Sample Accounting Worksheet in Excel

An accounting worksheet is a tool used by accountants to organize and calculate financial information. It serves as a manual worksheet where various financial transactions and calculations can be recorded. In this blog post, we will provide a sample accounting worksheet in Excel, which will be beneficial for small business owners, accounting professionals, and students studying accounting.

Table of Images 👆

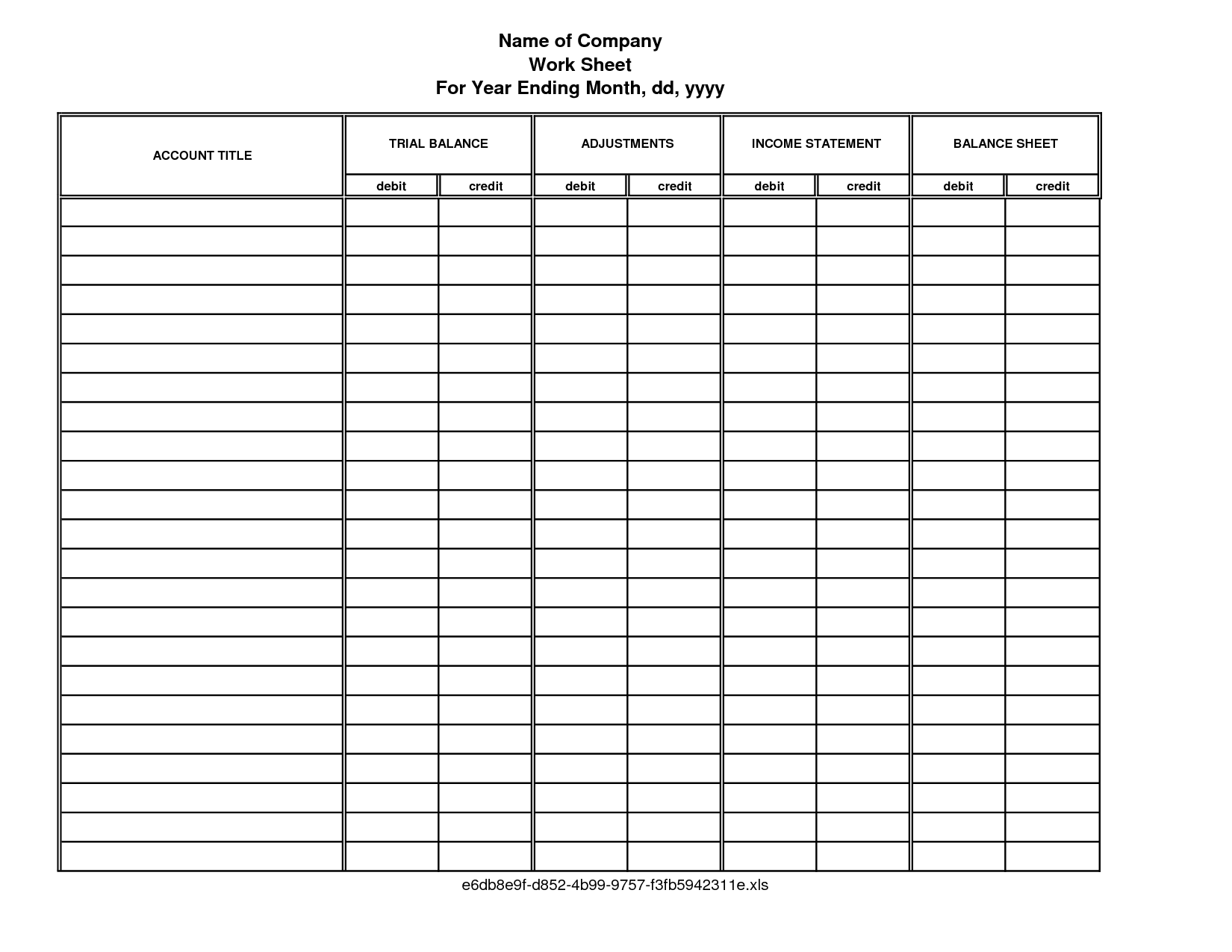

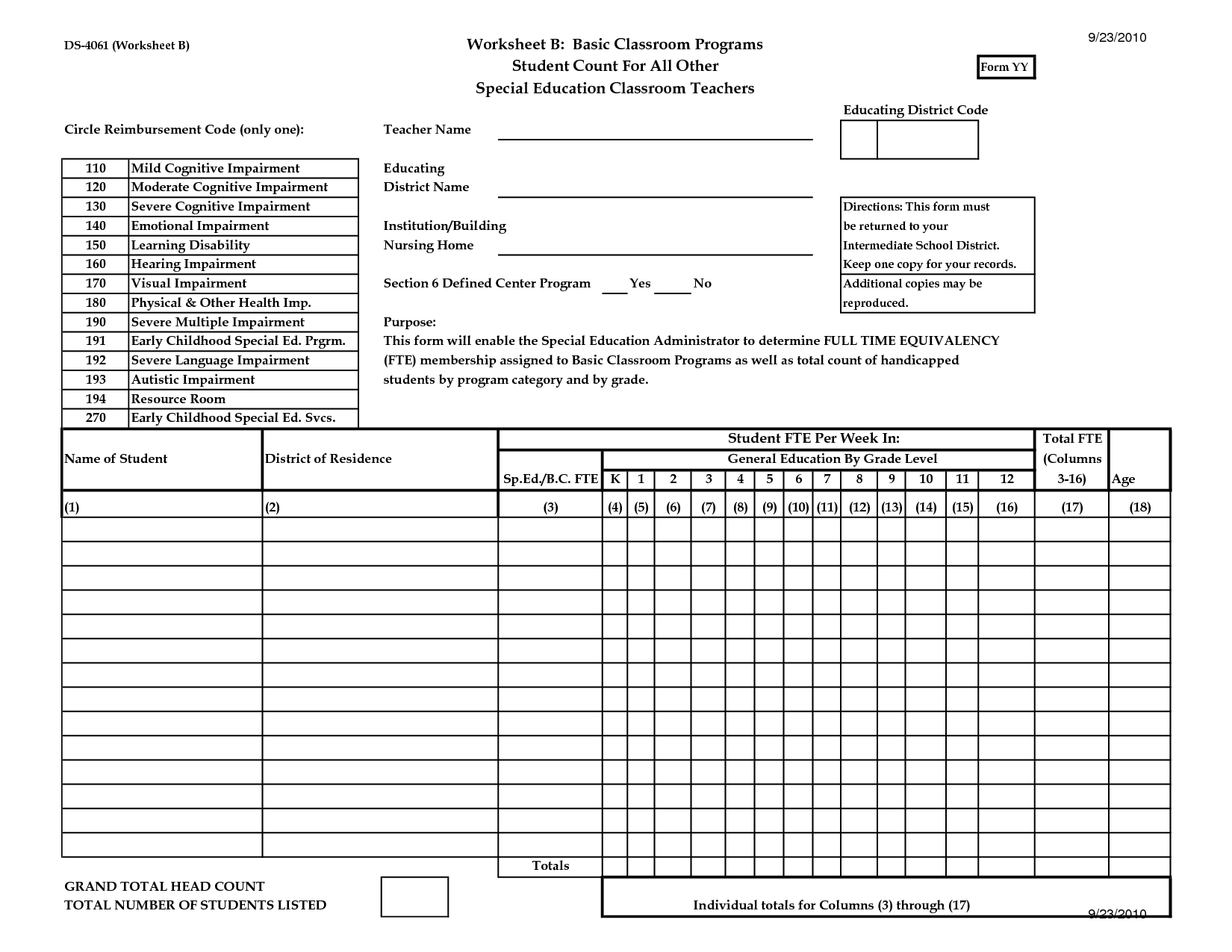

- Free Printable Accounting Ledger Sheets

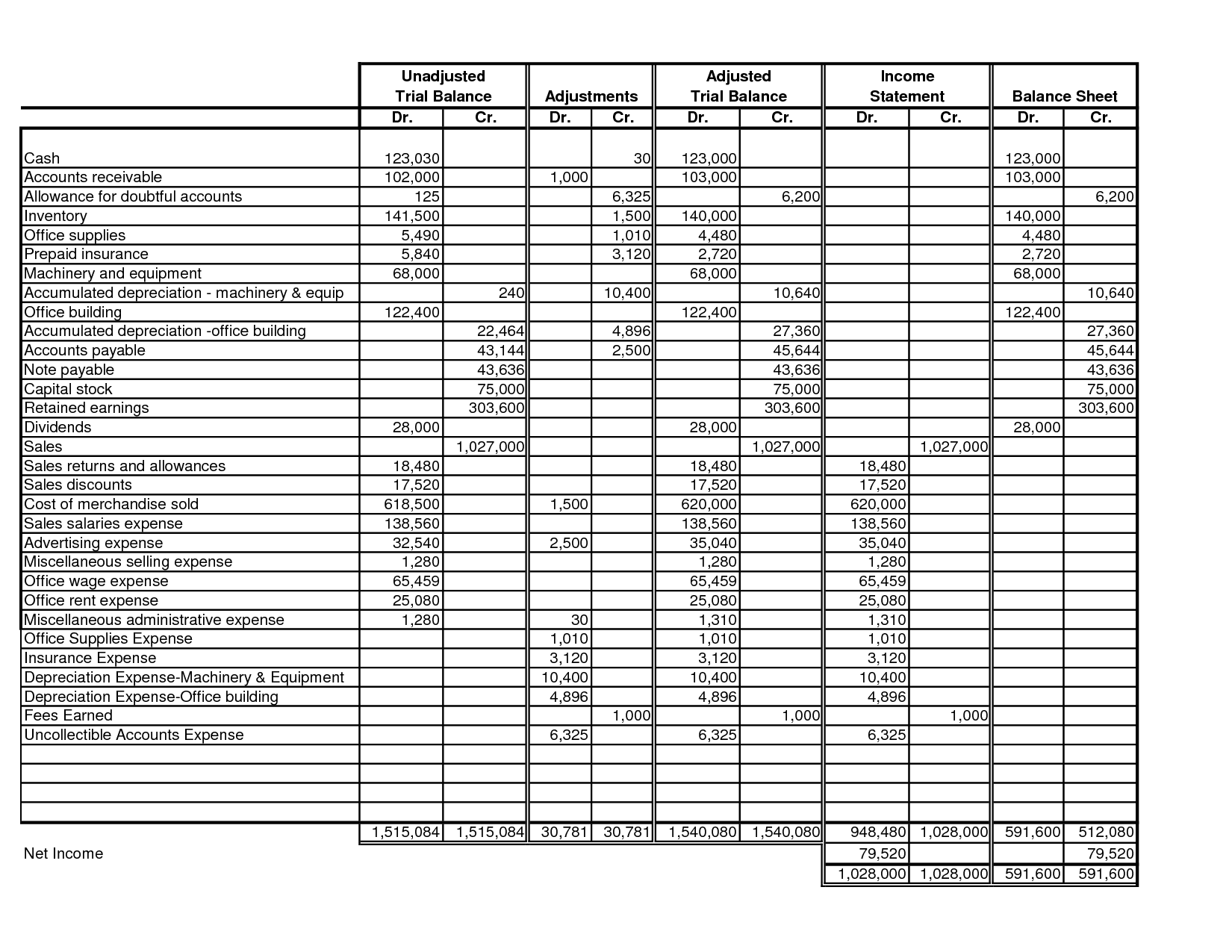

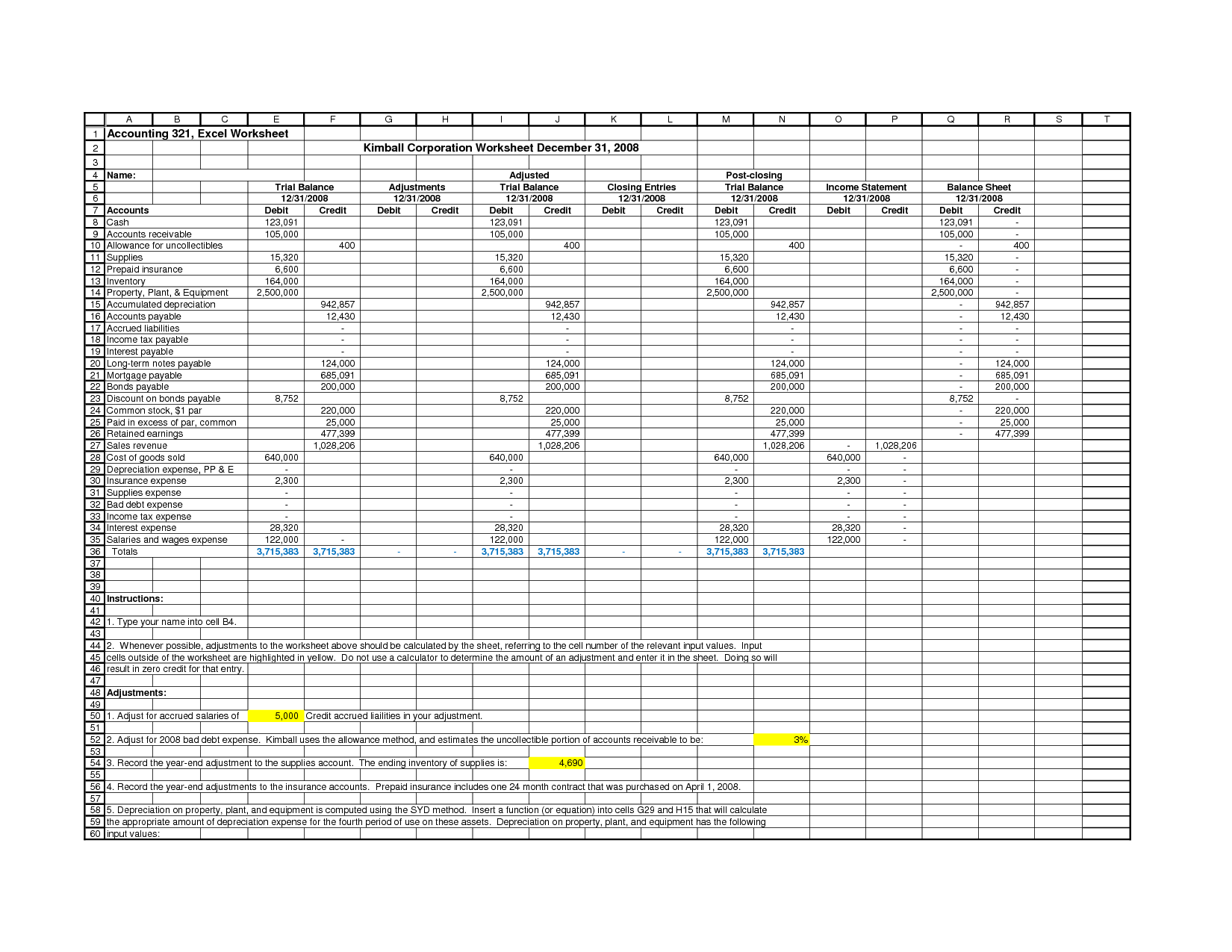

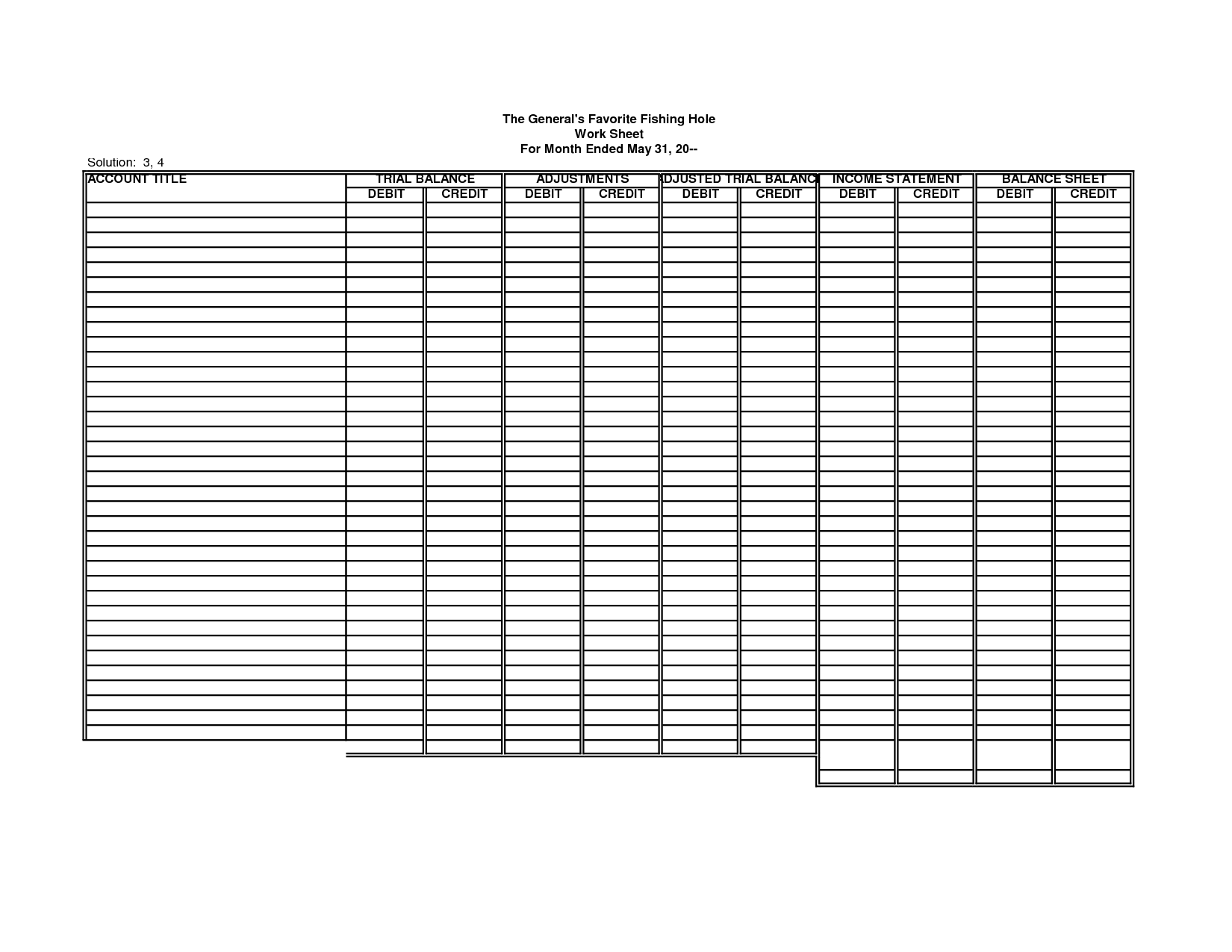

- Trial Balance Worksheet Template

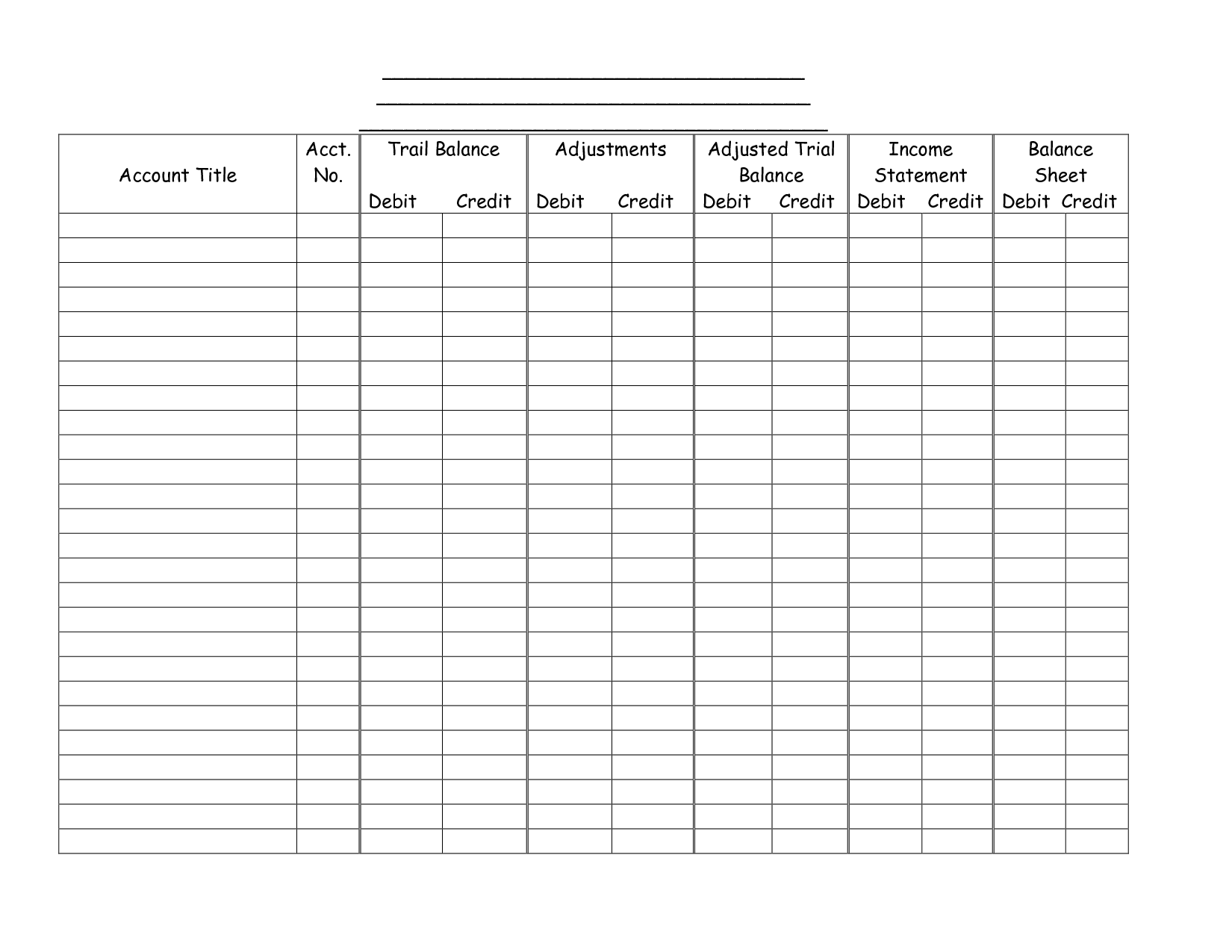

- Blank 10 Column Accounting Worksheet Template

- Basic Accounting Worksheets

- 10 Column Worksheet Template

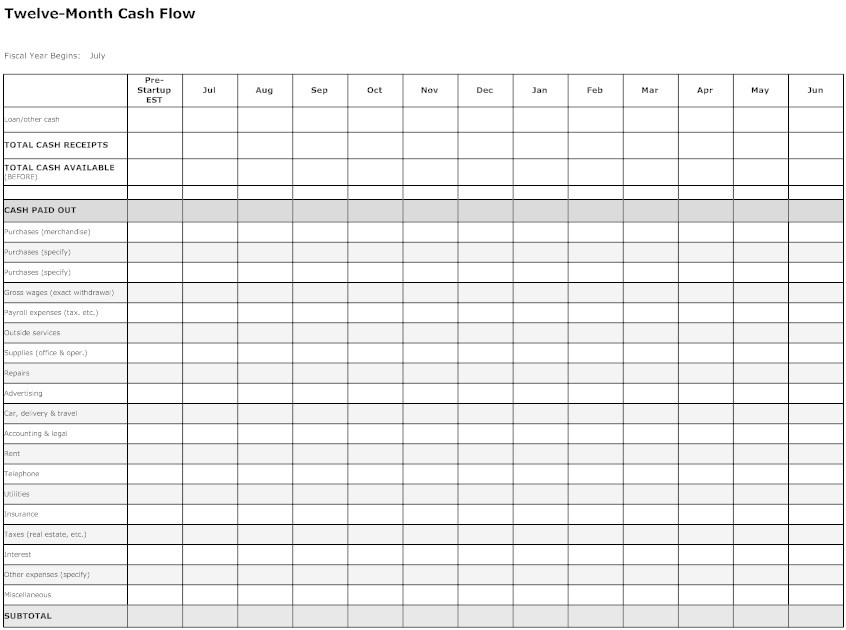

- Free Printable Cash Flow Sheets

- Basic Accounting Worksheet Template

- Accounting Balance Sheet Excel

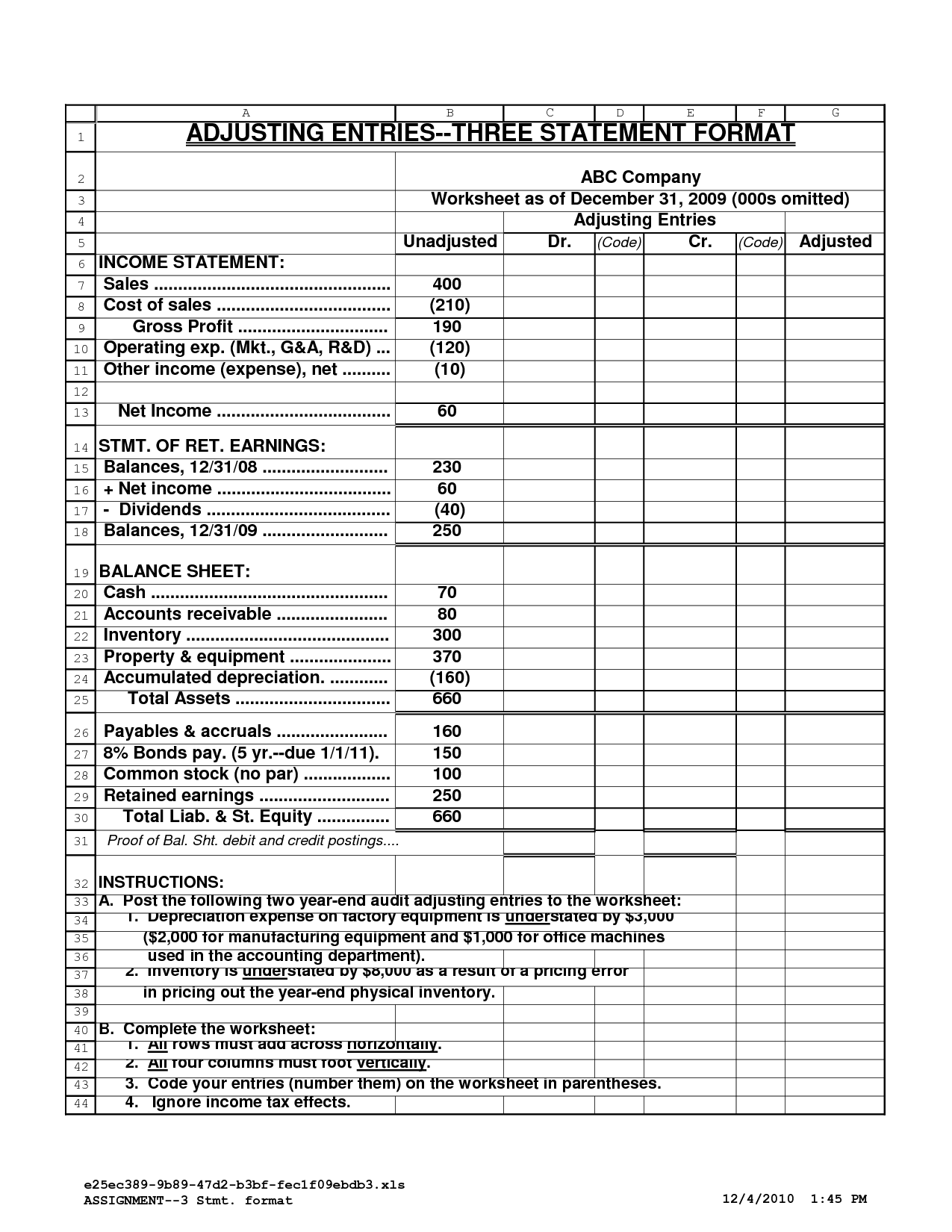

- Adjusting Entry Accounting Worksheet

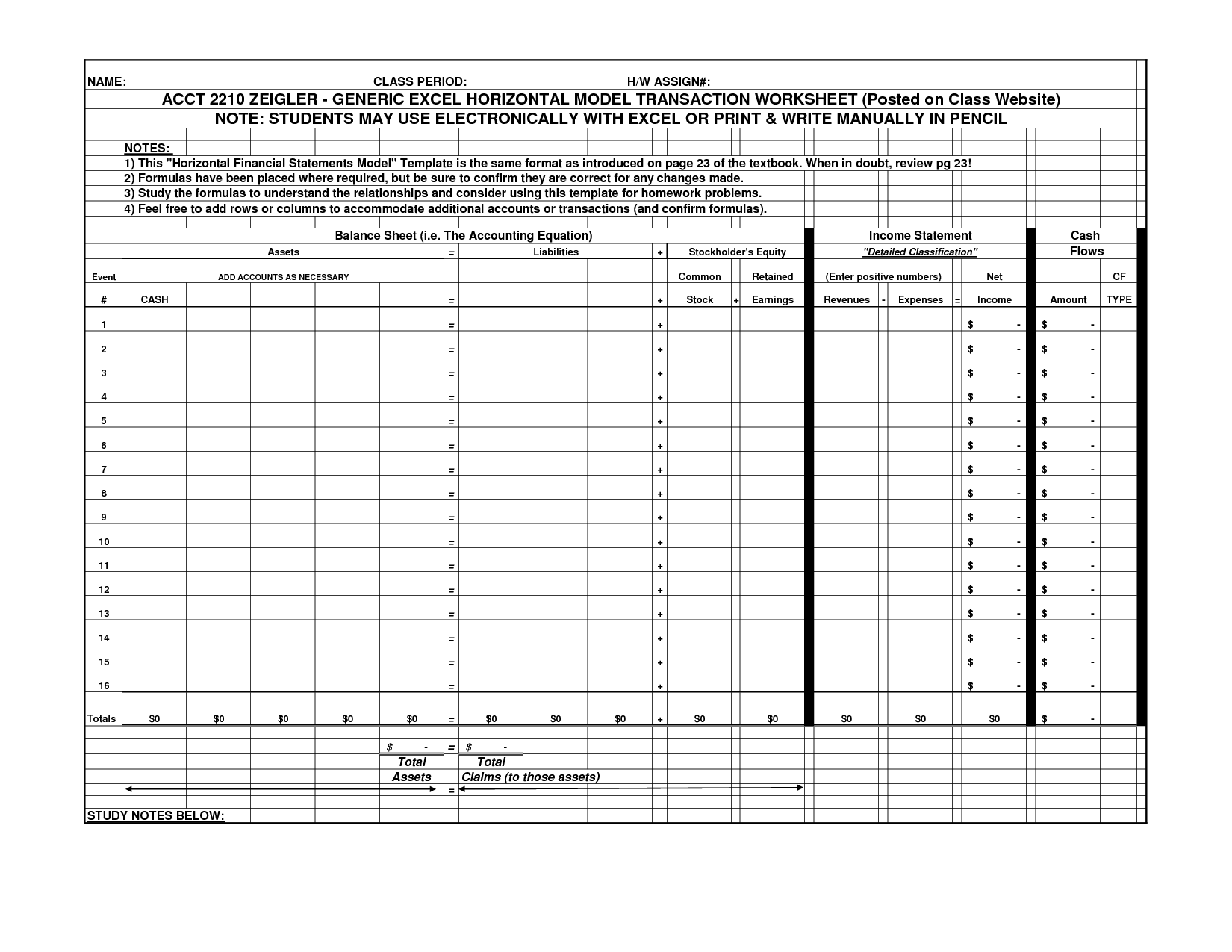

- Accounting Equation Worksheet Template

- Accounting Worksheet Example

- Blank Accounting Worksheets

- Ledger Balance Sheet Template

- Printable Blank Excel Spreadsheet Template

- Accounting T Account Balance Sheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a sample accounting worksheet?

An accounting worksheet is a tool used by accountants to organize and summarize information needed to prepare financial statements. It typically includes columns for trial balances, adjustments, income statements, and balance sheets. It acts as a working paper in the accounting process, allowing accountants to make adjustments and calculate financial results before transferring the information to the formal financial statements.

How is an accounting worksheet typically formatted in Excel?

An accounting worksheet in Excel is typically formatted with columns for account titles, debit and credit amounts, and a row for each account. The leftmost column usually contains account numbers or names, with corresponding debit and credit columns for entering amounts. The worksheet may also include columns for adjusting entries, totals, and a trial balance to help organize and summarize financial information for preparing financial statements.

What are the main sections of an accounting worksheet?

The main sections of an accounting worksheet typically include the trial balance, adjustments, adjusted trial balance, income statement, balance sheet, and closing entries. The trial balance lists all accounts and their balances, adjustments are made to ensure accurate financial reporting, the adjusted trial balance reflects these adjustments, the income statement shows the company's revenues and expenses, the balance sheet presents the company's financial position, and closing entries prepare the accounts for the next accounting period.

What types of financial information are recorded in an accounting worksheet?

In an accounting worksheet, various types of financial information are recorded including trial balances, adjustments for accruals and deferrals, income statements, balance sheets, and cash flow statements. Additionally, calculations for net income, gross profit, operating expenses, and other financial metrics are typically included in an accounting worksheet to provide a comprehensive overview of a company's financial performance and position.

How are assets and liabilities represented in an accounting worksheet?

Assets are typically represented on the left side of an accounting worksheet under the "Assets" section, while liabilities are represented on the right side under the "Liabilities" section. This layout helps to visually categorize and balance the financial statement by listing all assets on one side and all liabilities on the other.

How are revenues and expenses recorded in an accounting worksheet?

Revenues are recorded on the credit side of the income statement column on an accounting worksheet, while expenses are recorded on the debit side of the income statement column. This is done to calculate the net income for the period by subtracting total expenses from total revenues.

What formulas and functions can be used in an accounting worksheet?

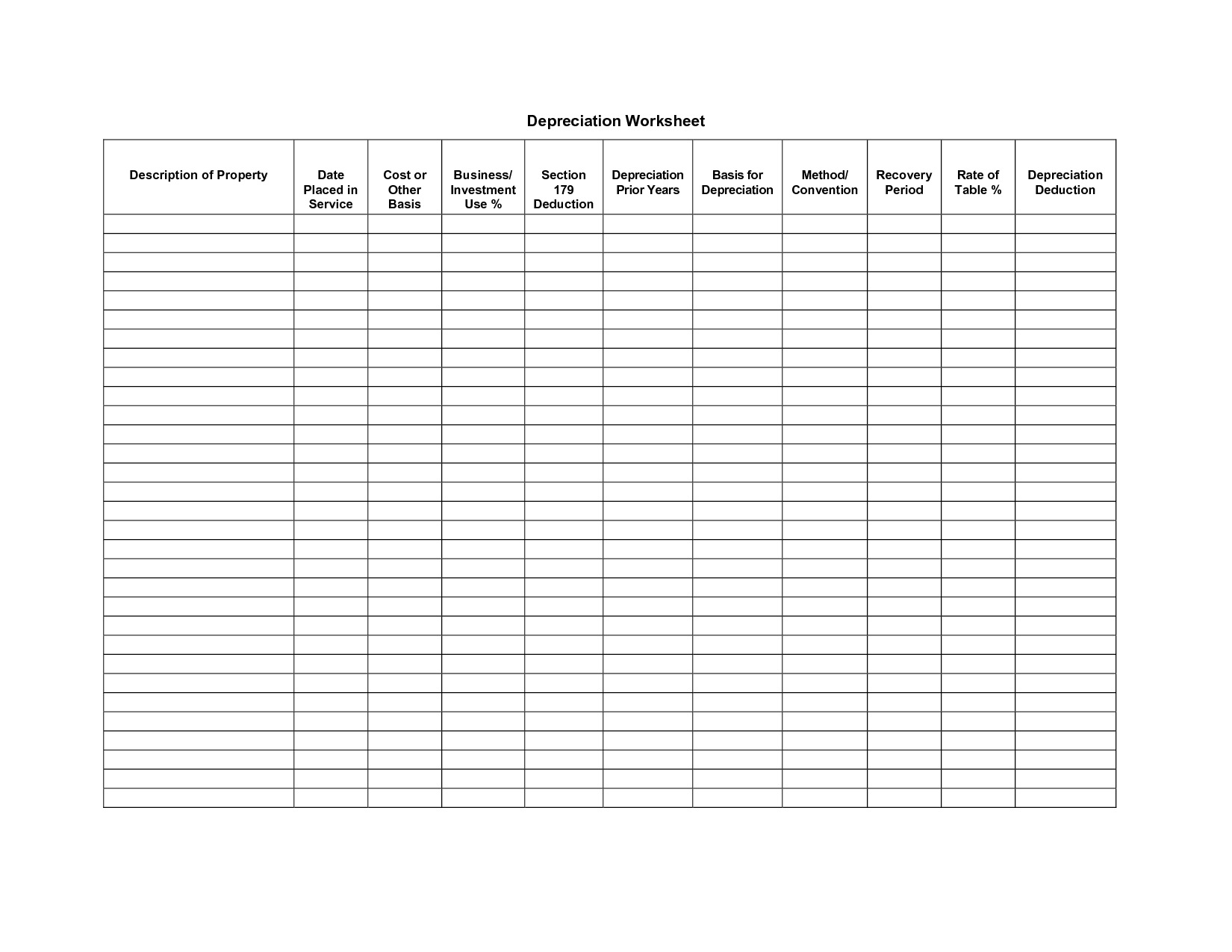

In an accounting worksheet, various formulas and functions can be used to perform calculations and analysis. Commonly used functions include SUM, AVERAGE, MAX, and MIN for calculating totals, averages, and identifying the highest and lowest values. Additionally, functions like IF, VLOOKUP, and HLOOKUP can be utilized for logical tests, searching for specific data, and referencing information in other worksheets or workbooks. Formulas such as for calculating percentages, depreciation, and interest payments can also be applied to financial statements and reports in an accounting worksheet.

How are adjustments and corrections handled in an accounting worksheet?

Adjustments and corrections in an accounting worksheet are typically made by identifying errors, discrepancies, or missing entries and making the necessary changes to accurately reflect the financial transactions. Adjustments are typically made at the end of an accounting period to update account balances and ensure the accuracy of the financial statements. Corrections are made to fix mistakes in recording transactions or errors in calculations. Both adjustments and corrections are recorded in the worksheet by adjusting journal entries, which are then transferred to the general ledger to reflect the accurate financial position of the company.

What is the purpose of preparing an accounting worksheet in Excel?

The purpose of preparing an accounting worksheet in Excel is to organize and summarize financial information for a specific accounting period. It allows accounting professionals to make any necessary adjustments, perform calculations, and ensure accuracy before finalizing financial statements. The worksheet helps streamline the preparation process and provides a clear overview of the financial data, facilitating decision-making and analysis for the business.

What are some benefits of using Excel for creating accounting worksheets?

Some benefits of using Excel for creating accounting worksheets include ease of data entry and manipulation, ability to perform calculations and formulas accurately and efficiently, organization of data through formatting and sorting, creation of professional-looking reports and graphs, collaboration and sharing of workbooks with others, and the ability to customize templates for specific accounting needs. Additionally, Excel provides audit trails and revision histories, allowing for accountability and tracking changes made to the worksheets.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments