Yearly Budget Worksheet

A yearly budget worksheet is a helpful tool for individuals or families who are seeking to gain control over their finances and plan for future expenses. This worksheet serves as an entity that provides a clear and organized way to track income and expenses, helping users to establish a comprehensive understanding of their financial situation.

Table of Images 👆

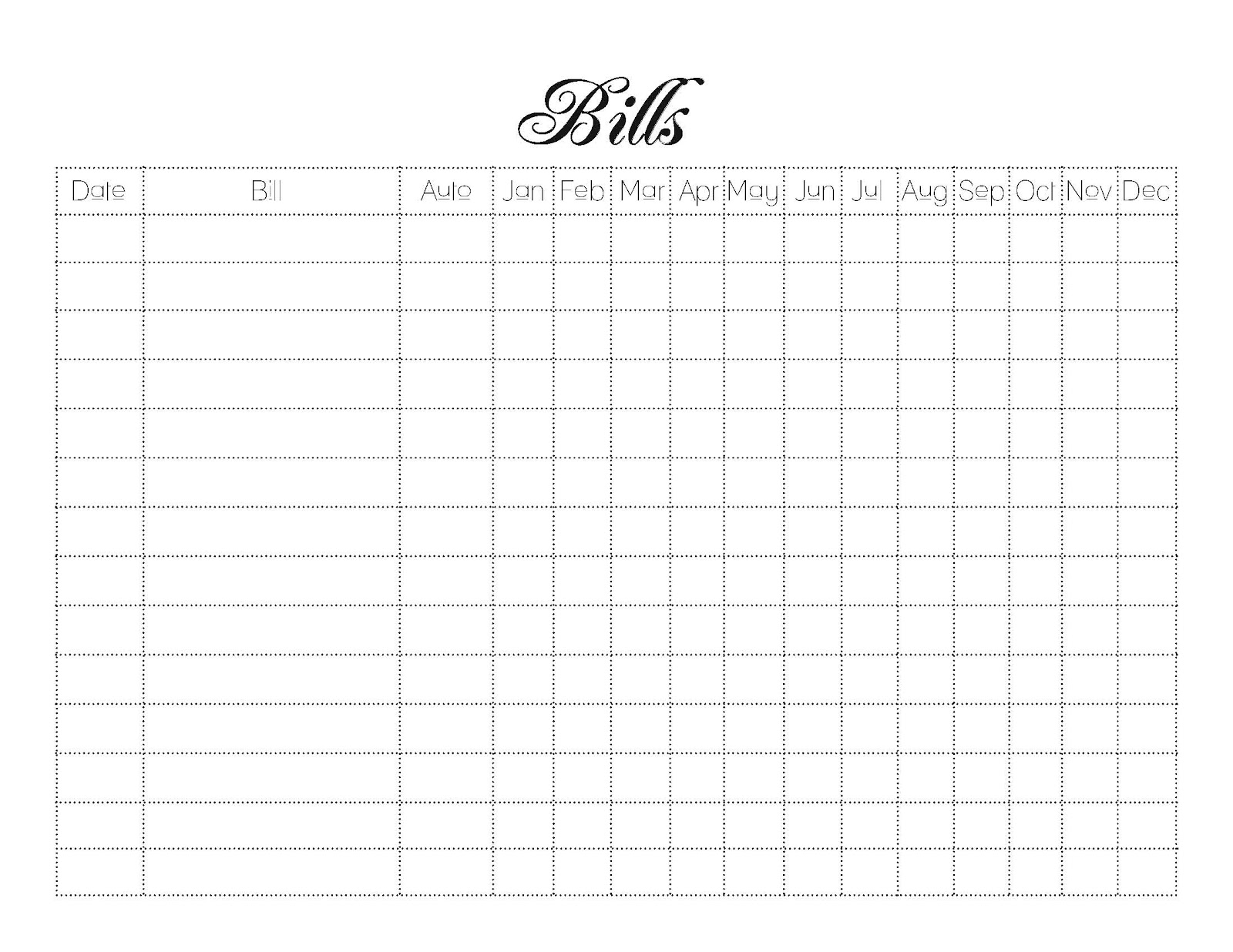

- Free Printable Monthly Bill Templates

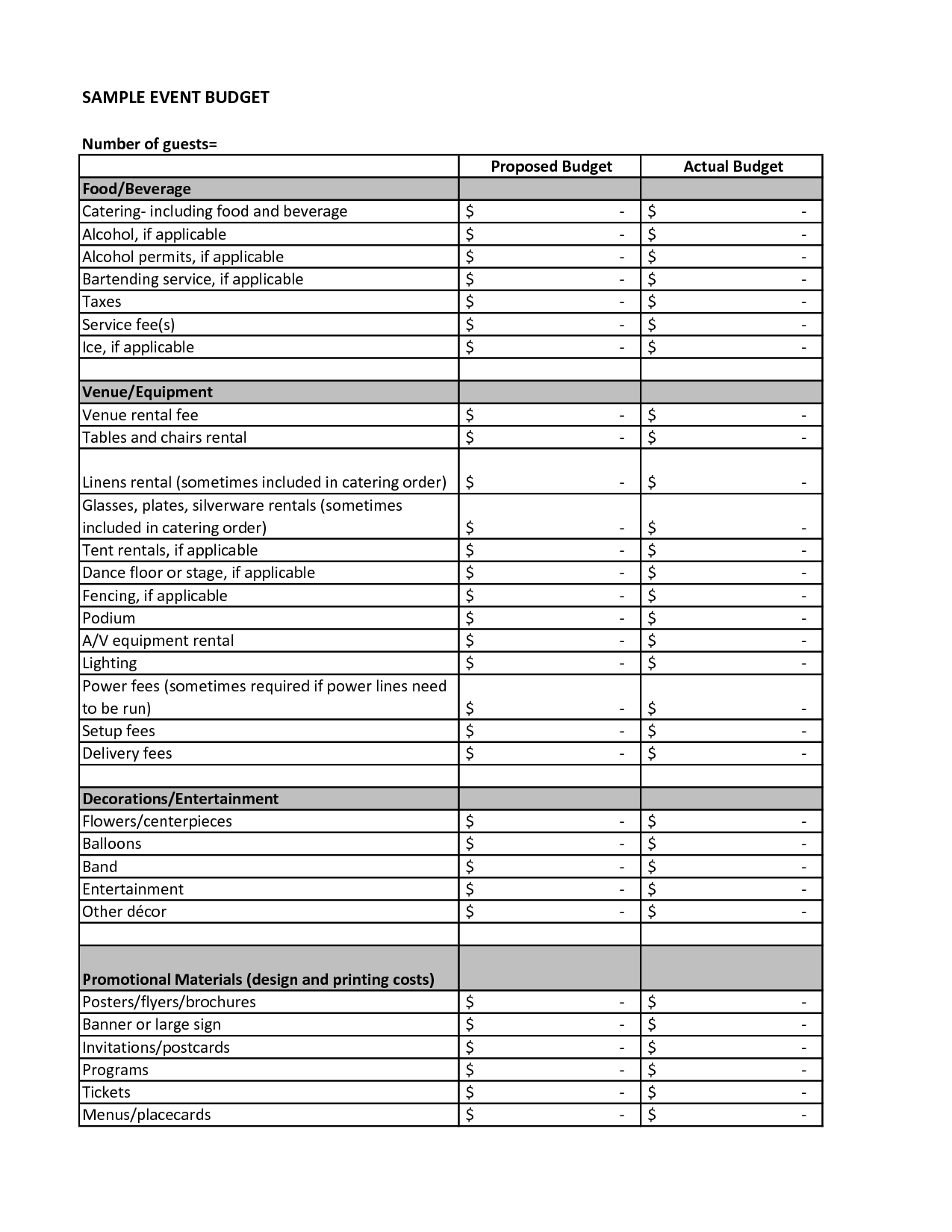

- Sample Event Budget Template

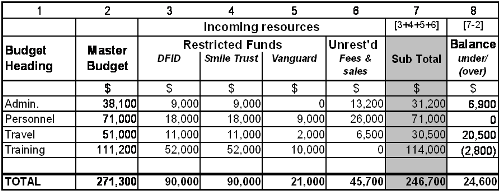

- Grant Budget Template Excel

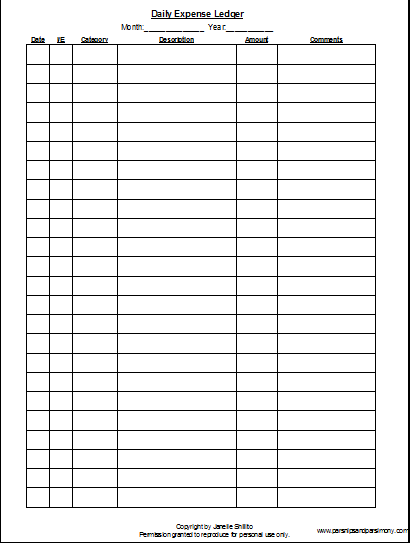

- Free Printable Daily Expense Ledger

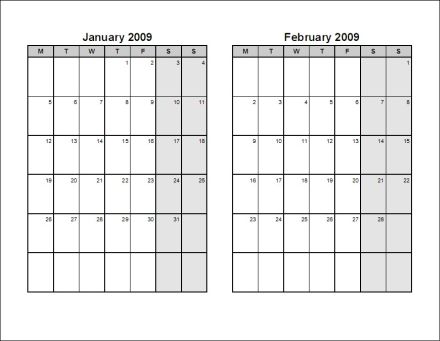

- February 2009 Calendar Printable

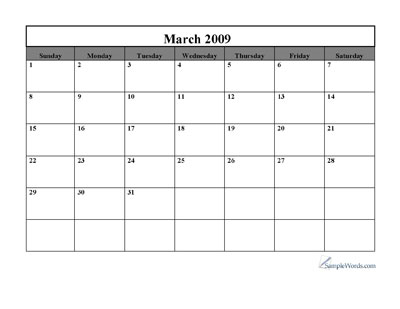

- Free Printable Lined Calendar Templates

- December 2015 Calendar Printable Template

- Reading Comprehension

- Reading Comprehension

- Reading Comprehension

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

What is a Yearly Budget Worksheet?

A Yearly Budget Worksheet is a tool used to plan and track expenses and income over the course of a year. It typically includes categories for various expenses such as housing, transportation, groceries, and savings, allowing individuals to allocate funds accordingly and monitor their financial health throughout the year.

What is the purpose of a Yearly Budget Worksheet?

A Yearly Budget Worksheet helps individuals and businesses to plan and track their income and expenses over the course of a year. It enables them to set financial goals, allocate funds to different categories, monitor their spending patterns, and make adjustments as needed to stay on track with their financial objectives.

What sections are typically included in a Yearly Budget Worksheet?

A Yearly Budget Worksheet typically includes sections such as income, expense categories (such as housing, transportation, groceries, utilities, etc.), monthly breakdowns, total yearly income and expenses, savings goals, debt repayment plan, and a final summary or analysis of the budget. These sections help individuals or households effectively plan and track their finances over the course of a year.

How can a Yearly Budget Worksheet help with financial planning?

A Yearly Budget Worksheet can help with financial planning by providing an organized overview of income and expenses over the course of a year. By tracking all sources of income and categorizing expenses, individuals can identify areas where they can save money, allocate funds towards important goals such as savings or investments, and plan for large expenses or emergencies. It promotes better decision-making and accountability in managing finances, ultimately leading to greater financial stability and success.

What information should be documented in the income section of a Yearly Budget Worksheet?

In the income section of a Yearly Budget Worksheet, you should document all sources of income for the year, including wages, salaries, bonuses, side hustles, rental income, investment income, alimony, child support, or any other forms of income. It is important to be comprehensive and accurate to have a clear understanding of your total income for the year.

What expenses should be included in the expenses section of a Yearly Budget Worksheet?

In the expenses section of a Yearly Budget Worksheet, you should include all regular and expected expenses such as rent or mortgage payments, utilities, groceries, transportation costs, insurance premiums, loan payments, credit card bills, entertainment expenses, savings contributions, and any other regular or fixed expenses. It's important to also budget for unexpected or irregular expenses, such as medical emergencies or car repairs, by setting aside a sum for emergencies or creating a miscellaneous category. Tracking and including all expenses will help provide a comprehensive overview of your financial situation and allow for better budget planning.

How can a Yearly Budget Worksheet be used to track savings and investments?

A Yearly Budget Worksheet can be used to track savings and investments by dedicating specific categories for these purposes. You can allocate a portion of your income towards savings and investments, and track the progress over the year to ensure you are meeting your financial goals. By regularly updating the worksheet with your contributions and monitoring your savings and investment accounts, you can gain a clear understanding of how your money is growing and make adjustments as needed to enhance your financial stability in the long term.

How often should a Yearly Budget Worksheet be updated?

A Yearly Budget Worksheet should ideally be updated on a monthly basis. This frequency allows you to track your spending, adjust your budget as needed, and stay on top of your financial goals throughout the year. Regular updates also give you a clear picture of your financial health and help you make informed decisions about your spending and saving habits.

What are some common mistakes people make when using a Yearly Budget Worksheet?

Some common mistakes people make when using a Yearly Budget Worksheet include not updating it regularly, underestimating expenses, forgetting to account for irregular expenses, like car repairs or medical bills, setting unrealistic savings goals, and not using categories that accurately reflect their spending habits. It's important to review and adjust the budget regularly to ensure it remains effective in helping achieve financial goals.

Are there any additional tips or strategies for using a Yearly Budget Worksheet effectively?

To use a Yearly Budget Worksheet effectively, consider reviewing your expenses regularly to ensure accuracy and make necessary adjustments. It's also helpful to categorize expenses and set specific, achievable financial goals to track your progress throughout the year. Additionally, consider using budgeting apps or tools to streamline the process and maintain your budget on the go. Lastly, don't forget to incorporate any unexpected expenses or savings goals into your budget to ensure a comprehensive and successful financial plan.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments