Preparing a Budget Worksheet

Budgeting is an essential financial tool that helps individuals and families manage their expenses and achieve their financial goals. However, organizing and tracking expenses can often feel overwhelming. That's where budget worksheets come in. By providing a structured format and mapping out all your income and expenses, worksheets help you gain clarity and control over your finances. Whether you are new to budgeting or looking to fine-tune your existing budget, a budget worksheet can be a valuable resource.

Table of Images 👆

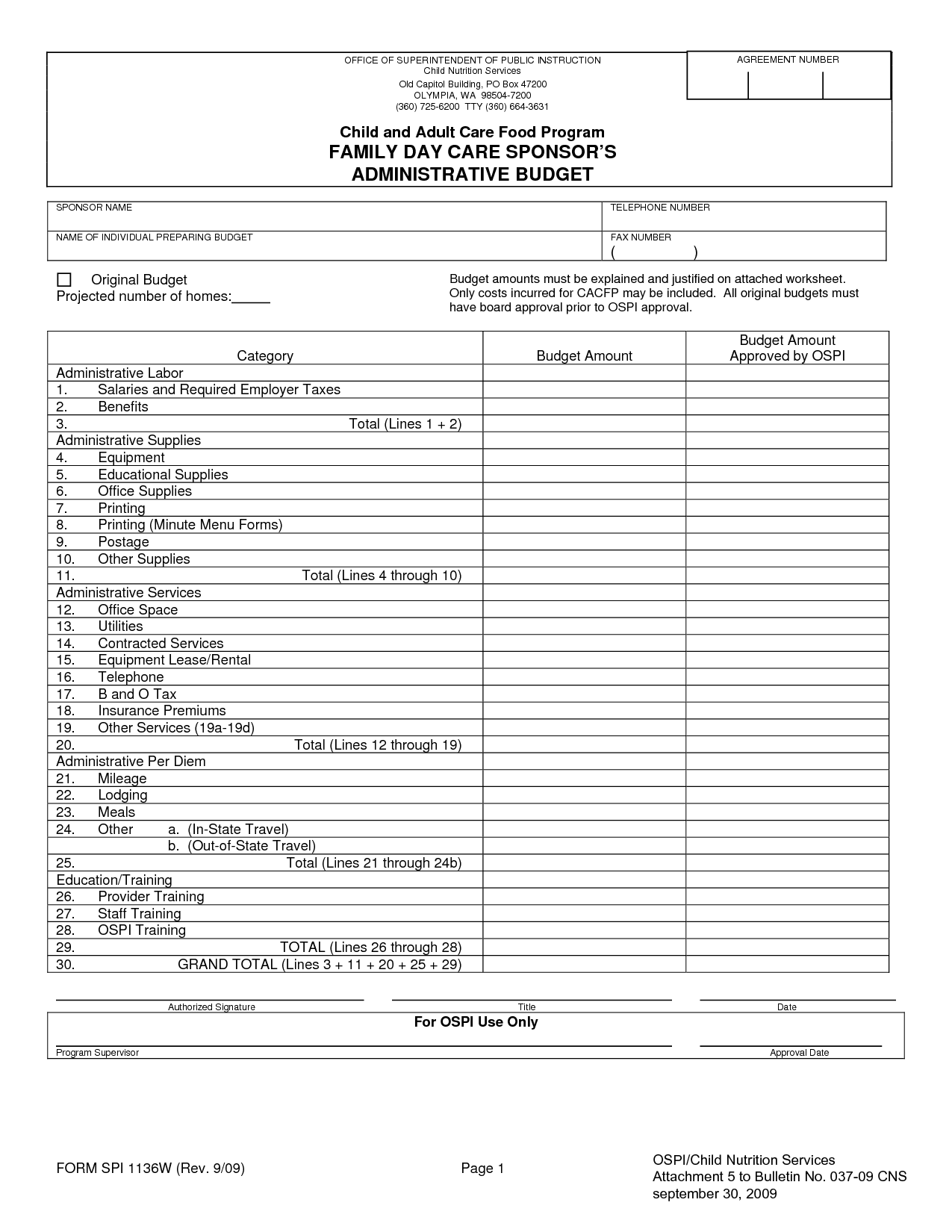

- Day Care Budget Template

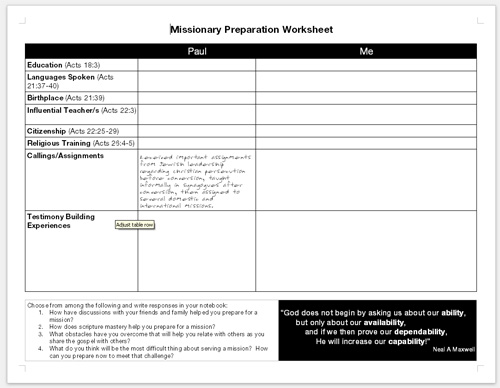

- Missionary LDS Worksheet

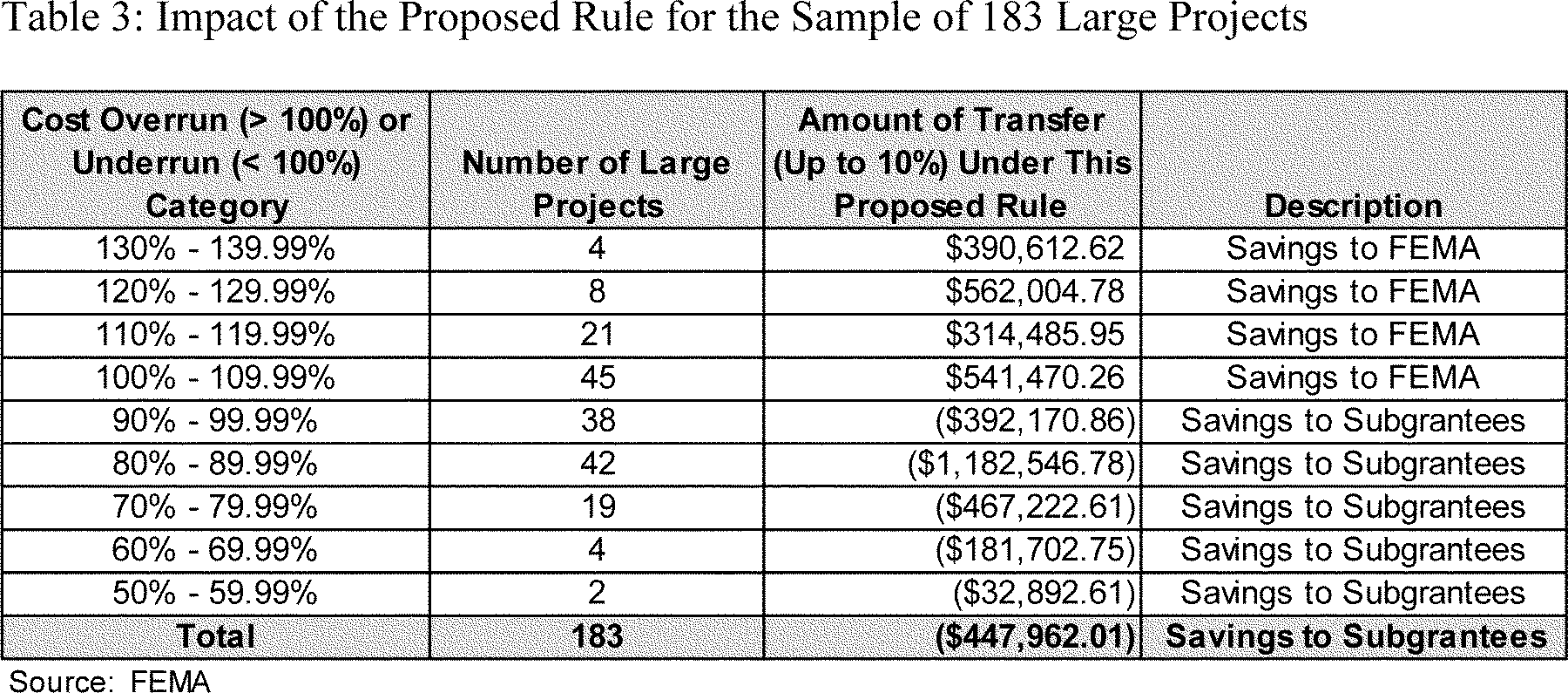

- Project Cost Estimate Spreadsheet

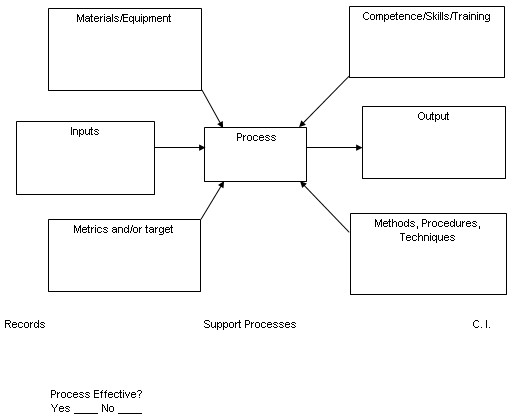

- Blank Turtle Diagram Process

- Sample Grant Proposal Timeline

- Sample Grant Proposal Timeline

- Sample Grant Proposal Timeline

- Sample Grant Proposal Timeline

- Sample Grant Proposal Timeline

- Sample Grant Proposal Timeline

- Sample Grant Proposal Timeline

- Sample Grant Proposal Timeline

- Sample Grant Proposal Timeline

- Sample Grant Proposal Timeline

- Sample Grant Proposal Timeline

- Sample Grant Proposal Timeline

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is the purpose of a budget worksheet?

A budget worksheet is used to track income and expenses in order to better understand and manage personal finances. It helps individuals or households allocate funds for different categories, prioritize spending, identify areas for savings, and ultimately achieve financial goals. By documenting and analyzing financial patterns, a budget worksheet serves as a valuable tool for optimizing financial health and making informed decisions about money management.

What are the key components included in a budget worksheet?

A budget worksheet typically includes key components such as income sources (salary, benefits, etc.), fixed expenses (rent, utilities, loan payments), variable expenses (groceries, entertainment, clothing), savings goals, as well as a section for tracking actual spending to compare against the budgeted amounts. Additionally, some budget worksheets may incorporate categories for debt repayment, emergency fund contributions, and investment allocations to provide a comprehensive overview of an individual or household's financial health and goals.

How do you identify and categorize your sources of income?

To identify and categorize sources of income, start by listing all sources of money received, such as wages, dividends, rental income, etc. Categorize them based on whether they are active (earned from work) or passive (from investments or assets). You can further categorize them by fixed (consistent) or variable (fluctuating) sources. Keeping track of your sources of income in a spreadsheet or financial software can help you better understand and manage your finances.

How do you track and categorize your expenses?

To track and categorize my expenses, I use a combination of methods. I input all transactions into a budgeting app or spreadsheet, categorizing them into preset categories such as food, transportation, bills, etc. I also keep receipts and review credit card and bank statements. This allows me to see where my money is going and helps me make informed decisions about spending and saving.

What are fixed expenses and why are they important to include in a budget worksheet?

Fixed expenses are regular, predictable costs that remain the same each month, such as rent, insurance premiums, and loan payments. They are important to include in a budget worksheet because they represent non-negotiable expenses that need to be paid regularly, and failing to account for them can result in financial problems. By including fixed expenses in a budget, individuals can better understand their financial obligations, plan for them accordingly, and ensure that they have enough money to cover these expenses each month.

What are variable expenses and why should they be accounted for in a budget worksheet?

Variable expenses are costs that fluctuate depending on usage or activity, such as groceries, entertainment, and transportation. It is important to account for variable expenses in a budget worksheet because they can have a significant impact on your overall financial health. By tracking and budgeting for these expenses, you can better control your spending, avoid overspending, and allocate funds more effectively towards your financial goals.

How do you prioritize your spending and allocate funds accordingly in a budget worksheet?

When prioritizing spending and allocating funds in a budget worksheet, start by listing fixed expenses like rent or mortgage, utilities, and debt payments. Then allocate funds for essentials like groceries, transportation, and healthcare. Next, set aside money for savings, emergency funds, and retirement. Finally, allocate funds for discretionary spending on non-essential items like entertainment and dining out. Regularly review and adjust your budget to ensure you are meeting financial goals and staying on track.

What strategies can be used to minimize expenses and increase savings?

To minimize expenses and increase savings, you can start by creating a budget to track your income and expenditures, prioritize spending on essentials, and cut back on non-essential purchases. You can also look for ways to reduce fixed costs such as negotiating bills, refinancing loans for better rates, and canceling subscriptions or memberships that are not crucial. Additionally, consider increasing your income through additional sources such as freelance work or a part-time job, and automate your savings by setting up automatic transfers to a high-interest savings account or retirement fund. Lastly, regularly review your financial goals and adjust your budget as needed to stay on track towards achieving them.

How often should a budget worksheet be reviewed and adjusted?

A budget worksheet should ideally be reviewed and adjusted on a monthly basis. This allows you to track your income and expenses regularly, identify any discrepancies, and make necessary changes to stay on track with your financial goals. Additionally, reviewing your budget monthly also gives you the opportunity to adapt to any changes in your financial situation or lifestyle.

What are the benefits of using a budget worksheet?

A budget worksheet helps in organizing and tracking expenses, providing a clear overview of income and expenditures, guiding in prioritizing spending, aiding in identifying areas for potential savings or cutbacks, facilitating setting and achieving financial goals, and promoting financial awareness and discipline.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments