Worksheet Dental Insurance

Dental insurance can be complex to navigate, with various terms and coverage options to consider. Whether you're an individual seeking coverage or a dentist trying to simplify the process for your patients, having access to well-designed worksheets can make all the difference. With clearly labeled sections and organized information, worksheets can help you better understand the entity and subject of dental insurance, enabling you to make informed decisions and communication.

Table of Images 👆

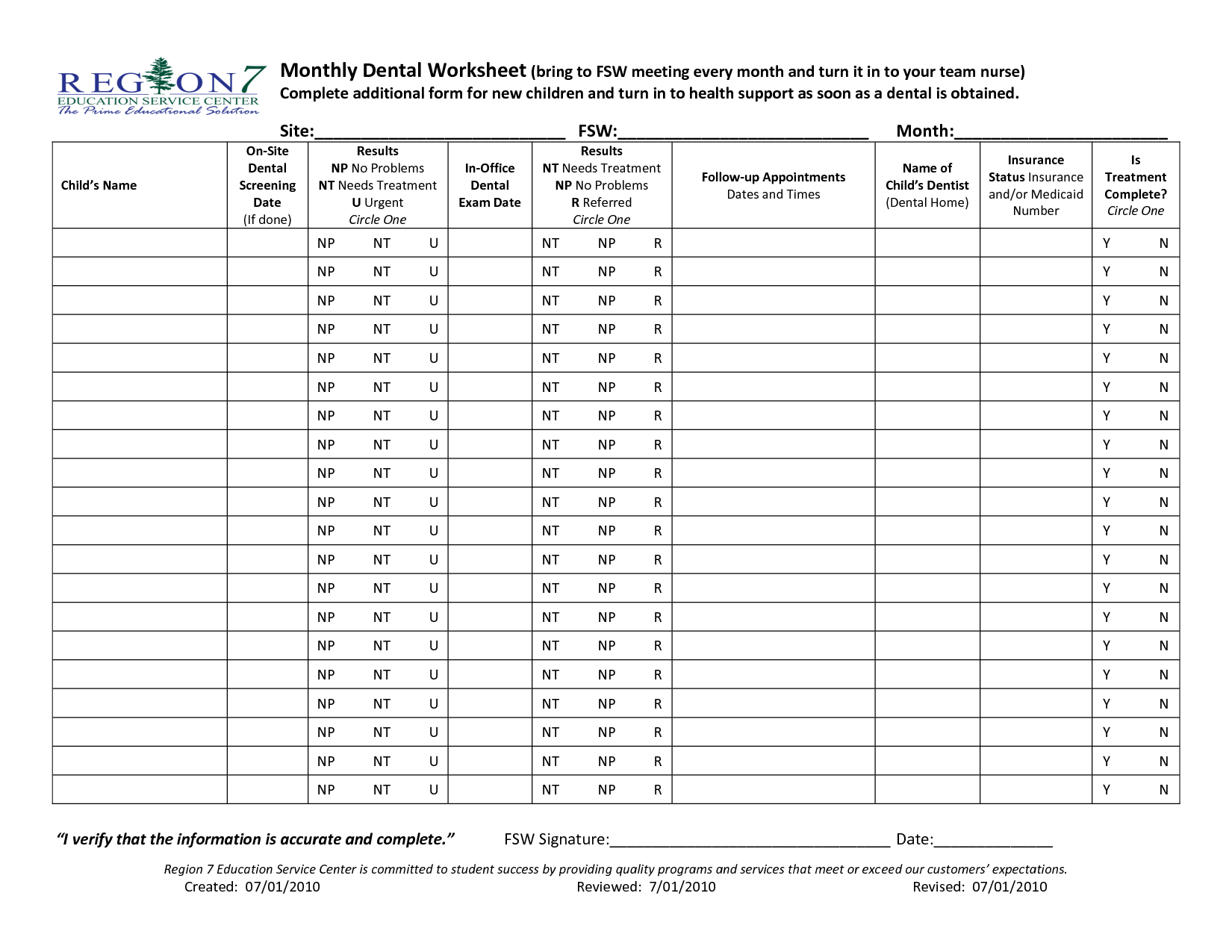

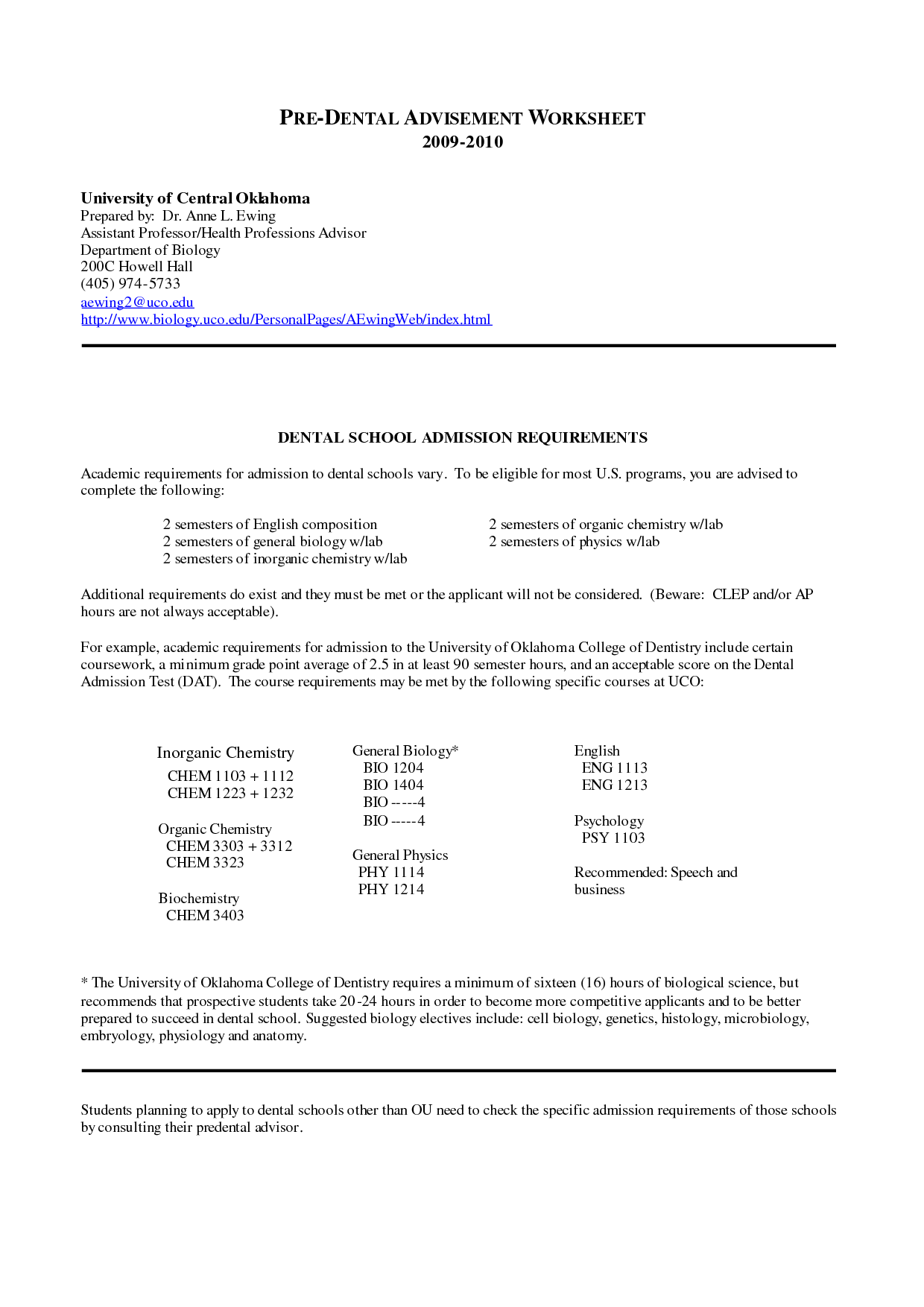

- Dental Health Printable Worksheets

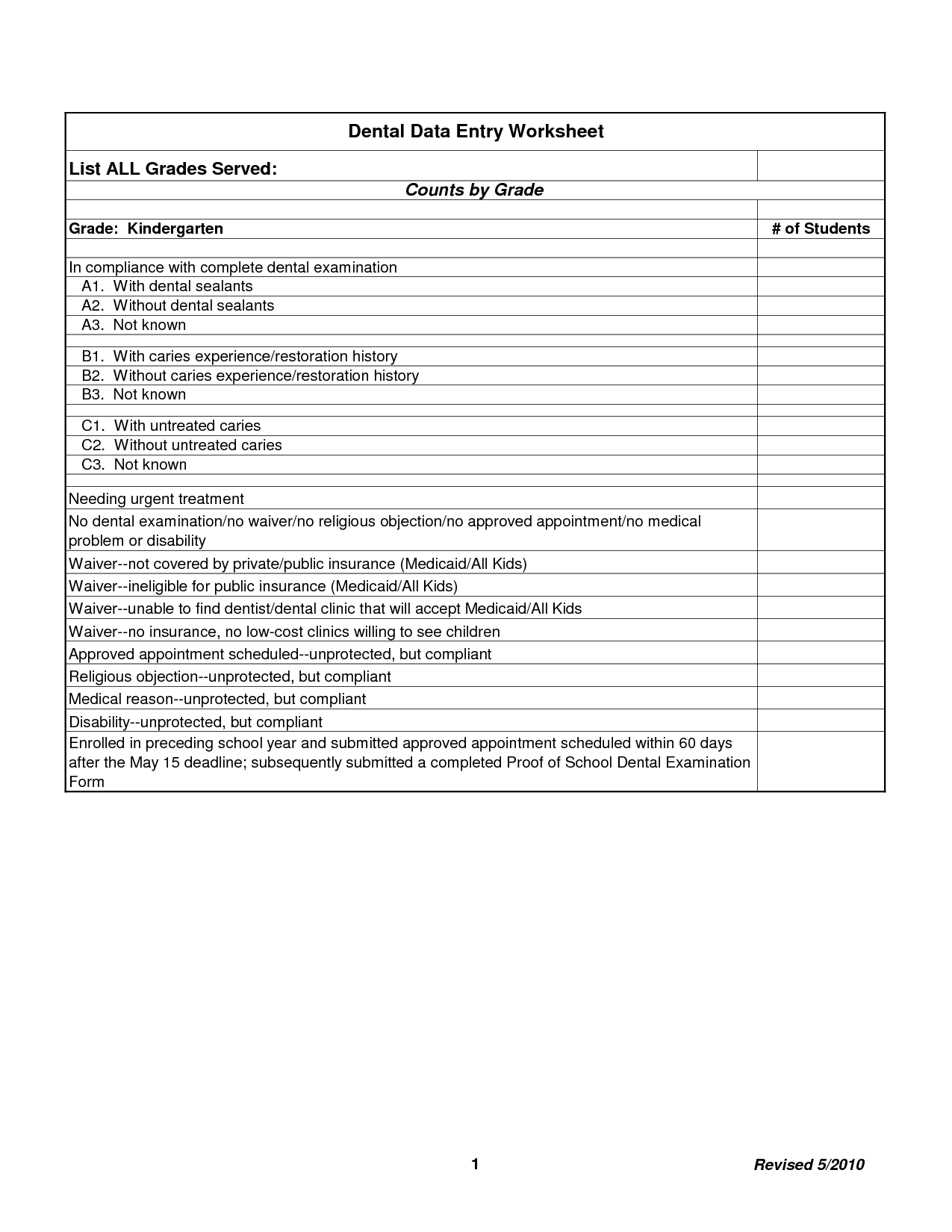

- Dental Treatment Worksheet

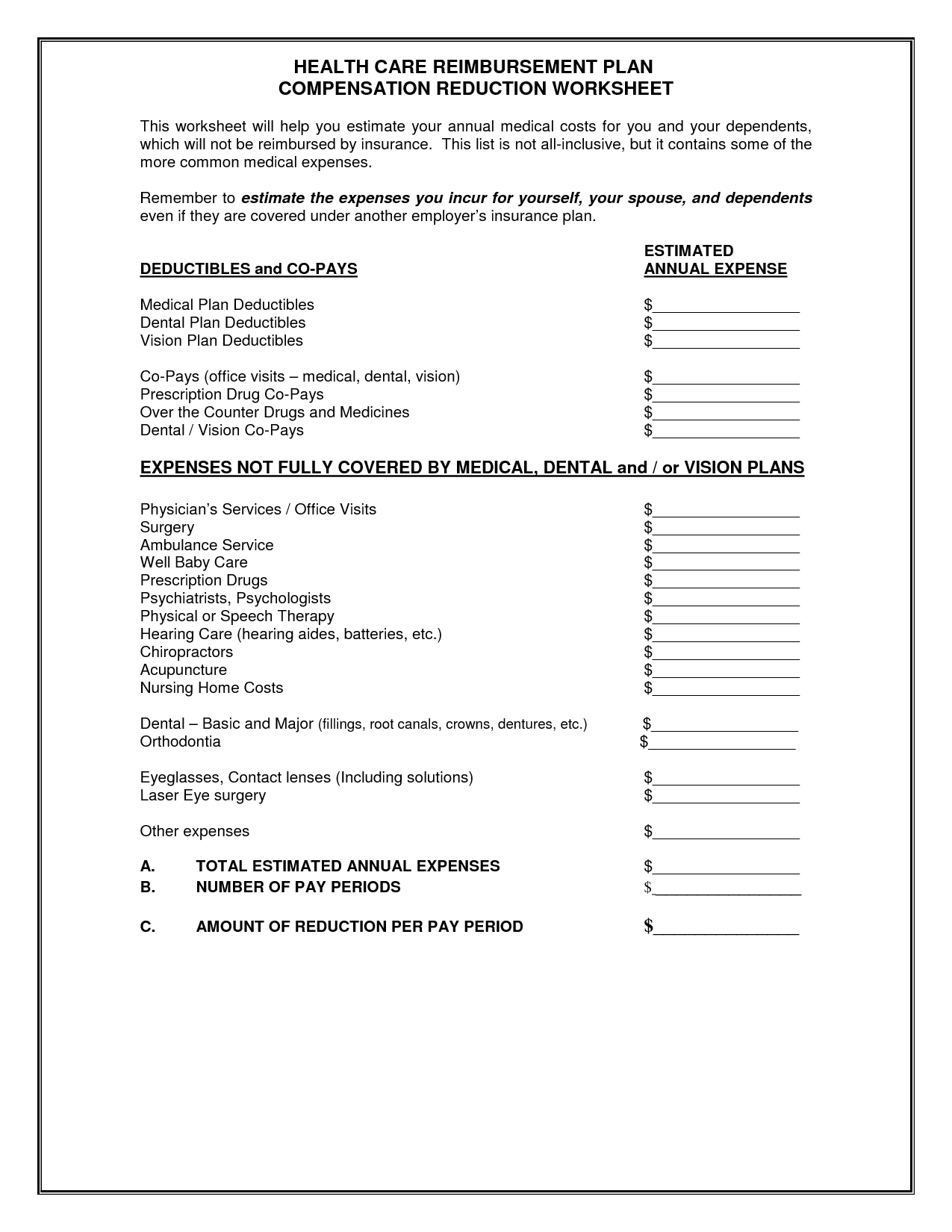

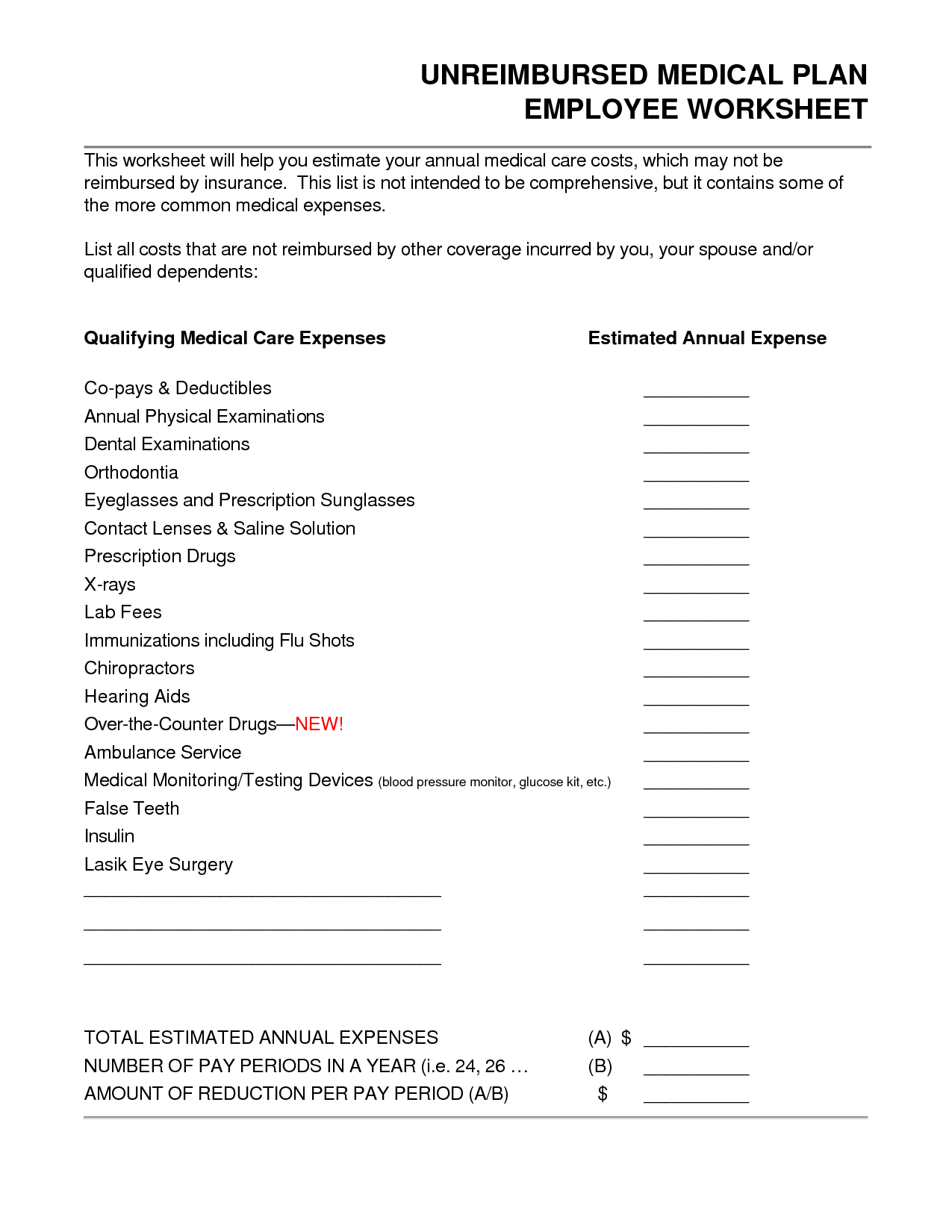

- Plans Health Care Reimbursements

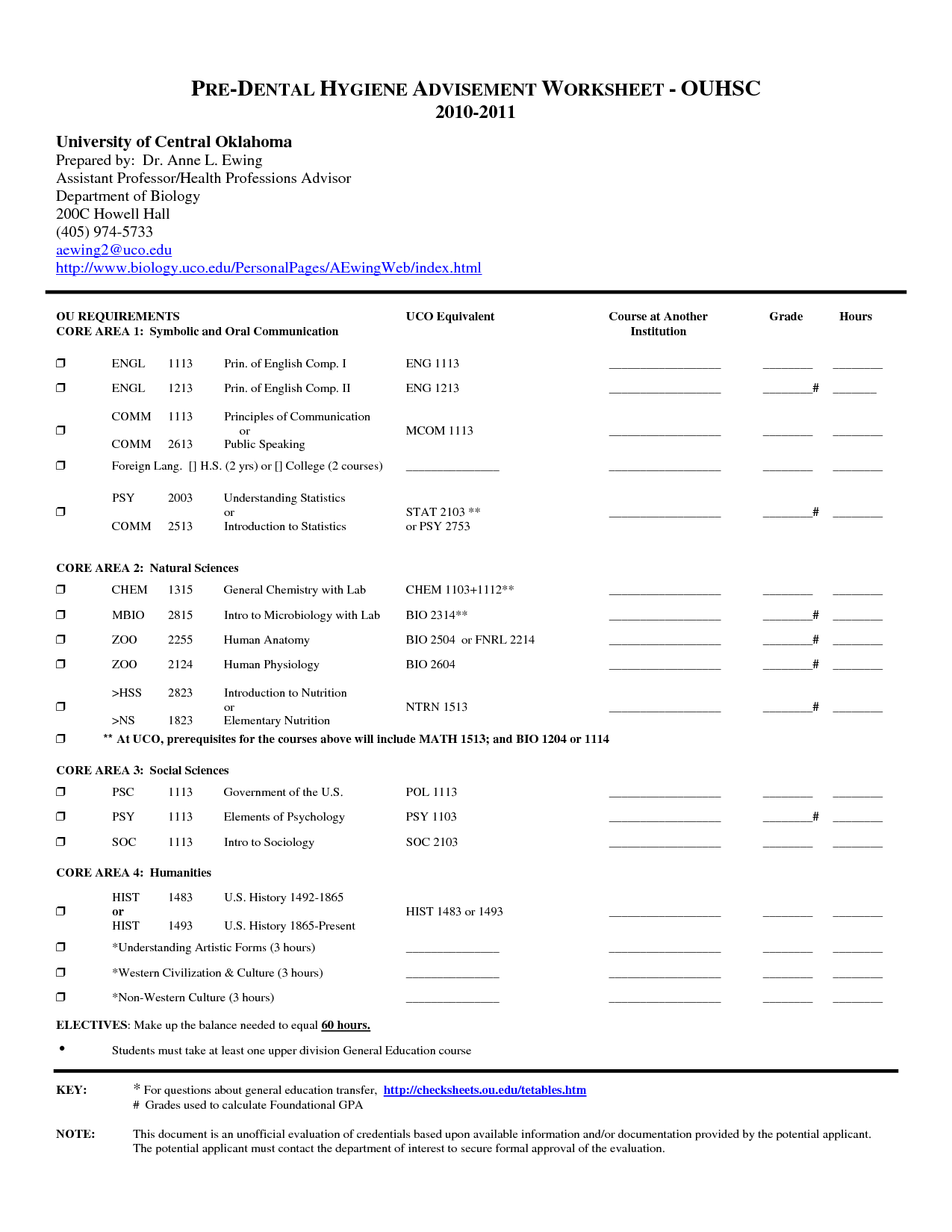

- Dental Hygiene Worksheet Printable

- Dental Care Worksheets for Kids

- Printable Dental Worksheets

- Marijuana Education Worksheet

- Dental Assistant Worksheets

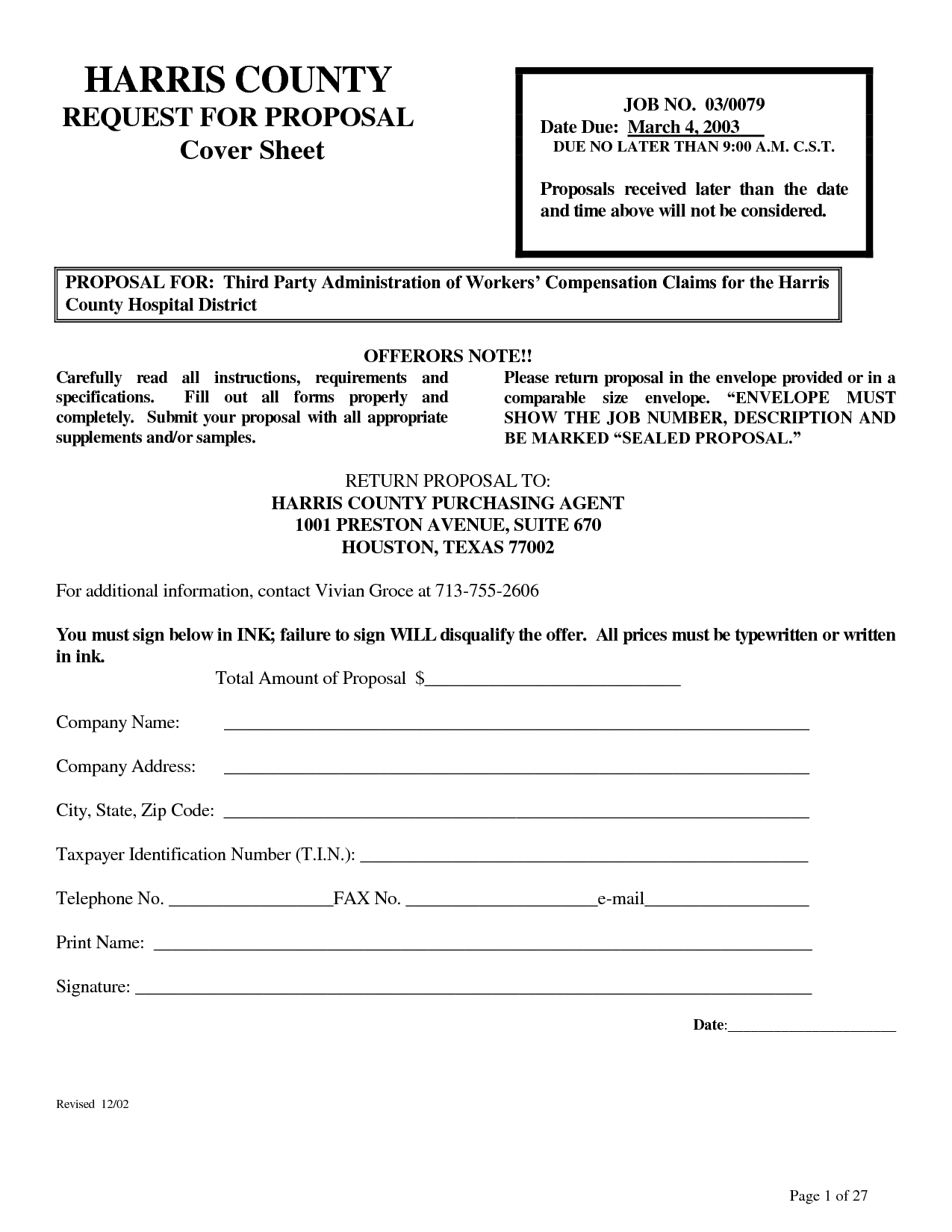

- Sample Insurance Proposal Template

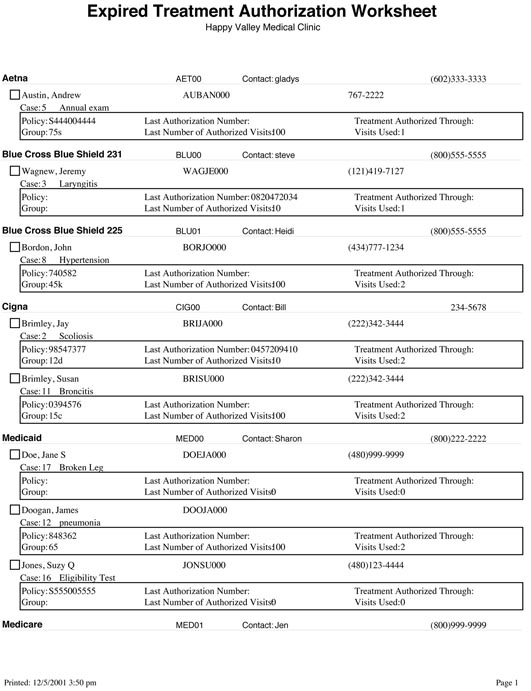

- Patient Care Report Worksheet

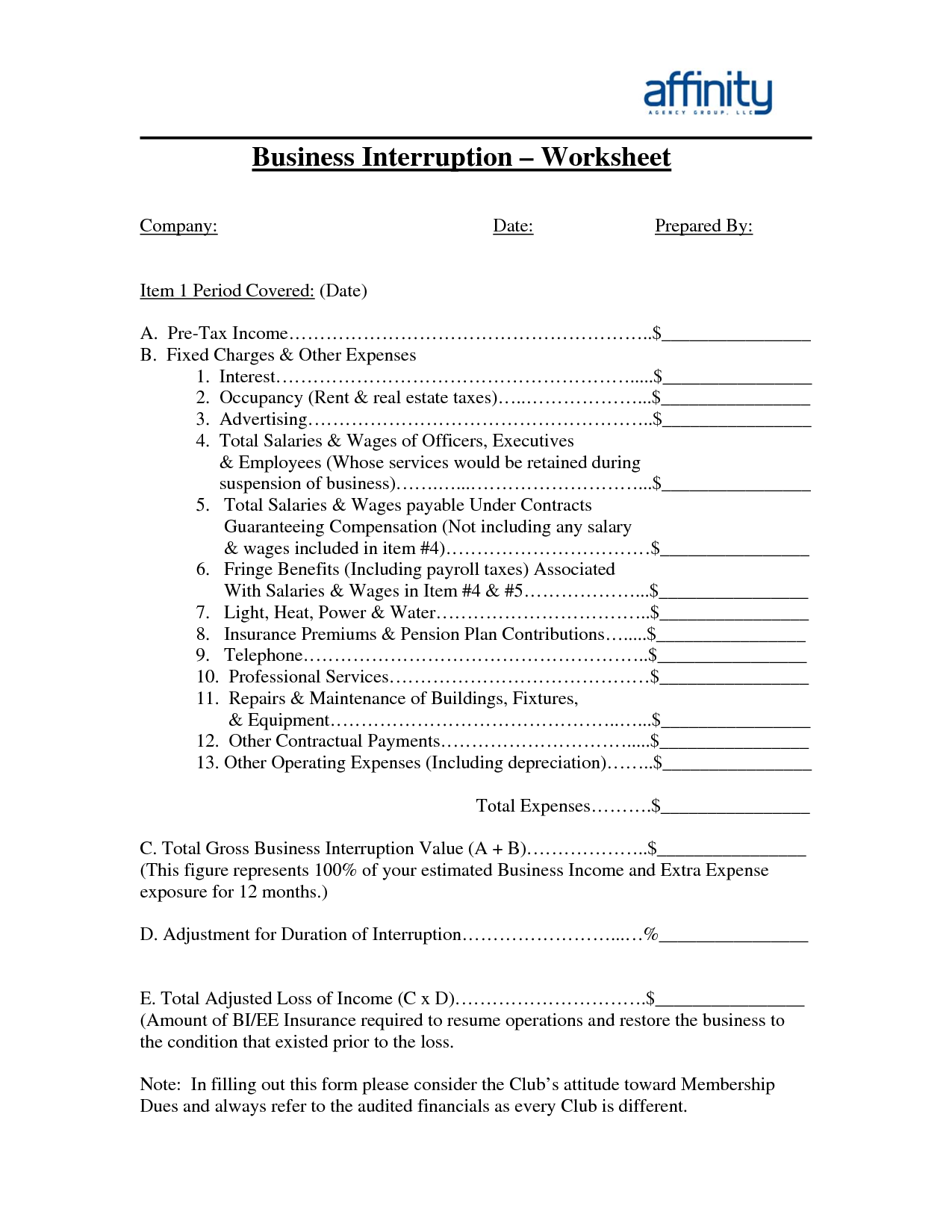

- Business Interruption Insurance Worksheet

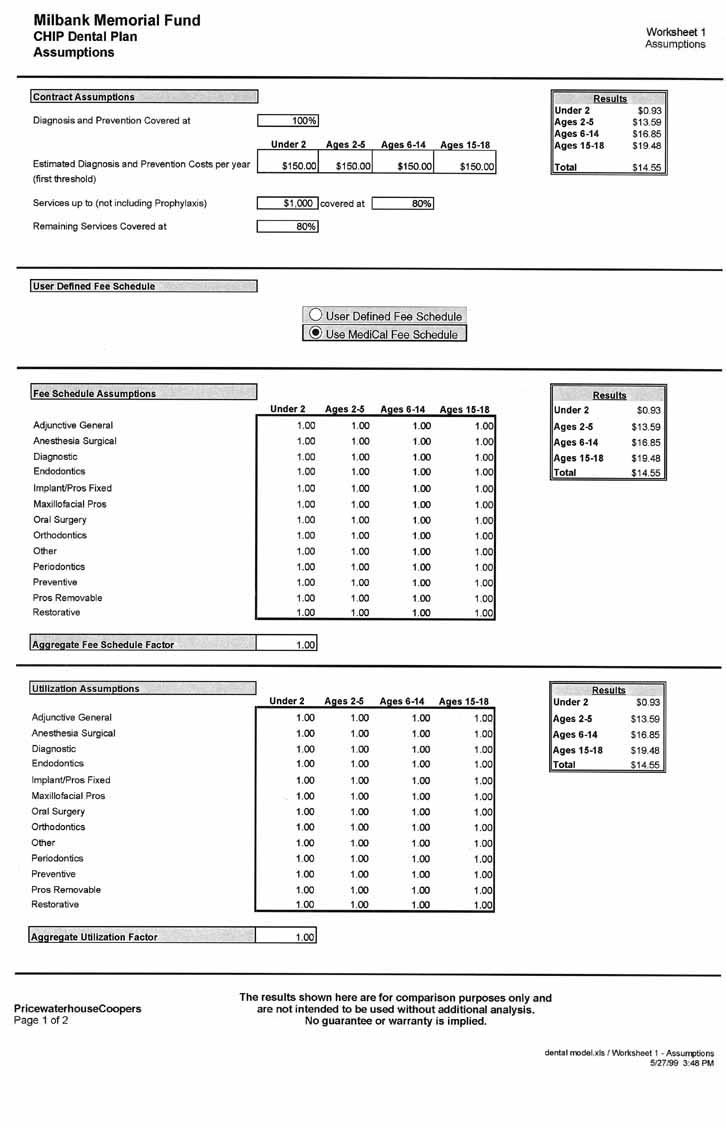

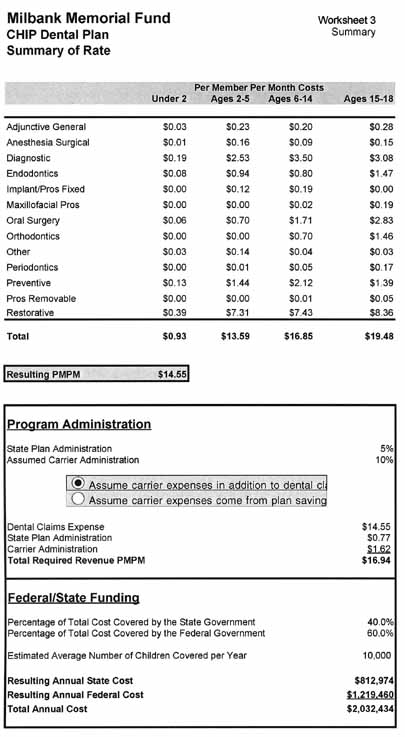

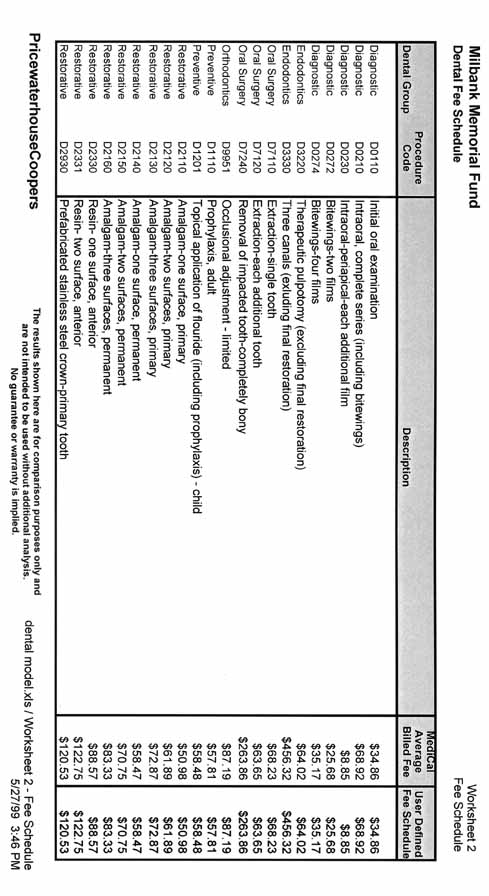

- Dental Fee Schedule

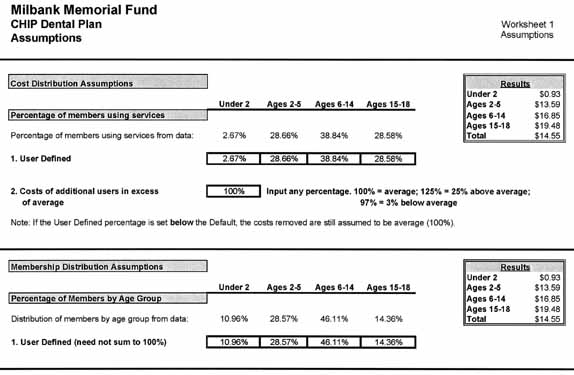

- Insurance Summary Worksheet

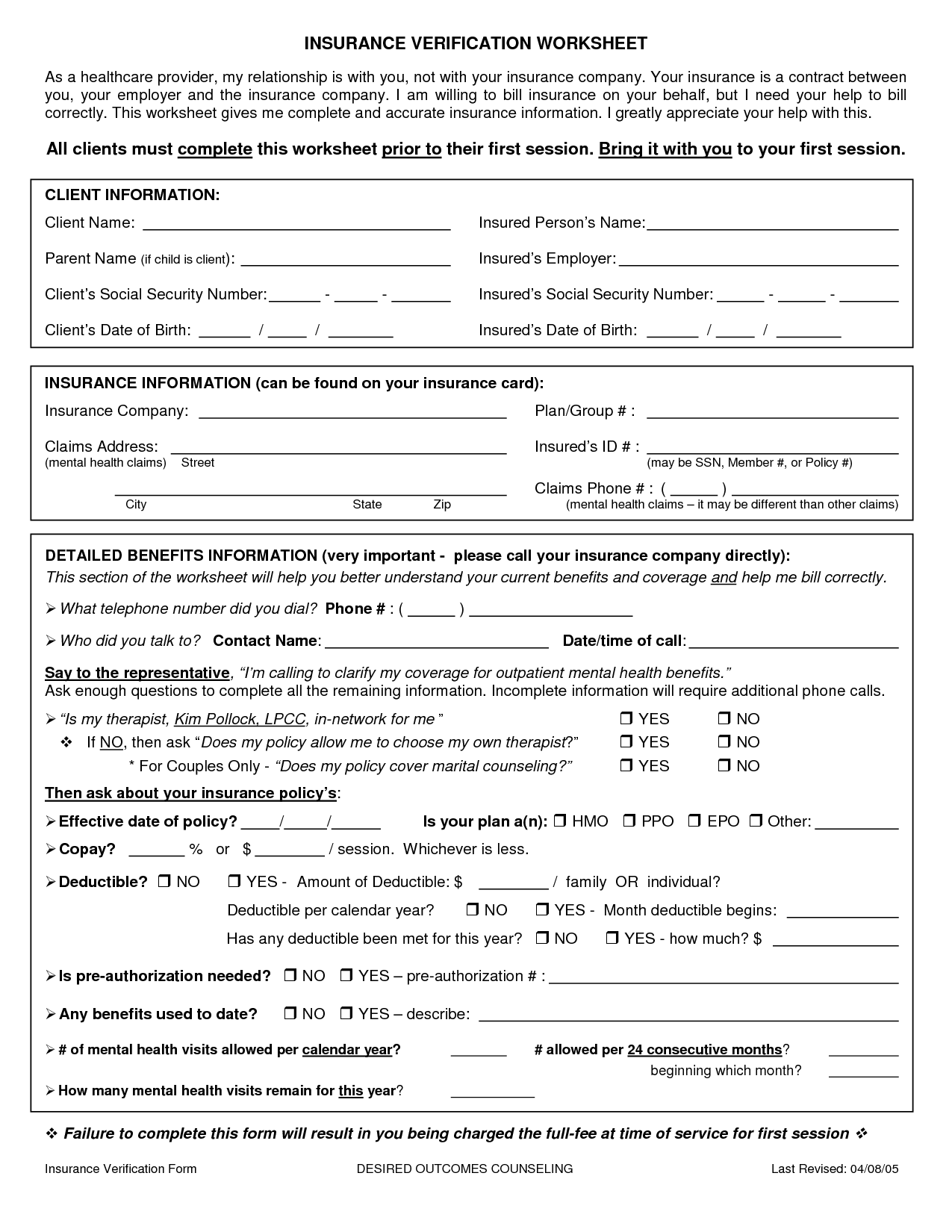

- Health Insurance Verification Form

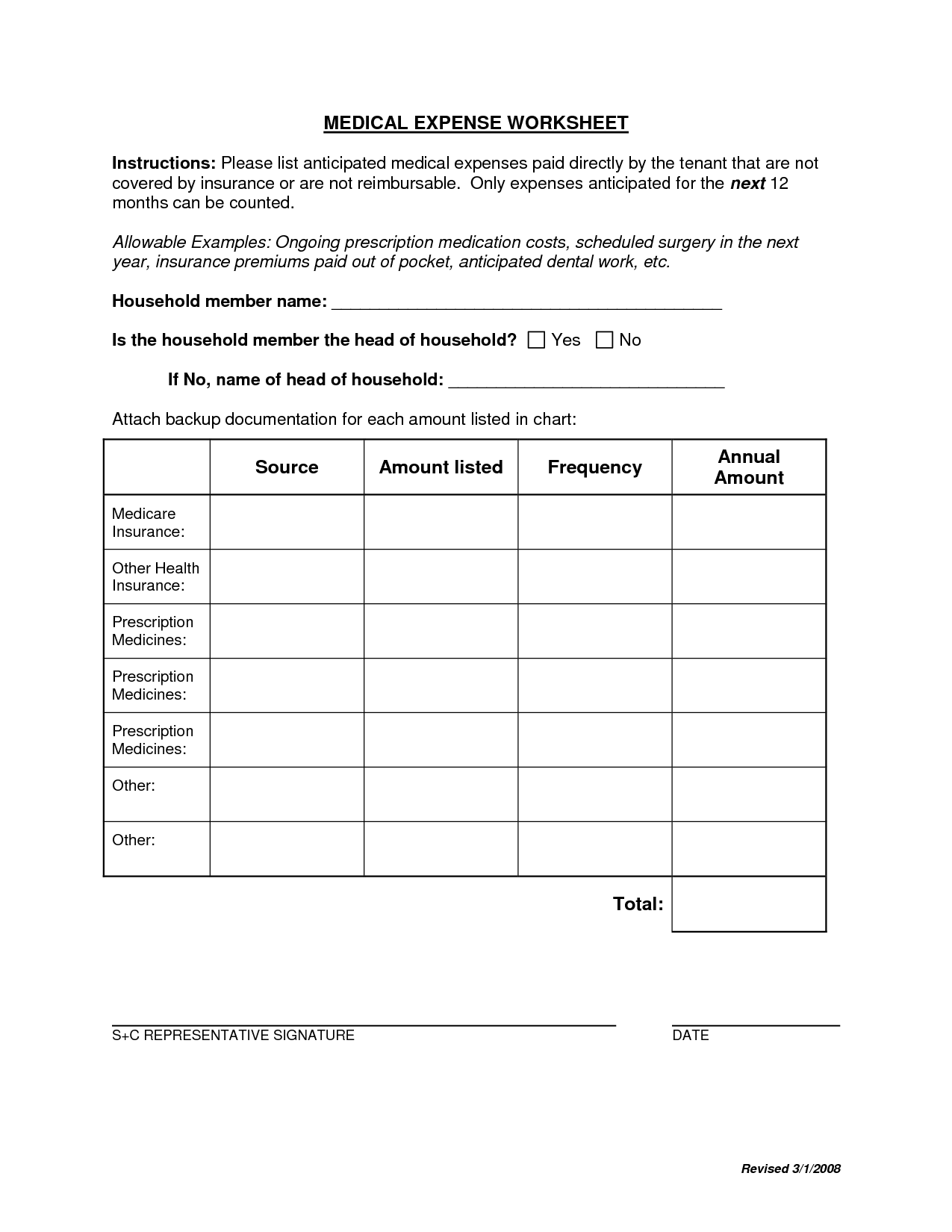

- Medical Expense Worksheet Printable

- Delta Dental Fee Schedule

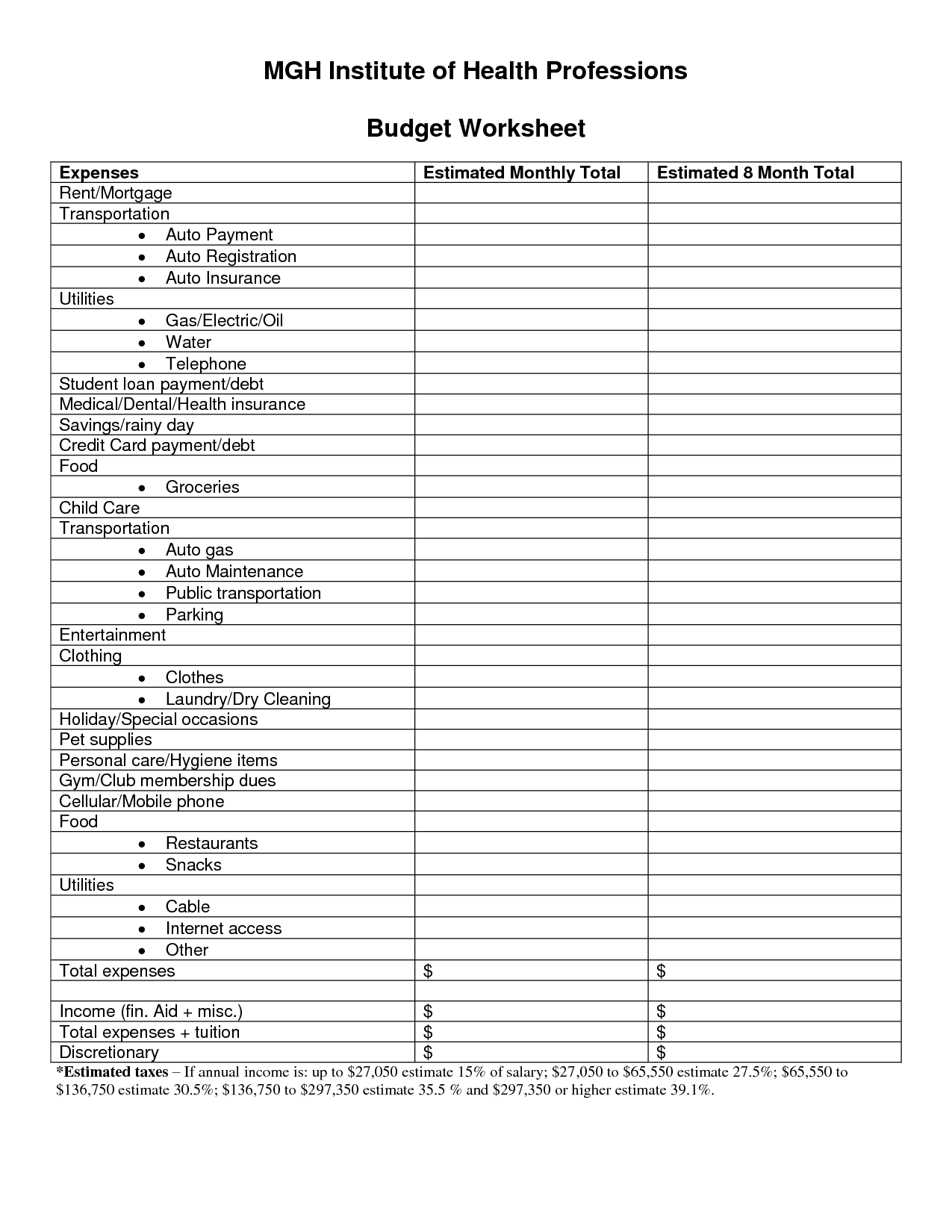

- Health Care Budget Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is dental insurance?

Dental insurance is a type of insurance that helps cover the cost of dental care and treatments. It can help offset expenses such as routine check-ups, cleanings, X-rays, fillings, and other procedures. Dental insurance plans typically involve paying a monthly premium in exchange for coverage of certain dental services, with different plans offering varying levels of coverage and benefits.

How does dental insurance coverage work?

Dental insurance coverage typically works by providing you with a list of covered services, such as cleanings, fillings, and X-rays, along with a schedule of benefits that details what percentage of the cost is covered for each service. You pay a monthly premium for your insurance, and when you visit a dentist, you often pay a copayment or coinsurance amount for the services received. There may also be annual maximums and deductibles that you are responsible for before the insurance kicks in to cover a larger portion of the costs.

What are the different types of dental insurance plans available?

The different types of dental insurance plans available include DHMO (Dental Health Maintenance Organization) plans where members must choose a primary dentist but generally have lower out-of-pocket costs, PPO (Preferred Provider Organization) plans offering a network of dentists but allowing members to see out-of-network providers at a higher cost, and indemnity plans offering the most freedom to choose any dentist but often at higher out-of-pocket costs. Discount dental plans are another option where members pay an annual fee for a discount on dental services from participating providers, without insurance coverage.

What services are typically covered by dental insurance?

Typically, dental insurance covers a range of preventive and diagnostic services such as routine cleanings, exams, X-rays, and fillings. Some plans also cover more extensive treatments like crowns, bridges, root canals, and extractions. However, coverage can vary widely between plans, so it's important to check your specific policy for details on what services are included.

What services are usually not covered by dental insurance?

Cosmetic procedures such as teeth whitening, porcelain veneers, and braces for purely cosmetic reasons are typically not covered by dental insurance. Additionally, dental insurance may not cover certain specialty services such as orthodontics, dental implants, and some oral surgeries. It is important to review the specifics of your dental insurance coverage to understand which services may not be covered.

What is the difference between in-network and out-of-network providers?

In-network providers are healthcare professionals and facilities that have a contract with an insurance company to provide services at a negotiated rate, while out-of-network providers do not have a contract with the insurance company. This means that when you visit an in-network provider, your insurance will typically cover a larger portion of the cost, whereas with an out-of-network provider, you may have to pay a higher percentage of the cost out of pocket.

How does dental insurance handle pre-existing conditions?

Dental insurance plans typically do not cover pre-existing conditions, meaning any oral health issues that were present before enrolling in the insurance plan. This includes conditions such as missing teeth, gum disease, or oral infections that were already diagnosed or treated prior to obtaining the insurance coverage. In most cases, individuals with pre-existing dental conditions may need to undergo a waiting period before those specific conditions can be covered by their insurance plan. It's important to review the terms and conditions of the insurance policy to understand how pre-existing conditions are handled.

What is a premium in dental insurance?

A premium in dental insurance is the amount of money homeowners pay to have coverage and access to dental services. This fee is typically paid on a monthly basis in exchange for the insurance provider covering a portion of dental expenses or providing benefits for various dental procedures.

How does dental insurance handle deductibles and co-pays?

Dental insurance typically handles deductibles and co-pays similarly to medical insurance. A deductible is the amount you must pay out of pocket before your insurance starts covering costs, while a co-pay is a fixed amount you pay for each service or visit. For dental insurance, once you meet your deductible, your insurance will typically cover a portion of your dental costs, with you being responsible for the remaining co-pay. The specific amounts for deductibles and co-pays can vary depending on your insurance plan.

What should I consider when selecting a dental insurance plan?

When selecting a dental insurance plan, consider factors such as the coverage and benefits offered, including preventive care, major services, and orthodontic treatment options. Look at the cost of premiums, co-pays, and deductibles to ensure they fit your budget. Check for any limitations or exclusions in the plan, as well as the network of dentists available to you. It's also important to review customer reviews and ratings of the insurance provider to gauge their reputation for customer service and claims processing efficiency.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments