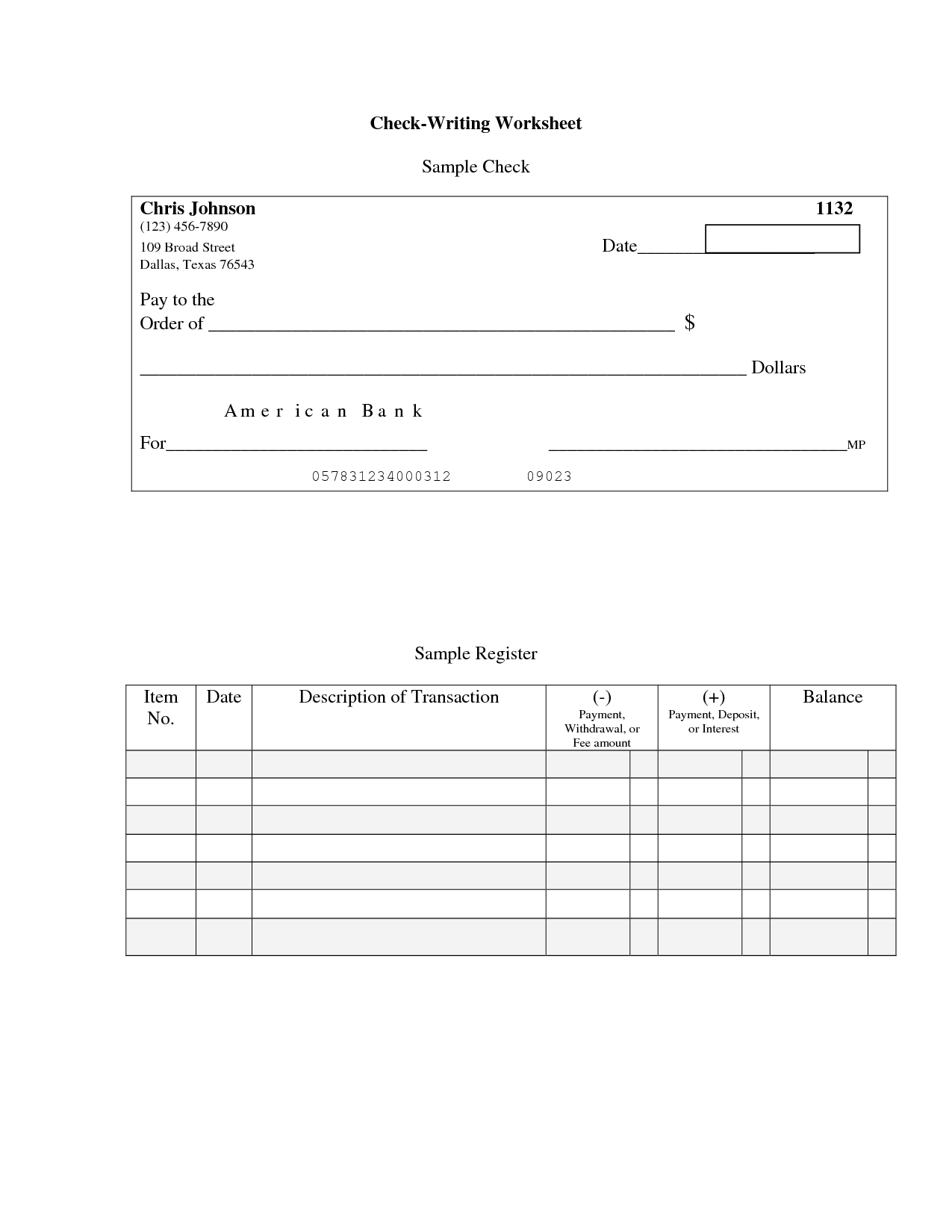

Sample Checkbook Worksheet

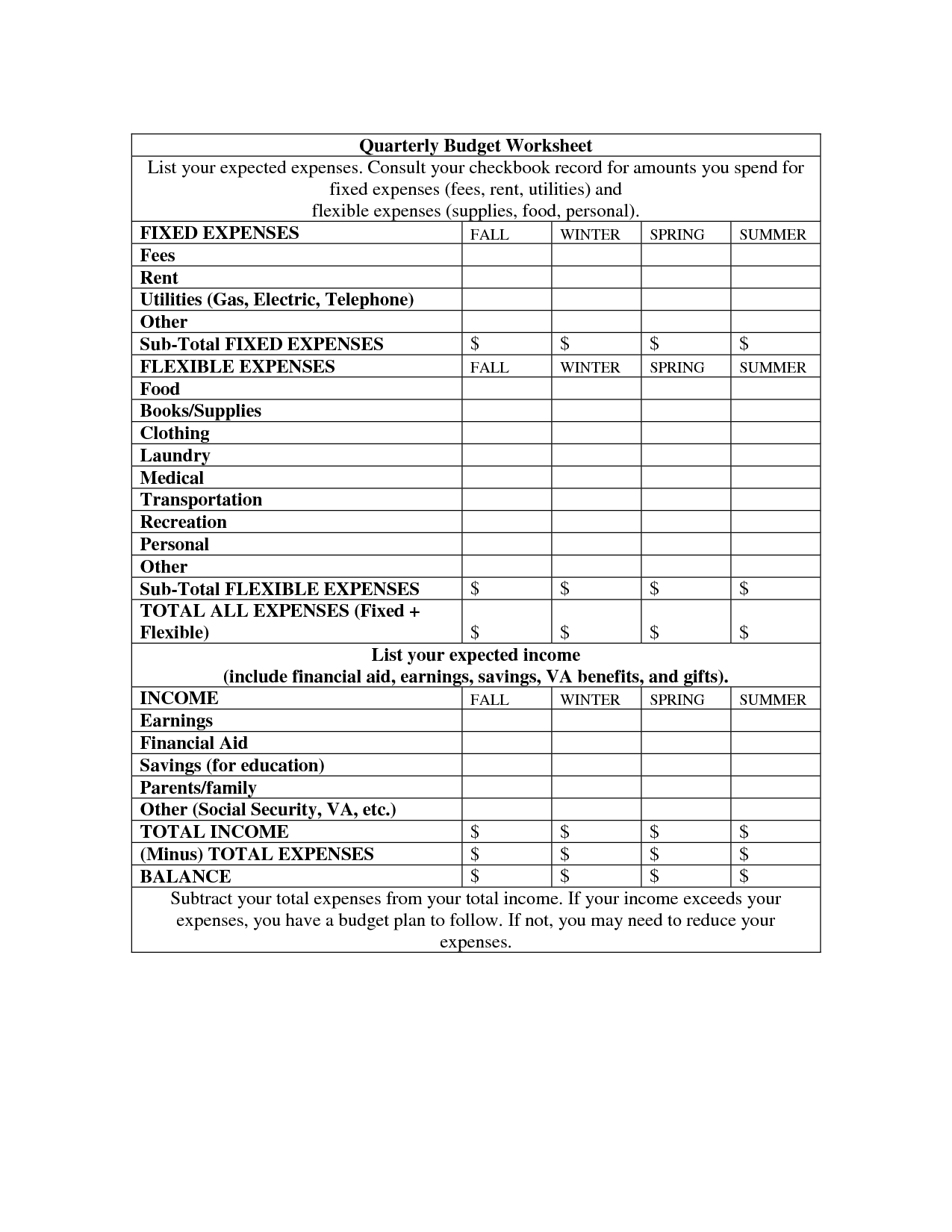

Are you searching for an effective tool to help you manage your finances? Look no further. Introducing the Checkbook Worksheet, a comprehensive tool designed to assist individuals and businesses in tracking their incomes and expenses. Whether you are a solopreneur, a student learning about personal finance, or a small business owner, this worksheet will allow you to easily monitor your financial transactions, keep a balanced budget, and make informed decisions about your expenses.

Table of Images 👆

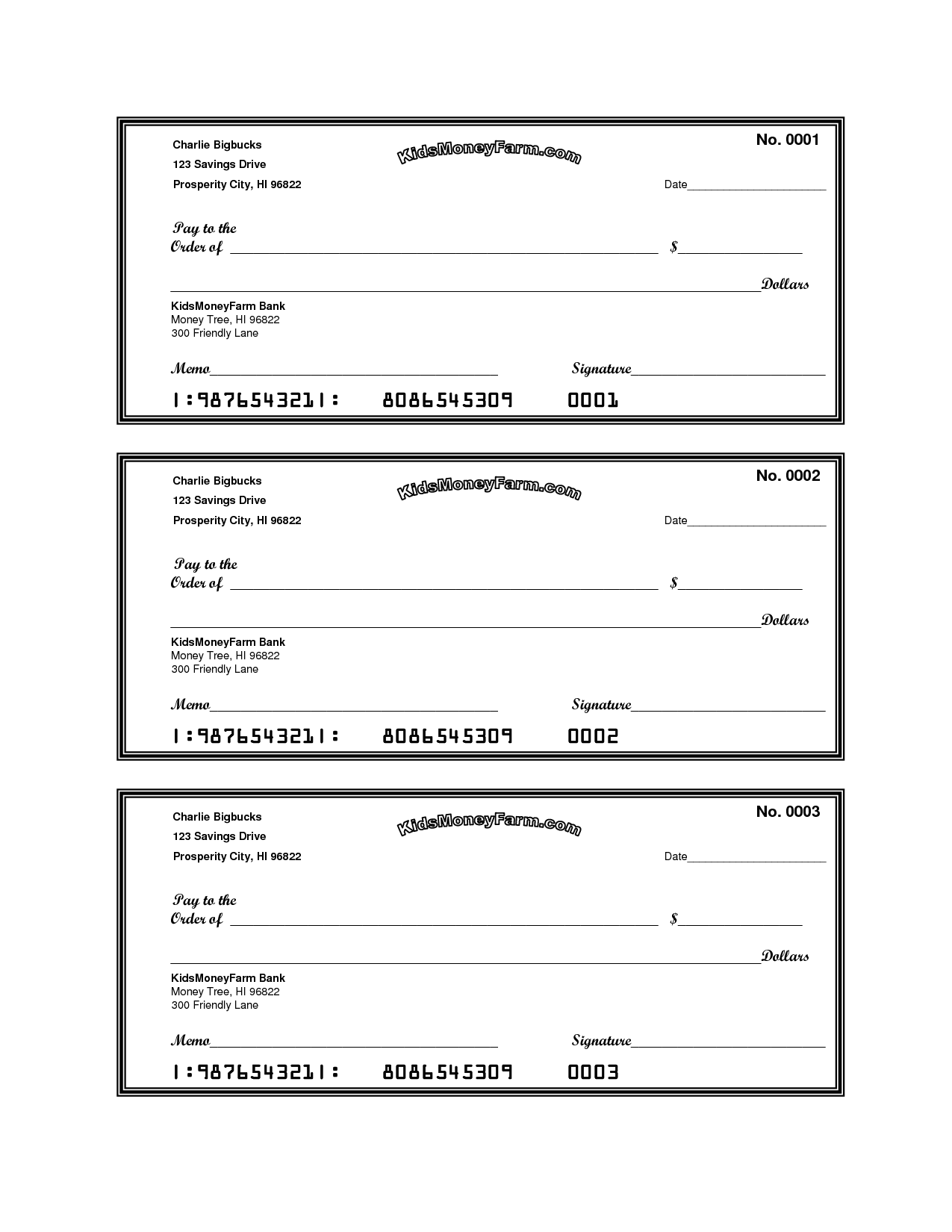

- Sample Check Register Worksheet

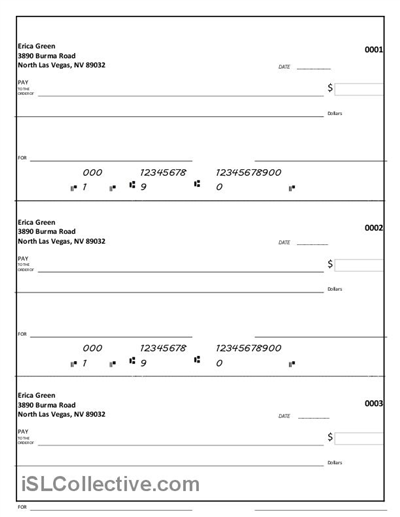

- Check Writing Practice Worksheets

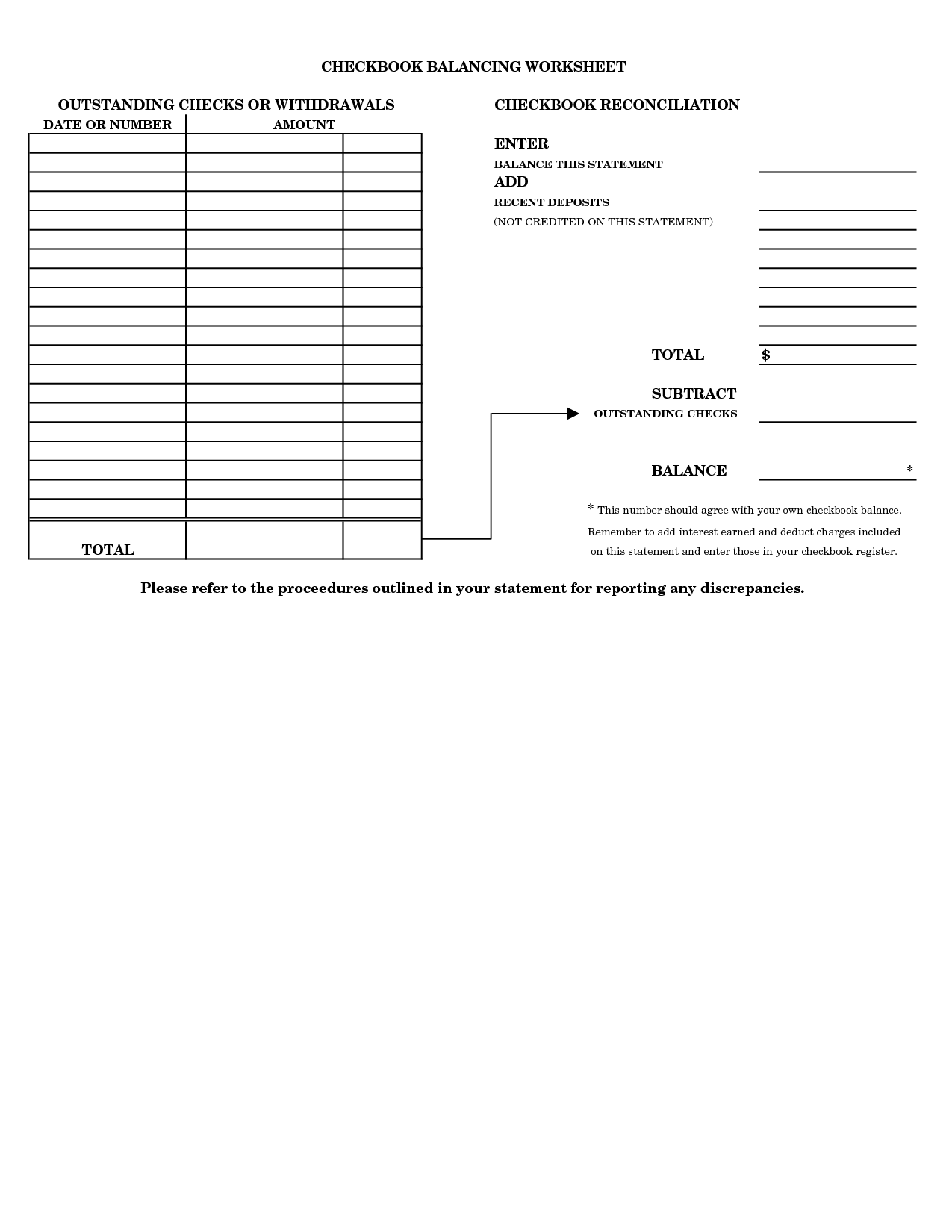

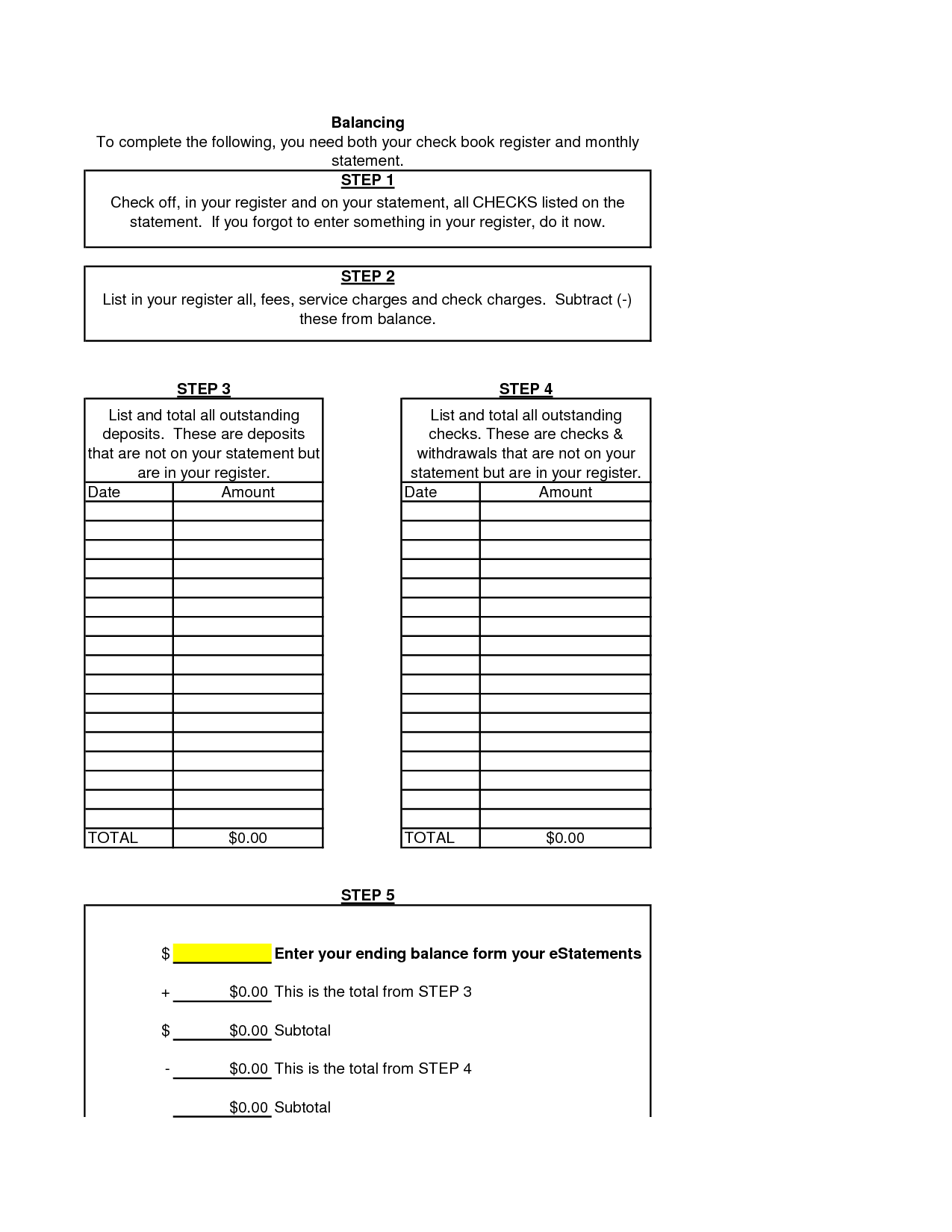

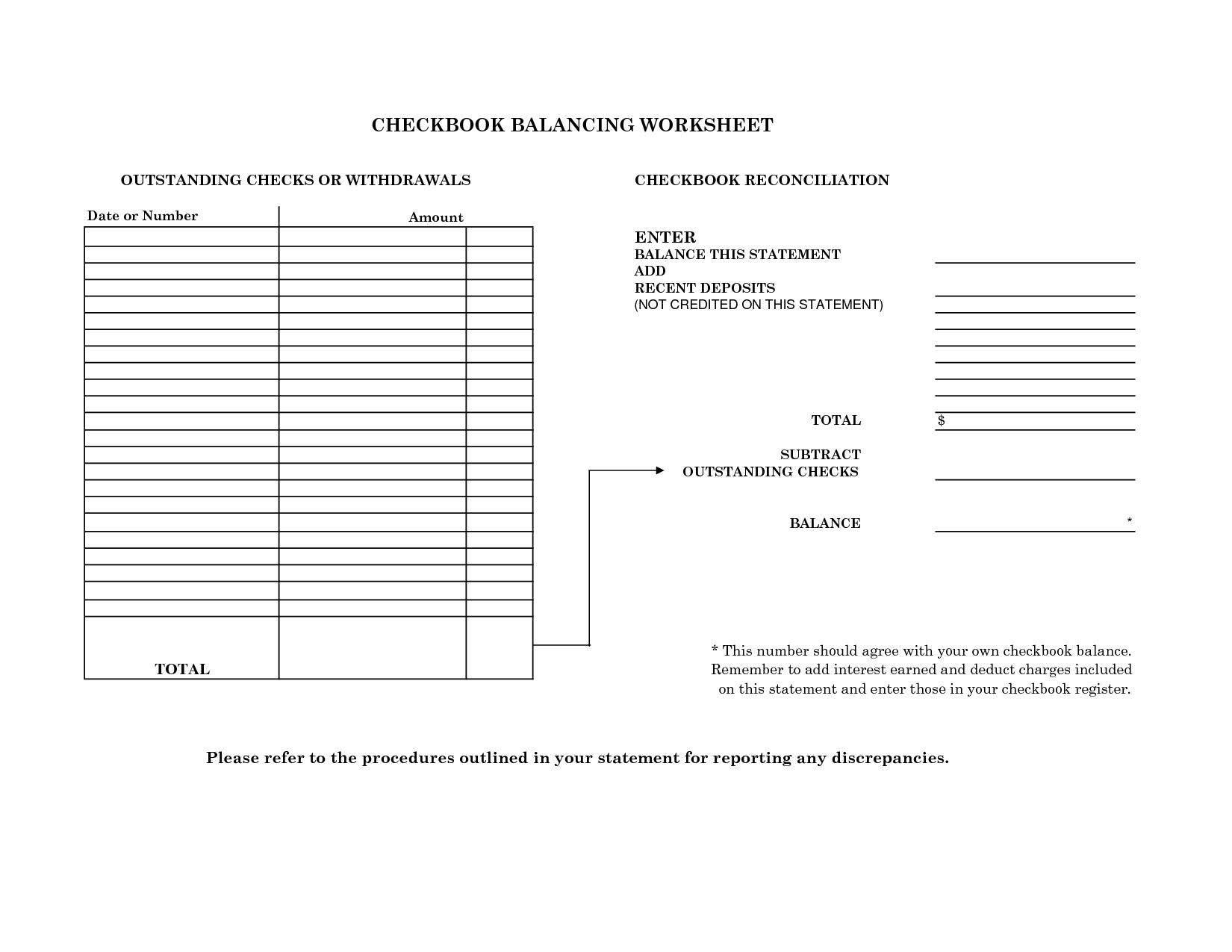

- Balance Checkbook Worksheet

- Printable Balancing Checkbook Worksheet

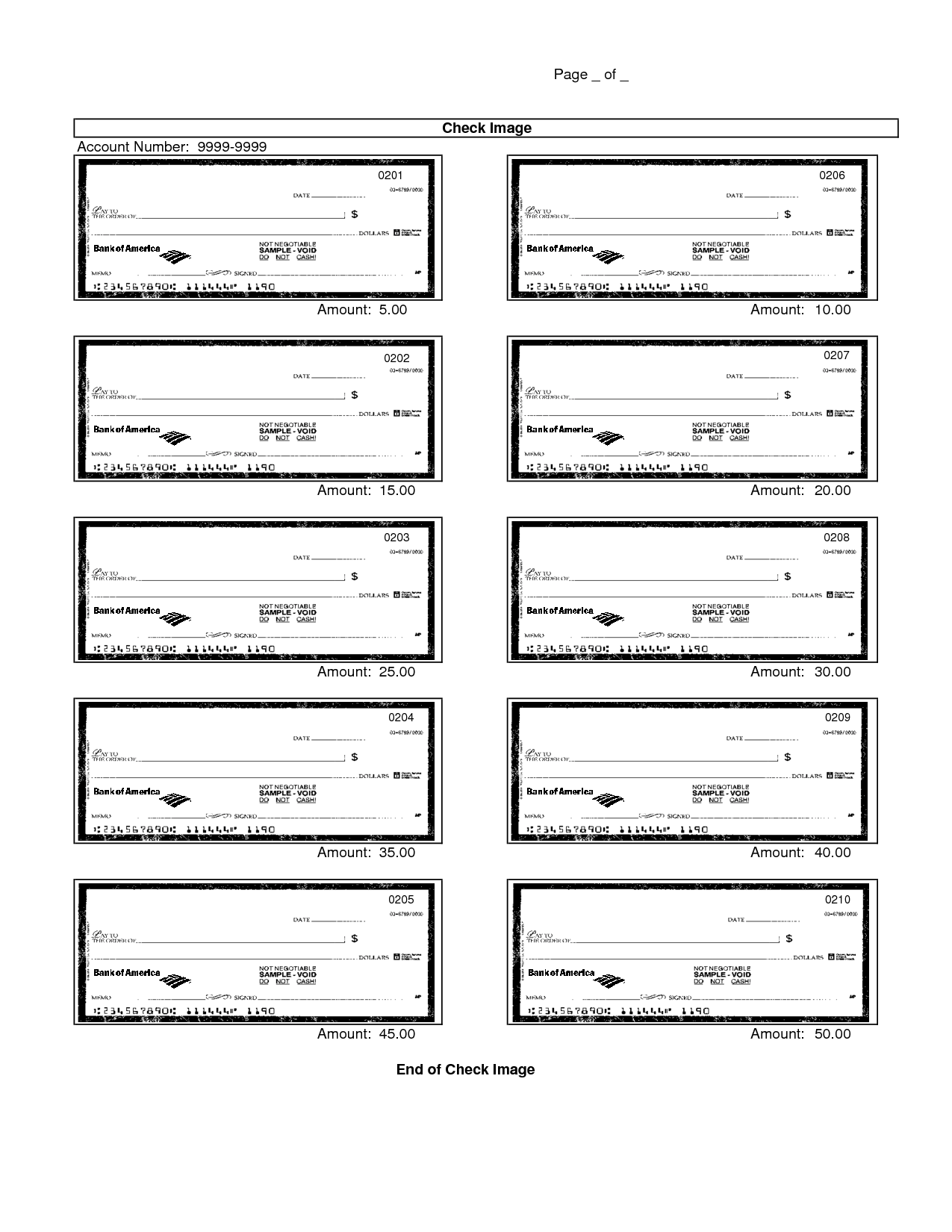

- Blank Check Writing Worksheets

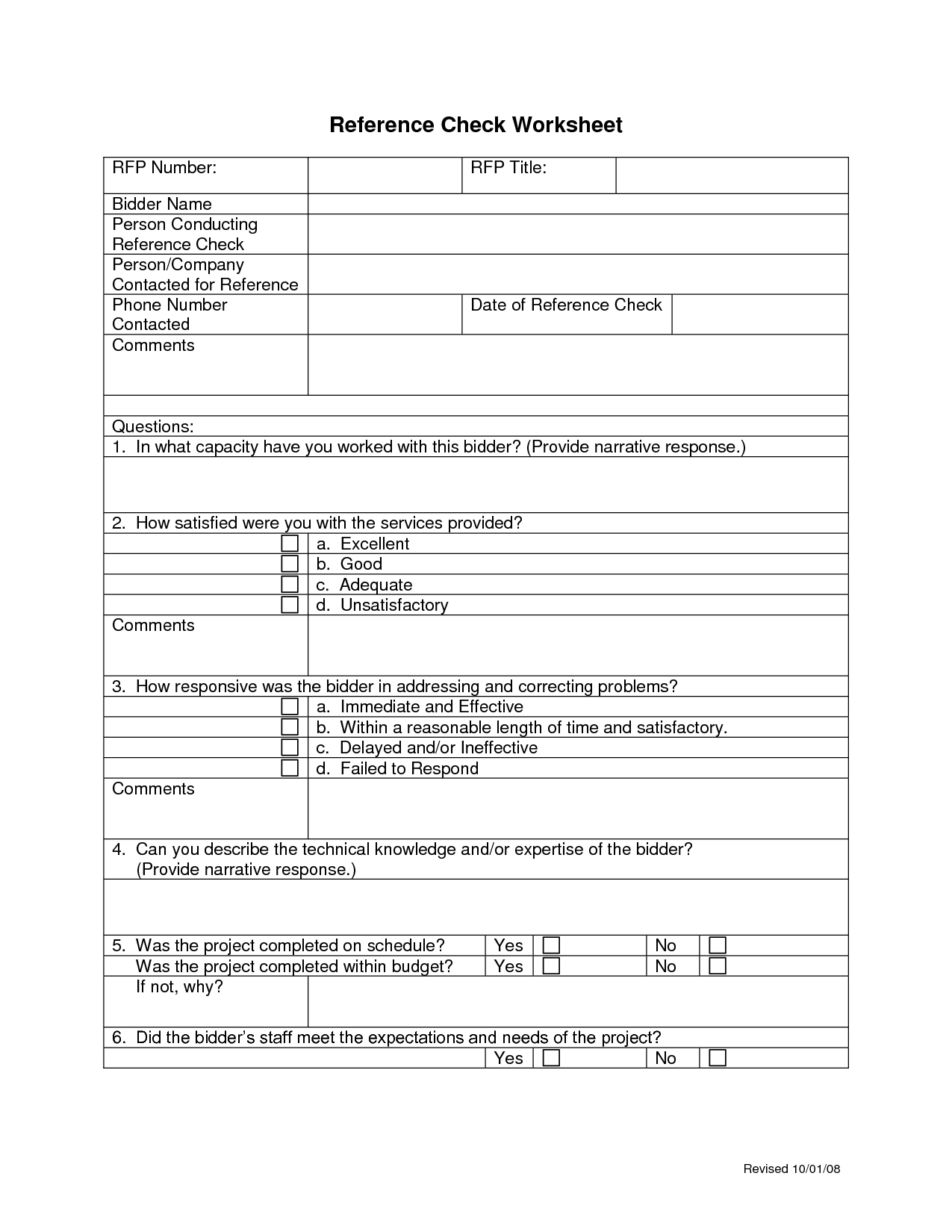

- Reference Check Worksheet

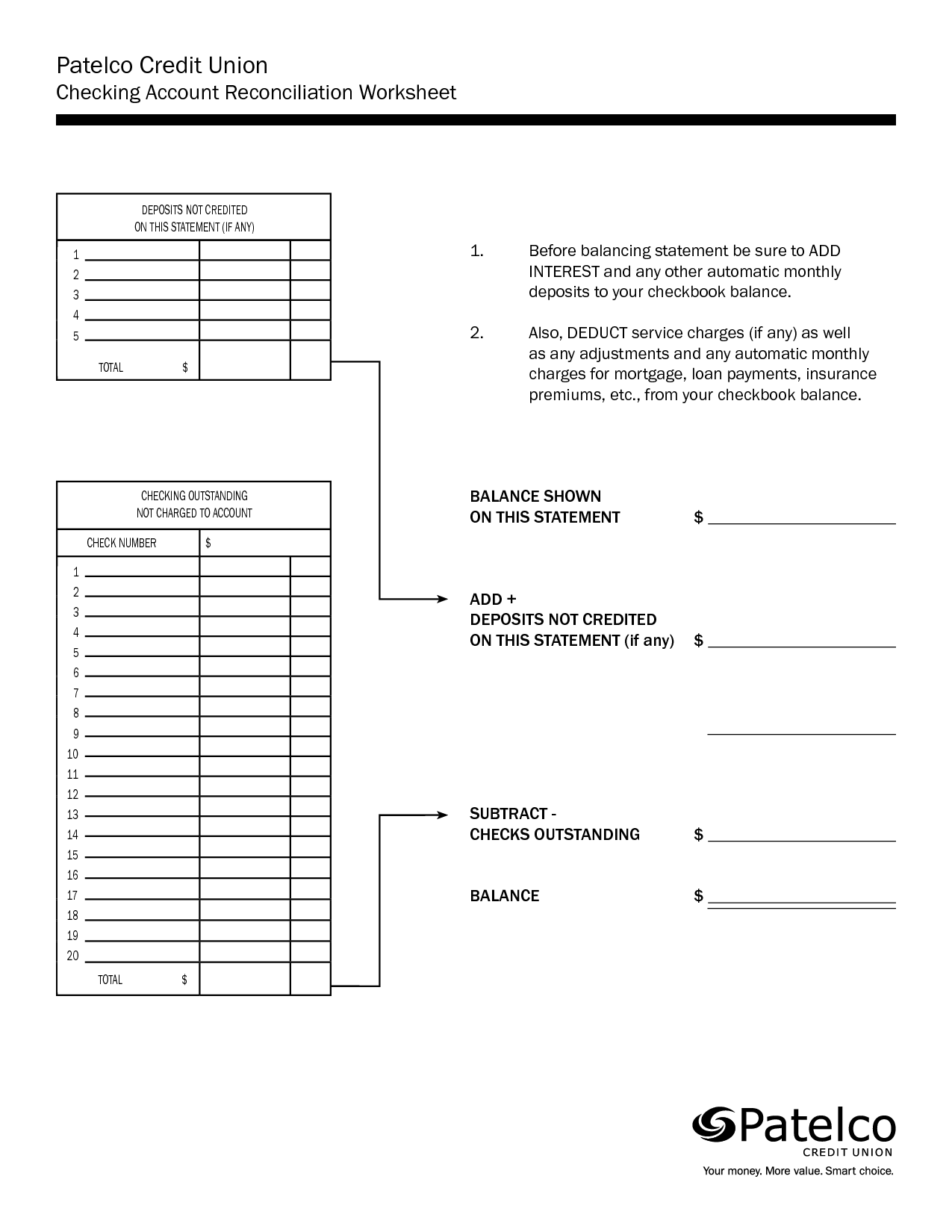

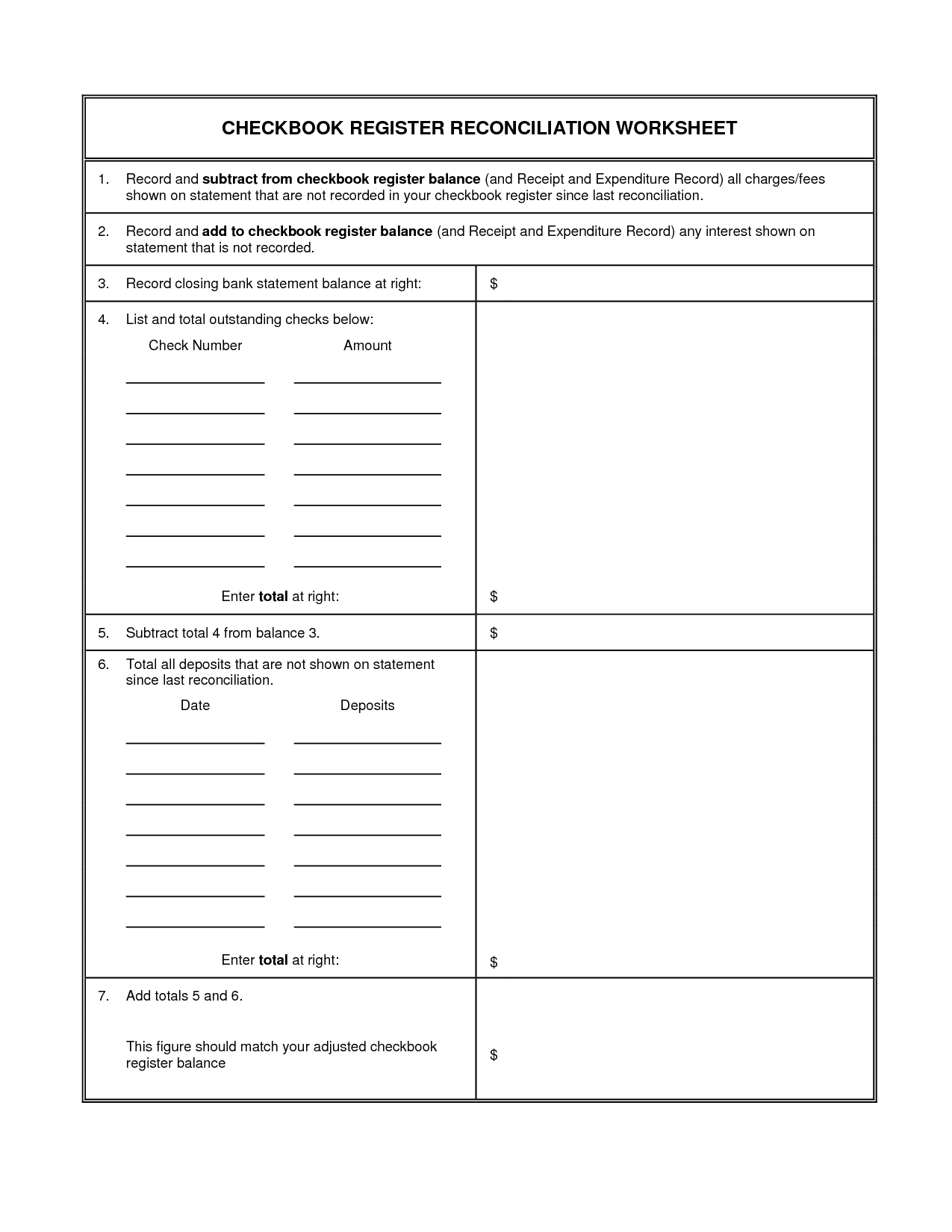

- Checkbook Reconciliation Worksheet

- Free Printable Checkbook Balance Worksheet

- Sample Checkbook Register Worksheet

- Check Writing Template Worksheet

- Printable Checkbook Balance Worksheet

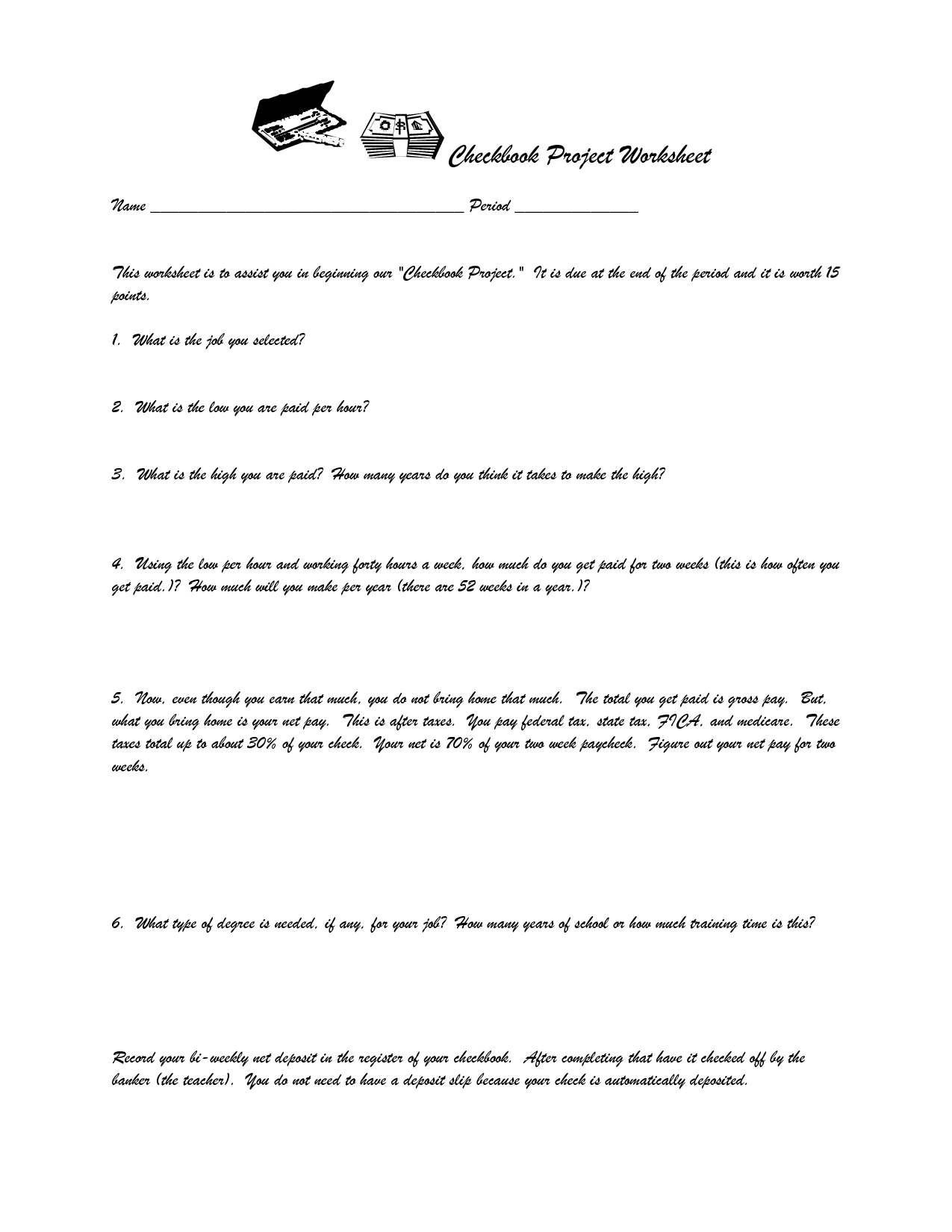

- Checkbook Math Worksheets

- Check Writing Practice Worksheets

- Blank Checks for Student Practice Worksheets

- Sample Check Register Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a sample checkbook worksheet?

A sample checkbook worksheet is a document that helps individuals organize their financial transactions, such as recording check payments, deposits, and account balances. It typically includes columns for the date, description of the transaction, check number, debit or credit amount, and running balance. This tool assists in tracking expenses, managing cash flow, and maintaining accurate records of financial transactions.

How can a sample checkbook worksheet be used to track expenses?

A sample checkbook worksheet can be used to track expenses by recording all transactions made, including checks written, deposits made and withdrawals. By entering each transaction in the appropriate categories such as date, payee, description, amount, and balance, you can easily monitor your expenses, identify trends, and better manage your finances. Regularly updating the worksheet and reconciling it against your bank statement can help you stay on top of your spending and make informed decisions about your budget.

What are the columns included in a sample checkbook worksheet?

A sample checkbook worksheet typically includes columns for the date of the transaction, a description or purpose of the transaction, the check number (if applicable), a column for deposits, a column for withdrawals or checks written, and a running balance that keeps track of the total amount in the account after each transaction.

Is it possible to customize a sample checkbook worksheet to fit individual needs?

Yes, it is possible to customize a sample checkbook worksheet to fit individual needs. You can adjust the categories, layout, formulas, and formatting to tailor it to your specific requirements. By making changes such as adding or removing columns, renaming categories, or incorporating additional features, you can create a personalized checkbook worksheet that meets your unique financial tracking needs.

How can a sample checkbook worksheet help in budgeting?

A sample checkbook worksheet can help in budgeting by providing a clear and organized way to track income and expenses. By recording all financial transactions in the checkbook worksheet, individuals can easily see where their money is going, identify any unnecessary spending, and create a budget based on their income and expenses. This can help in managing finances more effectively, avoiding overspending, and achieving financial goals.

Can a sample checkbook worksheet be used for both personal and business finances?

A sample checkbook worksheet can certainly be used for both personal and business finances, as they typically cover similar financial transactions such as deposits, withdrawals, and account balances. However, it's important to keep accurate records and separate your personal and business finances to maintain clarity and organization. Consider customizing the checkbook worksheet to include specific categories or columns for each type of transaction, ensuring a clear distinction between personal and business expenses.

Are there any formulas or calculations included in a sample checkbook worksheet?

Yes, a checkbook worksheet typically includes formulas and calculations to help users keep track of their finances accurately. These may include formulas for calculating the running balance after each transaction, total income, total expenses, and overall account balance. The purpose of these formulas is to automate the process of reconciling transactions and ensuring that the checkbook is up to date.

How often should a sample checkbook worksheet be updated?

A sample checkbook worksheet should ideally be updated every time a transaction is made on the account, ensuring accurate and up-to-date records. This frequent updating helps individuals stay on top of their finances, track their spending, and avoid overdrawing their account.

What are the benefits of using a sample checkbook worksheet compared to manual record-keeping?

Using a sample checkbook worksheet offers several benefits compared to manual record-keeping, including accuracy in calculations, organization of financial transactions, easy monitoring of expenses, and convenience in tracking account balances. The worksheet simplifies the process of balancing a checkbook, reduces the risk of errors, and provides a clear overview of income and expenses, ultimately saving time and effort in managing personal finances.

Where can I find a template or example of a sample checkbook worksheet to use?

You can find templates or examples of sample checkbook worksheets online through various websites that offer free financial planning resources and tools, such as Microsoft Office templates, Google Sheets templates, or financial planning websites like Mint or Personal Capital. Additionally, you can also create your own checkbook worksheet by setting up a simple spreadsheet in Microsoft Excel or Google Sheets with columns for date, check number, description, deposit, withdrawal, and balance to track your finances effectively.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments