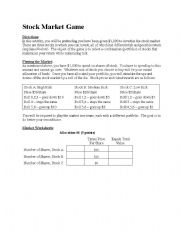

Stock Research Worksheet

A stock research worksheet is a valuable tool for investors who want to effectively analyze and track their investments. This guide will walk you through the essential components of creating a comprehensive worksheet that focuses on key entities and subjects relevant to your desired target audience.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is the purpose of a Stock Research Worksheet?

The purpose of a Stock Research Worksheet is to help investors organize and evaluate information about a particular stock in order to make informed investment decisions. It typically includes key financial data, company information, industry analysis, and any relevant news or events that may impact the stock's performance. By using a Stock Research Worksheet, investors can conduct thorough research and analysis to better understand the potential risks and rewards of investing in a particular stock.

What information should be included in the "Company Background" section of the worksheet?

In the "Company Background" section of a worksheet, you should include details such as the company's history, mission statement, key executives, products or services offered, target market, competitive advantages, and any other relevant information that provides a comprehensive understanding of the company's background and operations. This section serves as an introduction to the company and sets the context for the rest of the worksheet.

How can you analyze a company's financial performance using the worksheet?

To analyze a company's financial performance using a worksheet, you can create a financial model that includes key financial ratios and metrics such as profitability, liquidity, efficiency, and solvency ratios. By inputting the company's financial data into the worksheet, you can calculate these ratios and metrics to evaluate its performance and compare it to industry benchmarks or historical data. This analysis can help to identify financial strengths and weaknesses, track trends over time, and make informed decisions about the company's financial position and future prospects.

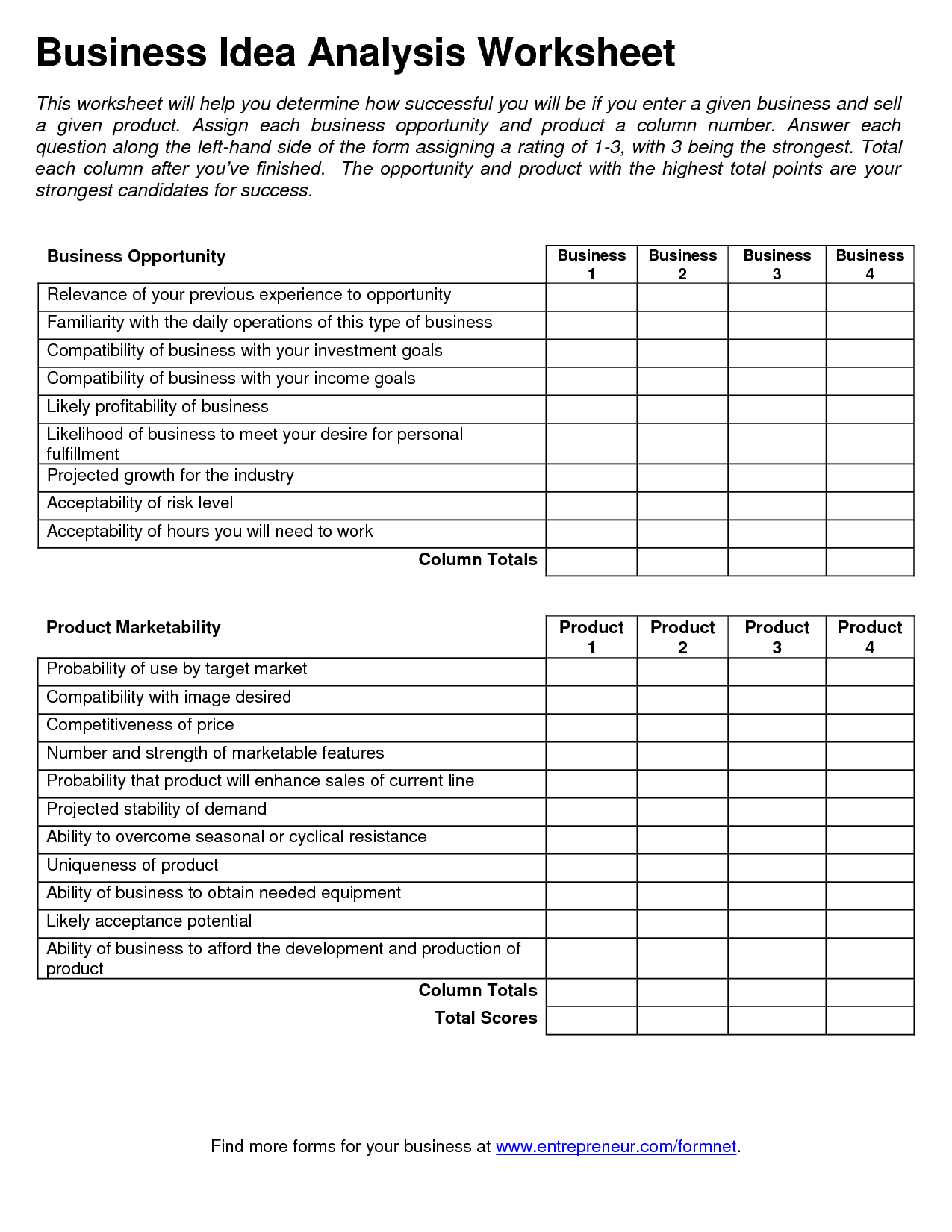

What factors should be considered when evaluating a company's industry position?

When evaluating a company's industry position, factors such as market share, competitive landscape, regulatory environment, technological advancements, customer preferences, and overall market trends should be considered. Understanding a company's position relative to its competitors, barriers to entry for new players, potential for growth and profitability, and the company's ability to innovate and adapt to industry changes are all important in assessing its competitive standing within the industry. Additionally, analyzing financial performance, operational efficiencies, and strategic partnerships can provide insights into a company's strength and position in its industry.

How can you assess a company's management team using the worksheet?

To assess a company's management team using a worksheet, you can carefully evaluate each member's qualifications, experience, track record, and effectiveness in their respective roles. This involves analyzing factors such as their strategic decision-making abilities, leadership skills, communication style, and alignment with the company's goals and values. By systematically gathering and analyzing this information, you can gain insights into the strengths and weaknesses of the management team, identify areas for improvement, and make informed decisions about the company's leadership capabilities.

What data should be included in the "Competitor Analysis" section of the worksheet?

In the "Competitor Analysis" section of the worksheet, data should include information such as competitors' products or services, pricing strategies, market share, target customer demographics, distribution channels, marketing tactics, strengths and weaknesses, and any recent or upcoming developments or innovations. This data can help in understanding the competitive landscape and identifying opportunities and threats that can inform the development of the business strategy.

How can you determine a company's growth potential using the worksheet?

To determine a company's growth potential using a worksheet, you can analyze key financial metrics such as revenue growth rate, profit margin, return on investment, and earnings per share growth. These metrics can help you assess the company's past performance and project its future growth potential. By comparing these metrics with industry standards and benchmarks, you can gain insight into the company's competitiveness and potential for sustainable growth. Additionally, analyzing factors such as market demand, competition, technological advancements, and macroeconomic trends can provide further insight into the company's growth prospects.

What factors should be evaluated when assessing a company's risks and challenges?

When assessing a company's risks and challenges, factors such as market conditions, competition, regulatory environment, financial performance, strategic direction, operational efficiency, talent management, technological advancements, supply chain vulnerabilities, and potential disruptive events should be evaluated. It's important to look at both internal and external factors that could impact the company's ability to achieve its objectives and sustain its operations in the long term. Conducting a thorough risk assessment can help in identifying potential threats and developing effective mitigation strategies to navigate challenges successfully.

How can you determine if a company's stock is undervalued or overvalued using the worksheet?

To determine if a company's stock is undervalued or overvalued using a worksheet, you can calculate the company's intrinsic value by analyzing various financial metrics such as earnings per share, revenue growth, cash flow, and return on equity. Compare these metrics with the current market price of the stock to see if the stock is trading below its intrinsic value, indicating that it may be undervalued, or above its intrinsic value, suggesting that it may be overvalued. Conducting a thorough analysis of the company's financials and considering industry trends can also help in making a more informed decision about the stock's valuation.

What additional information or resources can be used in conjunction with the Stock Research Worksheet?

In conjunction with the Stock Research Worksheet, investors can utilize financial news websites and publications, company investor relations pages, analyst reports, financial statement databases such as SEC filings, and stock valuation tools like Price-to-Earnings ratios or discounted cash flow models. Additionally, attending company earnings calls, industry conferences, and seeking advice from financial professionals can also provide valuable insights. By incorporating these resources, investors can conduct a more comprehensive analysis to make informed investment decisions.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments