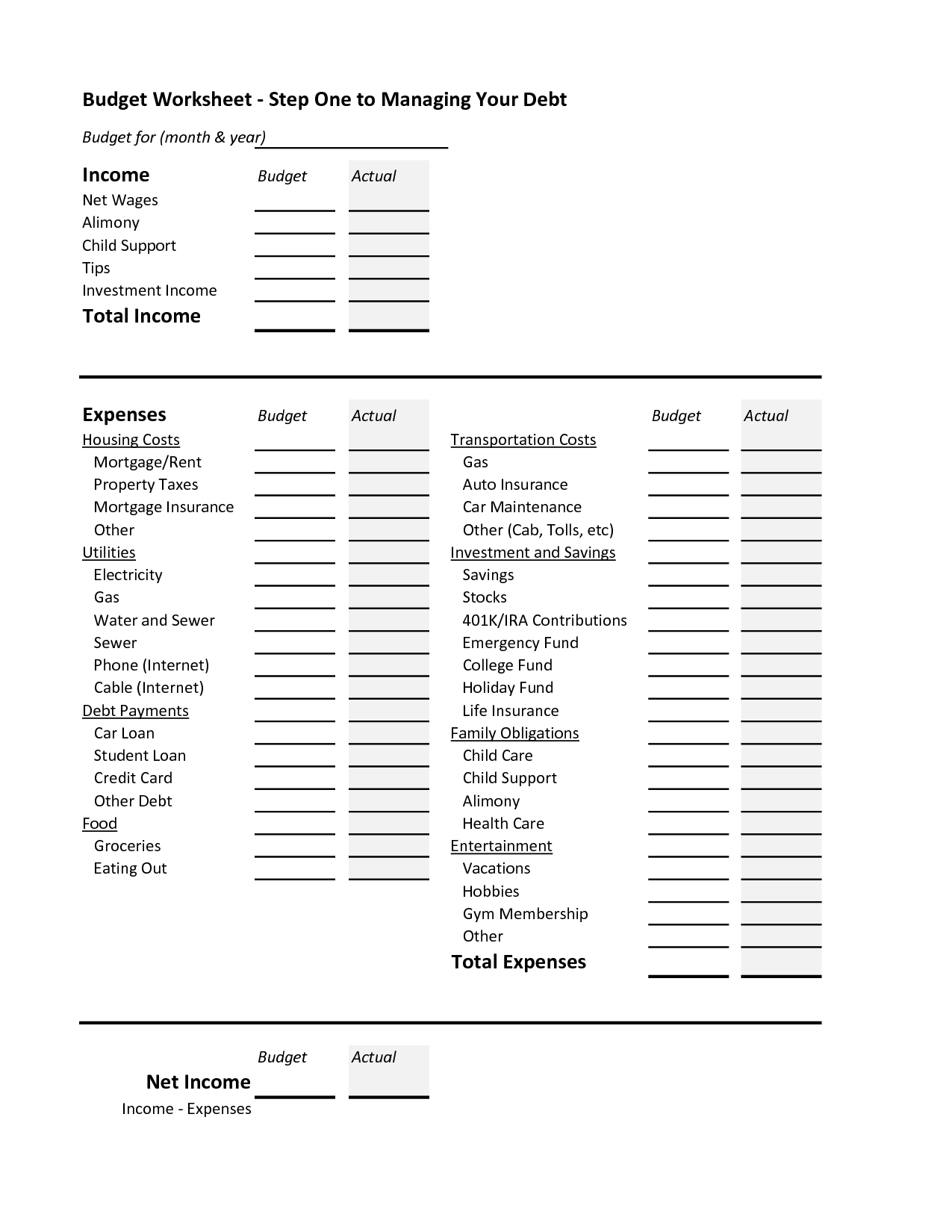

Sample Personal Budget Worksheet

A personal budget worksheet is a valuable tool for individuals who want to get a handle on their finances. By tracking income and expenses, this entity allows users to gain a clear understanding of their financial situation and make informed decisions. With a variety of sections dedicated to different areas of spending, such as housing, transportation, and entertainment, a personal budget worksheet provides a comprehensive overview of where money is being allocated. Whether you are a student trying to manage a limited budget or an adult looking to save for the future, utilizing a personal budget worksheet can help you take control of your financial well-being.

Table of Images 👆

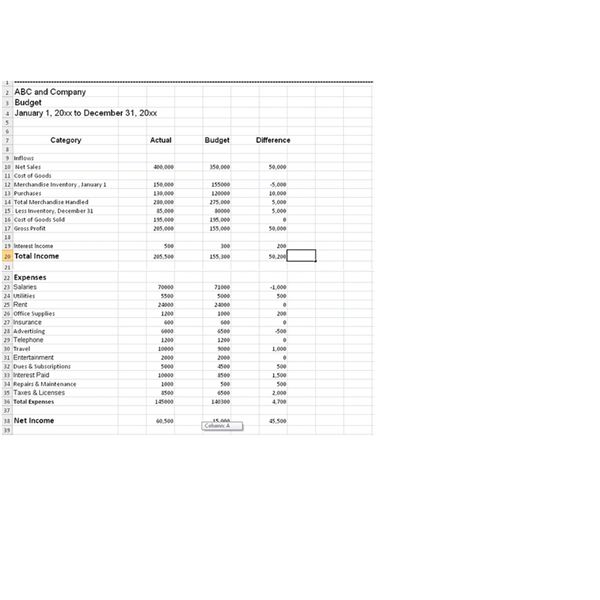

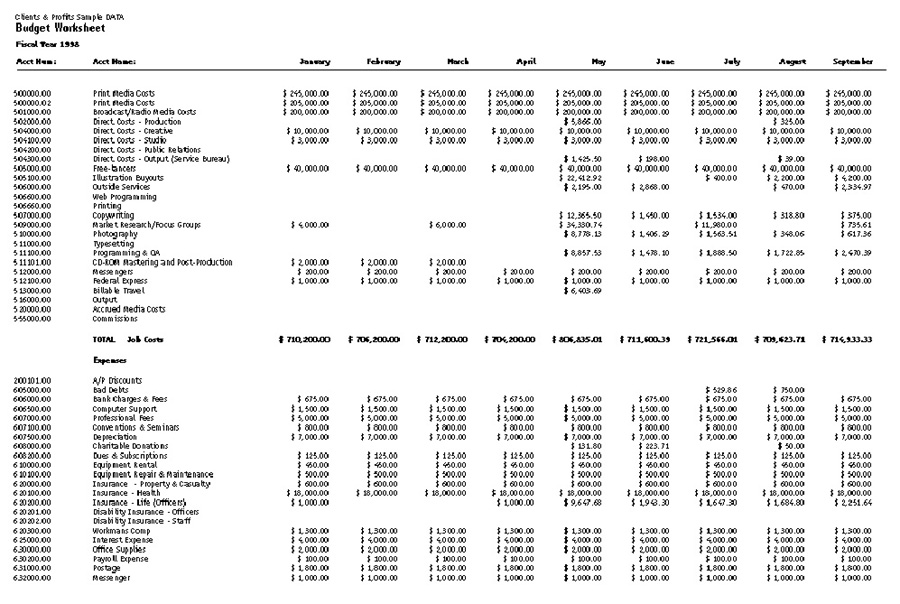

- Small Business Budget Worksheet

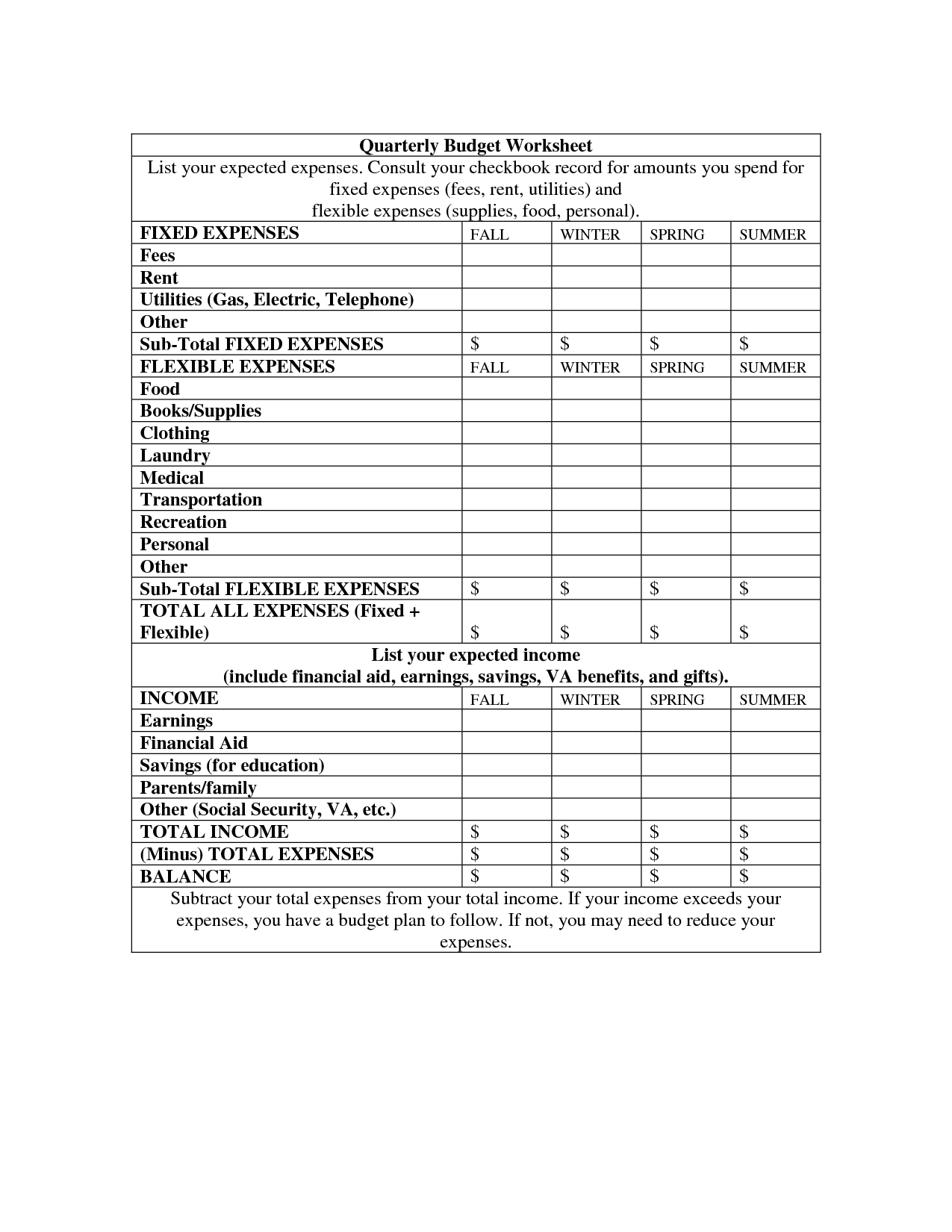

- Household Budget Forms Templates

- Sample Checkbook Register Worksheet

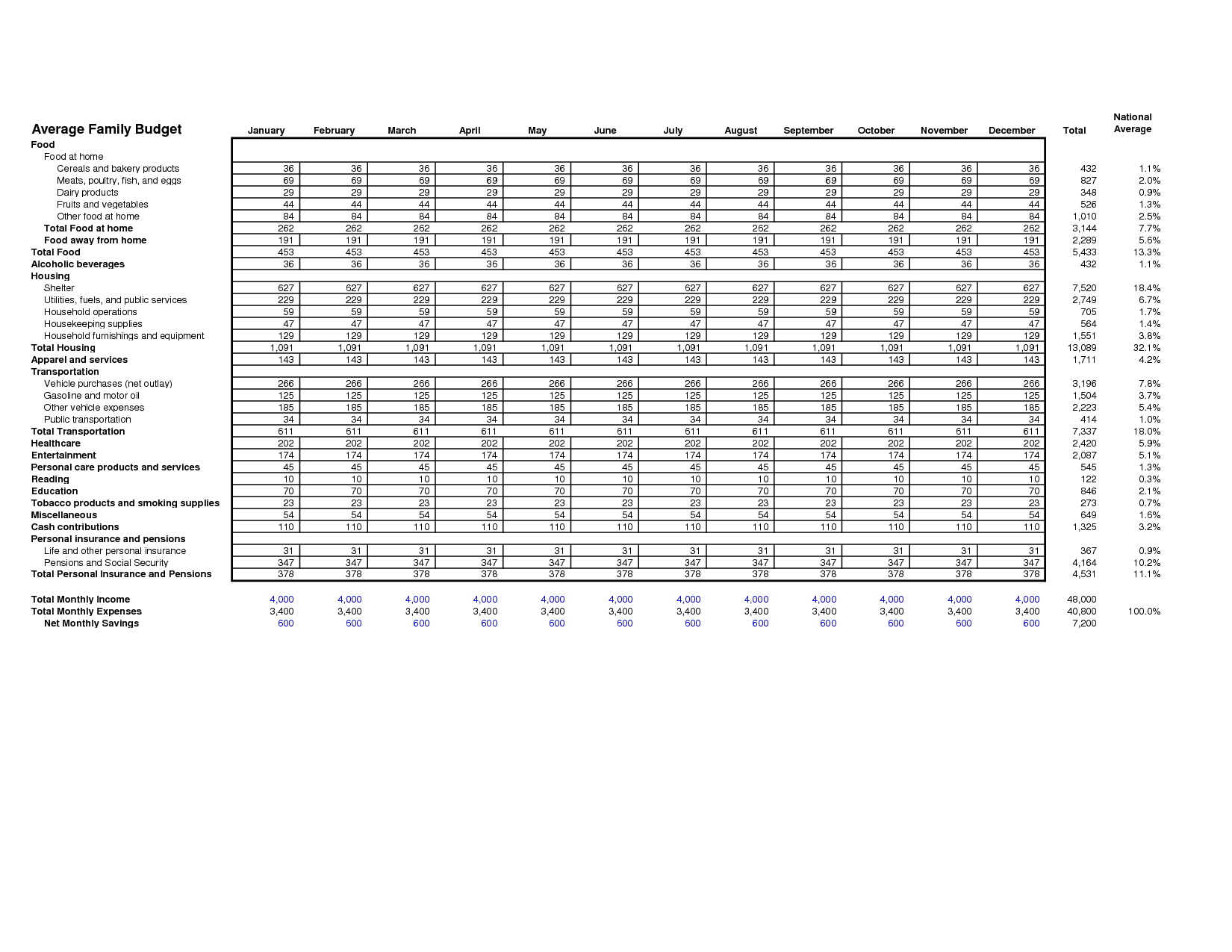

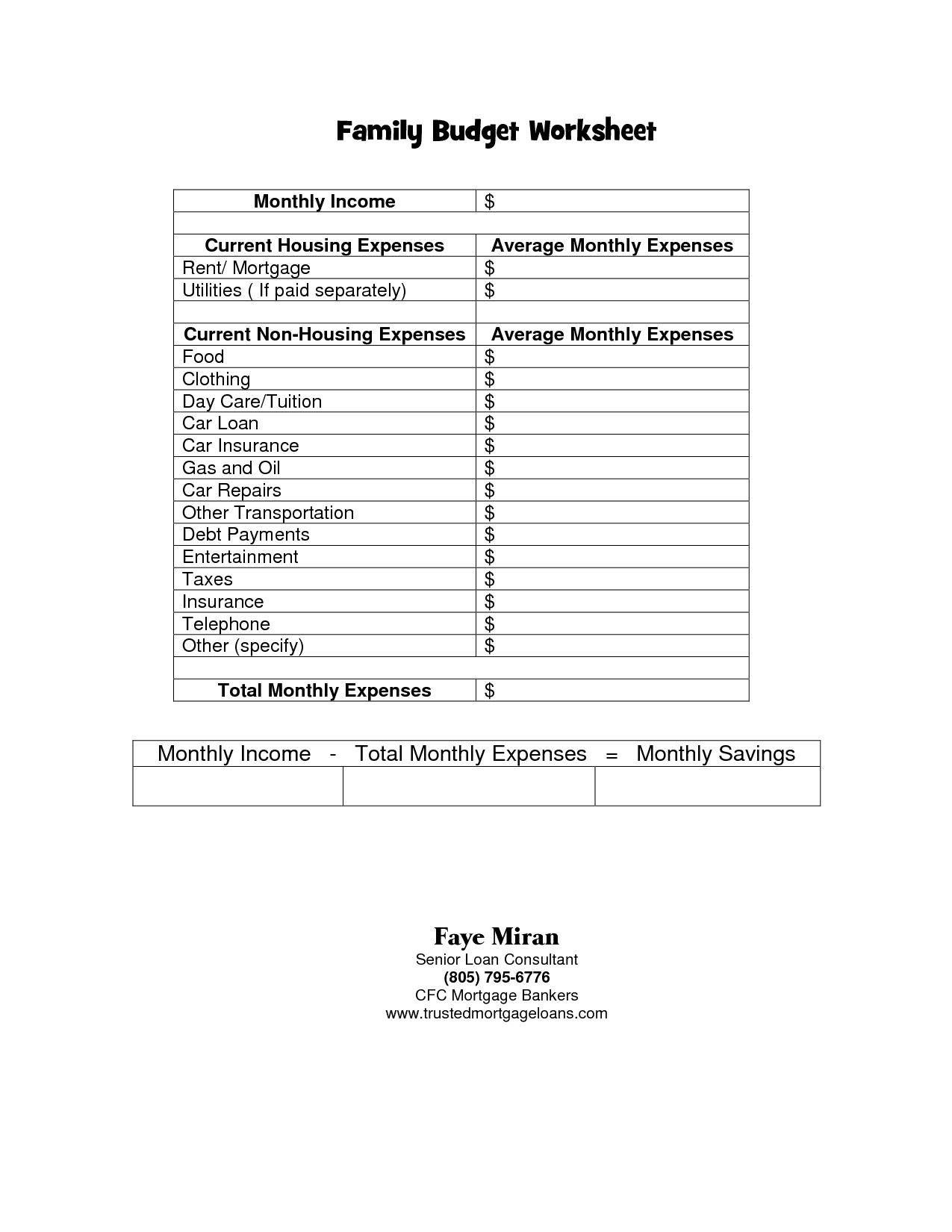

- Sample Family Budget Worksheet

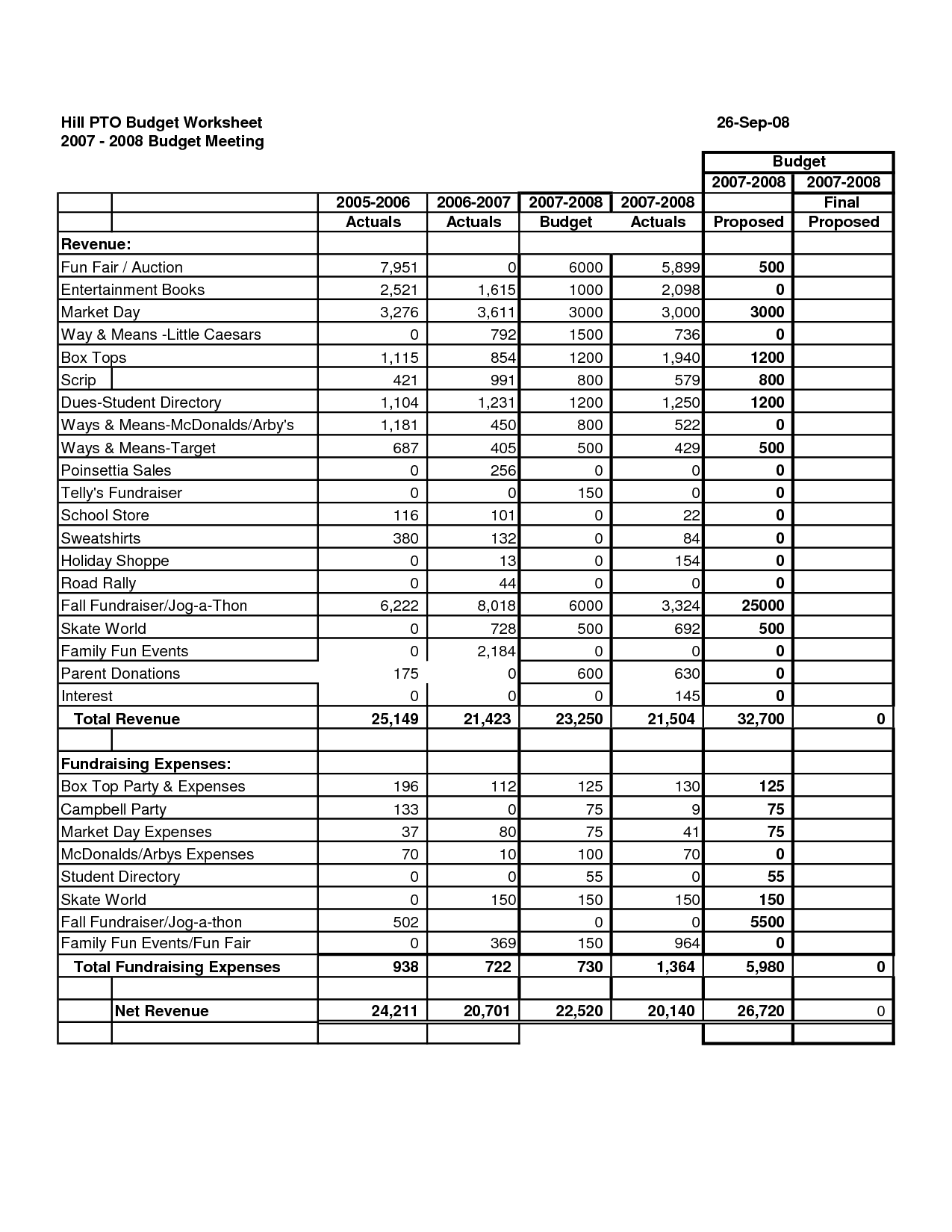

- PTO Budget Spreadsheet Template

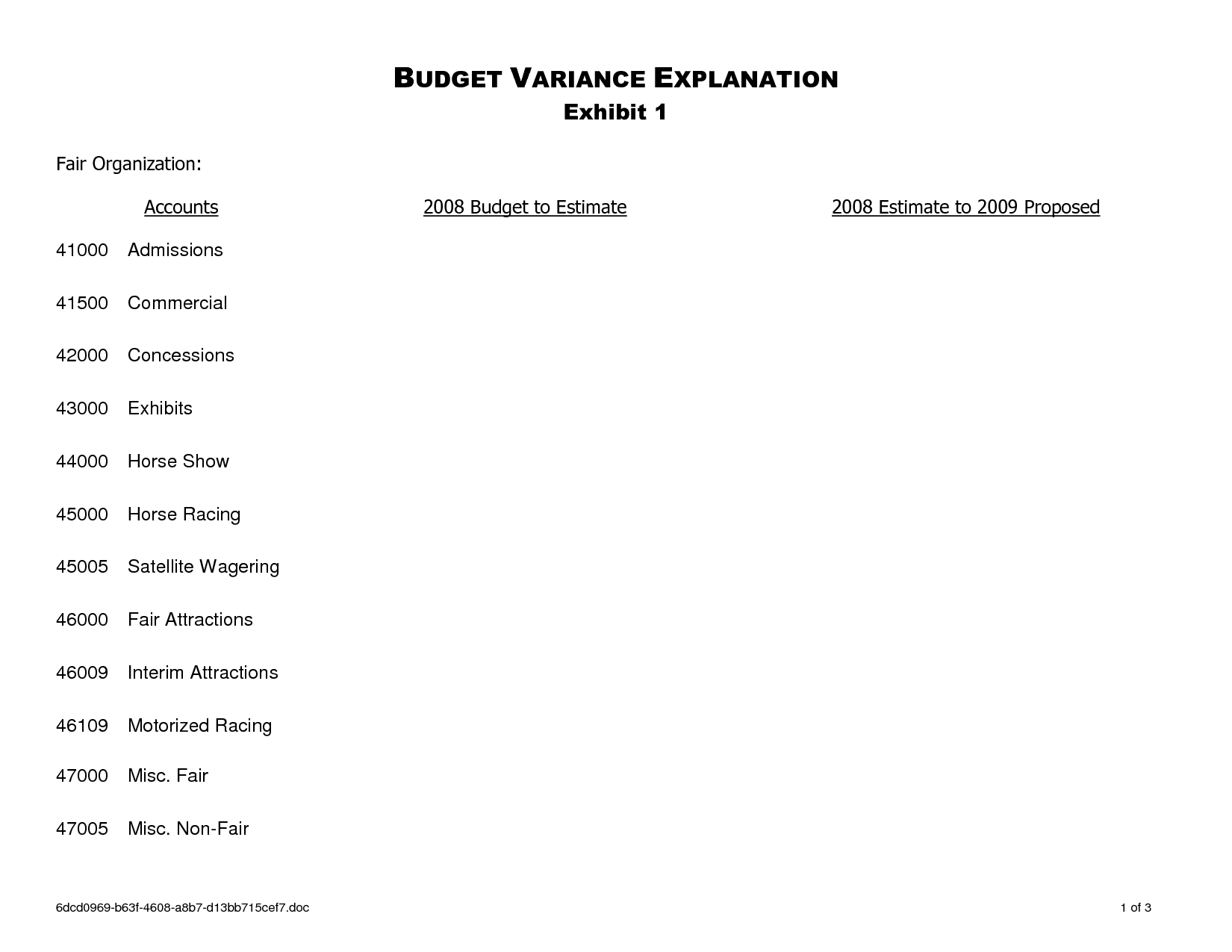

- Horse Budget Worksheet

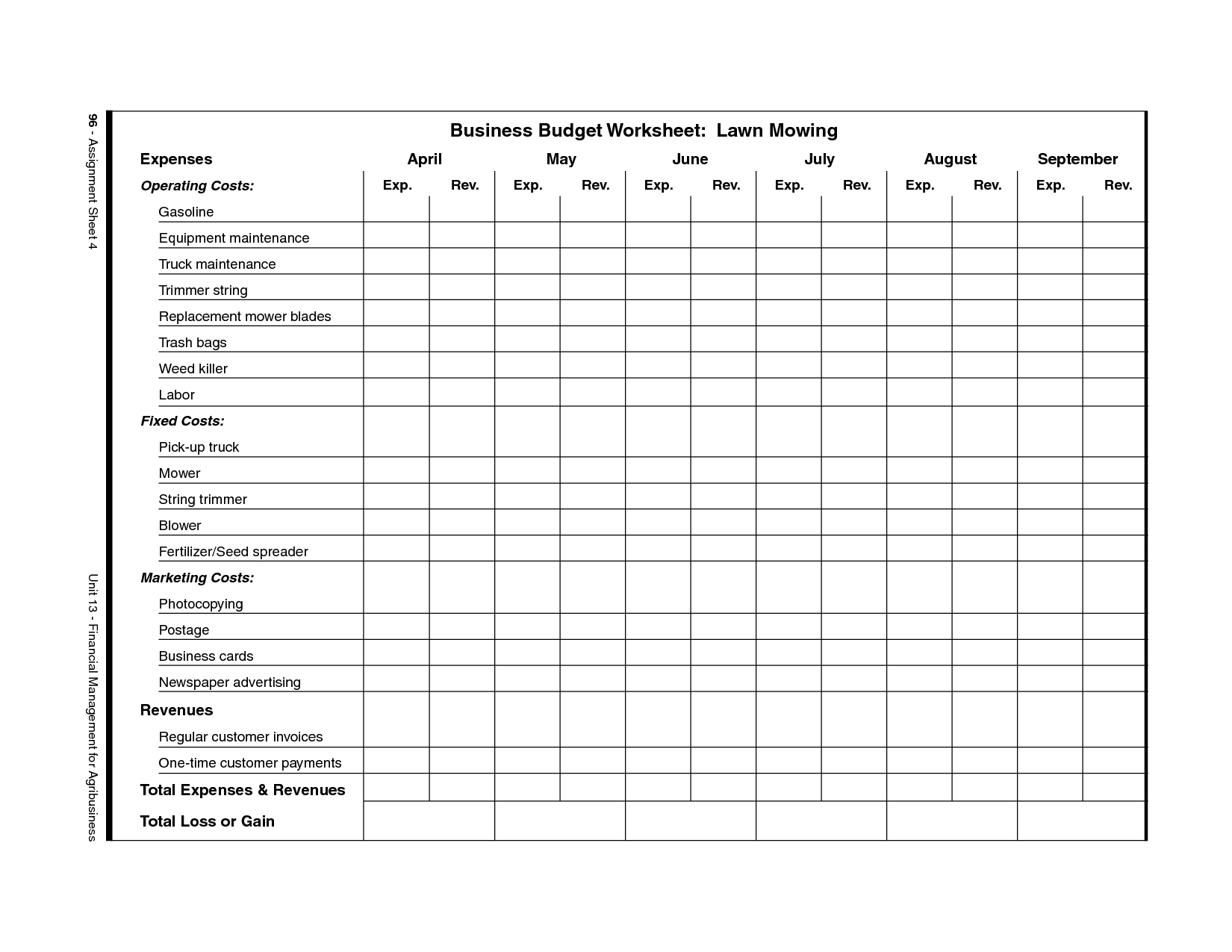

- Lawn Mowing Business Budget Worksheet

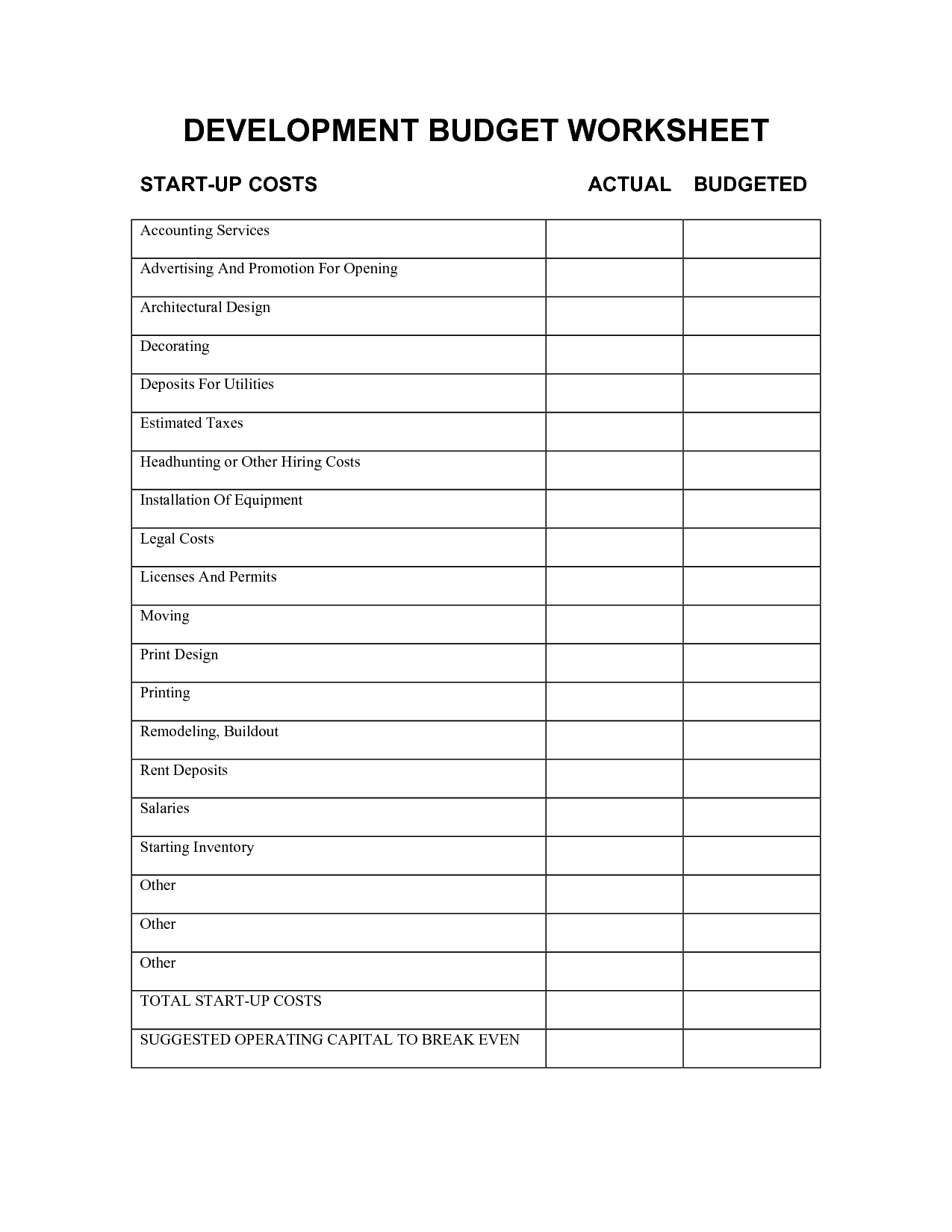

- Start Up Business Budget Worksheet Template

- Family Budget Worksheet PDF

- Debt Budget Worksheet Sample

- Budget Worksheet

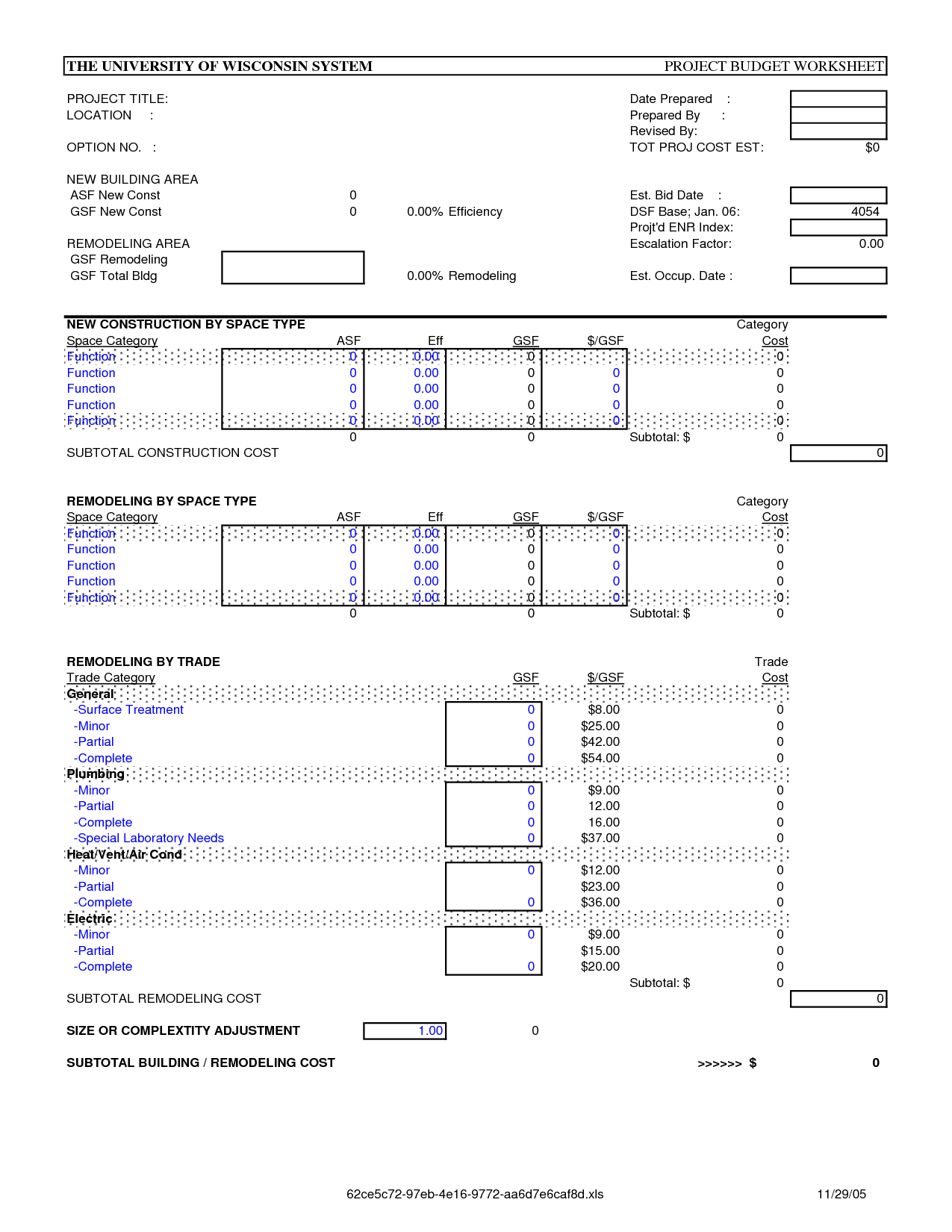

- Construction Bid Estimate Template

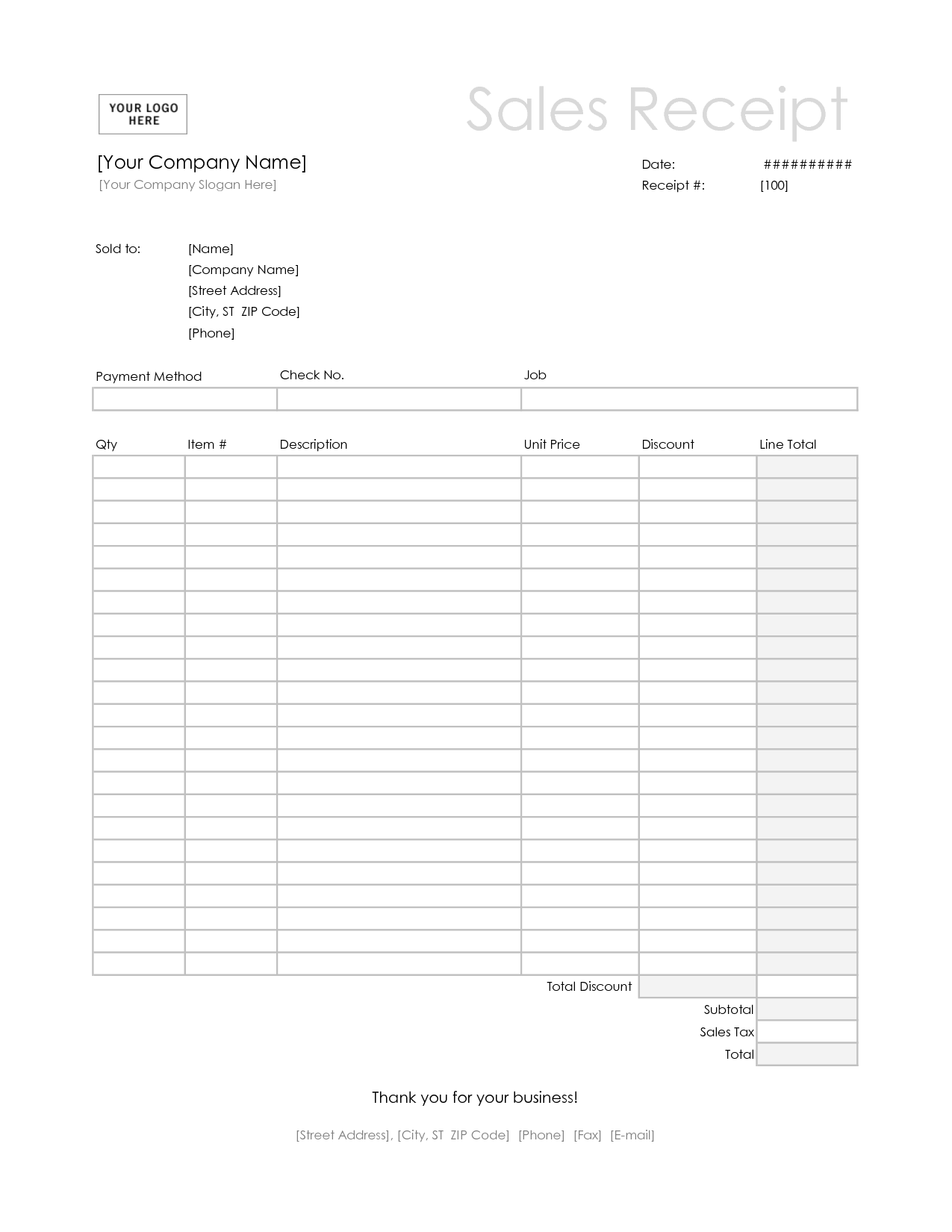

- Sales Receipt Template

- Cost Analysis Worksheet Answers

- Office Cleaning Contract Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

What is a Sample Personal Budget Worksheet?

A Sample Personal Budget Worksheet is a tool used to track income and expenses on a monthly basis. It typically includes sections for different sources of income, such as salary or side hustles, as well as categories for various expenses like rent, groceries, and utilities. By detailing all sources of revenue and expenditures, individuals can better monitor their financial health, identify areas for potential savings, and plan accordingly to achieve their financial goals.

What are the key components of a Sample Personal Budget Worksheet?

A sample personal budget worksheet typically includes sections for income sources, expenses (such as housing, utilities, groceries, transportation, and entertainment), savings and investments, debt payments, and miscellaneous spending. It also factors in variable expenses, set financial goals, and calculate total income versus total expenses to determine if there is a surplus or deficit. Additionally, it often includes a section for tracking actual spending to compare against the budgeted amounts and make adjustments as needed.

How can a Sample Personal Budget Worksheet help in managing finances?

A sample personal budget worksheet can help in managing finances by providing a structured tool for tracking income and expenses, identifying areas for potential savings or cuts, setting financial goals, and monitoring progress towards achieving those goals. By using a budget worksheet, individuals can gain a clear overview of their financial situation, make informed decisions about spending and saving, and ultimately improve their financial stability and well-being.

What types of expenses should be included in a Sample Personal Budget Worksheet?

A Sample Personal Budget Worksheet should include categories such as housing (rent or mortgage), utilities (electricity, water, gas), transportation (car payments, gas, insurance), groceries, dining out, entertainment, savings, healthcare, personal care, and debt payments. Other categories to consider are investments, clothing, gifts, and miscellaneous expenses. It is important to include all regular and irregular expenses to get an accurate picture of your financial situation.

How often should a Sample Personal Budget Worksheet be updated?

A Sample Personal Budget Worksheet should ideally be updated on a monthly basis. This allows you to track your income and expenses accurately, make adjustments if needed, and stay on top of your financial goals. Regularly updating your budget can help you make informed decisions about your spending and saving habits.

Can a Sample Personal Budget Worksheet be used for long-term financial planning?

A sample personal budget worksheet can be a valuable tool for both short-term budgeting and long-term financial planning. By tracking income, expenses, and savings goals over time, individuals can gain a clear understanding of their financial situation and make informed decisions to meet their long-term financial objectives. It helps in identifying areas for improvement, setting realistic goals, and adapting the budget as financial circumstances evolve.

Are there any specific formulas or calculations used in a Sample Personal Budget Worksheet?

Yes, there are common formulas and calculations used in a Sample Personal Budget Worksheet to help individuals track their finances effectively. Some formulas include: calculating total income (sum of all sources of income), total expenses (sum of all expenses), net income (total income minus total expenses), savings rate (savings divided by total income multiplied by 100 to get a percentage), and percentage breakdowns of spending categories (individual expense divided by total expenses multiplied by 100 to get a percentage). These calculations help individuals understand their financial situation and make informed decisions about managing their money.

How can a Sample Personal Budget Worksheet help in identifying spending patterns?

A Sample Personal Budget Worksheet can help in identifying spending patterns by providing a structured format to track and categorize expenses. By recording income and allocating funds to different expense categories, individuals can visually see where their money is being spent. This allows for a clear overview of spending habits, highlighting areas where adjustments can be made to better align spending with financial goals. Over time, consistent use of the budget worksheet can reveal trends and patterns in spending, making it easier to identify areas of overspending or opportunities for saving.

Is it possible to track savings goals using a Sample Personal Budget Worksheet?

Yes, it is possible to track savings goals using a Sample Personal Budget Worksheet by creating a category specifically for savings and setting a target amount to save each month. You can then track your progress towards your savings goals by comparing your actual savings with your target savings on a regular basis to stay on track and make adjustments if needed.

What are the benefits of using a Sample Personal Budget Worksheet compared to other budgeting methods?

A Sample Personal Budget Worksheet provides a structured framework for individuals to track their expenses, income, and savings in one place, making it easier to see their financial situation at a glance. It can help users identify areas where they can cut back on spending, set specific financial goals, and track their progress over time. In comparison to other budgeting methods, such as mental tracking or apps, a worksheet can be more visual, customizable, and offers a hands-on approach to managing finances, making it easier for individuals to stay organized and accountable for their financial health.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments