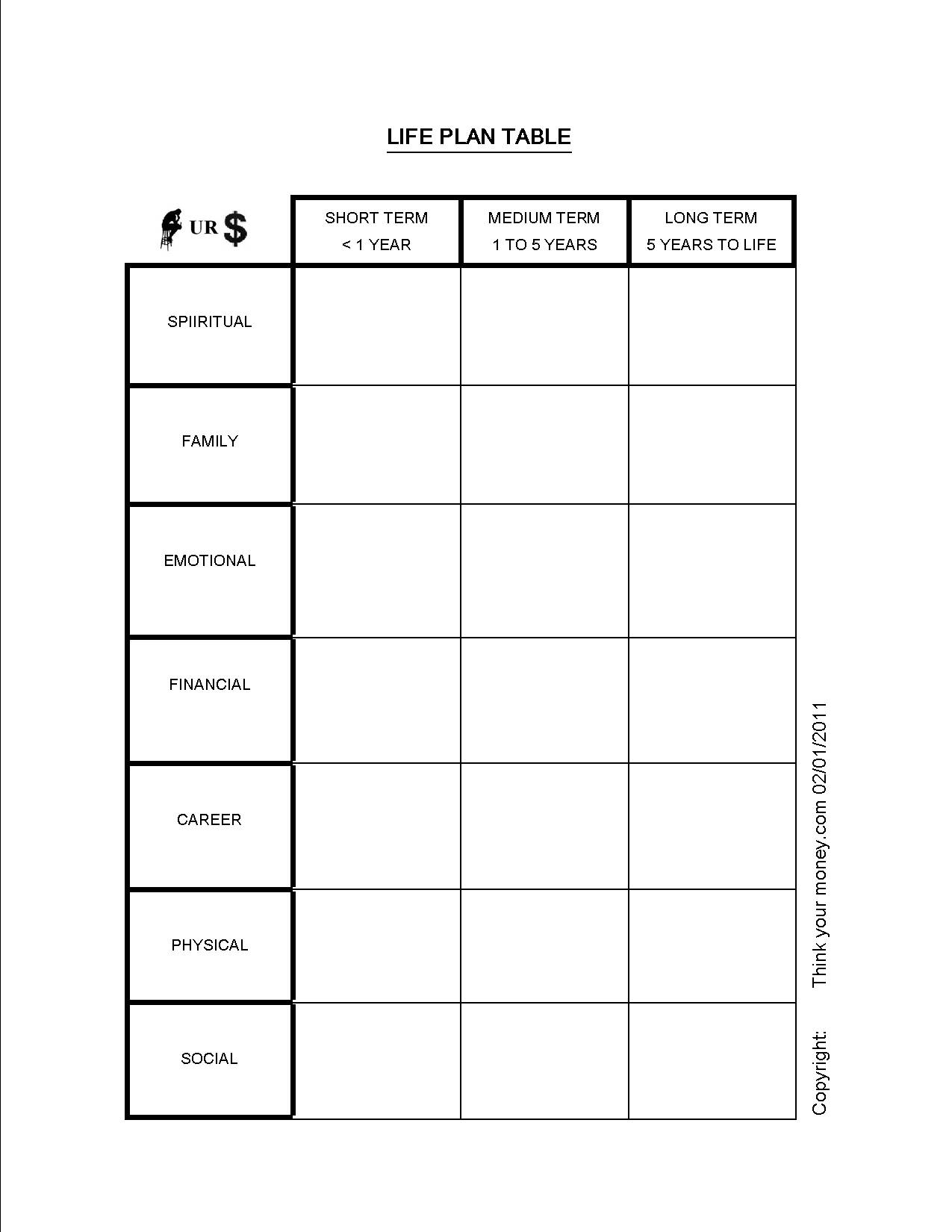

Common sections or categories in a financial goal worksheet include short-term goals, long-term goals, emergency fund, debt repayment, retirement savings, investments, budgeting, income sources, expenses, and progress tracking. Each of these sections helps individuals organize and prioritize their financial objectives and create a plan to achieve them.

How can a 2016 financial goal worksheet be personalized to fit individual needs and circumstances?

To personalize a 2016 financial goal worksheet, individuals can start by identifying their specific financial goals, whether it's saving for a home, paying off debt, or investing for retirement. They should then break down these goals into specific, measurable targets with deadlines. Next, they can customize the worksheet by adjusting income sources, expenses, and saving/investment strategies based on their unique financial situation, such as income level, expenses, debt amount, and risk tolerance. Regularly reviewing and updating the worksheet will help ensure it remains relevant and aligned with changing circumstances.

Can a 2016 financial goal worksheet be used for both short-term and long-term financial goals?

A 2016 financial goal worksheet can be used for both short-term and long-term financial goals, as it can help individuals outline their financial objectives, plan for achieving them, track progress, and make necessary adjustments. It provides a structured approach to setting goals, breaking them down into manageable steps, and monitoring performance, which is essential for achieving success in both short-term and long-term financial planning.

How can a 2016 financial goal worksheet help individuals prioritize and make financial decisions?

A 2016 financial goal worksheet can help individuals prioritize and make financial decisions by providing a structured way to outline their financial objectives, track progress towards achieving them, and allocate resources accordingly. By clearly defining goals, breaking them down into manageable steps, and establishing deadlines, the worksheet can help individuals focus on what is most important to them financially and develop a plan to reach those goals. Additionally, regularly reviewing and updating the worksheet can help individuals stay on track and make informed decisions about their finances throughout the year.

Are there any specific strategies or tips to make the most out of a 2016 financial goal worksheet?

To make the most out of a 2016 financial goal worksheet, start by setting specific and achievable goals. Track your progress regularly, adjust goals as needed, and celebrate small successes. Utilize budgeting tools to monitor your finances closely and identify areas where you can save or cut back expenses. Consider automating savings and investments to stay on track, seek professional guidance if needed, and stay motivated by visualizing the rewards of achieving your financial goals. Remember that consistency and discipline are key to successfully utilizing a financial goal worksheet.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments