Small Business Worksheets

Are you a small business owner looking for a reliable resource to help you manage your finances more efficiently? Look no further. Small business worksheets are the perfect solution to help streamline your bookkeeping and stay organized. These worksheets are designed specifically for entrepreneurs who want to track their expenses, income, and other financial information in a clear and organized manner. With the help of these worksheets, you can take control of your financial records and make informed decisions for the growth of your business.

Table of Images 👆

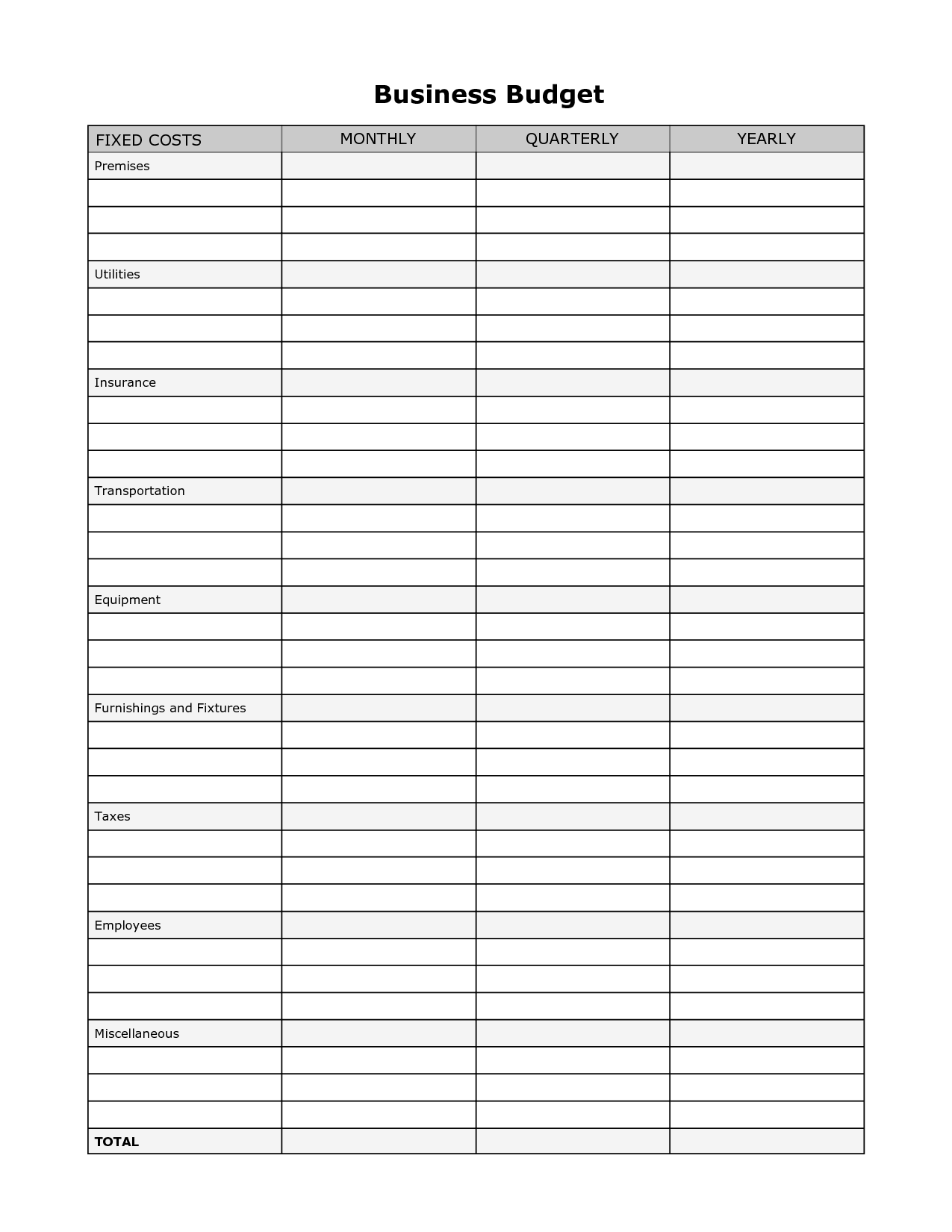

- Free Business Budget Template Printable

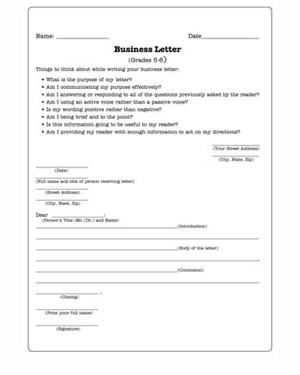

- Writing Business Letters for Kids

- Spanish Vocabulary Worksheets for High School

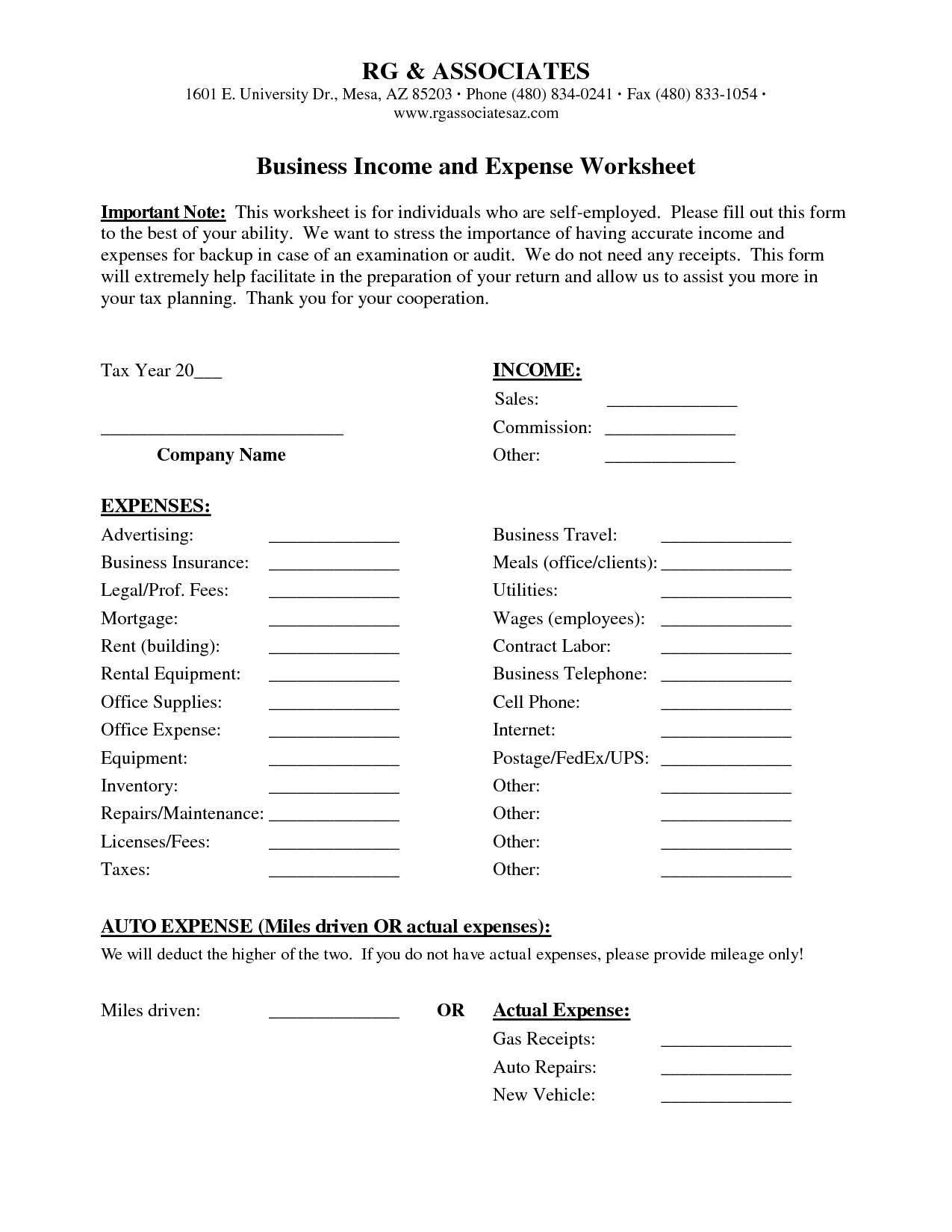

- Business Income and Expense Worksheet

- Conjunction Worksheet for Adults

- Writing Complaint Business Letter

- Behavior Change Worksheets

- Time Matching Worksheets

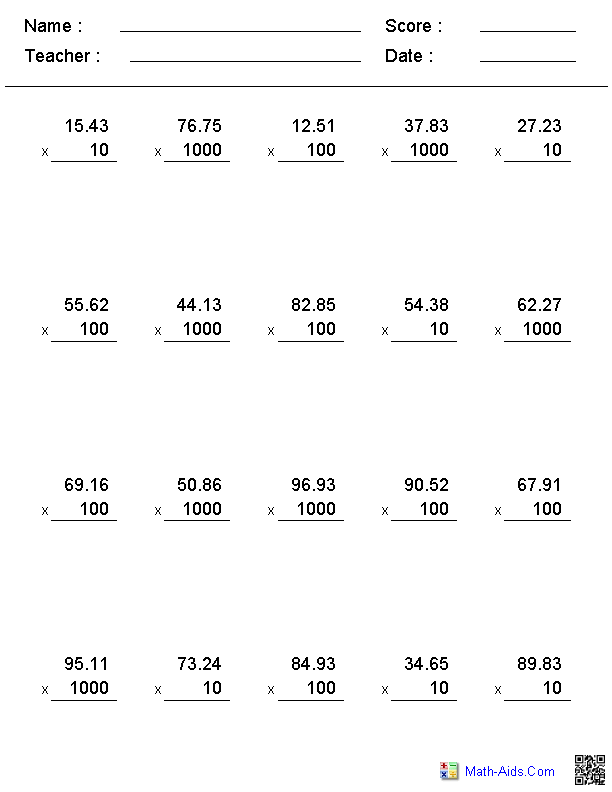

- 5th Grade Decimal Multiplication Worksheets

- High School Word Search Worksheets

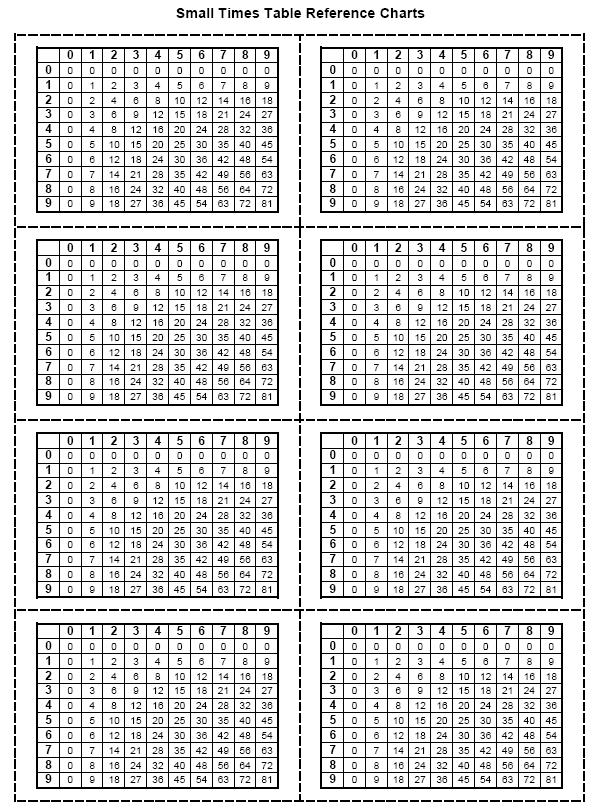

- Small Printable Multiplication Table

- Indefinite Pronoun Worksheet

- Let Me Introduce My Self Worksheet

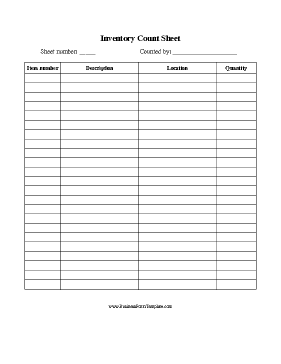

- Blank Inventory Sheet Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

How do small business worksheets help in budgeting?

Small business worksheets help in budgeting by providing a structured way to organize and track expenses, income, and other financial aspects of the business. By using worksheets, small business owners can easily identify areas where they can cut costs, allocate resources more efficiently, and make informed decisions about their finances. Additionally, worksheets can help in creating realistic financial goals and forecasts, as well as in monitoring progress towards those goals. Overall, small business worksheets serve as valuable tools for maintaining financial health and stability.

What information is typically included in a small business income statement worksheet?

A small business income statement worksheet typically includes details of revenue earned from sales, cost of goods sold, operating expenses such as utilities, rent, salaries, and other overhead costs, along with information on taxes paid and net income. It paints a comprehensive picture of the financial performance of the business over a specific period, helping owners and stakeholders assess profitability and make informed decisions for future planning and strategies.

Why is it important to track expenses using a small business expense worksheet?

Tracking expenses using a small business expense worksheet is important because it helps businesses stay organized, monitor their financial health, and make informed decisions. By recording all expenses in one place, businesses can easily track where their money is going, identify areas of overspending or cost-saving opportunities, and ensure they are staying within their budget. This practice also simplifies tax preparation, provides a clear financial picture for potential investors or lenders, and promotes financial accountability within the business.

How can a balance sheet worksheet help small businesses assess their financial health?

A balance sheet worksheet can help small businesses assess their financial health by providing a snapshot of their assets, liabilities, and equity at a specific point in time. By comparing the company's assets (what it owns) to its liabilities (what it owes), business owners can gauge their financial stability and solvency. They can identify trends, evaluate their liquidity, measure their financial leverage, and make informed decisions about managing their finances more effectively. This tool allows small businesses to understand their current financial status and plan for future growth and sustainability.

What key financial ratios can be calculated using a small business ratio analysis worksheet?

Key financial ratios that can be calculated using a small business ratio analysis worksheet include profitability ratios (such as gross profit margin and net profit margin), liquidity ratios (like current ratio and quick ratio), efficiency ratios (including inventory turnover and accounts receivable turnover), and solvency ratios (such as debt-to-equity ratio and interest coverage ratio). These ratios help small businesses assess their financial health, efficiency, and ability to meet short-term and long-term obligations.

What role does a cash flow statement worksheet play in monitoring a small business's cash flow?

A cash flow statement worksheet plays a crucial role in monitoring a small business's cash flow by providing a detailed breakdown of the inflows and outflows of cash over a specific period. It helps business owners track where the money is coming from and where it is going, allowing them to identify any potential cash flow issues and make informed decisions to manage and improve their cash flow effectively. By analyzing the cash flow statement regularly, small businesses can ensure they have enough liquidity to cover expenses, invest in growth opportunities, and ultimately maintain financial stability.

How can a small business inventory worksheet aid in managing inventory levels?

A small business inventory worksheet can aid in managing inventory levels by providing a clear overview of current stock quantities, tracking sales trends, identifying fast-moving and slow-moving items, calculating reorder points, and monitoring stock turnover rates. By regularly updating and analyzing the data on the worksheet, businesses can make informed decisions on inventory replenishment, reduce excess stock levels, prevent stockouts, and improve overall inventory management efficiency to meet customer demand effectively.

What are the benefits of preparing a small business break-even analysis worksheet?

A small business break-even analysis worksheet helps entrepreneurs determine the point at which their total revenues match their total expenses, resulting in neither profit nor loss. This tool is essential for making informed decisions about pricing, sales volume targets, and cost control measures, enabling business owners to understand their financial performance better. By using a break-even analysis, small business owners can assess various scenarios to help set realistic goals, manage risks, and ultimately improve their profitability and overall financial health.

How does a small business sales forecast worksheet assist in setting revenue goals?

A small business sales forecast worksheet assists in setting revenue goals by providing a systematic way to project future sales based on historical data, market trends, and other relevant factors. By analyzing past sales performance and considering factors such as seasonality, competitive landscape, and industry trends, businesses can make informed projections to set achievable revenue goals. The worksheet helps in identifying opportunities for growth, potential challenges, and areas for improvement, enabling businesses to create realistic targets and develop strategies to reach their revenue goals effectively.

What information is typically documented in a small business tax preparation worksheet?

A small business tax preparation worksheet typically documents information such as the business's income and expenses, details of any deductions or credits, information about the business structure (such as whether it's a sole proprietorship, partnership, or corporation), information about owners and their personal tax information if applicable, depreciation schedules for assets, details of any estimated tax payments made throughout the year, and any other relevant financial information necessary for accurately preparing and filing the business's tax return.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments