Worksheet Budget Bill Paying

Are you looking for a practical tool to help you efficiently manage your budget and track your bill payments? Look no further! Worksheets can be an excellent solution for individuals or families who want to take control of their finances. These simple yet effective entities provide a structured framework to organize and monitor your expenses, ensuring that you stay on top of your bills and financial commitments.

Table of Images 👆

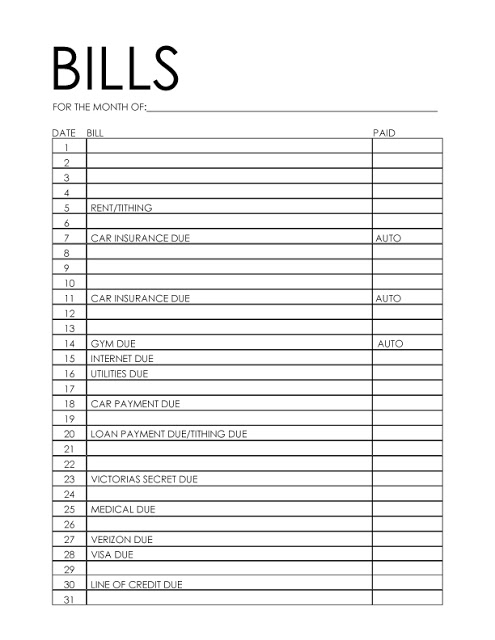

- Printable Monthly Bill Paying Worksheet

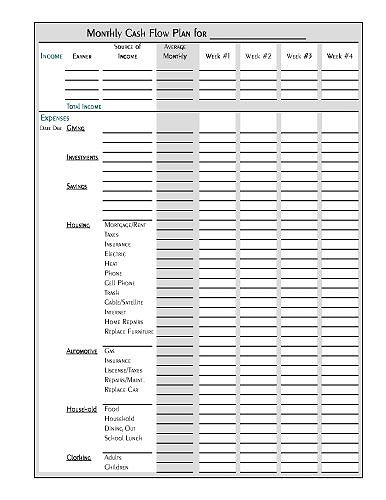

- Monthly Bill Payment Worksheet

- Free Printable Household Budget Worksheets

- Marsha Linehan DBT Worksheets.pdf

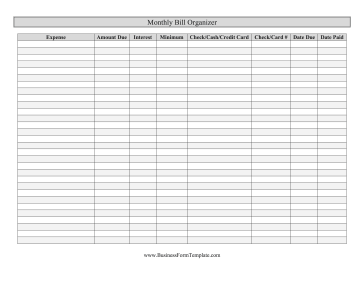

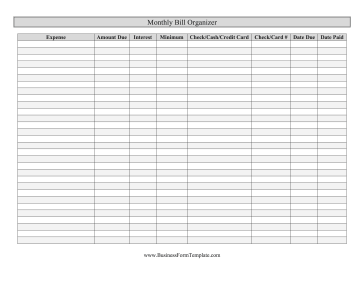

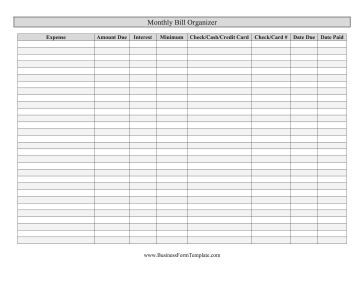

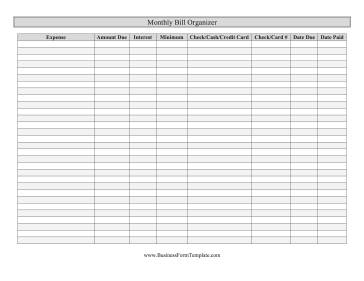

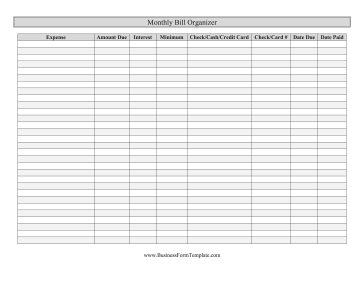

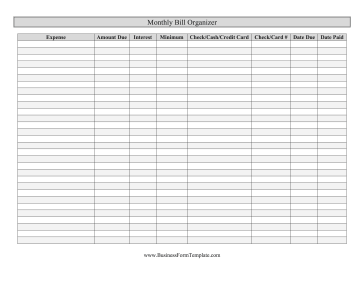

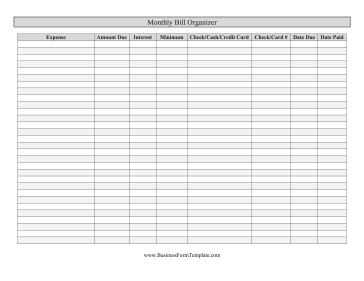

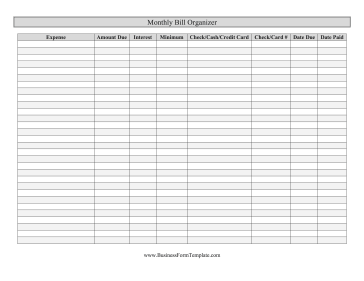

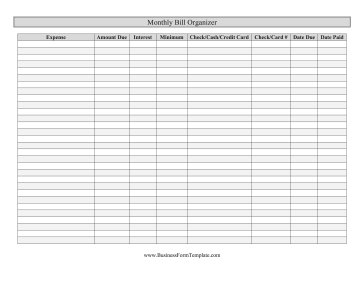

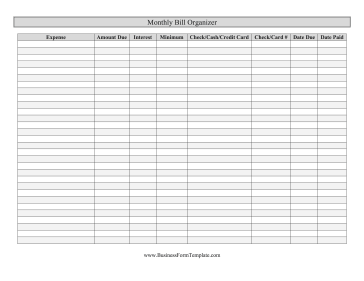

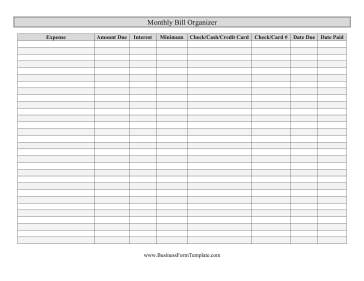

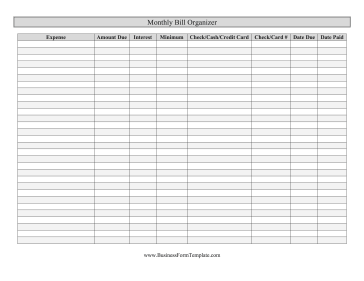

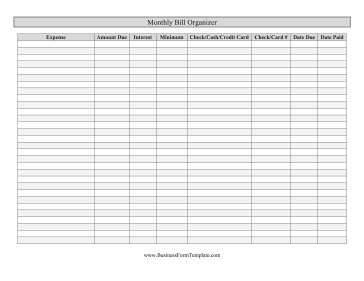

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

- Free Monthly Bill Organizer Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a budget?

A budget is a financial plan that outlines an organization's or individual's expenses and revenues over a specific period, typically for a year. It helps to track and control spending, allocate resources effectively, and achieve financial goals by setting limits and priorities for expenditures.

Why is budgeting important for bill paying?

Budgeting is important for bill paying because it helps individuals manage their finances effectively by allocating funds for different expenses, including bills. By creating a budget, individuals can track their income and expenses, prioritize bill payments, avoid overspending, and ensure that they have enough money set aside to cover their bills in a timely manner. This can help individuals avoid financial struggles, late fees, and missed payments, ultimately leading to better financial stability and peace of mind.

How can you create a budget for bill paying?

To create a budget for bill paying, start by listing all your monthly bills, including utilities, rent/mortgage, insurance, loans, subscriptions, and any other fixed expenses. Next, calculate your total monthly income and subtract your total bills to ensure they don't exceed your income. Consider setting aside a portion of your income for savings or unexpected expenses. Track your spending throughout the month to stay on budget and adjust as needed. Automating bill payments can also help ensure they are paid on time.

What are some common bills that need to be included in a budget?

Common bills that need to be included in a budget typically include rent or mortgage payments, utilities such as electricity, water, and gas, groceries, transportation costs like car payments, insurance, and gas, healthcare expenses, internet and phone bills, debt payments like student loans or credit cards, and savings contributions for emergencies or future goals. It's important to consider these essential expenses when creating a budget to ensure that all bills are paid on time and that adequate funds are allocated for each category.

How often should you review and update your budget for bill paying?

It is recommended to review and update your budget for bill paying on a monthly basis. This allows you to track your expenses, adjust for any changes in income or bills, and stay on top of your financial goals. Regularly reviewing and updating your budget can help you identify any areas where you may need to cut back or save more, ensuring that you are able to effectively manage your finances.

What are some strategies for minimizing bills and expenses?

To minimize bills and expenses, consider creating a budget to track spending, negotiate with service providers for discounts or lower rates, cut back on non-essential purchases, automate bill payments to avoid late fees, conserve energy and water usage to reduce utility bills, shop around for cheaper insurance policies and subscriptions, cook meals at home instead of dining out, and consider selling unused items to generate extra income.

How can you prioritize and allocate funds for bill paying?

To prioritize and allocate funds for bill paying, it is crucial to first create a budget outlining all monthly expenses and income sources. Next, categorize bills into essentials (such as rent, utilities, and groceries) and non-essentials (like subscription services). Allocate funds to cover essential bills first to ensure basic needs are met, then focus on non-essential bills. Consider negotiating payment plans with creditors if unable to cover all bills at once and track expenses to stay within budget and avoid late fees. Adjust the allocation of funds as needed based on changing financial circumstances.

What are some consequences of not paying bills on time?

Some consequences of not paying bills on time include incurring late fees, penalty interest rates, and potential damage to your credit score. Additionally, not paying bills on time can result in service disruptions or disconnections for essential utilities such as electricity, water, or internet. Over time, consistent late payments can lead to increased financial stress, debt accumulation, and decreased access to credit in the future.

How can you track and monitor bill payments?

You can track and monitor bill payments by setting up reminders in your calendar or using a dedicated bill tracking app. Keep a record of due dates, amounts, and payment methods to stay organized. You can also consider setting up automatic payments or using online banking to track bill payments in real-time. Regularly reviewing your bank statements and credit card transactions will help ensure that all bills are being paid on time.

What resources or tools are available to help with budgeting and bill paying?

There are various resources and tools available to help with budgeting and bill paying, such as budgeting apps like Mint, You Need a Budget (YNAB), and EveryDollar. These apps can help track expenses, set financial goals, and create a budget that fits your lifestyle. Additionally, online banking platforms often offer bill pay services that allow you to easily schedule and automate payments for recurring bills. Setting up automatic transfers to a separate savings account can also help you save for emergencies and future expenses. Lastly, utilizing spreadsheets or budgeting templates can be a helpful way to organize your finances and stay on top of bill payments.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments