Sample Insolvency Worksheet

Worksheets are valuable tools that can help individuals and businesses organize their financial information and gain a clear understanding of their financial situation. Whether you are an individual struggling with debt or a business owner facing insolvency, an insolvency worksheet can be a useful entity for organizing and documenting your financial information. By providing a structured format to list your income, expenses, assets, and liabilities, an insolvency worksheet can help you assess your financial position and make informed decisions moving forward.

Table of Images 👆

- Forgiveness Worksheets Printables

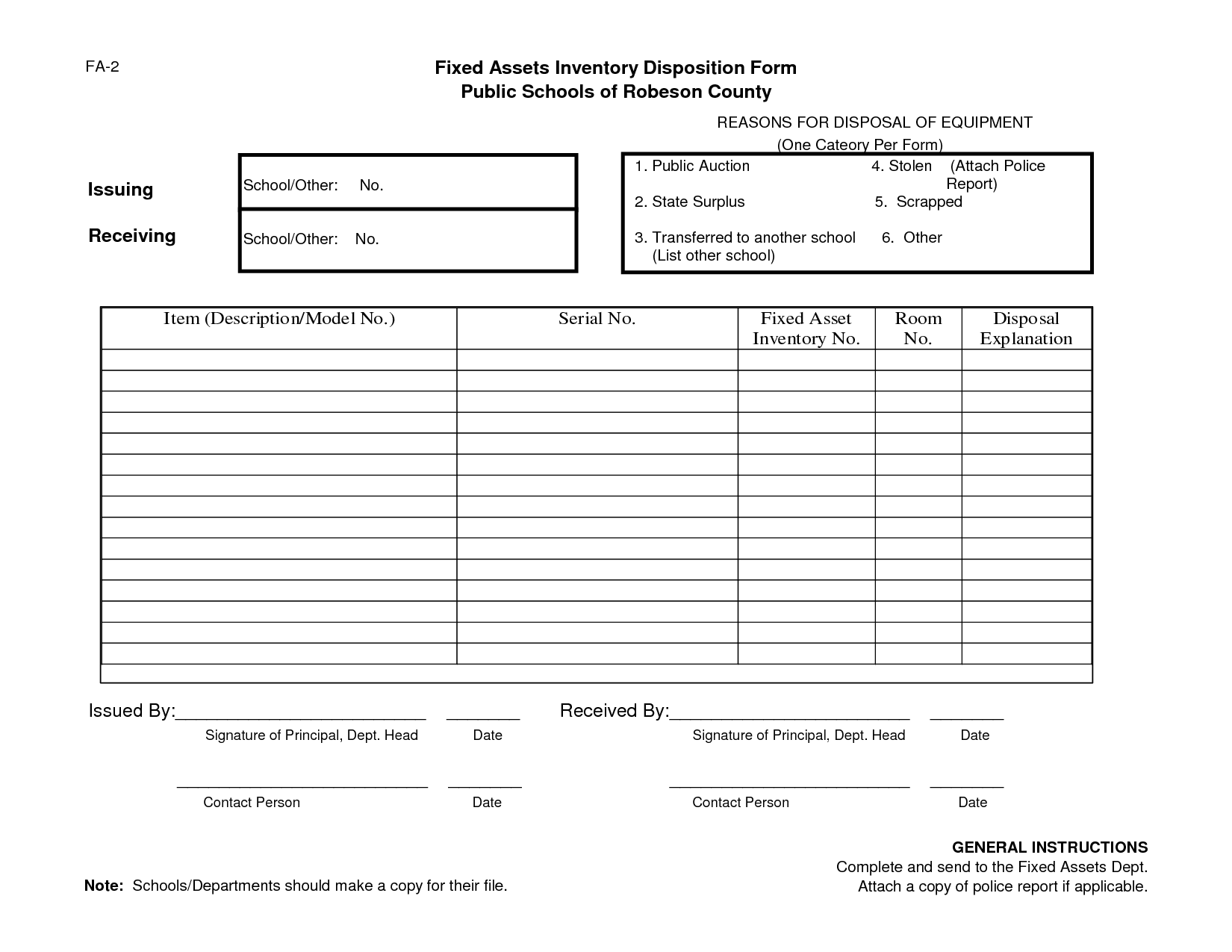

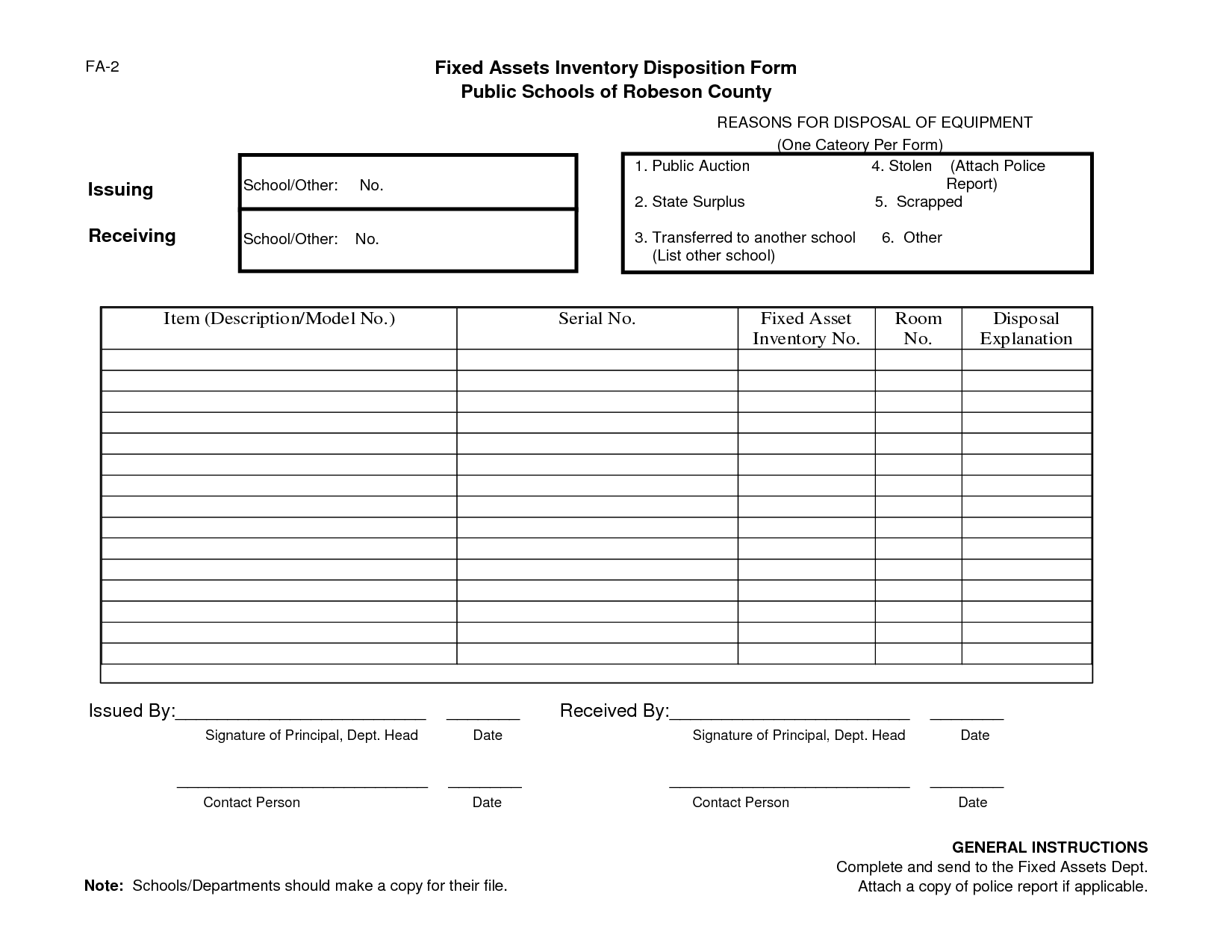

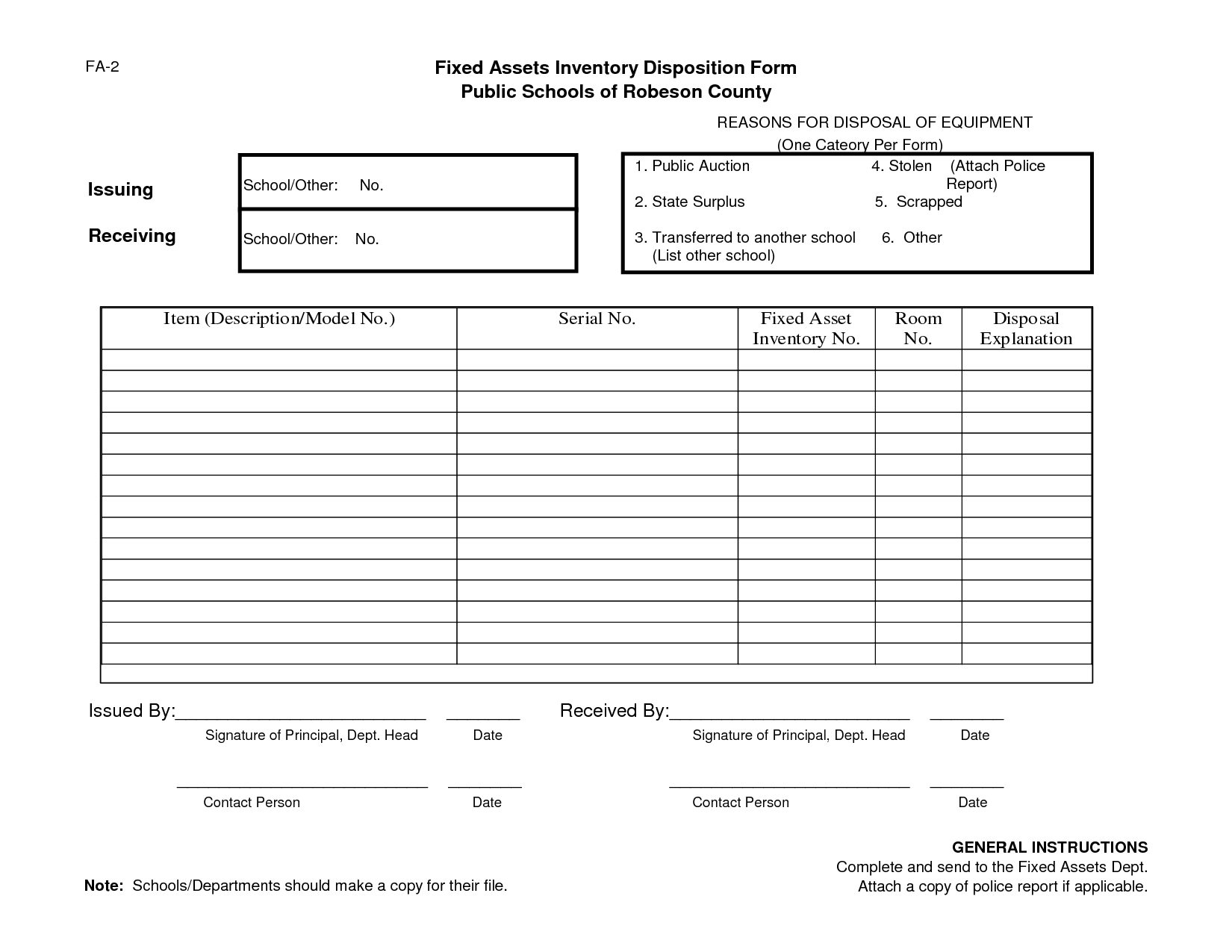

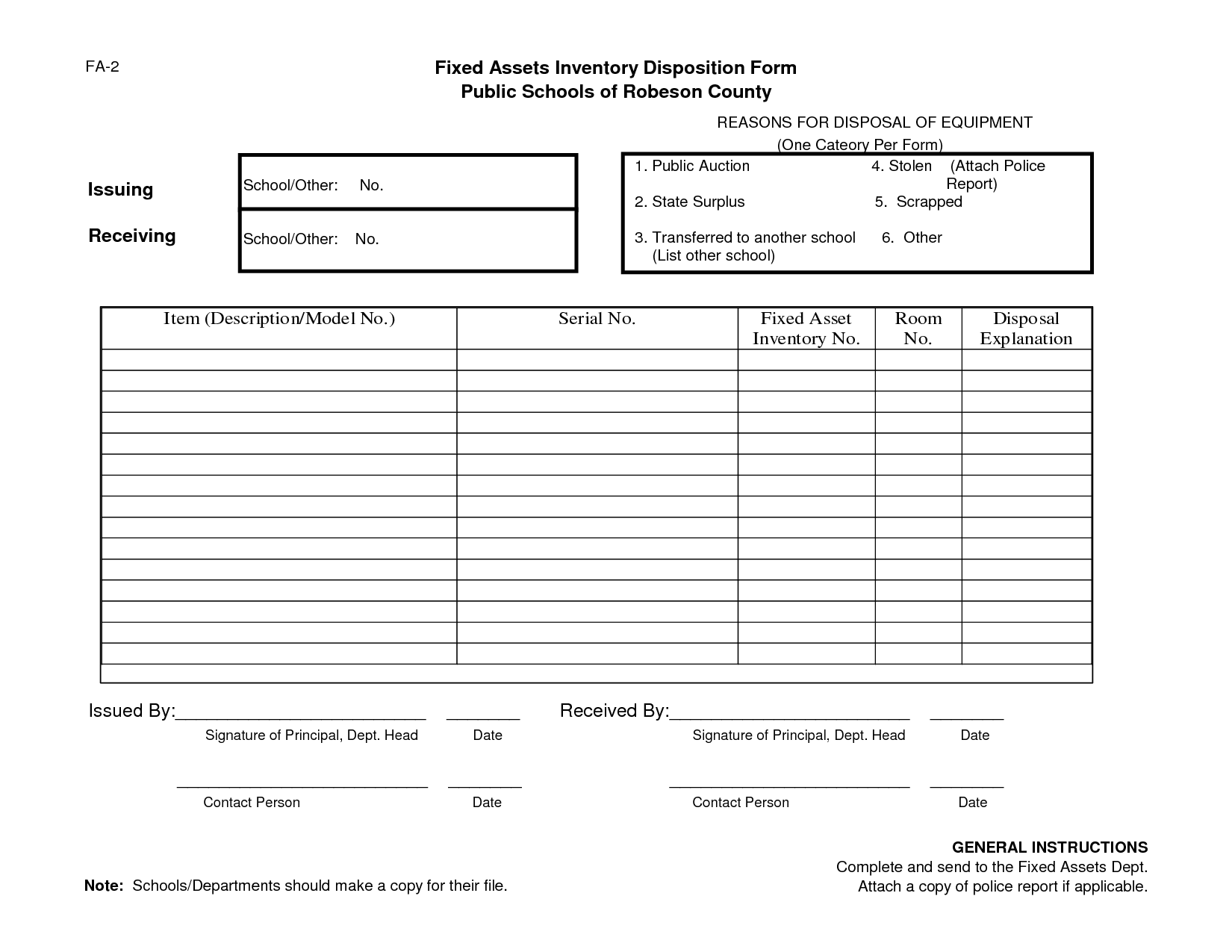

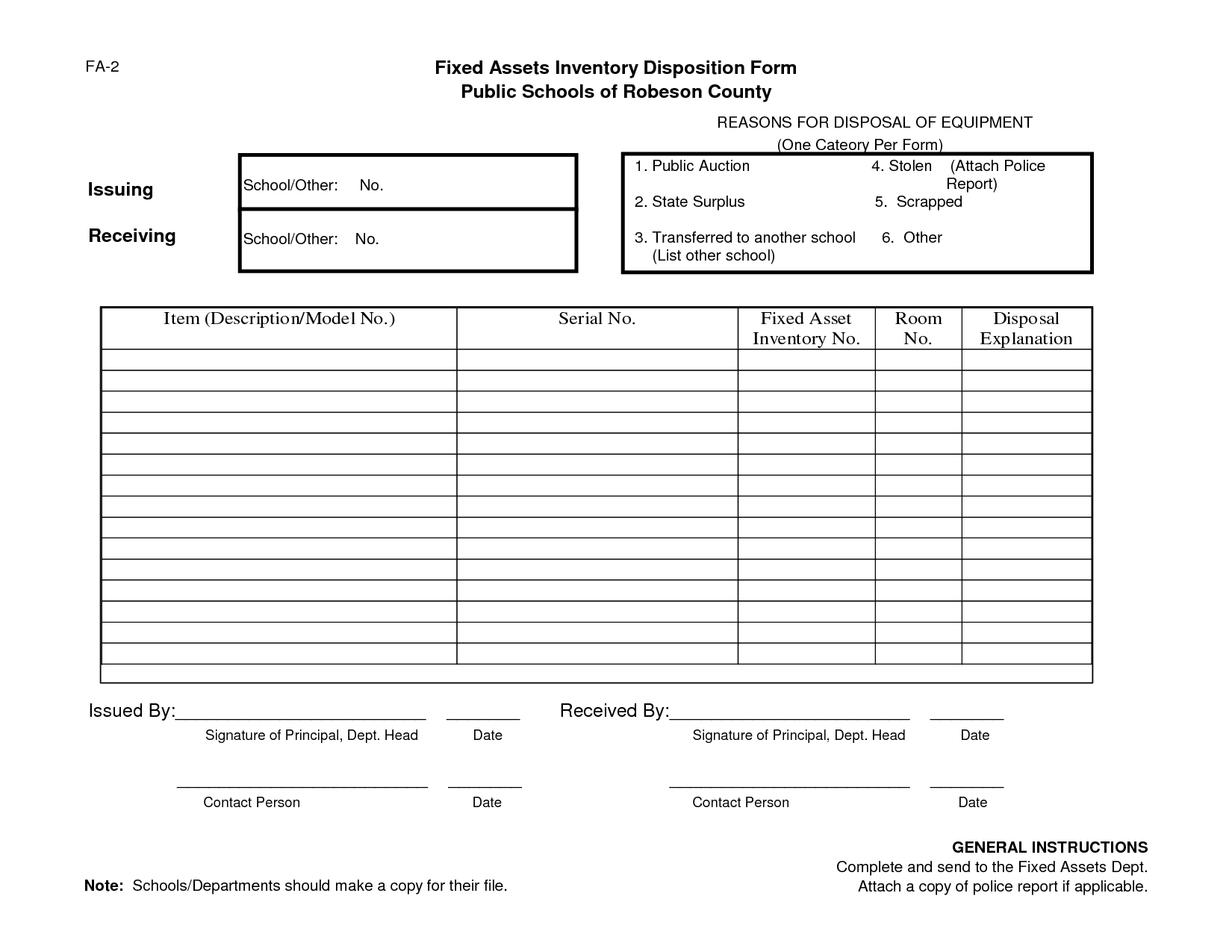

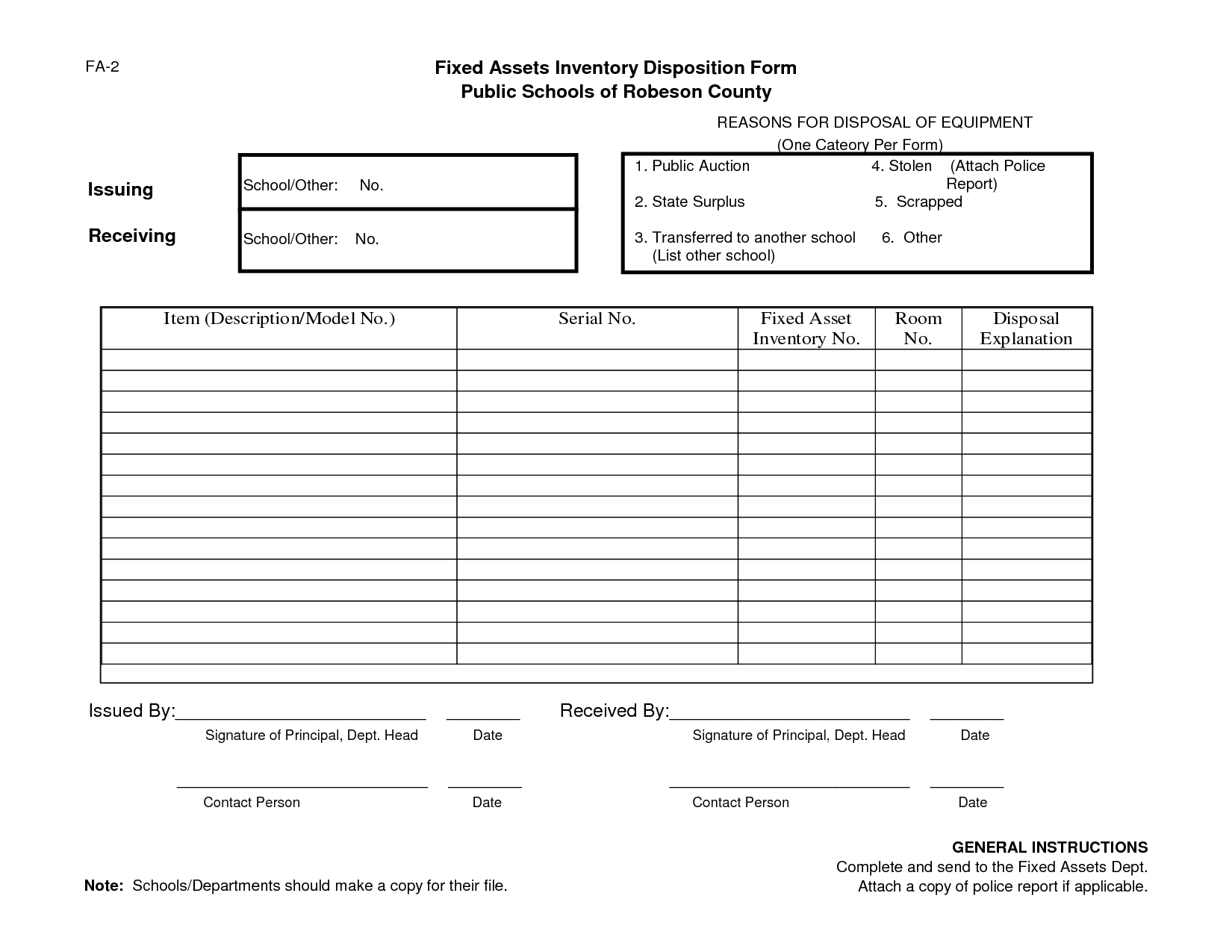

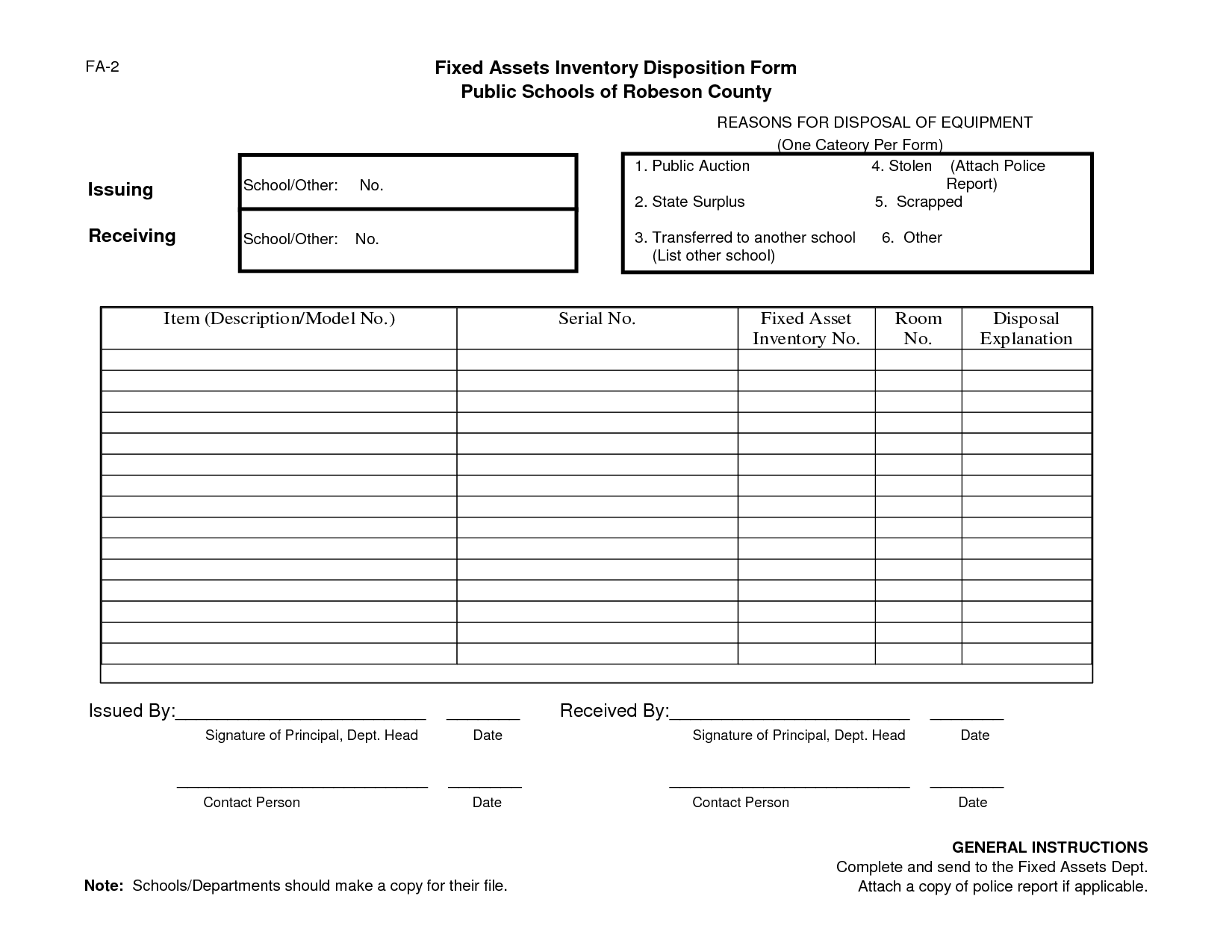

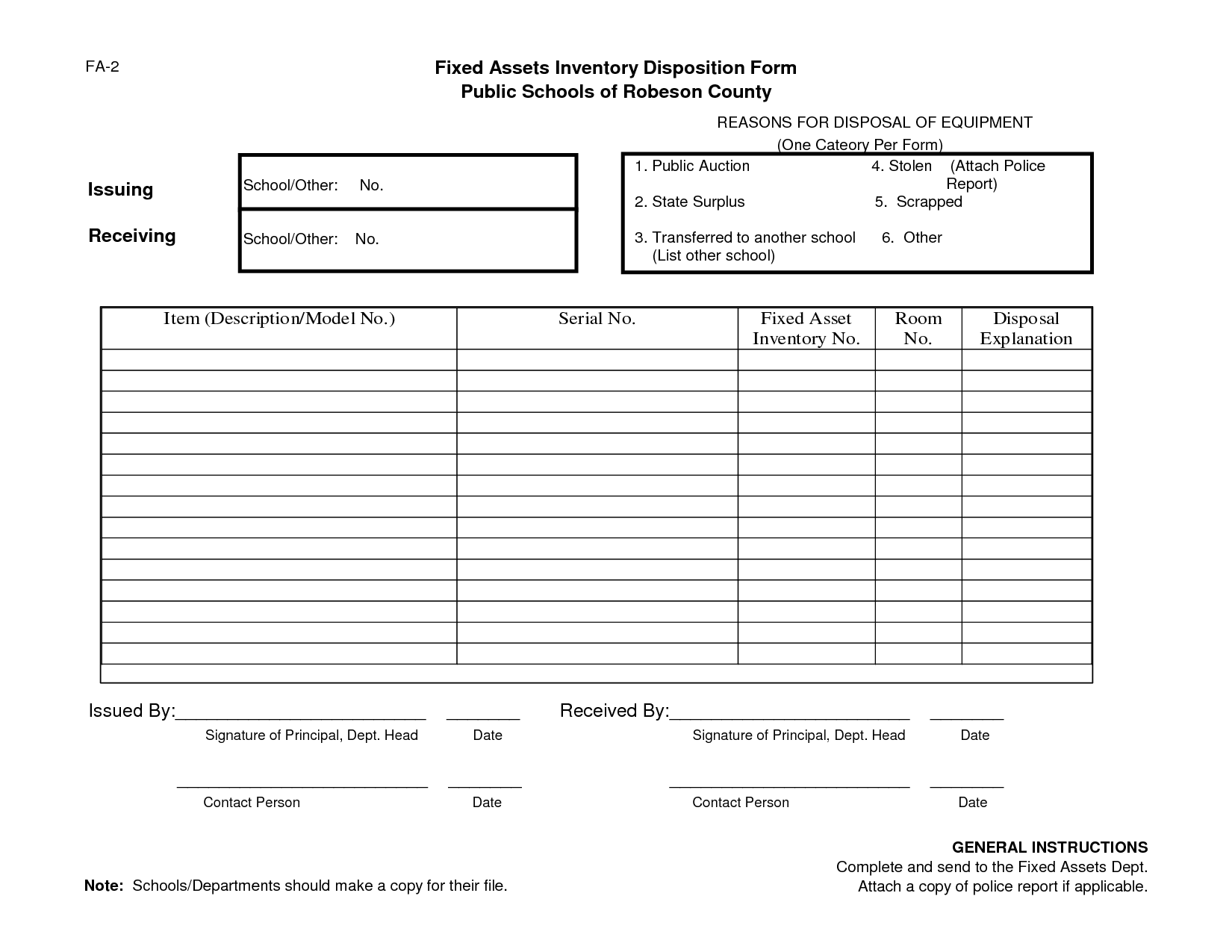

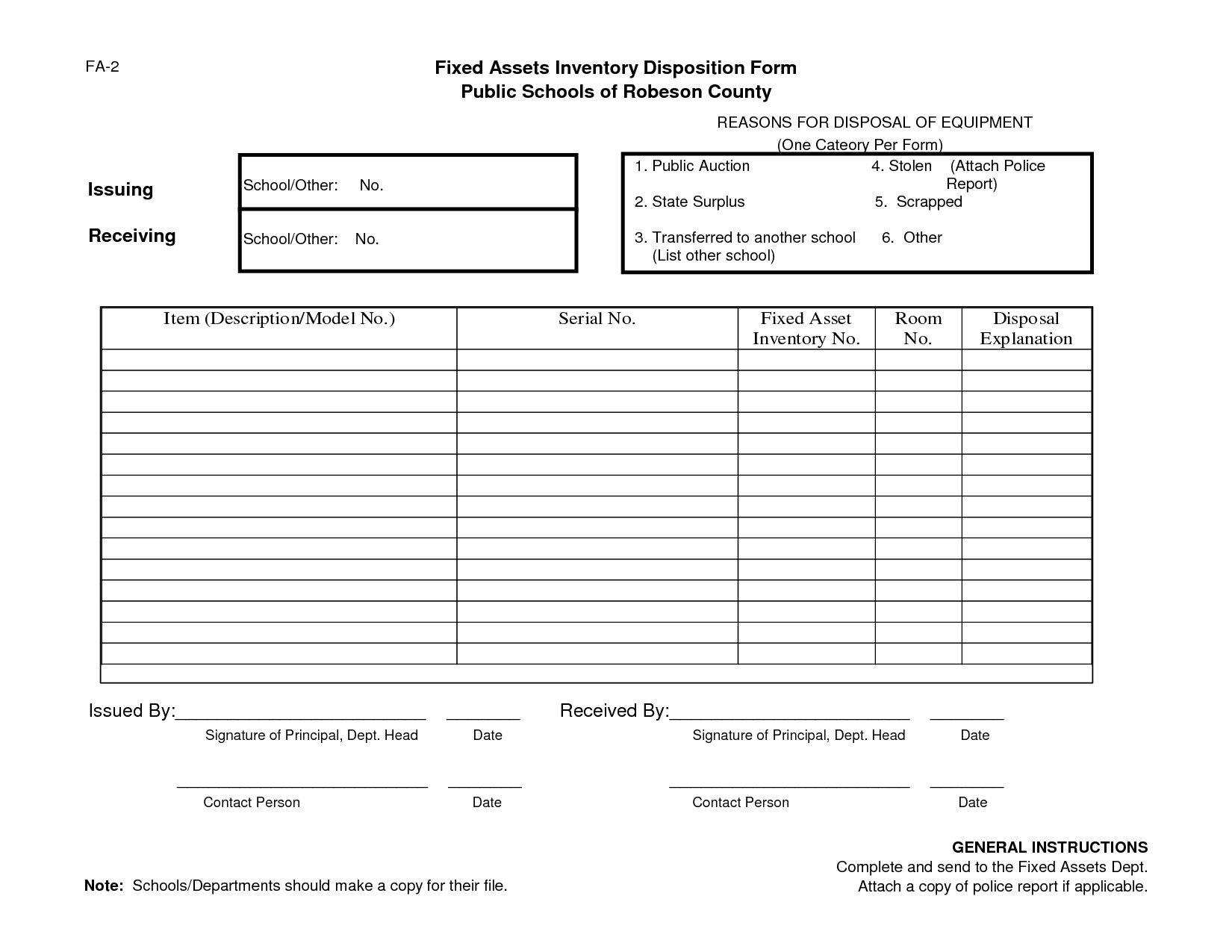

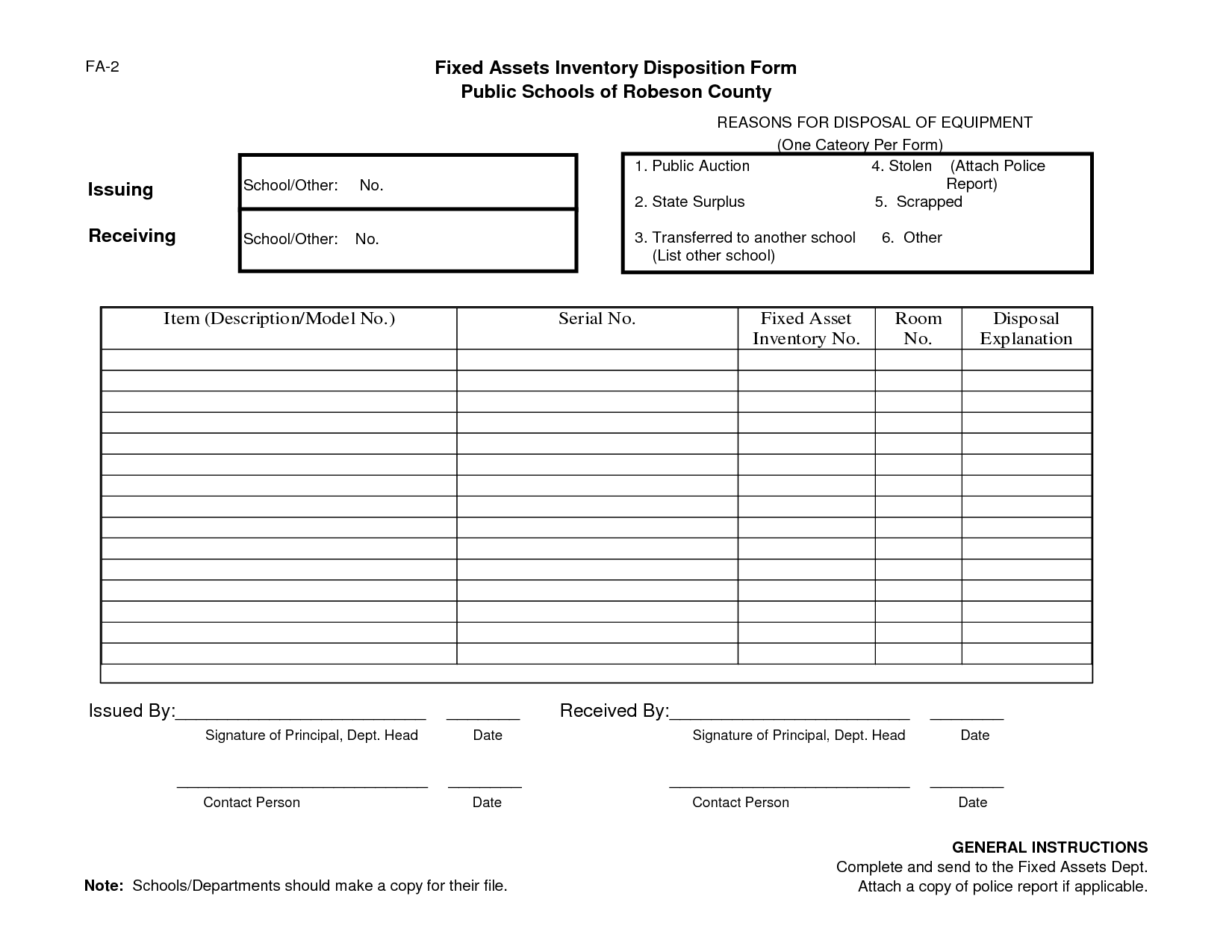

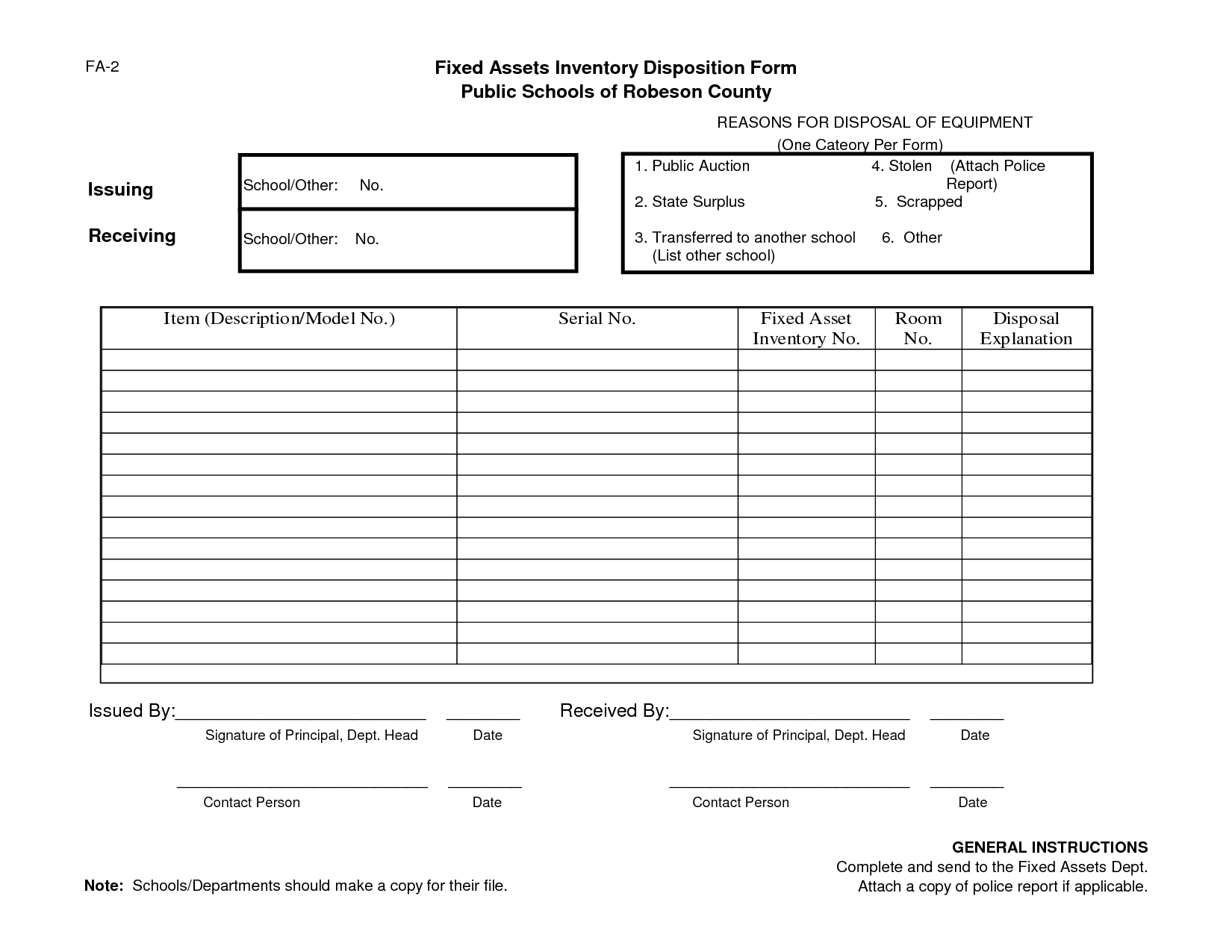

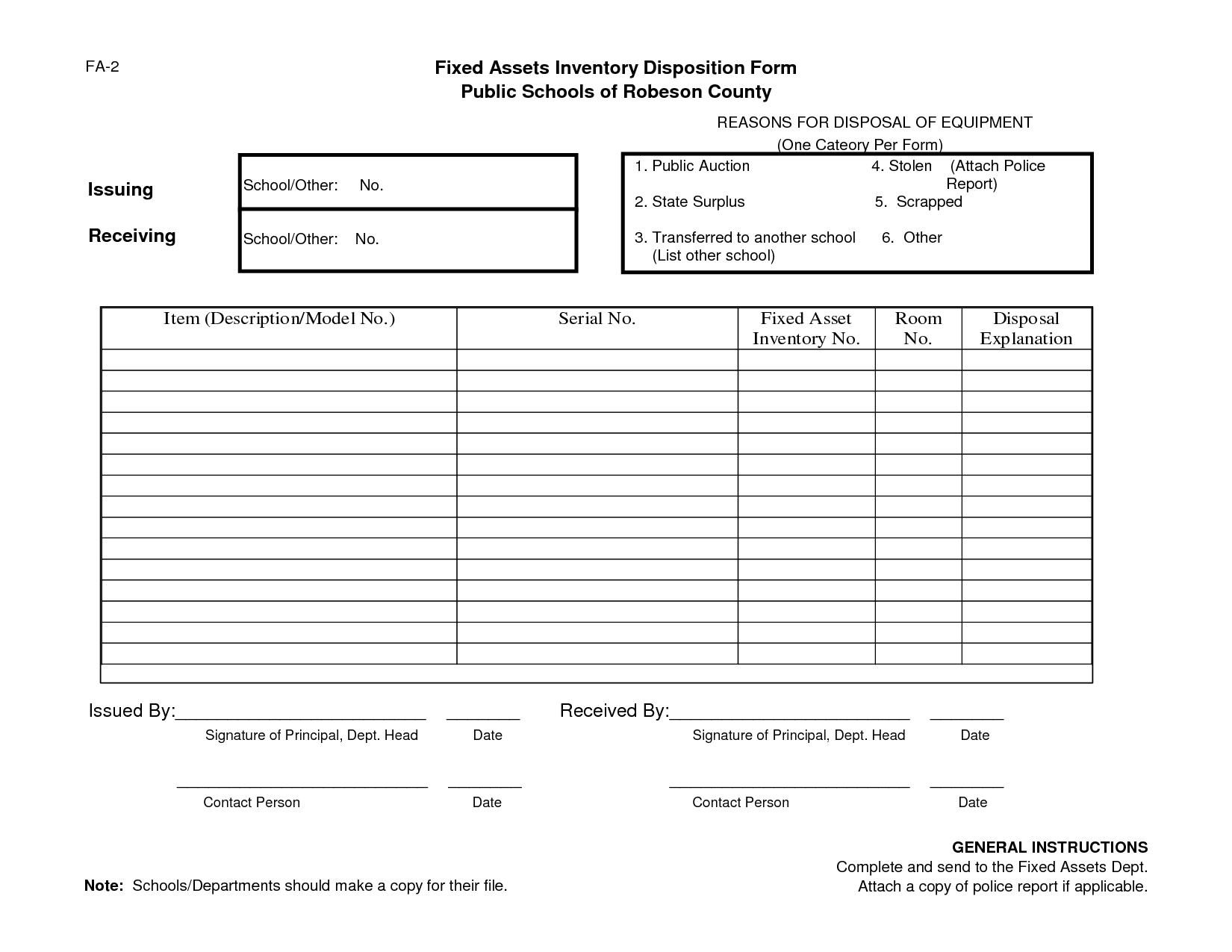

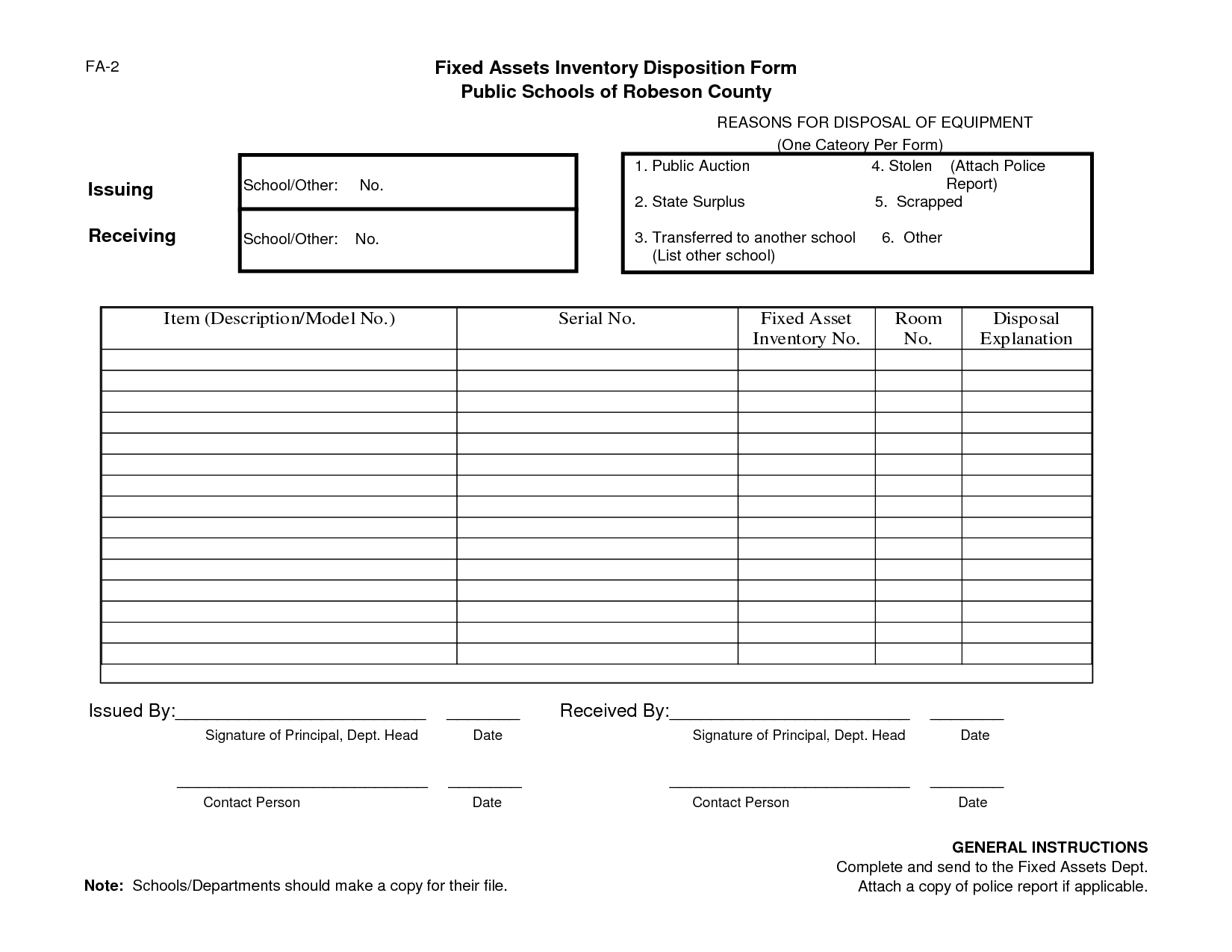

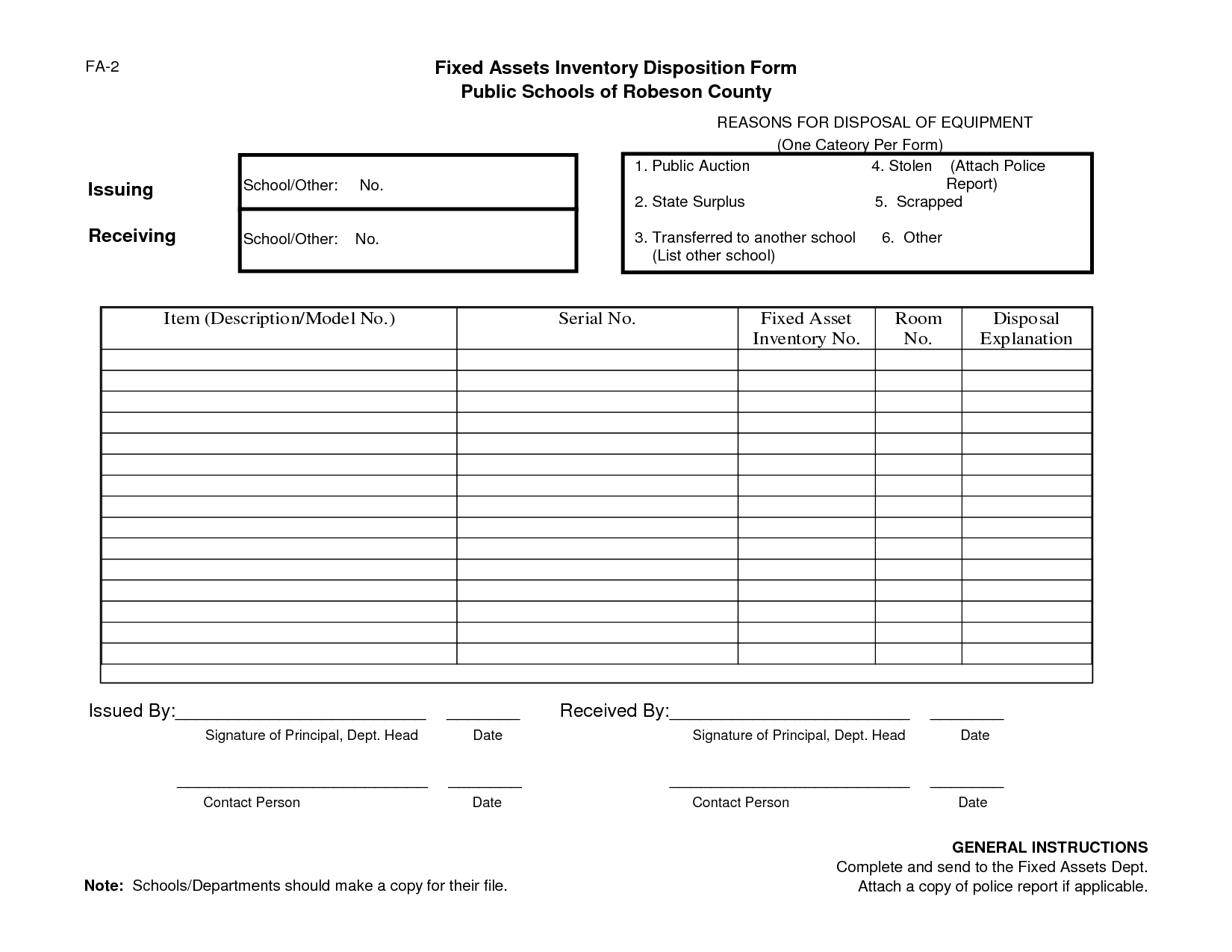

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

- Fixed Asset Inventory Form

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a Sample Insolvency Worksheet?

A Sample Insolvency Worksheet is a document used to calculate a taxpayer's insolvency status. It helps to determine if a taxpayer is insolvent by comparing their total liabilities to their total assets. If the total liabilities are greater than the total assets, the taxpayer is considered insolvent. This worksheet is commonly used when an individual is facing financial difficulties and is unable to pay their debts.

What information is typically included in a Sample Insolvency Worksheet?

A Sample Insolvency Worksheet typically includes a list of assets, liabilities, and other financial information to help individuals determine if they are insolvent. This can include details such as the market value of assets, outstanding debts, and potentially excluded items like retirement accounts. The worksheet is used to calculate the individual's insolvency status by comparing total liabilities to total assets to ascertain if the individual's debts exceed their assets.

How is a Sample Insolvency Worksheet used in the context of insolvency?

A Sample Insolvency Worksheet is used in the context of insolvency to calculate an individual's insolvency status by comparing their assets to their liabilities. By listing all assets and liabilities, the worksheet helps determine if a person's debts exceed their assets, which is a key factor in assessing insolvency. This information is crucial in bankruptcy proceedings as it helps creditors and the individual understand their financial situation and make informed decisions about debt repayment and restructuring.

Who typically prepares a Sample Insolvency Worksheet?

A Sample Insolvency Worksheet is typically prepared by a financial professional such as a bankruptcy attorney, accountant, or financial advisor in collaboration with the individual or entity facing insolvency.

What is the purpose of filling out a Sample Insolvency Worksheet?

The purpose of filling out a Sample Insolvency Worksheet is to help individuals determine if they are insolvent, meaning their total liabilities exceed their total assets. This information is important for tax purposes, as individuals who are deemed insolvent may be able to exclude canceled debt from their taxable income. The worksheet helps individuals organize and calculate their financial information to assess their insolvency status.

What are the potential consequences of not accurately completing a Sample Insolvency Worksheet?

Failure to accurately complete a Sample Insolvency Worksheet could lead to incorrect financial assessments, misrepresentation of assets and liabilities, and ultimately may result in inaccurate decision-making. This could potentially lead to legal consequences, financial loss, and challenges when dealing with insolvency proceedings. It is crucial to ensure the accuracy of such documents to provide a clear picture of one's financial situation and to comply with any legal requirements.

Are there any specific regulations or guidelines that govern the use of a Sample Insolvency Worksheet?

Yes, there are regulations and guidelines that govern the use of a Sample Insolvency Worksheet. These regulations typically relate to the accuracy and completeness of the information provided in the worksheet, as well as the confidentiality of the data. It's essential to ensure that the worksheet complies with relevant laws and industry standards to avoid any legal issues and to achieve its intended purpose effectively.

How does a Sample Insolvency Worksheet assist in determining insolvency?

A Sample Insolvency Worksheet can assist in determining insolvency by calculating a taxpayer's total liabilities and total fair market value of their assets. By comparing these two figures, individuals and businesses can establish whether their debts exceed the value of their assets, indicating insolvency. This tool helps in assessing financial circumstances accurately and can be used for tax-related matters, such as determining if a forgiven debt is taxable income due to insolvency.

Can a Sample Insolvency Worksheet be used for both personal and business insolvency scenarios?

A Sample Insolvency Worksheet can be used for both personal and business insolvency scenarios, as the worksheet typically includes key financial information such as assets, liabilities, income, and expenses for assessing insolvency in both cases. However, it is important to tailor the worksheet to accurately reflect the specific financial situation of the individual or business in question to ensure a thorough and accurate assessment of insolvency.

Are there any limitations or limitations to consider when using a Sample Insolvency Worksheet?

When using a Sample Insolvency Worksheet, it is important to keep in mind that it may not capture all possible financial scenarios or debts specific to your situation. Additionally, the accuracy of the calculations depends on the information provided, so ensuring that all details are accurate is crucial. It is advisable to seek guidance from a financial professional or insolvency expert to ensure that the insolvency determination is done correctly and to discuss any potential limitations of using a generic worksheet.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments