Worksheet for a Service Business

Are you a service business owner searching for an effective tool to help streamline your daily operations? Look no further than worksheets! These versatile and customizable resources can provide a structured framework for organizing crucial information and tasks specific to your industry. From tracking client details to managing appointment schedules, worksheets can be a valuable asset in maximizing efficiency and productivity within your service-oriented business.

Table of Images 👆

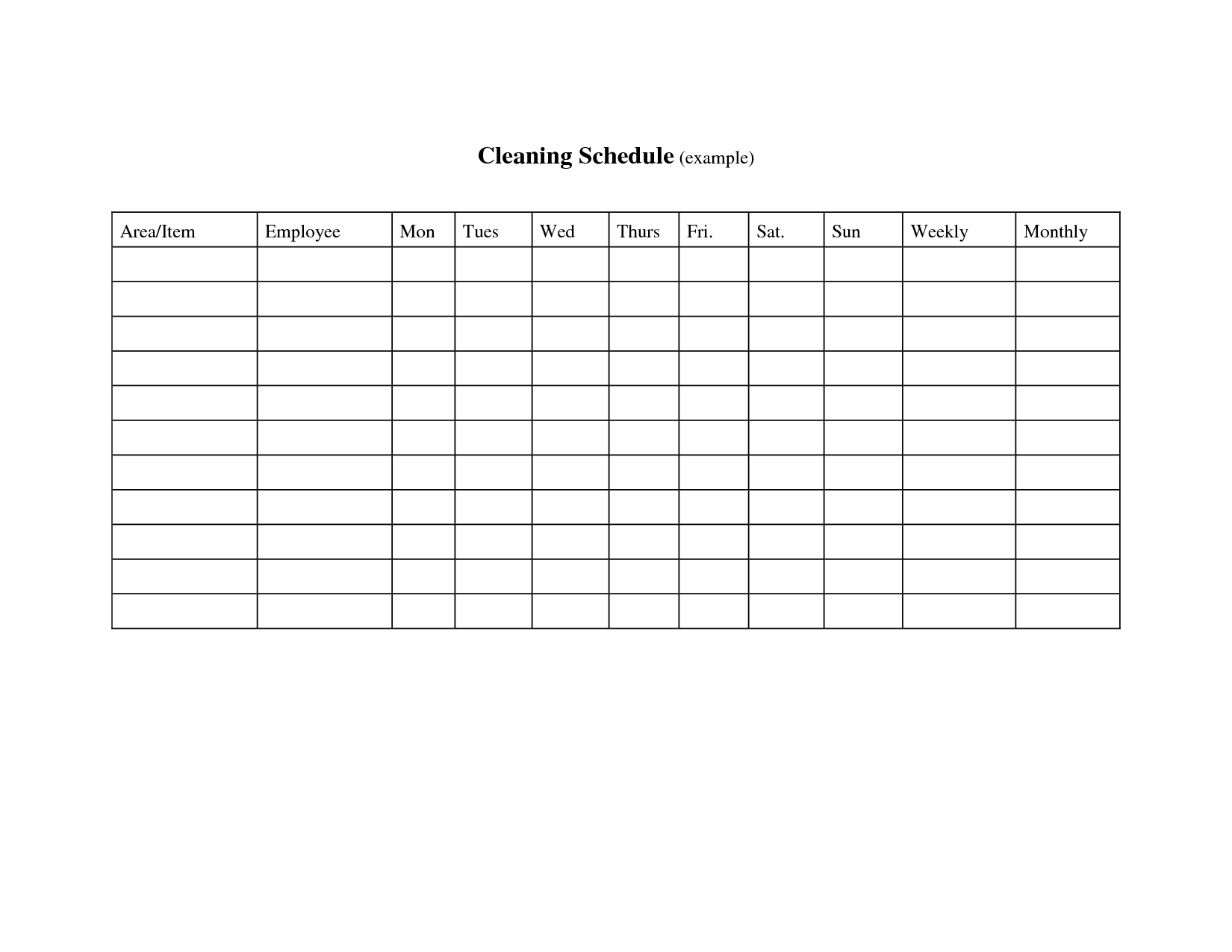

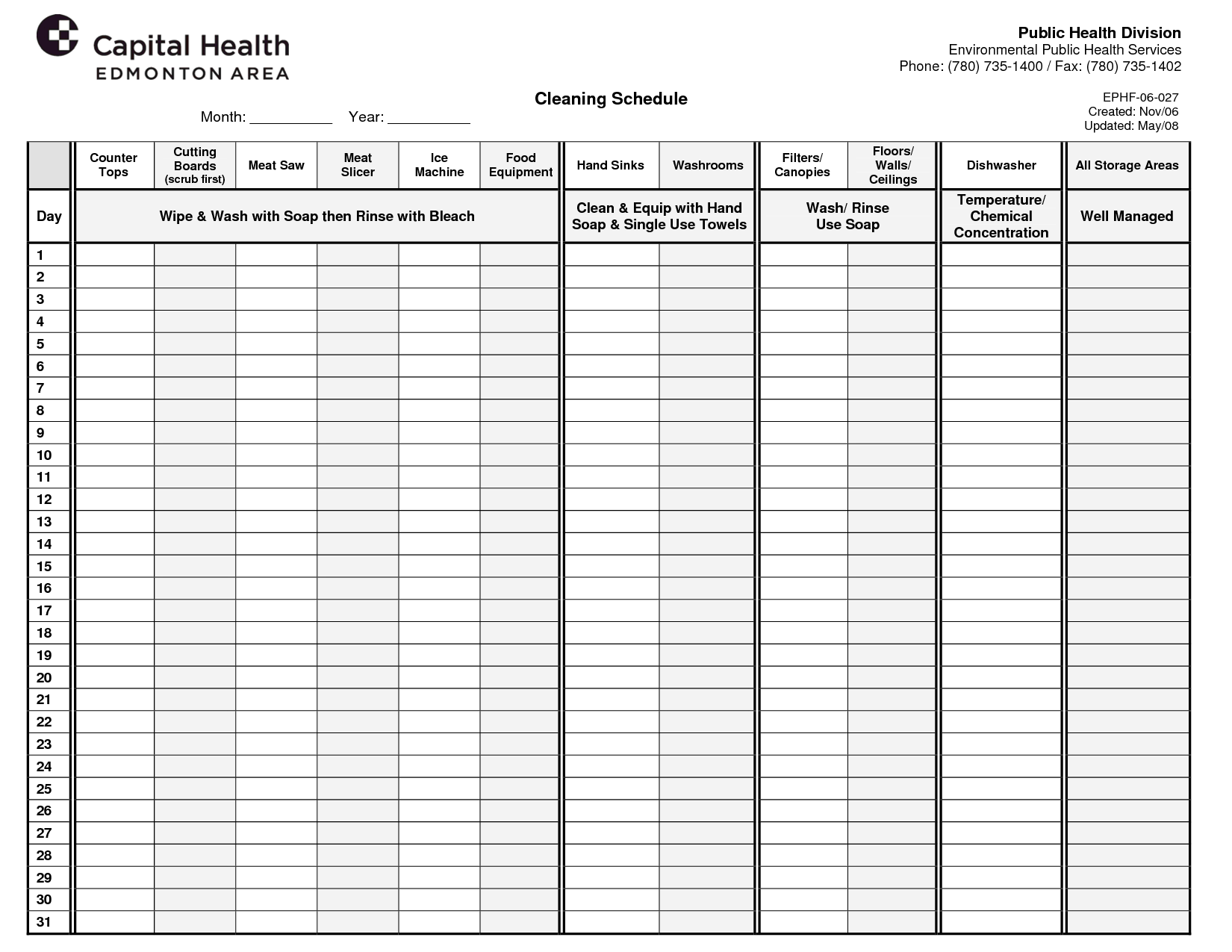

- Cleaning Schedule Log Template

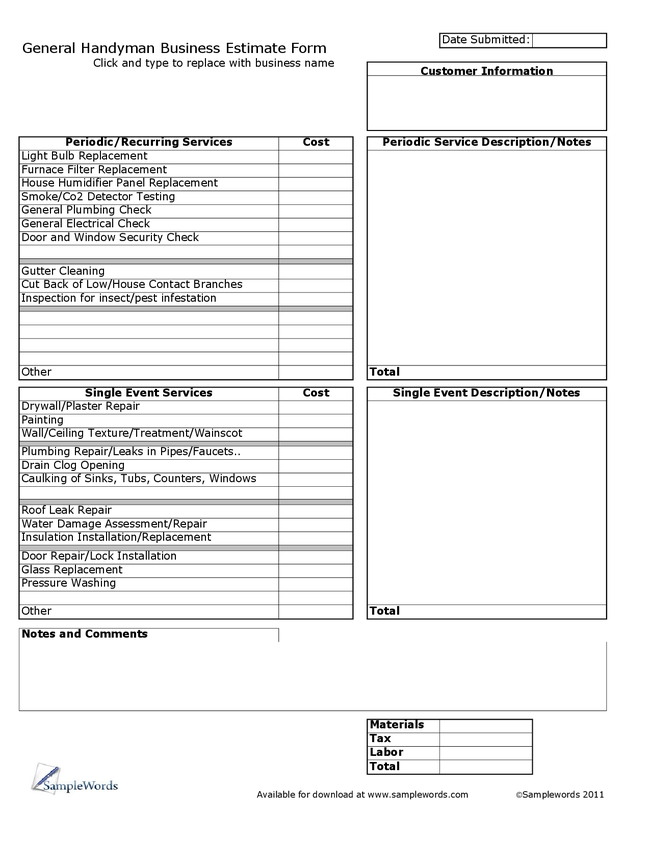

- Handyman Estimate Forms

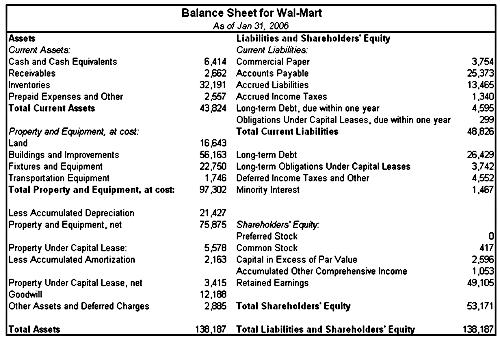

- Balance Sheet as Of

- Blank Weekly Work Schedule Template

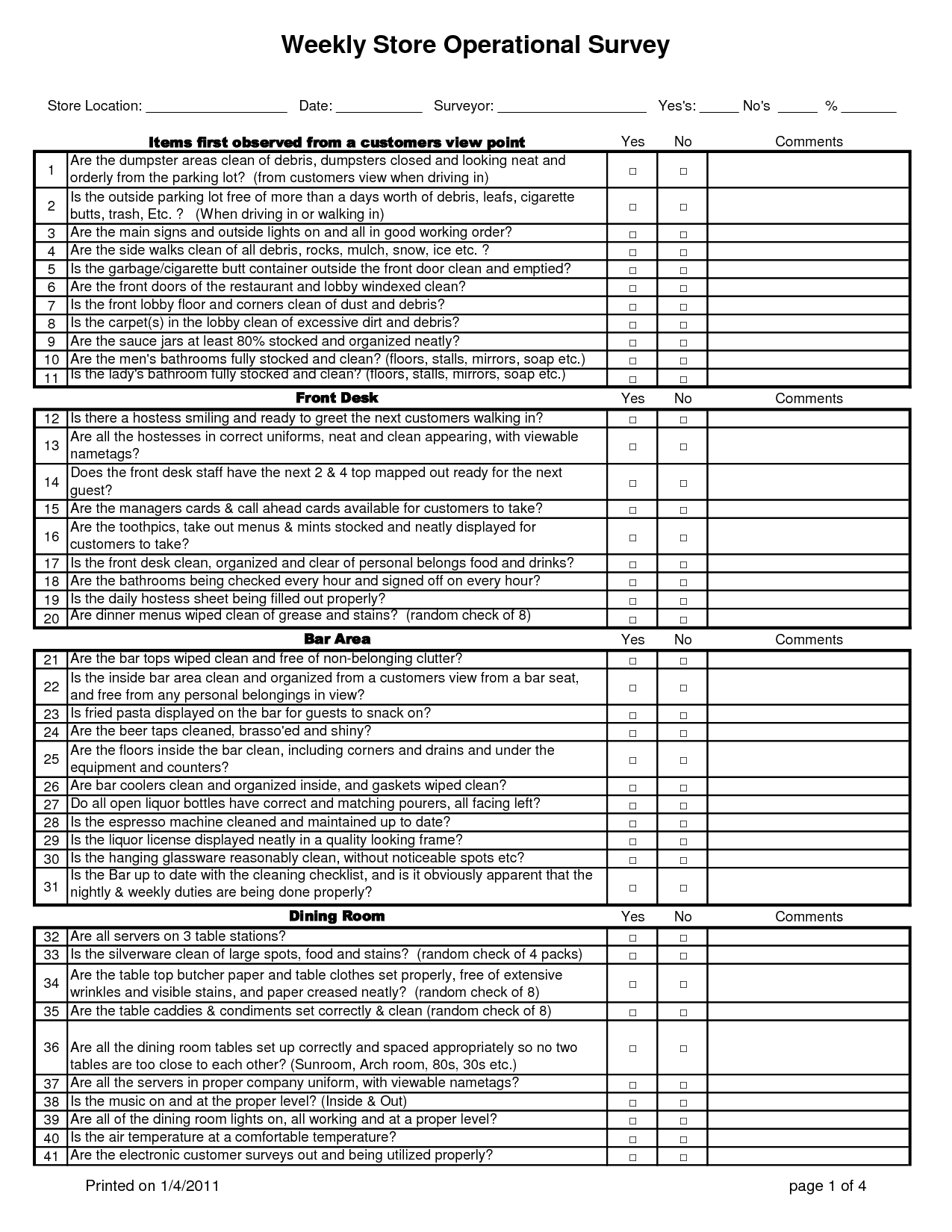

- Restaurant Cleaning Schedule Checklist Template

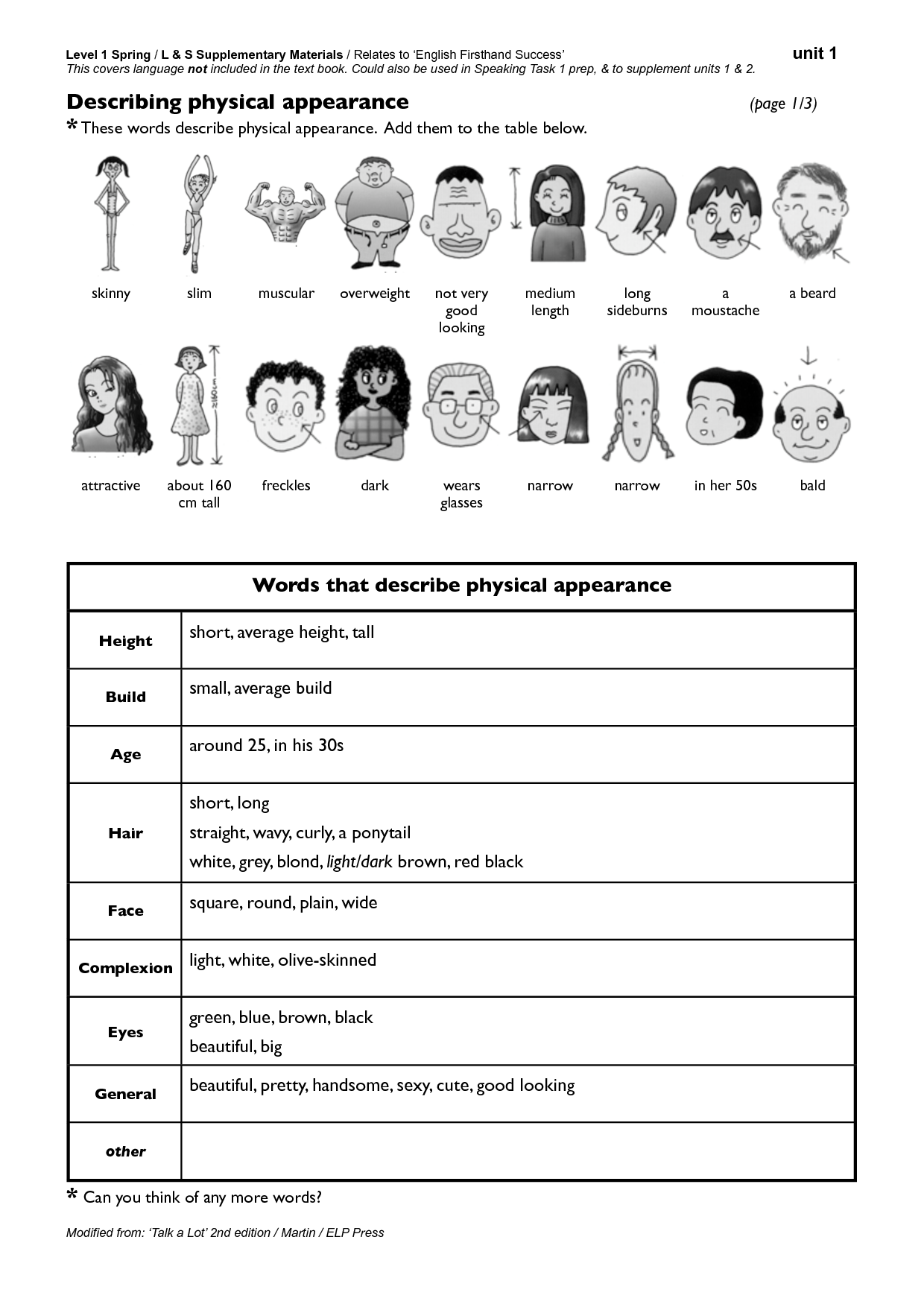

- Describing People Worksheet

- Density Practice Worksheet

- Office Cleaning Schedule Template

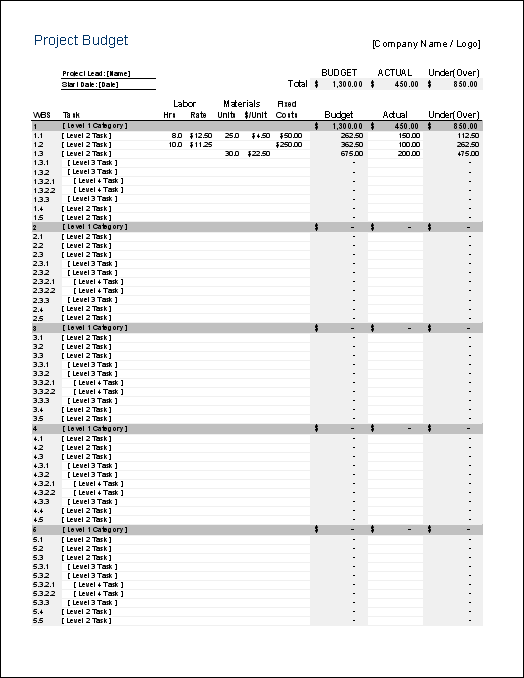

- Construction Project Budget Template Excel

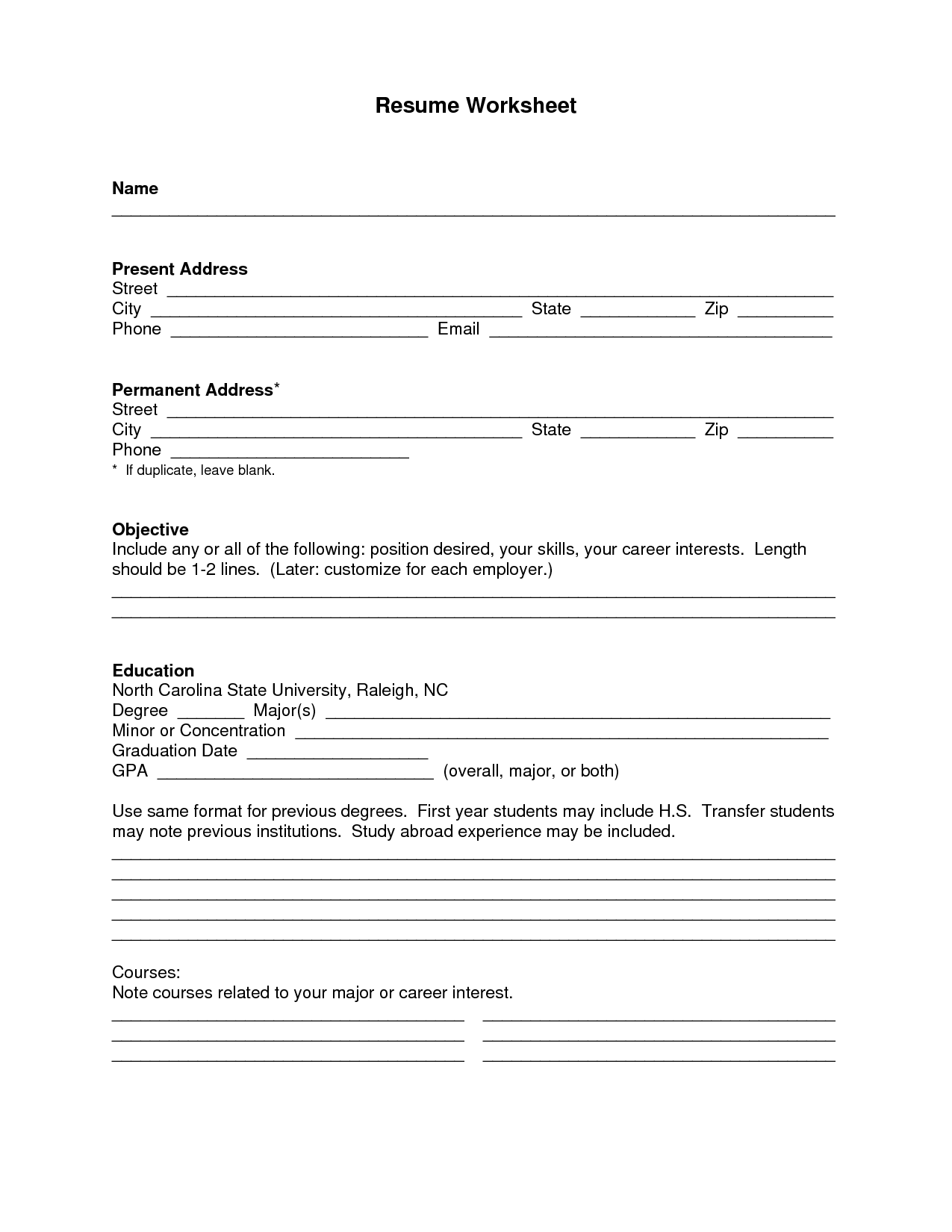

- Free Blank Resume Templates Word

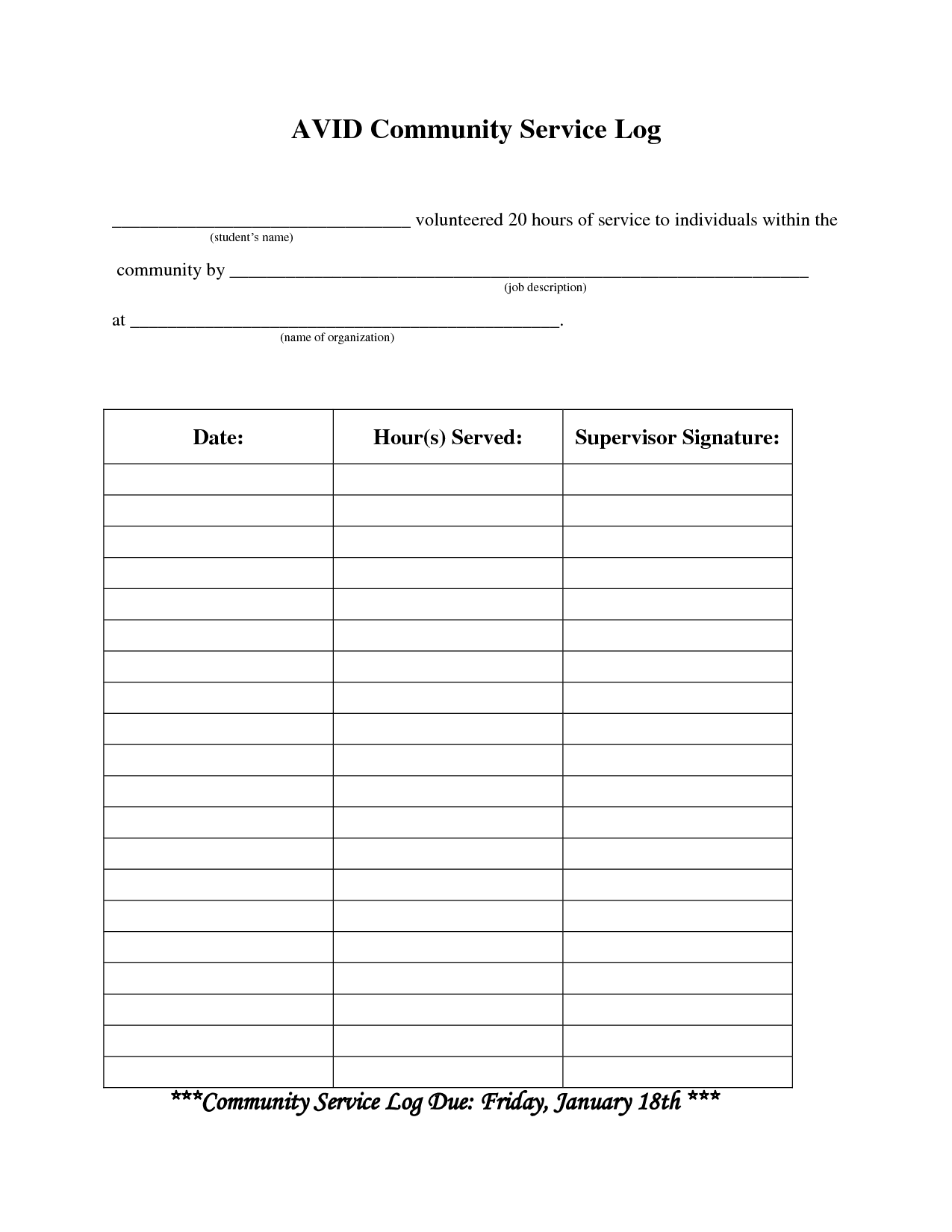

- Community Service Log Sheet Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

How does a worksheet help a service business organize its financial information?

A worksheet helps a service business organize its financial information by providing a structured layout for recording and tracking income, expenses, and other financial data in an organized manner. It allows for the categorization and calculation of various financial metrics, such as revenues, costs, profits, and taxes, enabling the business to analyze its financial performance, make informed decisions, and prepare accurate financial statements. Additionally, a worksheet can serve as a reference tool for monitoring cash flow, budgeting, and forecasting future financial activities, ultimately supporting effective financial management and planning within the service business.

What are the key components included in a worksheet for a service business?

Key components included in a worksheet for a service business typically are sections for recording service revenue, expenses related to providing the service (such as labor costs, materials, and overhead), calculations for determining net income or loss, tracking of accounts receivable and accounts payable, budget projections, and any other relevant financial metrics specific to the service industry.

How is revenue or income calculated on a service business worksheet?

Revenue or income on a service business worksheet is typically calculated by multiplying the quantity of services provided by the price charged per service. This calculates the total amount of money earned from providing services to customers. The revenue or income calculation is essential for understanding the financial performance of a service business by showing how much money is being generated from providing services.

What expenses are typically listed on a service business worksheet?

Expenses listed on a service business worksheet typically include costs directly related to providing the service such as labor (wages, benefits), supplies, utilities, rent for office space, insurance, marketing expenses, equipment maintenance, and any other overhead expenses necessary for the operation of the service business. Tracking and monitoring these expenses allows the business to accurately assess its financial health and make informed decisions to improve profitability.

Why is it important to track and categorize expenses for a service business?

It is important to track and categorize expenses for a service business because it provides valuable insights into the financial health of the company, helps in making informed decisions on budgeting and cost control, ensures compliance with tax regulations, allows for accurate financial reporting, and enables the business to identify areas of inefficiency or overspending that can be optimized to improve profitability and overall operations.

How does a service business calculate its net income or loss on a worksheet?

A service business calculates its net income or loss on a worksheet by subtracting its total expenses, including operating expenses, overhead costs, and any other expenditures, from its total revenue or sales. The resulting figure, after deducting expenses from revenue, represents the net income if it is positive or a net loss if it is negative. This calculation helps the business track its financial performance and assess its profitability.

What is the purpose of reconciling bank statements on a service business worksheet?

The purpose of reconciling bank statements on a service business worksheet is to ensure that the business's financial records accurately reflect the transactions that have occurred in its bank account. By comparing the bank statement with the company's internal records, discrepancies can be identified and resolved, such as errors in recording transactions, unauthorized charges, or missing deposits. This process helps to maintain the integrity of the business's financial data and provides assurance that the company's financial statements are accurate.

How does a service business account for any outstanding invoices on a worksheet?

A service business accounts for any outstanding invoices on a worksheet by recording them as accounts receivable, which is a current asset on the balance sheet. The outstanding invoices represent payments that the business is yet to receive from its customers, so they are listed as a form of income that is still owed. By including these outstanding invoices in the accounts receivable section of the worksheet, the business can track and manage its unpaid income effectively.

What role does a worksheet play in preparing financial statements for a service business?

Worksheets play a crucial role in preparing financial statements for a service business by serving as an intermediary step between the trial balance and the financial statements. It helps in adjusting and summarizing the trial balance data to ensure accuracy and consistency before transferring the final figures to the financial statements. Additionally, worksheets also aid in organizing and classifying accounts, calculating adjustments, and providing a structured framework for the presentation of financial information, ultimately facilitating the timely and accurate preparation of financial statements for stakeholders to analyze and make informed decisions.

How can a service business use a worksheet to analyze its financial performance and make informed decisions?

A service business can use a worksheet to analyze its financial performance by organizing and summarizing key financial data such as revenue, expenses, and profits. By creating a worksheet that tracks these metrics over time, the business can identify patterns and trends that can help in making informed decisions. For example, by comparing revenue and expenses against each other, the business can determine its profit margins and make adjustments to improve profitability. Additionally, a worksheet can also be used to create financial projections and forecasts based on past data, aiding in strategic planning and budgeting for the future.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments