Two Income Budget Worksheet

Are you struggling to stay organized and keep track of your finances? A two-income budget worksheet might be just what you need. This simple tool is designed to help couples who rely on two sources of income effectively manage their money. By organizing your expenses and income in one place, you can gain a clearer understanding of where your money is going and make more informed financial decisions. Whether you're a newlywed couple or have been managing your finances together for years, using a two-income budget worksheet can make a significant difference in your financial well-being.

Table of Images 👆

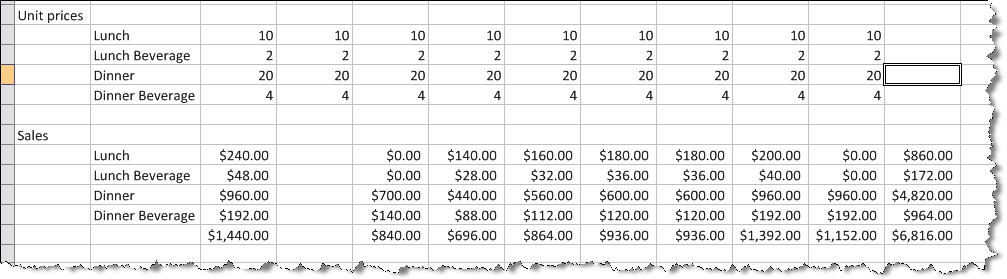

- Restaurant Sales Forecast Template

- Free Personal Budget Worksheet

- Free Printable Budget Worksheets

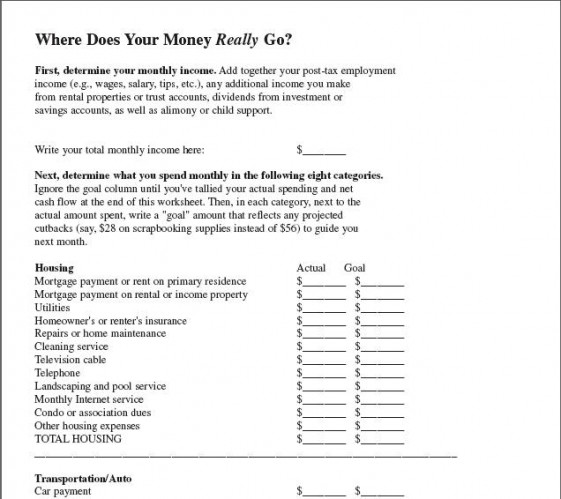

- Sample Monthly Budget Worksheet

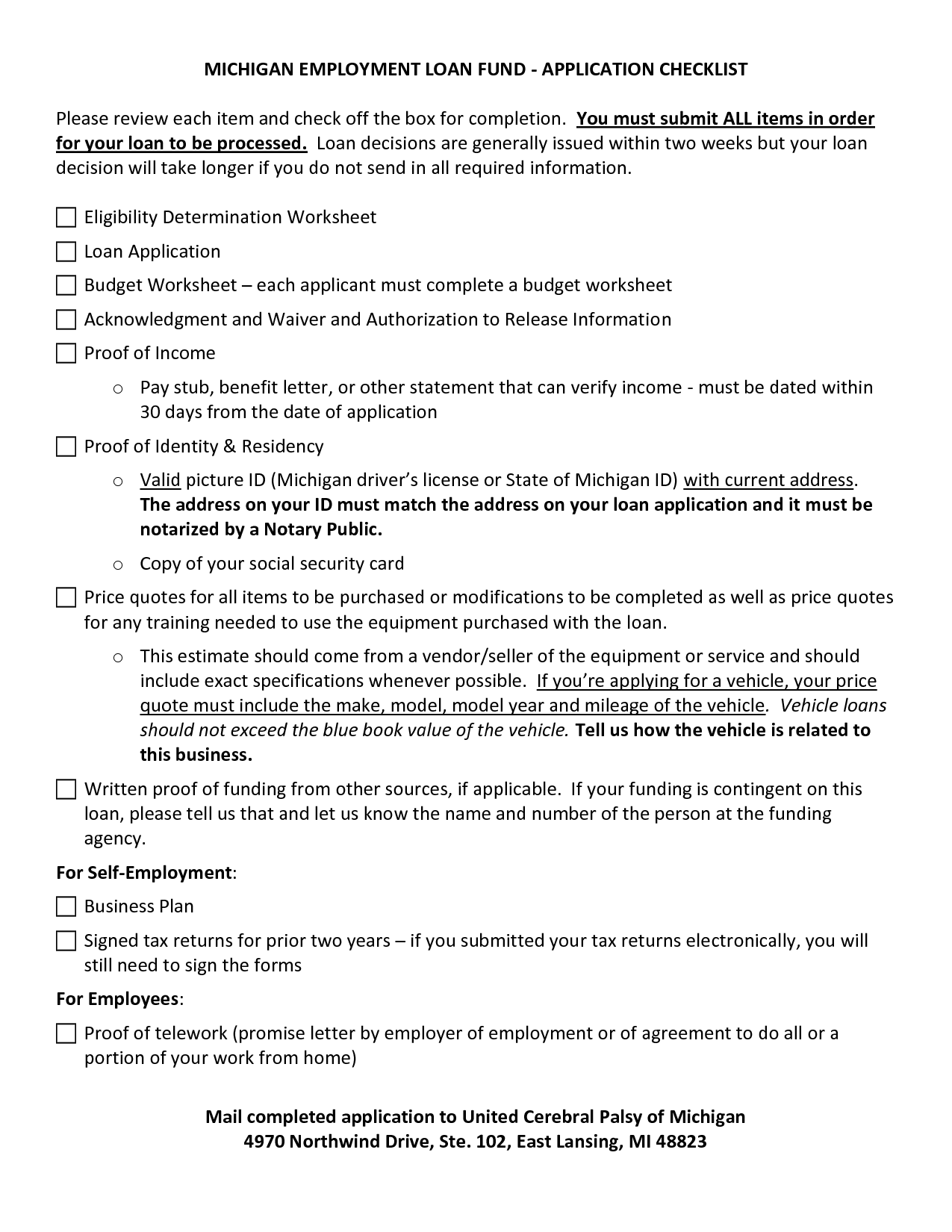

- Home Loan Application Checklist

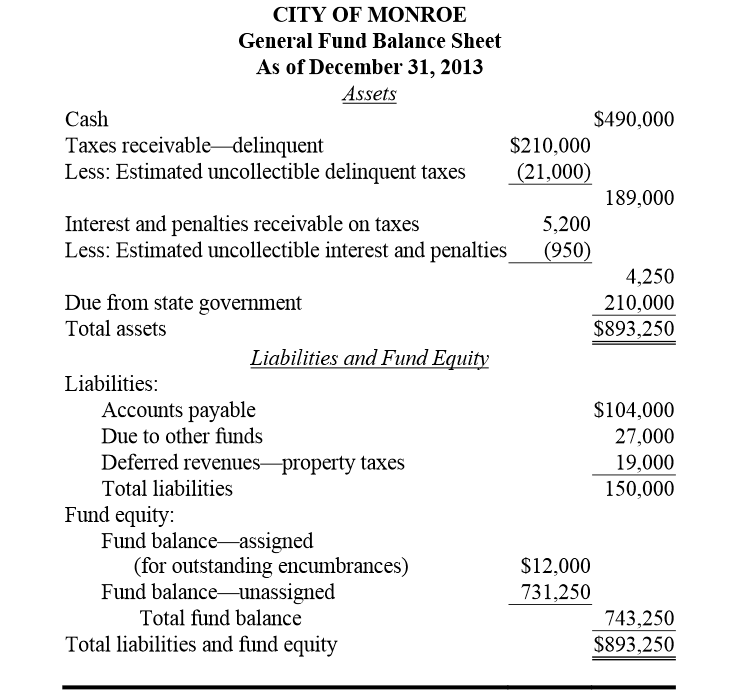

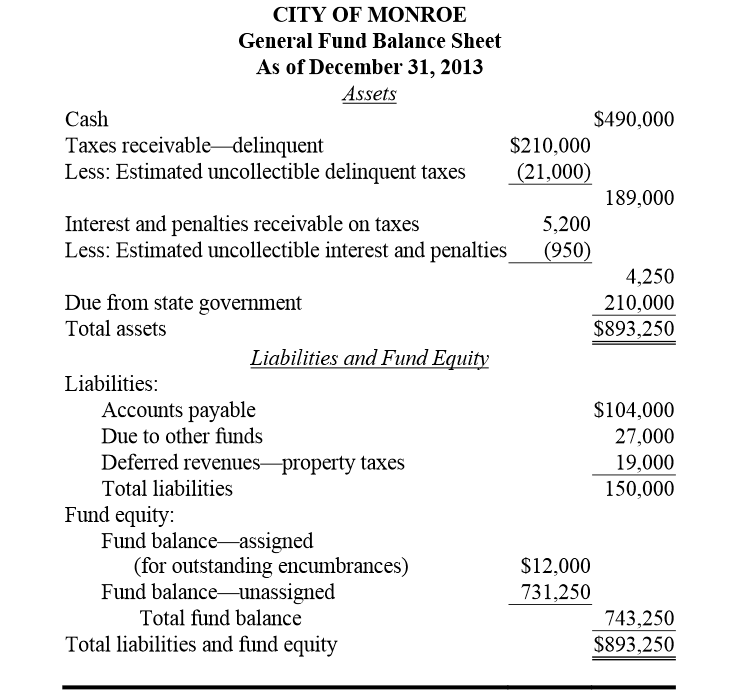

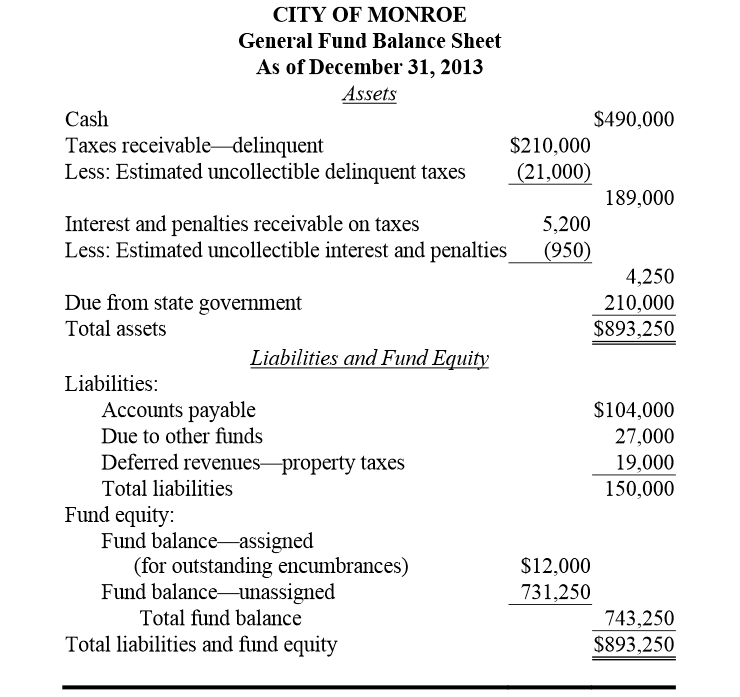

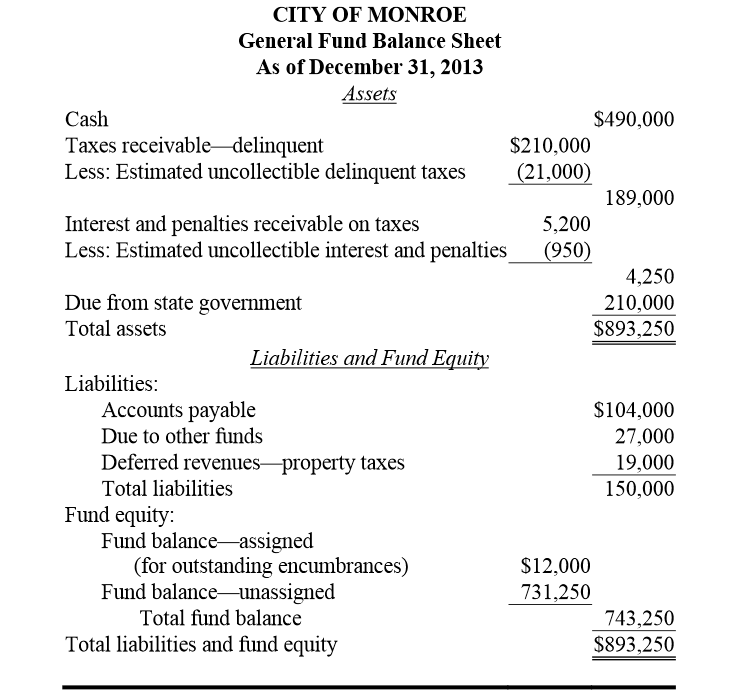

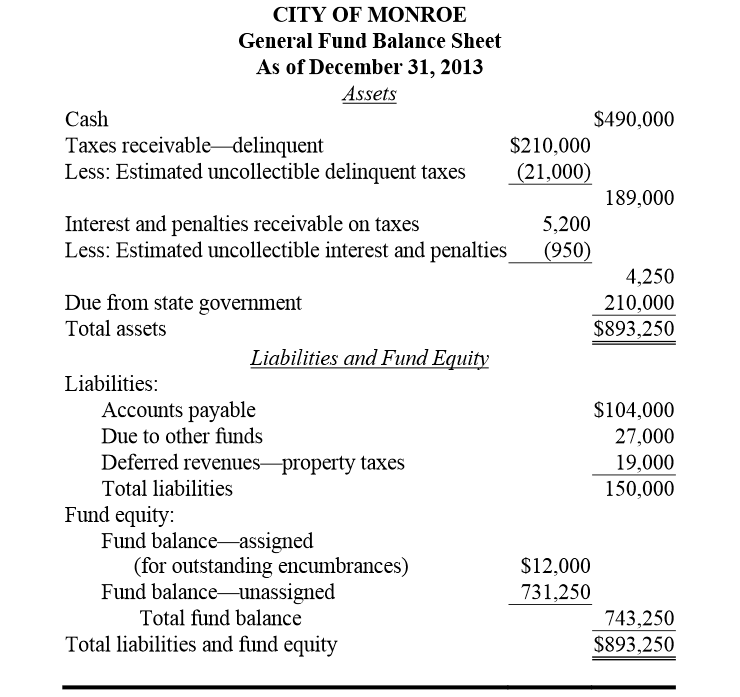

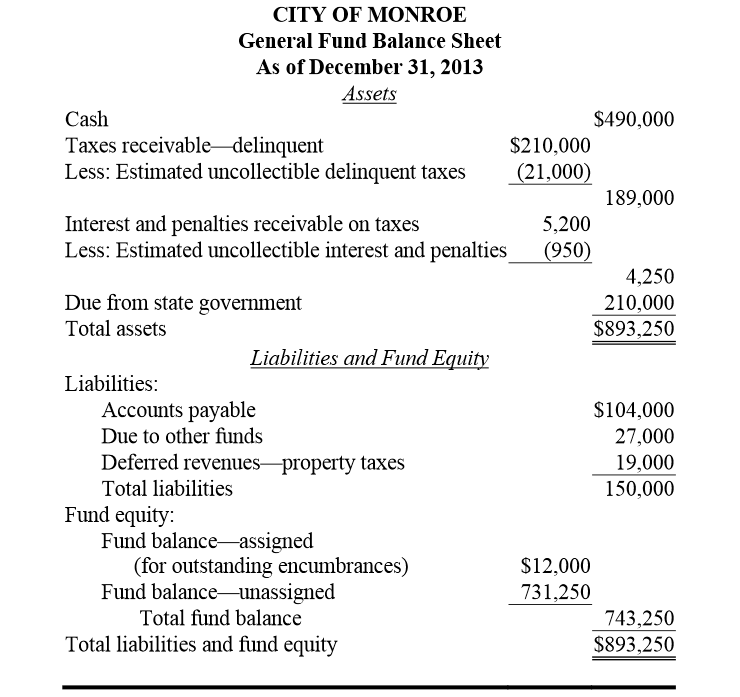

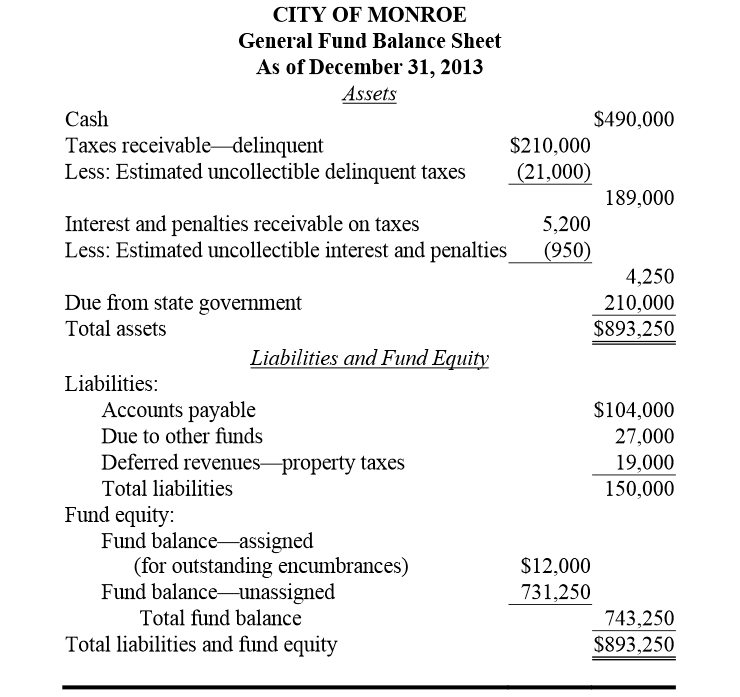

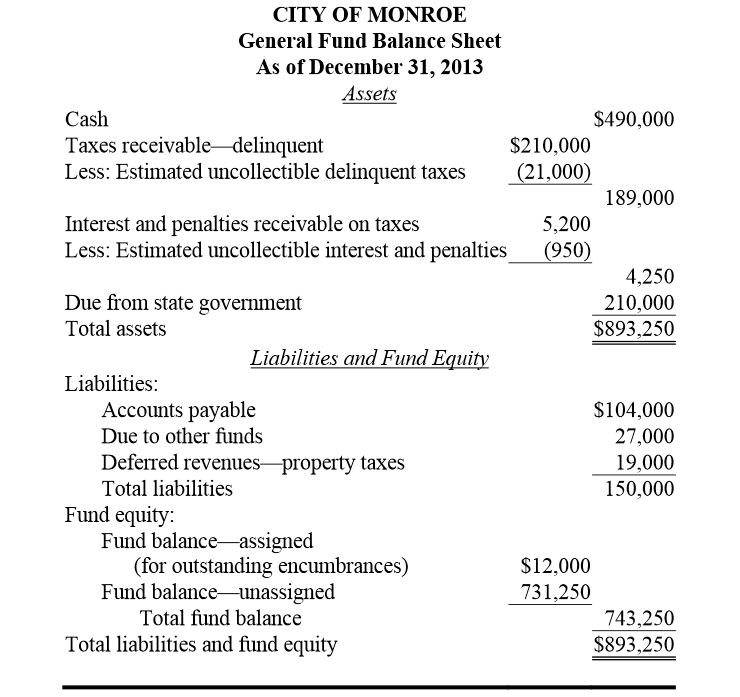

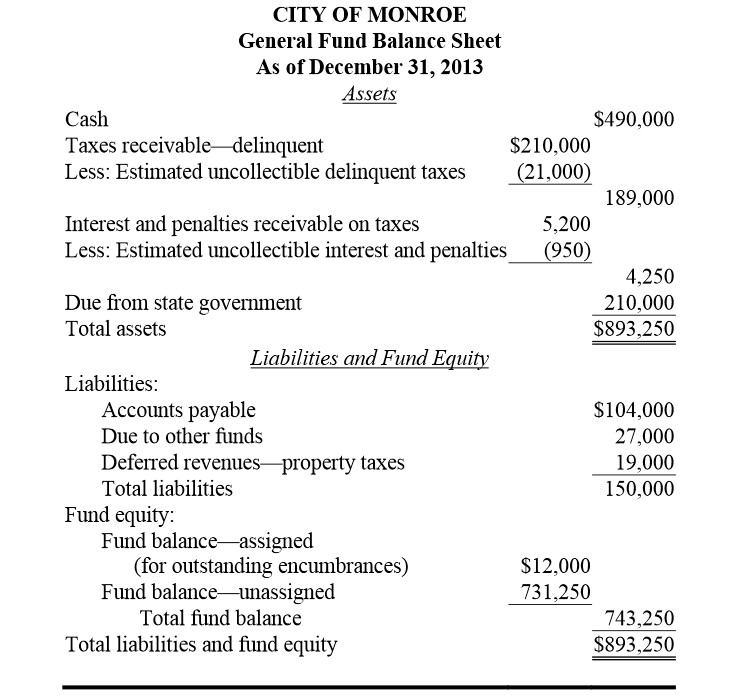

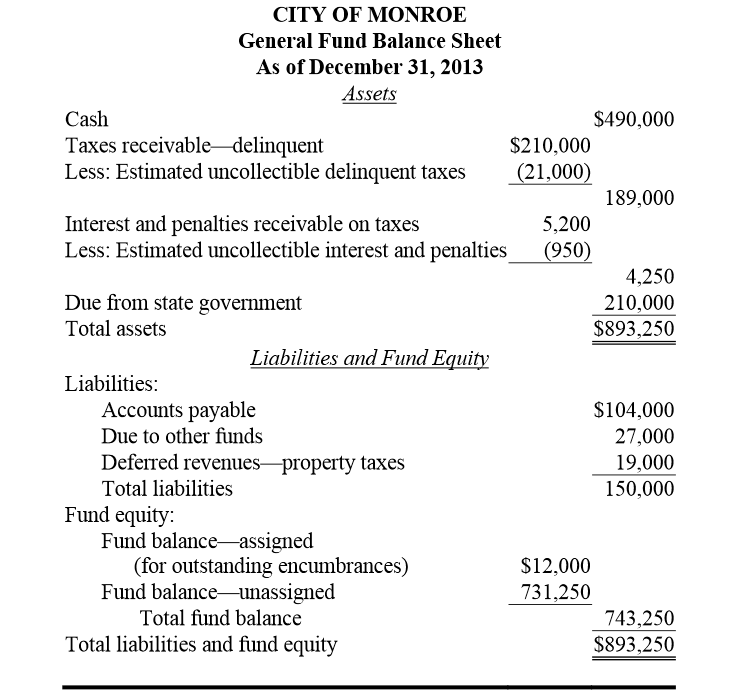

- General Fund Balance Sheet Example

- General Fund Balance Sheet Example

- General Fund Balance Sheet Example

- General Fund Balance Sheet Example

- General Fund Balance Sheet Example

- General Fund Balance Sheet Example

- General Fund Balance Sheet Example

- General Fund Balance Sheet Example

- General Fund Balance Sheet Example

- General Fund Balance Sheet Example

- General Fund Balance Sheet Example

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a Two Income Budget Worksheet?

A Two Income Budget Worksheet is a financial planning tool that helps couples manage their shared expenses and income. It typically includes sections for listing all sources of income from both partners, as well as categories for tracking joint expenses such as rent or mortgage, utilities, groceries, transportation, and savings goals. This worksheet can help couples allocate funds wisely, identify areas where they can cut costs, and work towards shared financial goals together.

How does a Two Income Budget Worksheet help a household?

A two income budget worksheet helps a household by providing a clear overview of their financial situation, tracking both incomes and expenses in a structured manner. This tool enables individuals to allocate funds effectively, identify areas where savings can be made, and monitor progress towards financial goals. It encourages communication between partners regarding money management and fosters a sense of control and empowerment over their finances, ultimately leading to better financial stability and decision-making within the household.

What types of income should be included in the worksheet?

All types of income, including wages, salaries, bonuses, self-employment income, rental income, interest, dividends, alimony, retirement income, and any other sources of income should be included in the worksheet to calculate an accurate total income.

Why is it important to track both incomes separately?

Tracking incomes separately is important because it allows for a clear and accurate understanding of where money is coming from and how it is being spent. By separating different sources of income, individuals and businesses can better plan and allocate funds, analyze financial trends, assess the profitability of different revenue streams, and make informed decisions about financial priorities and expenditures. This level of detail ensures more effective financial management and can help identify opportunities for growth and improvement.

How does the worksheet help in determining expenses?

Worksheets help in determining expenses by providing a structured format to track and categorize various expenses such as fixed costs, variable costs, one-time expenses, and recurring expenses. By organizing expenses in a worksheet, individuals or businesses can easily calculate totals, analyze trends, identify areas of overspending, and make informed decisions on budgeting or cost-cutting measures. Additionally, worksheets can serve as a reference tool for financial planning and forecasting future expenses.

What are some common expense categories included in the worksheet?

Some common expense categories included in a worksheet are housing (rent/mortgage), utilities (electricity, water, internet), transportation (car payment, gas), groceries, dining out, entertainment, healthcare, insurance (car, health), savings, debt payments, and miscellaneous expenses. These categories help individuals track and manage their spending to achieve financial goals and budget effectively.

How often should the worksheet be updated?

The worksheet should be updated regularly in order to ensure accuracy and relevance. It is recommended to update the worksheet whenever there are changes to the information it contains or on a regular schedule, such as weekly, monthly, or quarterly, depending on the specific needs of the project or task. Regular updates will help to keep the information current and prevent any discrepancies or errors from occurring.

How can the worksheet be used to monitor savings goals?

The worksheet can be used to monitor savings goals by creating a column for the target savings amount and another column for the actual amount saved. Regularly updating the worksheet with the current savings balance allows for easy tracking of progress towards the goal. Additionally, using formulas to calculate the percentage of the goal achieved can provide a visual representation of progress. Any adjustments to the savings plan can also be reflected in the worksheet to ensure goals are being met effectively.

How does the worksheet assist in identifying spending patterns?

Worksheets can assist in identifying spending patterns by providing a systematic way to track and categorize expenses over a specific period of time. By entering in details of each expense, such as the amount spent, category, and date, individuals can visually see where their money is going and identify trends or areas where they may be overspending. This allows for a better understanding of spending habits and enables individuals to make more informed decisions about their finances moving forward.

What other benefits does a Two Income Budget Worksheet provide for managing finances?

A Two Income Budget Worksheet provides several benefits for managing finances, such as allowing couples to clearly see and track their combined income, expenses, and savings goals in one place, leading to better communication and collaboration in financial planning. It helps identify areas where adjustments can be made to achieve financial goals faster, promotes transparency in money management, helps prevent overspending, and enables couples to work together towards a shared financial future.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments