Worksheet Finding Percent Tax

Calculating taxes can be a challenging task, but with the help of worksheets, you can simplify the process and ensure accurate results. Whether you are a student studying personal finance or an individual needing to file taxes, worksheets are the perfect tool to help you understand and calculate the percent tax owed. With comprehensive worksheets that break down the steps and provide clear explanations, you can easily navigate through the complexities of calculating taxes.

Table of Images 👆

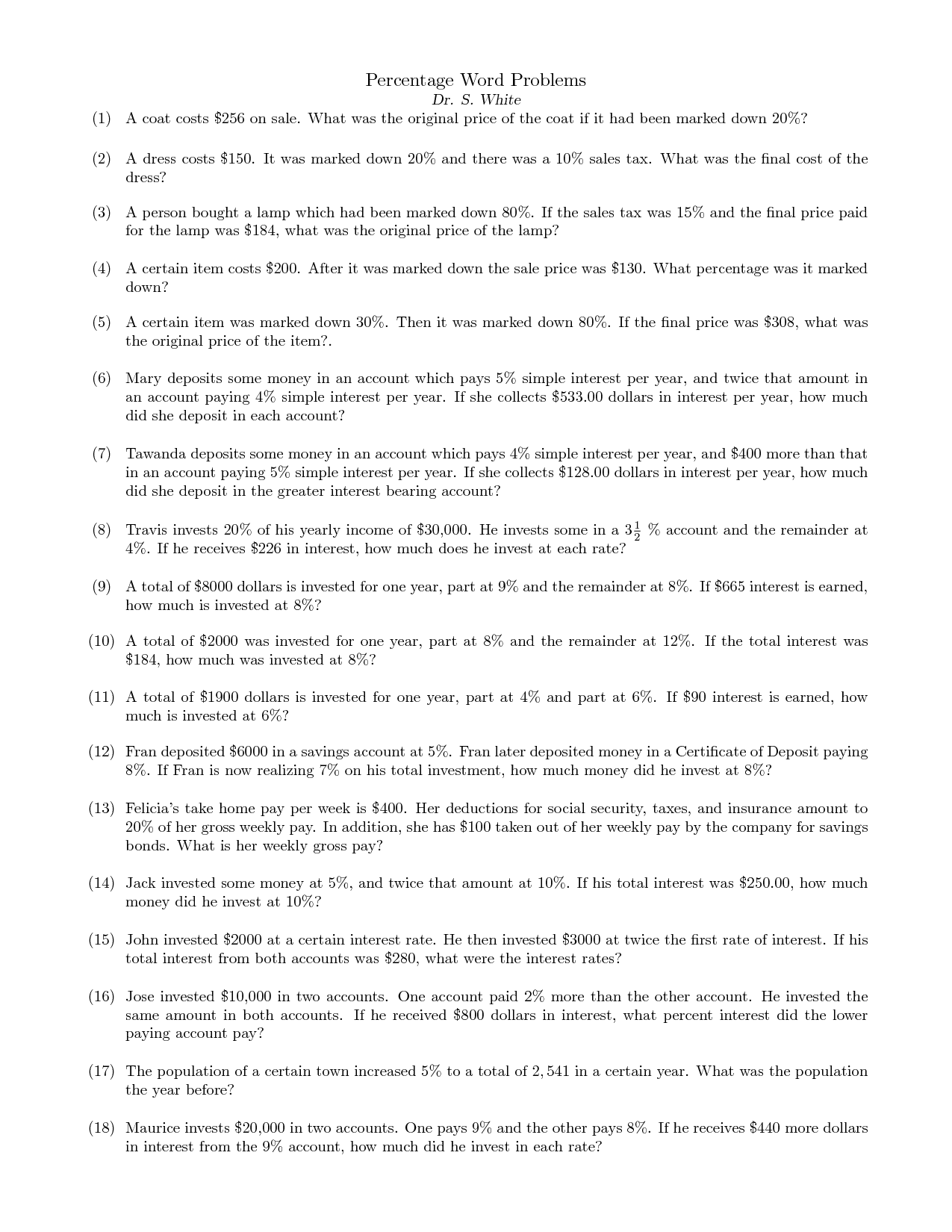

- Percent Tax Tip Discount Word Problems Worksheet Answers

- Percent Word Problems Worksheets

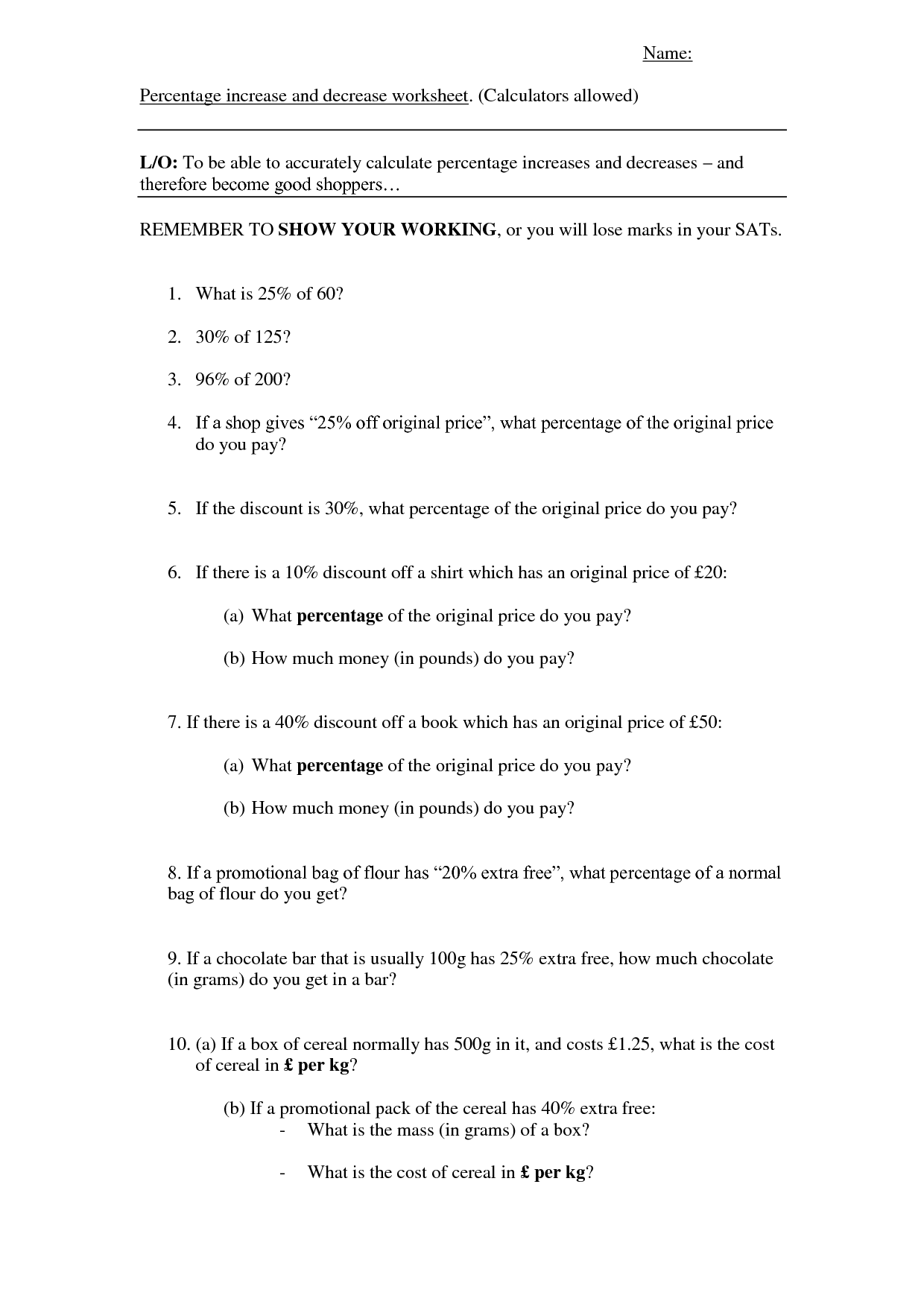

- Tips Tax and Sales Discounts Worksheets

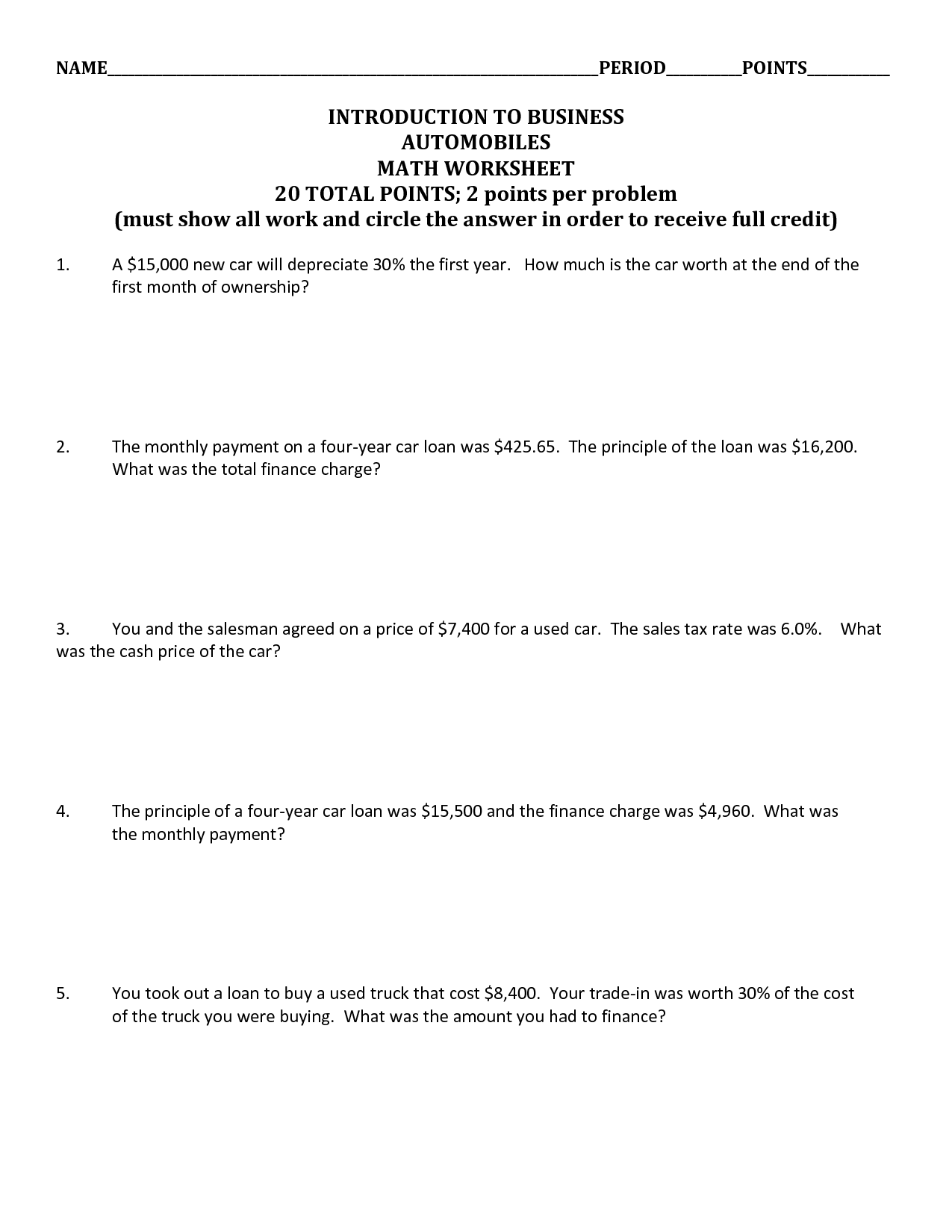

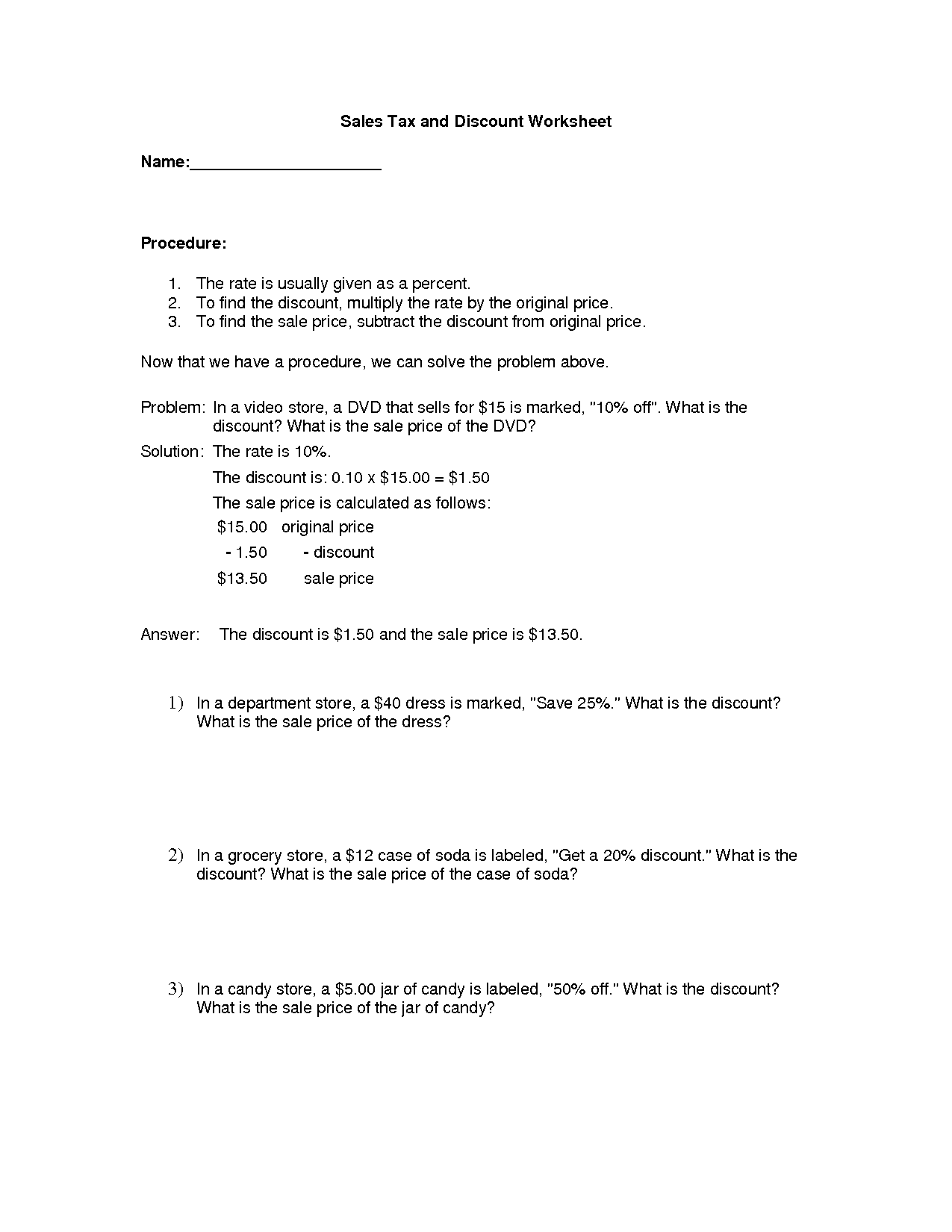

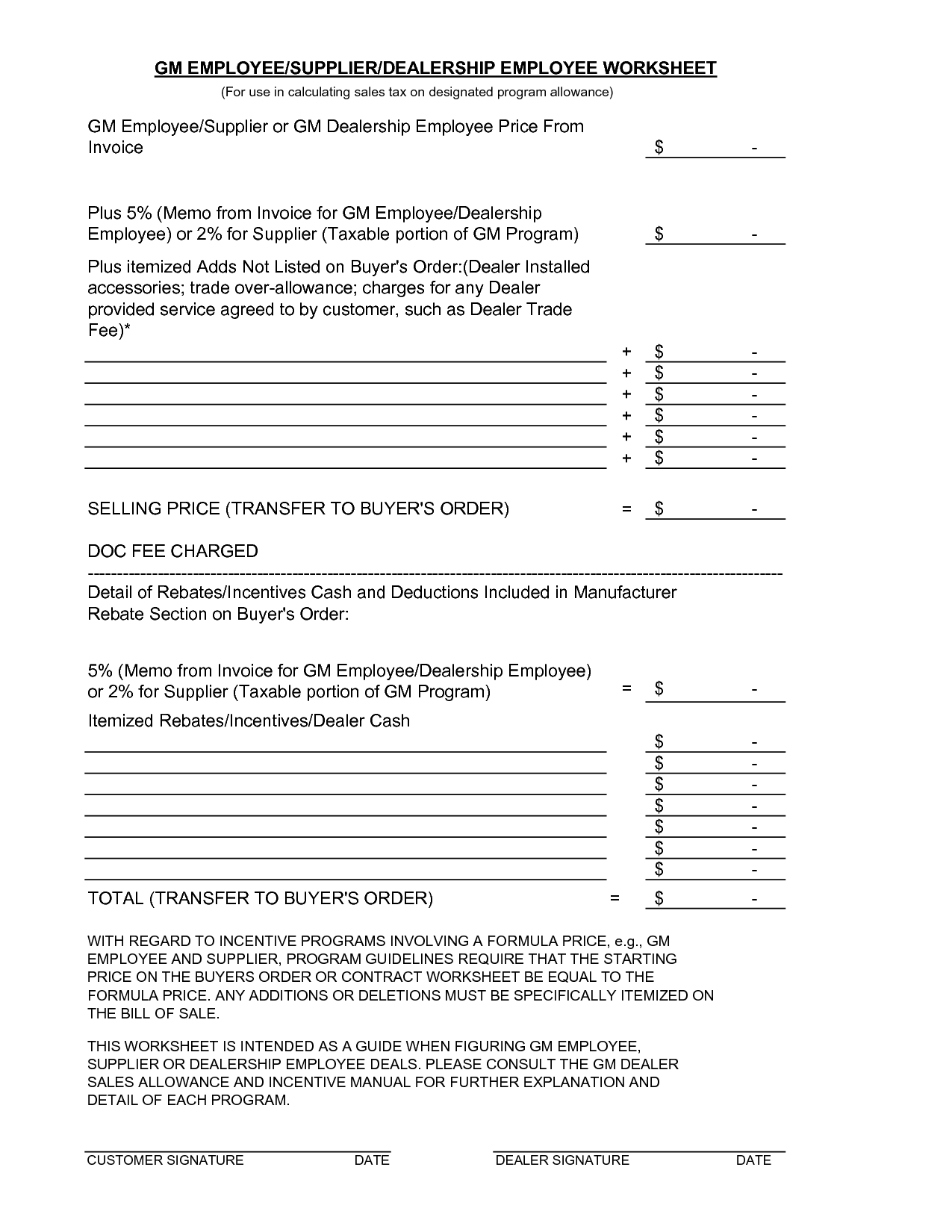

- Sales Tax and Discount Worksheets

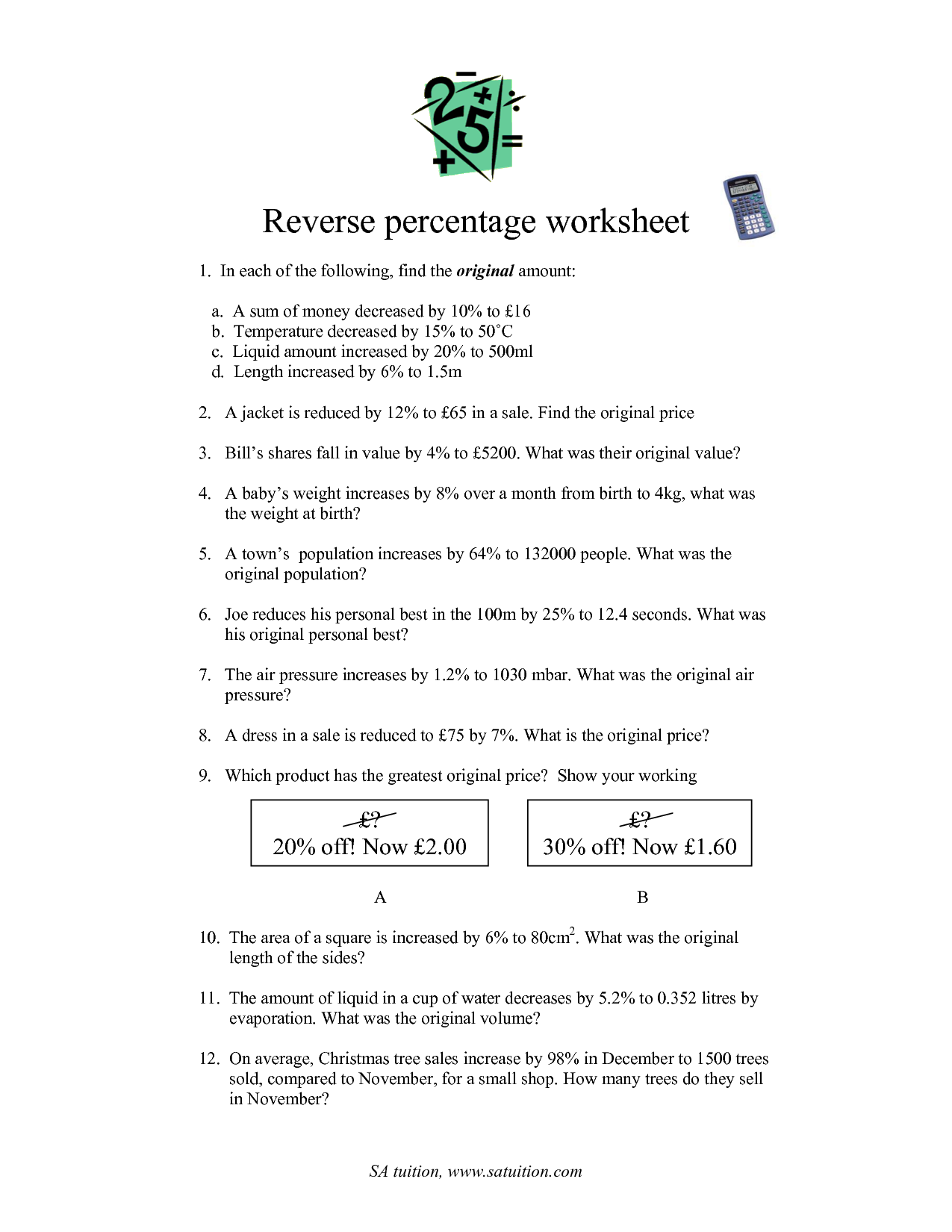

- Percent Increase and Decrease Worksheets

- Sales Tax Math Problems Worksheets

- Sales Tax and Discount Worksheets

- Percent Increase and Decrease Worksheets

- Sales Tax and Discount Worksheets

- Percent Composition Worksheet Answer Key

- Sales Tax and Discount Worksheets

- Percent Increase and Decrease Worksheets

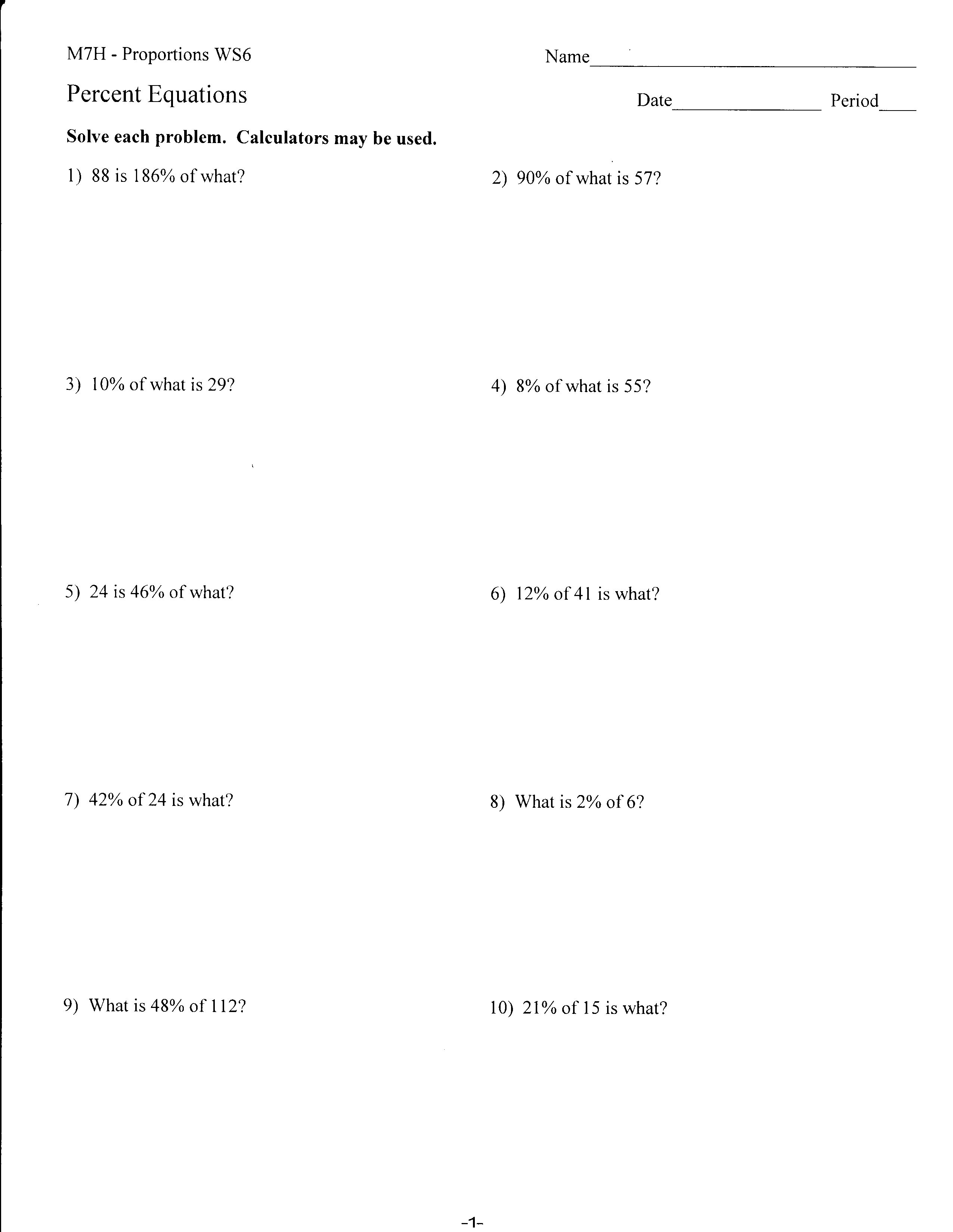

- Percent Proportion Worksheets

- Percent Tax Tip Discount Word Problems Worksheet Answers

- Percent Composition Empirical Formula Worksheet and Answers

- 7th Grade Math Worksheets Percentages

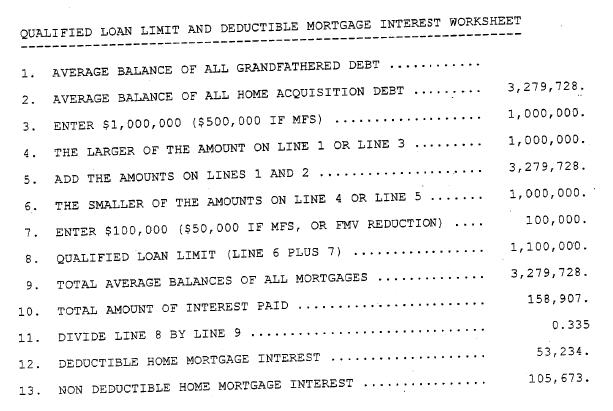

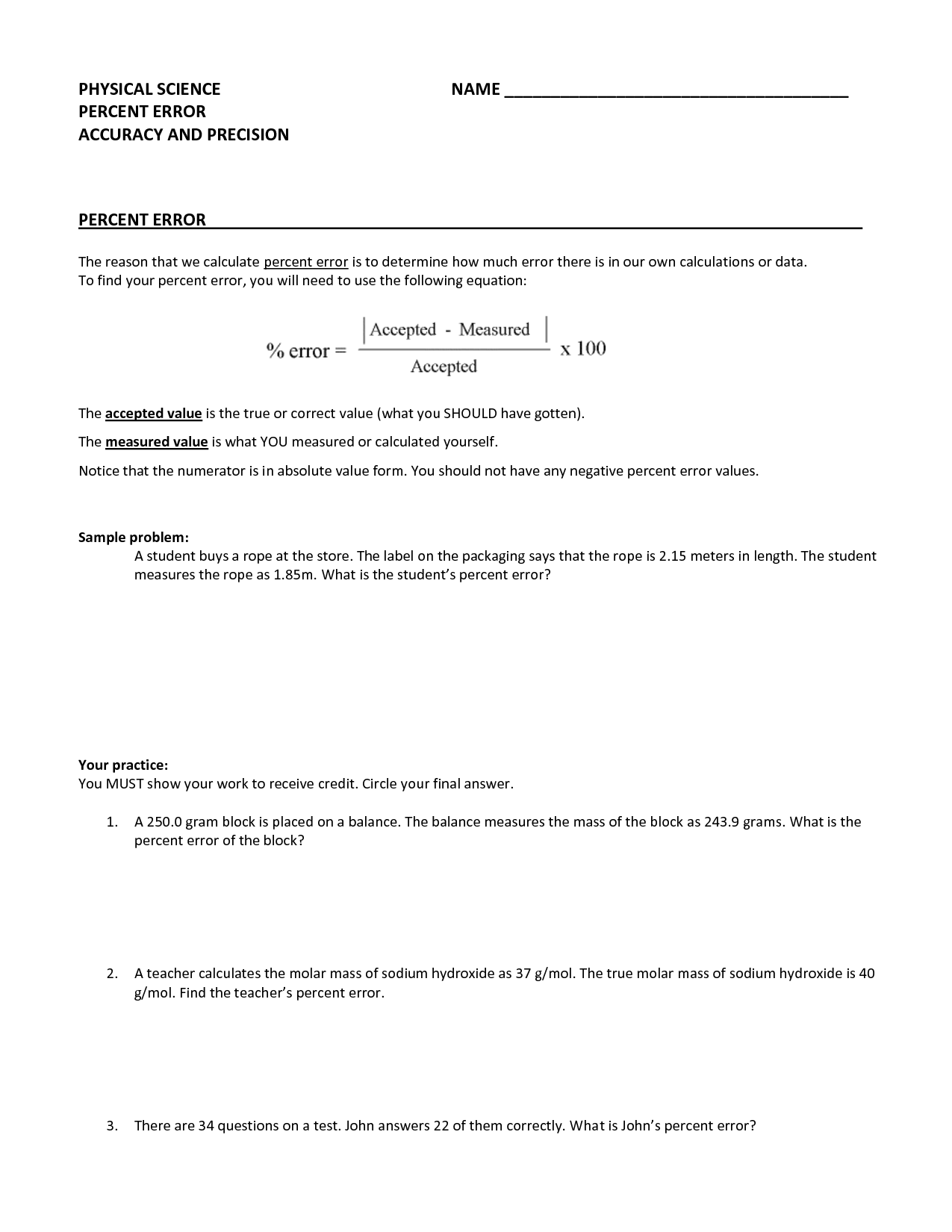

- Percent Error Accuracy and Precision Worksheet Answers

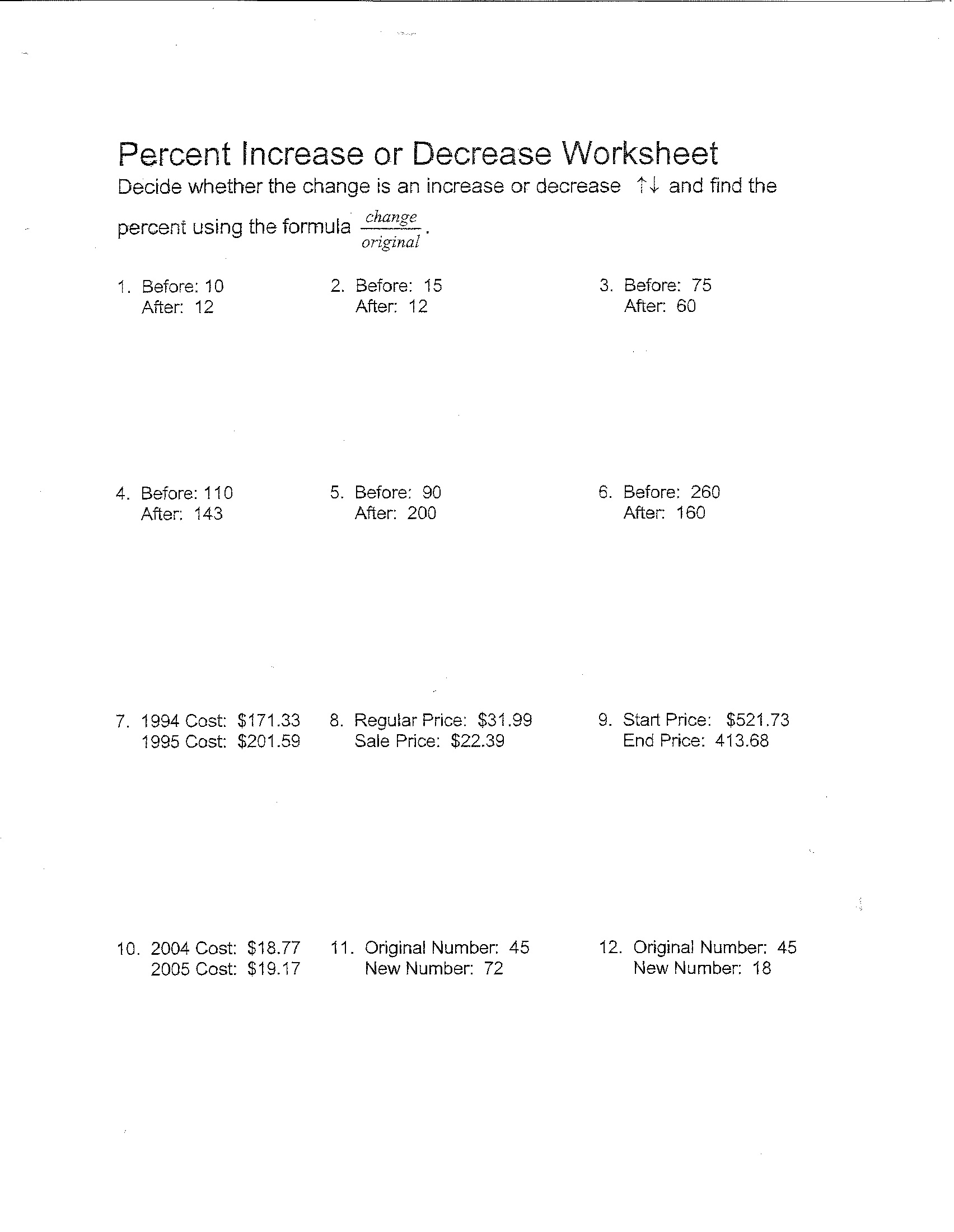

- Percent Increase or Decrease Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is the purpose of the worksheet "Finding Percent Tax"?

The purpose of the worksheet "Finding Percent Tax" is to calculate the amount of tax owed based on a certain percentage rate applied to a specific income or transaction. This worksheet helps individuals or businesses determine their tax liability accurately and efficiently by simplifying the process of calculating taxes using percentages.

How is the tax rate determined in this worksheet?

The tax rate in this worksheet is typically determined based on the taxable income of an individual or entity. Tax brackets are used to divide taxable income into different ranges, with each range corresponding to a specific tax rate. As the taxable income increases, the tax rate applied to that income also increases, following the progression set by the tax brackets. This ensures that higher income earners pay a larger proportion of their income in taxes compared to lower income earners.

What is the formula used to calculate the tax amount?

The formula used to calculate the tax amount is: Tax Amount = Tax Rate x Taxable Income. The Tax Rate is the percentage imposed by the government on the taxable income, while the Taxable Income is the portion of income subject to taxation after deducting any exemptions, deductions, or credits. By multiplying the Tax Rate by the Taxable Income, you can determine the amount of taxes owed.

What are the essential components required to find the tax?

The essential components required to determine the tax amount are the individual or entity's taxable income, applicable tax bracket, deductions, credits, and any other relevant tax factors that may impact the final tax liability. By considering these components, one can calculate the total tax due based on the specific tax laws and regulations applicable to the situation.

How is the taxable amount determined?

The taxable amount is determined by subtracting any allowable deductions and exemptions from the total income earned in a given year. This can include deductions for expenses related to work, education, healthcare, or charitable contributions, as well as exemptions for dependents. After these deductions and exemptions are accounted for, the remaining amount is subject to taxation at the applicable tax rates based on the individual's income level.

What happens if there are multiple tax rates involved?

When multiple tax rates are involved, each item or service subject to taxation will be charged according to the specific tax rate applicable to that item or service. This means that individuals or businesses will need to calculate and track taxes owed for each separate rate, potentially resulting in more complex accounting and record-keeping requirements. It is important to accurately apply the correct tax rates to avoid underpayment or overpayment of taxes.

How is the tax amount calculated when there are exemptions or deductions?

When calculating taxes with exemptions or deductions, you would typically start with your total income and then subtract any eligible exemptions or deductions to arrive at your taxable income. Your tax amount would then be determined based on the tax rates that apply to that taxable income. Exemptions and deductions can vary depending on the type of income and specific tax laws in your jurisdiction.

What information is needed to complete the worksheet accurately?

To complete the worksheet accurately, you will need all relevant data, including any numerical values, dates, and specific instructions provided on the worksheet. It's also important to have a clear understanding of the purpose of the worksheet and any formulas or calculations required to fill it out correctly. Lastly, having access to supporting documents or references may also be helpful in ensuring accuracy.

How can the worksheet help individuals or businesses in understanding their tax obligations?

Worksheets can help individuals or businesses understand their tax obligations by organizing and calculating relevant financial information in a structured manner. They can assist in keeping track of income, expenses, deductions, and credits necessary for accurately filing tax returns. By completing a worksheet, individuals or businesses can ensure they are claiming all eligible deductions and credits, thus maximizing their tax savings and complying with tax laws. The process of filling out a worksheet can also serve as a helpful tool for identifying areas where further documentation or clarification may be needed to support tax obligations.

Can the worksheet be customized for specific tax requirements or jurisdictions?

Yes, worksheets can be customized to meet specific tax requirements or jurisdictions by adjusting formulas, calculations, and data inputs accordingly. This customization ensures that the worksheet is tailored to accurately reflect the tax regulations and guidelines applicable to a specific jurisdiction or set of tax requirements.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments