Schedule C Deductions Worksheet

Are you a small business owner who needs help organizing and maximizing your deductions for Schedule C? Look no further than the Schedule C Deductions Worksheet. This informative and easy-to-use tool is designed specifically for individuals who file a Schedule C tax form and want to navigate the complex world of deductions with ease and accuracy. With this worksheet, you can keep track of your business expenses, determine eligible deductions, and ensure that you're optimizing your tax savings.

Table of Images 👆

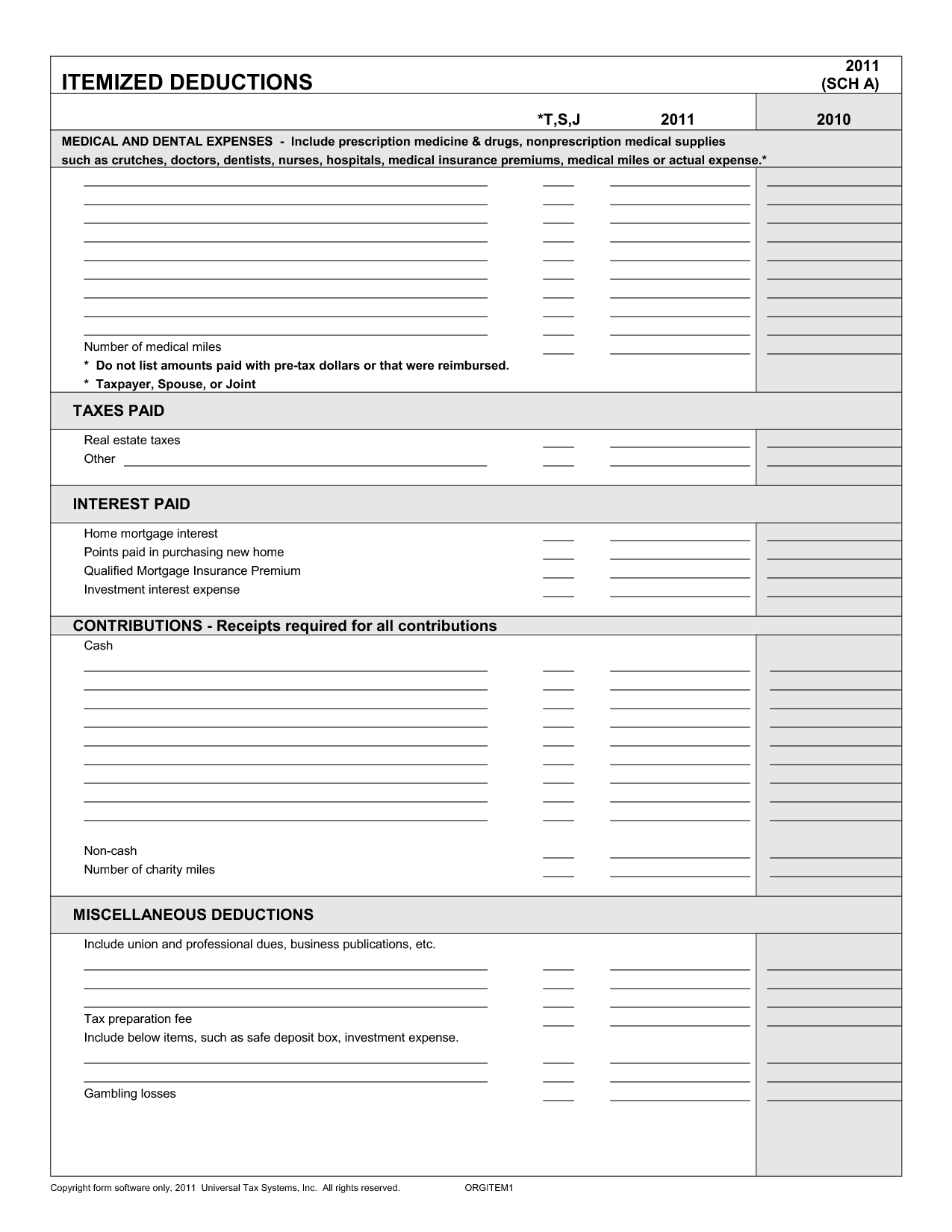

- Itemized Deduction List Template

- Itemized Deductions Worksheet

- Federal Income Tax Deduction Worksheet

- Tax Itemized Deduction Worksheet

- Itemized Tax Deduction Forms

- Sample K-1 Tax Form

- Tax Form 6251 Worksheet

- 2014 IRS Tax Forms 1040 Schedule A

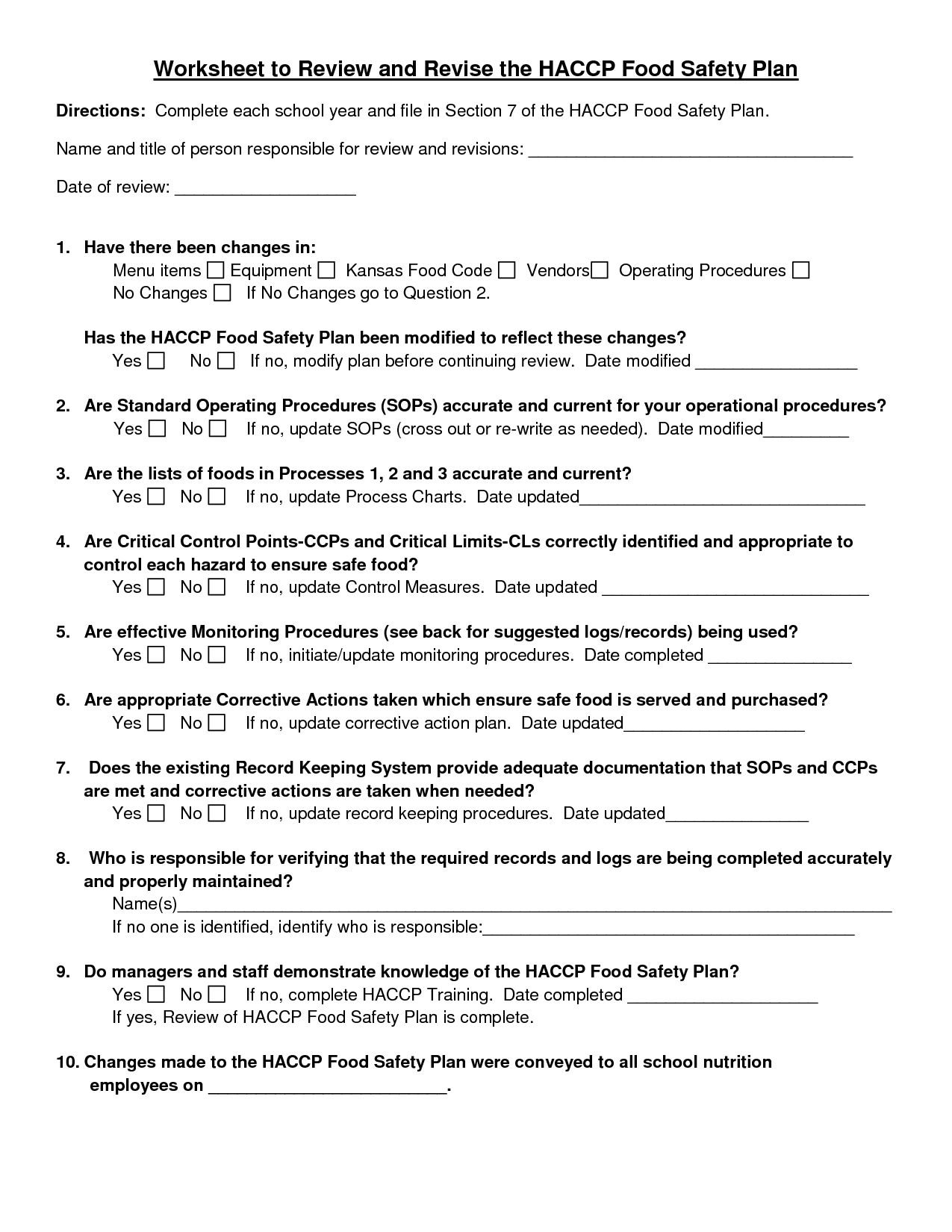

- Cooking Safety Worksheets

- Cooking Safety Worksheets

- Cooking Safety Worksheets

- Cooking Safety Worksheets

- Cooking Safety Worksheets

- Cooking Safety Worksheets

- Cooking Safety Worksheets

- Cooking Safety Worksheets

- Cooking Safety Worksheets

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

What is the purpose of the Schedule C Deductions Worksheet?

The purpose of the Schedule C Deductions Worksheet is to help self-employed individuals calculate and determine their business expenses that can be deducted from their gross income on their Schedule C form for reporting income and expenses related to their business.

How do you calculate the Cost of Goods Sold on the worksheet?

To calculate the Cost of Goods Sold on a worksheet, you typically start with the beginning inventory for the period, add any purchases during the period, and then subtract the ending inventory value. The formula for calculating Cost of Goods Sold is: Beginning Inventory + Purchases - Ending Inventory. By using this formula, you can determine the total cost incurred to produce or purchase the goods that were sold during the period.

What types of expenses can be deducted using this worksheet?

The worksheet can be used to deduct various types of business expenses such as office supplies, travel expenses, rent, utilities, insurance, advertising, and professional services. These expenses can be deducted to reduce taxable income and overall tax liability for the business.

How do you determine if an expense is ordinary and necessary for your business?

To determine if an expense is ordinary and necessary for your business, you should evaluate whether it is common and accepted in your industry (ordinary) and if it is helpful and appropriate for your business operations (necessary). Consider if the expense is directly related to generating income or running the business efficiently. Additionally, keeping thorough records and consulting with a financial advisor or tax professional can help ensure that your expenses meet the criteria for being ordinary and necessary for your business.

Can home office expenses be included on the Schedule C Deductions Worksheet?

Yes, home office expenses can be included on the Schedule C Deductions Worksheet if you use a portion of your home regularly and exclusively for business purposes. These expenses can include things like utilities, rent, mortgage interest, and home maintenance costs directly related to your home office. Make sure to follow the IRS guidelines for deducting home office expenses to ensure compliance with tax laws.

Is it necessary to fill out this worksheet if you use the standard mileage rate for business use of your vehicle?

Yes, it is necessary to fill out the worksheet in order to accurately calculate the business use of your vehicle when using the standard mileage rate. The worksheet helps track the number of business miles driven, which is essential for claiming the appropriate deduction on your tax return.

Can you deduct meals and entertainment expenses on the worksheet?

Unfortunately, starting from 2018, the Tax Cuts and Jobs Act eliminated the deduction for entertainment expenses. However, you may still be able to deduct 50% of qualifying business meal expenses. It's essential to keep detailed records of these expenses, including the purpose of the meal and the individuals present, to support your deduction in case of an audit. Be sure to consult with a tax professional or refer to the IRS guidelines for specific rules and requirements.

How do you handle expenses that are partially personal and partially business-related on the worksheet?

When dealing with expenses that are partially personal and partially business-related on a worksheet, it's important to clearly separate and track both aspects. You can allocate the appropriate percentage or amount to each category and calculate the business-related portion only. This helps ensure accurate financial records and tax calculations, maintaining transparency and compliance in your business operations.

Can you deduct expenses for advertising and marketing efforts on the worksheet?

Yes, you can typically deduct expenses for advertising and marketing efforts on a worksheet if they are considered ordinary and necessary expenses for your business. Ensure that you keep accurate records and receipts to support these deductions when filing your taxes.

What documentation should you keep to support the deductions claimed on the Schedule C Deductions Worksheet?

To support the deductions claimed on the Schedule C Deductions Worksheet, you should keep detailed records of all business expenses, such as receipts, invoices, bank statements, mileage logs, and any other relevant documentation that proves the expenses were ordinary and necessary for your business. It is important to maintain organized and accurate records to substantiate your deductions in case of an audit by the IRS.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments