Sales and Use Tax Worksheet

The Sales and Use Tax Worksheet is a tool designed to help individuals and businesses calculate their sales and use tax obligations accurately. Whether you are a small business owner or an individual taxpayer, this worksheet provides a structured format to assess your taxable sales and purchases, ensuring compliance with tax laws. By utilizing this useful tool, you can simplify the process of calculating and reporting your sales and use tax, saving time and reducing the risk of errors.

Table of Images 👆

- Texas Sales and Use Tax Form

- Maryland Sales and Use Tax

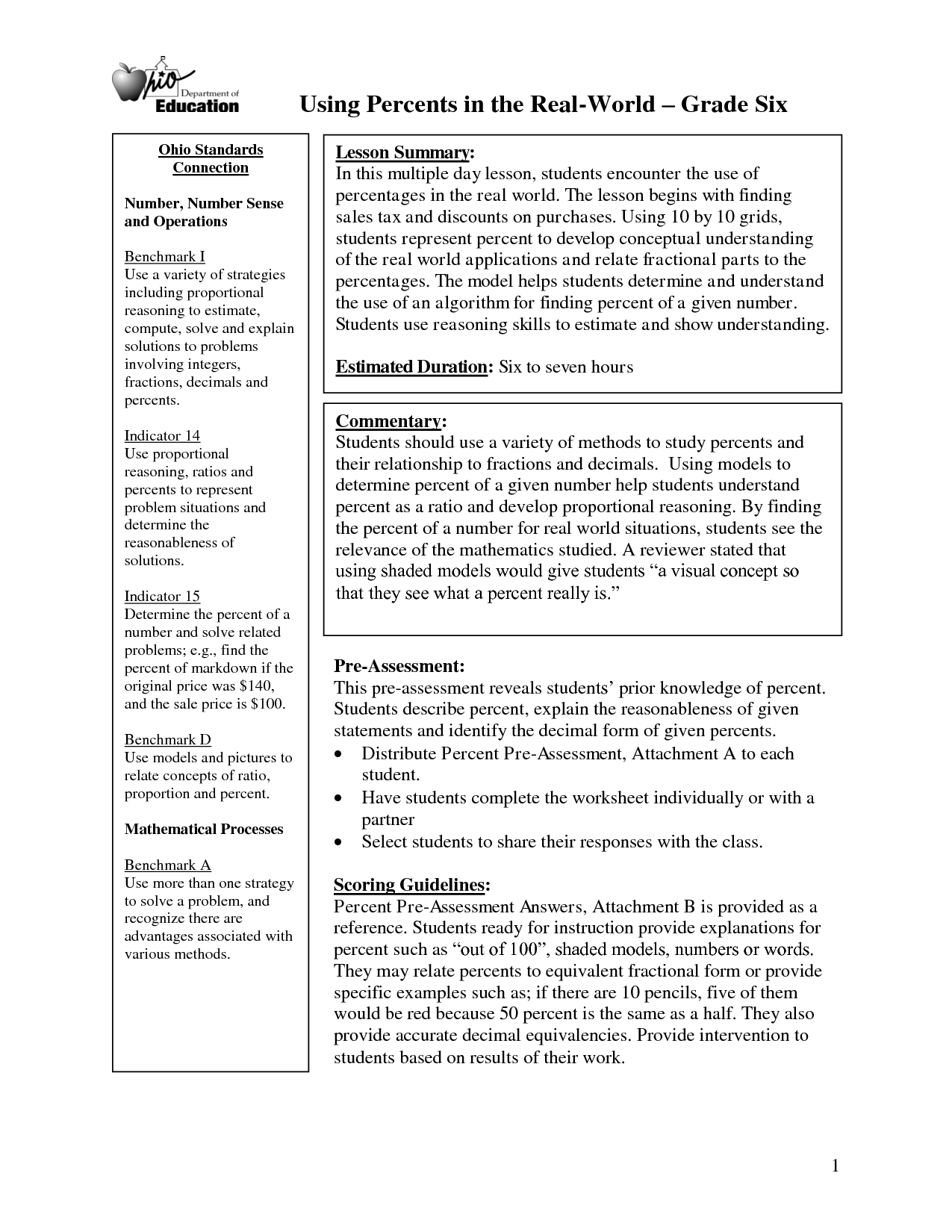

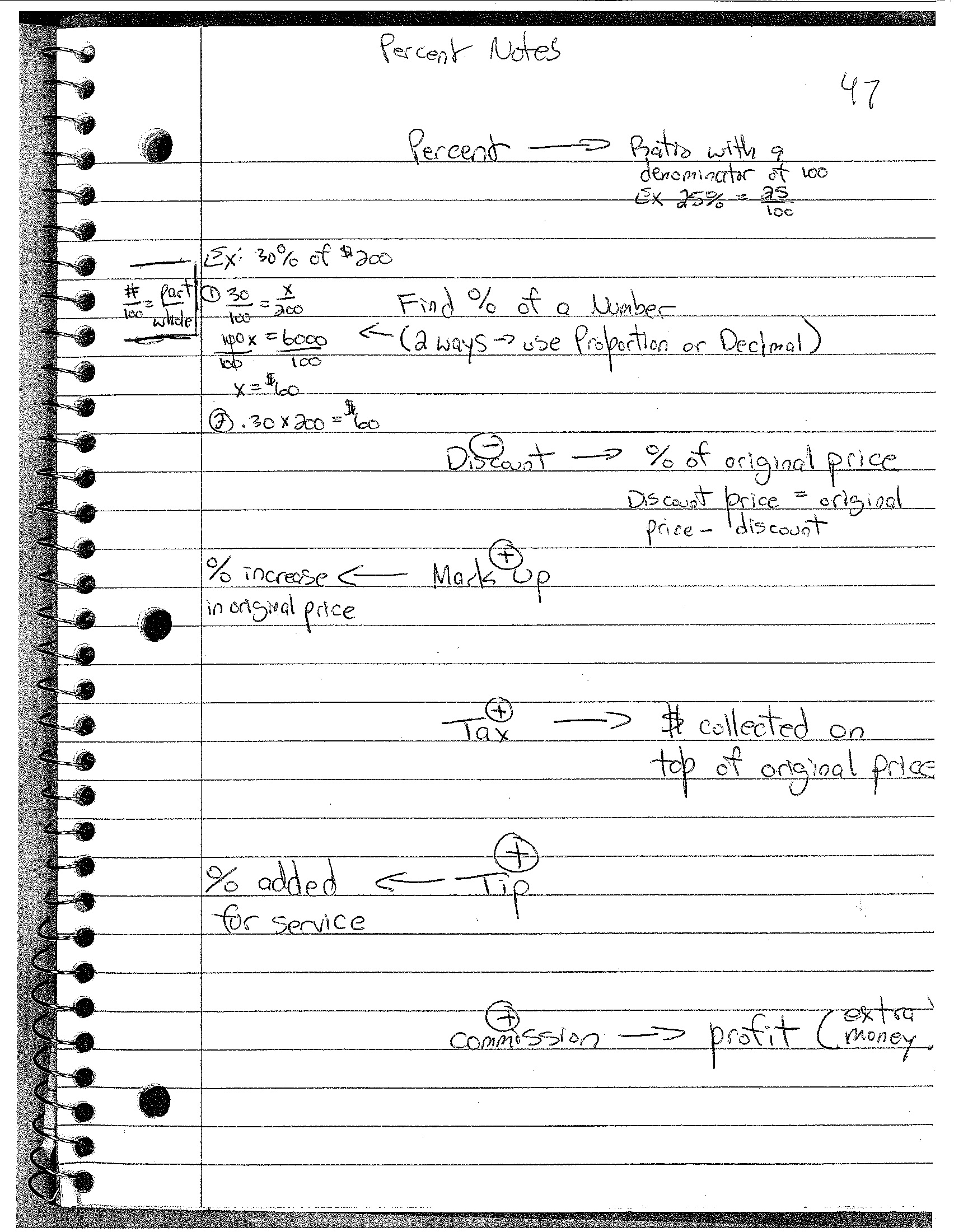

- Tips Tax and Sales Discounts Worksheets

- IFTA Quarterly Fuel Tax Forms

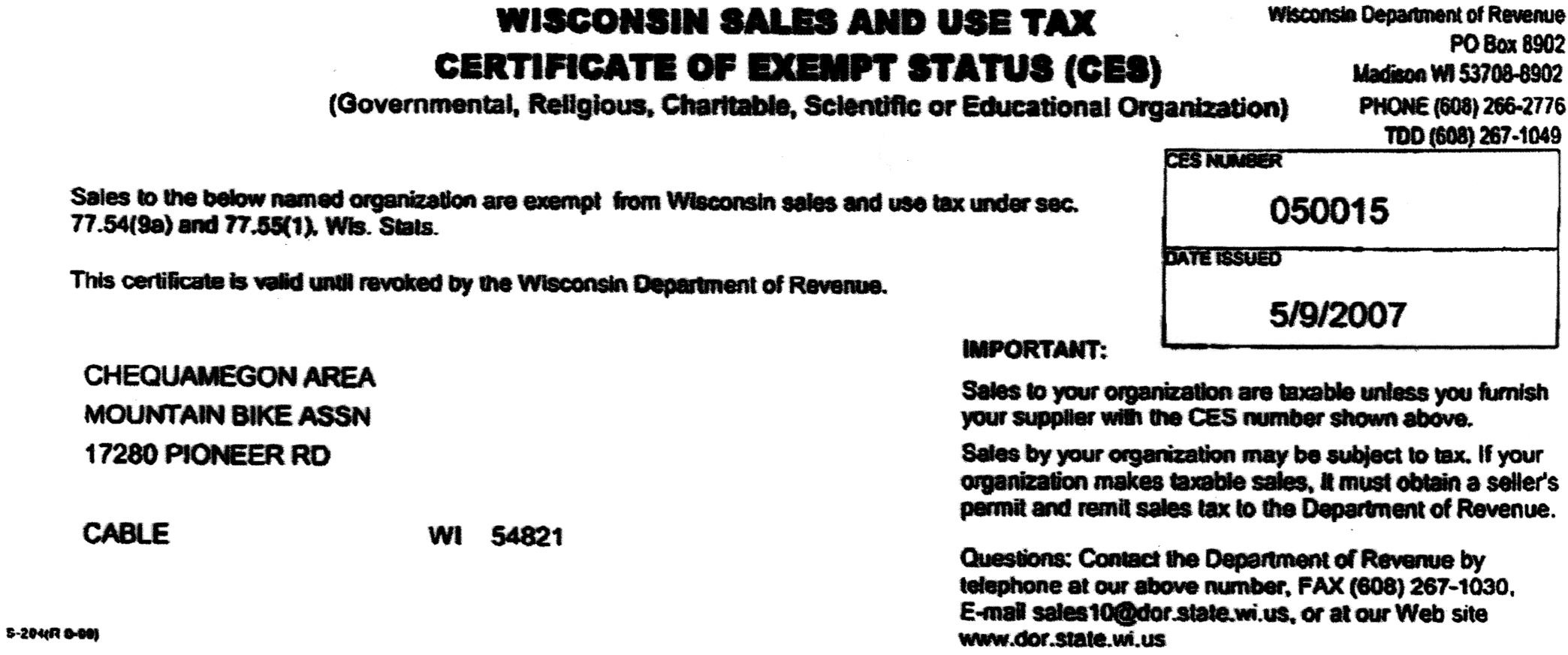

- Sales and Use Tax Certificate

- Percent Tax Tip Discount Word Problems Worksheet Answers

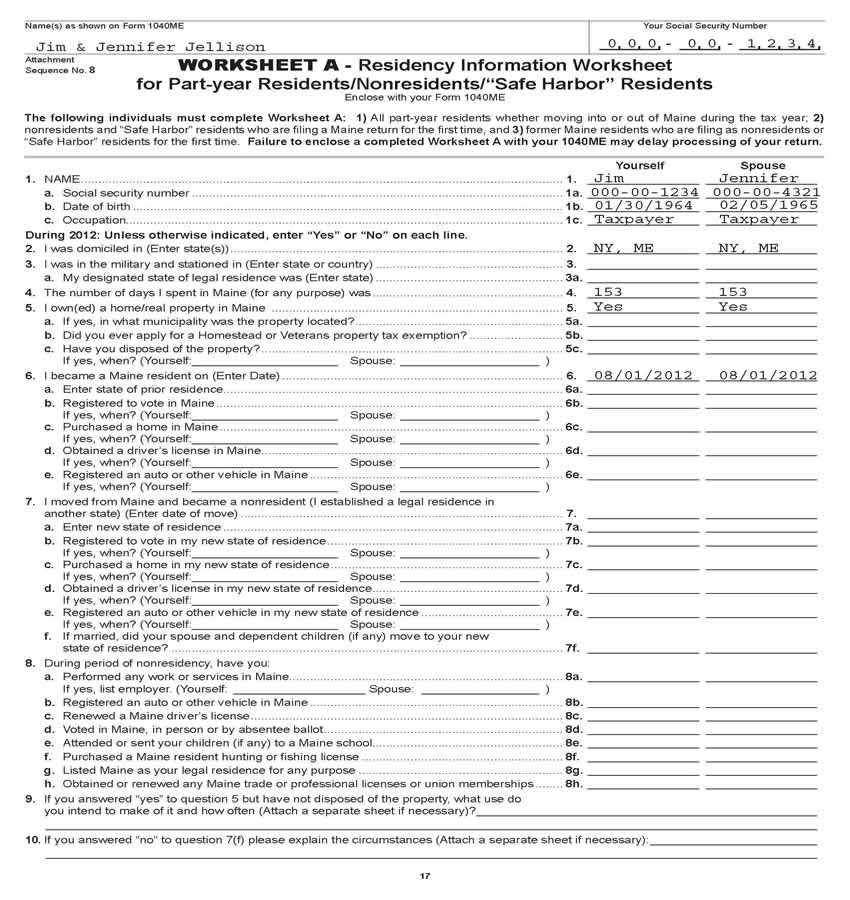

- Federal Income Tax Worksheet

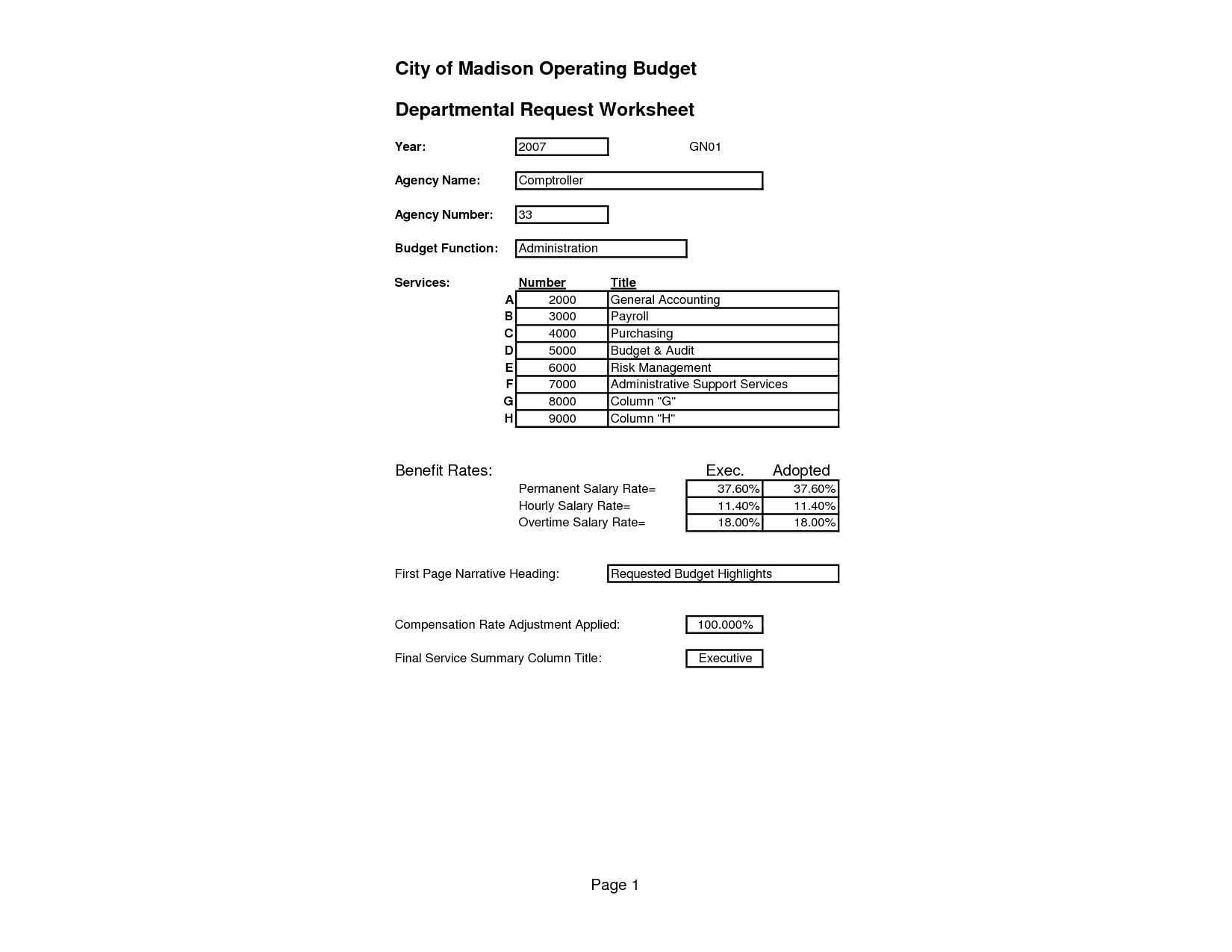

- Service Calculation Worksheet

- Income Tax Organizer Worksheet

- California Sales Tax Exemption Certificate

- Aircraft Maintenance Worksheet

- Case Study Analysis Worksheet

- Long and Short Vowel Worksheets

- Certified Public Accountant

- Certified Public Accountant

- Certified Public Accountant

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a sales and use tax worksheet?

A sales and use tax worksheet is a document used by businesses to calculate the amount of sales and use tax owed to the state or local government. It typically includes information such as the total sales amount, taxable sales, exempt sales, and any other relevant factors that impact the calculation of sales and use tax. This worksheet helps businesses ensure they are collecting and remitting the correct amount of sales tax in compliance with tax regulations.

How is the sales and use tax calculated?

Sales and use tax is typically calculated by multiplying the taxable sales amount by the applicable tax rate. The tax rate can vary depending on the location and type of goods or services being sold. The total tax amount is then added to the sale price to determine the final amount the customer pays. Some states may have additional rules or exemptions that could affect how sales and use tax is calculated.

What are the different rates of sales and use tax?

Sales and use tax rates vary by state and even within states based on local municipalities. For example, some states have a flat sales and use tax rate, while others have different rates for different types of goods or services. Additionally, local governments within a state may add their own sales and use tax on top of the state rate. It is important to check with the specific state and local tax authorities for the most current and accurate information on sales and use tax rates applicable to your location.

How do you determine if an item is subject to sales tax?

The determination of whether an item is subject to sales tax depends on the laws and regulations set forth by the specific jurisdiction. Generally, commonly taxed items include tangible personal property and certain services, while necessities like groceries and prescription medications may be exempt. It is important to review the tax laws of the particular state or locality in question to determine what items are subject to sales tax.

What are the exemptions or exclusions from sales and use tax?

Exemptions or exclusions from sales and use tax vary by state but commonly include items like groceries, prescription drugs, medical equipment, and some services like healthcare and education. Additionally, certain organizations such as non-profits or government entities may be exempt from sales and use tax when making purchases for specific purposes. It's important to check the specific laws and regulations in your state for a comprehensive list of exemptions or exclusions.

How do you record sales tax collected on the worksheet?

To record sales tax collected on a worksheet, you would typically create a separate line item or column specifically for the sales tax amount. This line item or column would capture the total sales tax collected based on the taxable sales made during the reporting period. You would then calculate and enter the total sales tax amount collected in this designated area to ensure it is accounted for accurately in your financial records.

How do you report and pay sales and use tax to the appropriate authorities?

To report and pay sales and use tax to the appropriate authorities, you need to first obtain a sales tax permit from the tax authority in your state. Sales tax is typically collected from your customers at the time of purchase, and you are required to report and remit these taxes to the state tax authority on a regular basis, usually monthly or quarterly. This can be done electronically or through paper forms provided by the tax authority. Make sure to accurately report the sales tax collected and pay the amount owed by the specified deadline to avoid penalties or fines.

What information is typically included in a sales and use tax worksheet?

A sales and use tax worksheet typically includes details such as the amount of sales made in a specific period, the applicable tax rate, any exempt sales, taxable sales, total tax due, and any credits or adjustments. It is used to track and calculate the sales tax owed by a business based on its sales transactions.

Can you provide an example of calculating sales and use tax on a purchase?

Sure, here's an example: suppose you are buying a $50 item with a sales tax rate of 8%. To calculate the sales tax, you multiply the purchase price by the sales tax rate (50 x 0.08 = 4), which gives you $4. So, the total amount you will pay for the item including sales tax would be $50 (purchase price) + $4 (sales tax) = $54.

What are the consequences of failing to accurately report and pay sales and use tax?

The consequences of failing to accurately report and pay sales and use tax can be severe and include penalties, fines, and interest being levied by tax authorities. In addition, a company may face audits and audits that can disrupt business operations and damage its reputation. Failure to comply with tax laws can also result in legal action, such as lawsuits or criminal charges, being brought against the business or its owners. It is essential for businesses to ensure they properly report and pay sales and use tax to avoid these consequences and maintain their financial and legal standing.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments