2014 Itemized Deductions Worksheet

As tax season approaches, it is essential for individuals and small business owners to have a clear understanding of their itemized deductions. The 2014 Itemized Deductions Worksheet can be a valuable tool for determining the eligible deductions and organizing relevant information. By providing a comprehensive breakdown of the various categories and requirements, this worksheet enables taxpayers to accurately calculate their deductions and ensure that they are maximizing their tax benefits. Whether you are a self-employed professional or a homeowner, understanding the complexities of itemized deductions can help you make informed financial decisions and potentially lower your tax liability.

Table of Images 👆

- 1040 Forms Itemized Deductions Worksheet 2015

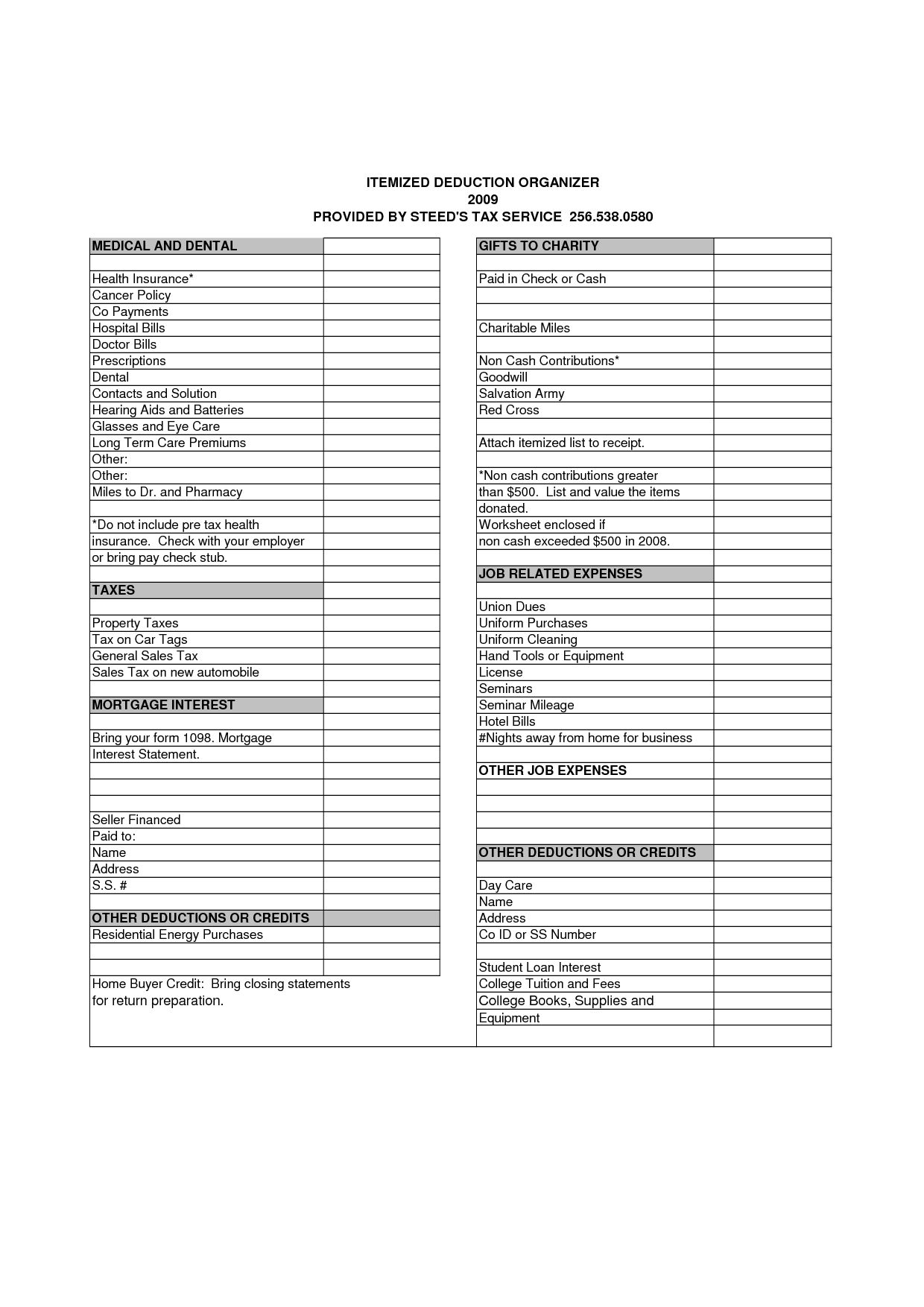

- Itemized Deductions Worksheet

- List Itemized Tax Deductions Worksheet

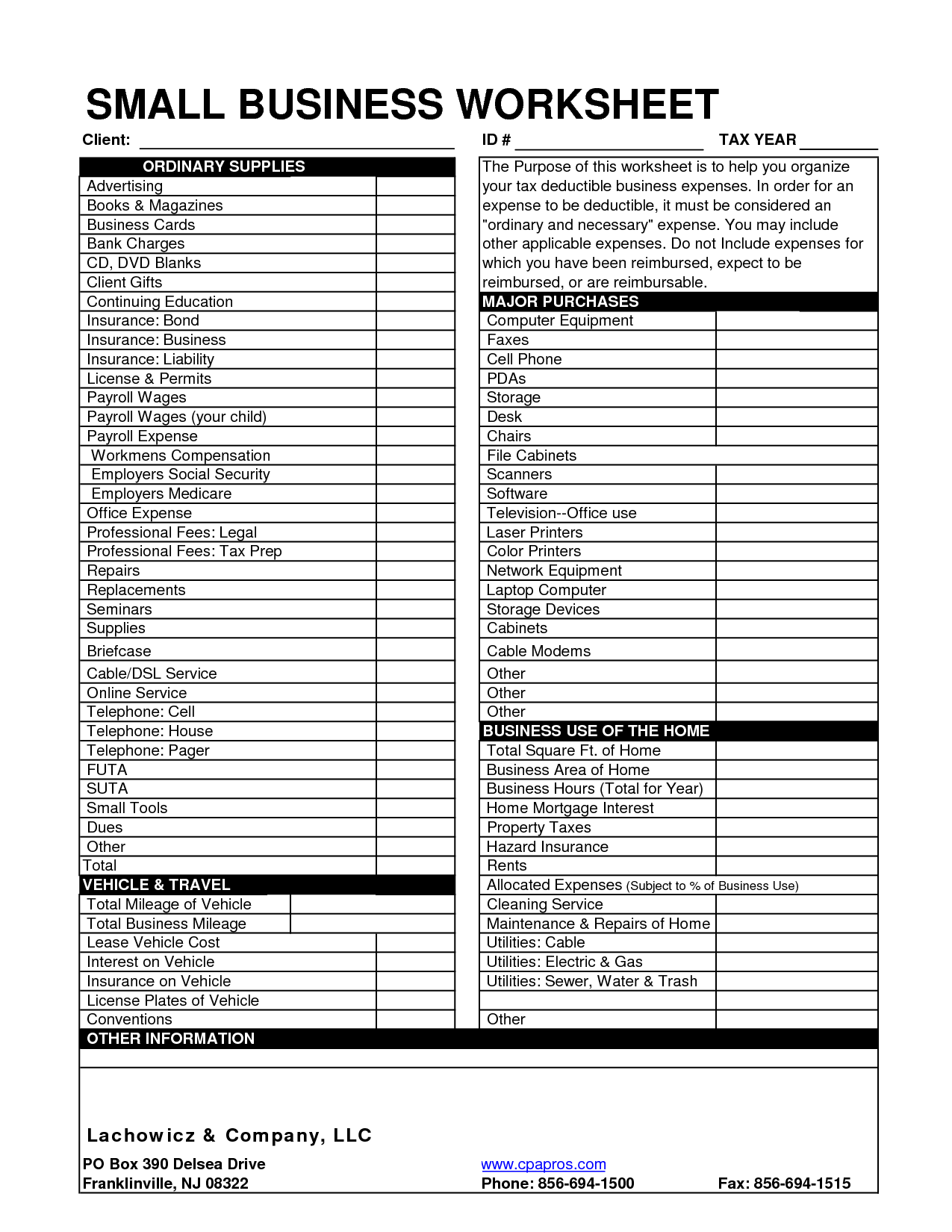

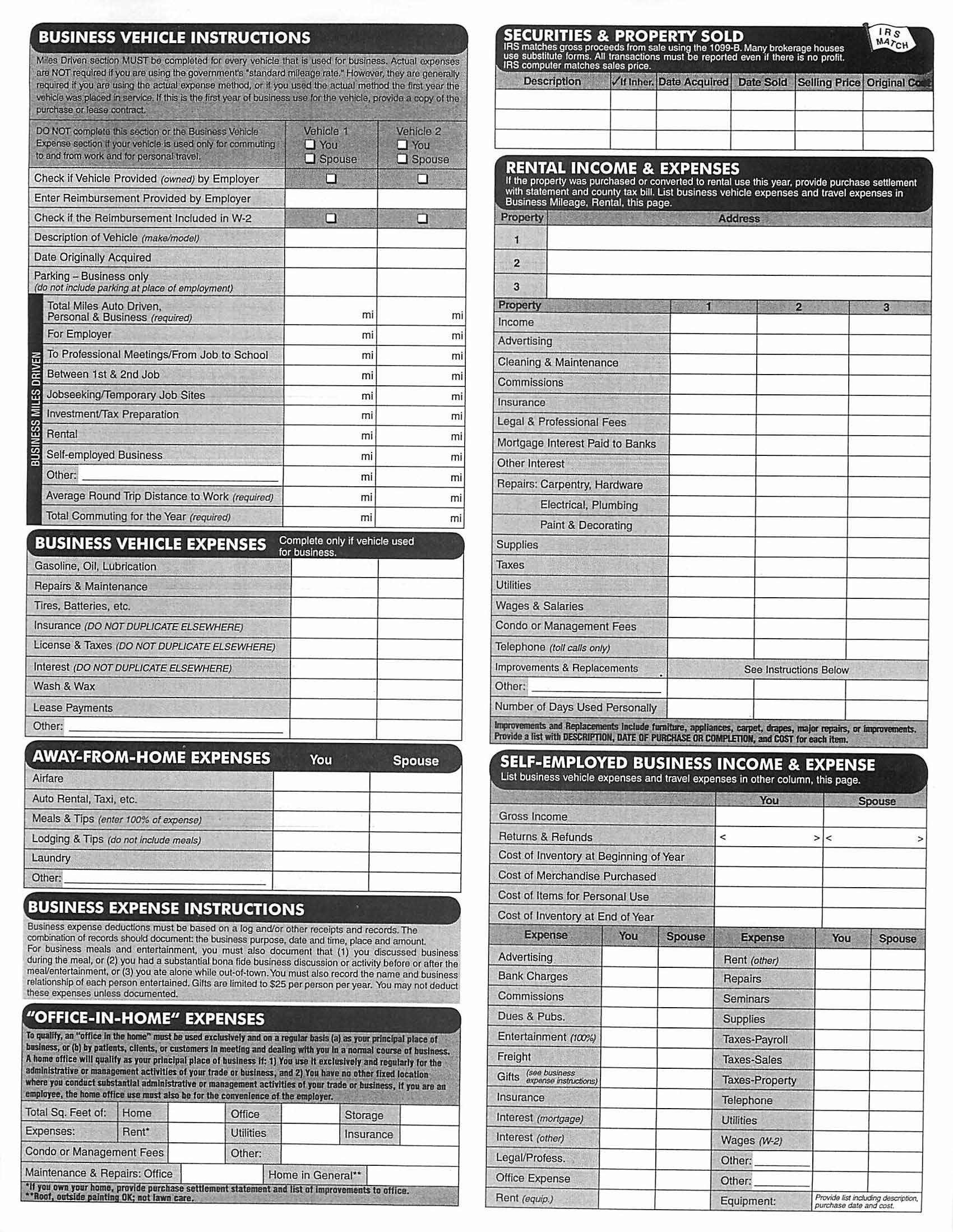

- Small Business Tax Deduction Worksheet

- Form 1040 Itemized Deduction Worksheet 2014

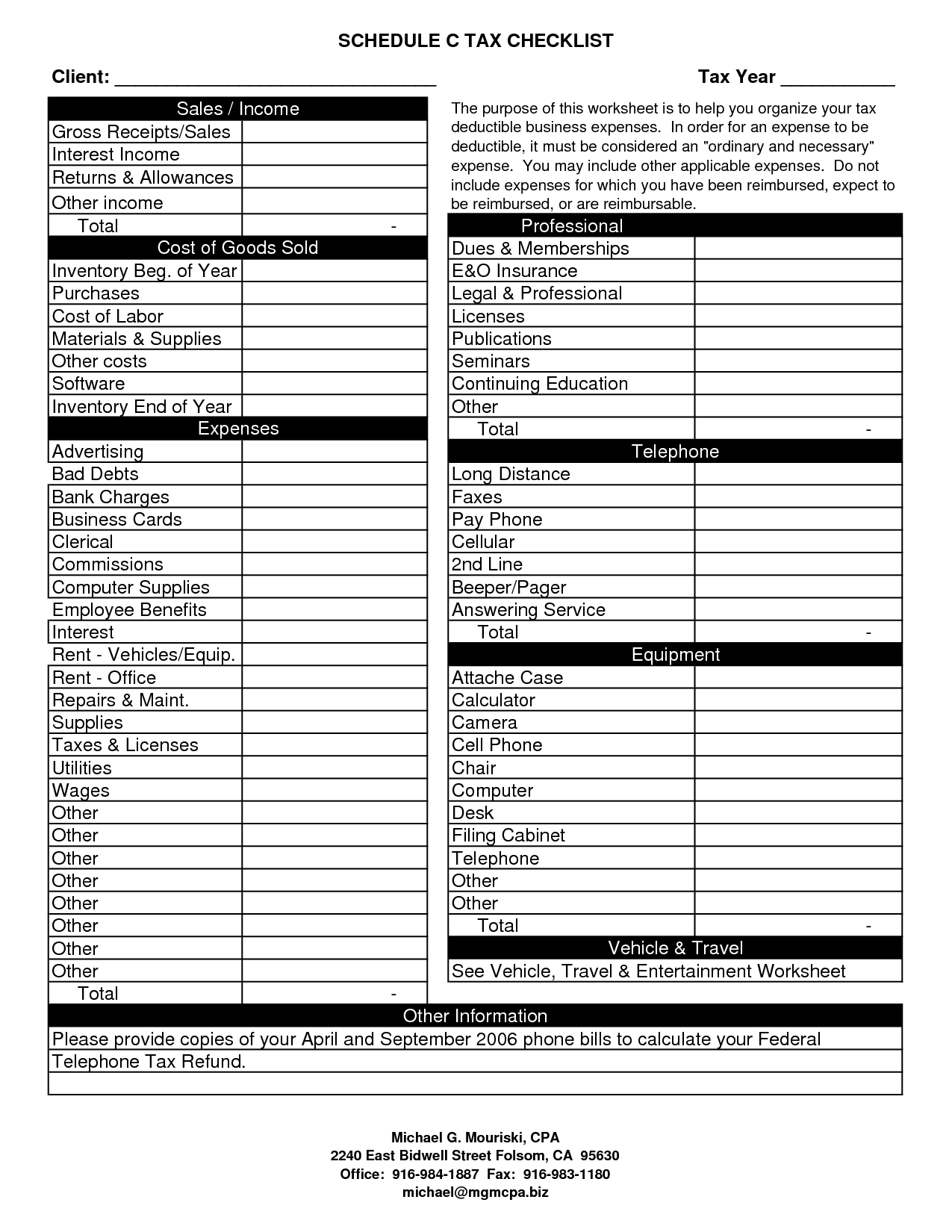

- Schedule C Tax Deduction Worksheet

- Tax Deduction Worksheet

- Small Business Expenses Tax Deductions List

- Tax Preparation Organizer Worksheet

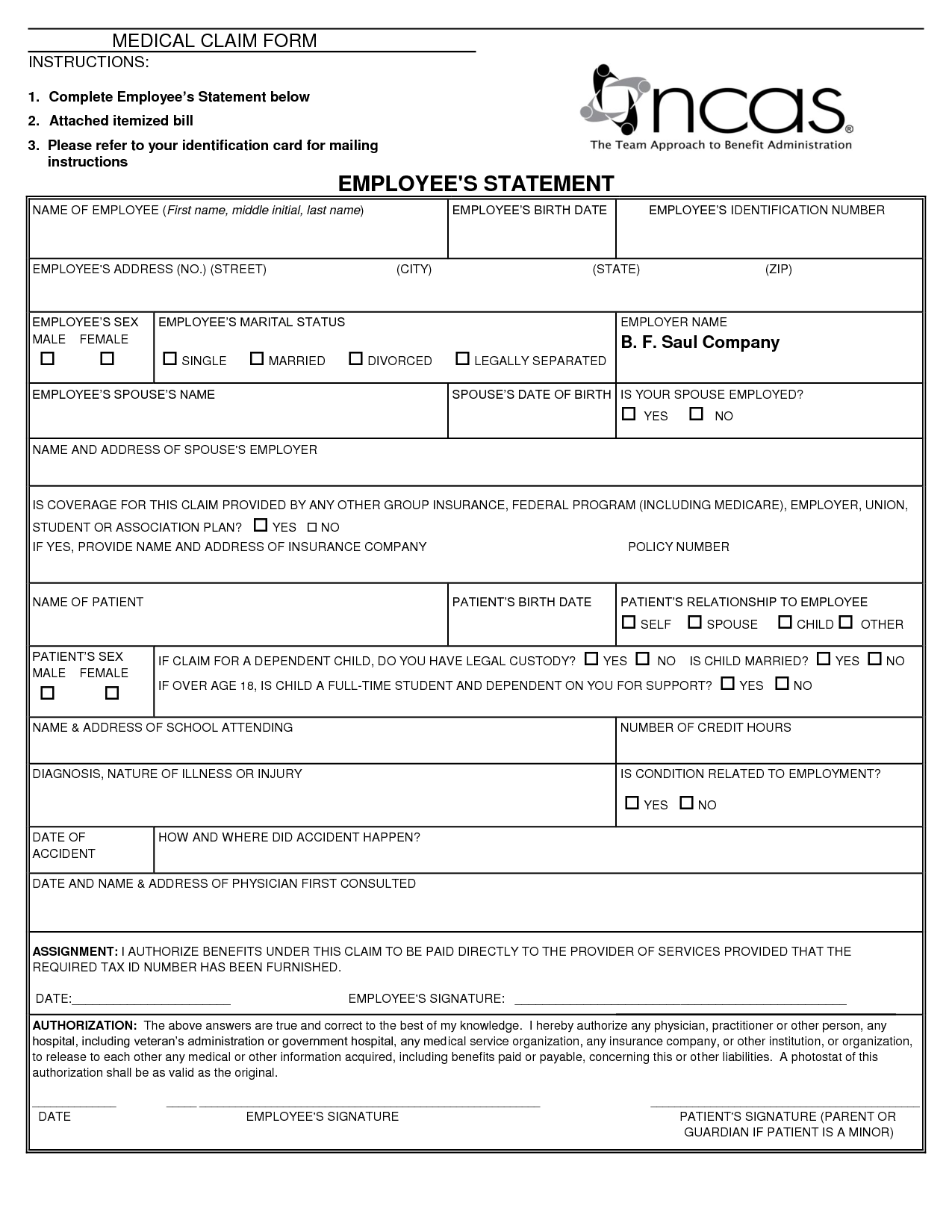

- Medical Bill Itemized Claim Form

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is the purpose of the 2014 Itemized Deductions Worksheet?

The purpose of the 2014 Itemized Deductions Worksheet is to help taxpayers determine their total itemized deductions for the year. This form assists taxpayers in calculating the various expenses that can be included in their itemized deductions, such as medical expenses, state and local taxes, mortgage interest, charitable contributions, and miscellaneous expenses. By providing a structured format for taxpayers to list and calculate their deductions, the worksheet ensures accuracy and compliance with the IRS guidelines.

How do you calculate your total medical and dental expenses using the worksheet?

To calculate your total medical and dental expenses using the worksheet, start by listing all your eligible medical and dental expenses incurred during the tax year. Then, categorize and total these expenses based on the IRS guidelines for deductible medical and dental expenses. Lastly, use the information from the worksheet to determine your total qualifying expenses and subtract any reimbursed amounts to arrive at your allowable deduction for medical and dental expenses on your tax return.

What types of taxes are considered deductible on the worksheet?

The types of taxes that are typically considered deductible on a tax worksheet include state and local income taxes, real estate taxes, personal property taxes, and certain types of sales tax. Deductibility of these taxes may vary depending on specific tax laws and regulations, so it is important to consult with a tax professional or refer to the most current tax guidelines to determine what taxes can be deducted on a tax worksheet.

How do you calculate your state and local income taxes using the worksheet?

To calculate your state and local income taxes using a worksheet, first gather all necessary income and deduction information. Consult the specific worksheet provided by your state or local tax authority, and follow the instructions closely. Typically, you will input your income, deductions, and credits to arrive at your taxable income. Once you have determined your taxable income, refer to the tax rate schedule provided on the worksheet to calculate the amount of tax you owe. Finally, make sure to check for any additional forms or documentation required and submit your tax return by the deadline set by your state or local tax authority.

What is the threshold for deducting home mortgage interest on the worksheet?

The threshold for deducting home mortgage interest on the worksheet is generally when the mortgage is used to buy, build, or improve a primary or secondary home and the total mortgage debt is $750,000 or less if you are married filing jointly or $375,000 or less if you are married filing separately or single.

How do you calculate your deductible charitable contributions using the worksheet?

To calculate your deductible charitable contributions using the worksheet, you need to list each donation amount, the name of the charity, and the date of the donation. Then, add up all the donation amounts to get your total annual charitable contributions. Next, refer to the IRS guidelines to determine the percentage of your adjusted gross income that you can deduct for charitable contributions. Finally, enter the total donation amount on the appropriate line of your tax return based on your filing status and income level.

Can you deduct any expenses related to the purchase or sale of property on the worksheet?

No, you cannot deduct expenses related to the purchase or sale of property on the worksheet. These expenses are typically considered part of the cost basis of the property and may impact the taxes you owe when you sell the property. It is important to consult with a tax professional for guidance on how to properly account for these expenses.

How do you calculate the deductible amount for casualty or theft losses on the worksheet?

To calculate the deductible amount for casualty or theft losses on the worksheet, you will need to subtract the total amount of the losses from any reimbursement received, such as insurance proceeds. The deductible amount is the portion of the losses that exceed 10% of your adjusted gross income, plus a $100 per event deduction. This calculation can be done on IRS Form 4684, Casualties and Thefts, to determine the final deductible amount for your tax return.

Are there any limitations or phase-outs for certain deductions on the worksheet?

Yes, some deductions on the worksheet may have limitations or phase-outs depending on the specific tax laws and regulations applicable to that particular deduction. These limitations or phase-outs are typically determined based on factors such as income level, filing status, or the type of expense being deducted. It is important to review the specific guidelines and rules for each deduction to understand any limitations or phase-outs that may apply.

How do you determine your total itemized deductions using the worksheet?

To determine your total itemized deductions using the worksheet, you need to gather all relevant documents such as receipts, invoices, and statements for deductible expenses such as medical expenses, mortgage interest, charitable contributions, and state and local taxes. Then, follow the specific instructions on the worksheet provided with your tax forms, enter the appropriate amounts for each category, and calculate the total sum to arrive at your total itemized deductions for the tax year.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments